Académique Documents

Professionnel Documents

Culture Documents

Wiley The Scandinavian Journal of Economics

Transféré par

Aadi RulexTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Wiley The Scandinavian Journal of Economics

Transféré par

Aadi RulexDroits d'auteur :

Formats disponibles

Inflation and Unemployment in General Equilibrium Author(s): Guillaume Rocheteau, Peter Rupert and Randall Wright Source: The

Scandinavian Journal of Economics, Vol. 109, No. 4, Macroeconomic Fluctuations and the Labor Market (Dec., 2007), pp. 837-855 Published by: Wiley on behalf of The Scandinavian Journal of Economics Stable URL: http://www.jstor.org/stable/25195319 . Accessed: 01/10/2013 03:27

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Wiley and The Scandinavian Journal of Economics are collaborating with JSTOR to digitize, preserve and extend access to The Scandinavian Journal of Economics.

http://www.jstor.org

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Scand. J. of Economics 109(4), 837-855, DOI: 10.HH/j.1467-9442.2007.00511.x

2007

Inflation and Unemployment

General

Guillaume

Federal Reserve

in

Equilibrium*

Rocheteau

Bank, Cleveland, OH 44114, USA

guillaume.rocheteau@clev.frb.org

Peter Rupert

of California, University rupert@econ.ucsb.edu Santa Barbara, CA 93106, USA

Randall Wright

University of Pennsylvania, Philadelphia, PA 19104, USA rwright@econ.upenn.edu

Abstract

When ployed, labor as some agents randomly unem outcomes with there exist efficient is indivisible, in Rogerson this idea into the modern (1988). We integrate theory of monetary some trade occurs where in centralized markets and some in decentralized markets, and Wright with a general model of unemployment (2005). This delivers equilibrium foundations. We show that the implied relation explicit microeconomic can be positive or negative, on simple pref and unemployment depending curve provides a long-run, Our Phillips trade-off for monetary exploitable, that the optimal inflation; ?12; policy is the Friedman rule.

exchange, as in Lagos and money, between erence policy; Keywords'. JEL

inflation conditions.

it turns out, however, curve; ?40;

Phillips

unemployment ?13

classification:

?52;

I. Introduction The has been well known at least since the work of Rogerson following efficient in economies with indivisible allocations labor generally (1988): have some agents, chosen at random, unemployed, while others are em can be sup ployed, even if they are ex ante identical; and these allocations as we discuss where As trade lotteries. agents ported competitive equilibria

to this project, we thank Karl Shell, Bob Hall, Ken *For input on previous work related Christian at the Todd Keister, and seminar participants Burdett, Aruoba, Boragan Helwig, Cleveland Fed, Bank of Canada, Fed, Philadelphia Penn, Penn State, Princeton, LSE, UCLA, of Singapore, Simon Fraser, Essex, and the Cana Cornell, Notre Dame, National University at UBC. We thank the NSF Theory meetings here are those of the authors and not necessarily expressed or the Federal Reserve Bank of Cleveland System. dian Economic for research those of support. The views the Federal Reserve

? The editors of the Scandinavian Journal of Economics 2008. Published by Blackwell Publishing, 9600 Garsington Road, Oxford, OX4 2DQ, UK and 350 Main Street,Maiden, MA 02148, USA.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

838

G Rocheteau,

P. Rupert and R. Wright

in detail below, another interesting feature of these economies emphasized in Rocheteau, (2006) is that agents act as if they Rupert, Shell and Wright have quasi-linear utility. It turns out that one can use this result to con a struct fairly general yet very tractable model of monetary exchange, using search theory, where (as in Lagos and Wright, 2005) some trades occur in centralized markets and some in decentralized markets. To understand tractable is the this, note that what makes Lagos-Wright of quasi-linear utility, which implies agents exiting the central all hold the same amount of money, regardless of their histories to embrace quasi if one is willing interior solutions). Thus, (assuming one can in the avoid having to track the distribution of money linear utility, in Rocheteau market as a state variable.1 The observations decentralized as long as we have et al. (2006) allow one to dispense with quasi-linearity: assumption ized market indivisible for that matter, any indivisible commodity?identical labor?or, results concerning the money distribution hold for any utility function (again to using there are some advantages interior solutions). However, assuming indivisible labor instead of quasi-linear utility as a building block for mon etary theory, including the fact that it generates unemployment. In this paper we take seriously the implications of indivisible-labor mod In els with money for the relationship between inflation and unemployment. other words, we study the Phillips curve in general equilibrium. This seems to be a natural exercise. In addition to Rogerson (1988), many well-known papers adopt the indivisible-labor model, (1985), Cooley including Hansen and Eichenbaum and Hansen (1992), Kydland (1994), (1989), Christiano and Wallenius Prescott, Rogerson (2006). (2006) and Sargent and Lungqvist or with issues either without money These papers analyze macroeconomic some in ad hoc via added cash-in-advance way (e.g. money constraints). and inflation in a We want to study the relation between unemployment of with relatively explicit descriptions model with microfoundations?i.e., the frictions that make money essential.2 The main goal is to derive precise analytic results showing how the rela inflation and unemployment tion between depends on primitives. We prove on that the Phillips curve can have a positive or negative slope depending

1 one has For monetary models that are much less tractable because see Green and Corbae relevant distribution, and Zhou (1998), Camera Zhu were (2003, also 2005) simple, {0, and Molico (2006). Earlier search-based models, to keep track of the (1999), Zhou (1999), such as Kiyotaki and could only to achieve

Wright (1989, 1993),Aiyagari andWallace (1991), Shi (1995) or Trejos andWright (1995),

hold m 2 An 1} units but only because An of money. the issue by assuming agents they avoided that uses alternative large families approach

tractability is provided by Shi (1997). See also Faig (2005).

alternative unemployment sarides (1994), are advantages ? Menzio and Wright taken up in Berentsen, approach, into monetary the search-based model theory using As we discuss labor model. instead of the indivisible to each approach. is to integrate (2007), of Mortensen and Pis in the conclusion, there

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

839

the utility function in a simple and natural way. The intuition is straight forward. To consider one version of our results, suppose the economy has two sectors, one of which uses cash relatively Inflation is ob intensively. a tax on activity sector. If goods traded in in the cash-intensive viously that sector are substitutes for those traded in the other sector, inflation re of the former and increases consumption duces consumption of the latter. If those latter goods are relatively labor intensive, employment must increase in equilibrium. Hence, when the goods in the two sectors are substitutes, inflation reduces unemployment. when the goods are com Symmetrically, inflation increases plements unemployment. Our inflation-unemployment is based on rudimentary trade-off public finance considerations, and does not depend on any complicated features like sticky wages or prices, irrational expectations, imperfect information, etc. Thus we conclude that one does not have to work very hard to generate an interesting relation between inflation and unemployment. in this Now, is paper, we do not take a stand on what the relation is in the data?that an entirely different project. Here we focus on providing a simple charac terization in theory. Also, note that our trade-off is a long-run trade-off in the sense that it does not depend on features like stickiness or imperfect that are likely to be important only in the short run. And it is it fully exploitable by monetary policy: under conditions we make precise, as to permanently isfeasible reduce unemployment by increasing inflation, (used to?) think. We prove, however, that it is optimal to reduce Keynesians as Friedman always said.3 inflation to a minimum, information

II. Basic Assumptions

Time is discrete. There is a [0,1] continuum of agents who live forever. There are two types of markets in which these agents interact. One is a or CM. The other is a decentralized mar frictionless centralized market, that together make money essential: ket, or DM, with two main frictions

that our results are reminiscent of Stockman shows that suggested (1981), who in the long run when on in reduces there is a cash-in-advance constraint capital on consumption to a cash-in-advance we vestment constraint Indeed, (as opposed only). to those that one could derive results very in some of our proposi similar acknowledge referee inflation tions in indivisible-labor goods allows models are some assuming as long as one subject in a reduced-form is introduced fashion money by to a cash-in-advance are not, constraint and some goods so that one can compare the cases where these preferences where

3 A

general are complements and when and allows different labor intensities goods they are substitutes, see no reason to take such a short cut, however, We in production. since it is no harder and it generates one derives the role of money additional from first principles. insights when are wed we emphasize But for those who to reduced-form that our main economic models, results also hold in that context. ?

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

840

G. Rocheteau,

P. Rupert and R. Wright

as detailed below, and anonymity, which problem, credit precludes private arrangements.4 We are interested in equilibria where is valued?i.e., the price of M is positive in the CM at every date? money and choose dollars to be the unit of account. The stock of money evolves = z to M ? where indicates the value of variable any (\ +j)M9 according next period. New money is injected (or withdrawn if 7 < 0) via lump-sum transfers (or taxes) in the CM, to neutralize the fiscal effects of monetary policy.5 It is easy to allow a general vector of consumption goods x R+ and e e in the CM; see our working paper, Rocheteau, endowment Rupert R+ and Wright In order to reduce notation, however, we assume a (2007). = 0. This single CM good x and e good is produced by firms using labor as h. For an individual, labor is indivisible: he {0, 1}. Hence, or in trade randomized bundles, lotteries, agents consumption the DM there is a different good, q, that is not produced, but an endowment one CM in an interval encompassing q. Utility a at start where shock the is realized j preference vJ(q,x,h), is standard, the CM. In agents have and DM is of the DM, after (x,h) but before q is chosen. This timing, and in particular the before that the shock is revealed after but (x,h) preference assumption that q is chosen, is not especially important, but we like the interpretation the CM closes before the DM opens. The related monetary literature assumes utility is separable between (jc,h) and q, but for reasons that will become clear we do not want to restrict attention to this case. Indeed, papers following Lagos and Wright (2005) assume utility is linear in either x or h, but as will become clear we do not it would be straightforward need to restrict attention to this case. Although or endowment to allow general preference shocks, it suffices here to as sume the following: with probability a the utility function is vH, and with for all I?a it is vL, where dvH(q,x,h)ldq> probability dvL(q,x,h)/dq, (q,x,h), which generates gains from trade similar to, for example, Berentsen is that there is no and Rocheteau (2003). The key point for our purposes

and Wright (1998), Wallace (2001), Corbae, Temzelides (2003) or Alipran Puzzello for formal discussions of essentiality and the role of (2007) et al. is especially since they explicitly consider models with relevant anonymity. Aliprantis and decentralized both centralized meetings. 5 out to us, under As Todd Keister the alternative that increasing M pointed assumption an means in in this increase reduces model, 7 government always increasing spending, See Kocherlakota tis, Camera and on employment is the wealth effect of fiscal by emphasized unemployment?this policy While Christiano and Eichenbaum this is and potentially (1992). quantitatively interesting, currency, relevant, we want to focus on the effects of monetary policy on the return to holding so we hold government constant. Note, rather than the pure wealth effect, spending by the way, there on ? in case there is no wealth supply. is any confusion, quasi-linear but effect on money demand, labor models utility or indivisible a wealth there is still most definitely imply effect 4

a double-coincidence

labor

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

841

so employment in the DM?it is a pure exchange market?and production in worked the CM. is unambiguously hours given by Trade in the DM is bilateral, and so we have to say how people meet. as in one could consider a more general matching technology, Although = a et al. (2007), here we set and assume every agent that Rocheteau \ draws vH is matched with one that draws vL. We call the former a buyer and the latter a seller, since there is a deal to be done where the agent with vL transfers some q to the one with vH in exchange for some cash. the frictions in the DM imply an essential role for some medium Generally, of exchange. We assume that the good x cannot be carried into the DM, and there is no other storable object, so that this role must be played by this paper is not about the coexistence of money money (in other words, and other assets). on utility to guarantee con We impose standard curvature conditions x one of With is indivisible labor, sumption strictly positive. obviously similar for A, and interiority of (the probability do something of) an we assume to return is which issue below. We dis agents employment count between the DM and next CM at rate ? e (0, 1), but not between the CM and DM. Let W(m) denote the CM value function, which depends only on money since in all other respects agents are identical in this balances, denote the DM value function, which, market. Let V(m,x,h) in addition to m, also depends on (x,h) since these are given when one enters this market. This completes our description of the basic model. In the next four sections we analyze the CM, we analyze the DM, we put them together to define equilibrium, and we discuss the implications for the relation between inflation and unemployment. cannot

III. The CM

As we said, going back to Rogerson in models with indivisible (1988), labor agents trade lotteries. Thus, in the CM, given m, an agent chooses ? {t, x\, jco, rh\, mo), where i is the probability of employment (i.e., of h 1), if employed, and xq and mo while x\ and rh\ are consumption and money are consumption if unemployed. and money The problem is W(m)= max _

(l,x\,xo,mi,m0)

{?V(mx,

xx, 1) +(1

-l)V(m0,

jc0, 0)},

(1)

s.t. l{px\ where fer,

+mi)

(l

i)(pxo + mo) <wt

+ m + j M + A,

the wage, 7M trans the lump-sum money in dollars. As is standard, income, all measured of working i. What agents effectively get paid for selling a probability is slightly non-standard here is that they do not derive utility directly in p is the price and A dividend

? The editors of the Scandinavian Journal of Economics 2008.

of x, w

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

842

G. Rocheteau,

P. Rupert and R. Wright

this market;

occur.

instead

they

take

(m,x,h)

to the DM,

where

other

events

A few additional comments are in order concerning (1). First, as is well an individual's choice will generally be contingent known in related models, on his employment status A, but if V is separable between x and h then and if V is separable between m and h then m\=mo.6 x0=xi, Second, a model et al. (2006) actually derive problem with from Rocheteau (1) standard Arrow-Debreu markets, and no lotteries, where agents trade state contingent commodity bundles [x(s), h(s), m(s)] and s represents a sunspot; for simplicity we start directly with lotteries.7 Finally, although (1) generally et al. (2006) does not have a quasi-concave function, Rocheteau objective conditions hold. show there is a unique solution and the second-order to reduce the notation we assume this is very easy to generalize, Although so that an aggregate production function that converts h into x one-for-one, for (1) can be the Lagrangian and A = 0. Hence, in any equilibrium w =p written W(m) = F(mi,xi,l)+(l-?)F(w0,JCo,0)

+Ar.-^1-(i-^o+,w+7M-^i-(i-^oi

where

an interior solution A is a multiplier. Assuming are see conditions first-order below), (but xh:Vx(mh,xh,h) mh : Vm(mh,xh,h) = \, = \/p, A = 0,1 h = 0,l (2) (3)

for i e (0, 1) for now

I: V(mx,xu\)-V(m0,x(),0) m+

\lxx-xQ-\

+ mx~mo\

(4)

X:l-ixx-jl-t)x,

Since tions

6 Of

lM-i^-{l-i)^=0. P

(5)

does not depend on m, (2)-(4) constitute five equa V{t?h,Xh,h) and m, that can be solved for (x\,XQ,m\, mo, A), independent of

on the under it is separable depends V(-) is an endogenous object, and whether role for One of the function money explicitly, advantage deriving lying utility vJ(q,x,h). one some discipline: it in the utility instead of just sticking function, say, is that it imposes m In clear it will be assume enter and h cannot that case, very any e.g. separably. simply or wi =mo if xi =xq below 7 it is shown how to support effi That result is based on Shell and Wright (1993), where as sunspot equilibria instead of lottery equilibria. in non-convex economies cient allocations some in this over but in have contexts, lotteries, including general, advantages Sunspots see Garratt, Keister and Shell (2004). model, they are equivalent; course, ? The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

843

under weak

regularity

conditions.8

Once

we

have

(jci,jco, wi,wo,

A), (5)

yields i as the following function of m: pxp + mp-^M-m o o? \

e=t(m)=-7r--t?~??

p(l+xo-x\)

+ mo-m\

(6)

Individuals with more money supply less labor in the CM?i.e., they work can afford the same with a lower probability?which is how everyone a key part of the economics, (jci, jco,mi, mo, A). In terms of monetary status but not result is that the choice of m h may depend on employment on m, and hence all agents take the same money holdings out of the CM on h. conditional This is similar to the basic result in the Lagos-Wright model, where all agents take the same money holdings out of the CM, and hence we get a of m in the DM. Here we get at most a two-point degenerate distribution since in general the employed and unemployed do not have the distribution, same m, although as we said above they do when V is separable between m and h. In any case, a two-point distribution is not hard to handle; the of m on (the dependence important part is to eliminate history dependence that the result in the Lagos-Wright model m). We emphasize only holds with quasi-linear utility, while here it holds for any utility function. Another result that carries over from quasi-linear models is linear: is that W(m) = that W\m) A//?, by the envelope theorem, where we already established ? is independent of m. One might say agents in the indivisible-labor model act as if they have quasi-linear utility. Summarizing: in the CM the choice of riih

? e (0, I) for Lemma 1. Assuming and W\m) = X/p are independent

all agents of m.

IV. The DM

a meeting where the values of and ms. mb arbitrary of the good, subject to d<mb over more than he has. There trade (q,d): Lagos and Wright and Waller Aruoba, Rocheteau Consider ing solutions;

8 See Rocheteau

Rocheteau

et al. ?

buyer has mb and the seller ms dollars, for Generally, they trade d dollars for q units and q<q, since neither agent can turn are several ways to determine the terms of use Nash (2005) generalized bargaining; (2007) consider several alternative bargain and Wright (2005) consider price taking, as in

need

to rule out p{x\ implies a singularity for one

only

even Actually, see Rocheteau

special in this case, our et al. (2006).

for details, but basically the regularity condition is that we (2006) ? - w = = i, or equivalently jco 1) m0 V(m \, x\, 1) V(mo, *o> 0)> which in (2)-(4). In the indivisible-labor to occur literature, this case is known see e.g. Cooper and Wright (1987) or Rogerson utilty function; (1988). results go through, but we need a different argument. Again,

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

844

G. Rocheteau,

P. Rupert

and R. Wright

the Lucas-Prescott search model and price posting, labor-market (1974) as in the directed search model of Shimer (1996) and Moen (1997); and Galenianos and Kircher (2006) and Dutu, Julien and King (2007) use auc that allow for some multilateral tions (in versions of the model matches, it would clearly be inter which we could easily accommodate). Although in this paper we stick to bargaining, esting to consider various alternatives, and indeed to take-it-or-leave-it offers by the buyer. The reason is the following. There is a complication here, compared to several types of meetings there are, in principle, because many models, on their employment that can occur between buyers and sellers depending an meet status in the CM?an could seller, an employed employed buyer we an etc. if But meet could seller, adopt unemployed buyer employed take-it-or-leave-it offers by the buyer, and if we also assume that sellers' = are separable, say vL(q,x,h) then the terms + G(q), F(x,h) preferences in the meeting of trade will not depend on anything except the money to allow it will be important below the buyer mb. Although we can still to and be between q, (x,h) non-separable buyers' preferences we are therefore when results sellers' get interesting preferences separable; focus on this case to facilitate the presentation.9 a take-it-or-leave-it the buyer makes Given offer, one can easily show the buyer offers all his money d = mb, and asks for that in any equilibrium the seller indifferent between the q that makes trading and not trading: holdings of

G(q-q)

where

+ ?W(msVmb) = G(q) + ?W(ms),

function next period.10 By Lemma is the CM value 1, W(m) = to reduces and the previous W(ms +mb)?W(ms) expression mb\/p, ? ? = In general, some buyers were employed while G(q) G(q q) ?mbX/p. some were unemployed in the CM, and the former have rh\ and trade for while the latter have m0 and trade for q0 = q(m0) in the DM. q\=q(rh\) But the deal is independent of the value of (xh,h) for either the buyer or the seller as well as ms. Summarizing:

the buyer has general the case where bargaining (2007), we present 2 and 3) for 6 = 1, on main could the results (Propositions power only prove case. This is somewhat here to this special the suggestion of a referee we restrict attention = 1 does it rules since 6 many however, unfortunate, extensions?e.g. interesting preclude in the out a version sellers have to pay a fixed entry cost to participate of the model where DM. 10 that but here is the idea. It is easy to check and Wright for details, See Lagos (2005) some <m* in and a buyer threshold m* is below that his iff mb all mb money spends one can show that q is increasing in mb and mb = m* Also, q=q* implies equilibrium. = with strict equality that q < q* in equilibrium, where imply below c'(q*). This will uf(q*) iff the nominal interest rate is i= 0. In Rocheteau 9, but et al. since we ? The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation and unemployment

in general

equilibrium

845

Lemma

2. The DM q(-)

the function

bargaining is the solution

solution to

is d ? mb and q = q(mb),

where

?m?\/p

G(q)-G(q-q).

(7)

Now, for an agent in the DM with (m/,, jc^, h), when has some possibly random amount of money p,

every

other agent

V(mh,xh,h) =

\{vH[q+q(mJh),xh,h]+?W(0)} + \E?{vL [q-q(p),xh,h] + ?W(m+ p)},

and with ( ), probability 1/2 he is a

since with seller.

1/2 he is a buyer probability Inserting the separable form of i/

V(mh,xh, h) = \{vH [q+q(mh\ xh, h] + ?W(0) } + lE,{F(xh,h) + G[q-q(p)] + ?W(n + p)}.

and inserting W'(-) Differentiating, arrive at the envelope conditions and q\-) fr?m Lemmas

(8)

1 and 2, we

Vm(mk,xh,h)=--\-*-?---=??

2p [

G'[q-q(mh)]

1|

(9)

j

(10)

Vx(mh,xh, h)=\v?

[q+q(mh), xh, h] + {Fx{xh, A).

V.

Equilibrium

some results. First, insert the expressions We begin by collecting for V and its derivatives in (8)?(10) plus the bargaining solution (7) from the DM into the first-order conditions (2)-{4) from the CM and simplify to get

\=\v?[q+q(j?h),xh,h\+\Fx(xk,h), A p ?\\v%[q+q{mh),xh,h] G>[q-q{mh)\ 2p\ + 1 ,

A=0,1 h= 0,1

(11)

(12)

= (j^Z

-vH[q+

?)

[G[q-q(j?x)] -G[q-q(m0)])

-

+ \(l-xi+x0)+j{vH[q+q(mxlxl,l]

q(m0), x0, 0] + F(x?,

?

1)

F(x0,

0)}.

(13)

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

846

G. Rocheteau,

P Rupert and R. Wright m to get l)m0 M, clears (Walras'

Next,

integrate

(6) over agents with diff?rent ?xx (1 p[?l)x0] =lr?i+(l-

which

says the money market clears law). Goods market clearing implies 75

iff the goods market *0

1+Xo?X\'

(14)

Also,

by Lemma

2:

?mx+(\-?)m0

={l[G(q)-G(q-qi)]

+

and money market clearing

(\-l)[G(q)-G(q-qo)]}^

implies =_???_

l[G(q)-G(q-qi)]+(l-l)[G(q)-G(q-qo)Y

one can proceed more generally, we focus on steady states Although are constant.11 infla where all real variables Then (15) pins down we can use the tion by p/p = M/M=l+j. Fisher Also, equation 1+ i= p/p? = (1 + 7)//3 to define the nominal interest rate /.12 Then (11>

(13) become \=\v?(q+qh,xh,h)+\Fx(xk,h), 1 /= 2 0 = (i+i)

+

A= 0. 1 A=0,1 (17)

(16)

G'(q-qh)

[G(q-q0-

G(q -q0)] +A(1

xx +x0)

11[vH(q+qi,xu\)-vH(q+qo,xo,0)+F(xi,?)-F(xo,0)],

(18)

where tions qi, for q(nth). System (16)?(18) in (x\, xo, q\, qo, A). Given this, aggregate we write constitutes five equa is given employment

by (14), the price level by (15), and individual money holdings by mh =p(l+7)[G(q) G(q-qh)]/?\.

11 are discussed for in a footnote below. See e.g. Lagos and Wright (2003) briefly Dynamics a general treatment of dynamics in these kinds of models. 12 as a no-arbitrage can be interpreted for pricing a hypothetical condition The Fisher equation off in the next CM, which asset purchased in one CM and paying nominal by assumption cannot defining ? to (traded in) the DM; or one can interpret itmerely be brought rate 7. i in terms of ? and the exogenous money growth as a piece of notation

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

847

A rium,

solution subject

to the above to one

caveat: we

set of equations defines a steady-state need to discuss the maintained

equilib assump

tion 0 < ?(m) < 1 for all m in the support of the equilibrium distribution

across agents entering the CM, upon which much of is the based.13 We now discuss conditions under which analysis is that is maintained valid. recall First, l(m) assumption given by (6), the ? ? can of which, p(\ + xo denominator be + mo m\, x\) positive or nega tive. We concentrate on the former case, in which we have ?\m) < 0, and to leave the latter as an exercise.14 After using money market clearing eliminate M and goods market clearing to eliminate ?, we have of money the above holdings ?( }- (l+7)(l-*i+*o)P*o + 0 -X1+XQ + 7*o)"*o -7*0^1 - (1 -xi+x0)(\+j)m (1+7)(1 -x\ +x0)[p(\ -x\ +*o) +mo-m\]

(19)

We use this to check whether 0 < ?(m) < 1 in equilibrium. Note that all agents who were buyers in the previous DM enter the CM with m = 0, while those who were sellers enter with the money they brought themselves plus what they acquired from sales. Letting m = max{m0, mi}, the most an agent could have entering the CM is therefore 2m. Since we are considering the case where ?'(ni) < 0, we have 0 < ?(ni) < 1 for all m in

the support of the equilibrium distribution iff ?(0) < 1 and ?(2m) > 0. By

(19) these

X\

inequalities

< 1

are equivalent

to: ~7(1 -*i)m

(1 -xi+x0

+ 7-7Xi)mi

/?(1+7)(1 -xi+xo)

7x0mi

Xo >-,

-(1

?x\ p(\

+Xo + 7-x;o)mo-2(l -+7)0 -x\ +*o)

~x\

+*o)^

can be checked for any solution to the set of equations defining which In some cases this is really quite easy. For instance, if utility equilibrium. = m are all is separable between q and (x,/z), so that m\?mo equal to

It is not that there is anything wrong in principle with equilibria with l(m) = 0 or l(m) = 1 for some m, but in practice reason is that, when the algebra becomes The main complicated. some agents hit corner solutions, we cannot guarantee all bring the same amount they will on employment of money then has to keep track of the (contingent status) to the DM. One DM money distribution one can use numerical closely 14 The related models. case where it is 0 is ruled out that the denominator is positive the more methods, as a state variable, which as e.g. Molico makes (2006) analytic or Chiu results difficult. and Molico (2007) However, do in

13

Note

in footnote condition mentioned 8. by the regularity iff the unemployed are better off than the employed in common the CM, which is actually if not the only possible if utility is case?e.g. h and (x, q), then the employed and unemployed separable between get the same consumption, while the latter enjoy leisure and hence are clearly better off. ? The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

848

G. Rocheteau,

P. Rupert

and R. Wright

M(l + 7), these inequalities reduce ratherdramatically to M M t

x\<\-and jco> ?.

can also express this in terms of consumption goods by insert ? ? = If, for example, utility is also p(\ + 7) [G(q) ing M/p G(q qh)] /?\. separable between x and h then things are especially neat, since then x and ? are independent of q, and since q < q* in any equilibrium, where q* is the first-best quantity, we simply need to choose preferences so that q* One is small. Intuitively, if the value of money is too big, either agents with m = 0 would have to supply i(m) > 1 to get back up to the equilibrium m = M(l+7), or those with m=2M to would have to supply l(m)<0 hence we need q to be not too big. In nu get back down to M(\ +7); merical it was not hard to choose parameters to guarantee calculations, 0 < l(m) < 1 for all relevant m, or to choose other parameters where the constraint ?(m) g [0, 1] is binding. In what follows, we do not dwell on this, and simply take for granted 0 < l(m) < 1 in equilibrium. that conditions hold so as to guarantee

VI. The Phillips Curve

We now study the relation between unemployment and monetary policy, where policy here can be described in terms of either inflation 7 or the nominal interest /, by virtue of (1 4- /) = (1 + 7)//?. We separate the analysis on buyers' preferences. into three cases, depending In the first case, as in most of the related literature, utility is separable between the CM and DM allocations (x, h) and q; in the second case q interacts with x; and in to reduce the notation, for the final case q interacts with h. Also, mainly this exercise we assume sellers' utility is separable in all three arguments, = the cases are: F(x) + G(q) + H(h). Summarizing, vL(q,x,h)

(1) Case (i):vH(q,x,h) = f(x,h) + g(q) (2) Case (ii):vH(q,x,h) = f(q,x) + g(h) (3) Case (iii):vH(q,x,h) = f(q,h) + g(x).

In the first case, (17) reduces to

= Since (20) has a unique solution for qh, we have qi=q0 q. Moreover, we can solve for q independently of the rest of the equilibrium. Then (16)?(18) reduce to

\=\[fx(xh,h)

?

+ F'(xh)],

A= 0,1

(21)

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

849

0=\[f(xul)

These three equations

+ F(xl)-f(x0,0)-F(x0)]-\(xl~xo-l).

can be solved

(22)

for (xj, x0, A), from which we get and the rest of the equilibrium. Note that policy i im ?=xo/(\+xo-x\) on with but not at all on (jci, jtn, A) or ?. One might q, pacts dq/di<0, a as this of in the cur version the neoclassical dichotomy, which recognize rent context has the implication that the Phillips curve is vertical.15 1. In case (i), dqldi < 0 and dl/di First, =0. (16) and (17) now become

Proposition In case

(ii) things are quite different.

A=i[/x(?+?A,x?) fq(q+qh,Xh)

Gf(q-qh) These conditions ?= ? = \ [g(0)~ rium conveniently

+ Ffe)], l

A=0,

* = 0,1

1.

= and qi=q0 q. Then (18) pins down imply x\=xo=x ? can we H Now summarize (I)]. g(l)-\- H(0) equilib as the solution (q,x) to

0= fx(q+q,x) 0 = fq(q+q9x)-(2i

=

+ FXx)-2\

(23) (24)

-

+ l)G'(q-qh).

=

< 0 and dx/di Therefore, dq/di 2G'(fxx + F')/D ~fxq, -2G'fxq/D where a ^ b means a and b are equal in sign and D = + + + + \)G" > 0. fxxfqq (/? F;/) (2i f2xq F"fqq falls with /, while the effect on x depends on the Thus, q unambiguously and since increases iffx increases. ~??x employment cross-derivativefxq, Proposition

15 As subset supply

2. In case

(ii), dqldi < 0 and dl/di

> 0 iff < 0. fxq

is said with to dichotomize if a

(1979, p. 43) puts Sargent can determine of equations no playing values role of

model it, "A macroeconomic the values of all real variables

in determining the equilibrium value of any the level of the money the real variables, supply helps determine but cannot values of all nominal that are endogenous variables influence equilibrium In a system real variable. that dichotomizes the equilibrium of all real variables values equilibrium

the level of the money real variable. Given the the any are

into real and of the absolute here does not dichotomize independent price level." The model can only affect the latter, since q is a real variable; nominal it instead parts, where money dichotomizes under this special into CM and DM parts, just like the baseline specification see Aruoba and Wright and Wright Waller (2003). Aruoba, in the CM and used that is produced capital by introducing DM goods. The plan here is to break the dichotomy by considering non-separable between CM and DM goods. model; Lagos-Wright break the dichotomy ? (2005) to make utility

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

850

G. Rocheteau,

P. Rupert and R. Wright

This is very intuitive. Inflation is a direct tax on reduces q. lffxq > 0 (q and x are complements) then and hence ?. But i?fxq < 0 (q and x are substitutes) x and ?. In the latter case, inflation causes people goods

and into CM goods, increasing ployment. We thus get a Phillips curve under simple and natural conditions. for Perhaps the most surprising part is that the results are so clean?why, are no rea there wealth and effects? The substitution example, ambiguous son is the same as the reason why the model is so tractable, in general: agents here act as if they have quasi-linear utility. Before moving that this model has a neat graphical on, we mention = and Condition (11) implies x=X(q) (23) implies q representation. Q(x), which have slopes in (x,q) space that depend onfxq\

dq_ dx

activity, and hence inflation also reduces x, then inflation increases to substitute out of DM CM production and reducing unem

DM

= X(q) \x

-(/? + F"> and <"

"X\ fxq

xq -A

q= Q(x) (fxx+ G")

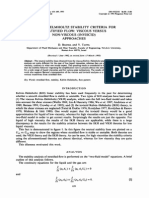

can be imposed to Figure 1 displays the three cases. Standard assumptions curves A these must existence. cross, guaranteeing imply simple calculation > one same curve must D that shows shows the be steeper than 0) (the X(q) the Q(x) curve, implying uniqueness of monetary steady state.16 An increase in / shifts the Q(x) curve down, leading to a fall in q and increase or a < 0 > 0. Hence, existence, uniqueness in x when we decrease orfxq have/^ in one simple diagram.17 and comparative statics can all be described case so we similar in sketch the analysis. (iii), merely happens Something becomes First, (16)

\=\[g,(xh)

which implies x\ =xo

+ F'(xh)], "I

A=0,1,

(25)

= x, but now

(17) becomes

1 \fg(q+qh,h)

with 17

is a value for x solving is of course also a non-monetary (23) steady state, which that here. 0, but we are ignoring can also depict in for 0<t(m)< the necessary and sufficient conditions 1, since < ?\ - [G(q) - G(q - q)], which we can this case they reduce to [G(q) q)] < ?\x G(q in the figure using Proposition easily plot in (x,q) space. One can also describe efficiency q One = to discuss Finally, we use the figure to show that if we peg the interest rate but if we peg 7, then in addition equilibrium; the non-monetary steady state over time along it is not standard methods: using dynamics i, then the steady state is the only monetary to there exist dynamic equilibria converging curve. the X(q)

16 There

4 below. hard

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

851

Q(x)

A/>0

I-1X*

(0/^=0

Fig. 1. Equilibrium representation

(ii)/^<0

(iii)/x,>0

which implies becomes

qo ^

q\

in this case, with

q\>qo

ifffqh>0.

Then

(18)

0 =?[f(q+qul)-f(q+qo,0) (I +i) [G(q-qx)We

+ H(l)-H(0)] G(q q0)] A.

(27)

~ or

of dqhldi < 0 for h = 0, 1 and dl/di leave as an exercise verification once increases The again, that employment important point is, ?fqh. decreases with inflation under simple conditions on the cross-derivative. Proposition 3. In case (Hi), dqhldi < 0 and dl/di > 0 iff < 0. fqh

inflation re This result is also very intuitive. As always, in the model, > or are 0 (q and h duces q. Iffqh q and leisure substitutes) complements, But if the reduction in q increases leisure and hence reduces employment. < 0 (q and leisure are complements) then, by reducing q, inflation also fqh reduces leisure and hence decreases Again, we equilibrium unemployment. or a curve Whether under very simple and natural conditions. get Phillips curve a an or a sees one not vertical upward-sloping, downward-sloping, in the data is another issue altogether, and not one we consider here. The for a relation point is simply that there is no problem in theory accounting inflation and between unemployment. Our results are all based on rudimentary public finance considerations, and do not require anything "tricky" like signal extraction problems, nom is that these con inal rigidities, and so on.18 The other point to emphasize siderations

18 One

lead to a relation between

inflation and employment

that is stable

to get unam is not used to compared to

set things up here. We say that there is one "tricky" ingredient might and labor that the DM is a pure exchange market, results by assuming as long as x production labor intensive, is relatively q. More produce generally, biguous ?

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

852

G. Rocheteau,

P. Rupert and R. Wright

our in the long run. Thus, given the right cross-derivatives, and exploitable can achieve a permanently lower indicate that policymakers propositions rate of unemployment at a faster rate. However, we now by printing money argue that this is not a good idea. To this end, consider the planner's problem: W = max

(?,Xl,XO,?i,0o)

? [I

\-v"(q+quXu ^ ?

I

1)+ ?r? i 1? I

1-i

?

vn(q +<?o,*o, 0)

+ -vL(q-quXUl)+??s.t. ixi+(l -i)x0

vL(q-q0,x0,0) <?.

+ ?W

It is easy to check that, given our assumptions, the first-order conditions for iff / = 0. Hence, the this problem coincide with the equilibrium conditions efficient policy is the Friedman rule, regardless of whether the Phillips curve or vertical. Of course, we set up is upward-sloping, downward-sloping, the framework and so on. If to be difficult case in which it is although addressing following: Proposition

ner s problem.

avoiding externalities, market incompleteness, to add features such as these, it should not to be too high or too low, get equilibrium unemployment the analysis might lead to different policy conclusions? not so clear that inflation is the only or the best tax for these issues. In any case, in the benchmark model we have the intentionally one is free

4. The Friedman

rule

i= 0 achieves

the solution

to the plan

VII.

Conclusion

are desirable and can randomized allocations economies, unem as not This with lotteries. generates only supported equilibria it it is because for convenient very monetary provides theory, ployment, an alternative to Lagos and Wright in the sense that it generates (2005) tractability without quasi-linearity. We used these ideas to construct a gen In non-convex be We inflation and unemployment. eral equilibrium model of the relation between on prove that the Phillips curve slopes either up or down, depending of the utility function. The idea is simple and plausible: cross-derivatives inflation is a tax on economic activity that uses cash, and so if either labor intensive goods are substitutes for this activity or leisure is complementary This does not mean we with this activity, inflation reduces unemployment.

to get q, it will be possible content will be similar. ? similar the exact conditions will but the economic

results;

change,

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation use

and unemployment

in general

equilibrium

853

should

inflation

complications) In Berentsen

to combat unemployment, since (without additional the optimal policy is the Friedman rule. et al. (2007), a very different model of the labor market?

the one provided by Mortensen and Pissarides (1994)?is integrated into economics. There are some advantages to that search-based model monetary of unemployment, including the fact that it generates more interesting indi vidual labor market histories, and also more interesting aggregate dynamics, is a state variable (it takes time for individuals to because unemployment find jobs). On the other hand, as is well known, the Mortensen-Pissarides model is analytically one cannot tractable only with linear utility. Hence, to quasi-linearity for monetary say it provides an alternative economics, and one certainly could not attempt to prove theorems like the ones in this curve depends the slope of the Phillips on cross paper, about how of the utility function. But it is good to know that both of derivatives of the labor market can easily be generalized these models to accommo date monetary exchange.

References

N. (1991), Existence S. R. and Wallace, of Steady States with Positive Consumption Aiyagari, in the Kiyotaki-Wright Review Studies Model, 58, 901-916. of Economic G. and Puzzello, D. (2007), Markets and Monetary C, Camera, Aliprantis, Anonymous Economics 54, 1905-1928. of Monetary Trading, Journal S. B. and Wright, R. (2003), Search, Money, and Capital: Aruoba, Journal and Banking Credit, 35, 1085-1105. of Money, S. B., Rocheteau, G. and Waller, C. (2007), Bargaining, Aruoba, nomics 54, 2636-2655. Aruoba, S. B., Waller, C. and Wright, R. (2005), Money of Pennsylvania, manuscript, University Philadelphia. A. and Rocheteau, G. (2003), Money and Berentsen, Review Economic 44, 263-297. Berentsen, Run, A., Menzio, G. manuscript, University D. G. and Corbae, Camera, Review 40, 985-1008. A Neoclassical Journal Dichotomy, Eco

of Monetary

and Capital the Gains

and the Value from

of Money,

Trade,

International in the Long Economic Bank

R. (2007), and Wright, Inflation of Pennsylvania, Philadelphia. (1999), Money and Price and Welfare Current Real

and Unemployment International

Dispersion, Costs of

M. Chiu, J. and Molico, (2007), Liquidity of Canada, Ottawa. L. and Eichenbaum, M. Christiano, (1992), gate Labor Market Cooley, American Fluctuations, T. J. and Hansen, G. D. Economic Review Wage American

Inflation,

manuscript,

Business Review

Economic Inflation

(1989), The 79, 733-748.

Tax

and Aggre Cycle Theory 82, 430^450. in a Real Business Cycle Model,

R. (1987), Cooper, and Macroeconomic Corbae, change, Dutu,

D., Temzelides, Econometrica Julien, B.

and Employment in Labor Contracts: Patterns Microfoundations Harwood Academic NJ. Publishers, Newark, Applications, T. and Wright, R. (2003), Directed Ex and Monetary Matching 71, 731-756. Competing Auctions in a Monetary Economy,

R.,

manuscript,

University

I. (2007), and King, of Auckland.

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

854

G. Rocheteau,

P. Rupert and R. Wright in an Economy with Villages, manuscript, University of

Faig, M. (2005), Divisible Money

Toronto. Galenianos, M.

P. (2006), Multilateral and Monetary and Kircher, Matching Exchange, of Pennsylvania, University Philadelphia. and Lottery T. and Shell, K. (2004), Garratt, R., Keister, Comparing Equilibrium Sunspot Economic Review The Finite Case, International Allocations: 45, 351-386. Equilibrium manuscript, Green, Money Hansen, nomics Kiyotaki, Economy Kiyotaki, American E. J. and Zhou, R. (1998), A Rudimentary with Divisible Model Random-matching and Prices, Journal Theory 81, 252-271. of Economic Eco G. D. (1985), Indivisible Labor and the Business Cycle, Journal of Monetary 16, 309-327. N. and Wright, 97, 927-954. N. and Wright, Economic N. (1998), R. R. Review (1989), (1993), 83, On Money A 63-77. is Memory, Journal of Economic Labor Market Princeton Theory Fluctuations, Press, 81, 232 in T. F. Princeton, as a Medium of Exchange, Approach Journal of Political Economics,

Search-theoretic

to Monetary

Kocherlakota, 251. Kydland, Cooley NJ. Lagos, R. F. E.

Money

and Aggregate (1994), Business Cycles (ed.), Frontiers of Business Cycle Research, and Wright, R. (2003), Dynamics,

University

Dynamic, Fundamentally 109, 156-171. Lagos, R.

Disaggregative

in Genuinely and Sunspot Equilibria Cycles Economic of Money, Journal Models Theory of for Monetary Theory and Policy Journal of

Analysis, Lucas, R. Economic

R. (2005), A Unified Framework and Wright, Journal 113, 463-484. of Political Economy and Prescott, Theory 7, E. C. 188-209. (1974), Equilibrium Search

and Unemployment,

E. R. (1997), Journal Search Equilibrium. 105, Moen, Economy Competitive of Political 385^111. Interna in Search Equilibrium, and Prices M. of Money Molico, (2006), The Distribution tional Economic Review 46, 701-722. Mortensen, in the Theory of C. (1994), Job Creation and Job Destruction D. and Pissarides, Studies Review 61, 397?415. of Economic Unemployment, J. (2006), Aggregate Labor Supply: A Statement E. C, Rogerson, R. and Wallenius, Prescott, Arizona State University, and their Interaction, manuscript, about Preferences, Technology, G.

in Competitive R. (2005), Money in Search Equilibrium, and Wright, Equi Econometrica in Competitive Search Equilibrium, 73, 175-202. R. (2006), General with Non Rocheteau, G., Rupert, P., Shell, K. and Wright, Equilibrium of Cleveland, Bank and Money, convexities, paper, Federal Reserve Working Sunspots, OH. librium, and Rocheteau, in General R. (2007), Inflation and Unemployment P. and Wright, Rupert, Santa Barbara. of California, University manuscript, Eco and Equilibrium, Journal Indivisible Labor, Lotteries (1988), of Monetary 21, 3-16. in Economies with Efficient R. (1988), R. and Wright, Involuntary Unemployment G., Economics

Tempe. Rocheteau,

Equilibrium, R. Rogerson, nomics

Rogerson, Risk Sharing, Journal of Monetary Sargent, T. J. (1979), Macroeconomic

22, 501-515. Press. Theory, New York: Academic Indivisible L. (2006), Do Taxes Explain European Employment? Sargent, T. J. and Ljungqvist, and Savings, CEPR Discussion Lotteries, Labor, Human Paper no. 6196. Capital, Economic R. (1993), and Sunspot Equilibria, Lotteries, Indivisibilities, Shell, K. and Wright, Theory 3, 1-17.

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Inflation

and unemployment

in general

equilibrium

855

Shi, S. (1995), Money and Prices: A Model of Search and Bargaining, Journal of Economic Theory 67, 467^96. Shi, S. (1997), A Divisible SearchModel of Fiat Money, Econometrica 65, 75-102.

Shimer, Stockman, R. (1996), Contracts NJ. Inflation Economics Search, and the Capital 8, 387-393. Money, International Balances Stock in a Cash-in-Advance Journal Review of Political 42, 847 in a Frictional Labor Market, Ph.D. Dissertation, Princeton University, Princeton,

A. (1981), Anticipated Journal Economy, of Monetary R. (1995), Trejos, A. and Wright, 103, 118-141. Economy Wallace, 869. N. (2001), Whither

Bargaining,

and Prices, Economic

Monetary

Economics?,

and Aggregate Real Individual Zhou, R. (1999), Economic Review International 40, 1009-1038. Existence of a Monetary Zhu, T. (2003), Steady

in a Random-matching in a Matching Model: Model: Divisible

Model, Indivisible

State

Journal 112, 307-324. Money, of Economic Theory of a Monetary Zhu, T. (2005), Existence Steady State Journal 123, 130-160. of Economic Theory

in a Matching

Money,

The editors of the Scandinavian Journal of Economics 2008.

This content downloaded from 203.170.79.82 on Tue, 1 Oct 2013 03:27:47 AM All use subject to JSTOR Terms and Conditions

Vous aimerez peut-être aussi

- A Unified Framework For Monetary Theory and Policy Analysis: Ricardo LagosDocument22 pagesA Unified Framework For Monetary Theory and Policy Analysis: Ricardo LagosSyed Aal-e RazaPas encore d'évaluation

- A Unified Framework For Monetary Theory and Policy Analysis: Ricardo LagosDocument23 pagesA Unified Framework For Monetary Theory and Policy Analysis: Ricardo LagosTomas FriasPas encore d'évaluation

- NBER Macroeconomics Annual 2013: Volume 28D'EverandNBER Macroeconomics Annual 2013: Volume 28Jonathan A. ParkerPas encore d'évaluation

- Interest Rate Pass-Through, Monetary Policy Rules and Macroeconomic StabilityDocument39 pagesInterest Rate Pass-Through, Monetary Policy Rules and Macroeconomic Stabilitybrendan lanzaPas encore d'évaluation

- Monetary Exchange and The Irreducible Cost of Inflation: SciencedirectDocument12 pagesMonetary Exchange and The Irreducible Cost of Inflation: Sciencedirectsilvia indahsariPas encore d'évaluation

- Research Papers On Interest Rate ParityDocument4 pagesResearch Papers On Interest Rate Parityxmniibvkg100% (1)

- Literature Review On Interest Rate ChangesDocument4 pagesLiterature Review On Interest Rate Changesea8m12sm100% (1)

- 2005 - NominalRigiditiesPM - Christiano Et - AlDocument45 pages2005 - NominalRigiditiesPM - Christiano Et - AlJuan Manuel Báez CanoPas encore d'évaluation

- After the Flood: How the Great Recession Changed Economic ThoughtD'EverandAfter the Flood: How the Great Recession Changed Economic ThoughtPas encore d'évaluation

- Exchange Rates and The Balance of Payments: Reconciling An Inconsistency in Post Keynesian TheoryDocument27 pagesExchange Rates and The Balance of Payments: Reconciling An Inconsistency in Post Keynesian TheoryGregor SchwindelmeisterPas encore d'évaluation

- Predictability of Asset Returns and The Effi Cient Market HypothesisDocument37 pagesPredictability of Asset Returns and The Effi Cient Market Hypothesisndem29837Pas encore d'évaluation

- The Real Exchange Rate and Economic DevelopmentDocument36 pagesThe Real Exchange Rate and Economic DevelopmentYonimile RodriguezPas encore d'évaluation

- Lecture Notes 1Document16 pagesLecture Notes 1amrith vardhanPas encore d'évaluation

- Interest Rates and Inflation: Federal Reserve Bank of Minneapolis Research DepartmentDocument19 pagesInterest Rates and Inflation: Federal Reserve Bank of Minneapolis Research DepartmentHarshit JainPas encore d'évaluation

- Literature Review On Exchange Rate RegimeDocument8 pagesLiterature Review On Exchange Rate Regimegw2cgcd9100% (1)

- Interest Rate Through, Monetary Policy Rules and Macro Economic StabilityDocument29 pagesInterest Rate Through, Monetary Policy Rules and Macro Economic StabilityĐặng Thế HòaPas encore d'évaluation

- A Cointegrated Structural VAR Model of The Canadian Economy: William J. Crowder Mark E. WoharDocument38 pagesA Cointegrated Structural VAR Model of The Canadian Economy: William J. Crowder Mark E. WoharRodrigoPas encore d'évaluation

- Momentum Strategies Futures MarketsDocument60 pagesMomentum Strategies Futures MarketsdevinlPas encore d'évaluation

- In Which Exchange Rate Models Do Forecasters Trust?: David Hauner, Jaewoo Lee, and Hajime TakizawaDocument18 pagesIn Which Exchange Rate Models Do Forecasters Trust?: David Hauner, Jaewoo Lee, and Hajime TakizawadlavinutzzaPas encore d'évaluation

- Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary SystemsD'EverandModern Money Theory: A Primer on Macroeconomics for Sovereign Monetary SystemsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Financialization, Crisis and Commodity Correlation DynamicsDocument24 pagesFinancialization, Crisis and Commodity Correlation DynamicsSebaMillaPas encore d'évaluation

- Exley Mehta SmithDocument32 pagesExley Mehta SmithRohit GuptaPas encore d'évaluation

- Pas in Etti 1962Document14 pagesPas in Etti 1962Dawn HarrisPas encore d'évaluation

- Inflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithDocument33 pagesInflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithSamuel Mulu SahilePas encore d'évaluation

- SSRN Id4069575Document78 pagesSSRN Id4069575swavomirPas encore d'évaluation

- Austerity: When is it a mistake and when is it necessary?D'EverandAusterity: When is it a mistake and when is it necessary?Pas encore d'évaluation

- Introduction To The Equilibrium Model: Intermediate MacroeconomicsDocument8 pagesIntroduction To The Equilibrium Model: Intermediate MacroeconomicsDinda AmeliaPas encore d'évaluation

- Ruge Murcia PDFDocument43 pagesRuge Murcia PDFJoab Dan Valdivia CoriaPas encore d'évaluation

- Wiley American Finance AssociationDocument18 pagesWiley American Finance Associationtareq tanjimPas encore d'évaluation

- Unemployment and Business Cycles: WWW - Federalreserve.gov/pubs/ifdpDocument63 pagesUnemployment and Business Cycles: WWW - Federalreserve.gov/pubs/ifdpTBP_Think_TankPas encore d'évaluation

- The Carry Trade and FundamentalsDocument36 pagesThe Carry Trade and FundamentalsJean-Jacques RousseauPas encore d'évaluation

- Output and Unemployment Dynamics in Transition: April 3, 2000 Revised: January 19, 2004Document35 pagesOutput and Unemployment Dynamics in Transition: April 3, 2000 Revised: January 19, 2004marhelunPas encore d'évaluation

- Wiley Journal of Money, Credit and Banking: This Content Downloaded From 201.234.75.121 On Tue, 30 Oct 2018 22:11:34 UTCDocument46 pagesWiley Journal of Money, Credit and Banking: This Content Downloaded From 201.234.75.121 On Tue, 30 Oct 2018 22:11:34 UTCFredy A. CastañedaPas encore d'évaluation

- Optimal Fiscal Policy, Public Capital, and The Productivity SlowdownDocument37 pagesOptimal Fiscal Policy, Public Capital, and The Productivity SlowdownBett K. BernardPas encore d'évaluation

- Swoboda 1973Document20 pagesSwoboda 1973Tiến ĐứcPas encore d'évaluation

- Fellowship. Rodrik's Work Was Supported by An NBER Olin Fellowship. We Thank Naury Obstfeld, Roberto Perotti, TorstenDocument54 pagesFellowship. Rodrik's Work Was Supported by An NBER Olin Fellowship. We Thank Naury Obstfeld, Roberto Perotti, TorstenStéphane Villagómez CharbonneauPas encore d'évaluation

- NBER Macroeconomics Annual 2016D'EverandNBER Macroeconomics Annual 2016Martin EichenbaumPas encore d'évaluation

- Diamond 1984Document21 pagesDiamond 1984Cristian Fernando Sanabria BautistaPas encore d'évaluation

- Behavioural Economics: Psychology, neuroscience, and the human side of economicsD'EverandBehavioural Economics: Psychology, neuroscience, and the human side of economicsPas encore d'évaluation

- Quantitative Macro Models with Heterogeneous AgentsDocument52 pagesQuantitative Macro Models with Heterogeneous Agentsjooo93Pas encore d'évaluation

- Uncovered Interest Rate Parity Literature ReviewDocument4 pagesUncovered Interest Rate Parity Literature Reviewfuzkxnwgf100% (1)

- Monetary Policy and Exchange RatesDocument37 pagesMonetary Policy and Exchange RatesJenPas encore d'évaluation

- A New Approach To Forecasting Exchange Rates: Ylan@biz - Uwa.edu - AuDocument24 pagesA New Approach To Forecasting Exchange Rates: Ylan@biz - Uwa.edu - AueePas encore d'évaluation

- Author's Accepted Manuscript: International Review of Economics and FinanceDocument26 pagesAuthor's Accepted Manuscript: International Review of Economics and FinanceSufi KhanPas encore d'évaluation

- MSC MT 2023 Lecture1 Introduction To Development MacroeconomicsDocument14 pagesMSC MT 2023 Lecture1 Introduction To Development MacroeconomicstorinobrunnaPas encore d'évaluation

- CHARLES GOODHART - Monetary Economics - An Integrated Approach To Credit, Money, Income, Production and Wealth. by WYNNE GODLEY and MARC LAVOIEDocument2 pagesCHARLES GOODHART - Monetary Economics - An Integrated Approach To Credit, Money, Income, Production and Wealth. by WYNNE GODLEY and MARC LAVOIEkingfund7823100% (1)

- Banerjee and Newman (1993), Occupational Choice and The Process of DevelopmentDocument26 pagesBanerjee and Newman (1993), Occupational Choice and The Process of DevelopmentVinicius Gomes de LimaPas encore d'évaluation

- The Log of GravityDocument43 pagesThe Log of GravityTommy CheungPas encore d'évaluation

- A Monetary Explanation of the Equity Premium, Term Premium, and Risk-Free Rate PuzzlesDocument38 pagesA Monetary Explanation of the Equity Premium, Term Premium, and Risk-Free Rate PuzzlesLeszek CzapiewskiPas encore d'évaluation

- Sissoko 2007Document77 pagesSissoko 2007Joel ChineduPas encore d'évaluation

- International Business Cycles With Endogenous Incomplete MarketsDocument37 pagesInternational Business Cycles With Endogenous Incomplete MarketsFernando DiazPas encore d'évaluation

- Redux ModelDocument37 pagesRedux ModelDr. Maryam IshaqPas encore d'évaluation

- Stock Return Research PaperDocument5 pagesStock Return Research Papercaswa3k1100% (1)

- From Crisis to Confidence: Macroeconomics after the CrashD'EverandFrom Crisis to Confidence: Macroeconomics after the CrashÉvaluation : 4 sur 5 étoiles4/5 (1)

- Labor Markets and Monetary Policy: A New Keynesian Model With UnemploymentDocument32 pagesLabor Markets and Monetary Policy: A New Keynesian Model With UnemploymentbulaPas encore d'évaluation

- APA GuidelinesDocument16 pagesAPA GuidelinesAadi RulexPas encore d'évaluation

- 475 - 10 - PetrucciDocument13 pages475 - 10 - PetrucciAadi RulexPas encore d'évaluation

- Low Inflation Targeting Raises Long-Term UnemploymentDocument23 pagesLow Inflation Targeting Raises Long-Term UnemploymentAadi RulexPas encore d'évaluation

- 2010 FrantaDocument147 pages2010 FrantaAadi RulexPas encore d'évaluation

- Michon Chebat 2007 EARCDDocument18 pagesMichon Chebat 2007 EARCDAadi RulexPas encore d'évaluation

- WRAP Oswald Aerfeb2000Document21 pagesWRAP Oswald Aerfeb2000Aadi RulexPas encore d'évaluation

- An Empirical Analysis of The Relationship Between Unemployment and Inflation in Nigeria From 1977-2009Document20 pagesAn Empirical Analysis of The Relationship Between Unemployment and Inflation in Nigeria From 1977-2009Aadi RulexPas encore d'évaluation

- The Duration of Unemployment and Unexpected Inflation - An Empirical AnalysisDocument35 pagesThe Duration of Unemployment and Unexpected Inflation - An Empirical AnalysisAadi RulexPas encore d'évaluation

- Michon Chebat 2007 EARCDDocument18 pagesMichon Chebat 2007 EARCDAadi RulexPas encore d'évaluation

- Odour Music Service QualityDocument18 pagesOdour Music Service QualityAadi Rulex100% (1)

- Michon Chebat 2007 EARCDDocument18 pagesMichon Chebat 2007 EARCDAadi RulexPas encore d'évaluation

- From The CEO S Desk... : Equity Market Review and OutlookDocument6 pagesFrom The CEO S Desk... : Equity Market Review and OutlookAadi RulexPas encore d'évaluation

- Hackathon Statements V1Document10 pagesHackathon Statements V1AayushPas encore d'évaluation

- Popular Mechanics 2010-06Document171 pagesPopular Mechanics 2010-06BookshebooksPas encore d'évaluation

- 713 Catalog PagesDocument2 pages713 Catalog PagesJosé AcostaPas encore d'évaluation

- Quiz 1Document3 pagesQuiz 1JULIANNE BAYHONPas encore d'évaluation

- Language II Module 2 Adjectives and AdverbsDocument25 pagesLanguage II Module 2 Adjectives and AdverbsCarla Arredondo MagnerePas encore d'évaluation

- Coating Inspector Program Level 1 Studen 1Document20 pagesCoating Inspector Program Level 1 Studen 1AhmedBalaoutaPas encore d'évaluation

- BA 302 Lesson 3Document26 pagesBA 302 Lesson 3ピザンメルビンPas encore d'évaluation

- Saes H 201Document9 pagesSaes H 201heartbreakkid132Pas encore d'évaluation

- Symbiosis Skills and Professional UniversityDocument3 pagesSymbiosis Skills and Professional UniversityAakash TiwariPas encore d'évaluation

- DLP Din8Document2 pagesDLP Din8KOUDJIL MohamedPas encore d'évaluation

- C172M QRH (VH-JZJ) v1.1Document49 pagesC172M QRH (VH-JZJ) v1.1alphaPas encore d'évaluation

- Dball-Gm5 en Ig Cp20110328aDocument18 pagesDball-Gm5 en Ig Cp20110328aMichael MartinezPas encore d'évaluation

- Understanding Power Dynamics and Developing Political ExpertiseDocument29 pagesUnderstanding Power Dynamics and Developing Political Expertisealessiacon100% (1)

- Chemical Engineering Assignment SubmissionDocument10 pagesChemical Engineering Assignment SubmissionFahad KamranPas encore d'évaluation

- Alaris 8210 and 8220 SpO2 Module Service ManualDocument63 pagesAlaris 8210 and 8220 SpO2 Module Service ManualNaveen Kumar TiwaryPas encore d'évaluation

- Internal Controls and Risk Management: Learning ObjectivesDocument24 pagesInternal Controls and Risk Management: Learning ObjectivesRamil SagubanPas encore d'évaluation

- Ancon Channel & Bolt FixingsDocument20 pagesAncon Channel & Bolt FixingsatiattiPas encore d'évaluation

- Sewer CadDocument10 pagesSewer CadAlvaro Jesus Añazco YllpaPas encore d'évaluation

- Naaqs 2009Document2 pagesNaaqs 2009sreenPas encore d'évaluation

- Alside Brochure - Zen Windows The TriangleDocument13 pagesAlside Brochure - Zen Windows The TriangleZenWindowsTheTrianglePas encore d'évaluation

- It 7sem Unit Ii IotDocument10 pagesIt 7sem Unit Ii IotMaitrayee SulePas encore d'évaluation

- Ziva RWW ManuscriptDocument3 pagesZiva RWW ManuscriptroderunnersdPas encore d'évaluation

- How To Approach To Case Study Type Questions and MCQsDocument4 pagesHow To Approach To Case Study Type Questions and MCQsKushang ShahPas encore d'évaluation

- Confirmation Form: Pillar Regional Conference (NCR)Document1 pageConfirmation Form: Pillar Regional Conference (NCR)Llano Multi-Purpose CooperativePas encore d'évaluation

- Teodorico M. Collano, JR.: ENRM 223 StudentDocument5 pagesTeodorico M. Collano, JR.: ENRM 223 StudentJepoyCollanoPas encore d'évaluation

- Language Culture and ThoughtDocument24 pagesLanguage Culture and ThoughtLý Hiển NhiênPas encore d'évaluation

- 21 Great Answers To: Order ID: 0028913Document13 pages21 Great Answers To: Order ID: 0028913Yvette HOUNGUE100% (1)

- Events of National Importance 2016Document345 pagesEvents of National Importance 2016TapasKumarDashPas encore d'évaluation

- 1993 - Kelvin-Helmholtz Stability Criteria For Stratfied Flow - Viscous Versus Non-Viscous (Inviscid) Approaches PDFDocument11 pages1993 - Kelvin-Helmholtz Stability Criteria For Stratfied Flow - Viscous Versus Non-Viscous (Inviscid) Approaches PDFBonnie JamesPas encore d'évaluation

- Designers' Guide To Eurocode 7 Geothechnical DesignDocument213 pagesDesigners' Guide To Eurocode 7 Geothechnical DesignJoão Gamboias100% (9)