Académique Documents

Professionnel Documents

Culture Documents

Design Accounting Systems

Transféré par

SweetCherrieDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Design Accounting Systems

Transféré par

SweetCherrieDroits d'auteur :

Formats disponibles

BUSINESS SCHOOL

Unit of Study Outline

Unit Code ACCT6014 Unit Title Designing Accounting Systems Semester 1, 2013

Pre-requisite Units: ACCT5001 Co-requisite Units: Prohibited Units: Assumed Knowledge and/or Skills: Basic knowledge of accounting principles, business transactions, business processes, information flows, financial statements and reports in typical business organizations and basic Information Technology skills

Unit Coordinator: Ravi Seethamraju Address: Room 342, The Business School Building(H69), The University of Sydney NSW 2006 Email: ravi.seethamraju@sydney.edu.au Phone: 93513267 Consultation Hours: Please go to Blackboard for details of all staff consultation times. Class Day(s): Please go to Blackboard for class times and locations

Required Text / Resources: None

This Guide to Unit Learning Content and Assessment MUST be read in conjunction with the Business School Student Administration Manual for information about all processes (sydney.edu.au/business/currentstudents/student_information/student_administration_manual) and the Business School unit of study common policy and implementation information that apply to every unit of study offered by the Business School (http://sydney.edu.au/business/currentstudents/policy). In determining applications and appeals relating to these matters it will be assumed that every student has taken the time to familiarise themselves with these key policies and procedures.

Version: 2013 Business School

BUSINESS SCHOOL

1. Unit of study information This unit introduces students to the concepts, challenges and approaches associated with the evaluation, design, introduction, operation and improvement of accounting systems and reflect the differences in the needs of family-owned business, small and medium sized enterprise and multi-national business firms. Elements of those systems include methods of documenting transactions and events; internal control procedures designed to safeguard human physical and financial resources; manual, semi-automated or fully automated source data entry, transaction processing methods and financial and non-financial reports on operational activities. These issues are also considered with regard to the capabilities of contemporary industry-standard accounting and business application software such as spreadsheets, MYOB and SAP in a cost-effective and secure manner. Topics include the design of charts of accounts; in solutions context; internal controls and maintaining audit trails, records management; the identification of requirements and the use of selection criteria for the evaluation, introduction, configuration and operation of packaged accounting software solutions. It provides students with the hands-on skills in the design and implementation of an accounting system to a real-world medium sized organisation using an industry standard accounting software solution by integrating concepts, approaches, commercial realities and capabilities of contemporary enterprise resource planning systems. At the commencement, students are provided with review of business frameworks including cycles, systems, source documents and recording transactions which act as a common starting point on which the unit builds.

2. Program learning outcomes 1. Accounting Knowledge: Our Masters programs develop each graduate to be a knowledgeable business practitioner leading to students who are able to demonstrate an advanced integrated understanding of accounting principles, techniques, standards, regulatory requirements and current global developments in accounting and reporting. (Assured in ACCT6010) 2. Critical Thinking: Our Masters programs develop each graduate to be an autonomous and constructive critical thinker leading to students who are able to interrogate, evaluate and respond creatively to assumptions, propositions and debates within the field of accounting. (Assured in ACCT6010) 3. Business Analysis and Problem-Solving: Our Masters programs develop each graduate to be a capable business analyst and strategic problem-solver leading to students who are able to identify and diagnose complex and unfamiliar challenges and opportunities in accounting and reporting, in diverse contexts and formulate strategically-appropriate solutions. (Assured in ACCT6010) 4. Communication: Our Masters programs develop each graduate to be a persuasive communicator and negotiator leading to students who are able to reach agreement with others about appropriate responses to problems and opportunities within accounting and reporting, using a range of communication strategies. (Assured in ACCT6010) 5. Team Working: Our Masters programs develop each graduate to be a capable team leader in work-related contexts leading to students who are able to influence others to work collaboratively to address complex business challenges and opportunities in accounting and reporting in diverse contexts. (Assured in ACCT6010) 6. Ethical and Social Responsibility: Our Masters programs develop each graduate to be an ethically- and socially-responsible professional leading to students who are able to demonstrate social, ethical, personal and professional considerations in the field of accounting and reporting.

Version: 2013 Business School

BUSINESS SCHOOL

(Assured in ACCT6010)

3. Unit learning aims In relation to the first programme learning goal - Accounting Knowledge - this unit aims to cover 1. Concepts, principles and techniques associated with the design and improvement of accounting systems 2. Application of selection criteria relevant to the evaluation, introduction and re-design of a packaged accounting system focusing on changes to business operations, controls and realisation of expected benefits In relation to the third programme learning goal - Business Analysis and Problem-solving, this unit aims to impart 1. Ability to evaluate and design a packaged accounting software solution for a medium sized business organization by modelling and executing relevant business processes, transactions, controls and reports. 2. Ability to integrate understanding of concepts, processes, practices, internal controls, and specialist software skills and construct a recommendation for the design of a suitable accounting system to real world organizations.

Version: 2013 Business School

BUSINESS SCHOOL

4. Assessment

Assessment Name Program Learning Work Type Outcomes Assessed Individual 1, 2, 3, 4 1, 3 1, 2, 3, 6 1, 2, 3, 6 Length Weight Due Date 2000 N/A N/A 2000 30% 10% 20% 40% 26-Apr-2013 Weekly 07-Jun-2013 Closing Date 26-Apr-2013 Weekly 07-Jun-2013

Manual system design study Lab/workshop Exercises weeks 8 to Individual 12 Online Quiz & Design skills test Individual (in-class) Final examination Individual Academic Honesty

Final Exam Period Final Exam Period Week 4

Assessment Manual system design study is Compulsory. This means you must undertake the assessment. If you do not undertake the assessment you will receive zero for this assessment. Assessment Lab/workshop Exercises weeks 8 to 12 is Compulsory. This means you must undertake the assessment. If you do not undertake the assessment you will receive zero for this assessment. Assessment Online Quiz & Design skills test (in-class) is Compulsory. This means you must undertake the assessment. If you do not undertake the assessment you will receive zero for this assessment. Assessment Final examination is Mandatory. This means you must undertake the assessment and achieve a mark above 40%. Students who fail to achieve this minimum standard in this assessment, even when their aggregate mark for the entire unit is above 50%, will be given an AF grade for this unit. As a result a student's academic transcript will show AF and the actual mark achieved if between 0-49 and AF and a capped mark of 49 for all other marks. ** Students must complete the Academic Honesty module in Blackboard with a mark above 80% by the final day of exam, or an Absent Fail (AF) grade will be given for the entire unit. Students can complete the module multiple times until this grade is achieved. Students who completed the module with a score of 80% or above in any previous semesters do not need to do it again. *** The due date for an assessment is the last day on which you can submit the assessment without penalty. If you submit the assessment after that date, you will receive a late penalty, unless excused by special consideration, special arrangement or disability services adjustment. The closing date is the last day on which an assessment will be accepted for marking. Conditions of Assessment The Business School has standard conditions governing assessments such as late penalties, word length and so on. Please go to the Business School policy and implementation information at http://sydney.edu.au/business/currentstudents/policy

Referencing Style Students should adhere to the Business School Referencing Guide at http://sydney.edu.au/business/reference_guide

Version: 2013 Business School

BUSINESS SCHOOL

Assessment details Manual system design study

G

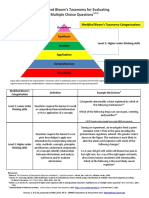

Task Description There is one practice test and one real test which counts for marks. All the manual design study assessments are conducted in class with feedback being provided. Students may use their lecture notes and other materials covered from weeks1 to 7. However, there will not be time to read through the notes and answer the questions if the material is not already familiar to you. The aim of these in-class assessment tests is to test theoretical understanding and critical thinking and ability to apply concepts and principles to case studies and real-world business scenarios. It may comprise of multiple choice questions, short answer questions and/or case study scenarios. This assessment will cover topics covered in weeks 1 to 7 as shown in the schedule.

Assessment Criteria 1. Use of literature/ Knowledge of theory 2. Data/information gathering/processing 3. Analysis 4. Problem solving 5. Synthesis

Lab/workshop Exercises weeks 8 to 12

G

Task Description These computer workshop tutorials from week 8 to week 12, will introduce students to commercial industry standard Accounting software solutions and give them basic software technology skills in designing an automated accounting system including the redesign, execution and simple configuration for a medium sized business organisation. It requires students to modify chart of accounts, create general ledger accounts and other master data, configure a simple accounting system, test the system by executing accounting transactions and cycles, produce reports and interact with financial and non-financial information online. This will allow students to practice organising, analysing and presenting accounting information in an electronic format. A document detailing the lab/workshop exercises and step-by-step instructions are posted in the blackboard (under SAP materials section). Assessment Criteria 1. Use of literature/ Knowledge of theory 2. Methodology used is the most appropriate to the aims and objectives of the task 3. Data/information gathering/processing 4. Analysis 5. Problem solving 6. Synthesis 7. Time management/self management 8. Performance Skills

Version: 2013 Business School

BUSINESS SCHOOL

Online Quiz & Design skills test (in-class)

G

Task Description This assessment task will test students' understanding of the concepts and techniques in the evalation, design and adoption of an automated (packaged) accounting system and their ability to analyse the risks, controls and reporting capabilities of the system, discussed from weeks 7 to 12 (topics shown in the schedule). In addition, this will test students' skills in the design and exeuction of accounting system parameters, configuration elements, transaction cycles and reports using a packaged accounting software solution for a given business scenario. This assessment task will be carried out online in class under controlled conditions and a consolidated feedback will be provided. This will consist of multiple choice questions, short questions, basic design transactions and reports to be performed online. Assessment Criteria 1. Use of literature/ Knowledge of theory 2. Analysis 3. Problem solving 4. Critical reasoning / critical thinking 5. Time management/self management 6. Performance Skills

Final examination

G

Task Description This final examination is designed to test students ability to analyse, synthesise and apply the concepts and techniques introduced within the unit in specific contexts and demonstrate knowledge and skills in the selection, evaluation, design, operation and improvement of accounting system considering the contextual factors and varying business scenarios. This will test students' accounting knowledge, critical thinking and problem solving skills and their ability to demonstrate an understanding of principles and theories in the design of an accounting system. This assessment covers all the topics covered from weeks 1 to 12 as shown in the schedule. Students must achieve a minimum of 40% of the available marks in the final exam for this unit in order to pass the unit as a whole. Students who fail to achieve this minimum standard in the final exam, even with their aggregate mark is above 50%, will be given an AF grade for this UoS. As a result a student's academic transcript will note both an AF grade and a mark of 49 for this UoS.

Assessment Criteria 1. Use of literature/ Knowledge of theory 2. Context in which subject is used 3. Analysis 4. Problem solving 5. Performance Skills

Version: 2013 Business School

BUSINESS SCHOOL

5. Other suggested resources for students All lectures and seminars are recorded and will be available within Blackboard for student use. Please note the Business School does not own the system and cannot guarantee that the system will operate or that every class will be recorded. Students should ensure they attend and participate in all classes. Ackoff (1967) Management misinformation systems, Management Science, 14 (4), B147-B156. Arif, N., and Tauseef, S. (2008) SAP Enterprise Structure. In Arif, N. & Tauseef, S. SAP ERP Financials: Configuration and Design, Galileo Press, Boston, pp.33-65. Considine, B., Parkes, A., Olesen, K., Sopeer, D. and Lee, M. (2010) Enterprise information systems. In Considine, B. et al Accounting Information Systems understanding business processes, 3rd edition, Milton: John Wiley & Sons Australia, pp.249-285. Hall, J. (2011) Enterprise Resource Planning Systems. In Hall, J. Accounting Information systems, eighth edition, Southwestern Cengage Learning, pp.485-513. Mintzberg (1977): Impediments to the use of management information Panco, R.R. (2008) What we know about spreadsheet errors, Journal of End User Computing, 10(2), pp.15-21. Patel, M. (2008) Overview, General Ledger, Receivables and Payables. In Discover SAP Financials, pp.1-37. Galile Press,Canada. Oliver, G. & Walker, R. (2006): Reporting on software development projects to senior managers and the board. Abacus, 42 (1): 43-67. Romney, M., Steinhart, P., Mula, J., McNamara, R. and Tonkin, T. (2013) Fundamentals of business processes and transaction processing and General Ledger reporting cycle. In Romney et al Accounting Information Systems, Pearson Australia,pp.36-61 and pp.314-335. Seethamraju R. (2013) Reading materials for SAP workshops adapted from Quarles, R. and Noman (2011) and other sources, SAP University Alliances. Walker, R. and Oliver, G. (2005) Accounting for expenditure on software development for internal use, Abacus, 41(1), pp.66-91. Other resources: Breen, J., Scuilli, N. and Calvert, C. (2003) The Role of External Accountants in Small Firms, Proceedings of the 16th Annual Conference of Small Enterprise Association of Australia and New Zealand, 28 Sept 1 Oct 2003, Ballarat, Vic. Monk, E. and Wagner, B. (2006) Concepts in Enterprise Resource Planning, third edition, Boston: Course Technology Cengage Learning.

Version: 2013 Business School

BUSINESS SCHOOL

Newman, M. and Westrup, C. (2005) Making ERPs work: accountants and the introduction of ERP systems, European Journal of Information Systems, 14, pp.258-272. Sumner, M. (2005) ERP systems: accounting and finance. In Enterprise Resource Planning Systems, Prentice hall, pp.72-86.

6. Feedback and improvements made in response to feedback The Business School seeks feedback from students and staff in order to continually improve and innovate all units offered. For information on previously collected feedback and innovation made in response to feedback, please see http://sydney.edu.au/business/learning/planning_and_quality/feedback/student

Version: 2013 Business School

BUSINESS SCHOOL

7. Unit schedule

Week/ Topic 1 4 Mar 2013 2 11 Mar 2013 3 18 Mar 2013 4 25 Mar 2013 Materials (e.g. readings) Lecture/Seminar/TBL Session Lecture slides, Ackoff (1967) and Mintzberg (1977) Introduction to the unit: Managing the design of an Accounting System cycles, processes & transactions Manual system practice Assessments Due

Lecture slides and tutorial Key issues in designing Accounting systems materials controls, audits and risk Oliver & Walker (2006), Manual system designing reports and lecture slides and tutorial reporting materials No class - Public holiday (Easter Friday) Common week 1 to 7 Apr

5 8 Apr 2013 6 15 Apr 2013 7 22 Apr 2013 8 29 Apr 2013 9 6 May 2013 10 13 May 2013 11 20 May 2013 12 27 May 2013 13 3 Jun 2013

Walker & Oliver (2005), lecture slides and tutorial materials Panko (2000), lecture slides and tutorial materials

Manual system designing source documents Semi-automated system designing spreadsheets to reduce errors

Manual system design study#1

Lecture slides and tutorial Semi-automated system relationship of materials MYOB to other business systems Lecture slides, tutorial materials, Considine et al (2010), Romney et al (2013), Sumner (2005), Monk & Wagner (2006) Evaluation & design of packaged software systems to support Accounting functions; Best practices, Chart of accounts, General Ledger and master data

Manual system design study#2

SAP and MyOB tutorials

Packaged accounting system - accounts Lecture slides and tutorial payable and accounts receivable cycles, cost materials accounting Lecture slides, tutorial materials, Sumner Packaged accounting system - reporting cycle, (2005), Hall (2011) & controls, risks & performance reporting Romney et al (2013) Lecture slides, tutorial materials, Monk & Packaged accounting system controls, risks, Wagner (2009), Hall performance reporting (2011) Lecture slides, tutorial Adoption and configuration of an accounting materials, Arif & Tausee system with a packaged software - controls (2008) and Patel (2009) and reports Accounting system design review and Lecture slides and tutorial challenges in the design, adoption & materials configuration

SAP tutorials

SAP tutorials

SAP tutorials

SAP tutorials Online quiz & Design skills test

Version: 2013 Business School

Vous aimerez peut-être aussi

- UoS Outline ACCT6007 SEM2 2013 ApprovedDocument9 pagesUoS Outline ACCT6007 SEM2 2013 ApprovedSweetCherriePas encore d'évaluation

- UoS Outline BUSS3500 SEM2 2013 ApprovedDocument7 pagesUoS Outline BUSS3500 SEM2 2013 ApprovedMichaelTimothyPas encore d'évaluation

- UoS Outline ACCT6007 SEM1 2013 ApprovedDocument9 pagesUoS Outline ACCT6007 SEM1 2013 ApprovedSweetCherriePas encore d'évaluation

- Unit of Study Outline FINC2012bDocument8 pagesUnit of Study Outline FINC2012bMichaelTimothy0% (1)

- ECON 007 Course OutlineDocument4 pagesECON 007 Course OutlineLê Chấn PhongPas encore d'évaluation

- Lean Production and Lean Construction Brief 2019 20 FinalDocument9 pagesLean Production and Lean Construction Brief 2019 20 Finalsikandar abbasPas encore d'évaluation

- UoS Outline BUSS3500 SUM JAN 2014 ApprovedDocument5 pagesUoS Outline BUSS3500 SUM JAN 2014 ApprovedTecwyn LimPas encore d'évaluation

- Course Outline: Business 2257: Accounting and Business AnalysisDocument9 pagesCourse Outline: Business 2257: Accounting and Business AnalysistigerPas encore d'évaluation

- MBA in Business AnalyticsDocument12 pagesMBA in Business AnalyticsOmkar DesaiPas encore d'évaluation

- MBA in Business Analytics for Career GrowthDocument12 pagesMBA in Business Analytics for Career GrowthShatrughna SamalPas encore d'évaluation

- Managerial Accounting Course at Ateneo MBA ProgramDocument37 pagesManagerial Accounting Course at Ateneo MBA ProgramCyn SyjucoPas encore d'évaluation

- UT Dallas Syllabus For Opre6302.501.11s Taught by Ganesh Janakiraman (gxj091000)Document8 pagesUT Dallas Syllabus For Opre6302.501.11s Taught by Ganesh Janakiraman (gxj091000)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Co Operative Education Revised June 2011Document50 pagesCo Operative Education Revised June 2011ibrahimshareef1Pas encore d'évaluation

- UoS Outline ACCT1006 SEM2 2014 ApprovedDocument6 pagesUoS Outline ACCT1006 SEM2 2014 ApprovedAbdulla ShaheedPas encore d'évaluation

- Managerial Accounting Insights for Decision MakingDocument0 pageManagerial Accounting Insights for Decision MakingMichael YuPas encore d'évaluation

- INFS2605 S2 2015 Course Outline - v1.5Document11 pagesINFS2605 S2 2015 Course Outline - v1.5mounica_veraPas encore d'évaluation

- Information Systems, Technology and ManagementDocument10 pagesInformation Systems, Technology and ManagementAliPas encore d'évaluation

- Paper Introduction: AcknowledgementsDocument6 pagesPaper Introduction: AcknowledgementsskulandaiswamyPas encore d'évaluation

- INFS2603 Course Outline Part A S2 2014Document13 pagesINFS2603 Course Outline Part A S2 2014MadhurVermaPas encore d'évaluation

- MAN7064 - International Operations and Project Management Assessment 2020-06Document6 pagesMAN7064 - International Operations and Project Management Assessment 2020-06Shah Taj Aftab Shaikh0% (1)

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDocument5 pagesFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohPas encore d'évaluation

- Unit OutlineDocument11 pagesUnit OutlinemuhammadmusakhanPas encore d'évaluation

- Taking Coursework For Audit OnlyDocument8 pagesTaking Coursework For Audit Onlypkhdyfdjd100% (2)

- Business Studies: AS and A Level SpecificationDocument33 pagesBusiness Studies: AS and A Level SpecificationAbdulHameedAdamPas encore d'évaluation

- Syllabus Latest Evolution of The Aca Advanced LevelDocument21 pagesSyllabus Latest Evolution of The Aca Advanced LevelAli IqbalPas encore d'évaluation

- MGT208 2015-2016Document5 pagesMGT208 2015-2016Deepanshu SHarma100% (1)

- 94-774 Business Process Modeling: Karyn@cmu - EduDocument8 pages94-774 Business Process Modeling: Karyn@cmu - Eduro paPas encore d'évaluation

- MBA 5241E - Course OutlinesDocument12 pagesMBA 5241E - Course OutlinesEmad ToubarPas encore d'évaluation

- ACCTG222Document4 pagesACCTG222SyedAshirBukhariPas encore d'évaluation

- MGT208 2016-2017Document5 pagesMGT208 2016-2017Deepanshu SHarmaPas encore d'évaluation

- Revised Acct 3039 Course GuideDocument20 pagesRevised Acct 3039 Course GuideDaniel FergersonPas encore d'évaluation

- Operations and Information Management Assessment Brief 1 - 33320Document6 pagesOperations and Information Management Assessment Brief 1 - 33320Safar ppPas encore d'évaluation

- Business GraduateDocument14 pagesBusiness GraduateGeoffrey KaraaPas encore d'évaluation

- MBA (Service Excellence) OnlineDocument2 pagesMBA (Service Excellence) OnlineHannah CresseyPas encore d'évaluation

- ACTG 360 Syllabus (Winter 2020) Michael Schuster Portland State University Management AccountingDocument10 pagesACTG 360 Syllabus (Winter 2020) Michael Schuster Portland State University Management AccountingHardlyPas encore d'évaluation

- Business Research Paper RubricDocument8 pagesBusiness Research Paper Rubricafnhcikzzncojo100% (1)

- Syllabus Fin MGMTDocument6 pagesSyllabus Fin MGMTJamesPas encore d'évaluation

- Acct408 - Cheng Nam SangDocument5 pagesAcct408 - Cheng Nam SangHohoho134Pas encore d'évaluation

- Cost & Management Accounting Course OutlineDocument7 pagesCost & Management Accounting Course OutlineBilal ShahidPas encore d'évaluation

- Managerial Accounting-Qazi Saud AhmedDocument4 pagesManagerial Accounting-Qazi Saud Ahmedqazisaudahmed100% (1)

- Agw610 Course Outline Sem 1 2013-14 PDFDocument12 pagesAgw610 Course Outline Sem 1 2013-14 PDFsamhensemPas encore d'évaluation

- Strategic Cost Analysis For Decision Making Acc 3416Document7 pagesStrategic Cost Analysis For Decision Making Acc 3416Paul SchulmanPas encore d'évaluation

- Course Guide Sem. 1 2011Document6 pagesCourse Guide Sem. 1 2011sir bookkeeperPas encore d'évaluation

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelPas encore d'évaluation

- UT Dallas Syllabus For Aim6202.091.10f Taught by Zhonglan Dai (zxd051000)Document6 pagesUT Dallas Syllabus For Aim6202.091.10f Taught by Zhonglan Dai (zxd051000)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Strategic Management Module HandbookDocument10 pagesStrategic Management Module HandbookAyesha IrumPas encore d'évaluation

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Document4 pagesACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134Pas encore d'évaluation

- UT Dallas Online Course Syllabus For AIM 6201 - Financial Accounting - 07sDocument10 pagesUT Dallas Online Course Syllabus For AIM 6201 - Financial Accounting - 07sUT Dallas Provost's Technology GroupPas encore d'évaluation

- Marketing 4285 Course OutlineDocument4 pagesMarketing 4285 Course OutlineMashal JamilPas encore d'évaluation

- Course Outline Financial Management Dipm BSC PM 2022Document9 pagesCourse Outline Financial Management Dipm BSC PM 2022Car Tha GePas encore d'évaluation

- ACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafDocument7 pagesACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafmuhammadmusakhanPas encore d'évaluation

- Course Workbook SamplesDocument7 pagesCourse Workbook Samplesjxaeizhfg100% (2)

- Mba 2023Document14 pagesMba 2023Allwyn joseph (Aj)Pas encore d'évaluation

- A S D C O: Ccounting Pecialist Iploma Ourse UtlineDocument8 pagesA S D C O: Ccounting Pecialist Iploma Ourse UtlineinfoexecproPas encore d'évaluation

- Coursework Evaluation ToolDocument7 pagesCoursework Evaluation Toolafjwfzekzdzrtp100% (2)

- Audit and Assurance Syllabus 2015Document12 pagesAudit and Assurance Syllabus 2015Maddie GreenPas encore d'évaluation

- BSc Investment & Financial Risk ManagementDocument13 pagesBSc Investment & Financial Risk ManagementchimaegbukolePas encore d'évaluation

- SyllabusDocument10 pagesSyllabus임민수Pas encore d'évaluation

- Ato - ItrDocument90 pagesAto - ItrSweetCherriePas encore d'évaluation

- ATO - Research and Development Tax IncentiveDocument39 pagesATO - Research and Development Tax IncentiveSweetCherriePas encore d'évaluation

- CH 11Document38 pagesCH 11SweetCherriePas encore d'évaluation

- Essay Question 2014Document2 pagesEssay Question 2014SweetCherriePas encore d'évaluation

- Jane Eyre PDFDocument691 pagesJane Eyre PDFSweetCherriePas encore d'évaluation

- UoS Outline FINC3011 SEM1 2014Document5 pagesUoS Outline FINC3011 SEM1 2014SweetCherriePas encore d'évaluation

- UoS Outline ACCT6010 SEM2 2013 ApprovedDocument9 pagesUoS Outline ACCT6010 SEM2 2013 ApprovedSweetCherriePas encore d'évaluation

- UoS Outline ACCT6010 SEM1 2013 ApprovedDocument9 pagesUoS Outline ACCT6010 SEM1 2013 ApprovedSweetCherriePas encore d'évaluation

- Matheletics - Probability Series IDocument14 pagesMatheletics - Probability Series ITO ChauPas encore d'évaluation

- Anatol Basarab Numerologia in Viata Fiecaruia 1Document11 pagesAnatol Basarab Numerologia in Viata Fiecaruia 1Ilav LivasiPas encore d'évaluation

- Synergy Examination Flyer 2023 PDFDocument7 pagesSynergy Examination Flyer 2023 PDFPadam SinghPas encore d'évaluation

- Comprehensive English language learning guideDocument1 pageComprehensive English language learning guideMyrto PapadakiPas encore d'évaluation

- BETT - PHASE - 2 (1) - UnlockedDocument23 pagesBETT - PHASE - 2 (1) - UnlockedSukhveer VermaPas encore d'évaluation

- ACER Primary Scholarship: Practice TestDocument40 pagesACER Primary Scholarship: Practice Testcloud moon82% (17)

- Summative Q1M4-PhiloDocument2 pagesSummative Q1M4-PhiloKaren Blyth100% (2)

- CGPSC LECTURER Physics AT POLYTECHNIC 2016Document96 pagesCGPSC LECTURER Physics AT POLYTECHNIC 2016SAHIN InspirePas encore d'évaluation

- #1 Jeopardy Classroom Review Game - Factile ManualDocument149 pages#1 Jeopardy Classroom Review Game - Factile ManualAnonymous YXfD1iRPas encore d'évaluation

- Pakistan Marine Academy Entry Test Sample PaperDocument8 pagesPakistan Marine Academy Entry Test Sample PaperShawn Parker78% (27)

- Constrtucting Written Test QuestionsDocument7 pagesConstrtucting Written Test QuestionsUkris G.Pas encore d'évaluation

- Principles and Guidelines For Assessments 6.15.15Document5 pagesPrinciples and Guidelines For Assessments 6.15.15AILENPas encore d'évaluation

- Numerical Reasoning PDFDocument30 pagesNumerical Reasoning PDFEldie TappaPas encore d'évaluation

- 0004 Tech TipsDocument51 pages0004 Tech TipsMaría Hernandis CaballeroPas encore d'évaluation

- CSETDocument5 pagesCSETLinda SchweitzerPas encore d'évaluation

- Subjective Test Further ExplanationDocument16 pagesSubjective Test Further ExplanationMiechel RowyPas encore d'évaluation

- Rahmawati 2018 J. Phys. Conf. Ser. 1006 012014Document6 pagesRahmawati 2018 J. Phys. Conf. Ser. 1006 012014marosaPas encore d'évaluation

- Teachers' Professional GrowthDocument74 pagesTeachers' Professional GrowthRoland Gadela100% (1)

- BSA Program QUALIFYING 2021Document6 pagesBSA Program QUALIFYING 2021Justin Calina100% (1)

- Social networks: A concise guideDocument6 pagesSocial networks: A concise guideKaren K50% (6)

- Programming, Planning & Practice Exam Guide - Architecure Exam - NCARBDocument16 pagesProgramming, Planning & Practice Exam Guide - Architecure Exam - NCARBiamarrPas encore d'évaluation

- OBJECTIVE TEST (Matching Test, True-False Test, Multiple Choice Question)Document20 pagesOBJECTIVE TEST (Matching Test, True-False Test, Multiple Choice Question)Phandit Arya perdanaPas encore d'évaluation

- Business Studies GR 12 Exam Guidelines 2020 EngDocument40 pagesBusiness Studies GR 12 Exam Guidelines 2020 EngArdinePas encore d'évaluation

- MCQs in Microwave Communications Part IIIDocument10 pagesMCQs in Microwave Communications Part IIIRaghu Veer KPas encore d'évaluation

- Methods of Collecting Primary Data (Final)Document22 pagesMethods of Collecting Primary Data (Final)asadfarooqi4102100% (3)

- Activity Sheet TOSDocument7 pagesActivity Sheet TOSRoselyn GabonPas encore d'évaluation

- Pre Board 1 Session 23-24 Marks Slips and Action PlanDocument19 pagesPre Board 1 Session 23-24 Marks Slips and Action Plantiru05aPas encore d'évaluation

- Comprehensive Assessment of Professional CompetenceDocument11 pagesComprehensive Assessment of Professional CompetenceRizka PutrantiPas encore d'évaluation

- 2015 Module 2 PPT 1Document65 pages2015 Module 2 PPT 1Tengku Ahmad HakimiPas encore d'évaluation

- Writing Good Multiple Choice ExamsDocument40 pagesWriting Good Multiple Choice ExamskexonPas encore d'évaluation