Académique Documents

Professionnel Documents

Culture Documents

FICO Transaction Code and Configuration Step

Transféré par

Debabrata SahooTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

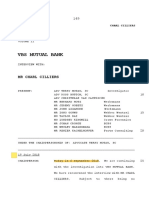

FICO Transaction Code and Configuration Step

Transféré par

Debabrata SahooDroits d'auteur :

Formats disponibles

12/4/13

FICO

FICO

SAP FICO Transaction Codes General Ledger Accounting: Basic Settings I Enterprise Structure 1 Creation of Company 2 Creation of Company Code 3 Assign Company Code to Company 4 Creation of Business Areas II Fiscal Year 1 Creation of Fiscal Year Variant 2 Assign Company Code to Fiscal Year Variant III Chart of Accounts 1 Creation of Chart of Accounts 2 Assign Company Code to Chart of Accounts 3 Define Account Groups 4 Define Retained Earnings Account IV Posting Periods 1 Define Posting Period Variant 2 Assign Company Code to Posting Period Variant 3 Open and Close Posting Periods V Document Types and Number Ranges 1 Define Document Types 2 Define Number Ranges VI Tolerances 1 Define Tolerance Groups for G/L Accounts 2 Define Tolerance Groups for Employees 3 Assign Users to Tolerance Groups VII Field Status 1 Define Field Status Variants 2 Assign Company Code to Field Status Variants VIII Calculation Procedures 1 Assign Country to Calculation Procedure IX Global Parameters 1 Enter Global Parameters X Foreign Currency Settings 1 Check Exchange Rate Types 2 Define Translation Ratios for Currency Translation 3 Enter Exchange Rates 4 Specify Default Exchange Rate Type in Document Type

vvemula.blogspot.in/p/fico.html

OX15 OX02 OX16 OX03 OB29 OB37 OB13 OB62 OBD4 OB53 OBBO OBBP OB52 OBA7 FBN1 OBA0 OBA4 OB57 OBC4 OBC5 OBBG OBY6 OB07 OBBS OB08 OBA7

1/11

12/4/13

FICO

XI Creation of G/L Accounts 1 Creation of G/L Account at Chart of Accounts Level 2 Creation of G/L Account at Company Code Level 3 Creation of G/L Account Centrally Document Posting and Other Transactions I Document Posting 1 G/L Document Posting 2 Post Outgoing Payment for G/L Accounts 3 G/L Account Posting - Enjoy Transaction 4 Posting a Document with reference to another Document 5 Display Document 6 Change Document 7 Display G/L Account Balances 8 Display G/L Account Balances for Open Item Managed A/cs II Activation of Line Item Display 1 Flag "Line Item Display" Checkbox in G/L Account 2 Block GL Account 3 Run Program "RFSEPA01" for activation of Line Items 4 Unblock GL Account

FSP0 FSS0 FS00

F-02 F-07 FB50 FBR2 FB03 FB02 FS10N FBL3N FS00 FS00 SE38 FS00

III Other Transactions 1 Copy Company Code Settings from one Company Code to another EC01 2 Copy Number Ranges from one Company Code to another OBH1 3 Copy Number Ranges from one Fiscal Year to another OBH2 4 To see the changes in the G/L Account Master FS04 5 Define Posting Keys OB41 6 Define Line Item Text Templates OB56 7 Define Countries - Define Group Currency OY01 8 Define Additional Local Currencies for Company Code OB22 9 Define Account Assignment Model FKMT 10 Define Fast Entry Screens O7E6 11 Accounting Editing Options FB00 12 Reset Transaction Data - Delete Transaction Data in a Company Code OBR1 13 Deleting Master Data - Customers, Vendors & G/L Accounts OBR2 14 Transport Chart of Accounts OBY9 15 Copy G/L Accounts from One Company Code to another OBY2 16 Copy Chart of Accounts and Account Determinations OBY7 17 Delete Chart of Accounts OBY8 18 Maintain Validation GGB0 19 Activate Validation OB28 20 Maintain Substitution GGB1 21 Activate Substitution OBBH 22 Display Intercompany Document FBU3 23 Define Clearing Accounts for Intercompany Transactions OBYA IV Other Transactions - Technical 1 To View Transport Request 2 To Post Batch Input Session

vvemula.blogspot.in/p/fico.html

SE01; SE09;SE10 SM35

2/11

12/4/13

FICO

3 Table Maintenance View Screen 4 To View Spool Requests 5 To View Background Jobs 6 ABAP Data Dictionary 7 ABAP Data Browser 8 ABAP Editor 9 SAP Quick Viewer V Document Parking 1 Creation of Parked Document 2 Send System Message 3 Display Parked Documents VI Hold Documents 1 Run Program "RFTMPBLU" for conversion of Held Documents 2 Creation of Hold Document: From the Menu DocumentHold 3 Display Held Documents VII Sample Documents 1 Creation of Number Range "X2" for Sample Documents 2 Creation of Sample Document 3 Display Sample Documents 4 Posting of a Document with reference to Sample Document (or) F-02 : From the Menu Document Post withReference VIII Accrual/Deferral Documents 1 Creation of Reversal Reason 2 Creation of Accrual/Deferral Document 3 Reversal of Accrual/Deferral Document IX Recurring Documents 1 Creation of Number Range "X1" for Recurring Documents 2 Creation of Recurring Document 3 Display of Recurring Document 4 Posting of Transactions by using Recurring Document templates by way of Batch Input Session 5 Change Recurring Document 6 Define Document Change Rules X Open Item Management 1 Full Clearing 2 Partial Clearing 3 Balance Clearing 4 Residual Clearing XI Reversals 1 Individual Reversal 2 Mass Reversal 3 Reversal of a Reversed Document 4 Reversal of a Cleared Item 5 Accrual/Deferral Reversal

vvemula.blogspot.in/p/fico.html

SM30 SP01 SM37 SE11 SE16 SE38 SQVI F-65 SO00 FBV0 SE38 F-02 FB11 FBN1 F-01 FBM3 FBR2

FBS1 F.81 FBN1 FBD1 F.15 F.14 FBD2 OB32

FB08 F.80 FBR2 FBRA F.81

3/11

12/4/13

FICO

XII Interest Calculations: Account Balance Interest Calculation 1 Define Interest Calculation Types 2 Prepare Account Balance Interest Calculation 3 Define Reference Interest Rates 4 Define Time Dependent Terms 5 Enter Interest Rates 6 Creation of G/L Account 7 Assignment of Accounts for Automatic Posting 8 Posting of Term Loan 9 Repayment of Term Loan 10 Interest Calculations XIII Foreign Currencies Balances Revaluation 1 Define Valuation Methods 2 Creation of G/L Accounts 3 Prepare Automatic Postings 4 Term Loan Receipt in Foreign Currency 5 Enter Exchange Rates 6 Foreign Currency Balances Revaluation (Forex Run) XIV Tax on Sales/Purchases 1 Define Tax Procedures 2 Assign Country to Calculation Procedures 3 Define Tax Codes 4 Assign Tax Codes for Non-Taxable Transactions 5 Creation of "VAT Pool A/c" G/L Account 6 Define Tax Accounts 7 Assign Tax Codes in G/L Accounts 8 Posting of Sale or Purchase Invoice to Check Input and Output Taxes Accounts Payable I Basic Settings 1 Creation of Vendor Accounts Groups 2 Creation of Number Ranges for Vendor Account Groups 3 Assign Number Ranges to Vendor Account Groups 4 Maintain Customer/Vendor Tolerance Groups 5 Creation of G/L Accounts - Reconciliation A/c 6 Creation of Vendor Master 7 Document Types and Number Ranges II Transactions 1 Posting of Vendor Invoice 2 Posting Outgoing Payment 3 Posting Vendor Invoice - Enjoy Transaction 4 To View Vendor Account 5 Vendor Credit Memo 6 Vendor Credit Memo - Enjoy Transaction

OB46 OBAA OBAC OB81 OB83 FS00 OBV2 F-02 F-02 F.52 OB59 FS00 OBA1 F-02 OB08 F.05 OBQ3 OBBG FTXP OBCL FS00 OB40 FS00 F-22,F-43

OBD3 XKN1 OBAS OBA3 FS00 XK01 OBA7;FBN1 F-43 F-53 FB60 FBL1N F-41 FB65

vvemula.blogspot.in/p/fico.html

4/11

12/4/13

FICO

III House Banks 1 Creation of "Bank A/c" G/L Account 2 Creation of House Bank and Assign G/L A/c in House Bank 3 Creation of Check Lots 4 Manual Check Updates 5 Display Check Register 6 Change Check Issue Date/Check Encashment Date Updating 7 Creation of Void Reason Code 8 Void Check/Unissued Check Cancellation 9 Remove Check Encashment Date Data 10 Issued Check Cancellation IV Advance Payments or Down Payments 1 Creation of "Advance to Vendors A/c" G/L Account 2 Define Alternative Reconciliation Account for Vendor Down Payments 3 Down Payment Request (Noted Item) 4 Down Payment Made 5 Purchase Invoice Posting 6 Transfer of Advance from Special G/L to Normal by clearing Special G/L A/c 7 Clearing of Normal Item - Account Clear V Terms of Payment 1 Creation of Terms of Payment 2 Creation of G/L Accounts Discount Received A/c Discount Given A/c | FS00 3 Assign G/L Account for Automatic Posting of Discount Received 4 Assign G/L Account for Automatic Posting of Discount Given VI Party Statement of Account 1 Assign Programs for Correspondence Types 2 Request for Correspondence 3 Maintain Correspondence

FS00 FI12 FCHI FCH5 FCHN FCH6 FCHV FCH3 FCHG FCH8 FS00 OBYR F-47 F-48 F-43 F-54 F-44 OBB8

OBXU OBXI OB78 FB12 F.64

VII Automatic Payment Program FBZP 1 Setup Payment Method per Country for Payment Transactions 2 Setup Payment Method Per Company Code for Payment Transactions 3 Setup All Company Codes for Payment Transactions 4 Setup Paying Company Code for Payment Transactions 5 Setup Bank Determination 6 Assign Payment Method in Vendor Master XK02 7 Creation of Check Lots FCHI 8 Payment Run F110 VIII Cash Journal 1 Create G/L Account for Cash Journal 2 Define Document Types for Cash Journal Documents 3 Define Number Range Intervals for Cash Journal Documents 4 Set Up Cash Journal

vvemula.blogspot.in/p/fico.html

FS00 OBA7 FBCJC1 FBCJC0

5/11

12/4/13

FICO

5 Create, Change, Delete Business Transactions 6 Set Up Print Parameters for Cash Journal Extended Withholding Tax 1 Check Withholding Tax Countries 2 Define Official Withholding Tax Keys 3 Define Business Places 4 Creation of Factory Calendar: a) Creation of Holiday Calendar b) Assign Holiday Calendar in Factory Calendar 5 Assign Factory Calendar to Business Places 6 Define Withholding Tax Types for Invoice Posting 7 Define Withholding Tax Types for Payment Posting 8 Define Withholding Tax Codes 9 Check Recipient Types 10 Maintain Tax Due Dates 11 Maintain Surcharge Calculation Methods 12 Maintain Surcharge Tax Codes 13 Maintain Surcharge Rates 14 Assign Withholding Tax Types to Company Codes 15 Activate Extended Withholding Tax 16 Creation of G/L Accounts 17 Assignment of Accounts 18 Maintain Company Code Settings [Logistics General] 19 Specify Document Type for Remittance Challan Posting 20 Maintain Number Groups for Remittance Challans 21 Assign Number Ranges to Number Groups 22 Maintain Number Ranges 23 Maintain Number Group and SAP Script Forms 24 Assign Number Ranges to Number Groups 25 Maintain Number Ranges 26 Assign PAN & TAN Numbers 27 Assign Extended Withholding Tax Codes in Vendor Master 28 Purchase Invoice Posting 29 Create Remittance Challan 30 Enter Bank Challan 31 Creation of TDS Certificate 32 Creation of Annual Return Accounts Receivable I Basic Settings 1 Creation of Customer Account Groups 2 Creation of Number Ranges for Customer Account Groups 3 Assign Number Ranges to Customer Account Groups 4 Creation of G/L Account - Reconciliation Account 5 Creation of Customer Master 6 Document Types and Number Ranges II Transactions

vvemula.blogspot.in/p/fico.html

FBCJC2 FBCJC3

OY05 J1INCAL

FS00 OBWW

OBY6 XK02 F-43 J1INCHLN J1INBANK J1INCERT J1INAR

OBD2 XDN1 OBAR FS00 XD01 OBA7; FBN1

6/11

12/4/13

FICO

1 Posting of Customer Invoice 2 Posting Incoming Payment 3 Posting Customer Invoice - Enjoy Transaction 4 To View Customer Account 5 Customer Credit Memo 6 Customer Credit Memo - Enjoy Transaction III Advance Payments or Down Payments 1 Creation of "Advance from Customers A/c" G/L Account 2 Define Alternative Reconciliation Account for Customer Down Payments 3 Down Payment Request (Noted Item) 4 Down Payment Received 5 Sale Invoice Posting 6 Transfer of Advance from Special G/L to Normal by clearing Special G/L A/c 7 Clearing of Normal Item - Account Clear IV Bill Discounting 1 Creation of G/L Accounts Sundry Debtors - BOE : Alternative Recon A/c Bills Discounting A/c | FS00 2 Define Alternative Reconciliation Account for Bills of Exchange Receivable 3 Define Bank Sub Accounts 4 Sale Invoice Posting 5 Bills of Exchange Payment 6 Bank Bill Discounting 7 Report to view Customer wise, Due Date wise, Bank wise Outstanding 8 Reverse Contingent Liability V Dunning 1 Define Dunning Areas 2 Define Dunning Procedures 3 Assign Dunning Procedure in Customer Master 4 Sale Invoice Postings 5 Dunning VI Credit Management 1 Maintain Credit Control Area 2 Assign Company Code to Credit Control Area 3 Define Credit Risk Categories 4 Define Accounting Clerk Groups [Credit Representative Groups] 5 Define Credit Representatives [Assign Employee to Credit Representative Groups] 6 Define Intervals for Days in Arrears for Credit management

F-22 F-28 FB70 FBL5N F-27 FB75 FS00 OBXR F-37 F-29 F-22 F-39 F-32

OBYN OBYK F-22 F-36 F-33 S_ALR_87012213 F-20

OB61 FBMP XD02 F-22 F150 OB45 OB38 OB01 OB02 OB51 OB39

Note: Sales Order Type and Delivery Type and Risk Category and order or Delivery Type is used to define the Warning or Error Messages. Path: Sales & Distribution Basic Functions Credit Processing

vvemula.blogspot.in/p/fico.html 7/11

12/4/13

FICO

Asset Accounting I Basic Settings 1 Copy Reference Chart of Depreciation/Depreciation Areas 2 Assign Tax Codes for non-taxable transactions 3 Assign Company Code to Chart of Depreciation 4 Maintain Account Determinations 5 Maintain Screen Layout Rules 6 Maintain Number Ranges for Asset Master Data 7 Maintain Asset Classes 8 Determine Depreciation Areas in the Asset Classes 9 Creation of G/L Accounts 10 Assignment of G/L Accounts for Automatic Postings 11 Specify Document type for posting of Depreciation 12 Specify Intervals and Posting Rules 13 Specify Rounding of Net Book Value and/or Depreciation 14 Define Screen Layout Rules for Asset Master Data 15 Define Screen Layout Rules for Asset Depreciation Areas 16 Depreciation Keys a) Define Base Methods b) Define Declining Balances Methods c) Define Multilevel Methods d) Define Period Control Methods e) Maintain Depreciation Keys 17 Creation of Asset Master 18 Creation of Sub-Asset Master 19 Main Asset Purchase Posting 20 Sub-Asset Purchase Posting 21 Asset Explorer 22 Asset History Sheet 23 Depreciation Run II Settlement of Capital Work-in-Progress 1 Define Settlement Profile 2 Define Number Ranges for Settlement 3 Creation of Capital Work-in-Progress Asset Master 4 Posting of Transactions Purchase Commissioning charges, etc., 5 Creation of Main Asset Master to which Asset Under Construction is to be settled 6 Settlement of Capital Work-in-Progress III Other Transactions 1 Transfer of APC Asset Values - Periodic Asset Postings 2 Reconciliation of Assets with General Ledger 3 Sale of Asset 4 Sale of Asset Without Customer 4 Transfer of Asset

vvemula.blogspot.in/p/fico.html

EC08 OBCL OAOB AS08 OAOA OAYZ FS00 AO90 OAYR OAYO OA77 OA78 AFAMD AFAMS AFAMP AFAMA AS01 AS11 F-90 F-90 AW01N S_ALR_87011965 AFAB

OKO7 SNUM AS01 F-90 AS01 AIAB ASKB ABST2 F-92 ABAON ABUMN

8/11

12/4/13

FICO

5 Transfer of Asset - Inter company 6 Scrapping of Asset 7 Post Capitalization of Asset 8 Manual Depreciation 9 Unplanned Depreciation 10 Depreciation Forecast 11 Fixation of the Schedule as per the Indian Company's Act (or) Asset History Sheet Closing Procedures I Financial Statement Version 1 Creation of Financial Statement Version 2 To view Balance Sheet and Profit and Loss Account

ABT1N ABAVN ABNAN ABMA ABAA S_ALR_87012936 AR02

OB58 F.01,S_ALR_87012284 F.07

II Closing Procedures 1 Carry Forward of Vendors and Customers Closing Balances 2 Carry Forward of Asset Balances To check which year is closed for Assets Closing of Assets for the Year To Open Next Year | AJAB AJRW | 3 Carry Forward of G/L Account Balances 4 Copy Number Range Intervals to the Next Year 5 Open/Close Previous Period III GL Reports 1 Chart of Accounts List 2 Trial Balance 3 Ledger IV Vendor Reports 1 Vendor List 2 Vendor wise Purchases 3 Vendor Outstanding List 4 Age wise Analysis of Vendors 5 Advances Report 6 Vendor's Ledger V Customer Reports 1 Customer List 2 Customer wise Sales 3 Customer Outstanding List 4 Age wise Analysis of Customers 5 Advances Report 6 Customer's Ledger MM to FI Integration

vvemula.blogspot.in/p/fico.html

OAAQ

F.16 OBH2 OB52 S_ALR_87012326 S_ALR_87012310 S_ALR_87100205 S_ALR_87012086 S_ALR_87012093 S_ALR_87012083 S_ALR_87012085 S_ALR_87012105 S_ALR_87012103 S_ALR_87012179 S_ALR_87012186 S_ALR_87012173 S_ALR_87012176 S_ALR_87012199 S_ALR_87012197

9/11

12/4/13

FICO

I Basic Settings from MM Side 1 Define Plant 2 Define Location 3 Maintain Storage Location 4 Maintain Purchasing Organization 5 Assign Plant to Company Code 6 Assign Purchasing Organization to Company Code 7 Assign Purchasing Organization to Plant 8 Define Attributes of Material Types 9 Maintain Company Codes for Materials Management 10 Set Tolerance Limits for Price Variances 11 Define Plant Parameters 12 Set Tolerance Limits for Goods Receipts 13 Define Default Values for Physical Inventory 14 Maintain Default Values for Tax Codes 15 Define Tax Jurisdiction 16 Configure Vendor Specific Tolerances 17 Define Automatic Status Change 18 Define Tolerance Limits for Invoice Verification 19 Define Number Ranges - 50 & 51 II Integration 1 Creation of G/L Accounts Inventory RM A/c Inventory FG A/c GR/IR Clearing A/c Price Differences A/c | FS00 | 2 Creation of Material Master 3 Creation of Vendor Master 4 Group Together Valuation Areas 5 Define Valuation Classes 6 Define Account Grouping for Movement Types 7 Configure Automatic Postings III Flow 1 Creation of Purchase Order 2 Goods Receipt Against Purchase Order 3 Invoice Verification/Invoice Receipt 4 Payment to Vendor - Outgoing Payment SD to FI Integration I Basic Settings from SD Side 1 Define Divisions 2 Define Sales Organization 3 Define Distribution Channels 4 Define Shipping Points 5 Assign Business Area to Plant/Valuation Area & Division 6 Assign Sales Organization to Company Code

vvemula.blogspot.in/p/fico.html

OX10 OIAS OX09 OX08 OX18 OX01 OX17 OMS2 OMSY OMR6 OMC0 OMBH OMR2 OMRX OMRV FBN1

MM01 XK01 OMWD OMSK OMWN OBYC

ME21N MIGO MIRO F-53

OVXB OVX5 OVXI OVXD OMJ7 OVX3

10/11

12/4/13

FICO

7 Assign Distribution Channel to Sales Organization 8 Assign Division to Sales Organization 9 Set up Sales Area 10 Assign Sales Organization - Distribution Channel - Plant 11 Assign Business Area to Plant & Division 12 Assign Shipping Point to Plant 13 Define and Assign Pricing Procedures 14 Define Tax Determination Rules 15 Assign Delivering Plants for Tax Determination 16 Define Number Ranges - 48 & 49 17 Assign Shipping Point II Integration 1 Creation of G/L Accounts Raw Material Consumption A/c Sales A/c | | 2 Creation of Finished Goods Material Master 3 Creation of Customer Master 4 Assign Material to Pricing Procedure 5 Assign General Ledger Accounts 6 Setup Partner Determination III Flow 1 Goods Receipt for Initial Start 2 Creation of Sales Order 3 Outbound Delivery 4 Billing Document 5 Issue Billing Document 6 Incoming Payment from Customers

OVXK OVXA OVXG OVX6 OVF0 OVXC OVKK OVK1 OX10 FBN1 OVL2

FS00 MM01 XD01 PR00 & MWST VK11 VKOA

MB1C VA01 VL01N VF01 VF31 F-28

vvemula.blogspot.in/p/fico.html

11/11

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- UATDocument6 pagesUATDebabrata SahooPas encore d'évaluation

- SAP FI Transaction Code List 1Document10 pagesSAP FI Transaction Code List 1Debabrata SahooPas encore d'évaluation

- SAP FICO Tcodes List (Transaction Codes) & Their Use - SkillstekDocument19 pagesSAP FICO Tcodes List (Transaction Codes) & Their Use - SkillstekDebabrata SahooPas encore d'évaluation

- SAP FICO SyllabusDocument1 pageSAP FICO SyllabusMaurya ShantanuPas encore d'évaluation

- SAP FICO SyllabusDocument1 pageSAP FICO SyllabusMaurya ShantanuPas encore d'évaluation

- SAP FICO SyllabusDocument1 pageSAP FICO SyllabusMaurya ShantanuPas encore d'évaluation

- Finance ProcessDocument13 pagesFinance ProcessDebabrata SahooPas encore d'évaluation

- ODN Number Configuration - Version 1.0Document9 pagesODN Number Configuration - Version 1.0Debabrata SahooPas encore d'évaluation

- Ldce - Fasp - 06 PDFDocument8 pagesLdce - Fasp - 06 PDFDinesh Talele100% (4)

- Sap Fico - Course ContentDocument4 pagesSap Fico - Course ContentDebabrata SahooPas encore d'évaluation

- History and Development of Philippine Public AdministrationDocument54 pagesHistory and Development of Philippine Public AdministrationKaren Faith ALABOTPas encore d'évaluation

- Test Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDocument6 pagesTest Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDebabrata SahooPas encore d'évaluation

- Ldis and RapidsDocument28 pagesLdis and RapidsRheii EstandartePas encore d'évaluation

- SAP FICO TCodes Only End User TCodesDocument8 pagesSAP FICO TCodes Only End User TCodesdjtaz13Pas encore d'évaluation

- SAP FICO TCodes Only End User TCodesDocument8 pagesSAP FICO TCodes Only End User TCodesdjtaz13Pas encore d'évaluation

- Travel ManagementDocument41 pagesTravel ManagementDebabrata SahooPas encore d'évaluation

- Travel ManagementDocument41 pagesTravel ManagementDebabrata SahooPas encore d'évaluation

- 2 Cost Behavior 2 (20 Pages)Document21 pages2 Cost Behavior 2 (20 Pages)Raju RiadPas encore d'évaluation

- Loan ManagementDocument34 pagesLoan ManagementDebabrata SahooPas encore d'évaluation

- Case QuestionDocument3 pagesCase QuestionNguyên Kim100% (4)

- Sap FicoDocument2 pagesSap FicoDebabrata SahooPas encore d'évaluation

- SAP FICO - ConfigDocument3 pagesSAP FICO - ConfigDebabrata SahooPas encore d'évaluation

- UT-FI - WCT CycleDocument6 pagesUT-FI - WCT CycleDebabrata SahooPas encore d'évaluation

- Basic Settings:: SAP FICO TrainingDocument3 pagesBasic Settings:: SAP FICO TrainingDebabrata SahooPas encore d'évaluation

- Procedure For Bank Reconciliation in FICODocument16 pagesProcedure For Bank Reconciliation in FICODebabrata SahooPas encore d'évaluation

- UT-FI - WCT CycleDocument6 pagesUT-FI - WCT CycleDebabrata SahooPas encore d'évaluation

- FICO ContentDocument15 pagesFICO ContentDebabrata SahooPas encore d'évaluation

- Test Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDocument6 pagesTest Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDebabrata SahooPas encore d'évaluation

- Accounts Payable ProcessDocument7 pagesAccounts Payable ProcessDebabrata SahooPas encore d'évaluation

- Test Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDocument8 pagesTest Script: NIT EST Cenario Etup ATA EST Xecution AND Esults Ummary OF EST EsultsDebabrata SahooPas encore d'évaluation

- Define Ledgers For General Ledger AccountingDocument2 pagesDefine Ledgers For General Ledger AccountingDebabrata SahooPas encore d'évaluation

- Procedure For Bank Reconciliation in FICODocument16 pagesProcedure For Bank Reconciliation in FICODebabrata SahooPas encore d'évaluation

- Procedure For Bank Reconciliation in FICODocument16 pagesProcedure For Bank Reconciliation in FICODebabrata SahooPas encore d'évaluation

- FICO ContentDocument15 pagesFICO ContentDebabrata SahooPas encore d'évaluation

- General Ledger Posting-FB50Document6 pagesGeneral Ledger Posting-FB50Debabrata SahooPas encore d'évaluation

- Lecture 5 Engineering Economics Interest Equivalence (Part 2) 1Document23 pagesLecture 5 Engineering Economics Interest Equivalence (Part 2) 1Natanael SiraitPas encore d'évaluation

- EHV Application FormatDocument2 pagesEHV Application FormatsunilgvoraPas encore d'évaluation

- Presented Here Are Selected Transactions For Norlan Inc During SeptemberDocument2 pagesPresented Here Are Selected Transactions For Norlan Inc During SeptemberMiroslav GegoskiPas encore d'évaluation

- Transcription - Charl Cilliers (06.09.18)Document86 pagesTranscription - Charl Cilliers (06.09.18)Leila DouganPas encore d'évaluation

- Certificate of Incorporation - 2022-12-29T114941.900Document1 pageCertificate of Incorporation - 2022-12-29T114941.900MoizPas encore d'évaluation

- Approved Supplier of IFR For IOCL Vijayawada Tender.Document2 pagesApproved Supplier of IFR For IOCL Vijayawada Tender.rohitPas encore d'évaluation

- Genealogical Sketch of William SimondsDocument39 pagesGenealogical Sketch of William SimondsseanredmondPas encore d'évaluation

- Provisional Merit List of Candidates - Written Test + AssessmentDocument31 pagesProvisional Merit List of Candidates - Written Test + Assessmentrangu prashanthhPas encore d'évaluation

- 09 - Chapter 6. - 7 PDFDocument23 pages09 - Chapter 6. - 7 PDFMotiram paudelPas encore d'évaluation

- Management and AccountingDocument11 pagesManagement and AccountingPranesh MajumderPas encore d'évaluation

- Ashby, Michael F. - Materials Selection in Mechanical Design-Elsevier (2011)Document22 pagesAshby, Michael F. - Materials Selection in Mechanical Design-Elsevier (2011)ritzky fachriPas encore d'évaluation

- HW 2.10 - CollocationsDocument4 pagesHW 2.10 - Collocationslongcnttvn1404Pas encore d'évaluation

- FYBMS Business Law SEM IDocument166 pagesFYBMS Business Law SEM IFearless GamingPas encore d'évaluation

- PB6MAT+Chapter 9 - Property, Plant & EquipmentDocument26 pagesPB6MAT+Chapter 9 - Property, Plant & EquipmentTirza NaomiPas encore d'évaluation

- NSTP 2 Activity Plan BS Accountancy 1Document9 pagesNSTP 2 Activity Plan BS Accountancy 1JEnnie CanoPas encore d'évaluation

- Rishabh Steel Supplier 2021-22: Particulars Credit Debit Opening Balance 1,98,256.000Document2 pagesRishabh Steel Supplier 2021-22: Particulars Credit Debit Opening Balance 1,98,256.000sureshstipl sureshPas encore d'évaluation

- Brics JSP 2018 PDFDocument293 pagesBrics JSP 2018 PDFgustavo_uff1577Pas encore d'évaluation

- 1.62 How To Handle Advance Purchase Bookings PDFDocument1 page1.62 How To Handle Advance Purchase Bookings PDFsPas encore d'évaluation

- Quiz2 3Document5 pagesQuiz2 3Kervin Rey JacksonPas encore d'évaluation

- Silver Members: Afghanistan Chamber of Commerce and IndustriesDocument78 pagesSilver Members: Afghanistan Chamber of Commerce and IndustriesHari BabuPas encore d'évaluation

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocument1 pageFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezPas encore d'évaluation

- Autocorrelation-Applied TestsDocument16 pagesAutocorrelation-Applied TestsAnsigar ChuwaPas encore d'évaluation

- Watco TechnicalDocument111 pagesWatco TechnicalSushant Kumar SarangiPas encore d'évaluation

- Ies TomDocument42 pagesIes TomLidiaCojocaruPas encore d'évaluation

- Eco 3 28.4 PDFDocument329 pagesEco 3 28.4 PDFDean Wood0% (1)