Académique Documents

Professionnel Documents

Culture Documents

Saudi Arabia Pharmaceutical Market Opportunity Analysis

Transféré par

Neeraj ChawlaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Saudi Arabia Pharmaceutical Market Opportunity Analysis

Transféré par

Neeraj ChawlaDroits d'auteur :

Formats disponibles

Saudi Arabia Pharmaceutical Market Opportunity Analysis

Saudi Arabia Pharmaceutical market has recorded significant growth over the years owing to

various factors like increasing ageing population mostly in the above 60 years bracket,

changing demographics and rise in the incidence of lifestyle diseases, increased spending

power, result driven government initiatives to promote the growth of indigenous

pharmaceutical companies. Inspite of all the progress, the pharmaceutical market in the

Saudi Arabia is still in an emerging phase, and the drug manufacturing is at a relatively

nascent stage owing to many challenges, which need to be resolved.

Saudi Arabia relies substantially on imports of pharmaceutical products, primarily from

Europe, to meet local demand as a result of insufficient domestic drug production and lack of

indigenous research capabilities. Government is taking efforts to promote FDI in the

pharmaceutical sector especially directed to help development of skills of local companies to

manufacture patented medicines as well. Policies like free trade agreements have played a

significant role in encouraging foreign investments. Increased penetration of the healthcare

sector by insurance providers, price regulation guidelines to ensure uniformity in pricing and

dedicated healthcare reforms, have further ensured growth of pharmaceutical market in

recent years.

Saudi Arabia is expected to emerge as one of the fastest growing markets in future. The

country is one of the most developed and technologically advanced medical sectors in the

GCC Region with modern equipment and amenities. Pharmaceuticals products sales in Saudi

Arabia are expected to surpass US$ 7 Billion by 2018 as compare to US$ 4 Billion 2012.

Saudi Arabia Pharmaceutical Market Opportunity Analysis gives comprehensive insight on

following aspects related to pharmaceutical market:

Market Overview

Drug Pricing system

Disease Prevalence

Market by segment: Generics, Branded & OTC

Favorable Market dynamics

Regulatory Framework

For Report Sample Contact: avinash@kuickresearch.com

Table of Content

1. Saudi Arabia Pharmaceutical Market Overview

1.1 Current Market Overview

1.2 Drug Pricing System

1.3 Disease Prevalence

2. Pharmaceutical Market by Segment

2.1 Branded Drugs

2.2 Generic drugs

2.3 OTC

3. Favourable Market Dynamics

3.1 Largest Market in Middle East

3.2 Promotion of Domestic Pharmaceutical Industry

3.3 Well Established Regulatory Framework

3.4 Demand for OTC & Generics Drugs

3.5 Import Dependent Market

3.6 Challenges to be Resolved

3.7 Future Growth Avenues

4. Regulatory & Policy Framework

4.1 Drug Approval Process (Generics, Biologicals, Radipharmaceuticals & New Chemical

Entity)

4.2 Monoclonal Antibodies and Related Products Quality Guideline

4.3 Law of Pharmaceutical Establishments and Preparations

4.4 Guidelines on Biosimilars

4.4.1 Insulin

4.4.2 Interferons

4.4.3 Erythropoietin

4.4.4 Granulocyte-Colony Stimulating Factor

4.4.5 Human Growth Hormone

5. Competitive Landscape

5.1 SPIMACO

5.2 Tabuk Pharmaceuticals

5.3 Jamjoom Pharma

5.4 Julphar (Gulf Pharmaceutical Industries)

5.5 GSK

5.6 Pfizer

5.7 Novartis

5.8 Astra

Figure 1-1: Saudi Arabia Pharmaceutical Market (US$ Billion), 2012-2018

Figure 1-2: Saudi Arabia Pharmaceutical Market by Segment (US$ Billion), 2012-2018

Figure 1-3: Saudi Arabia Pharmaceutical Market by Segment (%), 2012 & 2018

Figure 1-4: Factors Driving Growth in Saudi Pharmaceuticals Market

Figure 1-5: Components of Drug Pricing System in Saudi Arabia

Figure 1-6: Burden of Communicable & Non Communicable Diseases in Saudi Arabia, 2012 &

2030

Figure 1-7: Leading Causes of Death in Saudi Arabia, 2011

Figure 2-1: Saudi Arabian Branded Drugs Market Value (US$ Billion), 2012-2018

Figure 2-2: Saudi Arabian Generics Drug Market Value (US$ Billion), 2012-2018

Figure 2-3: Saudi Arabian OTC Drug Market(US$ Billion), 2012-2018

Figure 3-1: Share of Saudi Arabia in GCC Pharmaceuticals Market, 2012

Figure 3-2: Government Expenditure on Health as a % of Total Health Expenditure, 2011

Figure 3-3: Expenditure on Health as a % of Total Government Expenditure, 2011

Figure 4-1: Saudi Arabia Drug Approval Process

List of Tables

Table 1-1: Pricing History and Legal Background in Saudi Arabia

Table 1-2: Drug Pricing for Generics

Table 1-3: Drug Pricing for Fixed Combinations

Vous aimerez peut-être aussi

- Saudi Arabia Pharmaceutical Market Development AnalysisDocument4 pagesSaudi Arabia Pharmaceutical Market Development AnalysisNeeraj ChawlaPas encore d'évaluation

- Pharmaceutical Market Brief KSADocument20 pagesPharmaceutical Market Brief KSASandip Rana BallavPas encore d'évaluation

- Saudi Arabian Pharmaceuticals PDFDocument20 pagesSaudi Arabian Pharmaceuticals PDFVJ Reddy RPas encore d'évaluation

- Generics Opportunities & Challenges in The MENA RegionDocument20 pagesGenerics Opportunities & Challenges in The MENA Regionway2me9Pas encore d'évaluation

- Saudi Arabia Halal Cosmetics Market Opportunity AnalysisDocument0 pageSaudi Arabia Halal Cosmetics Market Opportunity AnalysisNeeraj ChawlaPas encore d'évaluation

- GCC Healthcare and Pharmaceutical Sector ReportDocument48 pagesGCC Healthcare and Pharmaceutical Sector ReportParamjot SinghPas encore d'évaluation

- GCC Healthcare IndustryDocument78 pagesGCC Healthcare IndustryDivakar NathPas encore d'évaluation

- KSA Healthcare OpportunitiesDocument6 pagesKSA Healthcare OpportunitiesRaven BlingPas encore d'évaluation

- Iraq Pharmaceuticals Market OpportunitiesDocument4 pagesIraq Pharmaceuticals Market Opportunitiesneerleo50% (2)

- Insurance Company Information in SaudiDocument11 pagesInsurance Company Information in SaudiArshad HussainPas encore d'évaluation

- Assignment Product and Brand ManagementDocument7 pagesAssignment Product and Brand ManagementYogesh GirgirwarPas encore d'évaluation

- 36 NetworkListDocument21 pages36 NetworkListHussain IftikharPas encore d'évaluation

- Egypt: Hospital NetworkDocument10 pagesEgypt: Hospital NetworkAmiraNagyPas encore d'évaluation

- Job Master 2020Document52 pagesJob Master 2020haidyPas encore d'évaluation

- Network Lists in UAE - Mar 2015Document93 pagesNetwork Lists in UAE - Mar 2015Kamran KhanPas encore d'évaluation

- EmployFair Catalog 2017 Draft01rv-1 5831Document72 pagesEmployFair Catalog 2017 Draft01rv-1 5831Ayman ShetaPas encore d'évaluation

- Eye Drop Producion Strategic Plan 2019Document14 pagesEye Drop Producion Strategic Plan 2019Arinda Living Testmony Rwanyarale100% (1)

- Pakistan Pharmaceutical IndustryDocument7 pagesPakistan Pharmaceutical Industryfahmeed786Pas encore d'évaluation

- Discover QatarDocument41 pagesDiscover Qatarheru2910Pas encore d'évaluation

- Hospitals - ASCICO InsuranceDocument40 pagesHospitals - ASCICO InsuranceAshiq MaanPas encore d'évaluation

- Best Hospitals in Nigeria: 1. Neuro-Psychiatric Hospital, Aro, AbeokutaDocument3 pagesBest Hospitals in Nigeria: 1. Neuro-Psychiatric Hospital, Aro, AbeokutaHussein Ibrahim GebiPas encore d'évaluation

- Egypt Country Commercial GuideDocument128 pagesEgypt Country Commercial GuideAlann83Pas encore d'évaluation

- Export of Indian Pharmaceuticals To NamibiaDocument58 pagesExport of Indian Pharmaceuticals To NamibiahabeebsheriffPas encore d'évaluation

- Dilip Shanghvi ReportDocument12 pagesDilip Shanghvi ReportMangalya ShahPas encore d'évaluation

- Middle East and North Africa Pharmaceutical Industry WhitepaperDocument17 pagesMiddle East and North Africa Pharmaceutical Industry WhitepaperPurva ChandakPas encore d'évaluation

- GCC Healthcare Industry ReportDocument59 pagesGCC Healthcare Industry ReportToni Rose RotulaPas encore d'évaluation

- Mars 'Principles in Action' Highlights 2013 en ReportDocument50 pagesMars 'Principles in Action' Highlights 2013 en ReportedienewsPas encore d'évaluation

- 01/ 8749700 (Ext.347) The Company Reserves The Right To Modify This List Without Prior Notice Customer Care 920003055Document8 pages01/ 8749700 (Ext.347) The Company Reserves The Right To Modify This List Without Prior Notice Customer Care 920003055ay_man713Pas encore d'évaluation

- Sudan IndexDocument614 pagesSudan Indexfakhribabiker100% (3)

- Paint CompaniesIn SaudiaDocument6 pagesPaint CompaniesIn Saudiaindianyogi21100% (1)

- Pharma Business Dynamics in ROW MarketsDocument9 pagesPharma Business Dynamics in ROW Marketskaushal_75Pas encore d'évaluation

- Rooh Afzal 4P'sDocument17 pagesRooh Afzal 4P'sreviving_soulsPas encore d'évaluation

- Jordan Manufacturing Company DetailsDocument6 pagesJordan Manufacturing Company DetailsCavz MediaPas encore d'évaluation

- KMR FinalDocument73 pagesKMR FinalTazeen KhanPas encore d'évaluation

- Healthcare Provider Network Directory - Kuwait - KFHDocument4 pagesHealthcare Provider Network Directory - Kuwait - KFHarif420_999Pas encore d'évaluation

- Nepalese Pharmaceutical Industries & Who GMPDocument6 pagesNepalese Pharmaceutical Industries & Who GMPJaya Bir Karmacharya100% (1)

- Suppliers of Ppe PDFDocument2 pagesSuppliers of Ppe PDFEdgar A. De JesusPas encore d'évaluation

- ME Hospital ListDocument3 pagesME Hospital ListmiribrahimaliPas encore d'évaluation

- Global Home Appliance Industry Market Research 2017Document8 pagesGlobal Home Appliance Industry Market Research 2017Norah TrentPas encore d'évaluation

- Radlabs Business PlanDocument28 pagesRadlabs Business PlanshyamchepurPas encore d'évaluation

- Indian Exports - Factors Inhibiting Its Growth What Can Be Done To Revive Its Growth?Document16 pagesIndian Exports - Factors Inhibiting Its Growth What Can Be Done To Revive Its Growth?Siva Krishna Reddy NallamilliPas encore d'évaluation

- Export Documentation of Elfin Pharma PVT Ltd.Document34 pagesExport Documentation of Elfin Pharma PVT Ltd.Paramvir SinghPas encore d'évaluation

- CPhI Japan InformationDocument22 pagesCPhI Japan InformationctyvtePas encore d'évaluation

- Hospital List English - Jan 2018Document14 pagesHospital List English - Jan 2018hany mohamedPas encore d'évaluation

- Media Contact DirectoryDocument5 pagesMedia Contact DirectorygebbiepressPas encore d'évaluation

- Final New Launch PPT AbhiDocument78 pagesFinal New Launch PPT AbhiabhimanyujainPas encore d'évaluation

- Dmart in UAEDocument19 pagesDmart in UAEPriti SawantPas encore d'évaluation

- 2017 BOOK OF Health Service Marketing Management in Africa PDFDocument309 pages2017 BOOK OF Health Service Marketing Management in Africa PDFRama DhanuPas encore d'évaluation

- 2021 Saudi Arabia Venture Capital Report 2021Document25 pages2021 Saudi Arabia Venture Capital Report 2021Rania DirarPas encore d'évaluation

- Maya DermDocument4 pagesMaya Dermydchou_69100% (1)

- OP IP Network - IRIS FortuneDocument88 pagesOP IP Network - IRIS FortunehamzadarbarPas encore d'évaluation

- Ghana Pharmaceutical MarketDocument98 pagesGhana Pharmaceutical MarketnaleesayajPas encore d'évaluation

- Enaya Pharmacy Network EnglishDocument8 pagesEnaya Pharmacy Network EnglishMD ABUL KHAYERPas encore d'évaluation

- Buiz in UAEDocument75 pagesBuiz in UAEnishithathiPas encore d'évaluation

- Cadila Healthcare Final PPT 160715Document18 pagesCadila Healthcare Final PPT 160715SaYani SamaDdarPas encore d'évaluation

- X1 Apr 2018Document17 pagesX1 Apr 2018ay_man713Pas encore d'évaluation

- Nutraceuticals IndiaDocument19 pagesNutraceuticals IndiaajmerlatherPas encore d'évaluation

- EMBA Class Directory FINAL LowresDocument12 pagesEMBA Class Directory FINAL Lowresssss1234dPas encore d'évaluation

- DWD Pharmaceuticals LTDDocument3 pagesDWD Pharmaceuticals LTDIshika JeswaniPas encore d'évaluation

- Roland Berger Saudi Arabian Pharmaceuticals 2 PDFDocument20 pagesRoland Berger Saudi Arabian Pharmaceuticals 2 PDFVJ Reddy RPas encore d'évaluation

- 2 PharmacodynamicsDocument51 pages2 PharmacodynamicsKriziaoumo P. Orpia100% (1)

- UCSI 2017 Building DirectoryDocument11 pagesUCSI 2017 Building DirectorySeanPas encore d'évaluation

- 861 Drug Prescribing For Dentistry 2 Web 2 Email PDFDocument94 pages861 Drug Prescribing For Dentistry 2 Web 2 Email PDFRaphaela TravassosPas encore d'évaluation

- Home Boddies TACTILEDocument52 pagesHome Boddies TACTILECosmin PavelPas encore d'évaluation

- Spinal Cord Injury: C M, S - P J - LDocument99 pagesSpinal Cord Injury: C M, S - P J - Lsheel1Pas encore d'évaluation

- Weeks Appellant BriefDocument54 pagesWeeks Appellant Briefthe kingfishPas encore d'évaluation

- Resume Mckenna JonesDocument1 pageResume Mckenna Jonesapi-427456327Pas encore d'évaluation

- SCREEMDocument2 pagesSCREEMDranreb Berylle MasangkayPas encore d'évaluation

- Phase 2Document849 pagesPhase 2api-134585735Pas encore d'évaluation

- Canine and Feline Mega EsophagusDocument10 pagesCanine and Feline Mega Esophagustaner_soysurenPas encore d'évaluation

- PAS HAndbookDocument375 pagesPAS HAndbookJheanell JamesPas encore d'évaluation

- Guru AppointmentDocument2 pagesGuru AppointmentKirankumar MutnaliPas encore d'évaluation

- WNHS Og AntepartumHaemorrhageDocument17 pagesWNHS Og AntepartumHaemorrhagelydia amaliaPas encore d'évaluation

- Intestinal Malrotation and VolvulusDocument14 pagesIntestinal Malrotation and VolvulusSaf Tanggo Diampuan100% (1)

- List of Herbal Ingredients Which Are Prohibited or Restricted in MedicinesDocument12 pagesList of Herbal Ingredients Which Are Prohibited or Restricted in MedicinesEtra PublishingPas encore d'évaluation

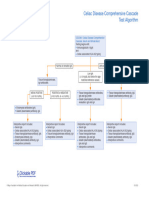

- Celiac Disease Comprehensive Cascade Test AlgorithmDocument1 pageCeliac Disease Comprehensive Cascade Test Algorithmayub7walkerPas encore d'évaluation

- Medical Laboratory Technology Journal: Potensi Antifungi Tangkai Daun Jarak Pagar Terhadap PERTUMBUHAN Candida AlbicansDocument5 pagesMedical Laboratory Technology Journal: Potensi Antifungi Tangkai Daun Jarak Pagar Terhadap PERTUMBUHAN Candida Albicanskhoko holicPas encore d'évaluation

- CE Strengths Based Nursing.24Document9 pagesCE Strengths Based Nursing.24THOHAROHPas encore d'évaluation

- Obstruktive Sleep ApneaDocument29 pagesObstruktive Sleep ApneaEfri SyaifullahPas encore d'évaluation

- A Compendium of Tranfusion Prectice Guidelines ARC Edition 4.0 Jan 2021Document75 pagesA Compendium of Tranfusion Prectice Guidelines ARC Edition 4.0 Jan 2021H Stuard B CocPas encore d'évaluation

- Para JumblesDocument8 pagesPara Jumblespinisettiswetha100% (1)

- Read and Choose The Correct Answer From The Box Below.: Boys GirlsDocument1 pageRead and Choose The Correct Answer From The Box Below.: Boys GirlsjekjekPas encore d'évaluation

- Exam 1Document13 pagesExam 1Ashley NhanPas encore d'évaluation

- Dorset County Hospital NHS Foundation TrustDocument1 pageDorset County Hospital NHS Foundation TrustRika FitriaPas encore d'évaluation

- Disclosure and Attestation Form - SPEAKERDocument1 pageDisclosure and Attestation Form - SPEAKERwethreePas encore d'évaluation

- Perdarahan Intra Dan Extra AxialDocument19 pagesPerdarahan Intra Dan Extra AxialFarmasi FKUNSPas encore d'évaluation

- #Spirochaetes & Mycoplasma#Document28 pages#Spirochaetes & Mycoplasma#Sarah PavuPas encore d'évaluation

- History of MedicineDocument33 pagesHistory of MedicineBradley KenneyPas encore d'évaluation

- Hidradenitis Suppurativa - Treatment - UpToDate PDFDocument24 pagesHidradenitis Suppurativa - Treatment - UpToDate PDFjandroPas encore d'évaluation

- Adrian Jess Galindo: DefinitionDocument2 pagesAdrian Jess Galindo: DefinitionAdrian MangahasPas encore d'évaluation