Académique Documents

Professionnel Documents

Culture Documents

Credit Supernova!: Investment Outlook

Transféré par

Joaquim MorenoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Credit Supernova!: Investment Outlook

Transféré par

Joaquim MorenoDroits d'auteur :

Formats disponibles

Your Global Investment Authority

Investment Outlook

February 2013

Bill Gross

Credit Supernova!

Tey say that time is

money.* What they dont

say is that money may be

running out of time.

There may be a natural

evolution to our fractionally

reserved credit system which

characterizes modern global

nance. Much like the universe,

which began with a big bang nearly 14 billion years ago, but is expanding

so rapidly that scientists predict it will all end in a big freeze trillions of

years from now, our current monetary system seems to require perpetual

expansion to maintain its existence. And too, the advancing entropy in the

physical universe may in fact portend a similar decline of energy and

heat within the credit markets. If so, then the legitimate response of

creditors, debtors and investors inextricably intertwined within it, should

logically be to ask about the economic and investment implications of its

ongoing transition.

But before mimicking T.S. Eliot on the way our monetary system might

evolve, let me rst describe the big bang beginning of credit markets,

so that you can more closely recognize its transition. The creation of credit

in our modern day fractional reserve banking system began with a deposit

and the protable expansion of that deposit via leverage. Banks and other

lenders dont always keep 100% of their deposits in the vault at any

one time in fact they keep very little thus the term fractional

This is the way the world ends

Not with a bang but a whimper.

T.S. Eliot

* The terms money and credit are used interchangeably in this IO. Purists would dispute the usage and I would

agree with them, arguing for the usage for simplicitys sake and the evolving homogeneity of the two.

2 FEBRUARY 2013 | INVESTMENT OUTLOOK

reserves. That rst deposit then, and the explosion

outward of 10x and more of levered lending, is modern

day nances equivalent of the big bang. When it began is

actually harder to determine than the birth of the physical

universe but it certainly accelerated with the invention of

central banking the U.S. in 1913 and with it the

increased condence that these newly licensed lenders of

last resort would provide support to nancial and real

economies. Banking and central banks were and remain

essential elements of a productive global economy.

But they carried within them an inherent instability that

required the perpetual creation of more and more credit

to stay alive. Those initial loans from that rst deposit?

They were made most certainly at yields close to the rate

of real growth and creation of real wealth in the economy.

Lenders demanded that yield because of their risk, and

borrowers were speculating that the prot on their

edgling enterprises would exceed the interest expense

on those loans. In many cases, they succeeded. But the

economy as a whole could not logically grow faster than

the real interest rates required to pay creditors, in

combination with the near double-digit returns that equity

holders demanded to support the initial leverage unless

unless it was supplied with additional credit to pay

the tab. In a sense this was a Sixteen Tons metaphor:

Another day older and deeper in debt, except few within

the credit system itself understood the implications.

Economist Hyman Minsky did. With credit now expanding,

the sophisticated economic model provided by Minsky was

working its way towards what he called Ponzi nance.

First, he claimed the system would borrow in low amounts

and be relatively self-sustaining what he termed

Hedge nance. Then the system would gain courage,

lever more into a Speculative nance mode which

required more credit to pay back previous borrowings at

maturity. Finally, the end phase of Ponzi nance would

appear when additional credit would be required just to

cover increasingly burdensome interest payments, with

accelerating ination the end result.

Minskys concept, developed nearly a half century ago

shortly after the explosive decoupling of the dollar from

gold in 1971, was primarily a cyclically contained model

which acknowledged recession and then rejuvenation once

the systems leverage had been reduced. That was then.

He perhaps could not have imagined the hyperbolic, as

opposed to linear, secular rise in U.S. credit creation that

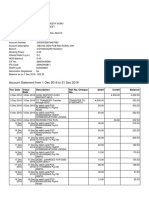

has occurred since as shown in Chart 1. (Patterns for other

developed economies are similar.) While there has been

cyclical delevering, it has always been mild even during

the Volcker era of 1979-81. When Minsky formulated his

theory in the early 70s, credit outstanding in the U.S.

totaled $3 trillion.

Today, at $56 trillion and counting, it is

a monster that requires perpetually increasing amounts of

fuel, a supernova star that expands and expands, yet, in the

Outstanding credit includes all government debt as well as corporate, household and personal debt. Does not include shadow debt estimated at $20-30 trillion.

INVESTMENT OUTLOOK | FEBRUARY 2013 3

process begins to consume itself. Each additional dollar

of credit seems to create less and less heat. In the

1980s, it took four dollars of new credit to generate

$1 of real GDP. Over the last decade, it has taken $10,

and since 2006, $20 to produce the same result.

Minskys Ponzi nance at the 2013 stage goes more and

more to creditors and market speculators and less and less

to the real economy. This Credit New Normal is entropic

much like the physical universe and the heat or real

growth that new credit now generates becomes less

and less each year: 2% real growth now instead of an

historical 3.5% over the past 50 years; likely even less as

the future unfolds.

EXPLODING SUPERNOVA

T

o

t

a

l

U

.

S

.

c

r

e

d

i

t

o

u

t

s

t

a

n

d

i

n

g

(

$

i

n

t

r

i

l

l

i

o

n

s

)

Source: Federal Reserve ow of fund accounts 2012

5

0

10

15

20

25

30

35

40

45

50

55

Total U.S. credit

market debt

(credit includes

all household,

corporate and

government debt)

1975 1980 1985 1990 2000 1995 2005 2010

Chart 1

Not only is more and more anemic credit created by lenders

as its sixteen tons becomes thirty-two, then sixty-

four, but in the process, todays near zero bound interest

rates cripple savers and business models previously

constructed on the basis of positive real yields and wider

margins for loans. Net interest margins at banks compress;

liabilities at insurance companies threaten their levered

equity; and underfunded pension plans require greater

contributions from their corporate funders unless

regulatory agencies intervene. What has followed has been

a gradual erosion of real growth as layoffs, bank branch

closings and business consolidations create less of a need

for labor and physical plant expansion. In effect, the initial

magic of credit creation turns less magical, in some cases

even destructive and begins to consume credit markets at

the margin as well as portions of the real economy it has

created. For readers demanding a more model-driven,

historical example of the negative impact of zero based

interest rates, they have only to witness the modern day

example of Japan. With interest rates close to zero for the

last decade or more, a sharply declining rate of investment

in productive plants and equipment, shown in Chart 2, is

the best evidence. A Japanese credit market supernova,

exploding and then contracting onto itself. Money and

credit may be losing heat and running out of time in other

developed economies as well, including the U.S.

Investment Strategy

If so then the legitimate question is: how much time

does money/credit have left and what are the investment

consequences between now and then? Well, rst I

will admit that my supernova metaphor is more

instructive than literal. The end of the global

4 FEBRUARY 2013 | INVESTMENT OUTLOOK

monetary system is not nigh. But the entropic

characterization is most illustrative. Credit is now

funneled increasingly into market speculation as opposed

to productive innovation. Asset price appreciation as

opposed to simple yield or carry is now critical to

maintain the systems momentum and longevity.

Investment banking, which only a decade ago promoted

small business development and transition to public

markets, now is dominated by leveraged speculation

and the Ponzi nance Minsky once warned against.

So our credit-based nancial markets and the

economy it supports are levered, fragile and

increasingly entropic it is running out of energy

and time. When does money run out of time? The

countdown begins when investable assets pose too

much risk for too little return; when lenders desert credit

markets for other alternatives such as cash or real assets.

REPEAT: THE COUNTDOWN BEGINS WHEN

INVESTABLE ASSETS POSE TOO MUCH RISK FOR

TOO LITTLE RETURN.

Visible rst signs for creditors would logically be 1) long-

term bond yields too low relative to duration risk, 2) credit

spreads too tight relative to default risk and 3) PE ratios

too high relative to growth risks. Not immediately, but over

time, credit is exchanged guratively or sometimes literally

for cash in a mattress or conversely for real assets (gold,

diamonds) in a vault. It also may move to other credit

markets denominated in alternative currencies. As it does,

domestic systems delever as credit and its supernova heat

is abandoned for alternative assets. Unless central banks

and credit extending private banks can generate real

or at second best, nominal growth with their trillions

of dollars, euros, and yen, then the risk of credit

market entropy will increase.

30

28

26

24

22

20

18

16

14

Japanese investment as a % of GDP U.S. investment as a % of GDP

Source: IMF, PIMCO

Chart 2

30

28

26

24

22

20

18

16

14

P

e

r

c

e

n

t

(

%

)

P

e

r

c

e

n

t

(

%

)

1999 2001 2003 2005 2007 2009 2011 1999 2001 2003 2005 2007 2009 2011

19.56

15.48

LANDS OF THE SETTING SUN?

INVESTMENT OUTLOOK | FEBRUARY 2013 5

The element of time is critical because investors

and speculators that support the system may not

necessarily fully participate in it for perpetuity. We

ask ourselves frequently at PIMCO, what else could we do,

what else could we invest in to avoid the consequences

of nancial repression and negative real interest rates

approaching minus 2%? The choices are varied: cash to

help protect against an inationary expansion or just the

opposite long Treasuries to take advantage of a

deationary bust; real assets; emerging market equities,

etc. One of our Investment Committee members swears

he would buy land in New Zealand and set sail. Most of

us cant do that, nor can you. The fact is that PIMCO and

almost all professional investors are in many cases index

constrained, and thus duration and risk constrained. We

operate in a world that is primarily credit based and as

credit loses energy we and our clients should acknowledge

its entropy, which means accepting lower returns on

bonds, stocks, real estate and derivative strategies that

likely will produce less than double-digit returns.

Still, investors cannot simply surrender to their

entropic destiny. Time may be running out, but time

is still money as the original saying goes. How can

you make some?

(1) Position for eventual ination: the end stage of a

supernova credit explosion is likely to produce more

ination than growth, and more chances of ination as

opposed to deation. In bonds, buy ination protection via

TIPS; shorten maturities and durations; dont ght central

banks anticipate them by buying what they buy rst;

look as well for offshore sovereign bonds with positive real

interest rates (Mexico, Italy, Brazil, for example).

(2) Get used to slower real growth: QEs and zero-based

interest rates have negative consequences. Move money

to currencies and asset markets in countries with less debt

and less hyperbolic credit systems. Australia, Brazil, Mexico

and Canada are candidates.

(3) Invest in global equities with stable cash ows

that should provide historically lower but relatively

attractive returns.

(4) Transition from nancial to real assets if possible

at the margin: buy something you can sink your teeth

into gold, other commodities, anything that cant be

reproduced as fast as credit. Think of PIMCO in this

transition. We hope to be Your Global Investment

Authority. We have a product menu to assist.

(5) Be cognizant of property rights and conscatory

policies in all governments.

(6) Appreciate the supernova characterization of our

current credit system. At some point it will transition to

something else.

We may be running out of time, but time will always

be money.

6 FEBRUARY 2013 | INVESTMENT OUTLOOK

Speed Read for Credit Supernova

1) Why is our credit market running out of heat or fuel?

a) As it expands at a rate of trillions per year, real

growth in the economy has failed to respond. More

credit goes to pay interest than future investment.

b) Zero-based interest rates, which are the result of QE

and credit creation, have negative as well as positive

effects. Historic business models may be negatively

affected and investment spending may be dampened.

c) Look to the Japanese historical example.

2) What options should an investor consider?

a) Seek ination protection in credit market assets/

shorten durations.

b) Increase real assets/commodities/stable cash ow

equities at the margin.

c) Accept lower future returns in portfolio planning.

William H. Gross

Managing Director

INVESTMENT OUTLOOK | FEBRUARY 2013 7

Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk

and may lose value. Investing in the bond market is subject to certain risks, including market, interest rate, issuer,

credit and ination risk. Equities may decline in value due to both real and perceived general market, economic and

industry conditions. Investing in foreign-denominated and/or -domiciled securities may involve heightened

risk due to currency uctuations, and economic and political risks, which may be enhanced in emerging markets.

Currency rates may uctuate signicantly over short periods of time and may reduce the returns of a portfolio.

Sovereign securities are generally backed by the issuing government. Obligations of U.S. government agencies and

authorities are supported by varying degrees, but are generally not backed by the full faith of the U.S. government;

portfolios that invest in such securities are not guaranteed and will uctuate in value. Ination-linked bonds

(ILBs) issued by a government are xed income securities whose principal value is periodically adjusted according to

the rate of ination; ILBs decline in value when real interest rates rise. Treasury Ination-Protected Securities

(TIPS) are ILBs issued by the U.S. government. Commodities contain heightened risk including market, political,

regulatory and natural conditions, and may not be suitable for all investors.

The views and strategies described herein are for illustrative purposes only and may not be suitable for all investors.

The information is not based on any particularized nancial situation, or need, and is not intended to be, and should

not be construed as investment advice or a recommendation for any specic PIMCO or other strategy, product or

service. Investors should consult their nancial advisor prior to making an investment decision. There is no guarantee

that these investment strategies will work under all market conditions and each investor should evaluate their ability

to invest long-term, especially during periods of downturn in the market.

This material contains the current opinions of the author but not necessarily those of PIMCO and such opinions are

subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates,

and certain information contained herein are based upon proprietary research and should not be considered as

investment advice or a recommendation of any particular security, strategy or investment product. Information

contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO provides services only to qualied institutions and investors. This is not an offer to any person in any

jurisdiction where unlawful or unauthorized. | Pacic Investment Management Company LLC, 840 Newport

Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. |

PIMCO Europe Ltd (Company No. 2604517), PIMCO Europe, Ltd Munich Branch (Company No. 157591), PIMCO

Europe, Ltd Amsterdam Branch (Company No. 24319743), and PIMCO Europe Ltd - Italy (Company No.

07533910969) are authorised and regulated by the Financial Services Authority (25 The North Colonnade, Canary

Wharf, London E14 5HS) in the UK. The Amsterdam, Italy and Munich Branches are additionally regulated by the AFM,

CONSOB in accordance with Article 27 of the Italian Consolidated Financial Act, and BaFin in accordance with Section

53b of the German Banking Act, respectively. PIMCO Europe Ltd services and products are available only to

professional clients as dened in the Financial Services Authoritys Handbook and are not available to individual

investors, who should not rely on this communication. | PIMCO Deutschland GmbH (Company No. 192083,

Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory

Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of

the German Banking Act (KWG). The services and products provided by PIMCO Deutschland GmbH are available only

to professional clients as dened in Section 31a para. 2 German Securities Trading Act (WpHG). They are not available

to individual investors, who should not rely on this communication. | PIMCO Asia Pte Ltd (501 Orchard Road

#08-03, Wheelock Place, Singapore 238880, Registration No. 199804652K) is regulated by the Monetary Authority of

Singapore as a holder of a capital markets services licence and an exempt nancial adviser. PIMCO Asia Pte Ltd

services and products are available only to accredited investors, expert investors and institutional investors as dened

in the Securities and Futures Act. | PIMCO Asia Limited (24th Floor, Units 2402, 2403 & 2405 Nine Queens Road

Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities

under the Securities and Futures Ordinance. The asset management services and investment products are not

available to persons where provision of such services and products is unauthorised. | PIMCO Australia Pty Ltd

(Level 19, 363 George Street, Sydney, NSW 2000, Australia), AFSL 246862 and ABN 54084280508, offers services to

wholesale clients as dened in the Corporations Act 2001. | PIMCO Japan Ltd (Toranomon Towers Ofce 18F,

4-1-28, Toranomon, Minato-ku, Tokyo, Japan 105-0001) Financial Instruments Business Registration Number is

Director of Kanto Local Finance Bureau (Financial Instruments Firm) No.382. PIMCO Japan Ltd is a member of Japan

Investment Advisers Association and Investment Trusts Association. Investment management products and services

offered by PIMCO Japan Ltd are offered only to persons within its respective jurisdiction, and are not available to

persons where provision of such products or services is unauthorized. Valuations of assets will uctuate based upon

prices of securities and values of derivative transactions in the portfolio, market conditions, interest rates, and credit

risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates.

There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be

realized; the investment could suffer a loss. All prots and losses incur to the investor. The amounts, maximum

amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending

on the investment strategy, the status of investment performance, period of management and outstanding balance of

assets and thus such fees and expenses cannot be set forth herein. | PIMCO Canada Corp. (120 Adelaide Street

West, Suite 1901, Toronto, Ontario, Canada M5H 1T1) services and products may only be available in certain

provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America

Edifcio Internacional Rio Praia do Flamengo, 154 1o andar, Rio de Janeiro RJ Brasil 22210-030. | No part of this

publication may be reproduced in any form, or referred to in any other publication, without express written

permission. PIMCO and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Allianz

Asset Management of America L.P. and Pacic Investment Management Company LLC, respectively, in the United

States and throughout the world. 2013, PIMCO.

12-1311_GBL

Newport Beach

840 Newport Center Drive

Newport Beach, CA 92660

+1 949.720.6000

Amsterdam

Hong Kong

London

Milan

Munich

New York

Rio de Janeiro

Singapore

Sydney

Tokyo

Toronto

Zurich

pimco.com

Vous aimerez peut-être aussi

- The New Depression: The Breakdown of the Paper Money EconomyD'EverandThe New Depression: The Breakdown of the Paper Money EconomyÉvaluation : 4 sur 5 étoiles4/5 (5)

- Liquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkDocument10 pagesLiquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkAnonymous i8ErYPPas encore d'évaluation

- Last Resort: The Financial Crisis and the Future of BailoutsD'EverandLast Resort: The Financial Crisis and the Future of BailoutsPas encore d'évaluation

- Economic Crisis Matttick JRDocument31 pagesEconomic Crisis Matttick JRAnonymous mOdaetXf7iPas encore d'évaluation

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsD'EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsPas encore d'évaluation

- Dawn of The New Inflation: by Keith ChesterDocument3 pagesDawn of The New Inflation: by Keith ChestercolleteantoinePas encore d'évaluation

- An Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedD'EverandAn Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedPas encore d'évaluation

- When Collateral Is KingDocument12 pagesWhen Collateral Is KingCoolidgeLowPas encore d'évaluation

- David Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1Document6 pagesDavid Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1AAOI2Pas encore d'évaluation

- Reinventing Banking: Capitalizing On CrisisDocument28 pagesReinventing Banking: Capitalizing On Crisisworrl samPas encore d'évaluation

- The Big Short Case StudyDocument5 pagesThe Big Short Case StudyMaricar RoquePas encore d'évaluation

- Jorg Guido Hulsmann - Deflation and Liberty (2008)Document46 pagesJorg Guido Hulsmann - Deflation and Liberty (2008)Ragnar DanneskjoldPas encore d'évaluation

- The Bailout's New Financial OligarchyDocument17 pagesThe Bailout's New Financial OligarchyvanathelPas encore d'évaluation

- Bill GrosBill GrossDocument4 pagesBill GrosBill GrossJuan HervadaPas encore d'évaluation

- U.S. Sub-Prime Crisis & Its Global ConsequencesDocument33 pagesU.S. Sub-Prime Crisis & Its Global ConsequencesakkikhanejadevPas encore d'évaluation

- Harry DentDocument7 pagesHarry DentScott Dykstra100% (1)

- Andreas Whittam Smith: We Could Be On The Brink of A Great DepressionDocument4 pagesAndreas Whittam Smith: We Could Be On The Brink of A Great DepressionBarbosinha45Pas encore d'évaluation

- Article 2014 06 Analytic Insights Mispriced RiskDocument12 pagesArticle 2014 06 Analytic Insights Mispriced RisklcmgroupePas encore d'évaluation

- Worst financial crisis marks end of eraDocument2 pagesWorst financial crisis marks end of eraJiajun YangPas encore d'évaluation

- Final Asignmnt 2 MacroDocument6 pagesFinal Asignmnt 2 Macrorashid6056Pas encore d'évaluation

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakerotePas encore d'évaluation

- Government Intervention and Debt Stimulus Rarely Solve Economic IssuesDocument9 pagesGovernment Intervention and Debt Stimulus Rarely Solve Economic IssueskakerotePas encore d'évaluation

- Wheres The Money-BLDocument32 pagesWheres The Money-BLMandela E'mmaPas encore d'évaluation

- The 2008 Financial CrisisDocument14 pagesThe 2008 Financial Crisisann3cha100% (1)

- Macro PoloDocument14 pagesMacro PoloZerohedgePas encore d'évaluation

- SocGen End of The Super Cycle 7-20-2011Document5 pagesSocGen End of The Super Cycle 7-20-2011Red911TPas encore d'évaluation

- "Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleDocument7 pages"Misunderstanding Financial Crises", A Q&A With Gary Gorton - FT AlphavilleAloy31stPas encore d'évaluation

- ... For Economic EducationDocument3 pages... For Economic EducationsilberksouzaPas encore d'évaluation

- The Cyclical Nature of The World of Financial HistoryDocument3 pagesThe Cyclical Nature of The World of Financial HistoryRia ChowdhuryPas encore d'évaluation

- Mervyn King: Banking - From Bagehot To Basel, and Back AgainDocument14 pagesMervyn King: Banking - From Bagehot To Basel, and Back AgainriomjPas encore d'évaluation

- Where Does Money Come FromDocument32 pagesWhere Does Money Come FromiaintPas encore d'évaluation

- Wall Street Lies Blame Victims To Avoid ResponsibilityDocument8 pagesWall Street Lies Blame Victims To Avoid ResponsibilityTA WebsterPas encore d'évaluation

- The Crisis & What To Do About It: George SorosDocument7 pagesThe Crisis & What To Do About It: George SorosCarlos PLPas encore d'évaluation

- Bridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessDocument0 pageBridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessChad Thayer V100% (2)

- Economic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Document32 pagesEconomic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Jariwala BhaveshPas encore d'évaluation

- Why We Must End Too Big To FailDocument21 pagesWhy We Must End Too Big To FailBryan CastañedaPas encore d'évaluation

- Where's The Money To Come From??Document32 pagesWhere's The Money To Come From??kronblom100% (1)

- How the Fed Became the Dealer of Last ResortDocument9 pagesHow the Fed Became the Dealer of Last ResortMichael Joseph KellyPas encore d'évaluation

- Shamik Bhose The Coming Economic ChangesDocument5 pagesShamik Bhose The Coming Economic ChangesshamikbhosePas encore d'évaluation

- Current Issues in Financial MarketsDocument5 pagesCurrent Issues in Financial Marketsreb_nicolePas encore d'évaluation

- The Absolute Return Letter 0709Document8 pagesThe Absolute Return Letter 0709tatsrus1Pas encore d'évaluation

- Guide To Understanding Deflation - pt3Document18 pagesGuide To Understanding Deflation - pt3jurgenbleihoferPas encore d'évaluation

- Innovations For Crisis' and Financial Meltdown: Implications For Growth and Economic PolicyDocument16 pagesInnovations For Crisis' and Financial Meltdown: Implications For Growth and Economic PolicySanthosh T VarghesePas encore d'évaluation

- MONEY AND BANKING (School Work)Document9 pagesMONEY AND BANKING (School Work)Lan Mr-aPas encore d'évaluation

- Interview With Gary GortonDocument16 pagesInterview With Gary GortonHossein KazemiPas encore d'évaluation

- Why Gold May Not Be the Best Hedge Against Future US Economic TroublesDocument3 pagesWhy Gold May Not Be the Best Hedge Against Future US Economic TroublesmercosurPas encore d'évaluation

- The Credit Crisis: How Lax Regulations Led to Market CollapseDocument3 pagesThe Credit Crisis: How Lax Regulations Led to Market CollapseDubstep ImtiyajPas encore d'évaluation

- Debt Trap: January 2006Document4 pagesDebt Trap: January 2006Daniel O'ConnorPas encore d'évaluation

- CS - Global Money NotesDocument14 pagesCS - Global Money NotesrockstarlivePas encore d'évaluation

- Our FrameworkDocument5 pagesOur FrameworkbienvillecapPas encore d'évaluation

- 2010 Barrons IntvuDocument3 pages2010 Barrons IntvuZuresh PathPas encore d'évaluation

- Inside JobDocument5 pagesInside Jobpkb0% (1)

- The Great Global Debt PrisonDocument4 pagesThe Great Global Debt Prisonjas2maui100% (1)

- Keynesian Economics Doesn't WorkDocument8 pagesKeynesian Economics Doesn't WorkkakerotePas encore d'évaluation

- National Debt ThesisDocument6 pagesNational Debt Thesisbrandygranttallahassee100% (2)

- Alasdair Macleod's 2011 CMRE speech on sound moneyDocument5 pagesAlasdair Macleod's 2011 CMRE speech on sound moneyKevin CreaseyPas encore d'évaluation

- The Perfect StormDocument3 pagesThe Perfect StormWolfSnapPas encore d'évaluation

- A Study On Economic CrisisDocument12 pagesA Study On Economic CrisisShelby ShajahanPas encore d'évaluation

- On Target: Martin Spring's Private Newsletter On Global StrategyDocument13 pagesOn Target: Martin Spring's Private Newsletter On Global StrategydiannebPas encore d'évaluation

- Sunny ProDocument62 pagesSunny ProVincent ClementPas encore d'évaluation

- Voicing The Vertical PianoDocument6 pagesVoicing The Vertical PianoJoaquim MorenoPas encore d'évaluation

- 2014 VoicingDocument6 pages2014 VoicinghhggddgjjjjgffPas encore d'évaluation

- 4 Annual Platsis Symposium University of Michigan September 16, 2005Document19 pages4 Annual Platsis Symposium University of Michigan September 16, 2005Joaquim MorenoPas encore d'évaluation

- The Deepening Capitalist CrisisDocument13 pagesThe Deepening Capitalist CrisisJoaquim MorenoPas encore d'évaluation

- From Gold Money To Fictitous MoneyDocument15 pagesFrom Gold Money To Fictitous MoneyJoaquim MorenoPas encore d'évaluation

- Ancient Chinese Music Theories ExploredDocument16 pagesAncient Chinese Music Theories ExploredJoaquim Moreno100% (1)

- Journal of Interdisciplinary History Volume 22 Issue 1 1991 (Doi 10.2307/204587) Review by - Patricia Herlihy - Politics and Public Health in Revolutionary Russia, 1890-1918by John F. Hutchinson HeaDocument4 pagesJournal of Interdisciplinary History Volume 22 Issue 1 1991 (Doi 10.2307/204587) Review by - Patricia Herlihy - Politics and Public Health in Revolutionary Russia, 1890-1918by John F. Hutchinson HeaJoaquim MorenoPas encore d'évaluation

- Furno Rules 1817 PDFDocument32 pagesFurno Rules 1817 PDFJoaquim Moreno100% (1)

- Global Dimensions of Unconventional Moneatary PolicyDocument14 pagesGlobal Dimensions of Unconventional Moneatary PolicyJoaquim MorenoPas encore d'évaluation

- Rakovsky, Russia's Economic FutureDocument8 pagesRakovsky, Russia's Economic FutureJoaquim MorenoPas encore d'évaluation

- Endogeneity of Money and The State in Marx's Theory of Non-Commodity MoneyDocument21 pagesEndogeneity of Money and The State in Marx's Theory of Non-Commodity MoneySebastián HernándezPas encore d'évaluation

- Currency Wars A Threat To Global Recovery October 2010Document6 pagesCurrency Wars A Threat To Global Recovery October 2010Joaquim MorenoPas encore d'évaluation

- The Impact of CloudDocument21 pagesThe Impact of CloudmgojPas encore d'évaluation

- Mitteilungen Der Paul Pacher Sacher Stiftung 11 Peter C Van Den ToornDocument5 pagesMitteilungen Der Paul Pacher Sacher Stiftung 11 Peter C Van Den ToornJoaquim MorenoPas encore d'évaluation

- Festina Lente - ErasmoDocument11 pagesFestina Lente - ErasmoJoaquim MorenoPas encore d'évaluation

- Psalm-Singing in CalvinismDocument66 pagesPsalm-Singing in CalvinismJoaquim Moreno100% (1)

- Smart GoalsDocument1 pageSmart GoalsJoaquim MorenoPas encore d'évaluation

- Hexachord SystemDocument1 pageHexachord SystemJoaquim MorenoPas encore d'évaluation

- Graphics Primitives and Drawing: Processing CodeDocument1 pageGraphics Primitives and Drawing: Processing CodeJoaquim MorenoPas encore d'évaluation

- Dramatic JargonDocument6 pagesDramatic JargonJoaquim MorenoPas encore d'évaluation

- Fingers in String InstrumentsDocument5 pagesFingers in String InstrumentsJoaquim MorenoPas encore d'évaluation

- Konrad - SchaffensweiseDocument4 pagesKonrad - SchaffensweiseJoaquim MorenoPas encore d'évaluation

- Marx On Full and Free DevelopmentDocument12 pagesMarx On Full and Free DevelopmentJoaquim MorenoPas encore d'évaluation

- 01.01 ChordsDocument3 pages01.01 ChordsJoaquim MorenoPas encore d'évaluation

- Realizing Roman Numeral HarmonyDocument1 pageRealizing Roman Numeral HarmonyJoaquim MorenoPas encore d'évaluation

- Glossary ClausesDocument6 pagesGlossary ClausesJoaquim MorenoPas encore d'évaluation

- Musical Composition: Using 12-Tone Chords With Minimum TensionDocument7 pagesMusical Composition: Using 12-Tone Chords With Minimum TensionFábio LopesPas encore d'évaluation

- Piano StaffDocument1 pagePiano StaffJoaquim MorenoPas encore d'évaluation

- Glossary Imitative PolyphonyDocument3 pagesGlossary Imitative PolyphonyJoaquim MorenoPas encore d'évaluation

- Glossary FormDocument3 pagesGlossary FormJoaquim MorenoPas encore d'évaluation

- Conduct Rules 1966Document6 pagesConduct Rules 1966Rajendra KumarPas encore d'évaluation

- 25 Integrated Realty Corp Vs PNBDocument2 pages25 Integrated Realty Corp Vs PNBangelo doceoPas encore d'évaluation

- Oil & Gas Mini MBA 19-30 March 2012 - Registration Form MacameDocument1 pageOil & Gas Mini MBA 19-30 March 2012 - Registration Form Macamethemak76Pas encore d'évaluation

- Nov Paper11 2010Document20 pagesNov Paper11 2010Aung Zaw HtwePas encore d'évaluation

- Transforming Rural YouthDocument340 pagesTransforming Rural Youthudi9690% (2)

- Section 20Document2 pagesSection 20einel dcPas encore d'évaluation

- Ppe 2016Document40 pagesPpe 2016Benny Wee0% (1)

- Plastene India Ltd.Document326 pagesPlastene India Ltd.Ganesh100% (1)

- Kiosk Banking Solution KBSDocument2 pagesKiosk Banking Solution KBSMANISHPas encore d'évaluation

- Ex1 ExportDocument16 pagesEx1 ExportRicha KashyapPas encore d'évaluation

- Stock Audit PresentationDocument27 pagesStock Audit PresentationShan BsmaniPas encore d'évaluation

- Investor investment patternsDocument4 pagesInvestor investment patternsSaiKumarSeelamPas encore d'évaluation

- CEO Analysis of Cherat Cement CompanyDocument30 pagesCEO Analysis of Cherat Cement Companyfaisal aminPas encore d'évaluation

- MINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTDocument158 pagesMINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTRina KusumaPas encore d'évaluation

- Grade 5 English Module 1 FinalDocument19 pagesGrade 5 English Module 1 FinalAlicia Nhs100% (4)

- Financial Institutions AssignmentDocument22 pagesFinancial Institutions AssignmentProbortok Somaj80% (5)

- Corporate PPT - Nucleus SoftwareDocument13 pagesCorporate PPT - Nucleus SoftwarePriyanshu AggarwalPas encore d'évaluation

- Fundamental of Banking MarathiDocument256 pagesFundamental of Banking MarathisunilPas encore d'évaluation

- VW Approved Used Cover BookletDocument18 pagesVW Approved Used Cover BookletagathianPas encore d'évaluation

- Gaotian Vs GaffudDocument4 pagesGaotian Vs GaffudCelinka ChunPas encore d'évaluation

- Star Two vs. Paper CityDocument2 pagesStar Two vs. Paper CityJewel Ivy Balabag DumapiasPas encore d'évaluation

- LeasesDocument9 pagesLeasesCris Joy BiabasPas encore d'évaluation

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarPas encore d'évaluation

- Staff - p45Document4 pagesStaff - p45velorutionPas encore d'évaluation

- Sumit Black BookDocument51 pagesSumit Black BookSuraj BenbansiPas encore d'évaluation

- Tata Steel 09 Balance SheetDocument1 pageTata Steel 09 Balance SheetGoPas encore d'évaluation

- MAS16Document12 pagesMAS16Kyaw Htin Win50% (2)

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARPas encore d'évaluation

- 10000027207Document76 pages10000027207Chapter 11 Dockets0% (1)

- CFP Risk Analysis and Insurance Planning Practice Book SampleDocument34 pagesCFP Risk Analysis and Insurance Planning Practice Book SampleMeenakshi100% (7)