Académique Documents

Professionnel Documents

Culture Documents

Crash Course: Schools Brief

Transféré par

Joaquim MorenoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Crash Course: Schools Brief

Transféré par

Joaquim MorenoDroits d'auteur :

Formats disponibles

74

Schools brief

The Economist September 7th 2013

The origins of the nancial crisis

Crash course

The e ects of the nancial crisis are still being felt, ve years on. This article, the rst of a series of ve on the lessons of the upheaval, looks at its causes

HE collapse of Lehman Brothers, a sprawling global bank, in September 2008 almost brought down the worlds nancial system. It took huge taxpayernanced bail-outs to shore up the industry. Even so, the ensuing credit crunch turned what was already a nasty downturn into the worst recession in 80 years. Massive monetary and scal stimulus prevented a buddy-can-you-spare-a-dime depression, but the recovery remains feeble compared with previous post-war upturns. GDP is still below its pre-crisis peak in many rich countries, especially in Europe, where the nancial crisis has evolved into the euro crisis. The e ects of the crash are still rippling through the world economy: witness the wobbles in nancial markets as Americas Federal Reserve prepares to scale back its e ort to pep up growth by buying bonds. With half a decades hindsight, it is clear the crisis had multiple causes. The most obvious is the nanciers themselves especially the irrationally exuberant Anglo-Saxon sort, who claimed to have found a way to banish risk when in fact they had simply lost track of it. Central bankers and other regulators also bear blame, for it was they who tolerated this folly. The macroeconomic backdrop was important, too. The Great Moderation years of low in ation and stable growth fostered complacency and risk-taking. A savings glut in Asia pushed down global interest rates. Some research also implicates European banks, which borrowed greedily in American money markets before the crisis and used the funds to buy dodgy securities. All these factors came together to foster a surge of debt in what seemed to have become a less risky world. Start with the folly of the nanciers. The years before the crisis saw a ood of irresponsible mortgage lending in America. Loans were doled out to subprime borrowers with poor credit histories who struggled to repay them. These risky mortgages were passed on to nancial engineers at the big banks, who turned them

into supposedly low-risk securities by putting large numbers of them together in pools. Pooling works when the risks of each loan are uncorrelated. The big banks argued that the property markets in di erent American cities would rise and fall independently of one another. But this proved wrong. Starting in 2006, America su ered a nationwide house-price slump. The pooled mortgages were used to back securities known as collateralised debt obligations (CDOs), which were sliced into tranches by degree of exposure to default. Investors bought the safer tranches because they trusted the triple-A credit ratings assigned by agencies such as Moodys and Standard & Poors. This was another mistake. The agencies were paid by, and so beholden to, the banks that created the CDOs. They were far too generous in their assessments of them. Investors sought out these securitised products because they appeared to be relatively safe while providing higher returns in a world of low interest rates. Economists still disagree over whether these low rates were the result of central bankers mistakes or broader shifts in the world economy. Some accuse the Fed of keeping short-term rates too low, pulling longer-term mortgage rates down with them. The Feds defenders shift the blame to the savings glut the surfeit of saving

over investment in emerging economies, especially China. That capital ooded into safe American-government bonds, driving down interest rates. Low interest rates created an incentive for banks, hedge funds and other investors to hunt for riskier assets that o ered higher returns. They also made it pro table for such out ts to borrow and use the extra cash to amplify their investments, on the assumption that the returns would exceed the cost of borrowing. The low volatility of the Great Moderation increased the temptation to leverage in this way. If short-term interest rates are low but unstable, investors will hesitate before leveraging their bets. But if rates appear stable, investors will take the risk of borrowing in the money markets to buy longer-dated, higher-yielding securities. That is indeed what happened. From houses to money markets When Americas housing market turned, a chain reaction exposed fragilities in the nancial system. Pooling and other clever nancial engineering did not provide investors with the promised protection. Mortgage-backed securities slumped in value, if they could be valued at all. Supposedly safe CDOs turned out to be worthless, despite the ratings agencies seal of approval. It became di cult to sell suspect assets at almost any price, or to use them as collateral for the short-term funding that so many banks relied on. Fire-sale prices, in turn, instantly dented banks capital thanks to mark-to-market accounting rules, which required them to revalue their assets at current prices and thus acknowledge losses on paper that might never actually be incurred. Trust, the ultimate glue of all nancial systems, began to dissolve in 2007 a year before Lehmans bankruptcy as banks started questioning the viability of their counterparties. They and other sources of wholesale funding began to withhold short-term credit, causing those most reliant on it to founder. Northern Rock, a British mortgage lender, was an early casualty in the autumn of 2007. Complex chains of debt between counterparties were vulnerable to just one link breaking. Financial instruments such as credit-default swaps (in which the seller agrees to compensate the buyer if a third party defaults on a loan) that were meant to spread risk turned out to concentrate it. AIG, an American insurance giant buck- 1

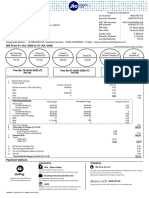

Risk on

Bank assets as % of GDP, selected countries Average Minimum/maximum range 500 400 300 200 100 0 1870 90 1910 30 50 70 90 2008

Source: Jorda, Schularick and Taylor (2011)

The Economist September 7th 2013

Schools Brief 75

In this series

1 2 3 4 5 The causes of the crisis How much debt is dangerous? How monetary policy has changed Fiscal stimulus v austerity Making the banks safer

Ill-founded optimism

Weighted average for 17 global banks* Risk-weighted assets as % of total assets 80 60 40 20 0 1993 95 97 99 2001 03 05 07 09 11

Source: The Banker, Bank of England *Including: Deutsche Bank, BNP Paribas, Barclays, Citigroup, UBS and BAML Total assets divided by Tier-1 capital

Leverage ratio 40 30 20 10 0

2 led within days of the Lehman bankrupt-

cy under the weight of the expansive credit-risk protection it had sold. The whole system was revealed to have been built on imsy foundations: banks had allowed their balance-sheets to bloat (see chart 1, on previous page), but set aside too little capital to absorb losses. In e ect they had bet on themselves with borrowed money, a gamble that had paid o in good times but proved catastrophic in bad. Regulators asleep at the wheel Failures in nance were at the heart of the crash. But bankers were not the only people to blame. Central bankers and other regulators bear responsibility too, for mishandling the crisis, for failing to keep economic imbalances in check and for failing to exercise proper oversight of nancial institutions. The regulators most dramatic error was to let Lehman Brothers go bankrupt. This multiplied the panic in markets. Suddenly, nobody trusted anybody, so nobody would lend. Non- nancial companies, unable to rely on being able to borrow to pay suppliers or workers, froze spending in order to hoard cash, causing a seizure in the real economy. Ironically, the decision to stand back and allow Lehman to go bankrupt resulted in more government intervention, not less. To stem the consequent panic, regulators had to rescue scores of other companies. But the regulators made mistakes long before the Lehman bankruptcy, most notably by tolerating global current-account imbalances and the housing bubbles that they helped to in ate. Central bankers had long expressed concerns about Americas big de cit and the o -

setting capital in ows from Asias excess savings. Ben Bernanke highlighted the savings glut in early 2005, a year before he took over as chairman of the Fed from Alan Greenspan. But the focus on net capital ows from Asia left a blind spot for the much bigger gross capital ows from European banks. They bought lots of dodgy American securities, nancing their purchases in large part by borrowing from American money-market funds. In other words, although Europeans claimed to be innocent victims of AngloSaxon excess, their banks were actually in the thick of things. The creation of the euro prompted an extraordinary expansion of the nancial sector both within the euro area and in nearby banking hubs such as London and Switzerland. Recent research by Hyun Song Shin, an economist at Princeton University, has focused on the European role in fomenting the crisis. The glut that caused Americas loose credit conditions before the crisis, he argues, was in global banking rather than in world savings. Moreover, Europe had its own internal imbalances that proved just as signi cant as those between America and China. Southern European economies racked up huge current-account de cits in the rst decade of the euro while countries in northern Europe ran o setting surpluses. The imbalances were nanced by credit ows from the euro-zone core to the overheated housing markets of countries like Spain and Ireland. The euro crisis has in this respect been a continuation of the nancial crisis by other means, as markets have agonised over the weaknesses of European banks loaded with bad debts following property busts. Central banks could have done more to address all this. The Fed made no attempt to stem the housing bubble. The European Central Bank did nothing to restrain the credit surge on the periphery, believing (wrongly) that current-account imbalances did not matter in a monetary union.

This series of schools briefs revives The Economists occasional primers on topical subjects. The rst series (published in 1975, on "Managing the British Economy") was intended to help British economics students prepare for school-leaving exams, though we hoped it would also be of wider use. Subsequent subjects ranged widely, from American government to science. We last published a schools brief in 1999. It was on nance, and concluded: "Some of the new nancial technologies are, in e ect, e orts to bottle up considerable uncertainties. If they work, the world economy will be more stable. If not, an economic disaster might ensue.

The Bank of England, having lost control over banking supervision when it was made independent in 1997, took a mistakenly narrow view of its responsibility to maintain nancial stability. Central bankers insist that it would have been di cult to temper the housing and credit boom through higher interest rates. Perhaps so, but they had other regulatory tools at their disposal, such as lowering maximum loan-to-value ratios for mortgages, or demanding that banks should set aside more capital. Lax capital ratios proved the biggest shortcoming. Since 1988 a committee of central bankers and supervisors meeting in Basel has negotiated international rules for the minimum amount of capital banks must hold relative to their assets. But these rules did not de ne capital strictly enough, which let banks smuggle in forms of debt that did not have the same lossabsorbing capacity as equity. Under pressure from shareholders to increase returns, banks operated with minimal equity, leaving them vulnerable if things went wrong. And from the mid-1990s they were allowed more and more to use their own internal models to assess risk in e ect setting their own capital requirements. Predictably, they judged their assets to be ever safer, allowing balance-sheets to balloon without a commensurate rise in capital (see chart 2). The Basel committee also did not make any rules regarding the share of a banks assets that should be liquid. And it failed to set up a mechanism to allow a big international bank to go bust without causing the rest of the system to seize up. All in it together The regulatory reforms that have since been pushed through at Basel read as an extended mea culpa by central bankers for getting things so grievously wrong before the nancial crisis. But regulators and bankers were not alone in making misjudgments. When economies are doing well there are powerful political pressures not to rock the boat. With in ation at bay central bankers could not appeal to their usual rationale for spoiling the party. The long period of economic and price stability over which they presided encouraged risk-taking. And as so often in the history of nancial crashes, humble consumers also joined in the collective delusion that lasting prosperity could be built on everbigger piles of debt. 7

Vous aimerez peut-être aussi

- Anul III Trad Business English Part III 15 Noiembrie 2014Document6 pagesAnul III Trad Business English Part III 15 Noiembrie 2014Ana-Maria Dumitroiu0% (1)

- The Financial Crisis of 2008Document2 pagesThe Financial Crisis of 2008Soufiane ZibouhPas encore d'évaluation

- Why Shadow Banking Didn’t Cause the Financial Crisis: And Why Regulating Contagion Won’t HelpD'EverandWhy Shadow Banking Didn’t Cause the Financial Crisis: And Why Regulating Contagion Won’t HelpPas encore d'évaluation

- Case BackgroundDocument7 pagesCase Backgroundabhilash191Pas encore d'évaluation

- The Perfect StormDocument3 pagesThe Perfect StormWolfSnapPas encore d'évaluation

- Financial Crisis of 2007Document6 pagesFinancial Crisis of 2007absolutelyarpitaPas encore d'évaluation

- Sub Prime CrisisDocument7 pagesSub Prime CrisisbistamasterPas encore d'évaluation

- K204040222 - Phạm Trần Cẩm Vi 4Document4 pagesK204040222 - Phạm Trần Cẩm Vi 4Nam Đỗ PhươngPas encore d'évaluation

- 2008 Financial Crisis Subprime Mortgage Crisis Caused by The Unregulated Use of Derivatives U.S. Treasury Federal Reserve Economic CollapseDocument4 pages2008 Financial Crisis Subprime Mortgage Crisis Caused by The Unregulated Use of Derivatives U.S. Treasury Federal Reserve Economic CollapseShane TabunggaoPas encore d'évaluation

- Globle EconomicsDocument9 pagesGloble Economicskabir_20004Pas encore d'évaluation

- A Study On Economic CrisisDocument12 pagesA Study On Economic CrisisShelby ShajahanPas encore d'évaluation

- Too Big To FailDocument9 pagesToo Big To FailPriyank Hariyani0% (1)

- Derivatives (Fin402) : Assignment: EssayDocument5 pagesDerivatives (Fin402) : Assignment: EssayNga Thị NguyễnPas encore d'évaluation

- Global Financial CrisisDocument7 pagesGlobal Financial CrisiskendecruzPas encore d'évaluation

- Understanding Financial Crisis of 2007 08Document3 pagesUnderstanding Financial Crisis of 2007 08Mahesh MohurlePas encore d'évaluation

- Financial CrisisDocument5 pagesFinancial CrisisUstaad GPas encore d'évaluation

- Safi Ullah BBA-7 (B) 011-18-0047Document10 pagesSafi Ullah BBA-7 (B) 011-18-0047Mir safi balochPas encore d'évaluation

- Spill-Over Effects of Mortgage Credit Crisis in USA On EuropeDocument15 pagesSpill-Over Effects of Mortgage Credit Crisis in USA On EuropeUsman SansiPas encore d'évaluation

- Assignment No.2 Inside JobDocument6 pagesAssignment No.2 Inside JobJill SanghrajkaPas encore d'évaluation

- Financial Crisis of 2007-2010 in US: Evolution of Economic SystemsDocument24 pagesFinancial Crisis of 2007-2010 in US: Evolution of Economic Systemsanca_giorgiana01Pas encore d'évaluation

- U.S. Subprime Mortgage Crisis: Policy Reactions: Case BackgroundDocument8 pagesU.S. Subprime Mortgage Crisis: Policy Reactions: Case BackgroundShubham TapadiyaPas encore d'évaluation

- Subprime CrisisDocument10 pagesSubprime Crisisbackup cmbmpPas encore d'évaluation

- Michael Burry and Mark BaumDocument13 pagesMichael Burry and Mark BaumMario Nakhleh0% (1)

- Global Financial Crisis (Edited)Document7 pagesGlobal Financial Crisis (Edited)AngelicaP.Ordonia100% (1)

- An Overview of The Crisis: Causes, Consequences and SolutionsDocument46 pagesAn Overview of The Crisis: Causes, Consequences and SolutionsAlberto QuintavoPas encore d'évaluation

- Chronicle of World Financial Crisis 2007-2008Document4 pagesChronicle of World Financial Crisis 2007-2008Md. Azim Ferdous100% (1)

- Group Task 3 Week 7Document9 pagesGroup Task 3 Week 7umang nathPas encore d'évaluation

- The Financial Crisis of 2008: What Happened in Simple TermsDocument2 pagesThe Financial Crisis of 2008: What Happened in Simple TermsBig ALPas encore d'évaluation

- Financial Markets Final SubmissionDocument10 pagesFinancial Markets Final Submissionabhishek kumarPas encore d'évaluation

- The Crisis & What To Do About It: George SorosDocument7 pagesThe Crisis & What To Do About It: George SorosCarlos PLPas encore d'évaluation

- Causes of The Financial Crisis 2010 PDFDocument10 pagesCauses of The Financial Crisis 2010 PDFSilvana ElenaPas encore d'évaluation

- Brief History of Federal ReserveDocument11 pagesBrief History of Federal ReserveDuyen TranPas encore d'évaluation

- Macroeconomics Assignment 4Document7 pagesMacroeconomics Assignment 4AMOGHSHANKER GOSWAMIPas encore d'évaluation

- 2008 CrisisDocument3 pages2008 CrisismoshiPas encore d'évaluation

- U.S. Sub-Prime Crisis & Its Global ConsequencesDocument33 pagesU.S. Sub-Prime Crisis & Its Global ConsequencesakkikhanejadevPas encore d'évaluation

- The Big Short Case StudyDocument5 pagesThe Big Short Case StudyMaricar RoquePas encore d'évaluation

- 2007-2008 Housing CrashDocument5 pages2007-2008 Housing CrashKanishk R.SinghPas encore d'évaluation

- Financial Crisis of 2008 Momodou JallowDocument17 pagesFinancial Crisis of 2008 Momodou JallowJester BorresPas encore d'évaluation

- Ho Chi Minh City International University Critical ThinkingDocument25 pagesHo Chi Minh City International University Critical ThinkingChi NguyenPas encore d'évaluation

- Financial Crisis Case (Borja, Bucog, Gresola)Document7 pagesFinancial Crisis Case (Borja, Bucog, Gresola)Early Joy BorjaPas encore d'évaluation

- Fall of Lehman BrothersDocument3 pagesFall of Lehman BrothersFrFlordianPas encore d'évaluation

- Financial Crisis 2Document12 pagesFinancial Crisis 2neevanjain121Pas encore d'évaluation

- 6 - Trần Thị Thu Trang - E4Document17 pages6 - Trần Thị Thu Trang - E4Trang TrầnPas encore d'évaluation

- Aftermath Bubble - Great RecessionDocument2 pagesAftermath Bubble - Great RecessionGwenn PosoPas encore d'évaluation

- 2008crisissummary1 1Document3 pages2008crisissummary1 1Syed Rafey AbbasPas encore d'évaluation

- FI K204040181 - TranGiaHanDocument7 pagesFI K204040181 - TranGiaHanHân TrầnPas encore d'évaluation

- RGE Monitor Vitoria SaddiDocument27 pagesRGE Monitor Vitoria SaddisagarmaniarPas encore d'évaluation

- Case AnalysisDocument6 pagesCase AnalysisFranzing LebsPas encore d'évaluation

- MBF Group AsgnmentDocument10 pagesMBF Group AsgnmentEshahumayounPas encore d'évaluation

- The Global Financial CrisisDocument11 pagesThe Global Financial CrisisAmogh AroraPas encore d'évaluation

- Crisis and 2008 Financial Crisis, Is Considered by Many Economists To Be The WorstDocument54 pagesCrisis and 2008 Financial Crisis, Is Considered by Many Economists To Be The Worstdineshpatil186Pas encore d'évaluation

- Course File 3-AssessmentDocument5 pagesCourse File 3-AssessmentLilibeth OrongPas encore d'évaluation

- Financial Crisis Enforcing Global Banking Reforms: A. GuptaDocument9 pagesFinancial Crisis Enforcing Global Banking Reforms: A. Guptaann2020Pas encore d'évaluation

- Causes and Effects of Subprime CrisisDocument2 pagesCauses and Effects of Subprime CrisisAbhilasha PantPas encore d'évaluation

- Global Economic Environment PolicyDocument14 pagesGlobal Economic Environment Policyhappy_licPas encore d'évaluation

- Case Study 1 - What Was The Financial Crisis of 2007-2008Document4 pagesCase Study 1 - What Was The Financial Crisis of 2007-2008Anh NguyenPas encore d'évaluation

- The Great Recession 2007-09Document8 pagesThe Great Recession 2007-09Muhammad Taha AmerjeePas encore d'évaluation

- UssamaDocument12 pagesUssamaRizwan RizzuPas encore d'évaluation

- Voicing The Vertical PianoDocument6 pagesVoicing The Vertical PianoJoaquim MorenoPas encore d'évaluation

- 4 Annual Platsis Symposium University of Michigan September 16, 2005Document19 pages4 Annual Platsis Symposium University of Michigan September 16, 2005Joaquim MorenoPas encore d'évaluation

- Furno Rules 1817 PDFDocument32 pagesFurno Rules 1817 PDFJoaquim Moreno100% (1)

- The Deepening Capitalist CrisisDocument13 pagesThe Deepening Capitalist CrisisJoaquim MorenoPas encore d'évaluation

- Currency Wars A Threat To Global Recovery October 2010Document6 pagesCurrency Wars A Threat To Global Recovery October 2010Joaquim MorenoPas encore d'évaluation

- Chinese Theories of MusicDocument16 pagesChinese Theories of MusicJoaquim Moreno100% (1)

- Mitteilungen Der Paul Pacher Sacher Stiftung 11 Peter C Van Den ToornDocument5 pagesMitteilungen Der Paul Pacher Sacher Stiftung 11 Peter C Van Den ToornJoaquim MorenoPas encore d'évaluation

- Graphics Primitives and Drawing: Processing CodeDocument1 pageGraphics Primitives and Drawing: Processing CodeJoaquim MorenoPas encore d'évaluation

- Festina Lente - ErasmoDocument11 pagesFestina Lente - ErasmoJoaquim MorenoPas encore d'évaluation

- Psalm-Singing in CalvinismDocument66 pagesPsalm-Singing in CalvinismJoaquim Moreno100% (1)

- Konrad - SchaffensweiseDocument4 pagesKonrad - SchaffensweiseJoaquim MorenoPas encore d'évaluation

- Realizing Harmony From Figured BassDocument4 pagesRealizing Harmony From Figured BassJoaquim Moreno100% (1)

- Partimenti in Their Historical ContextDocument6 pagesPartimenti in Their Historical ContextJoaquim MorenoPas encore d'évaluation

- Musical Composition: Using 12-Tone Chords With Minimum TensionDocument7 pagesMusical Composition: Using 12-Tone Chords With Minimum TensionFábio LopesPas encore d'évaluation

- Liquidation 2Document3 pagesLiquidation 2Kenneth CuencaPas encore d'évaluation

- Netherlands Interchange FeesDocument1 pageNetherlands Interchange FeesAlessandro LongoniPas encore d'évaluation

- PPP Financial ModelDocument56 pagesPPP Financial Modelkaramat12Pas encore d'évaluation

- XXXXXX: Account Assistant (Feb 2015 To Sep 2017)Document4 pagesXXXXXX: Account Assistant (Feb 2015 To Sep 2017)Vicky APas encore d'évaluation

- Platinum Life Easy SupercardDocument12 pagesPlatinum Life Easy SupercardVipul SharmaPas encore d'évaluation

- ADP - Direct - Deposit - Editable2Document1 pageADP - Direct - Deposit - Editable2MOHAMMED ALSHUAIBIPas encore d'évaluation

- Cash and Marketable Securities Management R-1Document9 pagesCash and Marketable Securities Management R-1archivisimusPas encore d'évaluation

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaPas encore d'évaluation

- Credit Card Debt AssignmentDocument5 pagesCredit Card Debt Assignmentapi-581454156Pas encore d'évaluation

- ch10 Plant Assets, Natural ResourcesDocument24 pagesch10 Plant Assets, Natural ResourcesMạnh Hoàng Phi ĐứcPas encore d'évaluation

- A Project Report Final 1Document77 pagesA Project Report Final 1KEDARANATHA PADHYPas encore d'évaluation

- Payment Calculator-Low Cost HousingDocument7 pagesPayment Calculator-Low Cost HousingHumayyun Iftikhar RajaPas encore d'évaluation

- Bbob Current AffairsDocument28 pagesBbob Current AffairsGangwar AnkitPas encore d'évaluation

- Quiz - Assignment 03.06.2021Document3 pagesQuiz - Assignment 03.06.2021Thricia Lou OpialaPas encore d'évaluation

- Ach Code CardDocument2 pagesAch Code CardSankaetPathakPas encore d'évaluation

- The Accounting CycleDocument17 pagesThe Accounting Cycleyuvita prasadPas encore d'évaluation

- Accounting Policies and Procedures Manual (Draft)Document30 pagesAccounting Policies and Procedures Manual (Draft)Malaking Pulo Multi-Purpose CooperativePas encore d'évaluation

- Bharti AXA Life Insurance Company LimitedDocument8 pagesBharti AXA Life Insurance Company LimitedJinal SanghviPas encore d'évaluation

- KARUNANITHI SRINIVASAN1647319871895-credit-reportDocument26 pagesKARUNANITHI SRINIVASAN1647319871895-credit-reportHaritUchilPas encore d'évaluation

- Chap 1Document17 pagesChap 1akshat srivastavaPas encore d'évaluation

- Pro Forma StatementDocument14 pagesPro Forma StatementEse Peace100% (1)

- Practice of Banking Lecture Notes 5 - Types of Bank AccountsDocument15 pagesPractice of Banking Lecture Notes 5 - Types of Bank AccountsGaniyu TaslimPas encore d'évaluation

- Bill From 01-Jul-2020 To 31-Jul-2020: JiopayDocument1 pageBill From 01-Jul-2020 To 31-Jul-2020: JiopayAmitkumar SinghPas encore d'évaluation

- John Paul's Financial AspectDocument24 pagesJohn Paul's Financial Aspectmelvanne tamboboyPas encore d'évaluation

- Company To Trust Term SheetDocument2 pagesCompany To Trust Term SheetBobby BabPas encore d'évaluation

- Retail Banking in Suko Bank SNDDocument43 pagesRetail Banking in Suko Bank SNDhasanPas encore d'évaluation

- 1 Accounting For CashDocument1 page1 Accounting For CashAir CrlsPas encore d'évaluation

- Accounting ReportDocument44 pagesAccounting ReportAyoniseh CarolPas encore d'évaluation

- United Securities Registrars e DIVIDEND MANDATE FORMDocument1 pageUnited Securities Registrars e DIVIDEND MANDATE FORMAjibade RafiuPas encore d'évaluation

- Account Statement PDFDocument12 pagesAccount Statement PDFYuvraj Gogoi100% (1)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyD'EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyÉvaluation : 3 sur 5 étoiles3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursD'EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursÉvaluation : 5 sur 5 étoiles5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsD'EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsPas encore d'évaluation

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsD'EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondD'EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondPas encore d'évaluation

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)D'EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Évaluation : 4 sur 5 étoiles4/5 (5)

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsD'EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismD'EverandThe Value of a Whale: On the Illusions of Green CapitalismÉvaluation : 5 sur 5 étoiles5/5 (2)