Académique Documents

Professionnel Documents

Culture Documents

Monthly Treasury - Nov 2-13

Transféré par

Steven HansenTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Monthly Treasury - Nov 2-13

Transféré par

Steven HansenDroits d'auteur :

Formats disponibles

DECEMBER 6, 2013

Monthly Budget Review for November 2013

The federal government ran a budget deficit of $231 billion for the first two months of fiscal year 2014, $61 billion less than the shortfall recorded in October and November of last year, CBO estimates.

Budget Totals, OctoberNovember

(Billions of dollars) Actual, FY 2013 Receipts Outlays Deficit (-) 346 638 -292 Preliminary, FY 2014 380 612 -231 Estimated Change 34 -27 61

Sources: Congressional Budget Office; Department of the Treasury. Based on the Monthly Treasury Statement for October 2013 and the Daily Treasury Statements for November 2013.

Total Receipts: Up by 10 Percent in the First Two Months of Fiscal Year 2014 Receipts for the first two months of fiscal year 2014 totaled $380 billion, CBO estimates$34 billion more than receipts during the same period last year.

Receipts, OctoberNovember

(Billions of dollars) Estimated Change Major Program or Category Individual Income Taxes Social Insurance Taxes Corporate Income Taxes Other Receipts Total Memorandum: Combined Individual Income and Social Insurance Taxes Withheld Taxes Other, Net of Refunds Total 291 11 301 314 17 331 24 6 30 8.1 55.5 9.8 Actual, FY 2013 177 124 5 40 346 Preliminary, FY 2014 182 149 8 42 380 Billions of Dollars 5 24 3 2 34 Percent 2.9 19.6 58.4 5.1 9.9

Sources: Congressional Budget Office; Department of the Treasury.

Note: The amounts shown in this report include the surplus or deficit in the Social Security trust funds and the net cash flow of the Postal Service, which are off-budget. Numbers may not add up to totals because of rounding.

MONTHLY BUDGET REVIEW FOR NOVEMBER 2013

DECEMBER 6, 2013

Individual income taxes and social insurance (payroll) taxes together rose by $30 billion, or 10 percent. Increases in amounts withheld from workers paychecks ($24 billion, or 8 percent) accounted for most of that gain, mainly because of the expiration of the 2-percentage-point payroll tax cut in January 2013, higher wages and salaries, and increases (beginning in January) in tax rates for income above certain thresholds. Nonwithheld receipts, mainly from filings of 2012 tax returns by people who had received filing extensions, increased by $4 billion. Receipts from corporate income taxes, which are generally quite small at this point in the year, rose by $3 billion (from $5 billion in the first two months of fiscal year 2013 to $8 billion so far this year). The first quarterly estimated payment of those taxes in the current fiscal year is due December 16.

Outlays in October and November: Down by 5 Percent (Adjusted for Timing Shifts) Compared With Spending During the Same Months in Fiscal Year 2013 Outlays for the first two months of fiscal year 2014 were $27 billion less than they were during the same period last year, CBO estimates. That decrease would have been slightly larger if not for shifts in the timing of certain payments from December to November (because December 1 fell on a weekend in both years). Without those timing shifts, CBO estimates, spending would have declined by $29 billion (or 5 percent).

Outlays, OctoberNovember

(Billions of dollars) Estimated Change With Adjustments for Timing a Shifts Major Program or Category

a

Actual, FY 2013 116 130 101 44 13 187 590 48

Preliminary, FY 2014 106 136 96 46 9 175 567 44

Estimated Change -10 7 -5 1 -3 -12 -23 -3

Billions of Dollars -10 7 -7 1 -3 -13 -25 -3

Percent -9.3 5.1 -8.0 3.1 -26.4 -7.3 -4.5 -7.0

DoDMilitary Social Security Benefits Medicare Medicaid Unemployment Insurance Other Activities Subtotal Net Interest on the Public Debt

b

Total

638

612

-27

-29

-4.7

Sources: Congressional Budget Office; Department of the Treasury. Note: DoD = Department of Defense. a. Excludes the effects of payments shifted because of weekends or holidays and the effects of prepayments of deposit insurance premiums. b. Medicare outlays are net of offsetting receipts.

Outlays for several major programs or categories of spending were less than what was spent during the first two months of last year, CBO estimates:

Total spending for military activities of the Department of Defense fell by $10 billion (or 9 percent). Spending for Medicare declined by $7 billion (or 8 percent), mostly because a one-time intragovernmental transfer of $4 billion was made in October 2013 instead of September 2013. Without that shift in the timing of payments and the shifts that occurred because December 1 fell on a weekend in both 2012 and 2013, spending for Medicare would have declined by $3 billion (or 3 percent).

MONTHLY BUDGET REVIEW FOR NOVEMBER 2013

DECEMBER 6, 2013

Outlays for unemployment benefits and net interest on the public debt each declined by $3 billion (or by 26 percent and 7 percent, respectively). Spending by the Department of Agriculture decreased by $4 billion (or 12 percent). Outlays for the Federal Emergency Management Agency were $2 billion lower. Spending declined by smaller amounts for several other programs and activities.

Increases in spending for some other major programs during the first two months of fiscal year 2014 partially offset those declines. In particular, spending increased for two of the governments largest entitlement programs:

Spending for Social Security rose by $7 billion (or 5 percent); and Spending for Medicaid rose by $1 billion (or 3 percent).

Estimated Deficit in November 2013: $140 Billion The federal government incurred a deficit of $140 billion in November 2013, CBO estimates, $33 billion smaller than the $172 billion deficit incurred in the same month last year. Because December 1 fell on a weekend in both years, certain payments that ordinarily would have been made in December were instead made in November. Without that shift in the timing of payments (in both 2012 and 2013), the November 2013 deficit would have been $35 billion less than that in November 2012.

Budget Totals for November

(Billions of dollars) Estimated Change With Adjustments for Timing a Shifts Actual, FY 2013 Receipts Outlays Deficit(-) 162 334 -172 Preliminary, FY 2014 182 321 -140 Estimated Change 20 -13 33 Billions of Dollars 20 -15 35 Percent 12.3 -4.9 -25.2

Sources: Congressional Budget Office; Department of the Treasury. a. Excludes the effects of payments shifted because of weekends or holidays and the effects of prepayments of deposit insurance premiums.

CBO estimates that receipts in November totaled $182 billion$20 billion (or 12 percent) more than those in the same month last year. Individual income taxes and social insurance (payroll) taxes together rose by $20 billion (or 15 percent); a $19 billion increase in withheld taxes explains nearly all of the change. That increase reflects the expiration of the payroll tax cut in January 2013 as well as increases in other taxes and higher wages and salaries. Total spending in November 2013 was $321 billion, CBO estimates$13 billion less than outlays in the same month in 2012. If not for the effects of timing shifts, that difference would have been slightly larger $15 billion. (The month-over-month changes discussed below reflect adjustments to account for those shifts.) Among the larger changes in outlays compared with last year were the following:

Spending for military activities of the Department of Defense decreased by $5 billion. That decline was spread across operations and maintenance, procurement, and revolving funds. Outlays for unemployment benefits and the Federal Emergency Management Agency were down by $2 billion each. Social Security payments rose by $3 billion. Outlays for other programs and activities differed by smaller amounts in both directions. 3

MONTHLY BUDGET REVIEW FOR NOVEMBER 2013

DECEMBER 6, 2013

Actual Deficit in October 2013: $92 Billion The Treasury Department reported a deficit of $92 billion for October$28 billion less than in the same month last year.

This document was prepared by Barbara Edwards, Dawn Sauter Regan, Joshua Shakin, and Adam Wilson. It is available at www.cbo.gov/publication/44938.

Vous aimerez peut-être aussi

- Macro Fiscal Policy in Economic Unions: States As AgentsDocument49 pagesMacro Fiscal Policy in Economic Unions: States As AgentsSteven HansenPas encore d'évaluation

- Fomc Proj Tabl 20131218Document5 pagesFomc Proj Tabl 20131218Roy WeiPas encore d'évaluation

- Livingston SurveyDocument10 pagesLivingston SurveySteven HansenPas encore d'évaluation

- Market Tantrums and Monetary PolicyDocument55 pagesMarket Tantrums and Monetary PolicySteven Hansen100% (1)

- Household Debt Rises in Third Quarter 2013Document31 pagesHousehold Debt Rises in Third Quarter 2013Steven HansenPas encore d'évaluation

- The Political Polarization IndexDocument24 pagesThe Political Polarization IndexSteven HansenPas encore d'évaluation

- Options For Reducing The Deficit: 2014 To 2023Document316 pagesOptions For Reducing The Deficit: 2014 To 2023Steven HansenPas encore d'évaluation

- Smaller Counties Did Not Have A Housing CrisisDocument16 pagesSmaller Counties Did Not Have A Housing CrisisSteven HansenPas encore d'évaluation

- An Analysis of The Navy's Fiscal Year 2014 Shipbuilding PlanDocument35 pagesAn Analysis of The Navy's Fiscal Year 2014 Shipbuilding PlanSteven HansenPas encore d'évaluation

- Merit Aid, Student Mobility, and The Role of College SelectivityDocument51 pagesMerit Aid, Student Mobility, and The Role of College SelectivitySteven HansenPas encore d'évaluation

- The Political Polarization IndexDocument24 pagesThe Political Polarization IndexSteven HansenPas encore d'évaluation

- Global Financial Stability Report - Transition Challenges To StabilityDocument166 pagesGlobal Financial Stability Report - Transition Challenges To StabilitySteven HansenPas encore d'évaluation

- $100 Bill Brochure and Poster CombinationDocument4 pages$100 Bill Brochure and Poster CombinationSteven HansenPas encore d'évaluation

- Banking Globalization, Transmission, and Monetary Policy AutonomyDocument36 pagesBanking Globalization, Transmission, and Monetary Policy AutonomySteven HansenPas encore d'évaluation

- Welfare Analysis of Debit Card Interchange Fee RegulationDocument5 pagesWelfare Analysis of Debit Card Interchange Fee RegulationSteven HansenPas encore d'évaluation

- Learning About Fiscal Policy and The Effects of Policy UncertaintyDocument39 pagesLearning About Fiscal Policy and The Effects of Policy UncertaintySteven HansenPas encore d'évaluation

- Federal Reserve Tools For Managing Rates and ReservesDocument43 pagesFederal Reserve Tools For Managing Rates and ReservesSteven HansenPas encore d'évaluation

- Money Market Mutual Funds and Stable FundingDocument23 pagesMoney Market Mutual Funds and Stable FundingSteven HansenPas encore d'évaluation

- Detroit's Bankruptcy: The Uncharted Waters of Chapter 9Document4 pagesDetroit's Bankruptcy: The Uncharted Waters of Chapter 9Steven HansenPas encore d'évaluation

- The Promise and Challenges of Bank Capital ReformDocument8 pagesThe Promise and Challenges of Bank Capital ReformSteven HansenPas encore d'évaluation

- Clusters of Knowledge: R&D Proximity and The Spillover EffectDocument12 pagesClusters of Knowledge: R&D Proximity and The Spillover EffectSteven HansenPas encore d'évaluation

- The Economics of Student Loan Borrowing and RepaymentDocument10 pagesThe Economics of Student Loan Borrowing and RepaymentSteven HansenPas encore d'évaluation

- Shadow Bank MonitoringDocument35 pagesShadow Bank MonitoringSteven Hansen100% (1)

- Testimony On The 2013 Long-Term Budget OutlookDocument8 pagesTestimony On The 2013 Long-Term Budget OutlookSteven HansenPas encore d'évaluation

- Money Market Mutual Funds and Stable FundingDocument15 pagesMoney Market Mutual Funds and Stable FundingSteven HansenPas encore d'évaluation

- Banking in Sub-Saharan Africa: The Macroeconomic ContextDocument34 pagesBanking in Sub-Saharan Africa: The Macroeconomic ContextSteven HansenPas encore d'évaluation

- Accounting For Breakout in Britain: The Industrial Revolution Through A Malthusian Lens PDFDocument53 pagesAccounting For Breakout in Britain: The Industrial Revolution Through A Malthusian Lens PDFMario Trabucco della TorrettaPas encore d'évaluation

- Negative Equity and Housing InvestmentDocument44 pagesNegative Equity and Housing InvestmentSteven HansenPas encore d'évaluation

- Uninsured Growth For Health Care Insurance Coverage in 2012Document10 pagesUninsured Growth For Health Care Insurance Coverage in 2012Steven HansenPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Public Officers Sandiganbayan (On Quantum of Evidence)Document16 pagesPublic Officers Sandiganbayan (On Quantum of Evidence)Marjorie Cosares EchavezPas encore d'évaluation

- CHB Aprjun08 RosieDocument21 pagesCHB Aprjun08 RosieLoriPas encore d'évaluation

- The Case Geluz vs. Court of AppealsDocument5 pagesThe Case Geluz vs. Court of AppealsJhaquelynn DacomosPas encore d'évaluation

- Culpable Homicide (Section 299 of The Indian Penal Code, 1860)Document3 pagesCulpable Homicide (Section 299 of The Indian Penal Code, 1860)nikhil pathakPas encore d'évaluation

- De Vera vs. Aguilar ruling on secondary evidence admissibilityDocument2 pagesDe Vera vs. Aguilar ruling on secondary evidence admissibilityAdi LimPas encore d'évaluation

- RULES ON APPOINTMENT AND POWERS OF TRUSTEESDocument14 pagesRULES ON APPOINTMENT AND POWERS OF TRUSTEESHanzel Uy VillonesPas encore d'évaluation

- Olaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Document13 pagesOlaf Peter Juda v. Dennis Michael Nerney, Assistant U.S. Attorney, Northern District of California Stephen R. Kotz, Assistant U.S. Attorney, Albuquerque, New Mexico John J. Kelly, U.S. Attorney, Albuquerque, New Mexico Michael Yamaguchi, U.S. Attorney, San Francisco, California Robert L. Holler, District Director, U.S. Customs Service, El Paso, Texas Leonard S. Walton, Acting Assistant Commissioner, U.S. Customs Service, Washington, D.C. Bonnie L. Gay, Foia Unit, Attorney-In-Charge, Washington, D.C. John and Jane Does 1-25 United States of America, Olaf Peter Juda v. United States Customs Service, Robert L. Holler, Joy M. Hughan, Daniel Luar, Rita Alfaro, Dolores Payan, Gina E. Fuentes, Internal Revenue Service, George Terpack, Carolyn Leonard, Timothy A. Towns, John Does, Jane Does, 149 F.3d 1190, 10th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- 5.4 Arrests Press ReleasesDocument4 pages5.4 Arrests Press Releasesnpdfacebook7299Pas encore d'évaluation

- USDA - Forest ServiceDocument2 pagesUSDA - Forest ServiceMia Ragland-WeemsPas encore d'évaluation

- IRS Allotment Dependency by Philippine Province 2009-2018Document10 pagesIRS Allotment Dependency by Philippine Province 2009-2018Rheii EstandartePas encore d'évaluation

- Concepcion DiaDocument18 pagesConcepcion DiaChienette MedranoPas encore d'évaluation

- Taxation 2 Legal Paper DSTDocument20 pagesTaxation 2 Legal Paper DSTDonvidachiye Liwag CenaPas encore d'évaluation

- PCLL Examiner Comments on Business Associations ExamDocument3 pagesPCLL Examiner Comments on Business Associations ExamDenis PoonPas encore d'évaluation

- Mha Advisory 396650Document1 pageMha Advisory 396650Qwerty541Pas encore d'évaluation

- South China Morning Post (2023!07!05)Document26 pagesSouth China Morning Post (2023!07!05)murielPas encore d'évaluation

- APT vs. CA ET AL Digest on Moral Damages for CorporationsDocument1 pageAPT vs. CA ET AL Digest on Moral Damages for CorporationsIrish Bianca Usob LunaPas encore d'évaluation

- CHAPTER 4 - Basic Numbering System of Police ReportsDocument4 pagesCHAPTER 4 - Basic Numbering System of Police ReportsAilyne CabuquinPas encore d'évaluation

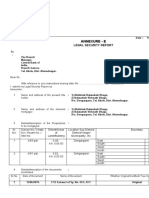

- Annexure - E: Legal Security ReportDocument7 pagesAnnexure - E: Legal Security Reportadv Balasaheb vaidyaPas encore d'évaluation

- Matibag Vs BenipayoDocument7 pagesMatibag Vs BenipayoMichael DonascoPas encore d'évaluation

- Microsoft Collaborate Terms of UseDocument6 pagesMicrosoft Collaborate Terms of UseZeeshan OpelPas encore d'évaluation

- S257a s40 Requirement To Provide BiometricsDocument4 pagesS257a s40 Requirement To Provide BiometricsBiraj ShresthaPas encore d'évaluation

- Social Security System v. Moonwalk Development and Housing CorporationDocument6 pagesSocial Security System v. Moonwalk Development and Housing CorporationRimvan Le SufeorPas encore d'évaluation

- Government of The Virgin Islands v. Eurie Joseph, 964 F.2d 1380, 3rd Cir. (1992)Document18 pagesGovernment of The Virgin Islands v. Eurie Joseph, 964 F.2d 1380, 3rd Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Extrajudicial Settlement of The Estate GurionDocument2 pagesExtrajudicial Settlement of The Estate GurionJheyps VillarosaPas encore d'évaluation

- 121-160 JurisprudenceDocument44 pages121-160 JurisprudencejilliankadPas encore d'évaluation

- Citibank V.dinopol, GR 188412Document7 pagesCitibank V.dinopol, GR 188412vyllettePas encore d'évaluation

- Broadway Centrum Condominium Corp vs. Tropical HutDocument9 pagesBroadway Centrum Condominium Corp vs. Tropical HutVeraNataaPas encore d'évaluation

- Ordinance Electronic LibarayDocument4 pagesOrdinance Electronic LibarayRaffy Roncales2100% (1)

- IsmailJafferAlibhai NandlalHarjivanKariaDocument46 pagesIsmailJafferAlibhai NandlalHarjivanKariaReal Trekstar80% (5)

- Architectural Consultancy AgreementDocument6 pagesArchitectural Consultancy AgreementprashinPas encore d'évaluation