Académique Documents

Professionnel Documents

Culture Documents

Analysis

Transféré par

Divya KakumanuCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Analysis

Transféré par

Divya KakumanuDroits d'auteur :

Formats disponibles

Introduction: Loan is a debt evidenced by a note which specifies, among other things, the pr incipal amount, interest rate,

and date of repayment. Loan entails reallocation of subject assets for a period of time between borrower and the lender. Loan is significantly dependent on rate on of interest and installments to pay b ack loan (Loan length), amount requested and amount funded. Based on the above k ey factors only the analysis can be carried out. Using exploratory analysis and standard multiple regression techniques we show that there is a significant rela tionship between interest amount and loan length, even after adjusting for impor tant confounders such as the amount requested and amount funded at which the Loa n transaction occur. Methods: Data Collection: We used to data provided to us in form of links in course era https://spark-public.s3.amazonaws.com/dataanalysis/loansData.csv https://spark-public.s3.amazonaws.com/dataanalysis/loansData.rda Exploratory Analysis: Exploratory analysis was performed by examining tables and plots of the obse rved data. We identified transformations to perform on the raw data on the basis of plots and knowledge of the scale of measured variables. Exploratory analysis was used to identify missing values, verify the quality of the data, and det ermine the terms used in the regression model relating interest rate and loan le ngth. Statistical Modelling: To relate interest rate to loan length we performed a standard multivariate linear regression model [4]. Model selection was performed on the basis of our exploratory analysis and prior knowledge of the relationship between amount requ ested and amount funded. Coefficients were estimated with ordinary least squares and standard errors were calculated using standard asymptotic approximations. Reproducibility: All analyses performed in this manuscript are reproduced in the R markdown file loansdata.rda.To reproduce the exact results presented in this manuscript the ca ched version of the analysis must be performed, as the data available from loans data.csv changes based on the date. Results: The Loans data used in this analysis contains information on the source network that measured the amount requested, amount funded, Interest Rate, Loan Purpose a nd Debt to income ratio, Home owner ship and Fico range and Loan length. We iden tified no missing values in the data set we collected and all measured variables were observed to be inside the standard ranges. Loans in this data set also did not seem to show major patterns over time in Interest rate or Fico rate.

Vous aimerez peut-être aussi

- AdidasDocument5 pagesAdidasDivya KakumanuPas encore d'évaluation

- LogDocument167 pagesLogDivya KakumanuPas encore d'évaluation

- Curriculum VitaeDocument1 pageCurriculum VitaeDivya KakumanuPas encore d'évaluation

- Introduction To WCF Data Service and ODATADocument21 pagesIntroduction To WCF Data Service and ODATADivya KakumanuPas encore d'évaluation

- Introduction To UID and Impact On MicropaymentsDocument14 pagesIntroduction To UID and Impact On MicropaymentsDivya KakumanuPas encore d'évaluation

- MatchDocument4 pagesMatchDivya KakumanuPas encore d'évaluation

- ClearCase Build Commands&ResultDocument11 pagesClearCase Build Commands&ResultDivya KakumanuPas encore d'évaluation

- Part List Publishing - Layout and Setup ScreenDocument6 pagesPart List Publishing - Layout and Setup ScreenDivya KakumanuPas encore d'évaluation

- ClearCase Build Commands&ResultDocument11 pagesClearCase Build Commands&ResultDivya KakumanuPas encore d'évaluation

- ClearCase Build Commands&ResultDocument11 pagesClearCase Build Commands&ResultDivya KakumanuPas encore d'évaluation

- FilesDocument1 pageFilesDivya KakumanuPas encore d'évaluation

- DescriptionDocument1 pageDescriptionDivya KakumanuPas encore d'évaluation

- AnalysisDocument3 pagesAnalysisDivya KakumanuPas encore d'évaluation

- 12thconvocation Andhrajyothi Nov27th2013Document1 page12thconvocation Andhrajyothi Nov27th2013Divya KakumanuPas encore d'évaluation

- Online Voting System - ScopeDocument2 pagesOnline Voting System - ScopeDivya KakumanuPas encore d'évaluation

- Proguard ProjectDocument1 pageProguard ProjecthenryquePas encore d'évaluation

- Missing NosDocument1 pageMissing NosDivya KakumanuPas encore d'évaluation

- PuzzleDocument1 pagePuzzleDivya KakumanuPas encore d'évaluation

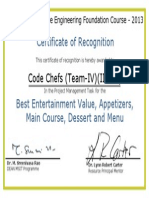

- Certificate - Team 1 (IIIT - Project Management Week) PDFDocument1 pageCertificate - Team 1 (IIIT - Project Management Week) PDFDivya KakumanuPas encore d'évaluation

- Section 1 - Introduction To Binary TreesDocument27 pagesSection 1 - Introduction To Binary Treesblack Snow100% (1)

- AnalysisDocument3 pagesAnalysisDivya KakumanuPas encore d'évaluation

- New Doc 7Document1 pageNew Doc 7Divya KakumanuPas encore d'évaluation

- My Interview ExperineceDocument2 pagesMy Interview ExperineceDivya KakumanuPas encore d'évaluation

- Certificate - Team 3 (IIIT - Project Management Week) PDFDocument1 pageCertificate - Team 3 (IIIT - Project Management Week) PDFDivya KakumanuPas encore d'évaluation

- Certificate - Team 4 (IIIT - Project Management Week) PDFDocument1 pageCertificate - Team 4 (IIIT - Project Management Week) PDFDivya KakumanuPas encore d'évaluation

- Android Staff PDFDocument7 pagesAndroid Staff PDFDivya KakumanuPas encore d'évaluation

- Certificate - Team 1 (IIIT - Project Management Week) PDFDocument1 pageCertificate - Team 1 (IIIT - Project Management Week) PDFDivya KakumanuPas encore d'évaluation

- Report On SJM Module-11 (User Access Control) : By: B.Mahesh (201285007) K.Divya (201285030) P.Rajesh (201285104)Document7 pagesReport On SJM Module-11 (User Access Control) : By: B.Mahesh (201285007) K.Divya (201285030) P.Rajesh (201285104)Divya KakumanuPas encore d'évaluation

- Report On SJM Module-11 (User Access Control) : By: B.Mahesh (201285007) K.Divya (201285030) P.Rajesh (201285104)Document7 pagesReport On SJM Module-11 (User Access Control) : By: B.Mahesh (201285007) K.Divya (201285030) P.Rajesh (201285104)Divya KakumanuPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ProjectDocument23 pagesProjectSaakshi TripathiPas encore d'évaluation

- A Stduy of Working Capital Management of Everest Bank Limited LaxmiDocument7 pagesA Stduy of Working Capital Management of Everest Bank Limited LaxmiMukesh CnghPas encore d'évaluation

- 2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Document116 pages2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Maha8888Pas encore d'évaluation

- BERLE Theory of Enterprise 1947Document17 pagesBERLE Theory of Enterprise 1947Sofia DavidPas encore d'évaluation

- Specialized Industry Finals - With AnswerDocument16 pagesSpecialized Industry Finals - With AnswerXXXXXXXXXXXXXXXXXXPas encore d'évaluation

- Assignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessDocument7 pagesAssignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in BusinessTuong Tran Gia LyPas encore d'évaluation

- PAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsDocument15 pagesPAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsSandeep ModhPas encore d'évaluation

- Module 11 DepreciationDocument15 pagesModule 11 Depreciationzulma siregarPas encore d'évaluation

- EPF Nomination FormDocument3 pagesEPF Nomination Formjhaji24Pas encore d'évaluation

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaPas encore d'évaluation

- Aof Dsa Odmfs05837 30112023Document8 pagesAof Dsa Odmfs05837 30112023kbank0510Pas encore d'évaluation

- Advanced Bank MamagementDocument43 pagesAdvanced Bank MamagementKarur KumarPas encore d'évaluation

- Dividend Discount Model - Commercial Bank Valuation (FIG)Document2 pagesDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiPas encore d'évaluation

- Finance of International Trade and Related Treasury OperationsDocument2 pagesFinance of International Trade and Related Treasury OperationsmuhammadPas encore d'évaluation

- Land Revenue Systems in British India: Zamindari, Ryotwari and Mahalwari Systems ExplainedDocument3 pagesLand Revenue Systems in British India: Zamindari, Ryotwari and Mahalwari Systems ExplainedSanjeev ChaudharyPas encore d'évaluation

- Joint and Solidary ObligationsDocument13 pagesJoint and Solidary ObligationsNimfa Sabanal100% (2)

- Call money market development in IndiaDocument17 pagesCall money market development in IndiaAnkit SaxenaPas encore d'évaluation

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshPas encore d'évaluation

- A Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byDocument23 pagesA Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byVarsha PaygudePas encore d'évaluation

- Journalizing TransactionsDocument19 pagesJournalizing TransactionsChristine Paola D. LorenzoPas encore d'évaluation

- Business Differences in Developing CountriesDocument2 pagesBusiness Differences in Developing CountriesSevinc SalmanovaPas encore d'évaluation

- Sashaevdakov 5cents On Life1Document142 pagesSashaevdakov 5cents On Life1abcdPas encore d'évaluation

- Community Profile LeskovacDocument118 pagesCommunity Profile Leskovacsrecko_stamenkovicPas encore d'évaluation

- Icici BankDocument37 pagesIcici BankNitinAgnihotriPas encore d'évaluation

- Credit Rating Changes and Stock Market Reaction: The Impact of Investor SentimentDocument30 pagesCredit Rating Changes and Stock Market Reaction: The Impact of Investor SentimenttavaxoPas encore d'évaluation

- Internship Report On Bank Alfalah On MarkeintgDocument64 pagesInternship Report On Bank Alfalah On Markeintgliza007100% (1)

- Intro To Banking M3 BankBusinessAndOperatingModels FINALDocument17 pagesIntro To Banking M3 BankBusinessAndOperatingModels FINALanuj guptaPas encore d'évaluation

- Children Education Allowance Claim FormDocument3 pagesChildren Education Allowance Claim FormSUSHIL KUMARPas encore d'évaluation

- The Following Information Is Available About The Capital Structure For PDFDocument1 pageThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanPas encore d'évaluation

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaPas encore d'évaluation