Académique Documents

Professionnel Documents

Culture Documents

06 - Ishares Markit Iboxx Euro High Yield Bond

Transféré par

Roberto PerezDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

06 - Ishares Markit Iboxx Euro High Yield Bond

Transféré par

Roberto PerezDroits d'auteur :

Formats disponibles

IRISH DOMICILED FUND

iShares Markit iBoxx Euro High Yield Bond

12 September 2011

Fund Description

iShares Markit iBoxx Euro High Yield Bond is an exchange traded fund (ETF) that aims to track the performance of the Markit iBoxx Euro Liquid High Yield Index as closely as possible. The ETF invests in physical index securities. The Markit iBoxx Euro Liquid High Yield Index offers exposure to the largest and most liquid Euro denominated corporate bonds with sub-investment grade rating. Only bonds with a minimum amount outstanding of 250 million are included in the index. The maximum original time to maturity is 10.5 years and the minimum time to maturity is 2 years for new bonds to be included (no minimum restriction for bonds already in the index). For diversification purposes the weight of each issuer in the index is capped at 5%. iShares ETFs are funds managed by BlackRock. They are transparent, cost-efficient, liquid vehicles that trade on stock exchanges like normal securities. iShares ETFs offer flexible and easy access to a wide range of markets and asset classes.

Fund Facts

UCITS III Compliant Domicile Issuing Company Fund Manager Fund Accountant UK Distributor/UK Reporting Status Moody's Rating Benchmark Index ("The Index") Total Return Index Ticker Price Index Ticker Index Rebalance Frequency Fiscal Year End Total Net Assets Net Asset Value per Share Use of Income Total Expense Ratio ETF Methodology Number of Holdings Shares Outstanding Inception Date Base Currency ISA Eligibility SIPP Eligibility London Stock Exchange Ticker Reuters (RIC) Bloomberg SEDOL Trading currency Yes Ireland iShares plc BlackRock Asset Management Ireland Limited State Street Fund Services (Ireland) Limited No/Yes

Sector allocation (12 September 2011)

n n n n Industrial Financial Institutions Utility NON - CORPORATE 94.12% 4.51% 0.77% 0.60%

Source: BlackRock Advisors (UK) Limited

Country (12 September 2011)

n n n n n n n n n n France Netherlands Luxembourg Germany United Kingdom United States Ireland Spain South Africa Others 21.14% 15.03% 14.76% 14.05% 7.55% 4.59% 3.81% 2.46% 2.18% 14.43%

Markit iBoxx Euro Liquid High Yield Index IBOXXMJA IBOXXMCA Monthly 28 February 2012 566.59m 92.29 Distributing 0.50% p.a. Sampled 213 6,139,000 3 September 2010 EUR Yes Yes IHYG IHYG.L IHYG LN B66F475 EUR

Others: Finland 2.01%, Hungary 1.72%, Cayman Islands 1.68%, Belgium 1.21%, Sweden 1.07%, Liberia 0.91%, Italy 0.91%, Japan 0.77%, Austria 0.74%, Canada 0.72%, Croatia (Hrvatska) 0.51%, Denmark 0.50%, Jersey 0.40%, Kazakhstan 0.36%, Bermuda 0.36%, Australia 0.34% and Norway 0.22%

Source: BlackRock Advisors (UK) Limited

London Stock Exchange (Secondary Listing) Ticker SHYG Reuters (RIC) SHYG.L Bloomberg SHYG LN SEDOL B650MJ9 Trading currency GBP Listing Date 6 September 2010 This fund is also listed on: Borsa Italiana, Deutsche Brse, SIX Swiss Exchange This fund is also registered in: Austria, Switzerland, Germany, Denmark, Spain, Finland, France, United Kingdom, Italy, Luxembourg, Netherlands, Norway, Sweden Bloomberg iNAV Reuters iNAV page ISIN Modified Duration (%) Coupon (%) Maturity (Years) Yield to Maturity (%) Distribution Yield Dividend Frequency Ex date Record date Pay Date Last distribution paid Entry Fees Exit Fees Performance Fees INAVHYGG IHYGGINAV.DE IE00B66F4759 3.58% 7.08% 4.57 9.13% 6.62% Semi-Annual 24 August 2011 26 August 2011 21 September 2011 3.1491 No No No

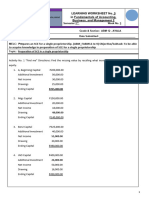

Fund Performance (12 September 2011)

Cumulative Performance

3 months 6 months 1 year 3 years Since Inception Fund -7.76% -6.54% -1.50% N/A -1.20% Index -7.55% -6.36% -1.90% N/A -1.50%

Standardised Yearly Fund Performance

12/9/10 - 12/9/11 12/9/09 - 12/9/10 12/9/08 - 12/9/09 12/9/07 - 12/9/08 12/9/06 - 12/9/07 Fund -1.50% N/A N/A N/A N/A Index -1.90% N/A N/A N/A N/A

Past performance is not a reliable indicator for future results. Performance is shown using the net asset value of the fund, calculated from the closing price of the underlying securities. Performance is shown after fees including re-invested dividends in the base currency of the fund and does not take into account any currency exposure that may exist against the trading currency of the fund, where this is different. iShares ETFs are a simple and cost-effective way to gain exposure to different markets. The aim of iShares ETFs is to offer investors returns based on the performance of the relevant underlying index. Using ETFs as building blocks, you can spread the risk of individual companies, entire sectors or even whole countries suffering losses. However, they will not mitigate all market risk, and you can still lose some, or all of your investment should the value of the underlying shares decrease. Note that investment in this fund may to expose you to currency risk and it Source: BlackRock Advisors (UK) Limited may be subject to specific risk considerations. For more details please refer to the prospectus.

Source: BlackRock Advisors (UK) Limited

iShares Markit iBoxx Euro High Yield Bond

Performance Chart (12 September 2011)

%

Top 10 Holdings (12 September 2011)

Issuer % of Fund FCE BANK PLC MTN 7.125 01/16/2012 1.41% WIND ACQUISITION FINANCE SA RegS 7.375 02/15/2018 1.31% LAFARGE SA MTN RegS 8.875 05/27/2014 1.22% UNITYMEDIA HESSEN / NRW RegS 8.125 12/01/2017 1.21% FCE BANK PLC MTN 7.125 01/15/2013 1.19% WIND ACQUISITION FINANCE RegS 11.75 07/15/2017 1.16% PERNOD-RICARD SA 4.875 03/18/2016 1.07% INEOS GROUP HOLDINGS PLC RegS 7.875 02/15/2016 1.05% HEIDELBERGCEMENT AG RegS 8 01/31/2017 1.05% ZIGGO BOND COMPANY BV RegS 8 05/15/2018 1.03%

n iShares Markit iBoxx Euro High Yield Bond ("The Fund") n Markit iBoxx Euro Liquid High Yield Index

Source: BlackRock Advisors (UK) Limited

iShares may not be suitable for all investors. BlackRock Advisors (UK) Limited does not guarantee the performance of the shares or funds. The value of the investment involving exposure to foreign currencies can be affected by exchange rate movements. We remind you that the levels and bases of, and reliefs from, taxation can change. Affiliated companies of BlackRock Advisors (UK) Limited may make markets in the securities mentioned in this document. Further, BlackRock Advisors (UK) Limited and/or its affiliated companies and/or their employees from time to time may hold shares or holdings in the underlying shares of, or options on, any security included in this document and may as principal or agent buy or sell securities.

BlackRock (BLK), which is authorised and regulated by the Financial Services Authority (FSA), has issued this document for access in the UK only and no other person should rely upon the information contained within it. iShares plc, iShares II plc and iShares III plc (together the Companies) are open-ended investment companies with variable capital having segregated liability between their funds organised under the laws of Ireland and authorised by the Financial Regulator. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act 2000. Important information is contained in the relevant prospectus, the simplified prospectus and other documents, copies of which can be obtained by calling 0845 357 7000, from your broker or financial adviser, by writing to BlackRock Advisors (UK) Limited, iShares Business Development, Murray House, 1 Royal Mint Court, London EC3N 4HH or by writing to the Manager of the Companies: BlackRock Advisors (UK) Limited Ireland Limited, New Century House, International Financial Services Centre, Mayor Street Lower, Dublin 1, Ireland. This document is not, and under no circumstances is to be construed as, an advertisement, or any other step in furtherance of a public offering of shares in the United States or Canada. This document is not aimed at persons who are resident in the United States, Canada or any province or territory thereof, where the Companies are not authorised or registered for distribution and where no prospectus for the Companies has been filed with any securities commission or regulatory authority. The Companies may not be acquired or owned by, or acquired with the assets of, an ERISA Plan. Markit iBoxx is a registered trade mark of Markit Indices Limited and has been licensed for use by BlackRock Advisors (UK) Limited. Markit Indices Limited does not approve, endorse or recommend BlackRock Advisors (UK) Limited or iShares plc. This product is not sponsored, endorsed or sold by IIC and IIC makes no representation regarding the suitability of investing in this product. 'iShares' is a registered trademark of BlackRock Institutional Trust Company, N.A. All other trademarks, servicemarks or registered trademarks are the property of their respective owners. 2010 BlackRock Advisors (UK) Limited. Registered Company No. 00796793. All rights reserved. Calls may be monitored or recorded.

www.iShares.co.uk

0845 357 7000

ISHARES <GO>

Vous aimerez peut-être aussi

- Amundi Etf Global Emerging Bond Markit IboxxDocument3 pagesAmundi Etf Global Emerging Bond Markit IboxxRoberto PerezPas encore d'évaluation

- Ishares JPMorgan USD Emerging Markets Bond FundDocument2 pagesIshares JPMorgan USD Emerging Markets Bond FundRoberto PerezPas encore d'évaluation

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezPas encore d'évaluation

- SPDRDocument268 pagesSPDRRoberto PerezPas encore d'évaluation

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezPas encore d'évaluation

- Amundi Etf Euro CorporatesDocument3 pagesAmundi Etf Euro CorporatesRoberto PerezPas encore d'évaluation

- Product Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ADocument1 pageProduct Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ARoberto PerezPas encore d'évaluation

- Amundi Etf Euro InflationDocument3 pagesAmundi Etf Euro InflationRoberto PerezPas encore d'évaluation

- Ishares Iboxx $ High Yield Corporate Bond FundDocument2 pagesIshares Iboxx $ High Yield Corporate Bond FundRoberto PerezPas encore d'évaluation

- Ishares Iboxx $ Investment Grade Corporate Bond FundDocument2 pagesIshares Iboxx $ Investment Grade Corporate Bond FundRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital Short Term Corporate Bond ETF 1-3YDocument2 pagesSPDR Barclays Capital Short Term Corporate Bond ETF 1-3YRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital High Yield Bond ETF (JNK)Document2 pagesSPDR Barclays Capital High Yield Bond ETF (JNK)Roberto PerezPas encore d'évaluation

- Vanguard Long-Term Government Bond ETF 10+Document2 pagesVanguard Long-Term Government Bond ETF 10+Roberto PerezPas encore d'évaluation

- SPDR ETF Fixed Income Characteristics Guide 10.31.2011Document5 pagesSPDR ETF Fixed Income Characteristics Guide 10.31.2011Roberto PerezPas encore d'évaluation

- Ishares Barclays 20+ Year Treasury Bond FundDocument0 pageIshares Barclays 20+ Year Treasury Bond FundRoberto PerezPas encore d'évaluation

- Vanguard Intermediate-Term Government Bond 3-10YDocument2 pagesVanguard Intermediate-Term Government Bond 3-10YRoberto PerezPas encore d'évaluation

- Vanguard Short-Term Government Bond ETF 1-3YDocument2 pagesVanguard Short-Term Government Bond ETF 1-3YRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YRoberto PerezPas encore d'évaluation

- Lyxor ETF Iboxx Liquid High Yield 30Document2 pagesLyxor ETF Iboxx Liquid High Yield 30Roberto PerezPas encore d'évaluation

- Vanguard Short-Term Corporate Bond ETF 1-5YDocument2 pagesVanguard Short-Term Corporate Bond ETF 1-5YRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezPas encore d'évaluation

- Vanguard Long-Term Corporate Bond ETF 10+Document2 pagesVanguard Long-Term Corporate Bond ETF 10+Roberto PerezPas encore d'évaluation

- SPDR Barclays Capital Intermediate Term Treasury ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Treasury ETF 1-10YRoberto PerezPas encore d'évaluation

- Vanguard Intermediate-Term Corporate Bond ETF 5-10YDocument2 pagesVanguard Intermediate-Term Corporate Bond ETF 5-10YRoberto PerezPas encore d'évaluation

- Ishares Barclays 7-10 Year Treasury Bond FundDocument0 pageIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezPas encore d'évaluation

- SPDR Barclays Capital Long Term Corporate Bond ETF 10+YDocument2 pagesSPDR Barclays Capital Long Term Corporate Bond ETF 10+YRoberto PerezPas encore d'évaluation

- Ishares Barclays 3-7 Year Treasury Bond FundDocument0 pageIshares Barclays 3-7 Year Treasury Bond FundRoberto PerezPas encore d'évaluation

- Ishares Barclays 10-20 Year Treasury Bond FundDocument0 pageIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezPas encore d'évaluation

- Ishares Barclays 1-3 Year Treasury Bond FundDocument0 pageIshares Barclays 1-3 Year Treasury Bond FundRoberto PerezPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDocument2 pagesSample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick CortezPas encore d'évaluation

- Capital StructureDocument41 pagesCapital StructurethejojosePas encore d'évaluation

- MT 309 Equity Shares: Benefits and RisksDocument2 pagesMT 309 Equity Shares: Benefits and Riskspiyush chauhanPas encore d'évaluation

- Chart of Difference Between The Provision and ReserveDocument1 pageChart of Difference Between The Provision and ReserveYuukiiPas encore d'évaluation

- Death of A Partner Test SPCC 23-24 Accounts - Docx (2)Document5 pagesDeath of A Partner Test SPCC 23-24 Accounts - Docx (2)Shivansh JaiswalPas encore d'évaluation

- Αλφαβητάρι των οικονομικών PDFDocument36 pagesΑλφαβητάρι των οικονομικών PDFMarianthi AnastasopoulouPas encore d'évaluation

- BangladeBangladesh Securities and Exchange Commissionsh Securities and Exchange CommissionDocument55 pagesBangladeBangladesh Securities and Exchange Commissionsh Securities and Exchange CommissionMd. Farid AhmedPas encore d'évaluation

- Account Details and Transaction History: Air Asia SaverDocument4 pagesAccount Details and Transaction History: Air Asia SaverSeema KhanPas encore d'évaluation

- S. Strange InternationalDocument28 pagesS. Strange InternationalMircea Muresan100% (1)

- Business Combination Lecture Notes. ACC 401Document4 pagesBusiness Combination Lecture Notes. ACC 401Ugbah Chidinma LilianPas encore d'évaluation

- Bond Valuation SensitivityDocument47 pagesBond Valuation SensitivityNino Natradze100% (1)

- Bailey Corp 2015 FCF, EVA, MVADocument8 pagesBailey Corp 2015 FCF, EVA, MVACASTOR, Vincent Paul0% (1)

- Receipt 1 PDFDocument3 pagesReceipt 1 PDFsomenathbasakPas encore d'évaluation

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- Kotak - TSK GarmentsDocument4 pagesKotak - TSK GarmentsVishnukumar KumarPas encore d'évaluation

- CBDTDocument11 pagesCBDTNidhi GowdaPas encore d'évaluation

- Capital Budgeting at Kesoram CementDocument12 pagesCapital Budgeting at Kesoram Cementammukhan khanPas encore d'évaluation

- Forming a Partnership with Cash and LandDocument2 pagesForming a Partnership with Cash and LandArian AmuraoPas encore d'évaluation

- IBIG 04 03 Projecting 3 StatementsDocument75 pagesIBIG 04 03 Projecting 3 StatementsCarloPas encore d'évaluation

- Background of The StudyDocument2 pagesBackground of The StudyAdonis GaoiranPas encore d'évaluation

- Investment BankingDocument4 pagesInvestment BankingNirajGBhaduwalaPas encore d'évaluation

- FAB2 W3 No Answer KeyDocument3 pagesFAB2 W3 No Answer KeyClintwest Caliste Autida BartinaPas encore d'évaluation

- METROPOLITAN BANK AND TRUST COMPANY vs. MARINA B. CUSTODIODocument2 pagesMETROPOLITAN BANK AND TRUST COMPANY vs. MARINA B. CUSTODIOKayee KatPas encore d'évaluation

- Pt. Aruna Karya Teknologi Nusantara Expenses Reimbushment FormDocument12 pagesPt. Aruna Karya Teknologi Nusantara Expenses Reimbushment Formfahmi ramadhanPas encore d'évaluation

- Multiple Cash Flows - FV Example 6.1: Discounted Cash Flow ValuationDocument26 pagesMultiple Cash Flows - FV Example 6.1: Discounted Cash Flow ValuationRawisara KeawsriPas encore d'évaluation

- PUP Review Handout 5 OfficialDocument2 pagesPUP Review Handout 5 OfficialDonalyn CalipusPas encore d'évaluation

- The Concept and Development of Money in 40 CharactersDocument1 pageThe Concept and Development of Money in 40 CharactersLeo Alvarez OmamalinPas encore d'évaluation

- The Big Mac IndexDocument7 pagesThe Big Mac IndexAli BabaPas encore d'évaluation

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepPas encore d'évaluation

- How To Calculate NPV (With Downloadable Calculator)Document7 pagesHow To Calculate NPV (With Downloadable Calculator)Richard Obeng KorantengPas encore d'évaluation