Académique Documents

Professionnel Documents

Culture Documents

ORACLE AR, FA AP Journal Entries

Transféré par

us_rs5Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ORACLE AR, FA AP Journal Entries

Transféré par

us_rs5Droits d'auteur :

Formats disponibles

AR Order to Cash LifecycleJournal entries

Order Management No accounting entries generated in OM Inventory When you ship the Goods Dr Cost of Goods sold (picked up from the Item) Cr Inventory (picked up from Subinventory) Receivables When you run the Auto invoice Program and create an Invoice Dr Receivables Cr Revenue When you Receive Cash Dr Cash/ Bank Account Cr Cash Clearing Account When you receive the payment Dr Cash Clearing Account Cr Receivables A/c

ENTRY 01: When Goods / Material Are In-Transit Or When We Receive Inventory, The Following Accounting Entry Will Be Generated. Description Receiving Inventory Account Inventory AP Accrual Account There are two inventory Organizations: <!--[if !supportLists]--><!--[endif]-->Receiving Organization <!--[if !supportLists]--><!--[endif]-->Inventory Organization When the inventory is received at Receiving Organization then the above entry will be generated. Receiving of Inventory can be made through Purchasing Responsibility as well as Inventory Responsibility. Receiving Inventory Account This account is defined in the Receiving Options of purchasing Responsibility. Dr. xxxxx xxxxx Cr.

Navigation: PURCHASING > SETUPS > ORGANIZATIONS > RECEIVING OPTIONS

Inventory AP Accrual Account This account is defined in the Inventory Organization Parameters window; click on Others (B) and then select Inventory Information and then chose the Other Accounting tab. Navigation: PURCHASING > SETUPS > ORGANIZATIONS > ORGANIZATIONS

ENTRY 02: When Inventory Is Delivered To Sub Inventory Stores Then The Following Accounting Entry Will Be Generated.

Description Material Account Receiving Inventory Account

Dr. xxxxx

Cr.

xxxxx

When the Inventory is delivered in the Stores this account will be hit in the Inventory Organization click on the others button and then select the Inventory Information and then choose the Costing Information tab and this account will be defined in the Valuation Account region named as Material. Receiving Inventory Account This account is defined in the Receiving Options of purchasing Responsibility. Material / Inventory Account This account is defined in the Inventory Organization Parameters window; click on Others (B) and then select Inventory Information and then chose the Costing Information tab. Navigation: PURCHASING > SETUPS > ORGANIZATIONS > ORGANIZATIONS

ENTRY 03: When We Book Liability At Invoice Level, The Following Accounting Entry Will Be Generated. Description Inventory AP Accrual Account Liability Account Dr. xxxxx xxxxx Cr.

At the Invoice Level when we book the liability the supplier liability account will be credited. Inventory AP Accrual Account This account is defined in the Inventory Organization Parameters window; click on Others (B) and then select Inventory Information and then chose the Other Accounting tab. Supplier Liability Account To define the Liability account in the Payables Responsibility click on Setups, choose Options, click on Financials, and then select the Accounting tab. Navigation: PAYABLES > SETUPS > OPTIONS > FINANCIALS

ENTRY 04: When Payment Is Made To Supplier, The Following Accounting Entry Will Be Generated. Description Liability Account Cash Clearing Account Dr. xxxxx xxxxx Cr.

Cash Clearing Account is defined in the Payables Responsibility while defining the banks. Supplier Liability Account To define the Liability account in the Payables Responsibility click on Setups, choose Options, click on Financials, and then select the Accounting tab. Cash Clearing Account To define Cash Clearing Account click on Setups, choose Payments and then click on Banks. After entering the required information in the main bank window click on the Bank Accounts button. In the Bank Accounts region choose the Account Use Type Internal to show the GL Accounts. Here we find the Cash Clearing Account. Navigation: PAYABLES > SETUPS > PAYMENT > BANKS

ENTRY 05: When Reconciliation Is Made In Cash Management, The Following Accounting Entry Will Be Generated. Description Cash Clearing Account Bank / Cash Account Dr. xxxxx xxxxx Cr.

Switch to the Cash Management Responsibility for Reconciliation purpose. When we made the Reconciliation then the above Accounting entry will be generated. Cash Clearing Account To define Cash Clearing Account click on Setups, choose Payments and then click on Banks. After entering the required information in the main bank window click on the Bank Accounts button. In the Bank Accounts region choose the Account Use Type Internal to show the GL Accounts. Here we find the Cash Clearing Account. Bank / Cash Account To define Cash Account click on Setups, choose Payments and then click on Banks. After entering the required information in the main bank window click on the Bank Accounts button. In the Bank Accounts region choose the Account Use Type Internal to show the GL Accounts.

Accounting Entries Fixed Assets

Account 1 2 3 4 5 6 7 8 9 10 Asset Cost Asset Clearing Depreciation Expense Accumulated Depreciation Deferred Depreciation Reserve Deferred Depreciation Expense Depreciation Adjustment Proceeds of Sale Clearing Cost of removal Clearing Gain & Loss

Segment Qualifier Asset Account Asset Account Expense Account Contra-Asset Account Liability Account Expense Account Expense Account Asset Account Liability Account Revenue Account

Here are the entries made by FA.

Asset is added

Asset Cost Asset Clearing

$100 $100

Asset Depreciation

Depreciation Expense Accumulated Depreciation

$100 $100

Asset Retirement W/o proceeds and W/o removal cost

Accumulated Depreciation Gain/Loss

$60

$40

Asset Cost

$100

Asset Retirement With Proceeds, W/o Cost of removal

Accumulated Depreciation Gain/Loss Gain/Loss Proceeds from Sale Asset Cost

$60

$40 $10 $10 $100

Asset Retirement With Cost of removal

Accumulated Depreciation Gain/Loss Gain/Loss Cost of removal Clearing Asset Cost

$60 $40 $5 $5 $100

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- E Health Business PlanDocument36 pagesE Health Business PlanZaman Ali100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- r12 Financials RCD OracleDocument159 pagesr12 Financials RCD Oracleus_rs5Pas encore d'évaluation

- Indian Law Solved Case StudiesDocument14 pagesIndian Law Solved Case StudiesJay PatelPas encore d'évaluation

- Drummond Subpeona To Doug Von AllmenDocument8 pagesDrummond Subpeona To Doug Von AllmenPaulWolfPas encore d'évaluation

- NEW Interview Document 2013Document80 pagesNEW Interview Document 2013us_rs5Pas encore d'évaluation

- Oracle R12 AP New FeaturesDocument120 pagesOracle R12 AP New Featuressanjayapps100% (6)

- Oracle R12 Legal Entity ConceptsDocument39 pagesOracle R12 Legal Entity Conceptssanjayapps80% (5)

- R12 TcaDocument244 pagesR12 Tcaharish198Pas encore d'évaluation

- R12 Oracle PaymentsDocument57 pagesR12 Oracle Paymentsrajprasa100% (2)

- UK Visa Requirements - From UAE 2013Document7 pagesUK Visa Requirements - From UAE 2013Shahid MohammedPas encore d'évaluation

- 115 SseigDocument233 pages115 Sseigus_rs5Pas encore d'évaluation

- UK Visa Requirements - From UAE 2013Document7 pagesUK Visa Requirements - From UAE 2013Shahid MohammedPas encore d'évaluation

- Oracle Payment by Hafiz Syed Umair Manzar TirmiziDocument50 pagesOracle Payment by Hafiz Syed Umair Manzar TirmiziSyed Umair ManzarPas encore d'évaluation

- Iexpense For BeginnersDocument352 pagesIexpense For BeginnersAbhilash KarappankuttyPas encore d'évaluation

- Purchasing User GuideDocument1 352 pagesPurchasing User Guideapi-26363981Pas encore d'évaluation

- End To End Processes - MFG To FinancialsDocument17 pagesEnd To End Processes - MFG To FinancialssugargPas encore d'évaluation

- Oracle Application Security LayersDocument5 pagesOracle Application Security Layersus_rs5Pas encore d'évaluation

- Examples Transfer PricingDocument15 pagesExamples Transfer PricingRajat RathPas encore d'évaluation

- A Study On Consumer Behavior Regarding Investment On Financial Instruments at Karvy Stock Broking LTDDocument88 pagesA Study On Consumer Behavior Regarding Investment On Financial Instruments at Karvy Stock Broking LTDBimal Kumar Dash100% (1)

- Importance of Project Management in ConstructionDocument10 pagesImportance of Project Management in ConstructionNicole SantillanPas encore d'évaluation

- Monthly Progress Report ofDocument50 pagesMonthly Progress Report ofHamayet RaselPas encore d'évaluation

- TCI Letter To Safran Chairman 2017-02-14Document4 pagesTCI Letter To Safran Chairman 2017-02-14marketfolly.comPas encore d'évaluation

- Share Holders Right To Participate in The Management of The CompanyDocument3 pagesShare Holders Right To Participate in The Management of The CompanyVishnu PathakPas encore d'évaluation

- (70448314976) 08112022Document2 pages(70448314976) 08112022DICH THUAT LONDON 0979521738Pas encore d'évaluation

- Significance of Cross Elasticity of DemandDocument4 pagesSignificance of Cross Elasticity of Demandvijay vijPas encore d'évaluation

- Pakistan Accumulator 4psDocument6 pagesPakistan Accumulator 4psHamza KhanPas encore d'évaluation

- Consolidated Edison Co. v. NLRB, 305 U.S. 197 (1938)Document26 pagesConsolidated Edison Co. v. NLRB, 305 U.S. 197 (1938)Scribd Government DocsPas encore d'évaluation

- This Research Paper Is Written by Naveed Iqbal ChaudhryDocument5 pagesThis Research Paper Is Written by Naveed Iqbal ChaudhryAleem MalikPas encore d'évaluation

- Caf 6 PT EsDocument58 pagesCaf 6 PT EsSyeda ItratPas encore d'évaluation

- XII Acc CH 4 and 5 Study Material 2024Document28 pagesXII Acc CH 4 and 5 Study Material 2024bhawanar674Pas encore d'évaluation

- FX4Cash CorporatesDocument4 pagesFX4Cash CorporatesAmeerHamsa0% (1)

- Lunar Rubbers PVT LTDDocument76 pagesLunar Rubbers PVT LTDSabeer Hamsa67% (3)

- Hypothesis Testing For A Single PopulationDocument37 pagesHypothesis Testing For A Single PopulationAna Salud LimPas encore d'évaluation

- Constitutional Provisions For Labor Law PhilippinesDocument1 pageConstitutional Provisions For Labor Law PhilippinesAgnes GamboaPas encore d'évaluation

- Tender Document Heliport ShimlaDocument128 pagesTender Document Heliport ShimlaAdarsh Kumar ManwalPas encore d'évaluation

- Analysis On Apollo Tyres LTDDocument43 pagesAnalysis On Apollo Tyres LTDCHAITANYA ANNEPas encore d'évaluation

- Business Basics Test: Please Complete This Puzzle by Finding The Hidden WordsDocument1 pageBusiness Basics Test: Please Complete This Puzzle by Finding The Hidden WordsCavene ScottPas encore d'évaluation

- Web Based Crime Management SystemDocument22 pagesWeb Based Crime Management SystemZain Ul Abedin SaleemPas encore d'évaluation

- RAD Project PlanDocument9 pagesRAD Project PlannasoonyPas encore d'évaluation

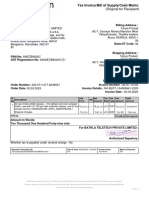

- InvoiceDocument1 pageInvoicetanya.prasadPas encore d'évaluation

- Jafza Rules 6th Edition 2016Document58 pagesJafza Rules 6th Edition 2016Binoy PsPas encore d'évaluation

- BCDR AT&T Wireless CommunicationsDocument17 pagesBCDR AT&T Wireless CommunicationsTrishPas encore d'évaluation

- Mergers and AcquisitionDocument17 pagesMergers and AcquisitionKhushal Mittal33% (3)