Académique Documents

Professionnel Documents

Culture Documents

The Impact of CAP Reform: Dr. Franz FISCHLER

Transféré par

loulou612Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Impact of CAP Reform: Dr. Franz FISCHLER

Transféré par

loulou612Droits d'auteur :

Formats disponibles

SPEECH/04/311

Dr. Franz FISCHLER

Member of the European Commission responsible for Agriculture, Rural Development and Fisheries

The impact of CAP reform

Meeting with NGOs Brussels, 18 June 2004

Thank you for coming to this meeting where I tend to briefly cover the state of play of CAP reform, its relevance domestically but especially internationally, and its linkage to the ongoing negotiations in the context of the DDA. The process of CAP reform is well known to all of you and I dont feel I need to describe it in any detail. Although it is true that both the reform of 2003 and the more recent one covering the Mediterranean products will be implemented during the 2005-2007 period, and some variations do exist among Member States, the overall direction and extent of the reform leaves no doubt about its scope: At the end of the reform process the bulk of our support would have moved away from product support to direct producer support. Most of the latter would be in the form of decoupled payments, i.e. payments to the farm for the provision of public goods. The provision of these public goods are guaranteed by cross-compliance, i.e. the respect of all these standards, be it environmental, animal welfare, food safety or quality standards. Rural development would be strengthened both with the shift of funds away from market and direct aid support towards rural development measures and more importantly with the strengthening of the instruments available through rural development programmes. The balance of support available to our new Member States would reflect their real needs and priorities for restructuring and for wider measures supporting their rural communities. The product coverage of CAP reform would include almost all sectors of EU agriculture, with the notable exception of sugar (for which a proposal will soon be available).

Even the most ardent critics of the CAP admit that this process is clearly significant. Yet, depending on the point of view of the various stakeholders, we have also heard arguments suggesting that either we have gone too far (admittedly such argument are more confined to the farming or agribusiness community) or that we have not gone far enough (an argument obviously coming from outside the farming community). With all due respect to these arguments, I think it is meaningless to attempt to debate or evaluate the impact of CAP reform in abstract terms; too far or not far enough with respect to what? In my view the best way to evaluate the impact of CAP reform is with respect to the clear objectives we have set out to achieve: The CAP makes EU agriculture clearly more competitive than before. The significant cut in support prices in all reformed sectors (Graph 1) has bridged the gap between our internal prices and world market prices, while decoupling would lead our producers to shift more freely towards what they can produce best. Their product would thus be of higher quality, further increasing the competitiveness of our agriculture.

The CAP makes EU agriculture clearly more environmentally friendly. Cross-compliance does not only imply reductions or even zero direct payments if producers do not respect standards. New rural developments policy instruments, new funds for rural development, and producer support that is decoupled from production (and thus from the need to intensify production methods) all imply a significant reorientation of incentives that enhance the positive contribution of agriculture to the environment. The CAP is clearly more acceptable domestically. Its reform has been demand-driven, reflecting all the priorities that our citizens have identified as relevant to our policy objectives. It has also been driven by the need to maximise the efficiency of the policy instruments we use, the manner in other words by which we support our farmers, given the budgetary constraint we face, thus rendering the value for money argument relevant in the whole CAP reform process. The CAP is also clearly more acceptable in the international context. The best way to judge that is not by evaluating it on the basis of slogans, by definition clearly more capable of catching the eye, but often prone to missing the point, but by evaluating its real impact in the context of the DDA negotiation. CAP reform has not only provided us with additional margin in all three pillars domestic support, market access and export subsidies - but it has clearly changed both the nature of the debate and the balance among negotiating parties (to this point I will come later).

You could obviously argue that this is what you would expect to hear from somebody who has pushed these reforms through. So let me now try to argue from a different angle, not based on what we have been saying and doing but based on the criticisms we have been hearing about the CAP and its alleged failures. I do not intend to repeat here the list of such criticisms which, as you know, could be long. I would only like to focus on what seem to me the most credible of such criticisms, at least with respect to the often legitimate concerns they reflect, although sometimes these concerns are accompanied by inappropriate solutions. I would summarise these criticisms by focusing on three areas, linked to the three pillars of the WTO negotiations in agriculture I mentioned earlier. In such a way, I could try to put them into perspective with what is clearly a very timely issue, the state of play of the DDA. The most evident point of CAP criticism related to domestic support is the alleged cost of the CAP. But here I think that, instead of going into details, one should go straight to the point. To what are we comparing these costs? To me the only relevant comparison is that of the cost of the CAP with respect to the overall cost of public expenditure in the EU, less than 1% (Graph 2) for 7% of the population; and the facts are very clear. Not only is the share of CAP in EU GDP small and declining (from 0,54% of GDP 10 years ago to 0,43% today, going towards 0,33 % by 2013), but this share is also declining much faster than EU public expenditure (3 times faster during the last decade). That all this is happening while we increased our membership from 12 to 25 demonstrates to me the crucial point. That the real issue is not how much is spent on the CAP but where this money goes and how it is spent.

Looking at the CAP cost evolution during the last two decades clearly shows the significant shift in the manner this support is given, starting in 1992 (Graph 3): less for export subsidies, less for market support (intervention stocks and the like) and more direct aid to producers and to rural development; and that before we even start the implementation of the recent reforms. The impact of the latter reforms on the CAP cost structure is evident from Graph 4; even less will be spent in the future for market support, less for product-specific direct aids, and more (most of the support) will go to decoupled payments. This is exactly the path of policy reform consistent will less trade-distortion based on previous OECD analysis (Graph 5). And since it is around this time of the year when misinterpretations of OECD indicators are so common, a reminder: this exactly the policy reform path whose impact you will not see by looking at OECDs PSE. As our wheat example demonstrates (Graph 6), reductions in our domestic support price, export subsidies manner or tariffs have had no impact on the EU PSE for wheat (or other commodities) because the PSE aggregates the composition of support (not just subsidies), but does not measure its trade distorting impact. One more visible impact of CAP reform has nevertheless been on our position on domestic support in the context of the current state of negotiations in DDA. No-one focuses anymore on how to discipline CAP domestic support. Rather the issue is how to force reform of US farm policies, while at the same time respecting within the modalities framework the significant contribution of CAP reform in bringing down trade distorting support. I would like to turn now to the external impact of CAP reform, and especially to its impact for on developing countries. To use as reference the other two pillars of agricultural agreement, the issues at stake here are related to the impact of our exports and of our export subsidies on world markets (the alleged dumping issue) and to our contribution to opening up our market for the developing world. And what we need here is to move away from a competition of how to dump more slogans and to focus on the real factors that determine developments in world markets. This is not so much necessary for the CAP, but for preparing the developing countries themselves for the real challenges they have to face. Let me start with the export side, focusing on one development that is very clear from a simple look at the facts: the EU net-export position has declined in every single sector since 1990 (Graphs 7 and 8). This has been not been the result of some accident but of the combined and cumulative impact of the reform process: lower domestic support prices also result in lower market prices, decreasing the exportable surplus by both lower production and higher consumption. They also result in lower export subsidies. How can then one seriously defend the so-called dumping assertion when clearly the implication of lower exports is also lower pressure on world-market prices? I think one of the fundamental problems is the lack of any serious discussion on the factors determining world prices. Let me use as an example two sectors that are often used as proof of the detrimental effect of developed country policies for developing countries sugar and cotton.

In sugar the dramatic increase of the exportable surplus in Brazil almost exclusively explains the decline in world market prices (Graph 9). In cotton fluctuations in netimports of China (a major player not only in cotton but also in synthetics) coincide with major fluctuations that characterise world prices in that sector (Graph 10). Does this imply that we do not need to reform developed country policies in these sectors? On the contrary, both for domestic but also for international reasons neither we nor the US can afford not to reform - we have done so in cotton and hope that the US does the same. I will soon propose to do the same in sugar, and I hope that others follow here as well. But we should have no illusions that by isolating one factor and focusing almost exclusively all debate on it, exaggerating in the process its real impact on world markets, would in the final analysis benefit developing countries. The world is too complex to fit into such a simplistic scheme, too colourful to be limited by black and white analyses. Yet despite its complexity, the world is certainly ready for a move into one area related to export policies, that of the complete elimination of all forms of export subsidisation: EU export subsidies, disciplined from the previous round and declining, but still trade-distorting, form; US export credits or food aid for surplus disposal, which without any disciplines have assumed a major role of trade distortions in recent years; single-desk sellers retaining export monopolies and all sorts of government guarantees; differential export taxes, used to distort the composition of exports.

All these forms should have to go in full parallelism. Their elimination would certainly not harm developing countries, as some now started to claim. Clearly defined rules allowing action in emergency situations do not require product or origin specificity. They require the clear identification of needs and a clear share of responsibilities of meeting these needs. Finally a few words on market access - few not because the issue is of less importance but it is of such complexity that we could spend hours discussing it. It is clear that in the current state of play of the DDA negotiations on the modalities framework for agriculture, the issue has become the trickiest to resolve. In a sense this is to be expected. Market access affects all WTO members, not just the two big elephants and some other developed countries as domestic supports and export subsidies do. It also affects both importers and exporters, with diametrically opposed interest and sensitivities. Finally it affects developing countries in a very complex manner. In addition, not only are most of the benefits from market opening going to come from increased opportunities for trade among the developing countries themselves, but most of the fears about the impact of trade liberalisation come from developing countries. But, whatever the outcome of the negotiations on how we need to reflect all this complexity in a modalities framework, there can be no doubt about the importance and contribution of market access in the EU for developing countries. The fact that the EU is by far the largest market of agricultural exports from the developing countries is the proof, thanks to the series of preferential access arrangements in place.

And our Everything But Arms agreement ensures that products from the least developed countries can enter the EU market duty and quota free. What we would like to see now is other developed countries following a similar approach, or at the very least allowing 50% of developing country exports to enter their markets duty free. But above all we would like to see in the negotiations a formula able to deliver the same extent of detail as we expect in the other two pillars if an agreement of a modalities framework is to be agreed by July. Priorities and sensitivities are obviously very varied across this pillar, hence the need to come up with a formula that can deliver a meaningful compromise. And what the EU is keen to ensure here is that sensitive products are determined by the parties concerned, and not automatically; that the final formula for tariff reductions takes account of these sensitive products; that the final result is a single system that unilaterally addresses the need to make significant improvements in market access.; and that the developing countries, in particular the least developed, receive special and differential treatment. I think I have by now covered enough space! So I would like to thank you for your attention and turn to you for your comments. Annex : The Common Agricultural Policy : reform and relevance for the developing world.

The Common Agricultural Policy:

reform and relevance for the developing world

Franz Fischler

European Commissioner Responsible for Agriculture, Rural Development and Fisheries

Brussels, 18 June 2004

Meeting with NGOs

1. EU price support reductions

0 -15 -30 -45 -60 -75 Soft wheat Durum wheat Rice Beef Butter SM Powder

% reduction

Support price reduction

2

Brussels, 18 June 2004 Meeting with NGOs 2

2. The cost of the CAP in perspective

Cost of the CAP (relative terms)

50% 40% 30% 20% 10% 0% Share of GDP CAP expenditure All EU public expenditure

3

Brussels, 18 June 2004 Meeting with NGOs 3 � �

CAP cost in perspective

�

CAP costs indicate a clear trend:

�

a declining share in EU GDP (from 0.54% to 0.43% to 0.33%) a declining share in EU budget a declining share in EU public expenditure a significant shift in manner of support

3. The evolution of CAP expenditure

50 40 30 20 10 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 billion

EU-10 EU-12 EU-15

Export subsidies

Market support

4

Direct aids

Rural development

Brussels, 18 June 2004

Meeting with NGOs

4. CAP budget support trend

40 30 20 10 0

1993 Market measures Area/animal payments 2000 2008 Single Farm Payment (minimum from 2003/2004 reforms)

5

Brussels, 18 June 2004 Meeting with NGOs 5

billion

5. OECD evaluation of policies

Payments on Historical Entitlements Payments on Area Planted/Animals

Output Payments

Input Payments

Market Price Support

0,00

0,25

0,50 0,75 Trade Effects, MPS=1

6

1,00

1,25

Brussels, 18 June 2004

Meeting with NGOs

6. PSE and EU wheat support

150 120 90 60 30 0

1992 1993 1994 1995 1996 1997 1998 1999 PSE 2000 2001 Price support Export subsidies

7

Brussels, 18 June 2004 Meeting with NGOs 7

1992 = 100

Tariff protection

World price

7. EU net export share (reform impact)

100% 80% 60% 40% 20% 0%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Wheat Beef

8

Brussels, 18 June 2004 Meeting with NGOs 8

Pork

Poultry

8. EU net export share (pre-reform)

100% 80% 60% 40% 20% 0%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Sugar

Butter

9

SMP

Cheese

Brussels, 18 June 2004

Meeting with NGOs

9. What drives sugar prices

16000 12000 8000 4000 0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Brazil sugar exports (000 mt)

10

Brussels, 18 June 2004 Meeting with NGOs 10

000 mt

$ / mt

320 240 160 80 0

Sugar price (FOB Caribbean)

10. What drives cotton prices

2500 2000 1500 1000 500 0 -500 -1000

1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

11

China net imports (000 mt)

11

Brussels, 18 June 2004 Meeting with NGOs

Cotton price (A index $ / mt)

Vous aimerez peut-être aussi

- Pothole Claim Form in PhiladelphiaDocument3 pagesPothole Claim Form in Philadelphiaphilly victorPas encore d'évaluation

- 18 - Carvana Is A Bad BoyDocument6 pages18 - Carvana Is A Bad BoyAsishPas encore d'évaluation

- Toles Higher SampleDocument13 pagesToles Higher SampleKarl Fazekas50% (2)

- MJ: The Genius of Michael JacksonDocument4 pagesMJ: The Genius of Michael Jacksonwamu8850% (1)

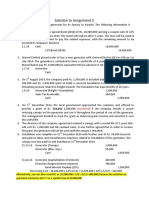

- Assignment 2 SolutionDocument4 pagesAssignment 2 SolutionSobhia Kamal100% (1)

- MACROECONOMICS 2 SHORT ANSWER QUESTIONS & ANSWERS PDFDocument21 pagesMACROECONOMICS 2 SHORT ANSWER QUESTIONS & ANSWERS PDFMon LuffyPas encore d'évaluation

- Pestle Analysis Planning Aid 2013Document32 pagesPestle Analysis Planning Aid 2013Tuhin MirPas encore d'évaluation

- Optional accessory charging link installationDocument4 pagesOptional accessory charging link installationloulou612Pas encore d'évaluation

- Ibn Mujahid and Seven Established Reading of The Quran PDFDocument19 pagesIbn Mujahid and Seven Established Reading of The Quran PDFMoPas encore d'évaluation

- Deposit Mobilization of Nabil Bank LimitedDocument41 pagesDeposit Mobilization of Nabil Bank Limitedram binod yadav76% (38)

- European Structural Policy s01Document7 pagesEuropean Structural Policy s01jasminnexPas encore d'évaluation

- Estimating Poverty ImpactsDocument16 pagesEstimating Poverty ImpactsMaruza Vieira Barboza TavaresPas encore d'évaluation

- Plan C - Shaping Up To Slow GrowthDocument11 pagesPlan C - Shaping Up To Slow GrowthThe RSAPas encore d'évaluation

- Berta-Tóth - Fiscal RulesDocument62 pagesBerta-Tóth - Fiscal Rulesdebreceni.sandor.770712Pas encore d'évaluation

- Economics AnswerDocument5 pagesEconomics AnswerJeeveshraj Gupta100% (1)

- TTIP: The Economic Analysis ExplainedDocument18 pagesTTIP: The Economic Analysis ExplainedOffice of Trade Negotiations (OTN), CARICOM SecretariatPas encore d'évaluation

- Economic convergence in EuropeDocument33 pagesEconomic convergence in EuropeYuris ZegaPas encore d'évaluation

- JPF Teamwork Eurozone FT 310805Document3 pagesJPF Teamwork Eurozone FT 310805BruegelPas encore d'évaluation

- The Relevance of Research Proposals To Community PoliciesDocument10 pagesThe Relevance of Research Proposals To Community PoliciesSimar PreetPas encore d'évaluation

- Who Gains and Loses From TradeDocument4 pagesWho Gains and Loses From TradeOsmanPas encore d'évaluation

- Mediocre Growth in The Euro Area: Is Governance Part of The Answer?Document5 pagesMediocre Growth in The Euro Area: Is Governance Part of The Answer?BruegelPas encore d'évaluation

- Agriculture'S Role in Development of Developing CountriesDocument7 pagesAgriculture'S Role in Development of Developing CountriesAhsenPas encore d'évaluation

- Economic Reforms in The Euro Area: Is There A Common Agenda?Document9 pagesEconomic Reforms in The Euro Area: Is There A Common Agenda?BruegelPas encore d'évaluation

- International Monetary and Financial Committee: Thirtieth M Eeting October 11, 2014Document21 pagesInternational Monetary and Financial Committee: Thirtieth M Eeting October 11, 2014IEco ClarinPas encore d'évaluation

- DownloadDocument3 pagesDownloadnickedia17Pas encore d'évaluation

- Ms-03 Solved Assignment 2015: Provided by WWW - Myignou.inDocument8 pagesMs-03 Solved Assignment 2015: Provided by WWW - Myignou.inJasonSpringPas encore d'évaluation

- Unit IDocument10 pagesUnit Ithanigaivelu4Pas encore d'évaluation

- Economic Analysis of Agricultural ProjectsDocument103 pagesEconomic Analysis of Agricultural Projectsprince marcPas encore d'évaluation

- Success Factors: European Coal and Steel Community European Economic CommunityDocument12 pagesSuccess Factors: European Coal and Steel Community European Economic CommunityVandanaPas encore d'évaluation

- Q-1Document40 pagesQ-1Gaurav AgarwalPas encore d'évaluation

- Utilising Equilibrium-Displacement Models To Evaluate The Market Effects of Countryside Stewardship Policies: Method and ApplicationDocument27 pagesUtilising Equilibrium-Displacement Models To Evaluate The Market Effects of Countryside Stewardship Policies: Method and ApplicationmahfuzscribdPas encore d'évaluation

- The Debate On Fiscal Policy in Europe: Beyond The Austerity MythDocument6 pagesThe Debate On Fiscal Policy in Europe: Beyond The Austerity MythБежовска СањаPas encore d'évaluation

- Proiecte EconomiceDocument16 pagesProiecte EconomiceFlorina StoicescuPas encore d'évaluation

- Edu Quality Economic GrowthDocument16 pagesEdu Quality Economic GrowthfastbankingPas encore d'évaluation

- Structural Reforms at The Zero BoundDocument28 pagesStructural Reforms at The Zero BoundClassic PhyXPas encore d'évaluation

- Issue5 3Document12 pagesIssue5 3Kule89Pas encore d'évaluation

- The G20 in The Aftermath of The Crisis: A Euro-Asian ViewDocument7 pagesThe G20 in The Aftermath of The Crisis: A Euro-Asian ViewBruegelPas encore d'évaluation

- Globalization RetakeDocument25 pagesGlobalization RetakeVictor MuchokiPas encore d'évaluation

- Large+Changes+in+Fiscal+Policy October 2009Document36 pagesLarge+Changes+in+Fiscal+Policy October 2009richardck50Pas encore d'évaluation

- 28 PDFDocument30 pages28 PDFdimikatsouPas encore d'évaluation

- SSRN Id4603658Document19 pagesSSRN Id4603658Joa PintoPas encore d'évaluation

- The Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthDocument31 pagesThe Effect of The VAT Rate Change On Aggregate Consumption and Economic GrowthCristina IonescuPas encore d'évaluation

- PCD in Focus - E-BookDocument8 pagesPCD in Focus - E-BookLauraZavaletaPas encore d'évaluation

- Opinion: Funding Agriculture: Not How Much?' But What For?'Document2 pagesOpinion: Funding Agriculture: Not How Much?' But What For?'Zoran H. VukchichPas encore d'évaluation

- Working Paper Series: Fiscal Policy and Growth Do Financial Crises Make A Difference?Document42 pagesWorking Paper Series: Fiscal Policy and Growth Do Financial Crises Make A Difference?Alen DzaficPas encore d'évaluation

- Technological Upgrading in GlobalDocument49 pagesTechnological Upgrading in GlobalAskederin MusahPas encore d'évaluation

- MIT paper examines China's growth strategy and path to balanced developmentDocument38 pagesMIT paper examines China's growth strategy and path to balanced developmentJiawei YePas encore d'évaluation

- Notes: Who Bears The Burden of Environmental PoliciesDocument4 pagesNotes: Who Bears The Burden of Environmental PoliciesAbou BaPas encore d'évaluation

- 19b XuanLam Export Refunds EUDocument15 pages19b XuanLam Export Refunds EUBenny DuongPas encore d'évaluation

- Thegattandenvironmental Protection: Problemsofconstruction: 1. The Consequences of Opening Up MarketsDocument28 pagesThegattandenvironmental Protection: Problemsofconstruction: 1. The Consequences of Opening Up MarketsNawress Ben AissaPas encore d'évaluation

- World Economic OutlookDocument6 pagesWorld Economic OutlookKEZIAH REVE B. RODRIGUEZPas encore d'évaluation

- The Earnings Effects of Multilateral Trade Liberalization by Hertel, Thomas Ivanic, Maros Preckel, Paul Cranfield, JohnDocument47 pagesThe Earnings Effects of Multilateral Trade Liberalization by Hertel, Thomas Ivanic, Maros Preckel, Paul Cranfield, JohnJoemar Rey Condor PayotPas encore d'évaluation

- B ColomerENDocument3 pagesB ColomerENelplastiPas encore d'évaluation

- How to do more monetary stimulusDocument31 pagesHow to do more monetary stimulusNorth41Pas encore d'évaluation

- SSRN Id1077082Document25 pagesSSRN Id1077082Revekka TheodorouPas encore d'évaluation

- Fuel Excise TaxDocument6 pagesFuel Excise TaxRobin BaricauaPas encore d'évaluation

- The French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Document25 pagesThe French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Center for Economic and Policy ResearchPas encore d'évaluation

- Economy Survey FranceDocument12 pagesEconomy Survey FrancekpossouPas encore d'évaluation

- European Comission Analysis: Fiscal Consolidation and Spillovers in The Euro Area Periphery and Core.Document32 pagesEuropean Comission Analysis: Fiscal Consolidation and Spillovers in The Euro Area Periphery and Core.Makedonas AkritasPas encore d'évaluation

- Matthews Potential Trade and Market Effects of The EU CAP Post 2020 ICTSD 2018Document50 pagesMatthews Potential Trade and Market Effects of The EU CAP Post 2020 ICTSD 2018Alan MatthewsPas encore d'évaluation

- Romero-Avila and Strauch (2008)Document20 pagesRomero-Avila and Strauch (2008)meone99Pas encore d'évaluation

- DP 13097Document51 pagesDP 13097zwapsPas encore d'évaluation

- PP China 1.1Document5 pagesPP China 1.1a01704836Pas encore d'évaluation

- Nicholas Kaldor 1971 Should The UK Join The EU Common Market? 3 EssaysDocument47 pagesNicholas Kaldor 1971 Should The UK Join The EU Common Market? 3 Essayspaul_a100% (2)

- Economic and Social Impacts of Trade LiberalizationDocument14 pagesEconomic and Social Impacts of Trade Liberalizationfasuoran@yahoo.comPas encore d'évaluation

- Fiscal PolicyDocument7 pagesFiscal PolicySara de la SernaPas encore d'évaluation

- S.No International Business Domestic BusinessDocument21 pagesS.No International Business Domestic BusinesssaandboxwizPas encore d'évaluation

- Austerity: When is it a mistake and when is it necessary?D'EverandAusterity: When is it a mistake and when is it necessary?Pas encore d'évaluation

- The Medal FormDocument3 pagesThe Medal Formloulou612Pas encore d'évaluation

- Amoredjenaue - The Geheime Vernietiging + OuttakeDocument1 627 pagesAmoredjenaue - The Geheime Vernietiging + Outtakeloulou612Pas encore d'évaluation

- Family DynamicsDocument5 pagesFamily Dynamicsloulou612Pas encore d'évaluation

- Updated Guidance On C.diff.Document29 pagesUpdated Guidance On C.diff.loulou612Pas encore d'évaluation

- Prevent frozen condensate pipesDocument6 pagesPrevent frozen condensate pipesloulou612Pas encore d'évaluation

- Fluid Balance Presentation For HAP 2012Document22 pagesFluid Balance Presentation For HAP 2012loulou612Pas encore d'évaluation

- Worcester Greenstar System Filter BrochureDocument6 pagesWorcester Greenstar System Filter Brochureloulou612Pas encore d'évaluation

- Managing Nutrition in An Acutely Ill Patient.31Document2 pagesManaging Nutrition in An Acutely Ill Patient.31loulou612Pas encore d'évaluation

- Greenstar Gas Boilers BrochureDocument36 pagesGreenstar Gas Boilers Brochureloulou612Pas encore d'évaluation

- Infection Control - Modes of Transmission - Some ExamplesDocument1 pageInfection Control - Modes of Transmission - Some Examplesloulou612Pas encore d'évaluation

- Who You Gonna CallDocument1 pageWho You Gonna Callloulou612Pas encore d'évaluation

- Consent Issues in Acute CareDocument24 pagesConsent Issues in Acute Careloulou612Pas encore d'évaluation

- Updated Guidance On C.diff.Document29 pagesUpdated Guidance On C.diff.loulou612Pas encore d'évaluation

- DPS Personal Hygiene and Oral CareDocument17 pagesDPS Personal Hygiene and Oral Careloulou612Pas encore d'évaluation

- Digestion Revision TestDocument2 pagesDigestion Revision Testloulou612Pas encore d'évaluation

- Hand Washing TechniqueDocument1 pageHand Washing Techniqueloulou612Pas encore d'évaluation

- Care Stands For: C A R E: WWW - Thecarecampaign.co - UkDocument1 pageCare Stands For: C A R E: WWW - Thecarecampaign.co - Ukloulou612Pas encore d'évaluation

- The Cell Student Copy 2012Document29 pagesThe Cell Student Copy 2012loulou612Pas encore d'évaluation

- Student Renal Presentation 2012Document19 pagesStudent Renal Presentation 2012loulou612Pas encore d'évaluation

- Thermoregulation MechanismsDocument17 pagesThermoregulation Mechanismsloulou612Pas encore d'évaluation

- Student Renal Presentation 2012Document19 pagesStudent Renal Presentation 2012loulou612Pas encore d'évaluation

- Consent Issues in Acute CareDocument24 pagesConsent Issues in Acute Careloulou612Pas encore d'évaluation

- Digestion Revision TestDocument2 pagesDigestion Revision Testloulou612Pas encore d'évaluation

- Skin 2012Document21 pagesSkin 2012loulou612Pas encore d'évaluation

- Powers of The European Parliament... : BrusselsDocument28 pagesPowers of The European Parliament... : Brusselsloulou612Pas encore d'évaluation

- Maintaining Balance: Homeostasis in the Human BodyDocument16 pagesMaintaining Balance: Homeostasis in the Human Bodyloulou612100% (1)

- Quick Reference GuideDocument3 pagesQuick Reference Guideloulou612Pas encore d'évaluation

- Biology PowerpointDocument12 pagesBiology Powerpointloulou612Pas encore d'évaluation

- Care Stands For: C A R E: WWW - Thecarecampaign.co - UkDocument1 pageCare Stands For: C A R E: WWW - Thecarecampaign.co - Ukloulou612Pas encore d'évaluation

- COMMERCIAL CORRESPONDENCE ADDRESSINGDocument44 pagesCOMMERCIAL CORRESPONDENCE ADDRESSINGKarla RazvanPas encore d'évaluation

- Psbank Auto Loan With Prime Rebate Application Form 2019Document2 pagesPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- JIRA Issue-Bug March OnwardsDocument10 pagesJIRA Issue-Bug March OnwardsMoses RashidPas encore d'évaluation

- The Jewish Religion - Chapter 3 - The Talmud and Bible BelieversDocument11 pagesThe Jewish Religion - Chapter 3 - The Talmud and Bible BelieversNatasha MyersPas encore d'évaluation

- Educations of Students With DisabilitiesDocument6 pagesEducations of Students With Disabilitiesapi-510584254Pas encore d'évaluation

- ACCA AAA Business Risk Notes by Alan Biju Palak ACCADocument5 pagesACCA AAA Business Risk Notes by Alan Biju Palak ACCAayush nandaPas encore d'évaluation

- RP-new Light DistrictsDocument16 pagesRP-new Light DistrictsShruti VermaPas encore d'évaluation

- Succession 092418Document37 pagesSuccession 092418Hyuga NejiPas encore d'évaluation

- DOJ Manila Criminal Complaint Against Robbery SuspectsDocument2 pagesDOJ Manila Criminal Complaint Against Robbery SuspectsDahn UyPas encore d'évaluation

- Hacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Document8 pagesHacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Martin SPas encore d'évaluation

- (U) D A R: Marshall DistrictDocument5 pages(U) D A R: Marshall DistrictFauquier NowPas encore d'évaluation

- RKMFiles Study Notes on Criminal Identification and InvestigationDocument168 pagesRKMFiles Study Notes on Criminal Identification and InvestigationTfig Fo EcaepPas encore d'évaluation

- Tendernotice - 1 - 2022-02-15T184553.611Document2 pagesTendernotice - 1 - 2022-02-15T184553.611Akhil VermaPas encore d'évaluation

- Affidavit of ConsentDocument2 pagesAffidavit of ConsentRocketLawyer100% (1)

- 해커스토익 김진태선생님 2020년 7월 적중예상문제Document7 pages해커스토익 김진태선생님 2020년 7월 적중예상문제포도쨈오뚜기Pas encore d'évaluation

- ZXSS10 Network Design Scheme (LLD) - Template - 361048Document16 pagesZXSS10 Network Design Scheme (LLD) - Template - 361048Mahmoud KarimiPas encore d'évaluation

- Labour Laws& Practice PDFDocument568 pagesLabour Laws& Practice PDFmahesh100% (1)

- Introduction:-: Mission & VisionDocument10 pagesIntroduction:-: Mission & Visionzalaks100% (5)

- Trilogy Monthly Income Trust PDS 22 July 2015 WEBDocument56 pagesTrilogy Monthly Income Trust PDS 22 July 2015 WEBRoger AllanPas encore d'évaluation

- Our Native Hero: The Rizal Retraction and Other CasesDocument7 pagesOur Native Hero: The Rizal Retraction and Other CasesKrichelle Anne Escarilla IIPas encore d'évaluation

- UT Dallas Syllabus For Hist4344.001.09f Taught by Debra Pfister (DHPF)Document8 pagesUT Dallas Syllabus For Hist4344.001.09f Taught by Debra Pfister (DHPF)UT Dallas Provost's Technology GroupPas encore d'évaluation

- GR No. 112497, August 4, 1994 FactsDocument2 pagesGR No. 112497, August 4, 1994 FactsIrene QuimsonPas encore d'évaluation

- Flyposting OrdinanceDocument2 pagesFlyposting OrdinanceJunil LagardePas encore d'évaluation