Académique Documents

Professionnel Documents

Culture Documents

Applebee Affidavit

Transféré par

Jon CampbellCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Applebee Affidavit

Transféré par

Jon CampbellDroits d'auteur :

Formats disponibles

STATE OF NEW YORK SUPREME COURT

COUNTY OF ALBANY

NEW YORK STATE UNITED TEACHERS by its President RICHARD C. IANNUZZI, NAOMI AVERY, SETII COHEN, TIMOTHY M1CHAEL EHLERS, KATHLEEN TOBIN FLUSSER, M1CHAEL LILLIS, ROBERT PEARL as a Parent, Individually and on behalf of his childrenKYLEIGH PEARL, MICAELA PEARL, AVA PEARL and NOLAN PEARL, BRIAN PICKFORD, HILARY STRONG as a Parent, Individually and on behalf of her child KEVIN STRONG, Plaintiffs, -againstThe STATE OF NEW YORK, ANDREWM. CUOMO as Governor of the State of New York, THOMAS P. DiNAPOLI as Comptroller of the State ofNew York, and JOHN B. KING, JR., as Commissioner of the New York State Education Department, Defendants.

AFFIDAVIT OF PETER APPLEBEE Index No.: 963-13 Hon. Kimberly A. O'Connor

STATE OF NEW YORK COUNTY OF ALBANY

) )ss.: )

PETER APPLEBEE, being duly sworn, deposes and says: 1. I currently serve as Manager of Higher Education, Education Finance, and Federal

Programs within plaintiff New York State United Teachers' ("NYSUT") Research Department. Prior to joining NYSUT in 2010, I served as Assistant Chief Budget Examiner for the New York State Division ofthe Budget, Deputy Director and Assistant Director ofthe New York State Senate Finance Committee, Director and Assistant Director of the New York State Senate Education

Committee, Program Associate in the New York State Senate's Office of Counsel and Program, and Education Finance Associate for the New York State Senate Education Committee. In all, I have nearly 20 years of experience in the government sector with budget analysis. In these positions I played significant roles in analyzing and negotiating education budgeting on behalf of both the Executive and the State Senate. My knowledge and expertise gives me unique insight into the effects of the tax cap insofar as school funding. 2. I submit this affidavit to provide background on the tax cap's requirements, the

disproportionate impact it has on school districts versus other municipalities, the overall effect the cap has on perpetuating funding inequities between wealthy and poor school districts, and specifically how that perpetuation has affected and will continue to affect student performance.

Summary o[Chapter 97 ofthe Laws 0[2011

3. In June, 2011, the Governor signed Chapter 97 of the Laws of 2011. Chapter 97

enacted a tax cap for both municipalities and school districts starting with fiscal years that began in the 2012 calendar year. There is no tax cap imposed on New York City. 4. Chapter 97 has been described as establishing a two percent tax cap. However, the

measure actually prohibits any tax increase without voter approval. Prior to the cap, after a school budget was defeated, a school board could impose a contingency budget that levied a tax increase, albeit within certain statutory spending parameters. Under the cap, without voter approval a school district may not increase the tax levy above the previous year's levy. In order for a district to

increase their tax levy within the calculated tax levy limit, a simple majority of voters must approve the budget. However, if a district wishes to raise the levy above their tax levy limit, then at least sixty percent of the voters must approve the budget. 2

5.

Chapter 97 severely limits the ability ofschool districts to provide a quality education

and will impair the ability of districts to close the student achievement gap in New York. The tax cap has had, and will continue to have, a detrimental effect on public schools in this state, particularly in low wealth communities. 6. This cap is pernicious in a variety of ways. First, school districts cannot increase the

tax levy without voter approval. Second, this limit on taxation is not connected or measured against any educational needs the students of a district may have. Third, schools with growing enrollment are at a significant disadvantage since the school district may not add tax levy to hire additional teachers, add bus routes, etc., as enrollment rises. Therefore if a district experienced a ten percent growth in student enrollment, the district may not increase the tax levy to fund the additional services required for these new students. Fourth, districts that are required to pay a refund oftaxes as a result of a tax certiorari process may not raise additional tax levy to make such a payment. In many instances, a large tax certiorari covers multiple tax years and the sum can be significant relative to district size. In addition, the tax certiorari process is a challenge to assessment levels which are not set by the district. 7. The contingency budget construct is particularly problematic for school districts. If

a district fails to pass a budget, then the district must adopt a contingency budget. Under Chapter 97 a district on a contingency budget cannot increase the dollar value ofthe levy above the prior year levy. In addition, the district incurs a permanent loss ofthe tax base generated by new construction when on a contingency budget. A district on a contingency budget may not increase the dollar value of the levy even if new construction occurs. Assume a large commercial construction project is undertaken in a small low-wealth school district. This large construction project may add 50% to

the total taxable value in the school district. However, if a school district is on a contingency budget in the year when this project first appears on the tax rolls, the school district would be required to reduce the tax rate proportionately to ensure that the total number ofdollars collected via the tax levy does not increase above the prior year. In future years the district does not receive the benefit of the increased tax base since the exemption for new construction only relates to new construction that occurs in that tax levy year, not in prior years.

Disproportionate Impact on School Districts Compared to Other Municipalities

8. The process by which the tax cap may be overridden is substantially different for

school districts versus all other entities covered by the tax cap enacted in Chapter 97 of 2011. School districts are required to obtain a sixty percent "yes" vote from the public in order to exceed their tax cap. In addition, a school district is required to place on the ballot a notice which indicates to voters that the proposed budget would increase the tax levy above the allowable tax levy limit. All other non-school municipalities covered by the tax cap must only 0 btain a sixty percent maj ority of the governing board of the municipality. Ifa municipal entity has a three or five member board, a simple majority is the same number of votes as a sixty percent majority. The effect of this bifurcated system between school districts and municipalities is to set a higher bar for schools districts to exceed their tax levy limit. As a result fewer school districts are able to exceed the tax cap. 9. There have been two years of tax levies that have been subj ect to the tax cap. In

September 2012, the Governor issued a report which detailed that out of3,077 local governments and school districts reporting, 84 percent reported a levy within the capped amount for the 2012-13

year. The report found that a much lower percentage ofschool districts were able to exceed their tax levy limit 36 of 678 or 5 percent of school districts exceeded their tax levy limit. This is

comparable to 455 of 2,399 or 19 percent of (non-school districts) local governments reported their proposed levy exceeded the cap. 10. The data for 2013 indicates a similar disparate impact of the tax cap on school

districts compared to other municipalities. The State Comptroller's Office collected data from municipalities on how many "planned" to exceed their tax cap limit for 2013. In 2013, 33% of counties (19 of the 57 non-NYC counties) indicated they would exceed the cap. The 19 override counties include Albany County, even though the Office of the State Comptroller data set did not include Albany County. Albany County did exceed their tax levy limit in 2013

(http://blog.timesunion.comllocalpolitics/I3 7131 albany-county-exceeds-tax-cap-again-with-govhelp/). 11. There are 62 cities in New York State but the cap doesn't apply to New York City.

Fourteen of the sixty-one cities (23%) to which the tax cap applies indicated they would override their tax cap for 2013.252 of the 932 towns (27%) indicated they would exceed their tax cap. 195 of the 551 villages (35%) indicated that they would override their tax cap. 12. However, only 28 of the 669 districts (4%) which held budget votes attempted to

override their tax cap for the 2013-14 school year. There were 28 school districts that attempted to override their tax levy limit, meaning the budget proposal required a "super-majority" 60% "yes" vote in order to be adopted. Of those 28 districts, 7 were successful in reaching that 60% threshold on the first attempt and 21 were defeated. Ofthe 21 defeated districts, 14 achieved a maj ority vote but failed to reach the 60% threshold. On re-vote, only three (3) of the defeated budgets were

5

successful in piercing the cap. Furthermore, three (3) additional districts failed to garner majority approval on re-vote and, under the tax cap, those districts were required to adopt contingency budgets that levy a tax no greater than the year before. Notably, two of those three districts are significantly less than average in terms ofwealth: Remsen Central School District (.698 Combined Wealth Ratio)1 and Wilson Central School District (.587 CWR). The chart below illustrates this disparate impact.

2013 Local Governments Number that Planned!Attempted to Override their Tax Cap School Districts Counties Cities Towns Villages 28 19 14 252 195

Percentage 4% 33% 23% 27% 35%

The Tax Cap Increases Funding Inequities Between Wealthy And Poor Districts 13. The 2012-13 School Property Tax Report Card, published by the New York State

Education Department, included data on tax levy and school spending. As illustrated below, the numbers staggeringly show that the districts that are able to raise significantly more revenue even without piercing the cap already spend significantly more per student. undoubtedly widen as a result of the cap. This disparity will

1 The Combined Wealth Ratio (CWR) is a measure of relative wealth, indexing each district against the statewide average on a combination of two factors, property wealth per pupil and income wealth per pupil. The state average CWR is defmed as being equivalent to 1.0. Districts with a ratio greater than 1.0 are wealthier than the state average, while districts with a ratio ofless than 1.0 have below average wealth.

2012-13 Change in Tax Levy

Decile by Combined Wealth Ratio Poorest Decile 2 nd Decile 3rd Decile 8th Decile 9th Decile Wealthiest Decile Change in Levy Per Pupil $114 $133 $206 $523 $614 $704 Spending per Pupil $19,823 $19,343 $19,241 $22,510 $26,066 $35,690

14.

In 2012-13, the poorest districts only raised their tax levy per pupil by amounts

between $114 and $206 dollars, whereas the wealthiest districts increased their levy per pupil by over $700 dollars. This further exacerbates the spending differences between low and high wealth communities. 15. Clearly, there is a significant spending difference between lowwealth and high wealth

districts. In 20 12-13 the wealthiest districts spent 80 percent more per pupil than the poorest districts as ranked by the Combined Wealth Ratio. The poorest decile of districts spent $19,823 per pupil and the wealthiest district spent $35,690 per pupil, even though the educational needs of pupils in poorer districts tend to be greater. 16. The table below represents the total amount of tax levy per pupil that would be

generated ifevery district in the respective deciles rose up to their maximum allowable tax levy limit under their tax cap calculation without needing a super majority voter approval. The wealthiest districts already spent over 80 percent more than the poorest districts and the tax cap only allows poor districts to raise $4,970 per pupil, less than 20 percent of the amount of dollars which high wealth districts can raise ($27,313). This will increase the spending disparity over time between low wealth and high wealth districts. 7

Total Allowable Tax Levy Per Pupil Under the Tax Levy Limit

Decile Poorest Wealthiest

2013-2014 $4,970 $27,313

School and Student Performance

17.

The state administered new assessments in the Spring 2013 which were aligned with

the new Common Core Learning Standards. The results from those assessments indicate an inexorable correlation between performance, wealth levels, and spending per student. The chart below displays the percent ofpupils who scored at "proficient" or higher on the grades 3 -8 Math and English Language Arts exams. Districts are sorted by the Combined Wealth Ratio. The poorest groups of districts have less than 25% of pupils scoring at a proficient level on the State exams and spend approximately $19,800 per student. On the other end of the spectrum, the wealthiest groups of districts have almost 50% of their pupils reaching the proficiency level and spend $35,690 per student. The chasm between these numbers will only widen if the lower performing districts are continued to be deprived oflocal control over budgeting, particularly in light of the state's failure to meet its funding obligations. See the chart below.

Percent Proficient on 2013 Grades 3 - 8 Math and ELA Exams Decile By CWR ELA Proficiency Math Proficiency Spending Per Pupil 18% 1 (Poorest) 21% $19,823 25% 22% 2 $19,343 28% 25% 3 $19,241 4 29% 27% $20,114 31% 5 28% $19,360 32% 28% 6 $20,345 39% 7 36% $21,092 40% 37% 8 $22,510 43% 40% 9 $26,066 10 (Wealthiest) 49% 45% $35,690

18.

For all the reasons set forth above, I respectfully submit that defendants' motion to

dismiss should be denied in its entirety.

Notary Public, State of � � � York No.02BE6092817 Ql!alffied in Onondaga COY CommISsion Expires May � � � � �

MATTHEWE. BERG!=RON

IJJ; 5_

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- FS ModelDocument13 pagesFS Modelalfx216Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Buy Your First HouseDocument13 pagesBuy Your First HouseAlonzo AventsPas encore d'évaluation

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazPas encore d'évaluation

- Comparative Analysis 8424 and 10963Document31 pagesComparative Analysis 8424 and 10963Rizza Angela Mangalleno100% (2)

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoPas encore d'évaluation

- AttyAffirmation For Omnibus Motion - FinalDocument4 pagesAttyAffirmation For Omnibus Motion - FinalJon CampbellPas encore d'évaluation

- Tax Return BillDocument4 pagesTax Return BillJon CampbellPas encore d'évaluation

- Opinion Re Legislative LawDocument4 pagesOpinion Re Legislative LawCasey SeilerPas encore d'évaluation

- Morabito DecisionDocument3 pagesMorabito DecisionJon CampbellPas encore d'évaluation

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490Pas encore d'évaluation

- NYS Department of Health Aca Repeal AnalysisDocument2 pagesNYS Department of Health Aca Repeal AnalysisMatthew HamiltonPas encore d'évaluation

- Schneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitDocument33 pagesSchneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitMatthew HamiltonPas encore d'évaluation

- Chamber of CommerceDocument1 pageChamber of CommerceRyan WhalenPas encore d'évaluation

- Sexual Offense Evidence Kit Inventory Report 3-1-17Document26 pagesSexual Offense Evidence Kit Inventory Report 3-1-17Jon Campbell100% (1)

- Schneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitDocument33 pagesSchneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitMatthew HamiltonPas encore d'évaluation

- FHWA DOT LettersDocument4 pagesFHWA DOT LettersJon CampbellPas encore d'évaluation

- Gaddy SummonsDocument2 pagesGaddy SummonsJon CampbellPas encore d'évaluation

- Acacia v. SUNY RF Et AlDocument12 pagesAcacia v. SUNY RF Et AlJon CampbellPas encore d'évaluation

- Cuomo StatementDocument5 pagesCuomo StatementJon CampbellPas encore d'évaluation

- FOIA 2017 0037 Response Letter 15 19Document5 pagesFOIA 2017 0037 Response Letter 15 19Jon CampbellPas encore d'évaluation

- US v. Percoco Et Al Indictment - Foreperson SignedDocument36 pagesUS v. Percoco Et Al Indictment - Foreperson SignedNick ReismanPas encore d'évaluation

- Orange County CaseDocument42 pagesOrange County CaseJon CampbellPas encore d'évaluation

- US v. Kang and Kelley IndictmentDocument27 pagesUS v. Kang and Kelley IndictmentJon CampbellPas encore d'évaluation

- Stronger Neighborhoods PAC/SerinoDocument2 pagesStronger Neighborhoods PAC/SerinoJon CampbellPas encore d'évaluation

- FHWA - Presentation - NY SignsDocument112 pagesFHWA - Presentation - NY SignsJon Campbell100% (1)

- FHWA Nov 2016 LetterDocument2 pagesFHWA Nov 2016 LetterJon CampbellPas encore d'évaluation

- NY DFS LawsuitDocument77 pagesNY DFS LawsuitJon CampbellPas encore d'évaluation

- Trump Foundation Notice of Violation 9-30-16Document2 pagesTrump Foundation Notice of Violation 9-30-16Cristian Farias100% (1)

- Stronger Neighborhoods PAC/SerinoDocument2 pagesStronger Neighborhoods PAC/SerinoJon CampbellPas encore d'évaluation

- Stronger Neighborhoods PAC/LatimerDocument2 pagesStronger Neighborhoods PAC/LatimerJon CampbellPas encore d'évaluation

- Skelos Opening Brief v17 - SignedDocument70 pagesSkelos Opening Brief v17 - SignedJon CampbellPas encore d'évaluation

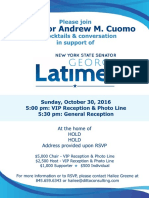

- Latimer Oct 30 EventDocument2 pagesLatimer Oct 30 EventJon CampbellPas encore d'évaluation

- DiNapoli MTA ReportDocument8 pagesDiNapoli MTA ReportJon CampbellPas encore d'évaluation

- New York State Offshore Wind BlueprintDocument24 pagesNew York State Offshore Wind BlueprintJon CampbellPas encore d'évaluation

- 2016 9 20 Letter To A David Re ISTOPDocument3 pages2016 9 20 Letter To A David Re ISTOPJon CampbellPas encore d'évaluation

- C.A IPCC May 2008 Tax SolutionsDocument13 pagesC.A IPCC May 2008 Tax SolutionsAkash GuptaPas encore d'évaluation

- The Effects of Education On CrimeDocument12 pagesThe Effects of Education On CrimeMicaela FORSCHBERG CASTORINOPas encore d'évaluation

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarPas encore d'évaluation

- Taxes During the Spanish Period: From Tribute to Cedula TaxDocument21 pagesTaxes During the Spanish Period: From Tribute to Cedula TaxJannah Fate100% (1)

- Assessment 1 - Written or Oral QuestionsDocument7 pagesAssessment 1 - Written or Oral Questionswilson garzonPas encore d'évaluation

- Bài tập trên lớp buổi 11Document4 pagesBài tập trên lớp buổi 11Thuỳ AnPas encore d'évaluation

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainPas encore d'évaluation

- WINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954Document6 pagesWINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954schwartzdaven7Pas encore d'évaluation

- Atty Lapuz (100-112) DigestDocument4 pagesAtty Lapuz (100-112) DigestRAINBOW AVALANCHE100% (1)

- Dimma HoneyDocument9 pagesDimma HoneyAnonymous h2hxB1Pas encore d'évaluation

- ITB NotesDocument84 pagesITB NotesSadiaPas encore d'évaluation

- Dissecting The India Hospitality IndustryDocument14 pagesDissecting The India Hospitality IndustrySwapnesh R JainPas encore d'évaluation

- Using ReceivingDocument94 pagesUsing ReceivingPavlina StoqnovaPas encore d'évaluation

- Plan Fiscal Del CRIMDocument34 pagesPlan Fiscal Del CRIMEl Nuevo DíaPas encore d'évaluation

- Uniform CPA Examination. Questions and Unofficial Answers 1989 N PDFDocument97 pagesUniform CPA Examination. Questions and Unofficial Answers 1989 N PDFJeremie RealinoPas encore d'évaluation

- DT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniDocument281 pagesDT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniIshani MukherjeePas encore d'évaluation

- Micro 2013 ZA QPDocument8 pagesMicro 2013 ZA QPSathis JayasuriyaPas encore d'évaluation

- 1601 CDocument16 pages1601 CROGELIO QUIAZON100% (1)

- Priyanka RajputDocument48 pagesPriyanka RajputNitinAgnihotriPas encore d'évaluation

- The Economic of Cloud ComputingDocument17 pagesThe Economic of Cloud ComputingLouise ANPas encore d'évaluation

- MH 2223 90443 PDFDocument6 pagesMH 2223 90443 PDFHarsh PatelPas encore d'évaluation

- Central & State RelationsDocument8 pagesCentral & State RelationsVISWA TEJA NemaliPas encore d'évaluation

- PCU Capstone Project Analyzes Demand for Job Order Contact Tracers at BIRDocument3 pagesPCU Capstone Project Analyzes Demand for Job Order Contact Tracers at BIRdaniela riveraPas encore d'évaluation

- Risk Analysis ExampleDocument8 pagesRisk Analysis ExampleRyan SooknarinePas encore d'évaluation

- Municipalities & Cities Reclaim Foreshore LandsDocument2 pagesMunicipalities & Cities Reclaim Foreshore LandsIELTSPas encore d'évaluation