Académique Documents

Professionnel Documents

Culture Documents

In Terco

Transféré par

Doanxuan HoiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

In Terco

Transféré par

Doanxuan HoiDroits d'auteur :

Formats disponibles

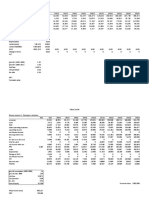

INTERCO

($000,000 except share price)

The following is supporting analysis for Exhibit 12.

EXHIBIT 12

CASH FLOW PROJECTIONS ($000,000)

Sales growth rate

Tax rate

7.2%

41%

1989

1990

1991

1992

1993

1994

1995

1996

3,582

9.20%

330

29

43

3,840

9.30%

357

29

43

4,116

9.40%

387

29

43

4,413

9.50%

419

29

43

4,730

9.60%

454

29

43

5,071

9.70%

492

29

43

5,436

9.80%

533

29

43

5,828

6,247

6,697

9.90% 10.00% 10.10%

577

625

676

29

29

29

43

43

43

4. EBIT

5. Taxes

316

129

343

140

373

153

406

166

440

180

478

195

519

212

563

230

611

250

663

271

6. Net income

7. Change in NWC

187

-

203

-

221

-

240

-

260

-

283

40

307

42

333

45

361

49

392

52

8. Cash flow (6-7)

187

203

221

240

260

243

265

288

313

340

1. Sales

2. Operating margin

3. Operating earnings (1x2)

Plus: other income

Less: corporate expense

1997

1998

Note: The tax rate is the same as in first quarter 1988. Other income and corporate expense

is the same as in year ending Feb. 29, 1988. Corporate expense was inferred from Exhibit 8,

using interest expense and other income data from Exhibit 7.

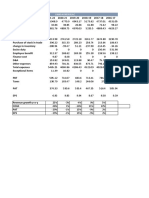

The following compares historical operating results to the projections.

HISTORICAL

1986

PROJECTED

1987

1988

Net sales

Operating earnings

Operating margin

2,832

252

8.9%

2,947

264

9.0%

3,341

301

9.0%

Curent assets

Current liabilities

1,216

250

1,287

358

1,359

373

Net working capital

NWC as % of sales

966

34%

928

32%

986

30%

Cash

Marketable securities

17

127

17

64

21

11

NWC less cash and securities

Adjusted NWC as % of sales

822

29%

848

29%

954

29%

Sales growth rate

4.0%

13.4%

Net property plant and equipment

442

Change (=investment less depreciation)

485

43

479

(6)

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

Vous aimerez peut-être aussi

- Pacific Spice CompanyDocument15 pagesPacific Spice CompanySubhajit MukherjeePas encore d'évaluation

- Interco CaseDocument12 pagesInterco CaseRyan LamPas encore d'évaluation

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gPas encore d'évaluation

- NPV CalculationDocument19 pagesNPV CalculationmschotoPas encore d'évaluation

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsD'EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsPas encore d'évaluation

- MW SolutionDocument19 pagesMW SolutionDhiren GalaPas encore d'évaluation

- Case IDocument20 pagesCase ICherry KanjanapornsinPas encore d'évaluation

- NetscapeDocument3 pagesNetscapeulix1985Pas encore d'évaluation

- Arcadian CaseDocument18 pagesArcadian CaseYulianaXie0% (1)

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RPas encore d'évaluation

- Bodie Industrial SupplyDocument14 pagesBodie Industrial SupplyHectorZaratePomajulca100% (2)

- Gas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Document3 pagesGas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Kazmi Qaim Ali ShahPas encore d'évaluation

- MSFTDocument83 pagesMSFTJohn wickPas encore d'évaluation

- 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 Macro Economic IndicatorsDocument10 pages2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 Macro Economic IndicatorsAjay KumarPas encore d'évaluation

- Netscape IPO Excel PDFDocument7 pagesNetscape IPO Excel PDFRishav AgarwalPas encore d'évaluation

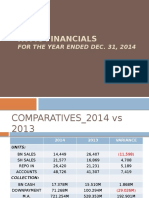

- RVMC Financials: For The Year Ended Dec. 31, 2014Document39 pagesRVMC Financials: For The Year Ended Dec. 31, 2014Marz PinzPas encore d'évaluation

- Rockwell Land CorporationDocument15 pagesRockwell Land CorporationaravillarinoPas encore d'évaluation

- Year Code Net Sales ($)Document7 pagesYear Code Net Sales ($)Tanvir KarimPas encore d'évaluation

- Supreme Annual Report 15 16Document104 pagesSupreme Annual Report 15 16adoniscalPas encore d'évaluation

- Xls179 Xls EngDocument3 pagesXls179 Xls EngIleannaPas encore d'évaluation

- BhartiAndMTN FinancialsDocument10 pagesBhartiAndMTN FinancialsGirish RamachandraPas encore d'évaluation

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RDocument4 pagesEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoPas encore d'évaluation

- Sales 1,000 1100 1210 1331Document44 pagesSales 1,000 1100 1210 1331Dỹ KhangPas encore d'évaluation

- Base Case: Economic AnalysisDocument4 pagesBase Case: Economic AnalysisjimyPas encore d'évaluation

- France UN Book 4Document32 pagesFrance UN Book 4Sophie WangPas encore d'évaluation

- AMF Bowling Ball - SSCDocument3 pagesAMF Bowling Ball - SSCAbubakar ShafiPas encore d'évaluation

- Income StatementDocument3 pagesIncome StatementGarvit JainPas encore d'évaluation

- Group 2 EconomicDocument14 pagesGroup 2 EconomicCourage ChigerwePas encore d'évaluation

- Financial Performance: 10 Year Track RecordDocument2 pagesFinancial Performance: 10 Year Track RecordSheikh HasanPas encore d'évaluation

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalPas encore d'évaluation

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlPas encore d'évaluation

- Assignment Data UsagesDocument2 pagesAssignment Data UsagesjgukykPas encore d'évaluation

- Home Depot in The New MillenniumDocument11 pagesHome Depot in The New MillenniumagnarPas encore d'évaluation

- UntitledDocument12 pagesUntitledSushil MohantyPas encore d'évaluation

- Audited Financial Results March 2009Document40 pagesAudited Financial Results March 2009Ashwin SwamiPas encore d'évaluation

- The Acquisition of Consolidated Rail Corporation (A)Document15 pagesThe Acquisition of Consolidated Rail Corporation (A)Neetesh ThakurPas encore d'évaluation

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasPas encore d'évaluation

- Tata MotorsDocument5 pagesTata Motorsinsurana73Pas encore d'évaluation

- ITC Presentation2.1Document10 pagesITC Presentation2.1Rohit singhPas encore d'évaluation

- Mari Gas Company Limited 2012 2013 2014 2015Document17 pagesMari Gas Company Limited 2012 2013 2014 2015Rahmatullah MardanviPas encore d'évaluation

- Data Interpretation and AnalysisDocument68 pagesData Interpretation and AnalysisajjansiPas encore d'évaluation

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalPas encore d'évaluation

- HelloDocument1 pageHellosonikonicaPas encore d'évaluation

- Ashok LeylandDocument27 pagesAshok LeylandBerkshire Hathway coldPas encore d'évaluation

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadPas encore d'évaluation

- Margins % of Sales: Gross Margin - 22.16 21.96 20.90 23.14 21.72 22.68Document2 pagesMargins % of Sales: Gross Margin - 22.16 21.96 20.90 23.14 21.72 22.68Sajid SaithPas encore d'évaluation

- Common Size Income Statement - TATA MOTORS LTDDocument6 pagesCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalPas encore d'évaluation

- HanssonDocument11 pagesHanssonJust Some EditsPas encore d'évaluation

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelMohamedPas encore d'évaluation

- Recommendation of Advisory CommitteeDocument1 pageRecommendation of Advisory Committeemadhumay23Pas encore d'évaluation

- 22 RAIN Standard Due Diligence Report Template Jan 09Document4 pages22 RAIN Standard Due Diligence Report Template Jan 09Chowkidar Rahul Srivastava100% (1)

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikPas encore d'évaluation

- INFO EDGE (INDIA) LIMITED (Standalone)Document2 pagesINFO EDGE (INDIA) LIMITED (Standalone)Arjun SomanPas encore d'évaluation

- Maybank BautoDocument7 pagesMaybank BautoPaul TanPas encore d'évaluation

- Economy-Excluding Agriculture: Solow Model For South Korea (Alwyn Young, QJE 1995)Document5 pagesEconomy-Excluding Agriculture: Solow Model For South Korea (Alwyn Young, QJE 1995)Bianca LenisPas encore d'évaluation

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikPas encore d'évaluation

- Details of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Rahul NaharPas encore d'évaluation

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouPas encore d'évaluation