Académique Documents

Professionnel Documents

Culture Documents

B Financial MGT

Transféré par

imzeeroDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

B Financial MGT

Transféré par

imzeeroDroits d'auteur :

Formats disponibles

Ratio Analysis Of Beximco Pharmaceuticals LTD Course Title: Financial Management. Course Co e :MBA !"" #u$mitte To: Dr.

Cho% hury #aleh Ahme #u$mitte By: #a am &ossain Fahim 'D (O : ")"")*+ MBA

Date of #u$mission:

INDEPENDENT UNIVERSITY BANGLADESH ( I U B)

1

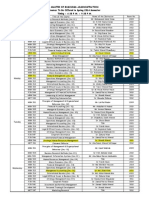

TABLE OF CONTENTS

SL NO. "# "' "& ". "/ "1 "2 "3 "5 #"

Particulars Curr!$t Rati% (uic) Rati% D!*t+T%+E,uit- Rati% D!*t+T%+T%tal+Ass!t Rati% R!c!i0a*l! Tur$%0!r Rati% I$0!$t%r- Tur$%0!r Rati% T%tal Ass!t Tur$%0!r Rati% A0!ra ! C%ll!cti%$ P!ri%4 R!tur$ %$ I$0!st6!$t (ROI) R!tur$ %$ E,uit- (ROE)

Pa ! NO. & & . . . . / / / /

#. Curr!$t rati%7 Current ratio shows how a company manages its current asset over short term liability. Current ratio provides the best single indicator of the extent to which the claims of short term creditors are covered by assets that are expected to be converted to cash fairly quick, it is the most commonly used measure of short term solvency. 2

Beximco pharmaceutical has curr!$t rati% #.." ti6!s i$ '"#"8 #.&& ti6!s i$ '"## a$4 #.3" ti6!s i$ '"#'. t!s ratio is basically sound in 2""# than lower ratio in 2""$. %he higher the current ratio, the greater the ability to pay its bills however increasing &iquidity shows the poor management in sales and investment. But Beximco has moderate current ratio in 2""#. 'o the company is efficient to manage its asset over current liability.

'. (uic)9Aci4 t!st rati%7 (uick)acid test ratio measure of the firm!s ability to pay off short*term obligations. +or pay off short*term obligation (uic)9aci4 t!st rati% measure without relying on the sale of inventories is important. Because inventories are typically the least liquid of the firm!s current asset. ,enerally 1 or more than 1 is good for the firms. Beximco has (uic)9aci4 t!st rati% ".2' ti6!s i$ '"#"8 ".1& ti6!s i$ '"## a$4 ".23

ti6!s i$ '"#'. -t first it was decreasing but again increasing in 2""#. (uick ratio is more conservative than current ratio and also measures how much the company fulfils over T).# short*term liability. Beximco has less liquidity. 'o the company can not pay the short*term liability accurately. 'o Beximco need to more concentrate on their efficient management to pay off short term liability.

&. D!*t+T%+E,uit- Rati%7 %he Company has decreasing 4!*t t% !,uit- rati% 1"..2: i$ '"#" .5.3.: i$ '"## a$4 ...32: i$ '"#'. %his ratio tells how much creditors are financing over tk. 1. %he lower the ratio, the higher the level of the firms financing that is being provided by the shareholders. Beximco .harma!s ratio is lower in '"#' than others so it would not experience difficulty. /

.. D!*t+T%+T%tal+Ass!t Rati%7 %his ratio shows the percentage of the firm!s asset that is supported by debt financing. %he lower this ratio, the lower the financial risk. Beximco has &2.13: i$ '"#"8 &&.'1: i$ '"##8 a$4 &".52: i$ '"#' debt to total asset ratio. 'o the decreasing ratio is good for the company.

/. R!c!i0a*l! Tur$%0!r Rati%7 %his ratio tells us the quality of the firm!s receivables and how successful the firm is in its collection. %he higher the turnover, the shorter the time between the typical scale and cash collection. %his company has tur$%0!r ..'2 ti6!s i$ '"#"8 3.1# ti6!s i$ '"##8 a$4 2.'" i$ '"#'.it increased in 2"11 but again decrease in 2"12. 'o it is slower and not satisfactory because median of this ratio is 3.# ti6!s.

1. I$0!$t%r- Tur$%0!r Rati%7 %his ratio determines how effectively the firm managing inventory. %he higher the inventory turnover, the more efficient the inventory management. Beximco Company has I$0!$t%r- Tur$%0!r Rati% #."/ ti6!s i$ '"#"8 #.#' ti6!s i$ '"## a$4 #.#5 ti6!s i$ '"#'. %he company!s turnover is increasing than other years so it is better in managing inventory.

2. T%tal Ass!t Tur$%0!r Rati%7 %his ratio tells us how much revenue is earned over each taka and relative efficiency with which a firm utili0es its total asset to generate sales. %his company has ".&" ti6!s i$ '"#"8 ".&# ti6!s i$ '"## a$4 ".&" ti6!s i$ '"#'. %he median of this ratio is #.11 ti6!s and if it is higher then it is good. %his Company has decreasing ratio so it is not good. 1

3. A0!ra ! C%ll!cti%$ P!ri%47 %his ratio shows how quickly a firm collects its receivables. -s slow it is as it is better. %he median of this is ./ 4a-s. f it is higher than this then it is bad. Beximco pharmaceutical!s c%ll!cti%$ ;!ri%4 3. 4a-s i$ '"#"8 .' 4a-s i$ '"## a$4 /" 4a-s i$ '"#'. 'o the company!s recent -verage Collection .eriod is not good.

5. R!tur$ %$ I$0!st6!$t (ROI)7 %his ratio measures how much profitability the firm has used to return its asset. %he Company earned R!tur$ %$ I$0!st6!$t ...2: i$ '"#"8 &.5/: i$ '"##a$4 '.5/: i$ '"#'. f it shows higher than 2 then it is good. But it is decreasing inadequately so it is not good.

#". R!tur$ %$ E,uit- (ROE)7 %his ratio shows the earning power on shareholder!s investment. - high return on equity reflects the firm!s acceptance of strong investment opportunity and effective expense management. Beximco has 2.#2: i$ '"#"8 /.5': i$ '"## a$4 ..'3: i$ '"#'. But the company!s return is decreasing. 'o it is dissatisfactory.

Vous aimerez peut-être aussi

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Pas encore d'évaluation

- Data Analysis and Interpretation: 1.stability RatiosDocument31 pagesData Analysis and Interpretation: 1.stability RatiosAnonymous nTxB1EPvPas encore d'évaluation

- Ratio Analysis of Singer Bangladesh LimitedDocument22 pagesRatio Analysis of Singer Bangladesh LimitedHamed RiyadhPas encore d'évaluation

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiPas encore d'évaluation

- Loan Recommendation For Loan ApprovalDocument6 pagesLoan Recommendation For Loan ApprovalPlace2790% (1)

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiPas encore d'évaluation

- University of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisDocument6 pagesUniversity of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisBarby AngelPas encore d'évaluation

- Module 2 SolutionsDocument61 pagesModule 2 Solutionsrasmussen123456Pas encore d'évaluation

- 5th Part of PBLDocument9 pages5th Part of PBLanwerhossanPas encore d'évaluation

- Penilaian Bisnis Dengan Menggunakan Laporan Keuangan Pada Pt. Gudang Garam, TBK TAHUN 2006-2010Document14 pagesPenilaian Bisnis Dengan Menggunakan Laporan Keuangan Pada Pt. Gudang Garam, TBK TAHUN 2006-2010Brannon WardPas encore d'évaluation

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesPas encore d'évaluation

- Chapter 1Document29 pagesChapter 1Chitose HarukiPas encore d'évaluation

- Analyzing Bank ResultsDocument4 pagesAnalyzing Bank ResultscabhargavPas encore d'évaluation

- Aaaaaaaaaaaa: Income StatementsDocument11 pagesAaaaaaaaaaaa: Income StatementszainalijanjuyaPas encore d'évaluation

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7Pas encore d'évaluation

- Strategic Management and Business Policy-1Document17 pagesStrategic Management and Business Policy-1gvenkatrPas encore d'évaluation

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Document12 pagesChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourPas encore d'évaluation

- A Comparative Study of Financial Performance of Sail and Tata Steel LTDDocument23 pagesA Comparative Study of Financial Performance of Sail and Tata Steel LTDSajib DevPas encore d'évaluation

- Categories of RatiosDocument6 pagesCategories of RatiosNicquainCTPas encore d'évaluation

- 10 Chapter Two Investment AlternativesDocument15 pages10 Chapter Two Investment AlternativesMuhammad HarisPas encore d'évaluation

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladPas encore d'évaluation

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliPas encore d'évaluation

- Orca Share Media1678615963308 7040625649368839273Document41 pagesOrca Share Media1678615963308 7040625649368839273Angeli Shane SisonPas encore d'évaluation

- Certificate: Mr. Neeraj Gupta "Financial Performance Analysis of NTPC"Document17 pagesCertificate: Mr. Neeraj Gupta "Financial Performance Analysis of NTPC"ajaynegi71Pas encore d'évaluation

- Small BusinessDocument29 pagesSmall Businessrayhan555Pas encore d'évaluation

- Modern Financial Management Solutions ManualDocument559 pagesModern Financial Management Solutions Manualrutemarlene40Pas encore d'évaluation

- Chapter 5-Basics of Analysis: Multiple ChoiceDocument15 pagesChapter 5-Basics of Analysis: Multiple ChoiceShoaib AkhtarPas encore d'évaluation

- Credit Analysis and FormulaeDocument6 pagesCredit Analysis and FormulaeNitin SharmaPas encore d'évaluation

- Chapter 15 Alternative Corporate Restructuring StrategiesDocument7 pagesChapter 15 Alternative Corporate Restructuring StrategiesNishtha SethPas encore d'évaluation

- Chap 3Document5 pagesChap 3Tahir Naeem JattPas encore d'évaluation

- Fin 635 Project FinalDocument54 pagesFin 635 Project FinalCarbon_AdilPas encore d'évaluation

- Chap 018Document53 pagesChap 018saud1411100% (2)

- 8e Ch4 Mini Case Und EntityDocument8 pages8e Ch4 Mini Case Und Entityspatel9167% (3)

- Risk Management in Commercial BanksDocument43 pagesRisk Management in Commercial BanksablevanPas encore d'évaluation

- PDF EvaDocument36 pagesPDF EvaShrey GoelPas encore d'évaluation

- Honda Case StudyDocument11 pagesHonda Case StudySarjodh SinghPas encore d'évaluation

- RatiosDocument6 pagesRatiosFaisal AwanPas encore d'évaluation

- An Illustration of Five Levels of Competence in Using Ratios To Analyse A Hardware StoreDocument2 pagesAn Illustration of Five Levels of Competence in Using Ratios To Analyse A Hardware StoreLinhdaica Vo DoiPas encore d'évaluation

- Chapter 18 International Capital BudgetingDocument26 pagesChapter 18 International Capital BudgetingBharat NayyarPas encore d'évaluation

- Financial Statement Analysis of Square PharmaceuticalsDocument15 pagesFinancial Statement Analysis of Square PharmaceuticalsAushru HasanPas encore d'évaluation

- Chapter-1 Background of StudyDocument62 pagesChapter-1 Background of StudySangram PandaPas encore d'évaluation

- Running Head: Financial AnalysisDocument11 pagesRunning Head: Financial AnalysisputtingitonlinePas encore d'évaluation

- Time Interest Earned RatioDocument40 pagesTime Interest Earned RatioFarihaFardeenPas encore d'évaluation

- Chapter 04 - AnswerDocument9 pagesChapter 04 - AnswerCrisalie Bocobo0% (1)

- E Labor CodeDocument4 pagesE Labor CodeKristina LayugPas encore d'évaluation

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraPas encore d'évaluation

- Introduction To Ratio Analysis and Interpretition: ObjectiveDocument66 pagesIntroduction To Ratio Analysis and Interpretition: Objectivedk6666Pas encore d'évaluation

- Investpror Behaviour in Stock MarketDocument78 pagesInvestpror Behaviour in Stock MarketankushjaggaPas encore d'évaluation

- CH02 ProblemsDocument10 pagesCH02 ProblemsHaley Ann Martens100% (1)

- A Study On Credit Management With Reference To Canara BankDocument93 pagesA Study On Credit Management With Reference To Canara BankDeepika KrishnaPas encore d'évaluation

- MBA Finance ProjectDocument89 pagesMBA Finance ProjectSushil KumarPas encore d'évaluation

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDocument3 pagesHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraPas encore d'évaluation

- Chap 012Document77 pagesChap 012sucusucu3Pas encore d'évaluation

- Return On Assets (ROA) - Meaning, Formula, Assumptions and InterpretationDocument4 pagesReturn On Assets (ROA) - Meaning, Formula, Assumptions and Interpretationakashds16Pas encore d'évaluation

- Financial Ratios Analysis Report-SKSDocument6 pagesFinancial Ratios Analysis Report-SKSRamendra KumarPas encore d'évaluation

- Ratio Analysis On Dhaka BankDocument8 pagesRatio Analysis On Dhaka Banktoxictouch100% (1)

- Alm-Course Outlines-For Two DaysDocument40 pagesAlm-Course Outlines-For Two Daysrashed03nsuPas encore d'évaluation

- The Entrepreneur’S Dictionary of Business and Financial TermsD'EverandThe Entrepreneur’S Dictionary of Business and Financial TermsPas encore d'évaluation

- An Evaluation of The Impact of Information and Communication Technologies: Two Case Study ExamplesDocument7 pagesAn Evaluation of The Impact of Information and Communication Technologies: Two Case Study ExamplesimzeeroPas encore d'évaluation

- SDocument1 pageSimzeeroPas encore d'évaluation

- Economic Growth in Bangladesh - Experience and Policy PrioritiesDocument30 pagesEconomic Growth in Bangladesh - Experience and Policy PrioritiesimzeeroPas encore d'évaluation

- 1.2 History of The Banking IndustryDocument18 pages1.2 History of The Banking IndustryimzeeroPas encore d'évaluation

- B Financial MGTDocument5 pagesB Financial MGTimzeeroPas encore d'évaluation

- 1954018Document18 pages1954018imzeeroPas encore d'évaluation

- WahidDocument19 pagesWahidnurul000Pas encore d'évaluation

- Control fINALDocument20 pagesControl fINALimzeeroPas encore d'évaluation

- Role ICT PaperDocument17 pagesRole ICT PaperAmadasun Bigyouth OsayiPas encore d'évaluation

- BangladeshDocument19 pagesBangladeshimzeeroPas encore d'évaluation

- CBG (18.10.08)Document19 pagesCBG (18.10.08)najmulPas encore d'évaluation

- VangieDocument29 pagesVangieEvangeline G PadrigoPas encore d'évaluation

- Fin MGTDocument5 pagesFin MGTimzeeroPas encore d'évaluation

- Economic Growth in Bangladesh - Experience and Policy PrioritiesDocument30 pagesEconomic Growth in Bangladesh - Experience and Policy PrioritiesimzeeroPas encore d'évaluation

- BangladeshDocument19 pagesBangladeshimzeeroPas encore d'évaluation

- Wells Far Go TodayDocument5 pagesWells Far Go TodayimzeeroPas encore d'évaluation

- 1.2 History of The Banking IndustryDocument18 pages1.2 History of The Banking IndustryimzeeroPas encore d'évaluation

- A Take Home Exam Paper: Independent University, BangladeshDocument10 pagesA Take Home Exam Paper: Independent University, BangladeshimzeeroPas encore d'évaluation

- Hall Mark ScamDocument4 pagesHall Mark ScamSharika NahidPas encore d'évaluation

- Her Health Needs BangladeshDocument3 pagesHer Health Needs Bangladeshthief_BDPas encore d'évaluation

- MIS Final ReportDocument45 pagesMIS Final ReportAnonymous OeKGaINPas encore d'évaluation

- Application Form JobDocument3 pagesApplication Form Jobtanvir1674Pas encore d'évaluation

- MBA Academic Calendar-Spring 2014Document1 pageMBA Academic Calendar-Spring 2014imzeeroPas encore d'évaluation

- Article On Female Garments Workers (Final)Document23 pagesArticle On Female Garments Workers (Final)Hafij Ullah100% (1)

- Article On Female Garments Workers FinalDocument23 pagesArticle On Female Garments Workers FinalimzeeroPas encore d'évaluation

- An Evaluation of The Impact of Information and Communication Technologies: Two Case Study ExamplesDocument7 pagesAn Evaluation of The Impact of Information and Communication Technologies: Two Case Study ExamplesimzeeroPas encore d'évaluation

- HRM It PDFDocument20 pagesHRM It PDFjamarnath05Pas encore d'évaluation

- Finmanrisk and ReturnDocument29 pagesFinmanrisk and ReturnimzeeroPas encore d'évaluation

- ArticleDocument8 pagesArticleimzeeroPas encore d'évaluation

- B Financial MGTDocument5 pagesB Financial MGTimzeeroPas encore d'évaluation

- Margaret Thatcher 19252013Document2 pagesMargaret Thatcher 19252013selvamuthukumarPas encore d'évaluation

- Iocl Trichy 1st Po-27076875Document14 pagesIocl Trichy 1st Po-27076875SachinPas encore d'évaluation

- Advantages and Problems of PrivatisationDocument4 pagesAdvantages and Problems of PrivatisationShahriar HasanPas encore d'évaluation

- Types of SlabsDocument5 pagesTypes of SlabsOlga KosuoweiPas encore d'évaluation

- Demanda Del Humus en El PeruDocument14 pagesDemanda Del Humus en El PeruJeanAsconaRiverosPas encore d'évaluation

- Real Estate Properties For SaleDocument29 pagesReal Estate Properties For SalePablo Melgo Jr.100% (1)

- Proceeding IWRE2013Document420 pagesProceeding IWRE2013Nguyen Doan QuyetPas encore d'évaluation

- CEV 420 Basic Environmental SciencesDocument2 pagesCEV 420 Basic Environmental Sciencesbotakmbg6035Pas encore d'évaluation

- 669Document1 page669mundhrabharatPas encore d'évaluation

- PSG010Document1 pagePSG010Sigeo Kitatani JúniorPas encore d'évaluation

- 712 Topic 03Document26 pages712 Topic 03amrith vardhanPas encore d'évaluation

- Fin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Document3 pagesFin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Ray Gworld50% (2)

- Passingitonchapter7d TrustsDocument12 pagesPassingitonchapter7d Trustssonali boranaPas encore d'évaluation

- Pricing StrategyDocument5 pagesPricing StrategyShantonu RahmanPas encore d'évaluation

- App ADocument37 pagesApp AadeepcdmaPas encore d'évaluation

- A Report On Internship Project AT Reliance Jio, Bangalore: Master of Business AdministrationDocument51 pagesA Report On Internship Project AT Reliance Jio, Bangalore: Master of Business AdministrationSahas ShettyPas encore d'évaluation

- PDF Document 3Document1 pagePDF Document 3Bilby Jean ThomasPas encore d'évaluation

- Book by Sadiku Link For ItDocument6 pagesBook by Sadiku Link For ItShubhamPas encore d'évaluation

- Azulcocha 43-101 Tailing ReportDocument80 pagesAzulcocha 43-101 Tailing Reportwalter sanchez vargasPas encore d'évaluation

- Amartya Sen PPT FinDocument28 pagesAmartya Sen PPT FinTaher DahodwalaPas encore d'évaluation

- Industry Analysis of InsuranceDocument48 pagesIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- UNIT 1 - Grammar Choices For Graduate StudentsDocument21 pagesUNIT 1 - Grammar Choices For Graduate StudentsDragana BorenovicPas encore d'évaluation

- Mwakyusa Bupe Final E-Thesis (Master Copy) PDFDocument326 pagesMwakyusa Bupe Final E-Thesis (Master Copy) PDFRajendra LamsalPas encore d'évaluation

- EmamiDocument13 pagesEmamiManish JhaPas encore d'évaluation

- HOA - REG.0002 Articles of Incorporation Regular HOA PDFDocument5 pagesHOA - REG.0002 Articles of Incorporation Regular HOA PDFMelita LagumbayPas encore d'évaluation

- LaxmanDocument3 pagesLaxmanKANNADIGA ANIL KERURKARPas encore d'évaluation

- Econ 101 Cheat Sheet (FInal)Document1 pageEcon 101 Cheat Sheet (FInal)Alex MadarangPas encore d'évaluation

- Format Laporan Keu Makana Dan MinumanDocument11 pagesFormat Laporan Keu Makana Dan MinumanRahmat IlahiPas encore d'évaluation

- ISMA PPT Ethanol Belnding PDFDocument15 pagesISMA PPT Ethanol Belnding PDFPrasun PandeyPas encore d'évaluation

- Company Details 2.8Document3 pagesCompany Details 2.8Prakash KumarPas encore d'évaluation