Académique Documents

Professionnel Documents

Culture Documents

5 and Tyhe Way To The

Transféré par

Gideon HilardeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

5 and Tyhe Way To The

Transféré par

Gideon HilardeDroits d'auteur :

Formats disponibles

1

5. 4) The purpose must be to obtain profits etc. The purpose must be to obtain profits and to divide the same

among the partners and that it is necessary that such profits or benefits shall be common to all partners. 2 16. Sharing of profits Sharing of gross profits is not partnership when the agreement is to divide the gross

earning or receipts of a venture will not for itself constitute a partnership as to third persons. !t does not amount to an agreement to share profits and losses. Sharing of profits is a prima facie evidence of partnership because it is an essential element of the relationship. " 1#. $hen sharing profits not prima facie evidence of partnership% &ne who merely ma'es a loan or money

or credit to the owner of a business in consideration of a share of its profits in repayment of such loan or in lieu of or in addition to interest for its use does not thereby become a partner in the business. $here an employee receives "5( of the net profits instead of a salary there is no partnership in the absence of any contract showing the same. !n )avarro v. *+ 222 S*,+ 6#5-6#. /1..") a cursory e0amination of the evidence presented no proof that a partnership whether oral or written had been constituted at the inception of this transaction. $hile there may have been co-ownership or co-possession of some items and1or sharing of proceeds by way of advances received by both plaintiff and the defendant there is no indicative and supportive of the e0istence of partnership between them. The court held in 2u3as4ue v.*+ 1". S*,+ 5"" /1.55) even if there was a falling out or misunderstanding between the partners such does not convert it into a sham organi6ation. 4 15. 5) The purpose must be lawful + partnership cannot be formed for an illegal purpose and where the

thing to be done is illegal the contract of partnership for the purpose of doing such is e4ually illegal. +rt. 1##7 of the )ew *ivil *ode states 8$hen an unlawful partnership is dissolved by 9udicial decree the profits shall be confiscated in favor of the State.: 5 1.. ;ffect of unlawful purpose of partnership The *ourt will refuse to recogni6e its e0istance and will not

lend their aid to assist either of the parties thereto in an action against the other. The profits shall be confiscated in favor of the State. The instruments and effects of the crime if the purpose is a criminal act may be confiscated under the provisions of the ,<*. The contributions of the partners shall not be confiscated. 6 27. 6) The +rticles of <artnership must not be 'ept secret +rt. 1##5 provides that 8associations and

societies whose articles are 'ept secret among the members and wherein any one of the members may contract in his own name with third persons shall have no 9uridical personality and shall be governed by the provisions relating to co-ownership. # 21. =e >eon? $hat are the characteristic elements of partnership% ;0plain. *onsensual )ominate @ilateral

&nerous *ommutative <rincipal <reparatory 5 22. Auridicial <ersonality of <artnerships +rt. 1#65. The partnership has a 9udicial personality separate and

distinct from that of each of the partners even in case of failure to comply with the re4uirements of +rticle 1##2 first paragraph. Trivia Buestion? !f + and @ decide to form a partnership. Cow many persons are involved% ". + @ and the <artnership of + and @. . 2". +rt. 1##2. ;very contract of partnership having a capital of three thousand pesos or more in money or

property shall appear in a public instrument which must be recorded in the &ffice of the Securities and ;0change *ommission. 17 24. $hat is referred to in +rt. 1##2% $hat is referred to here is that registration in S;* is not necessary for the ac4uisition of 9uridical personality. The contract of partnership is a consensual contract. Cence it is perfected from the moment of consent and its 9uridical personality begins therefrom. 11 25. <artnerships li'e corporations are sub9ect to absolute 9urisdiction supervision and control of the S;* 12 26. +rt. 1#6.. !n determining whether a partnership e0ists these rules shall apply? /1) ;0cept as provided by +rticle 1525 persons who are not partners as to each other are not partners as to third personsD /2) *oownership or co-possession does not of itself establish a partnership whether such-co-owners or co-possessors do or do not share any profits made by the use of the propertyD /") The sharing of gross returns does not of itself establish a partnership whether or not the persons sharing them have a 9oint or common right or interest in any property from which the returns are derivedD /4) The receipt by a person of a share of the profits of a business is prima facie evidence that he is a partner in the business but no such inference shall be drawn if such profits were received in payment? /a) +s a debt by installments or otherwiseD /b) +s wages of an employee or rent to a landlordD /c) +s an annuity to a widow or representative of a deceased partnerD /d) +s interest on a loan though the amount of payment vary with the profits of the businessD /e) +s the consideration for the sale of a goodwill of a business or other property by installments or otherwise. /n) 1" 2#. Trivia Buestion !f Auan and <edro are merely co-owners but Auan represents to <adring that he and <edro are partners can they be partners as to <adring a third person% 14 25. +nswer The general rule is no they cannot be partners as to <adring who is a third person if they are not partners as to eachother. The e0ception is where there is estoppel in +rt. 1525 of the *ode. So as to <adring Auan and <edro are partners even if they are not real partners. 15 2.. Trivia Buestion? Auan and <edro agree to buy a piece of land under the condition that each should pay one-half of the price thereof and that the property should be divided between them. !s there partnership in the case% /Eallemit v. Tagbiliran 27 <hil 241) )o. 16 "7. <artnership v. *o-ownership +s a general rule an agreement between 9oint-owners of property to carry common trade or business and to share the profits and losses thereof will constitute a partnership. + mere community if interest such as e0ists between tenants in common or 9oint tenants of real or personal property

does not ma'e such owners partners or raise a presumption that partnership e0ists. 1# "1. <artnership once established has 9uridical personality while a co-ownership as none. + <artnership is created always by contract while co-ownership may e0ist by operation of law. + co-owner may dispose of his individual interest in the common property as an incident inherent in ownership a partner has no such power. The ob9ect of partnership is gain a co-ownership does not necessarily e0ist for profit. The right of a co-owner descent to his heirD those of a partner /as partner in partnership) do not unless e0pressly stipulated in the contract of partnership. 15 "2. Trivia *ase Auana died leaving heirs her husband <edro and her children. +fter the partition the properties were not distributed to <edro and the other heirs. !nstead <edro as administrator used such properties in business by leasing or selling them and investing the income derived therefrom and the proceeds from the sales thereof in real properties and securities. ;very Fear the heirs returned from income ta0 purposes their shares in the net income derived from the properties and investments and paid the corresponding income ta0es. Cowever the heirs did not actually receive their shares which were left in the hands of <edro the administrator. The @!, decided that the heirs had formed an unregistered partnership and therefore sub9ect to the corporate income ta0 pursuant to Section 24 and 54 /b) of the Ta0 *ode. 1. "". Buestion 1? !s the @!, correct in contending that the heirs had formed an unregistered partnership% $hen did the unregistered partnership begin% Fes the @!, is correct in contending that the heirs had formed an unregistered partnership from the partition of the properties of the deceased Auana was approved by the court. Grom the moment the

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Sample Docs 123456Document19 pagesSample Docs 123456Gideon HilardePas encore d'évaluation

- SMR - BirDocument1 pageSMR - BirGideon HilardePas encore d'évaluation

- KPMG Interim Audit Report 201516Document14 pagesKPMG Interim Audit Report 201516Gideon Hilarde100% (1)

- Annex 4.4 Audit Report Template (Model)Document45 pagesAnnex 4.4 Audit Report Template (Model)Gideon HilardePas encore d'évaluation

- Manual 2Document30 pagesManual 2Gideon HilardePas encore d'évaluation

- Application Form For Mall Store Supermarket OfficeDocument1 pageApplication Form For Mall Store Supermarket OfficeGideon HilardePas encore d'évaluation

- Orgauditreporttemplate 2Document13 pagesOrgauditreporttemplate 2Gideon HilardePas encore d'évaluation

- Inventory Control Models: To AccompanyDocument112 pagesInventory Control Models: To AccompanyGideon HilardePas encore d'évaluation

- Hotel - Price Quotation & Company ProfileDocument6 pagesHotel - Price Quotation & Company ProfileGideon HilardePas encore d'évaluation

- Application Form For Hotel Motel Inn ResortDocument2 pagesApplication Form For Hotel Motel Inn ResortGideon HilardePas encore d'évaluation

- Inventory ManagementDocument40 pagesInventory ManagementGideon HilardePas encore d'évaluation

- Inventory ManagementDocument41 pagesInventory ManagementGideon HilardePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Oblicon Reviewer BalaneDocument134 pagesOblicon Reviewer BalaneJustin HarrisPas encore d'évaluation

- 3rd Exam Cases OBLADIDocument147 pages3rd Exam Cases OBLADIMc Vharn CatrePas encore d'évaluation

- Continental Legal History: SeriesDocument10 pagesContinental Legal History: SeriesNejira AjkunicPas encore d'évaluation

- Presentation On Medical NegligenceDocument16 pagesPresentation On Medical NegligenceNamrata BhatiaPas encore d'évaluation

- Statista GTC 13 2 1 2Document10 pagesStatista GTC 13 2 1 2Nezer VergaraPas encore d'évaluation

- Surviving Compulsory Heirs Legitime Legal BasisDocument3 pagesSurviving Compulsory Heirs Legitime Legal BasisDon AmboyPas encore d'évaluation

- Civil Complaint and Demand For Jury TrialDocument14 pagesCivil Complaint and Demand For Jury TrialNBC Montana100% (1)

- Casualty Insurance NotesDocument2 pagesCasualty Insurance NotesPauline DgmPas encore d'évaluation

- Reconstitution of Partnership DeedDocument8 pagesReconstitution of Partnership DeedYathesht JainPas encore d'évaluation

- Nature of Equitable Rights and InterestsDocument3 pagesNature of Equitable Rights and InterestsKityo MartinPas encore d'évaluation

- Obligation and Contracts PDFDocument204 pagesObligation and Contracts PDFMJ GabrilloPas encore d'évaluation

- Security Agreement Long Form SampleDocument6 pagesSecurity Agreement Long Form SampleSony WilliamsPas encore d'évaluation

- Article For Commercial Law - Undisclosed PrincipalsDocument24 pagesArticle For Commercial Law - Undisclosed Principalsr4c1ng50% (2)

- Performance - Contract - LawDocument17 pagesPerformance - Contract - LawvijiPas encore d'évaluation

- Redemption AgreementDocument3 pagesRedemption AgreementRocketLawyerPas encore d'évaluation

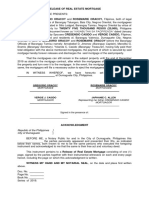

- Release of Real Estate MortgageDocument1 pageRelease of Real Estate MortgageAike SadjailPas encore d'évaluation

- KEY Clauses Under Commercial ContractDocument34 pagesKEY Clauses Under Commercial ContractKahmishKhanPas encore d'évaluation

- Neha Contracts ProjectDocument5 pagesNeha Contracts ProjectNeha PandeyPas encore d'évaluation

- Legal Environment 5th Edition Beatty Solutions Manual Full Chapter PDFDocument41 pagesLegal Environment 5th Edition Beatty Solutions Manual Full Chapter PDFlongchadudz100% (15)

- Novomet CatalogDocument641 pagesNovomet Catalogmolanoavila89% (19)

- 53 Quiamco Vs Capital Insurance and Surety Co IncDocument3 pages53 Quiamco Vs Capital Insurance and Surety Co IncJiana SinoCruz De Guzman100% (1)

- LAW CHAPTER 1 Obligations and ContractsDocument4 pagesLAW CHAPTER 1 Obligations and ContractsAndrea Miles VasquezPas encore d'évaluation

- Elements of A Common CarrierDocument8 pagesElements of A Common CarrierKyla Ellen CalelaoPas encore d'évaluation

- Chapter 1 Succession and Transfer Taxes Part 5Document2 pagesChapter 1 Succession and Transfer Taxes Part 5Angie100% (1)

- Banawa v. Mirano, 97 SCRA 517Document2 pagesBanawa v. Mirano, 97 SCRA 517Gabriel HernandezPas encore d'évaluation

- Oblicon - Week 1 To 3Document13 pagesOblicon - Week 1 To 3joyfandialanPas encore d'évaluation

- Indian Trust Act 1882Document2 pagesIndian Trust Act 1882mansisharma8301Pas encore d'évaluation

- Mikko Ringia (Atty. Mandocdoc)Document22 pagesMikko Ringia (Atty. Mandocdoc)Karina Bette RuizPas encore d'évaluation

- Sale of Goods Act, 1930: Question Bank Unit:1Document10 pagesSale of Goods Act, 1930: Question Bank Unit:1gargee thakarePas encore d'évaluation

- Property Course Outline - UMAKDocument43 pagesProperty Course Outline - UMAKJerlo Kevin RIalpPas encore d'évaluation