Académique Documents

Professionnel Documents

Culture Documents

(114370327) All India Stamp Duty Ready Reckoner

Transféré par

Vivek ThotaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

(114370327) All India Stamp Duty Ready Reckoner

Transféré par

Vivek ThotaDroits d'auteur :

Formats disponibles

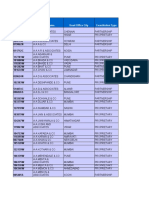

Sr. No.

State Andhra Pradesh

Rate of Stamp Duty (a) 5% (b) 5% plus 5% transfer tax on transfer = 10%

Remarks

of consideration or market value of property, whichev

2 3

Assam Bihar & Jharkhand

8.25% 7% + 2% duty on transfer (for property within municipal limits) i.e. 9% + additional surcharge @ 10% of amount of stamp duty. 8% 8% Note: (i) additional 25% for property in urban areas. (iii) Additional stamp duty is chargeable in case of instruments relating to conveyance of vacant land in urban areas @ 50% of stamp duty for Urban areas and 25% for areas other than urban areas

of consideration

of consideration or market value whichever is greater

4 5

Goa, Daman & Diu Gujarat (a) conveyance of immovable property

of consideration of the consideration or the market value whichever is greater.

(b) conveyance of immovable property if it relates to a premises of a co-operative society registered or deemed to have been registered under the Gujarat Co- operative Societies Act, 1961 by such society in favour of its member or such member in favour of another member. (c) conveyance relating to a premises

8% Note : Additional 25% stamp duty for property in Urban areas

of the consideration or the market value whichever is

8%

of the consideration or the market value whichever is

Note : (i) of a corporation formed and Additional 25% stamp duty for property registered under the Bombay in Urban areas Non-Trading Corporation Act, 1959 or (ii) of a Board constituted under the Gujarat Housing Board Act, 1961 or Gujarat

ket value of property, whichever is higher

ket value whichever is greater

the market value whichever is greater.

the market value whichever is greater.

1972. (iii) to which provisions of Gujarat Ownership Flats Act, 1973 apply. 6 7 8 Haryana Himachal Pradesh 12.5% 8% 10% of consideration for sale in instruments. of consideration of the market value

Karnataka

(1) property situated within the limits of (i) Bangalore Metropolitan Regional Development Authority

(ii) City Corporation or city or Town 9% Municipal Council or any Town Panchayat ofother the market than the value areas specified in item No. (i) above

(iii) any area other than areas specified 8% in items (i) and (ii) above.

of the market value

(2) where property relates to (i) 2% first instrument of conveyance executed by promoter, a land owner or developer pertaining (ii)Rs.6000/- + 3% to a flat or defined under Karnataka Ownership flats Act, 1972 or Apartment as defined under Karnataka Apartment Ownership Act, (iii) Rs.12000/- + 6% 1972 or transfer of shares by or in favour of Co- operative Society or Company. (iv)(a) Rs.42000/- +8%

of the market value not exceeding Rs.3 lakhs.

of the market value exceeding Rs.3 lakhs but not

of the market value exceeding Rs.5 lakhs, but not ex

of the value exceeding Rs.10 lakhs (if situated in the

(iv)(b) Rs.42000/- +7%

of the value exceeding Rs.10 lakhs (if the property si

e in instruments.

ot exceeding Rs.3 lakhs.

xceeding Rs.3 lakhs but not exceeding Rs.5 lakhs

ceeding Rs.5 lakhs, but not exceeding Rs.10 lakhs

Rs.10 lakhs (if situated in the Bangalore Metropolitan Regional Development Authority

Rs.10 lakhs (if the property situated in area other than the Bangalore Metropolitan Regional Development Authority

Kerala (a) for transfer of immovable property situated within the Municipal Corporation or Municipalities

8.5% Note : A surcharge of 4% in municipal areas and 5% in corporation area is to be levied separately.

of consideration

(b) Other than in (a) above 10 Madhya Pradesh and Chattisgarh

6% 7.5% Note : Additional duty of 4% on value of property on instruments of sales is payable immovable property within limits of corporation.

of consideration Of market value

11

Manipur

7%

On market value of property or consideration whiche

12

Maharashtra within Municipal Corporation of Greater Bombay, Pune, Thane, Navi Mumbai (a) for transfer other than in (b) (b) if relating to residential premises consisting of building or unit by or in favour of society registered or deemed to have registered under Maharashtra Co-operative Societies Act, 1960, or to which the Maharashtra Ownership Flat Act, 1963, or provisions of the Maharashtra Apartment Ownership Act, 1970, apply or by such society in favour of its member or by a member of such society to another member. Meghalaya

10 %

On market value.

i. upto Rs.1.00 Lakh Nil. ii. Rs.1.00 Lakh to Rs.2.5 Lakhs 0.5 % of Value. iii. Rs.2.5 Lakhs to Rs.5.00 Lakhs Rs.1,250/- + 3% of value above Rs.2.5 Lakhs. iv. Rs.5.00 Lakhs to Rs.15.00 Lakhs Rs.8,750/- + 6% of value above Rs.5.00 Lakhs. v. Value exceeding Rs.15.00 Lakhs Rs.68,750/- plus 8% of value above Rs.15.00 Lakhs. (i) upto Rs.50,000/- - 4.6 % Of the consideration

13

(ii) more than Rs.50,000/- and upto Rs.90,000/6% of the consideration (iii) more than Rs.90,000/- and upto Rs.1,50,000/Of the consideration - 8% (iv) more than Rs.1,50,000/- 9.9% 14 Manipur 7%

of the consideration

perty or consideration whichever is greater.

value whichever is greater 15 16 Nagaland. Orissa 7.5 % 4.2 % + of the amount of the consideration

of consideration in instrument or market value which

Note : (i) additional stamp duty of 10.5 % for property in urban areas (ii) additional stamp duty of 6.5% for property in rural areas 18 19 20 Punjab. Rajasthan. Tamil Nadu (a) Property within cities of Madras and Madurai & Municipal towns of Coimbtore Salem and Tiruchhirapalli 6% 11% 8%

of consideration in instrument

of consideration in instrument of consideration of market value of property of market value.

(b) if any other property

21 22 Tripura Uttar Pradesh

7% 5% 8% additional 2% stamp duty in areas to which U.P.Awas Evam Vikas Parishad Abhiyan is extended (Allahabad, Agra, Kanpur , Lucknow)

of market value

of consideration.

of consideration or market value whichever is greater

23

West Bengal

5% plus surcharge @1/5 of the stamp duty of plus the + market 2% additional value. duty under Calcutta Improvem

24

Union Territory of Delhi.

3% stamp duty plus additional 5% duty in form of surcharge under Delhi Municipal Corporate Act, 1957.

of consideration

rument or market value whichever is greater

ket value whichever is greater.

Vous aimerez peut-être aussi

- Sr. Market ResearchDocument2 pagesSr. Market ResearchVivek Thota100% (1)

- Chennai IT Companies HR EmailsDocument23 pagesChennai IT Companies HR EmailsPrasanth Kumar60% (10)

- Title Agency NameDocument6 pagesTitle Agency NameVivek ThotaPas encore d'évaluation

- Corporate AgentsDocument1 023 pagesCorporate AgentsVivek Thota0% (1)

- 58 - 15 - List - of - Ca - Firms - 843Document306 pages58 - 15 - List - of - Ca - Firms - 843vijayxkumarPas encore d'évaluation

- List of Software Companies in India PDFDocument44 pagesList of Software Companies in India PDFsanthoshinou50% (2)

- DelhiDocument22 pagesDelhiVivek Thota100% (1)

- Real Estate - August 2013Document37 pagesReal Estate - August 2013IBEFIndiaPas encore d'évaluation

- Companies in Delhi NCR With ContactsDocument77 pagesCompanies in Delhi NCR With ContactsVivek Thota77% (13)

- Dominos ReportDocument20 pagesDominos Reportkuntaljariwala100% (1)

- Companies Email IdsDocument23 pagesCompanies Email IdsVivek Thota100% (1)

- BaristaDocument40 pagesBaristaVivek Thota100% (1)

- Chap 03Document25 pagesChap 03Vivek ThotaPas encore d'évaluation

- Chapter - 1 Crime Survey: Rule of LawDocument19 pagesChapter - 1 Crime Survey: Rule of LawVivek ThotaPas encore d'évaluation

- Letter of AllotmentDocument6 pagesLetter of AllotmentVivek Thota50% (2)

- Agreement To Sell and PurchaseDocument2 pagesAgreement To Sell and PurchaseMuhammad DarwishPas encore d'évaluation

- Crime in Delhi-Final (PRESS) 17!01!13Document26 pagesCrime in Delhi-Final (PRESS) 17!01!13Vivek ThotaPas encore d'évaluation

- Rockwell Automation OverviewDocument13 pagesRockwell Automation OverviewVivek ThotaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 1, Aset TetapDocument45 pages1, Aset TetapM Syukrihady IrsyadPas encore d'évaluation

- Travel Service Invoice TemplateDocument2 pagesTravel Service Invoice TemplateIrshad AhmedPas encore d'évaluation

- Dagupan's "BangusDocument4 pagesDagupan's "BangusRomel BucaloyPas encore d'évaluation

- Asiana Airlines Reports Improved 4Q PerformanceDocument16 pagesAsiana Airlines Reports Improved 4Q PerformanceShiamak FrancoPas encore d'évaluation

- G - TESTS W/CODES - 3.0L 1996 ENGINE PERFORMANCE Chrysler Corp. - Self-DiagnosticsDocument4 pagesG - TESTS W/CODES - 3.0L 1996 ENGINE PERFORMANCE Chrysler Corp. - Self-DiagnosticsFer Olguin0% (1)

- 01 Ufshsi 4 Pczuf 2 FKWKTC 7 PDG 1 PyDocument9 pages01 Ufshsi 4 Pczuf 2 FKWKTC 7 PDG 1 PyPuti Benny LakraPas encore d'évaluation

- Economics Course OutlineDocument15 pagesEconomics Course OutlineDavidHuPas encore d'évaluation

- Human Development IndexDocument3 pagesHuman Development Indexapi-280903795Pas encore d'évaluation

- Complete Sewing Instructions 1917Document100 pagesComplete Sewing Instructions 1917shedzaPas encore d'évaluation

- Profile PropelisDocument6 pagesProfile PropelismaverickmuglikarPas encore d'évaluation

- Understand Residence Status for Individuals in MalaysiaDocument40 pagesUnderstand Residence Status for Individuals in MalaysiaIfa Chan100% (1)

- MCQ - III Sem BCom - Corporate AccountingDocument7 pagesMCQ - III Sem BCom - Corporate AccountingWani SuhailPas encore d'évaluation

- Chapter 2 Solutions To Assignment ProblemsDocument2 pagesChapter 2 Solutions To Assignment ProblemsBhadra MenonPas encore d'évaluation

- Why Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementDocument2 pagesWhy Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementAkif AlamPas encore d'évaluation

- Chapter 10aDocument81 pagesChapter 10aAlec Trevelyan100% (3)

- P.7 - Cost AccumulationDocument8 pagesP.7 - Cost AccumulationSaeed RahamanPas encore d'évaluation

- 3 ProcessDynamicsDocument11 pages3 ProcessDynamicsDare DevilPas encore d'évaluation

- Elf Shoes PDFDocument4 pagesElf Shoes PDFIreneIrene100% (1)

- AFV Methods for Settling DebtsDocument5 pagesAFV Methods for Settling DebtsJulian Williams©™60% (5)

- Salomón Juan Marcos and Grupo DenimDocument1 pageSalomón Juan Marcos and Grupo DenimSalomon Juan Marcos VillarrealPas encore d'évaluation

- Process Costing - Loss UnitsDocument10 pagesProcess Costing - Loss UnitsAkira Marantal ValdezPas encore d'évaluation

- Air Transport Beyond The Crisis - Pascal Huet - WTFL 2009Document18 pagesAir Transport Beyond The Crisis - Pascal Huet - WTFL 2009World Tourism Forum LucernePas encore d'évaluation

- Mohamed Nazeer CVDocument4 pagesMohamed Nazeer CVMohamed nazeerPas encore d'évaluation

- Recipe and CookingDocument45 pagesRecipe and Cookingtsanzo100% (2)

- Horizontal and Vertical AnalysisDocument3 pagesHorizontal and Vertical AnalysisNashwa SaadPas encore d'évaluation

- Ratio Analysis of Crown CementDocument26 pagesRatio Analysis of Crown CementMohammed Akhtab Ul Huda100% (1)

- Petroleum Economic and ManagementDocument74 pagesPetroleum Economic and ManagementWahid MiaPas encore d'évaluation

- Toeic Vocabulary 1Document2 pagesToeic Vocabulary 1giangmilk0812Pas encore d'évaluation

- Income Tax (Salary or Wages Tax) (Rates) Act 1979 PDFDocument35 pagesIncome Tax (Salary or Wages Tax) (Rates) Act 1979 PDFKSeegurPas encore d'évaluation

- Audit ReportDocument20 pagesAudit Reportrajath_kalyaniPas encore d'évaluation