Académique Documents

Professionnel Documents

Culture Documents

Talwalkar

Transféré par

yogeshdhuri22Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Talwalkar

Transféré par

yogeshdhuri22Droits d'auteur :

Formats disponibles

family name Talwalkars Better Value Fitness Ltd, popularly known as Talwalkars, is India's largest [2] chain of health

clubs. It has 110 Health Clubs across 60 major cities in India on a consolidated basis, with over 1,20,000 members Established in 1932, by late Vishnu Talwalkar, his eldest son - Madhukar Talwalkar, further continued the legacy under the name Talwalkars Gymnasium in Bandra, Mumbai in 1962 and the brand has been rapidly growing since then. Today Talwalkars has 80 years of rich experience in health and fitness [3] industry.

Genre

Fitness- Health -Aerobics - Cardio

Founded

1932

Founder(s)

Vishnu Talwalkar

Headquarters

Mumbai, India

Key people

Madhukar Talwalkar Prashant Talwalkar Vinayak Ratnakar Gawande Harsha Ramdas Bhatkal Anant Ratnakar Gawande[1] Girish Talwalkar

Revenue

104.34 crore (US$16 million)

Website

www.talwalkars.net

Competition: India is young, and it has gotten richer and fatter. This combination is swelling the revenues at the countrys largest listed gym operatorTalwalkars Better Value Fitness. The $28 million (revenue) Mumbai company makes its debut on the Best Under A Billion list this year. Revenues have more than tripled from 2008 and profits nearly quadrupled. Fitness has become a clinical necessity, says Prashant Sudhakar Talwalkar, the 51-year-old chief executive officer and managing director, who spearheads gym expansions across the country. Unhealthy lifestyles have given people a scare. Doctors are starting to prescribe exercise for everything from diabetes to high blood pressure. Talwalkars has expanded from 63 gyms in fiscal 2010 to 144 this year, and its membership has risen from 59,000 to over 1,33,000 for the same period. One addicted member is Chitra Narayanan, who hits the Talwalkars gym in the upscale Chennai neighbourhood of Alwarpet five times a week. Her sedentary job in IT ties her to the computer, so the 45-minute workout is important. Theres lots of positive energy when you walk into the gym, says the 44-yearold mother of two. Its clean and nice. Shes been gymming for six years and tried two other neighbourhood spots before settling on Talwalkars. They are very systematic, she says. They give you a card which tells you what you have to do each day. And there are floor trainers and physiotherapists who help you out. With a presence in 75 cities and 19 states, Talwalkars is pervasive enough to claim a national franchise, save for parts of eastern India. It owns 101 of the 144 branded sites. Even though the Indian economy is exhibiting signs of a slowdown, the company says it has not seen any significant impact on the business. In the current fiscal year it plans to add 20 to 30 fitness centres of different sorts. Just in the past year it invested $15 million in capital expenditure, including opening new gyms, upgrading equipment and retrofitting existing fitness

centres to accommodate Zumba (Latin dancing) and a new weight-loss programme, Reduce. These services are aimed at boosting net margins, which have already climbed from 12.6 percent in 2009 to 20 percent in fiscal 2013. Much of the fitness industry has focussed elsewhere in Asia, but Indias demographics are enough to merit another look. Nearly 40 percent of Indias population will be in the 20-to-44 age group by the end of 2016, and many have increasing disposable income. The fitness market is also nascent. Only 0.05 percent of urban Indians have a health club membershipcompared with 3.11 percent in Asia-Pacific and 17.5 percent in the US. The Talwalkars believe they have an edge in the business because of their long-standing presence in the Indian market. The legacy started with Vishnu Ramakrishna TalwalkarPrashants paternal grandfather. Vishnu, who grew up in the village of Ashta in Maharashtra, got into wrestling because his village was near the stronghold of the erstwhile Maratha warriors. He moved to Mumbai in the 1930s and started a training centre for wrestlers. In 1962, Prashants paternal uncleMadhukar, who is now 79 years old and is chairman of the companyopened one of Indias first gyms, in Mumbais Bandra area. Even though he completed a textile engineering degree from the prestigious VJTI and joined a mill as a spinning supervisor, Madhukars passions were bodybuilding and running gyms. So he veered from the cloth mill to the treadmill. When Madhukar set up the first Talwalkars gym he was heartened by the demand. People would travel 10 to 20 miles to come to the gym, he says, and in the India of the 1960s that was really saying something. But it was hard for the Talwalkars to meet the demand. The initial growth was slow for the family business because financing was difficult, says Prashant, who joined the business in 1982 after getting a degree in biology

from the University of Mumbai. The Talwalkars took the idea of a gym to everyone from celebrities to regular consumers who were interested in weight loss and fitness training. They built up their credibility because the family was personally involved in fitness. Madhukar, for instance, was the founder president of the Greater Bombay Body Builders Association. He still does weight training for one hour every day.

Prashant, for his part, grew up opposite a Talwalkars family gym. He started hanging out there when he was 7 or 8. He trained in judo when he was 15 and began bodybuilding in his early 20s. He still works out at least an hour daily. I eat the same bread and butter that I sell, says Prashant. In 2003 Prashant joined hands with Madhukar and Girish, Madhukars son, to jump-start the expansion. They roped in three professionals to set up the company as it exists today. It listed on the stock exchange in 2010. (Prashant, Madhukar and Girish each own about 11 percent, and the non-family promoters each own about 7 percent.) Talwalkars, which is perceived as a mid-tier brand, is now expanding at both ends of the spectrum. In smaller towns and cities it has started a no-frills, fully franchised chain called HiFi. At 2,500 to 2,800 square feet the HiFi gyms are half the size of regular fitness centres. Memberships cost 40 percent less than the full-service gyms. Meanwhile, at the premium end, Talwalkars is rolling out a sports club. It raised $8 million (through a qualified institutional placement) in November and has tied up with David Lloyd Leisure, an upmarket health club operator in Europe. But Prashant is the first to admit that its not easy to woo the masses. I sell punishmentwho likes to go out and exercise? he asks. My biggest competition is not the gym next door but the couch. Hence some of the special attractions. It has joined with Miamis Zumba Fitness to offer Latin dancingfor $60 a monthboth at its clubs and outside. The company has already trained more than 150 Zumba professionals and is looking to have 100 Zumba centres by the end of this fiscal yearup from the

current 29. It has also rolled out a weight-loss programme called Reduce, at $100 per month. This allows a person on a diet to eat regular meals in addition to special foods provided by the company. We have solutions for everyone, says Prashant. If you dont like coming to the gym frequently we have something called NuForm, where you come only for 20 minutes once a week. He claims that NuForm studios help in weight loss through what he calls electro-muscle stimulation. At $600 to $700 per year, its targeted at the affluent consumer in tier-one cities. As he broadens the offerings, Prashants focus is on retaining customers who walk in the door. In an industry where client churn is a rule of thumb, the company says it retains three out of four customers.

Golds Mine

India may not be top of mind for the fitness sector but, according to the international Health, Racquet & Sportsclub Association, its 1,200 clubs are

more than what Indonesia and Malaysia have combined and account for $510 million in industry revenues. Although the market is highly fragmented and dominated by mom-and-pop players, Talwalkars faces its biggest competition from Golds Gym of the US. Through 10 years of franchising it has set up 92 gyms in Indiaits largest foreign presence. And its looking to grow to 150 by the end of 2014. India has lots of operational and infrastructural challenges, says John Holsinger, Asia-Pacific director at the IHRSA trade group. Gym operators have to deal with everything from the high cost of real estate to the availability of rentals in the right locations to getting the right qualified trainers. Sometimes its even difficult to get proper water facilities for the gym showers. Nonetheless, weve seen explosive development in India over the past decade, says Tim Hicks, director of franchising at Golds. We have become the preferred gym of many Bollywood celebrities. We are very bullish on growth in India because of the low gym penetration. Golds Gym has visiting doctors who provide consultation to members on diabetes, cholesterol and hypertension. Trainers customise the workout programmes for these clients. Meanwhile, Portugals Vivafit, signing on three franchisees to cover the southern, northern and eastern parts of India, has carved out a niche by catering only to women.

What is origin and concept of Talwalkars HI FI ? How has been the journey so far? The health and fitness industry is the sunrise industry of India. People are more health conscious than ever and growing awareness of fitness and looks fueled by Bollywood has created a solid ground for the fitness business across India. The trend is upswing even in tier I, II and III towns. Under our Talwalkars brand, Indias largest chain of health clubs having presence across 70 Indian cities, we were getting extraordinary response as we moved to virgin towns. As we targeted to have 300 centres in three years, we decided to create a franchise business model that will allow us to achieve this objective. Thus Talwalkars Hi Fi was born with a vision of spreading fitness across India. Hi Fi stands for Healthy India Fit India. The brands franchising journey began in 2010 and so far we have already signed up 21 franchise units with another 30 in the pipeline.

What all services does Talwalkars Hi Fi offer? We offer state-of-the-art health club facilities and services which includes air-conditioned gymnasium, cardio and strength training equipments, personal training, diet counseling, separate changing rooms for gents and ladies, steam, showers, lockers, etc. The brand offers a unique proposition of working as a community fitness centre, expanding the appeal and making it accessible and affordable to all. How do you think franchising will help in the brands further growth? Talwalkars Hi Fi currently has 21 clubs pan India. Our focus is to grow exponentially over the next three years and set up 300 units. We have prototyped every aspect of the model from its interiors to operation specs thus an investor gets a fully packaged model with network of partners like contractors architects suppliers, system and software team. Our management team and support system builds in high degree of security for both franchisor and franchisee. We also expect that in time a slew of value added services launched around Hi Fi will add to both franchisee and companys bottom line and top line. Other than that, we look for a lot of involvement from the entrepreneurs who associate with our brand. What are your companys growth plans for India and international market? India has far greater potential in terms of consuming health care via health clubs and Talwalkars being the undisputed leader is all set to share its expertise and experience of successfully setting up and managing health clubs across India. We are targeting all towns and cities with population more than 1.5 lakh. The brand has successfully expanded even in small towns like Ichalkaranji, Bhimavaram, Ajmer etc. It is also entering cities like Osmanabad, Udgir, Ongole, Anand etc. To attain our target of over 300 Talwlakars Hi Fi centres across length and breadth of India, we are now launching a master franchisee model which will further allow us to expand faster. Moving further, we see the brand as one of the worlds largest fitness chain in terms of number of centres in next five years and we believe we have the ingredients to achieve that.We have chalked out plans to enter the international markets as well. Currently, we are in talks with a couple of groups from Dubai and Qatar for the Gulf market. What are your franchisee qualification criteria? What kind of franchisee training and support programme do you offer? We look for people who share our passion and belief for this sector and its tremendous potential going ahead. Ideally young entrepreneurs who may have been connected with health fitness body building nutrition or physiotherapy field or businessmen who are looking to tap into sunrise industry as a sustainable and continuous business line. We provide fitness, sales and systems training to the franchisees and their staff. These trainings are comprehensive and make it very easy for someone to effectively manage a health club.As said before the entire project is offered as a package with complete network of vendors, suppliers and agencies. How lucrative is the business opportunity for interested franchisee? How much investment and area is required for opening the franchise? The numbers speak for themselves. We have more than 130 centres across India and we are continuously expanding because of the phenomenal results we are seeing. Any franchisee that partners with Talwalkars gets not only the best service in health and fitness but also the revenue model is very lucrative. The area of Talwalkars HI FI health club depends on the citys potential more than anything else. It can be 1,500 2,500 sq.ft. The investment ranges from Rs 45 85 lakh. The payback period can be as less as 1.5 years, ROI is between 35 50 per cent and zero investment in inventory.

Indian economy The Indian economy grew a respectable 5% in 2012-13 amidst a slowdown in the globaleconomic environment. With committed investments and growing insistence on strategicpolicy shifts, the Indian economy is expected to revert to a growth rate of about 8% bythe end of the Twelfth Five Year Plan. This coincides with the country expected to emergeas the second largest manufacturing country in the next five years, followed by Brazil asthe third ranked country (Source: Planning Commission). Industry overview With increasing global and media exposure, for many consumers today to look good equalsfeel good. An increasing emphasis on a healthy and wholesome lifestyle has been thespringboard for the wellness industry in India. Wellness today is not just a 'metro'phenomenon but consumers across Tier-II and Tier-Ill cities and even pockets of ruralIndia are also seeking wellness solutions to meet their lifestyle challenges. The Indian healthcare sector is at an inflection point and is poised for rapid growthin the medium term. However, healthcare expenditure is still amongst the lowest globallyand there are significant challenges to be addressed both in terms of accessibility ofhealthcare service and quality of patient care. While this represents a significantopportunity for the privat e sector, the Government can also play an important role infacilitating this evolution. The wellness industry is a field of healthcare focused on improving everyday health andstate of well-being, rather than simply treating a disease or curing illness. The Indianwellness industry is set to grow at a CAGR of 18-20% over a period of three years to Rs940-960 billion by 2014. Fitness and slimming market is pegged at Rs 50 billion and is setto grow at a robust pace of 20-30% to Rs 110 billion over three years (Source: PwC FICCIWellness Report). In the Indian fitness and slimming market, fitness services such as gymnasiums comprise50% ( Rs 25 billion) of the entire revenue pool and is under-penetrated with less than 5%penetration of the urban population. Fitness equipment comprises 20% of the market withthe institutional segment contributing to the bulk of the current demand. Slimmingservices have a 20% market share and is one of the fastest growing segments. Slimmingproducts account for 10% of the market and includes meal-replacement slimming products andweight-loss supplements with key growth drivers being increasingly availablethroughorganised retail channels. Growth drivers Aspiration to be associated with a trusted brand If there is one word that describes the consumer of today like none other is,aspirational. There is emergent need to associate oneself with an established and trustedbrand. Talwalkars, the brand has grown from strength to strength over the past eightdecades delivering quality services, under the aegis of wellness. This growth can beattributed to not just having built a loyal consumer base but also attracting new membersby keeping up with ceaselessly changing trends of the segment. Urbanisation and rising income levels in Tier-II and III cities The Indian consumer nowdisplays a wide spectrum of behaviour characteristics - right from 'passives' where demandfor wellness products is still latent to 'believers' for whom wellness is an integral partof their regular schedule. There has been an increased demand for health and fitnessservices into Tier-II and III cities led by rising urbanisation and income levels.Increased urbanisation has had a dual impact as it has not only created more awareness forwellness service but also increased the discretionary spending especially in the urbanfront. The urban population in Tier II, III cities is now keeping pace admirably withTier-I cities offering huge pool to tap into. Households with a rising income bracket havebenefitted from increasing disposable incomes and have made healthcare more affordable.The HiFi model brought to the fore by Talwalkars fits the bill perfectly in these avenuesof growth. Today's HiFi is tomorrow's Talwalkars. Globalisation Globalisation has exposed people to international cultures, lifestyle which has openedavenues for services like Zumba programmes, aerobics, yoga, EMS training and spa to namea few. A shift in demographics has played a key role in the scheme of things. The demandfor these services has been higher among the youth (15-34 years) who also have higherpropensityto spend on these activities. Interestingly this phenomenon is not only confinedto metro cities but is spread across regions. To cater to this growing demand, Talwalkarshas widened its umbrella of service offerings by focusing on each of these forms offitness. This has also helped the companyto leverage and enhance the member profile. Thereis also an opportunity to start these services not only within fitness centres but also ona standalone basis in schools, colleges, auditoriums, home based services and standalonestudios. Need for convenience

Health and wellness, which till recently was a relatively niche concept targeting aselect few, has now gained mainstream audience. Consumers today want to take control ofhow they look and feel, and this is driving purchase decisions across categories such asfood, beverages, personal care products and services. Convenience has become need of thehour. Members today want one stop solution for all their health needs. At Talwalkars weoffer all the health and fitness service gym, aerobics, yoga, personal training, Zumbaprogramme, weight loss, diet, spa, massage, nutritional supplements, merchandising underone umbrella. In addition, proximity to the consumer at affordable pricing has been therule to service members which offers lot of convenience to members to focus on theirhealth needs. This has resulted in increased revenue per member and fitness centre. Increase in discretionary spending Rapid urbanisation has led to limited scope for open areas for physical activitiesleading to sedentary lifestyle and increased incidence of lifestyle diseases. Risingincome levels have grown in direct proportion with lifestyle diseases and as a result haveled to higher discretionary spending. As per the PwC FICCI Wellness Report the share ofdiscretionary spending is expected to grow to 50% by 2019-20 from 30% in 200001. Also, thedemonstrative effect on the youth by their role models actors, sportsmen, and leadingpersonalities from different arenas has propagated the message of wellness, far and wide,and thereby has increased the propensity to spend on discretionary services. Increasing population The population aging 40 years plus is expected to rise from 33% in 2012 to 43% by 2041.India's population of consumer age 40 years-plus is more than the total population of theUSA. This new breed of consumers is more inclined to spend on health, fitness and wellnessservices: driven bythe mantra of 'looking good and feeling good'. On the other hand theyouth population is expected to rise from 384 million in 2005 to 427million by 2015. Thisyouth population creates a potential market for alternative sources of fitness likeaerobics, yoga, Zumba programme and balanced dietary regimes. Talwalkars business model Talwalkars is India's largest, fastest-growing and one of the most trusted health andfitness brands enjoying an entrenched presence across the Indian landmass. The Companyoperates in three distinct models - 100% owned fitness centres, subsidiary fitness centresand a franchised fitness centres concept under Healthy India Fit India (HiFi). Thisextensive presence ensures faster roll out of fitness centres at optimal capex costs,providing the Company the twin benefit of quicker revenue accretion and an asset lightBalance Sheet. The company has widened its foot prints from 64 cities in FY12 to 75 cities today. Format Talwalkars Owned Subsidiary Franchisee Trademark Licensed HiFi Total 101 15 7 6 15 144 No. of fitness centres*

Out of the 144 fitness centres, 34% of the outlets were located in Tier-I cities, while41% and 25% units were situated in Tierll and Tier-Ill cities and towns respectively.While the majority of the fitness centres at 43% were located in West India, 26% each werelocated in South and North while the East represented the rest at 5%. Being the largest fitness chain in India, Talwalkars has focused its attention on thecore of its gym equipment. As a prudent corporate policy, Talwalkars purchases gymequipment directly from reputed international manufacturers including Precor, Matrix andHoist, among others, towards providing world-class and standardised fitness solutionsacross India. Moreover the Company has also entered into long-term contracts with thesesuppliers to ensure equipment refurbishment every 5-6 years (by changing parts whichsuffer the highest wear and tear) at a nominal cost. Also, for all equipment it has beenable to get extended warranties and AMCs (annual maintenance contracts) for a longerduration of about 8-10 years, enabling overall optimisation. Talwalkars - gaining muscle NuForm Studio - Fitness with just 20 minutes per week Miha Bodytec came up with theconcept of losing weight through the Electro Muscle Stimulation (EMS) technology. Mihamachines have been come to the aid of myriad users at more than 1,500 centres acrossGermany and the rest of Europe. The same, proven German technology is now being introducedas NuForm by Talwalkars in India.

Talwalkars NuForm model: Focuses on weight loss through EMS technology, counselingbyqualified dieticians boosting one's efforts to shed that extra pound, but just don'thave enough time for it. The EMS session isjust 20 minutes of work out once a week. Thetraining which one does is much more intense and faster than conventional weight training. Target customer segment: Nuform caters to that particular potential customerbase that has thus far avoided gyms due to a shortage of time, or due to health and ageingissues. The prime markets include Tier-I cities with a keen focus on the upwardly mobileand affluent classes. USPs: Time saving: The fitness regime only demands 20 minutes once a week but bringsthe benefit of a few hours worth of workout on a weekly basis. Premier home service: A portable and state-of-the-art German designed systemenables TBVFL to offer premier services to its clients right at their doorsteps. Total fitness: weight loss and fat removal, enhanced muscle formulation andstimulation, greater muscular strength and endurance. Advantages: Aims to target the metro and Tier-I cities and the middle-aged and geriatricsegment who hardly find time to workout. EMS method and home service are unique offerings introduced and aims to utilisethe first -mover advantage in this space. Standalone high-street studios: Six NuForm Studios are operational in Mumbai(Andheri, Bandra, Chembur and Vile Parle) and Thane (Panchpakhadi and Pokhran Road, VasantVihar). Zumba fitness programme Started in 2001, the Zumba fitness programme has grown steadily in stature to becomethe world's largest and most successful - dance-fitness programmes. Zumba programmeinvolves dance and aerobic elements. Zumba's choreography incorporates hip-hop, soca,samba, salsa, merengue, mambo, martial arts, and some Bollywood and belly dance moves.Squats and lunges are also included. This programme has received wide acceptance which canbe gauged from the already 14 million people taking weekly Zumba classes inover 140,000 locations across more than 151 countries. It offers a complete body workoutin a single session. The Company has increased the centres offering Zumba programmeto 29 from 15 earlier. The Company currently has created a strong bench of over 150certified Zumba trainers which shall facilitate in faster rollout of Zumba programmes.The company has received active response from large corporates, including MNCs, forZumba programme. The Company is actively looking at other avenues like schools,colleges, auditoriums among others. USPs: The usual gym and aerobic classes are a passe. The latest one gaining popularity acrossthe world as well as in India, that can help one stay in shape, is Zumbaprogramme. Zumba classes are known to reduce the stress levels of participants.Talwalkars expects to take Zumbaprogrammes to schools and colleges as well,representing an early entrant advantage in a niche and growing market. Advantages: Aids in targeting the younger generation through the integration of variousdance forms. Opens up opportunity of foraying into selling Zumba's branded merchandise suchas apparels, DVD and music sets, footwear, among others. Reduce Reduce is the easy weight loss solution. You might ask where the catch is. It's simple.The Reduce programme involves a strategic tweaking change in the frequency, timing andsize of the meals with no restraints on conducting ones' lifestyle the way they want.Members are provided personalised and motivational support by experts and require a visitjust once in a week. Members are not only given the diet plan but are also given ready to eat or cook food. The food products include items such as multigraincookies, amla ginger drink, pulav rice, baked chivda and sevia kheer (dessert) etc. Reduceprogramme is offered at 17 centres from 5 in July 2012. Reduce is also offered as 'Homebased Reduce', primarily catering to HNIs and corporates at their door step. This requiresminimal capex. Hence, it has an incremental positive impact on the fitness centre'sprofitability. USPs: Anytime, anywhere weight loss programme, strengthening convenience. Once a week programme, luring a larger number of participants. Talwalkar's has established a convenient home-based option for its consumers. Advantages: Weight-loss without rigorous training will aid in attracting substantialinterest from existing as well as prospective members. Once a week programme will attract members residing in Tier-I cities who areburdened with hectic schedules. Marketing initiatives

The marketing team works in close tandem with both external and internal environmentand finds innovative solutions to enhance revenue and widen reach of the brand. Pinkathon - Run to lead Talwalkars partnered with 'Pinkathon 2012- Run to lead', as their official fitnesspartners to spread awareness on breast cancer. The highlights of the Pinkathon Carnivalwere the electrifying Zumba performances by Talwalkars Zumba trainers.The winner of the marathon was gifted one year complimentary membership of Talwalkarsfitness centre. Losers challenge 2012 Talwalkars and Britannia NutriChoice created a wonderful partnership to encouragemembers to get in shape and create a healthy start for the New Year. The Losers Challengeis a unique 30 day team event that motivates members to lose weight in shortest duration.Losers challenge helped in active engagement of the members, creating awareness forfitness and inculcating healthy eating habits. Chairman's reward programme The Chairman's reward programme is held in appreciation for the contribution andefforts of the managers at fitness centre in adding value to the growth of theorganization. The Chairman's reward programme acts as a great motivator for the employeesat the fitness centres to set new standards of performance each year. Webinar A webinar is an on-line seminar more of having a live seminar experience. The speakerin the webinar is a consultant who has vast experience and knowledge of various subjects.The webinar acts as a new lead generation tool for various fitness centres. Also, thewebinar can act as a catalyst for up-selling to the existing members the various servicesoffered within the fitness centre. Miss Hyderabad 2012 Miss Hyderabad is the leading beauty pageant held in southern India. Talwalkars was theofficial fitness partner (2nd time in a row) of the pageant. Company's expert trainerstrained and groomed the 25 finalist to meet the fitness requirement and aspirations of thefashion and glamour world. Human resources Human resources are the key to the success of the organization and in meeting itsaspirations. In a service industry it is extremely essential to hire and retain qualityskilled manpower. A paucity of skilled and trained personnel is what ails the contemporarydomestic wellness industry the most. In this scenario the training academy at Thane hasemerged as the vital cog in the TBVFL wheel. The company in order to create a pool ofskilled manpower so as to facilitate standardised services across fitness centres and afaster roll out of fitness centres has opened a best-in-class residential training academyin the outskirts of Mumbai. In the last fiscal the Company has widened its repertoire ofservice offerings. Policies, processes and initiatives have been initiated which are inline to meet the demands of the growing business in the years to come. Training needsacross all functions are identified and training programmes are formulated and conductedon an ongoing basis both for existing and new employees. The remuneration policy is inline with the industry practices and reviewed periodically to match industry standards.Employer-employee relations have remained harmonious during the year under review. Risks and concerns Economic risks A slowdown in the global economy may adversely impact the discretionary spendingbehaviour of the consumer and thereby the Company. The Company identifies these risks andhas taken measures to minimise their impact. The Company has widened its reach beyondmetro and Tier-I cities to Tier-II and III cities which continue to exhibit strongconsumption demand. Along with its reach the Company has also widened its service offeringto leverage on and enhance the current member base and infrastructure. However any severesetback in the economy may affect the performance of the Company. Regulatory risks The wellness industry is of strategic importance to the Indian Government. By 2015,wellness services in India have the potential to generate over three million jobs (Source:PwC FICCI Wellness Report). Recognising the importance of this industry, thegovernment has already initiated measures to stimulate growth. Government can play a keypart in the making or breaking of this industry at such a nascent stage by supporting thehealth and wellness industry with subsidies and by reducing the taxes on fitnessequipment. In the event of change in taxation policy by the government in a manner adverseto the Company, Company's tax expenses can have a material impact on the profitability ofthe Company. If the government expedites on the economic reforms front, it would bepositive trigger for the economy, which in turn will enhance the prospects for the fitnessand wellness industry. Competition risks The increased demand for wellness services has made India an attractive destination forthe international players. The fitness industry in India is largely dominated byunorganised local players. Entry of new players creates more awareness and

open new marketof opportunities. However an emergence of a strong international or domestic player canpose a risk to the Company. It is imperative for the Company to create a strong brandrecall value among the consumers, something which the Company has done commendably overthe years of its existence. The Company has adopted the best practices in the industrysuch as loyalty, reward and customer referral schemes. Qualityand innovative serviceoffering has helped the Company to differentiate itself from its competitors. Further, thecompany's pan-India presence and international alliances gives an edge over other players. Availability of skilled manpower To meet customer expectations, the company needs to focus on quality service offeringsand availability of skilled manpower. To enhance member experience, the look and feel ofthe fitness centres and its services across India remains similar. The company has alsostandardized systems and process for smoother operations. Its training academy helpscreate skilled pool of resources that enables mitigating operational risks relating toskilled manpower availability. Financial risks The company is in constant mode of expansion. Hence it is critical to avail timely andadequate funds at effective rate to fun d the growth. The finance team monitors and timelyplans financial requirement through alternate sources of funding ensuring best possiblecost of borrowing. The company has been rated as 'AA-' by CARE which enables the companyto seek better terms from its bankers. Analysis of our key financials (consolidated) Keeping pace with the company's core competency of improving health, financial healthof the company exhibited all-round improvement. Outcome of consistent workout on revenuesfront and austere diet of expenses is stronger margins and financial wellbeing of thecompany. The significant financial highlights of the Company comprised the following: Revenues In addition to continuing its expansion by addition of new fitness centres the companylaunched new initiatives during the current year thereby expanding the service offeringsto members. Members now can choose from various products to suit their individualrequirements and achieve their health objectives. The revenues increased by 29% on YoY basis and stood at Rs 1688 million. Withconsistent robust performance the eight year CAGR stood at 49%. Operational Cost The company has been able to contain its total operating cost (before depreciation)which as a percentage of net revenue declined from 54% in FY12 to 51% in FY13. Promoting experienced staffand giving them additional responsibilities to utilize theirexperience and inducting new talents aided the control on employee benefit expenses.During FY13 the same was maintained at 20% of net revenue as in previous year. With help of experience gained by in-house talents from their visit to various nationaland international forums and expert advice from consultants, areas were identified wherecosts could be controlled or reduced using better management or technologies. Alternativemodels were screened, finalised, developed and tested at test locations. Successful modelswere replicated across most of the locations resulting in reduced cost. The success isevident in decrease in other expenses from 33% of income in FY12 to 31% in FY13. EBIDTA As a consequence of revenue increase and cost control the EBIDTA margins went up from46% in FY12 to 49% in FY13. The same stood at Rs 739 million in FY13 an increase of 32% onYoY basis. Finance cost Sequel to judicious mix of various sources of finance such as equity, loans, letter ofcredit, non-convertible debentures, temporary overdraft against deposits, parking ofexcess funds in mutual funds or bank deposits, etc was lower finance cost as percentage ofincome. The same reduced from 7.5% to 7% as percent of net revenue. Depreciation Depreciation for FY13 stood at Rs 146 million an increase from Rs 118 million inprevious year. The same was mainly on account of additional fitness centres added duringthe year. Profit After Tax Net profit (after minority) grew 36% to Rs 301 million; net profit margin climbed up200bps to 20% during the year under report as a result EPS increased by Rs 3 per share andstood at Rs 12.15 per share. Internal control systems The Company has focused on leveraging its IT infrastructure both in terms of hardwareand software. The Company has effective and robust system of internal controls to helpmanagement review the effectiveness of the financial and operating

controls and assuranceabout adherence to company's laid down systems and procedures. Proper controls are inplace which is reviewed at regular intervals to ensure that transactions are properlyauthorized & correctly reported and assets are safeguarded. The Audit Committee alongwith the management periodically review the findings and recommendations of the Auditorsand take necessary corrective actions as deemed necessary. Cautionary statement This management discussion and analysis contains forward-looking statements thatreflect our current views with respect to future events and financial performance. Ouractual results may differ materially from those anticipated in the forwardlookingstatements as a result of many factors. Outlook Talwalkars continue to dominate the health and fitness industry with 144 fitnesscentres spread across 75 cities and towns and the anticipated opening of 20-30 new fitnesscentres in 2013-14. The Company has proved its credentials in running successful fitnesscentres not only in larger cities but also smaller towns. The Company sees strong demand and potential in Tier-II and Tier-III cities and townsof India with increased awareness. The Company is focused in penetrating in to thesecities and towns to reach a wider customer base and enhance profitability. It also expectsto increasingly focus on optimising product offerings and introducing new services toleverage the current asset base and customer portfolio. New initiatives comprising NuForm, Reduce and Zumba programme have receivedsatisfactory responses and will be rolled out progressively to strategically cover mostparts of the Talwalkars network. Financially, the Company expects to maintain the marginsin the current year both at the operating and net levels.

Vous aimerez peut-être aussi

- Project Report On Gold's GymDocument21 pagesProject Report On Gold's GymAvinash Shaw33% (3)

- David SalonDocument5 pagesDavid Salonrotsacreijav6666660% (1)

- Cult FitDocument16 pagesCult Fitradhikaasharmaa2211Pas encore d'évaluation

- Spa Health Club Business PlanDocument25 pagesSpa Health Club Business PlanAvinash Supkar100% (1)

- 2013 IHRSA Global Report FeatureDocument7 pages2013 IHRSA Global Report FeatureromuloduquePas encore d'évaluation

- Our Iceberg Is MeltingDocument5 pagesOur Iceberg Is Meltingyogeshdhuri22Pas encore d'évaluation

- Chillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266Document31 pagesChillers, Fcu'S & Ahu'S: Yasser El Kabany 35366866 010-9977779 35366266mostafaabdelrazikPas encore d'évaluation

- Talwalkars Better Value Fitness LTDDocument4 pagesTalwalkars Better Value Fitness LTDAnonymous T8VqeaPas encore d'évaluation

- Talwalkars Better Value Fitness LTDDocument4 pagesTalwalkars Better Value Fitness LTDManav SinghPas encore d'évaluation

- Vandana Luthra: EducationDocument4 pagesVandana Luthra: EducationKalpeshkumar Patil0% (1)

- Business With GoldDocument14 pagesBusiness With GoldRohit GuptaPas encore d'évaluation

- Health and Fitness Industry AnalysisDocument13 pagesHealth and Fitness Industry AnalysisBhoomikaGuptaPas encore d'évaluation

- Understanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"Document3 pagesUnderstanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"International Journal of Application or Innovation in Engineering & Management100% (1)

- Control The MoneyDocument3 pagesControl The MoneyVivek TalwarPas encore d'évaluation

- 7 Simple Start-Up Ideas That Have Earned Lakhs & CroresDocument6 pages7 Simple Start-Up Ideas That Have Earned Lakhs & CroresFALCO1234Pas encore d'évaluation

- Case On RamdevDocument23 pagesCase On RamdevYuktarth Nagar0% (1)

- Business EnvironmentDocument17 pagesBusiness EnvironmentVanshika ChoudharyPas encore d'évaluation

- Group No. - 3: Bringing Out The Fittest in You!Document19 pagesGroup No. - 3: Bringing Out The Fittest in You!Sabbir Rahman Joy100% (1)

- Salon MarketDocument6 pagesSalon MarketAkshay JainPas encore d'évaluation

- A Growing Industry: CK Ranganathan, CMD of CavinkareDocument4 pagesA Growing Industry: CK Ranganathan, CMD of Cavinkaretsram13Pas encore d'évaluation

- CBDocument12 pagesCBPiyush ChitlangiaPas encore d'évaluation

- WICCI UP Entertainment & Media CouncilDocument32 pagesWICCI UP Entertainment & Media CouncilNeha sharmaPas encore d'évaluation

- Uhfushf SJFJSFVDocument20 pagesUhfushf SJFJSFVmonub8097Pas encore d'évaluation

- Gold GymDocument59 pagesGold GymGirija mirjePas encore d'évaluation

- Competition 1. Gold's GymDocument5 pagesCompetition 1. Gold's GymAkarsh Sandeep LoombaPas encore d'évaluation

- Different Forms To Go For A VentureDocument51 pagesDifferent Forms To Go For A VenturensukhramaniPas encore d'évaluation

- Small Scale Industry - Lijjat PapadDocument15 pagesSmall Scale Industry - Lijjat Papadtybbi20100% (1)

- Mallika Srinivasan Chairman &Ceo-Tafe: TH THDocument4 pagesMallika Srinivasan Chairman &Ceo-Tafe: TH THAnonymous 1Rj80jPas encore d'évaluation

- VLCCDocument2 pagesVLCCRajib ChePas encore d'évaluation

- Santé Gym Business PlanDocument13 pagesSanté Gym Business PlanRishabh RastogiPas encore d'évaluation

- Business ProfileDocument7 pagesBusiness ProfilekiuuuuPas encore d'évaluation

- Ahsan 62858 Sports Wear Business PlanDocument19 pagesAhsan 62858 Sports Wear Business PlanMuhammad Ahsan IrshadPas encore d'évaluation

- Swot Analysis On Successful Entrepreneur Success Story of Vandana Luthra - The Founder of VLCCDocument4 pagesSwot Analysis On Successful Entrepreneur Success Story of Vandana Luthra - The Founder of VLCCkrantiPas encore d'évaluation

- MD Maksood Khan-2021-334-129-Small Business and Entrepreneirship-Assignment-2Document9 pagesMD Maksood Khan-2021-334-129-Small Business and Entrepreneirship-Assignment-2MD MAKSOOD KHANPas encore d'évaluation

- 2013 IHRSA Media KitDocument16 pages2013 IHRSA Media KitAllan Israel Acosta PérezPas encore d'évaluation

- Case Study Vandana LuthraDocument3 pagesCase Study Vandana LuthraSangram Pawar50% (2)

- MM Group 7Document12 pagesMM Group 7Mukul MohtaPas encore d'évaluation

- Updated Sahara 2.1Document96 pagesUpdated Sahara 2.1brijeshcocoPas encore d'évaluation

- Striders: Running Away or Towards The Growth (Group 8)Document1 pageStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniPas encore d'évaluation

- Mahendragarh District: FounderDocument5 pagesMahendragarh District: FounderHarshdeep SinghPas encore d'évaluation

- FianlDocument67 pagesFianlRaj KushwahaPas encore d'évaluation

- Smita Mankad Bio Apr13Document2 pagesSmita Mankad Bio Apr13Shalini SrivastavPas encore d'évaluation

- Sportac Club IncDocument13 pagesSportac Club IncRaphael Atiyeh100% (1)

- Why India Need Women Entrepreneurs and Explain About 5 Women EntrepreneursDocument9 pagesWhy India Need Women Entrepreneurs and Explain About 5 Women Entrepreneurssaiganeshpatnala123Pas encore d'évaluation

- AyurvedaDocument3 pagesAyurvedaashish5189Pas encore d'évaluation

- Womenentrepreneurs2010 131028120718 Phpapp02 PDFDocument9 pagesWomenentrepreneurs2010 131028120718 Phpapp02 PDFHimani JindalPas encore d'évaluation

- DfjtydyugfDocument5 pagesDfjtydyugfNeha GargPas encore d'évaluation

- Riya ProjectDocument12 pagesRiya ProjectShivani JaswalPas encore d'évaluation

- Case Study - PatanjaliDocument19 pagesCase Study - PatanjalishruthiPas encore d'évaluation

- Major Players of Retail in IndiaDocument8 pagesMajor Players of Retail in IndiaVelmuruganPas encore d'évaluation

- Ana Economics Project 1Document10 pagesAna Economics Project 1Ana Irene ArunkumarPas encore d'évaluation

- 01 Kotler ch01 pp002-039Document38 pages01 Kotler ch01 pp002-039JohnPas encore d'évaluation

- Fitness Industry in India: Made By: Akash SaxenaDocument20 pagesFitness Industry in India: Made By: Akash SaxenaAnsh SaxenaPas encore d'évaluation

- SectionA Group1 ProjectDocument15 pagesSectionA Group1 Projectbinzidd007Pas encore d'évaluation

- Trade Partners Search SitemapDocument4 pagesTrade Partners Search SitemapSumit GuptaPas encore d'évaluation

- Presentation Women EntrepenurshipDocument12 pagesPresentation Women EntrepenurshipAnshuman PradhanPas encore d'évaluation

- CaseDocument41 pagesCasekjohnabrahamPas encore d'évaluation

- IBE On Swathi PiramalDocument10 pagesIBE On Swathi PiramalAmrutha AyinavoluPas encore d'évaluation

- LIME 5 Case Study Gold GymDocument5 pagesLIME 5 Case Study Gold GymUdit VarshneyPas encore d'évaluation

- Dairy CooperativesDocument11 pagesDairy CooperativesRahul SadhPas encore d'évaluation

- From Health Club to Healthcare: How Gym Owners Can 10x Their IncomeD'EverandFrom Health Club to Healthcare: How Gym Owners Can 10x Their IncomePas encore d'évaluation

- Basic Laptop Service Training (For Freshers) - 60 Days: 2-WeeksDocument6 pagesBasic Laptop Service Training (For Freshers) - 60 Days: 2-Weeksyogeshdhuri22Pas encore d'évaluation

- 30 - White Paper On Ocean AcidificationDocument8 pages30 - White Paper On Ocean Acidificationyogeshdhuri22Pas encore d'évaluation

- Human Resource ManagementDocument74 pagesHuman Resource Managementyogeshdhuri22Pas encore d'évaluation

- RACI FinalDocument27 pagesRACI Finalyogeshdhuri22Pas encore d'évaluation

- Units of MeasurentDocument2 pagesUnits of MeasurentSahul HameedPas encore d'évaluation

- Treating Customers FairlyDocument8 pagesTreating Customers Fairlyyogeshdhuri22Pas encore d'évaluation

- Banker-Customer Relationship DDocument18 pagesBanker-Customer Relationship Dyogeshdhuri22Pas encore d'évaluation

- Cement Prices Dec13Document2 pagesCement Prices Dec13yogeshdhuri22Pas encore d'évaluation

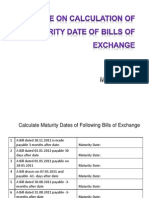

- Calculation of Maturity DateDocument4 pagesCalculation of Maturity Dateyogeshdhuri22Pas encore d'évaluation

- Promissory Notes, Bill of Exchange and Cheque Payable Either To Order or To BearerDocument26 pagesPromissory Notes, Bill of Exchange and Cheque Payable Either To Order or To Beareryogeshdhuri22Pas encore d'évaluation

- IkeaDocument22 pagesIkeayogeshdhuri22Pas encore d'évaluation

- What Is FirstcryDocument11 pagesWhat Is Firstcryyogeshdhuri22Pas encore d'évaluation

- The Effectiveness of Blue Ribbon Committee Recommendations in Mitigating Financial MisstatementDocument29 pagesThe Effectiveness of Blue Ribbon Committee Recommendations in Mitigating Financial MisstatementAdhiyanto Puji LaksonoPas encore d'évaluation

- SR No Name Gender Age Basic Qulaification MBA Specialisation (Finance/Marketing)Document4 pagesSR No Name Gender Age Basic Qulaification MBA Specialisation (Finance/Marketing)yogeshdhuri22Pas encore d'évaluation

- How We Classify CountriesDocument2 pagesHow We Classify Countriesyogeshdhuri22Pas encore d'évaluation

- Indian Emission Regulation BookletDocument30 pagesIndian Emission Regulation BookletPRABUICEPas encore d'évaluation

- Kennedy and His New FrontierDocument16 pagesKennedy and His New Frontieryogeshdhuri22Pas encore d'évaluation

- 162:dharma Tanna: MET Institute of Management Prof. Shannon Sir Presented by 144: Shweta ShahDocument15 pages162:dharma Tanna: MET Institute of Management Prof. Shannon Sir Presented by 144: Shweta Shahyogeshdhuri22Pas encore d'évaluation

- Vehicular Pollution Control in India Technical & Non-Technical Measure PolicyDocument34 pagesVehicular Pollution Control in India Technical & Non-Technical Measure Policyyogeshdhuri22Pas encore d'évaluation

- Polio Doc 1Document4 pagesPolio Doc 1yogeshdhuri22Pas encore d'évaluation

- Customer Distribution Retailers Consumer Wholesale: Promotion Mode Urban Market Rural MarketDocument3 pagesCustomer Distribution Retailers Consumer Wholesale: Promotion Mode Urban Market Rural Marketyogeshdhuri22Pas encore d'évaluation

- Polio Doc 1Document4 pagesPolio Doc 1yogeshdhuri22Pas encore d'évaluation

- Air India Roll No 27Document15 pagesAir India Roll No 27yogeshdhuri22Pas encore d'évaluation

- Census 2011 PDFDocument2 pagesCensus 2011 PDFvishaliPas encore d'évaluation

- AJWS Response To July 17 NoticeDocument3 pagesAJWS Response To July 17 NoticeInterActionPas encore d'évaluation

- Philippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Document2 pagesPhilippine National Development Goals Vis-A-Vis The Theories and Concepts of Public Administration and Their Applications.Christian LeijPas encore d'évaluation

- Architecture AsiaDocument84 pagesArchitecture AsiaBala SutharshanPas encore d'évaluation

- Resume-Pam NiehoffDocument2 pagesResume-Pam Niehoffapi-253710681Pas encore d'évaluation

- Chapter 1 Introduction To Quranic Studies PDFDocument19 pagesChapter 1 Introduction To Quranic Studies PDFtaha zafar100% (3)

- How To Write A Driving School Business Plan: Executive SummaryDocument3 pagesHow To Write A Driving School Business Plan: Executive SummaryLucas Reigner KallyPas encore d'évaluation

- Letter To Singaravelu by M N Roy 1925Document1 pageLetter To Singaravelu by M N Roy 1925Avinash BhalePas encore d'évaluation

- Jive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns AreDocument2 pagesJive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns Aretic apPas encore d'évaluation

- Pre-Qualification Document - Addendum 04Document4 pagesPre-Qualification Document - Addendum 04REHAZPas encore d'évaluation

- Salesforce Salesforce AssociateDocument6 pagesSalesforce Salesforce Associatemariana992011Pas encore d'évaluation

- CHAPTER 1 - 3 Q Flashcards - QuizletDocument17 pagesCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Letter Regarding Neil Green To UHP, District AttorneyDocument4 pagesLetter Regarding Neil Green To UHP, District AttorneyWordofgreenPas encore d'évaluation

- Trade Promotion Optimization - MarketelligentDocument12 pagesTrade Promotion Optimization - MarketelligentMarketelligentPas encore d'évaluation

- SiswaDocument5 pagesSiswaNurkholis MajidPas encore d'évaluation

- General Concepts and Principles of ObligationsDocument61 pagesGeneral Concepts and Principles of ObligationsJoAiza DiazPas encore d'évaluation

- 2015 3d Secure WhitepaperDocument7 pages2015 3d Secure WhitepapersafsdfPas encore d'évaluation

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Document2 pagesRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYPas encore d'évaluation

- All Region TMLDocument9 pagesAll Region TMLVijayalakshmiPas encore d'évaluation

- Objectives of Financial AnalysisDocument3 pagesObjectives of Financial AnalysisMahaveer SinghPas encore d'évaluation

- EIB Pan-European Guarantee Fund - Methodological NoteDocument6 pagesEIB Pan-European Guarantee Fund - Methodological NoteJimmy SisaPas encore d'évaluation

- ISE II Sample Paper 1 (With Answers)Document13 pagesISE II Sample Paper 1 (With Answers)Sara Pérez Muñoz100% (1)

- ADPO Syllabus - 10Document2 pagesADPO Syllabus - 10pranjal.singhPas encore d'évaluation

- Christian Biography ResourcesDocument7 pagesChristian Biography ResourcesAzhar QureshiPas encore d'évaluation

- ERRC Grid and Blue Ocean StrategyDocument2 pagesERRC Grid and Blue Ocean StrategyferePas encore d'évaluation

- Chapter 12Document72 pagesChapter 12Samaaraa NorPas encore d'évaluation

- SMART Train ScheduleDocument1 pageSMART Train ScheduleDave AllenPas encore d'évaluation

- rp200 Article Mbembe Society of Enmity PDFDocument14 pagesrp200 Article Mbembe Society of Enmity PDFIdrilPas encore d'évaluation

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityDocument21 pages4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianPas encore d'évaluation