Académique Documents

Professionnel Documents

Culture Documents

Congressional Testimony

Transféré par

shashankkapur220 évaluation0% ont trouvé ce document utile (0 vote)

11 vues3 pagesU.s. Gasoline Prices driven by tight link to cost of crude oil feedstock, says dr. James Smith. He says crude oil prices determined in a global market that isn't dominated by us players. OPEC deliberately attempts to manipulate price of crude oil for their benefit, he says.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentU.s. Gasoline Prices driven by tight link to cost of crude oil feedstock, says dr. James Smith. He says crude oil prices determined in a global market that isn't dominated by us players. OPEC deliberately attempts to manipulate price of crude oil for their benefit, he says.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues3 pagesCongressional Testimony

Transféré par

shashankkapur22U.s. Gasoline Prices driven by tight link to cost of crude oil feedstock, says dr. James Smith. He says crude oil prices determined in a global market that isn't dominated by us players. OPEC deliberately attempts to manipulate price of crude oil for their benefit, he says.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

U.S.

Gasoline Prices in the Context of the World Oil Market

Opening Statement of James L. Smith, Ph.D.

Before the Joint Economic Committee

May 23, 2007

1. Many factors contribute to the high level of gasoline prices

we currently see, and to the continuing volatility in prices that

keeps us wondering what to expect next.

a. The number one factor is the tight link that connects

gasoline prices to the cost of the crude oil feedstock from

which gasoline is refined. Over the past 15 years, 95% of

the month-to-month gasoline price fluctuations we have

observed are directly accounted for by changes in the cost of

crude oil feedstock. Some previous studies had pegged this

dependence at 85%, but my research indicates that it has

increased in recent years.

b. Dependence on the cost of crude oil feedstock is not

the only factor responsible for changes in the price of

gasoline, but its impact is so predominant that it usually

overwhelms all other factors.

c. We can not easily attain any desirable outcomes for

U.S. motorists without keeping this dependence on crude oil

prices in clear focus.

2. Crude oil prices are not determined within the U.S.

marketplace—rather crude prices are determined in a global

market that is not dominated by U.S. players.

a. The models and assumptions of the world oil market

that we might have relied on 40 years ago (indeed, the

market that we all grew up with) are no longer relevant. The

structure of the world oil market has changed in fundamental

ways.

b. The biggest change, one that we are all still learning to

grapple with, is the replacement of multinational oil

companies (the so-called “seven sisters”) by National Oil

Companies—which are quasi political/economic

organizations that control access to the resource base and

determine the supply of oil in most major oil producing

nations of the world.

c. The “seven sisters” (or what remains of them: BP,

Exxon, Shell, Total, Conoco, Chevron, and ENI) provide only

about 1/6th of our crude oil. NOCs provide more than half of

the total supply.

3. The crude oil market is not competitive, and this is no secret.

The members of OPEC (now 12 in number) deliberately attempt

to manipulate the price of crude oil for their benefit—and

sometimes they succeed. The NOCs are the instruments by

which control is exercised.

a. OPEC members do not share with or cede control of

the price mechanism to the multinational oil companies. The

multinationals themselves do not have enough crude oil

reserves or production to influence the price.

b. If you wish to deal with gasoline prices in a manner that

addresses the long-run interests of American motorists, then

you need to deal with OPEC. OPEC is the problem.

4. What are the options for dealing with OPEC? Precious few.

a. Legal challenges have been discussed; you can try to

win in court. Personally, I believe this is a tough road. The

OPEC members are sovereign nations, with economies that

are highly specialized and dependent on oil. They have

even more at stake than we do.

b. Encourage the development and growth of alternative

supplies (of oil and other forms of energy). This would

directly diminish OPEC’s ability to control prices and instill

greater competition.

c. Discourage oil consumption. The impact on OPEC of

reduced consumption is less direct and probably less potent

than developing alternative supplies because OPEC

reserves are the low-cost reserves. When demand slacks

and prices fall, it is the high-cost production flows that are

backed out of the market—that’s not OPEC. We could

actually see our dependence on OPEC rise as consumption

falls—if other changes are not made to stimulate alternative

supplies of oil and energy.

5. Summary

Gasoline prices are driven by crude oil prices. The volatility

we see at the gasoline pump is a mere reflection of the

underlying volatility that characterizes the world crude oil

market. Any new policy initiative, to be effective, must be

framed in the context of the world oil market and judged by

its ability to tame the factors that are driving that market.

Vous aimerez peut-être aussi

- Controls On PricesDocument18 pagesControls On PricesSam SaPas encore d'évaluation

- Price Dynamics of Crude OilDocument3 pagesPrice Dynamics of Crude OilnitroglyssPas encore d'évaluation

- Cause and Effect - US Gasoline Prices 2013Document7 pagesCause and Effect - US Gasoline Prices 2013The American Security ProjectPas encore d'évaluation

- Investigating The Asymmetric Impact of Oil Prices On GCC Stock MarketsDocument41 pagesInvestigating The Asymmetric Impact of Oil Prices On GCC Stock MarketsNacPas encore d'évaluation

- Index File FYI: Download The Original AttachmentDocument57 pagesIndex File FYI: Download The Original AttachmentAffNeg.Com100% (1)

- Academic Research Essay On Oil Prices: Prakhar GuptaDocument13 pagesAcademic Research Essay On Oil Prices: Prakhar GuptaPrakhar GuptaPas encore d'évaluation

- Factors Affecting Crude Oil Prices PDFDocument2 pagesFactors Affecting Crude Oil Prices PDFDeshawnPas encore d'évaluation

- Assignment Eco4 HSNDocument2 pagesAssignment Eco4 HSNnoPas encore d'évaluation

- Supply and Demand of Tanker MarketDocument21 pagesSupply and Demand of Tanker MarketHamad Bakar Hamad100% (1)

- BP Peak Oil Demand and Long Run Oil PricesDocument20 pagesBP Peak Oil Demand and Long Run Oil PricesKokil JainPas encore d'évaluation

- OPEC's Role in Oil Market DynamicsDocument71 pagesOPEC's Role in Oil Market Dynamicsraj bhutiyaPas encore d'évaluation

- Determining Fuel Prices: The Cost of CrudeDocument2 pagesDetermining Fuel Prices: The Cost of CrudeSharania Udhaya KumarPas encore d'évaluation

- BI PolicyReport 35Document6 pagesBI PolicyReport 35kirpaPas encore d'évaluation

- Financing The World Petroleum Industry A Talk by John D. Emerson Chase Bank, New YorkDocument24 pagesFinancing The World Petroleum Industry A Talk by John D. Emerson Chase Bank, New YorkIbrahim SalahudinPas encore d'évaluation

- EN Oil Supply and DemandDocument9 pagesEN Oil Supply and Demandtanyan.huangPas encore d'évaluation

- Research Paper Oil PricesDocument5 pagesResearch Paper Oil Pricesfvfr9cg8100% (1)

- Crude Oil Prices and FactorsDocument15 pagesCrude Oil Prices and FactorsGirish1412Pas encore d'évaluation

- An Introduction to Petroleum Technology, Economics, and PoliticsD'EverandAn Introduction to Petroleum Technology, Economics, and PoliticsPas encore d'évaluation

- SPE-191766-MS Assessment of Petroleum Sensitive Countries Economic Reforms in Reaction To Fluctuating Oil PricesDocument13 pagesSPE-191766-MS Assessment of Petroleum Sensitive Countries Economic Reforms in Reaction To Fluctuating Oil PricesGabriel SPas encore d'évaluation

- Economic Theories AnalysisDocument6 pagesEconomic Theories AnalysisKennethPas encore d'évaluation

- World Oil Demand and The Effect On Oil Prices 3Document16 pagesWorld Oil Demand and The Effect On Oil Prices 3Bhanu MehraPas encore d'évaluation

- Effects of Higher Oil PricesDocument7 pagesEffects of Higher Oil PricesLulav BarwaryPas encore d'évaluation

- Impact of Oil Prices On The Stock MarketDocument18 pagesImpact of Oil Prices On The Stock MarketDhruv AghiPas encore d'évaluation

- The Vega Factor: Oil Volatility and the Next Global CrisisD'EverandThe Vega Factor: Oil Volatility and the Next Global CrisisPas encore d'évaluation

- Literature Review On Oil PricesDocument6 pagesLiterature Review On Oil Pricesjicjtjxgf100% (1)

- Macro Factors Key Oil & Gas PricesDocument9 pagesMacro Factors Key Oil & Gas Prices10manbearpig01Pas encore d'évaluation

- Lai, Stanley 285109 - Id Thesis 4988Document41 pagesLai, Stanley 285109 - Id Thesis 4988Padma Narayan SmithPas encore d'évaluation

- The Role of Inventories and Speculative Trading in The Global Market For Crude OilDocument43 pagesThe Role of Inventories and Speculative Trading in The Global Market For Crude OilJeswin TomPas encore d'évaluation

- Understanding Shocks of Oil Prices: IJASCSE Vol 1 Issue 1 2012Document7 pagesUnderstanding Shocks of Oil Prices: IJASCSE Vol 1 Issue 1 2012IJASCSEPas encore d'évaluation

- Oil Prices Term PaperDocument5 pagesOil Prices Term Papereeyjzkwgf100% (1)

- Caselet EconomicsDocument3 pagesCaselet Economics010163Pas encore d'évaluation

- Physical Determinants of Crude Oil Prices and the Market PremiumDocument23 pagesPhysical Determinants of Crude Oil Prices and the Market PremiumGabrielaMSPas encore d'évaluation

- Oil and Gas Price FluctuationsDocument1 pageOil and Gas Price FluctuationsdattuPas encore d'évaluation

- Order 137543098Document9 pagesOrder 137543098PETER KAMOTHOPas encore d'évaluation

- Oil Price Research PaperDocument7 pagesOil Price Research Paperlrqylwznd100% (1)

- Ramady M Mahdi W Opec in A Shale Oil World Where To Next PDFDocument293 pagesRamady M Mahdi W Opec in A Shale Oil World Where To Next PDFBalanuța IanaPas encore d'évaluation

- CRS Report For Congress: World Oil Demand and Its Effect On Oil PricesDocument23 pagesCRS Report For Congress: World Oil Demand and Its Effect On Oil PricesAli Ahmed AliPas encore d'évaluation

- Crude OilDocument13 pagesCrude OilRajesh Kumar RoutPas encore d'évaluation

- Covid19 Submission VishalDocument14 pagesCovid19 Submission VishalabhijitPas encore d'évaluation

- Oil Price DissertationDocument7 pagesOil Price DissertationDoMyPaperForMeUK100% (1)

- Thesis About Oil Price HikeDocument8 pagesThesis About Oil Price Hikepamelacalusonewark100% (1)

- The SEDS World Oil Market ModelDocument18 pagesThe SEDS World Oil Market Modelmlkz_01Pas encore d'évaluation

- Oil Crisis - 2023Document4 pagesOil Crisis - 2023imymeweourusyouPas encore d'évaluation

- Study Guide 1 BMDocument5 pagesStudy Guide 1 BMera.malokuPas encore d'évaluation

- Crude Oil Price Trends in Global MarketDocument28 pagesCrude Oil Price Trends in Global MarketRITESH MADRECHA100% (1)

- History and MembershipDocument6 pagesHistory and Membershipt a khanPas encore d'évaluation

- Iv. Oil Price Developments: Drivers, Economic Consequences and Policy ResponsesDocument29 pagesIv. Oil Price Developments: Drivers, Economic Consequences and Policy Responsesdonghao66Pas encore d'évaluation

- Crude Oil Price Outlook Generic Nov05 ENGDocument10 pagesCrude Oil Price Outlook Generic Nov05 ENGgeorgiadisgPas encore d'évaluation

- Does Big Oil Collude and Price GougeDocument3 pagesDoes Big Oil Collude and Price GougeProtect Florida's BeachesPas encore d'évaluation

- WOO Boxes World Economy Oil PricesDocument3 pagesWOO Boxes World Economy Oil PricesمسعودPas encore d'évaluation

- Oil DiplomacyDocument2 pagesOil DiplomacyDigital NInjaPas encore d'évaluation

- Oil Price ThesisDocument4 pagesOil Price Thesisafloblnpeewxby100% (2)

- An Introduction To Petroleum Technology, Economics... - (PG 62 - 62)Document1 pageAn Introduction To Petroleum Technology, Economics... - (PG 62 - 62)BryanPas encore d'évaluation

- Decoding Oil Price Fall: Shale Firms to Feel Pinch in 2015Document1 pageDecoding Oil Price Fall: Shale Firms to Feel Pinch in 2015Mohit GautamPas encore d'évaluation

- Case SummaryDocument6 pagesCase SummaryMohamed IbrahimPas encore d'évaluation

- Financial Performance of The Major Oil Companies, 2007-2011: Robert PirogDocument12 pagesFinancial Performance of The Major Oil Companies, 2007-2011: Robert PirogFederovici Adrian GabrielPas encore d'évaluation

- Oil, Economic Growth and Strategic Petroleum StocksDocument21 pagesOil, Economic Growth and Strategic Petroleum StocksHasbi AsidikPas encore d'évaluation

- OPEC's Future Role in a Diversified Energy MixDocument18 pagesOPEC's Future Role in a Diversified Energy MixJulie Elizabeth Herring-SheilPas encore d'évaluation

- Oil Price Hike Research PaperDocument7 pagesOil Price Hike Research Paperzwyzywzjf100% (1)

- How America Can Stop Importing Foreign Oil & Those Preventing It From HappeningD'EverandHow America Can Stop Importing Foreign Oil & Those Preventing It From HappeningPas encore d'évaluation

- Financial Management: Class of 2011 ICFAI Business School Ipos (Session 26)Document19 pagesFinancial Management: Class of 2011 ICFAI Business School Ipos (Session 26)shashankkapur22Pas encore d'évaluation

- Multi RegressionDocument17 pagesMulti Regressionshashankkapur22Pas encore d'évaluation

- Lec On 28 Aug Distribution & Channel Decisions - 2Document9 pagesLec On 28 Aug Distribution & Channel Decisions - 2shashankkapur22Pas encore d'évaluation

- Lec On 21st Aug-Marketing of ServicesDocument11 pagesLec On 21st Aug-Marketing of Servicesshashankkapur22Pas encore d'évaluation

- Mark Hurd's MomentDocument9 pagesMark Hurd's Momentshashankkapur22100% (1)

- Product Life CycleDocument10 pagesProduct Life Cycleaditya_manishi@hotmail.comPas encore d'évaluation

- Employee MotivationDocument2 pagesEmployee Motivationshashankkapur22Pas encore d'évaluation

- Personality TestDocument9 pagesPersonality Testshashankkapur22100% (2)

- Into To OBDocument4 pagesInto To OBshashankkapur22Pas encore d'évaluation

- Lec On 27aug Distribution & Channel Decisions - 1Document6 pagesLec On 27aug Distribution & Channel Decisions - 1shashankkapur22Pas encore d'évaluation

- Build Customer Satisfaction Through Value DeliveryDocument9 pagesBuild Customer Satisfaction Through Value DeliveryPankit KediaPas encore d'évaluation

- Lec On 27aug Distribution & Channel Decisions - 1Document6 pagesLec On 27aug Distribution & Channel Decisions - 1shashankkapur22Pas encore d'évaluation

- Lec On 14aug - PLCDocument7 pagesLec On 14aug - PLCshashankkapur22Pas encore d'évaluation

- Lec On 16th July-PositioningDocument11 pagesLec On 16th July-Positioningshashankkapur22Pas encore d'évaluation

- Introduction To Marketing: - Marketing Is The Process of Planning andDocument16 pagesIntroduction To Marketing: - Marketing Is The Process of Planning andshashankkapur22Pas encore d'évaluation

- Lec On 7 Aug - New Product DevelopmentDocument10 pagesLec On 7 Aug - New Product Developmentshashankkapur22Pas encore d'évaluation

- Lec5-12thJune Mktg1 EnvironDocument7 pagesLec5-12thJune Mktg1 Environshashankkapur22Pas encore d'évaluation

- Chapter 8 Segmentation & TargetingDocument16 pagesChapter 8 Segmentation & Targetingsupriya1228Pas encore d'évaluation

- 19thJune-The Buyer Decision ProcessDocument10 pages19thJune-The Buyer Decision Processshashankkapur22Pas encore d'évaluation

- Consumer Markets and Buyer BehaviorDocument19 pagesConsumer Markets and Buyer Behaviorshashankkapur22Pas encore d'évaluation

- Economics Petroleum Industry SynopsisDocument3 pagesEconomics Petroleum Industry Synopsisshashankkapur22Pas encore d'évaluation

- Market Structure DiagramsDocument12 pagesMarket Structure Diagramsshashankkapur22Pas encore d'évaluation

- Accounting Standards As5newDocument9 pagesAccounting Standards As5newapi-3705877Pas encore d'évaluation

- Market Structure Diagrams MoreDocument29 pagesMarket Structure Diagrams Moreshashankkapur22Pas encore d'évaluation

- Accounting Standard 9Document13 pagesAccounting Standard 9MANJEET PANGHALPas encore d'évaluation

- As 26Document47 pagesAs 26Sujit ChakrabortyPas encore d'évaluation

- The Forecasting of The World Oil Price by Summing Up Linear Trend and Periodic FunctionsDocument18 pagesThe Forecasting of The World Oil Price by Summing Up Linear Trend and Periodic Functionsshashankkapur22Pas encore d'évaluation

- As 2 - Valuation of InventoriesDocument9 pagesAs 2 - Valuation of InventoriesRohit KumbharPas encore d'évaluation

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178Pas encore d'évaluation

- MBA Strategic Management Midterm ExamDocument5 pagesMBA Strategic Management Midterm Exammaksoud_ahmed100% (1)

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerPas encore d'évaluation

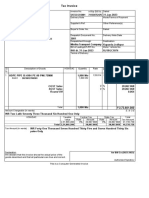

- Tax InvoiceDocument1 pageTax Invoicepiyush1809Pas encore d'évaluation

- STIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinDocument276 pagesSTIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinsanitermPas encore d'évaluation

- Encyclopedia of American BusinessDocument863 pagesEncyclopedia of American Businessshark_freire5046Pas encore d'évaluation

- Study of Supply Chain at Big BasketDocument10 pagesStudy of Supply Chain at Big BasketPratul Batra100% (1)

- E734415 40051 2nd Announcement International Seminar Bridge Inspection and Rehabilitation Techniques Tunis February 2023Document9 pagesE734415 40051 2nd Announcement International Seminar Bridge Inspection and Rehabilitation Techniques Tunis February 2023jihad1568Pas encore d'évaluation

- BIM Report 2019Document31 pagesBIM Report 2019ziddar100% (1)

- Questionnaire Fast FoodDocument6 pagesQuestionnaire Fast FoodAsh AsvinPas encore d'évaluation

- Book No. 13 Accountancy Financial Sybcom FinalDocument380 pagesBook No. 13 Accountancy Financial Sybcom FinalPratik DevarkarPas encore d'évaluation

- Death by PowerpointDocument12 pagesDeath by Powerpointapi-251968900Pas encore d'évaluation

- Industrial Visit ReportDocument6 pagesIndustrial Visit ReportgaureshraoPas encore d'évaluation

- Cobrapost II - Expose On Banks Full TextDocument13 pagesCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Myths and Realities of Eminent Domain AbuseDocument14 pagesMyths and Realities of Eminent Domain AbuseInstitute for JusticePas encore d'évaluation

- Voltas Case StudyDocument8 pagesVoltas Case StudyAlok Mittal100% (1)

- Globalization's Importance for EconomyDocument3 pagesGlobalization's Importance for EconomyOLIVER JACS SAENZ SERPAPas encore d'évaluation

- NSE ProjectDocument24 pagesNSE ProjectRonnie KapoorPas encore d'évaluation

- SWOT Analysis for Reet in QatarDocument3 pagesSWOT Analysis for Reet in QatarMahrosh BhattiPas encore d'évaluation

- Assumptions in EconomicsDocument9 pagesAssumptions in EconomicsAnthony JacobePas encore d'évaluation

- YMCA 2010 Annual Report - RevisedDocument8 pagesYMCA 2010 Annual Report - Revisedkoga1Pas encore d'évaluation

- 01 Fairness Cream ResearchDocument13 pages01 Fairness Cream ResearchgirijPas encore d'évaluation

- 2018 Farmers Market Vendor ApplicationDocument2 pages2018 Farmers Market Vendor Applicationapi-290651951Pas encore d'évaluation

- AGI3553 Plant ProtectionDocument241 pagesAGI3553 Plant ProtectionDK White LionPas encore d'évaluation

- Economics ProjectDocument15 pagesEconomics ProjectAniket taywadePas encore d'évaluation

- VhduwsDocument3 pagesVhduwsVia Samantha de AustriaPas encore d'évaluation

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningPrabhupreet SinghPas encore d'évaluation

- Environment PollutionDocument6 pagesEnvironment PollutionNikko Andrey GambalanPas encore d'évaluation

- Dokumen - Tips Unclaimed DividendsDocument107 pagesDokumen - Tips Unclaimed DividendsVM OPas encore d'évaluation

- Sources of FinanceDocument3 pagesSources of FinanceAero Vhing BucaoPas encore d'évaluation

- Hong Leong Bank auction of 5 Kuala Lumpur propertiesDocument1 pageHong Leong Bank auction of 5 Kuala Lumpur propertieschek86351Pas encore d'évaluation