Académique Documents

Professionnel Documents

Culture Documents

EconS 501 Microeconomic Theory Lecture Notes

Transféré par

ronaldovergaraDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EconS 501 Microeconomic Theory Lecture Notes

Transféré par

ronaldovergaraDroits d'auteur :

Formats disponibles

EconS 501: ADVANCED MICROECONOMIC THEORY I

LECTURE NOTES

Felix Munoz-Garcia

1

School of Economic Sciences

Washington State University

This document contains a set of partial lecture notes that are intended to serve as a starting

point when coming to class, so every student can complement them with additional examples,

exercises and applications discussed in class. (Do not quote).

1

103G Hulbert Hall, School of Economic Sciences, Washington State University. Pullman, WA 99164-6210,

fmunoz@wsu.edu. Tel. 509-335-8402.

1

Chapter 1 Preferences and Utility

Preference and Choice

We begin our analysis of individual decision-making in an abstract setting. We will first specify a set of

possible alternatives (denoted by set X) for a particular decision maker. This set might include the

consumption bundles that an individual is considering to consume, the career paths that the student is

considering, or any general list of alternatives. Given this set, we will approach the decision making

process in two different ways. First, using the preference-based approach and second using the choice-

based approach. The first approach analyzes how the individual would use his preferences to choose an

element (or elements) from the set of alternatives X. We will then impose some rationality assumptions

on the individuals preferences. The second approach analyzes, instead, the actual choices the individual

makes when he is called to choose an element (or elements) from the set of possible alternatives.

Similarly as we did for the preference-based approach, we will also impose some consistency conditions

on the choices that the individual makes. Both of the approaches have their own advantages. For instance,

the choice-based approach is based on observables (the actual choices made by the individual decision-

maker) while the preference-based approach is based on unobservables (the individuals preferences).

1

On

the other hand, the preference-based approach is more tractable than the choice-based approach,

especially when the set of alternatives X contains many elements (which usually is the case in individual

decision-making problems).

2

After describing both approaches, and the assumptions that we will impose

on each approach, we want to understand the relationship (and potential equivalence) between both

approaches. Hence, we will examine under which conditions rational preferences imply a consistent

choice behavior, and under which conditions the opposite relationship holds.

Preference-based approach

Let us start with the preference-based approach.

3

In this regard, we will understand preferences as

attitudes of the decision-maker towards the set of alternatives X. Preferences hence should specify the

attitudes of the decision-maker towards each pair of alternatives. These attitudes are obtained by

presenting a questionnaire Q to the individual. In particular, this questionnaire asks for all elements x and

y that belong to the set of alternatives X, how do you compare element x and y? Check one and only one

box.

I prefer x to y (which we write as x y), or

I prefer y to x (which we write as y x), or

I am indifferent (which we write as x y).

1

This approach could in principle allow for more general behavioral motives than the preference-based approach.

However, as we will see, this is only in principle, since the preference-based approach will also allow for very

general individual preferences.

2

This reason explains why the preference-based approach is explained in more detail in most intermediate

microeconomics textbooks.

3

We will be using Rubinstein (lecture one) and MWG (Ch. 1B).

2

Note that we are asking the individual decision-maker to check only one box. This is related with the

completeness assumption on individual preferences.

4

In particular, we define completeness in a

preference relation if for any to alternatives x and y that belong to the set of alternatives X, we have that

either alternative x is strictly preferred y, or y is strictly preferred to x, or both (which implies that the

individual decision-maker is indifferent between x and y). This implies that the individual is capable of

comparing any pair of alternatives that we present to him. This might be a relatively strong assumption if

we think about goods that we haven't consumed in the past or goods that we havent even seen before.

Think, for instance, about the last time you were in a new ethnic restaurant in which the descriptions in

the menu did not help you decide what to order. This assumption hence considers that the individual

decision-maker has had enough time to compare all alternatives, and that he is ready to express his

preference over one of them (or indifference between two alternatives) when we ask him to compare any

two alternatives x and y.

Remark: note however that not all binary relations satisfy completeness. Indeed, the binary

relation is the brother of is not satisfied for all the elements (persons) in the set of available

alternatives (set X in this case could be a given group of people). If we select John and Bob from

this group, we might observe that neither John is the brother of Bob nor Bob is the brother of

John; i.e., they are not related. That is, not all pairs of alternatives are comparable according to

this binary relation. Hence, this binary relation does not satisfy completeness. Similarly, the

binary relation to be the father of doesn't satisfy completeness since, from a group of people,

we can select two persons that are not related.

Let us now turn into weak preferences. In order to learn the weak preferences of an individual we present

a questionnaire R to him as follows: for all alternatives x and y in the set of alternatives X (where x and y

are not necessarily distinct),

5

is alternative x at least as preferred as y?

Yes, which we write as x

y .

No, which we write as y

x .

The respondents therefore must answer yes, no, or both.

6

We are now ready to define what we mean by a

rational preference relation. We say that a preference relation

is rational if it possesses the following

two properties:

4

Note also that we do not allow the individual to add a new box in which he writes I love X. and Y. in other

words, we do not allow him to specify the intensity of his preferences over two alternatives.

5

Note that we do not assume that alternatives x and y are different. In the case that they coincide, the definition of

completeness becomes the reflexivity assumption. We discuss this assumption below, but at this stage, we can

understand the reflexivity assumption as a condition on the preference relation guaranteeing that every alternative x

is weakly preferred to, at least, one alternative: itself.

6

Note that this refers to the assumption of completeness again, since we ask the individual to be able to compare

any pair of two alternatives, where now this comparison is done using the weak preference symbol rather than the

strict reference symbol.

3

Completeness: For any pair of alternatives x and y in the set of alternatives X, either x

y, or y

x, or

both (x y).

Transitivity: For any three alternatives x, y and z in the set of alternatives X, if x

y and y

z, then it

must be that x

z.

The assumption of transitivity is often understood as that individual preferences should not cycle. In order

to understand this point, let us consider an example in which an individuals preferences do not satisfy

transitivity. James weakly prefers an apple to a banana, and he weakly prefers a banana to an orange.

However, he prefers an orange to an apple. (Note that according to transitivity, he should have preferred

an apple to an orange.) What is the problem associated to this intransitive preference relation? James

would be wiped out from the market. Indeed, businessmen could approach James (when James owns an

orange) and offer him a banana for one dollar. James will probably accept the deal since he prefers a

banana to an orange. Then the businessmen could approach James again and offer him an apple for a

dollar, something James will also accept, since he prefers an apple to a banana. Finally, the businessmen

could approach James again offering him an orange for the apple he now owns. Since James preferences

are intransitive (and therefore he prefers an orange to an apple) he would accept this deal, paying another

dollar. However, this makes James return to his original position, owning an orange, but having spent

three dollars in the process. Of course, this cycle could be repeated ad infinitum, extracting all James

wealth.

Despite the previous argument about the reasons why we shouldn't observe individual decision-makers

with intransitive preference relations, there are however situations in which intransitivities might arise:

First example. Comparing elements that are too close to be distinguishable.

When two alternatives are extremely similar we are often unable to state which of them we prefer.

Consider the following example. Take the set of alternatives X to be the real numbers, e.g., a piece of pie.

An individual states that he prefers alternative x to y if x>=y-1 (x+1>=y) but he is indifferent between x

and y if the two alternatives are very close together, i.e., |x-y|<1. Intuitively, he prefers x to y only when

alternative x is larger than y in one unit. If the difference between the two alternatives is smaller than one

he cannot tell them apart, and the individual is indifferent between both of them. Then,

Alternative 1.5 is indifferent to 0.8 since 1.5-0.8=0.7<1, and

Alternative 0.8 is indifferent to 0.3 since 0.8-0.3=0.5<1

Therefore, by transitivity we would have that 1.5 is indifferent to 0.3, but in fact 1.5 is preferred to 0.3,

since the former is larger than the later by more than one unit. This shows the presence of an intransitive

preference relation.

7

7

Note that this example could be applicable to milligrams of sugar in your coffee (very difficult to distinguish) or to

similar shades of gray paint on the wall in a room. You might not be able to distinguish one milligram more of sugar

in your coffee (a slightly darker gray color on your office walls, respectively), but you can probably detect when

your coffee is becoming too sweet (or your office is almost black!).

4

Second example. Framing effects. In certain cases intransitivity might be violated because of the way in

which alternatives are presented to the individual decision-maker, also referred as framing effects. Let

us consider an example from Rubinstein, where he showed the following holiday packages to his Masters

students, asking each student: Which holiday package do you prefer?

a. A weekend in Paris for 574 at a four star hotel.

b. A weekend in Paris at the four star hotel for 574.

c. A weekend in Rome at the five star hotel for 612.

Alternatives a and b are, of course, the same. This was indeed detected by most of the students since they

stated to be indifferent between alternatives a and b. Moreover, they strictly preferred alternative b to c.

By transitivity, hence, we should expect that students who gave the previous responses should then

strictly prefer alternative a to c when asked to compare options a and c. However, this didn't happen.

Indeed, more than 50% of the students responded that they strictly preferred alternative c to a, showing an

intransitive preference relation, merely induced by the way in which the options were presented (framed)

to the students.

Third example. Aggregation of considerations. In some cases several individual preferences must be

aggregated into only one. In these situations we might find that the resulting preference relation violates

transitivity. Let us consider the following example. The set of possible alternatives X contains three

universities where you were admitted: MIT, WSU, and your home University. When considering which

university to attend you might compare them according to different criteria. First, if you only consider the

academic prestige reasonable comparison would be:

1

: MIT

1

WSU

1

Home Univ

Second, considering the city size or congestion your comparison could be:

2

: WSU

2

HOMEUNIV

2

MIT

Finally, considering the proximity of the university to your family and friends, a reasonable comparison

would be:

3

: HOMEUNIV

3

MIT

3

WSU

We must now aggregate all of these considerations (for example, using majority rule). We do so by

making all possible pair-wise comparisons and checking, for each pair, which university wins according

to most of the criteria described above. When comparing MIT versus WSU, the former wins according to

criteria 1 and 3. When comparing WSU versus your home university, the former beats the later according

to criteria 1 and 2. Finally, comparing your home university with MIT, the former wins against the later

5

according to criteria 2 and 3. However, this resulting preference relation violates transitivity.

8

A similar

argument can be used for the aggregation of individual preferences in group decision-making, where

every person in the group has a different (transitive) preference relation but the group preferences

(aggregated from these individual preferences in order to have a ranking of alternatives politicians can use

to take decisions affecting the welfare of the entire group) are not necessarily transitive.

9

Fourth example. Intransitive preferences because there is a change in the underlying preferences. This is

very common in individuals preferences over goods that create a strong dependency or that become

addictive. For instance, when an individual starts smoking his preferences over cigarettes might be: one

cigarette is weakly preferred to no smoking and no smoking is weakly preferred to smoking heavily.

Hence, according to transitivity, he should prefer one cigarette to smoking heavily. However, once this

individual has been smoking for several years, his preferences over cigarettes could have changed to:

smoking heavily is weakly preferred to one cigarette and one cigarette is weakly preferred to no smoking

at all. According to this new preference relation, and using transitivity, we can conclude that now this

individual prefers to smoke heavily versus having only one cigarette. But this conclusion contradicts this

individuals past preferences when he started to smoke.

10

Utility function

Once we have defined the main assumptions behind a rational preference relation, we are ready to define

a utility function. A function u:XR from the set of alternatives to the set of real numbers is a utility

function representing a preference relation if, for every pair of alternatives x and y that belong to X,

x

y is equivalent to u(x) u(y).

Let us emphasize two main points from this definition. First, only the ranking of alternatives matters.

Indeed, a utility function u(x) such that u(x)=14 and u(y)=10 provides the same ranking of alternatives x

and y than utility function u(x) where u(x)=2000 and u(y)=3, since both utility functions rank

alternative x above alternative y. Hence, the individual does not care about cardinality (the number that

the utility function associates with each alternative) but instead cares only about ordinality (the ranking of

utility values among alternatives). Second, if we apply any strictly increasing function f(.) on the utility

8

you should check that by noticing that we created a cycle, since:

condition 1&3 cond. 1&2 cond. 2&3

MIT WSU Home Univ MIT

9

This is the so-called Condorcet paradox, extensively studied in social choice problems.

10

This has been criticized as a real form of intransitivity, since the individual decision-maker could be regarded as

different according to the period of time in which he states his preferences over alternatives. Hence we will only

refer to the first three types of intransitivies.

6

function u(x), i.e., v(x)=f(u(x)). Importantly, the values associated to this new function keep the ranking

of alternatives intact, and therefore the new function still represents the same preference relation.

11

Note on reflexivity. Note that we didn't define reflexivity in our previous discussion. In particular a

preference relation satisfies reflexivity if for any alternative x in X, we have that:

1. x x, so that any bundle is indifferent to itself,

2. x

x, so that any bundle is preferred or indifferent to itself, and

3. x / x

4. This assumption ensures that any bundle belongs to at least one indifference set

12

, namely the set

containing itself if nothing else. Note however, that reflexivity is implied from completeness. Indeed,

if we replace alternative y for x, we can transform the assumption of completeness into the

assumption of reflexivity.

Choice based approach

In the choice based approach we focus on the actual choices made by the individual, rather than on the

process of introspection by which the individual discovers his own preferences over different alternatives.

In the choice based approach we use the so-called choice structure, which contains two elements:

1. | is a family of nonempty subsets of X, so that every element of | is a set B X c . Let us

provide some examples of sets B.

a. In consumer theory, set B can be understood as a particular set of all the affordable

bundles for a consumer, given his wealth and the market prices. (We refer to this set of

affordable bundles as the consumers budget set.) Note that the budget set can be defined

as a subset of the real numbers.

13

b. B as a particular list of all the universities where you were admitted, among all

universities in the scope of your imagination X, i.e., B X c .

2. c(.) is a choice rule that selects, for each budget set B, a subset of elements of B, with the

interpretation that c(B) are the chosen elements from B.

11

For instance, v(x)=3u(x), v(x)=5u(x)+8, etc. are all examples of strictly increasing functions applied to the

original utility function u(x) that represent the same preference relation as u(x) since all of them maintain the same

ranking of utility values associated to each alternative x in X.

12

Below we provide a more detailed description of indifference sets, but note that they can be understood as the set

of alternatives over which the consumer is indifferent. Using an example from consumer theory, recall that

indifference sets are graphically represented using indifference curves, reflecting the set of bundles for which the

consumer reaches the same utility level.

13

In the case of consuming only two goods, the set of affordable bundles B (budget set) becomes a subset of R

2

, i.e.,

a subset of the positive quadrant, which represents all possible bundles.

7

a. Following with our example of consumer theory, c(B) would be the bundle/s that the

individual chooses to buy, among all bundles he can afford in the budget set B; and

b. In the example of the universities you were admitted to, c(B) would contain the

university that you choose to attend.

Note that c(B) might contain a single element, in which case the choice rule is a function, or it

might contain more than one element, in which case the choice rule is correspondence.

14

Examples. Let us now see two examples of choice structures. Define the set of alternatives as X={x,y,z},

and consider two different budget sets (both of them being subsets of the set of alternatives X), budget set

B1={x,y} and budget set B2={x,y,z}.

In choice structure one, the individual chooses element x, and only x, regardless of which budget set is

presented to him. That is, c1({x,y})={x} and c2({x,y,z})={x}. In choice structure two the individual still

selects only alternative x when he is confronted with budget set B1, i.e., c1({x,y})={x}. However, when

the budget set is enlarged to contain alternative z as well, as it does in B2, his choice reverts to only

alternative y, i.e., c2({x,y,z})={y}. (We will comment on the consistency of this choice rule below).

Consistency on choices: the Weak Axiom of Revealed Preference (WARP)

Paralleling the rationality assumption on the preference-based approach, we now impose a consistency

requirement on the choice-based approach. Specifically, we consider that the actual choices of an

individual are consistent if they satisfy the following weak axiom revealed preference (WARP).

We say that the choices structure (B,c(.)) satisfies the WARP if,

For some budget set with , we have that element is chosen, ( ), then B x y B x x C B eB e e

For any other budget set where alternatives and are also available, , , and where

alternative is chosen, ( ), then we must have that alternative is chosen as well, ( ).

B x y x y B

y y C B x x C B

' ' eB e

' ' e e

Example. When the individual decision-maker faces budget set B={x,y}, he chooses only alternative x.

When he faces an enlarged budget set B (which contains the same alternatives as budget set B (x and y),

but also alternative z), then his legal choices according to the WARP are:

1. x, which can be rationalized because alternative x is still the best alternative even after including

z as an additional alternative.

2. z, which can be explained because the new option z is better than the previous alternatives x and

y.

14

Informally, we generally understand a function as a mathematical mapping that provides a single element in the

range to each element in the domain, while a correspondence is understood as a mapping providing more than one

element in the range to each element in the domain.

8

3. x and z, which can be justified because new option z is very similar to alternative x and as a

consequence the decision-maker chooses both.

Note, that the individual decision-maker cannot select alternative y alone if his choice rule satisfies

WARP. Indeed, this alternative was available under budget set B but the individual did not select it when

B was presented to him. Hence, the fact that new options are now available should not cause an

alternative that was affordable but not selected under the old budget to be selected under the newly

enlarged budget set B. This means the individual cannot choose {x,y} when facing budget set B since

alternative y is contained in this choice. As suggested in the previous argument, y was not selected under

budget set B, and therefore cannot be part of the choices made by the individual under budget set B.

The following figure illustrates a choice rule that satisfies the WARP. Indeed, the individual decision-

maker selects alternatives x and y, both when facing budget set B and B.

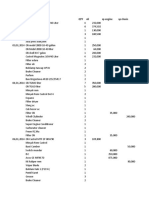

Figure #1.1

In contrast, the figure below represents a choice rule violating WARP, since the individual chooses only x

when facing budget set B, but switches to y when facing budget set B, despite of the fact that both

alternatives x and y were available under budget set B. (Note that this choice rule is similar to choice rule

2 in our above example in the previous section, where the individual decision-maker chooses only x when

confronted to budget set B, and only y when facing budget set B, where both x and y belong to budget

sets B and B. For this reason, we can conclude that choice rule 2 above violated the WARP).

9

Figure #1.2

We can now construct the preferences that the individual reveals in his actual choices when he is

confronted to choose an element (or elements) from different budget sets.

A. First, if there is some budget set B for which the individual chooses x, where alternatives x and y

belong to B, then we can say that alternative x is revealed at least as good as alternative y, and

denote it as

*

x y

.

B. Second, if there is some budget set B for which the individual chooses x but he does not select y,

where alternatives x and y belong to B, then we can say that alternative x is revealed preferred to

alternative y, and denote it as

*

x y .

[Note that when x

*

y in the above point, the individual decision-maker is allowed to choose both

alternative x and y. However, when x

*

y, the individual is only allowed to choose x.]

Let C*(B,

) be the set of optimal choices generated by the preference relation

when facing a budget

set B. using the notation, we can restate the WARP as follows:

If alternative x is revealed at least as good as y, then y cannot be revealed preferred to x, i.e., if x

*

y, then we cannot have y

*

x.

We finally examine the relationship between the preference-based approach and the choice based

approach. In particular we want to investigate under which cases a rational preference relation implies

that the choices structure satisfies the WARP, and under which conditions the opposite relationship holds.

Let us next check that a rational preference relation implies that the choices structure satisfies the WARP.

Proof:

- First, suppose that for some budget set BeB, we have that

*

, and ( , ) x y B x C B e e

.

*

( , ) , for all x C B x y y B e e

10

- In order to check WARP, assume some other budget set B' eB with , and x y B' e

*

( , ) y C B' e

.

*

( , ) , for all z y C B y z B ' ' e e

- Combining the conclusions from the previous two points, x y

and y z

, we can apply

transitivity (because the preference relation is rational), and we obtain x z

. Then

*

( , ) x C B' e

, and we find that

*

, ( , ) x y C B' e

, which proves that WARP is satisfied.

The opposite relationship (where the choice structure satisfying the WARP implies a rational preference

relation) only holds if the budget set B contains three or fewer elements. MWG describes a proof from

Arrow about this result.

Consumption sets

In this lecture we start considering the set of feasible bundles for the consumer. The consumption set is

the set of affordable bundles. One way to define a consumption set is by a set of prices, one for each

possible good, and a budget. Or a consumption set could be defined in a model by some other set of

restrictions on the set of possible consumption bundles. Also, consumption set is a subset of the

commodity space RL denoted by X contain RL whose element are the consumption bundle that the

individual can conceivably consume given the physical constrains imposed by his environment. e.g. if

consumer i can consume nonnegative quantities of all goods, it is standard to define xi as its consumption

set, a member of R+L where L is the number of goods. Normally if the agent is endowed with a set of

goods, the endowment is in the consumption set.

Let's denote a commodity bundle x as the vector of L components. For generality, at this stage we allow

each component to be positive or negative.

We can impose physical or economic constraints on the consumption set. The physical constraints are

only related with legal constraints (such as the maximum amount of consumption of a particular good, the

maximum amount of working hours, etc.). In contrast, economic constraints on the consumption set

emerge from market prices and the individual's income, which determine the set of affordable bundles for

the individual.

11

Physical constraints

Let us first have a look at the effect of imposing physical constraints on a consumption set. For simplicity

we will assume that the consumption set is defined in the set of positive real numbers. The following

figure illustrates a particular physical constraint in the labor market. Specifically, the human worker

cannot work more than 24 hours a day, and therefore his maximum amount of leisure is 24 hours. If, a

law establishes a maximum working day of 16 hours a day, his consumption set would shrink, and would

be represented by the area from 8 to 24 hours of leisure per day.

Figure #1.3

The following figure indicates the presence of indivisibilities in the consumption of good two. Indeed,

this good can only be consumed in integer amounts while good one can be consumed in any small

divisible parts. Therefore, the consumption set is given by the union of different horizontal lines, each of

them representing a particular amount of the indivisible good.

Figure #1.4

The next figure represents the consumption of two goods that cannot be enjoyed simultaneously in the

same consumption bundle. In particular, good one denotes the consumption of bread in Seattle at noon,

while good two denotes the consumption of bread in New York City at noon in the same day. Therefore,

the consumption set coincides with the two axes. Indeed, the consumer can choose to consume any

amount of bread in Seattle, or any in New York City, but not a combination of the two.

12

Figure #1.5

Finally, the following figure illustrates the presence of a minimum amount of bread that guarantees

survival. Specifically, the consumer must eat at least four slices of either type of bread (white or brown)

in order to avoid starvation. He can do so by consuming four slices of one type of bread, or a combination

of the two types.

Figure #1.6

We can now define convexity in consumption sets. We say that a consumption set X is convex if, for two

consumption bundles x and x in X, the bundle

(1 ) ( 0 , 1 ) x x x o o o '' ' = + e

is also an element of the consumption set X. Intuitively, a consumption set is convex if for any two

bundles that belong to the set we can construct a straight-line connecting them that lies completely in the

set. As a practice, let us check if some of the previous consumption sets satisfy this definition of

convexity. First, note that the consumption set representing the presence of indivisibilities in

consumption, where the individual can only consume integer amounts of good two, is not convex since

the linear combination (straight line) between any two bundles that belong to the set does not necessarily

lie in the set. Similarly, the consumption set with consumption of bread in Seattle and New York City at

noon on the same day does not satisfy convexity either. Indeed, the linear combination of any two bundles

lies entirely outside the consumption set.

15

Note that by aggregating data, such as considering the

15

As a remark, note that we are not conceding the extremes of the straight-line that connects bundles x and x in the

definition of convexity since we impose alpha>0 and <1 strictly.

13

consumption of bread in Seattle (or in New York City) during an entire month, we would be able to

convexify the consumption set, since individuals would be able to consume both goods during that time

span.

Economic constraints

Before defining the economic constraints in the individuals consumption set, let us first discuss some of

the assumptions we make on the price vector.

1. We assume that all commodities can be traded in a market, at prices that are publicly observable.

This is the so-called principle of completeness of markets (or universality of markets) seems all

goods can be traded. Importantly, note that this assumption discards the possibility that some

goods cannot be traded, such as pollution when no property rights are clearly defined.

2. Prices are assumed strictly positive for all L goods. We denote this by writing p>>0, i.e., pk>0 for

all goods k. Again, note that some prices could be negative in some circumstances, such as

pollution since individuals would be willing to pay in order to have less of them. We do not allow

for negative prices in the following chapters but we return to the possibility of negative prices

when we discuss externalities.

3. Price taking assumption: a consumers demand for all the goods he consumes represents a small

fraction of the total demand for good. Therefore, his position on whether to buy or not buy the

good does not affect market prices.

16

We are now ready to define the set of affordable bundles for the consumer. In particular bundle x,

describing the amounts purchased of L different goods, is affordable if

1 1 2 2

...

or in vector notation

L L

p x p x p x w

p x w

+ + + s

s

Note that px represents the total cost combined bundle X. at market prices p, while w represents the total

wealth of the consumer.

17

When we define the consumption set to coincide with the set of positive real

numbers, then the set of feasible (affordable) consumption bundles consists of the elements in the

following set:

{ }

,

:

L

p w

B x p x w

+

= e s

Let us next see one example of a set of affordable consumption bundles where, for simplicity, we only

consider two goods.

16

Note that this assumption will not be valid if the consumer possesses monopsony power in his demand for a

particular good. This is the case, for instance, in labor markets where only one employer buys labor services in a

relatively small locality.

17

Note here a usual distinction between wealth and income: wealth refers all of the resources of the consumer

during a certain time span (which can potentially include his entire lifetime), whereas income refers to the

individuals resources during a single time period.

14

Figure #1.7

Graphically, the upper boundary of the set of affordable consumption bundles represents the set of

bundles for which the individual entirely exhausts his wealth buying different combinations of good one

and two, i.e., p1x1+p2x2=w, or in vector notation, px=w. We refer to this upper boundary as the budget

line. Intuitively, note that the individual is exhausting all his wealth buying only good two (one), the

maximum amount of this good he can afford his w/p2 (w/p1, respectively). Finally, note that the slope of

the budget line is given by the price ratio p1/p2.

18

In the case that the consumer can buy more than two

goods, the budget line is usually referred as the budget hyperplane. The following figure illustrates the

budget hyperplane for the case in which the consumer buys three different goods. Graphically, note that

the budget hyperplane represents the surface of bundles for which the consumer exhausts his wealth.

Figure #1.8

One important characteristic of the price vector is that it is orthogonal to the budget line. In order to see

this, first note that on the budget line px=w for any x on the budget line. We can then take any other

18

Note that, solving for good two, the equation of the budget line is given by

1

2 1

2 2

p w

x x

p p

= , where w/p2

represents the vertical intercept while p1/p2 represents the negative slope.

15

bundle x which also lies on the budget line, so that px=w. Similarly for any other bundle xbar, i.e.,

pxbar=w. We can now combine these results, finding that pxbar=px=w, or p(x-xbar)=0, or simply

0 p x A =

And since this result is valid for any two bundles on the budget line, then the price vector must be

perpendicular to deltax on the budget line. Hence, this implies that the price vector is perpendicular

(orthogonal) to the budget line, as depicted in the following figure.

Figurer #1.9

Finally, we impose an assumption on the budget set which will become very convenient in later chapters

when we analyze the optimal consumption bundle that the consumer selects among all the bundles he can

afford. In particular, we consider that the budget set is convex. In this regard, we need that for any two

bundles on the budget set x and x, the linear combination

(1 ) (0,1) x x x o o o '' ' = + e

also belongs to the budget set.

19

We know that if and . Then, p x w p x w ' s s

(1 )

(1 )

p x p x p x

px px w

o o

o o

'' ' = +

' = + s

Note that the budget sets described above for two and three goods satisfied this definition of convexity

since we could select any two bundles from the budget set, construct a linear combination between both

of them (straight-line), and check that all the bundles in this linear combination belong to the budget set

as well.

Let us see next an example of a budget set that doesn't satisfy convexity. In particular, it describes the set

of affordable bundles for an individual working for a firm, with his consumption of leisure in the

19

Similarly as our definition of convexity for consumption set, note that here we only consider alpha>0 and <1

strictly, since otherwise the extremes of the linear combination between bundles x and x (that this, bundles x and x

themselves) would be included in our definition of convexity.

16

horizontal axis and his consumption of all other goods the vertical axis. Starting from the horizontal

intercept (where this individual enjoys 24 hours of leisure with no consumption of other goods), this

individual can start working and obtain a wage of s dollars per hour for his first eight hours of work. If he

works more than eight hours, he received overtime wage of s>s dollar per hour, which allows him to

consume a larger amount of other goods. However, when his labor income exceeds M dollars, he must

pay a proportion t from his total income, reducing his real wage (after taxes) to s(1-t). Graphically, this

implies that the budget line is relatively flat for the first eight hours of work, becomes steeper when the

worker starts to receive overtime pay, but becomes flatter again when the worker is taxed.

Figure #1.10

Importantly, this budget set is not convex since for any two bundles, such as x and x in the figure, its

linear combination does not lie in the budget set.

20

Quasilinear preference relations

20

In our initial discussion of convexity of the budget set, we suggested that a non-convex budget set could lead to

potential problems when solving for the optimal bundle that the consumer selects when solving his utility

maximization problem. Indeed, note that for several preference relations the above non-convex budget set could lead

to multiple solutions. Graphically, a given indifference curve could be tangent to the above budget line at several

points.

17

Intuitively, the first condition simply states that if two bundles lie on the same indifference curve then if

we increase the amount of the first good contained in both bundles, then the newly created bundles must

also lie on the same indifference curve. The second condition, on the other hand, states that if we increase

the amount of the first good in bundle X the newly created bundle must be strictly preferred to the

original bundle X. These conditions can be easily understood by looking at the following figure:

Figure #1.11

Finally, note implication of the above to conditions. In particular if bundle X is strictly preferred to

bundle y then if we increase the amount of good one in bundle X and y it must be the case that the

enlarged bundle X must be preferred to the enlarged bundle y this property is also illustrated in the figure.

After analyzing the definition of quasilinear preferences we can discuss how to detect quasilinear utility

functions. In particular, a quasilinear utility function that you might have encountered in your

intermediate microeconomics classes looks as follows

18

2

-

An example from undergrad:

( , ) ( ) where 0 and ( ) non-linear. ex: ( )

Easily generizable to 2 goods,

( , , ) ( , )

de

non linear in all other goods

U x y v x b y b v x is v x x or x

N

U x y z v x y b z

= + > =

>

= +

sirable good

The MRS of such functions is constant in the good that enters linearly in the utility function. In other

words, for a given level of good one, an increase in the amounts of good two does not affect the slope of

the indifference curve. Let us see that with an example.

Figure #1.12

Note that another example is that a linear preference relation (perfect substitutes), where both goods enter

linearly into the utility function. We can therefore conclude that preferences over perfectly substitutable

goods are a particular case of quasilinear preferences.

So far we have examined assumptions behind the preference relations and particular types of preference

relations and utility functions. However, we have not analyzed under which conditions we can guarantee

that a preference relation can be represented with a utility function. Specifically, the assumptions we

consider so far are not enough to guarantee that any preference relation can be represented with a utility

function. One example of a preference relation that cannot be represented by a utility function is the so-

called lexicographic preference relation that we discuss next.

Lexicographic preferences:

1 1

1 2 1 2

1 1 2 2

, or if

( , ) ( , ) iff

and

x y

x x y y

x y x y

>

= >

Intuitively, note that this preference relation works like alphabetizing a dictionary: first the individual

refers bundle X if it contains more of good one than bundle y if however, both bundles contain the same

amount of good one, then the individual prefers the bundle which contains more of the second good. One

important characteristic of this preference relation is that its indifference set cannot be drawn as an

19

indifference curve. For a given bundle there are no more bundles for which the consumer is indifferent.

Let us examine this property by identifying the upper contour set, lower contour set, and the indifference

set.

Figure #1.13

1 1 1

1 2

1

1

1

( , )

( ) :

( ) :

( ) : singletons

x x x

UCS x

LCS x

IND x

=

First, note that the upper contour set of bundle x is the set of bundles containing more of good one and

those bundles that, contain the same amount of good one but have more of good two. Similarly, the LCS

is defined by those bundle that contain less of good one and those that, containing the same amount of

good one, have less of good two. Hence, the UCS and LCS span all the positive quadrant, leaving no

room for the indifference set of bundle x, other than the bundle itself. As a consequence, we say that

indifference set for bundle x is the bundle itself, or in other words, that IND(x) is a singleton.

Hence, the previous example suggests that we need to impose an additional condition on preference

relations in order to guarantee that they can be represented with a utility function. This property is

continuity as we define below.

Continuity. A preference relation defined on X is continuous if it is preserved under limits. That is, for

any sequence of pairs } {

1

( , ) with for all

n n n n

n

x y x y n

and lim and lim

n n

n n

x x y y

= = , then we

have the preference relation is maintained in the limiting points, x y . Intuitively, this implies that there

are no jumps in my preferences over a sequence of pairs.

Intuitively, this property states that there can be no sudden jumps in an individual preference over a

sequence of bundles, i.e., there are no sudden preference reversals. The following figure illustrates

20

preferences that satisfy continuity, where the individual decision-maker refers bundle x1 to y1, x2 to y2,

and similarly at limiting points of the sequence, where he still prefers bundle x to y

Figure #1.14

Let us next show why a lexicographic preference relation doesn't satisfy continuity.

Figure #1.15

Notice the limits of the sequences. Intuitively, the individual prefers bundle x1 to y1 since the former

contains more of good one that the later. Similarly the individual prefers bundle x2 to y2 given that the

former still contains more of good one than the later. However, at the limiting points of the sequence,

21

bundle x becomes (0,0) while bundle y is still (0,1). Therefore, both bundles contain the same amount of

good one, and the individual ranks them based on the content of good two, leading to bundle y being

strictly preferred to bundle x. These is a preference reversal, and as a result a violation of continuity.

After describing continuity, we are ready to establish under which conditions any preference relation can

be represented using a utility function.

Figure #1.16

22

Note: as a remark, note that a utility function can satisfy continuity but still be non-differentiable. For

instance, the Leontieff utility function, min{ax1,bx2}, is continuous but cannot be differentiated at the

kink.

1

Chapter 2 Demand functions

The utility maximization problem

We are now ready to combine the tastes of the individual embodied in his utility function and the budget

line representing the set of bundles he can afford, in order to examine the set of optimal choices for the

individual. In particular, the consumer maximizes utility level by selecting a bundle X (choice variable)

subject to the fact that the cost of such bundle cannot exceed his wealth.

0

max ( ) ( )

. .

x

u x UMP

s t p x w

>

s

One important point is to know whether the above maximization problem has a solution. The Weierstrass

theorem provides us with an answer, since the objective function we are maximizing (utility function) is

continuous and the budget constraint defines a closed and bounded set (given that p>>0 and w>0),

therefore the problem does have a solution. Regarding the number of solutions to the above maximization

problem, note that if preferences are strictly convex, then the solution is unique.

For simplicity, we denote the solution to the UMP as the argmax of UMP. Argmax means: the argument,

x, that solves the maximization problem. We denote the solution as ( , ) x p w : the Walrasian demand.

We can conclude three main properties from the solution of the above maximization problem.

First, note that homogeneity of degree zero should come as no surprise. Specifically, an increase in both

the price vector and wealth level of the same extent doesn't change consumers budget set. Since the

budget set is unchanged, the optimal bundle selected by the individual shouldnt change either. Second,

note that WL follows from LNS. Indeed, if the consumer were not selecting a bundle x that lies strictly

inside the budget set (so that he is exhausting all of his wealth), we could find another bundle y at epsilon

distance from bundle x that is strictly preferred by the individual to bundle x. In this case, however, the

initial bundle x cannot be utility maximizing because there are other bundles that are still affordable and

which are strictly preferred by the consumer. If bundle x in contrast lies on the budget line we could

identify bundles that are strictly preferred to x but these bundles would be unaffordable to the consumer.

2

Figure #2.1

Finally, note that if preferences are convex (but not strictly convex) the set of bundles that maximize the

individual's utility define a convex set, as the figure below illustrates. If, in contrast, the consumers

preferences are strictly convex, he selects a unique bundle as Walrasian demand.

Figure #2.2

After describing the UMP, we can now examine the first order conditions of these maximization

problems.

3

A natural question at this point is whether the above necessary conditions are also sufficient. In other

words, under which conditions we can guarantee that the Walrasian demand that we have found is the

maximum of the UMP and not the minimum. In particular, this is the case when the utility function is

quasiconcave and monotone, and the vector of first order derivatives is different from zero for all x. Let

us briefly analyze these conditions. First, the condition stating that the utility function should be

monotone only implies that if we increase both goods simultaneously we reach a higher utility level,

which is expected in most applications. Second, the condition that the first order derivatives are different

from zero simply guarantees that there are no bliss points. Intuitively, if the vector of first-order

derivatives was zero we would have reached the peak of utility. At this point, however, the individual

would not be able to find any other preferred bundle, thus violating LNS. Finally, the condition that the

utility function satisfies quasiconcavity is also easy to justify. The following figure represents an

indifferece map of an individual whose preferences do not satisfy quasiconcavity.

Figure #2.3

4

Indeed, note that the UCS is not convex. This implies that the tangency condition between the

indifference curves under the budget line is not a sufficient condition for a utility maximization bundle.

Specifically note that a point of tangency condition such as bundle C gives a lower utility level than a

point of non-tangency, such as bundle B. therefore, if preferences do not satisfy quasiconcavity the KT

conditions (graphically represented by the tangency condition) are not sufficient for a maximum.

1

Because the three requirements for the necessary conditions to become sufficient are relatively mild, we

can then expect KT conditions to be sufficient in most economic applications.

Note: why does the MRS represent the slope of the indifference curve? Answer: note that in order to find

the slope of the indifference curve we must modify both x1 and x2 without altering the utility level of the

individual. We do that by totally differentiating the individuals utility function,

Importantly, note that so far we have been analyzing interior solutions. If, however, the individual prefers

to consume zero amounts of some of the goods, the above tangency condition will not be satisfied. In

particular, at the corner solution we find that, after taking the first order conditions,

* *

( ) ( )

,

, or alternatively, ,

because the consumer would like to consume even more of good !!

l k l

k

u x u x

x x p

l k p

l k

MRS

p p

l

c c

c c

> >

*

( )

*

In the FOCs, this implies for those goods whose consumption is zero,

x 0, and...

k

u x

k x

k

p

c

c

s

=

*

( ) *

for the good for which consumption is positve, x 0

l

u x

l l x

p

c

c

= >

* *

( ) ( )

per dollar per dollar

spent on good spent on good

l k

u x u x

x x

l k

MU MU

l k

p p

c c

c c

= >

1

Note that the two maximum this case is bundle A.

5

Figure #2.4

A note on the Lagrange multiplier. The Lagrange multiplier is usually referred as the marginal value of

relaxing the constraint in the UMP (or alternatively as the shadow price of wealth). Let us analyze why

this is the case. First, note that if we relax budget constraint in the UMP the consumer is capable of

reaching a higher indifference curve and as a consequence of obtaining a higher utility level. The

following figure illustrates this point.

Figure #2.5

Hence, we want to measure what is the increase in utility resulting from a marginal increase in wealth. In

order to do so, we take first order conditions on the individuals utility level measured at the bundle that

maximizes his utility (Walrasian demand).

6

As an example, note that if lambda=5, then a marginal increase in wealth induces an increase of five units

of utility.

Example: Lets consider a real example connected with utility maximization problem. Take the Cobb

Douglas function expressed by U (X, Y) = X

u

[

, which is subject to the following budget constraint

I = P

x

X + P

Y, where for convenience we assume +=1. We can now solve for the utility maximizing

values of X and Y for any prices (P

x

,P

) and income (I). Setting up the Lagrangian expression

1 = X

u

[

+(I -P

x

X -P

)

yields the first order conditions:

d

dx

= oX

u-

[

- P

x

=0

= X

u

[-1

- P

=0

= I - P

x

X - P

= u

Taking the ratio of the first two terms shows that

u

[X

= P

x

/P

or P

Y=

[

u

P

x

X =

1-u

u

P

x

X,

where the final equation follows because +=1. Substitution of the first order conditions to I = P

x

X +

P

Y gives P

x

X(1 +

1-u

u

)=

1

u

P

x

X. Solving for X yields X

-

= I/P

x

and a similar set of manipulations would

give

-

= I/P

.

7

Walrasian demand

We found the Walrasian demand function, ( , ) x p w , as the solution to the UMP. This demand function

satisfies several properties:

R

R

Walras' Law: for every p 0, w 0 we have

p x w for every x x(p, w)

Generally, Homog(R) of a function f (x, y) :

f (ax, ay) a f (x, y)

Example from production:

f (2L, 2K) 2 f (L, K)

>> >

= e

=

=

Recall that homogeneity of degree zero can easily be understood by the fact that an increase in prices and

wealth in the same proportion do not modify the consumers budget set.

2

Regarding Walras' law, note that

it only relies on LNS.

Let us now analyze how the Walrasian demand is affected by changes in the individuals wealth level or

in the prices of some of the goods. When demand increases in wealth we say that good is a normal good

while when it decreases in wealth we refer to those goods as inferior. Examples of the former can be

computers whereas examples of the later are Two-Buck Chuck or Wal-Mart during the economic crisis.

3

Graphically an increase in the wealth level produces an outward shift in the budget line, as the following

figure illustrates.

Figure #2.6

2

Remember that we say that a function is homogeneous of degree R if increasing all the elements of the function by

a factor alpha produces an increase in the value of the function of alpha to the power of R. hence, when a function is

homogeneous of degree zero an increase in all its arguments does not modify the initial value of the function.

3

Indeed, several reports suggest that a decrease in the average wealth during the 2009 economic crisis produced an

increase in the sales of certain discount supermarkets such as Wal-Mart.

8

At a given price level, the consumer chooses an optimal consumption bundle, as described in the figure.

We can then connect all these optimal consumption bundles for different levels of wealth forming what

we refer as the wealth expansion path, or Engel curve. When the wealth expansion indicates an increase

(decrease) in the consumption of good j as a consequence of further increments in the wealth level, we

say that this expansion path is reflecting that good j is normal (inferior, respectively). The above figure

illustrates an example in which good one is initially normal but then becomes inferior, while good two is

normal for all levels of wealth.

We now move to the analysis of how demand reacts to price changes. When the demand for good K

decreases as a result of an increase in the price of good K we simply regard that good as a usual good,

seems its quantity demanded reacts negatively to its own price. If, in contrast, quantity demanded of good

K increases as a result of an increase in the price of good K, we regard that good as Giffen.

4

We can

illustrate these negative and positive relationships in the following two figures, with demand for good K.

in the horizontal axis and own price in the vertical axis.

Figure #2.7

Other than analyzing the effect of its own price we are interested in examining the effect of a change in

the price of good L on the quantity demanded for good K (more compact preferred as cross-price

effects) we can either find that this relationship is positive for two goods regarded by the consumer as

substitutable (such as two brands of mineral water) or negative for two goods regarded as complementary

in consumption (such as left and right shoes, cars and gasoline, etc.). We can use a similar graphical

representation is the one employed above in order to represent these cross-price effects.

4

One of the few examples of Giffen goods is that of potatoes in Ireland during the 19th century. However, this is

still a strong controversy among economists on whether demand for potatoes actually moved in the same direction

as its own price.

9

Figure #2.8

In the figure on the left side we can observe that an increase in the price of one brand of mineral water

increases the demand of the other brand over no water that the consumer regards as a close substitute. In

the figure on the right, we observe how an increase in the price of gasoline reduces the demand for cars,

shifting it inwards.

We have discussed the set of properties of the optimal consumption bundle (Walrasian demand) as the

solution of the UMP. There are still, however, some important points about the UMP that we must stress.

First if we insert the optimal consumption bundle into the individuals utility function we obtain the

highest utility level that the individual can achieve by solving this UMP. More formally, we refer to the

utility function evaluated at the solution of the UMP as the indirect utility function, v(p,w). [More

generally, we will refer to the objective function of an optimization problem evaluated at the solution of

the optimization problem as the value function. Hence, the value function of the UMP is the indirect

utility function]. Function v(p,w) satisfies several properties:

1. Homogeneity of degree zero.

2. Strictly increasing in w and nonincreasing in

k

p for any k.

3. Quasiconvex: the set } {

( , ) : ( , ) p w v p w v s is convex for any v (Figures in Rubinsein and

MWG for examples).

4. Continuous in p and w.

First, note that homogeneity of degree zero should come as no surprise. In particular, it states that

increasing market prices and wealth by the same proportion does not modify consumers budget set, as a

consequence such increase does not modify the consumers optimal consumption bundle, and therefore it

doesn't modify the maximal utility level that the individual can reach, as measured by v(p,w). The second

property states that if we increase the wealth level of the individual we are enlarging the set of feasible

bundles he can afford and as a consequence the indifference curve he can reach when selecting his

optimal consumption bundle. Therefore, the maximal utility level that he can reach is strictly increasing in

his wealth level. In contrast, an increase in the price of any good shrinks the set of affordable bundles and

as a consequence the individual can only reach indifference curve associated to lower utility levels. Thus,

an increase in the price of any good K produces a reduction in the maximal utility level that the individual

10

can obtain by solving this UMP. Regarding the second property, quasi-convexity, let us provide an

intuitive explanation by using the following figures.

Figure #2.9

First, note that the indirect utility function is depicted in the prices in the horizontal axis and wealth level

in the vertical axis. Hence, when prices increase from P11 to P12, wealth must also increase in order to

maintain the same utility level for this individual. In addition, note that lower prices and higher wealth

levels are associated to higher maximal utilities. Quasiconvexity tells us that, if the max utility associated

to a given pair of prices and wealth (A) is weakly higher than the max utility associated to another pair of

prices of wealth (B), then max utility associated to the linear combination of prices and wealth between A

and B is weakly lower than that associated with A.

We can provide an alternative interpretation of Quasiconvexity as follows. The indirect utility function

satisfies quasiconvexity if the set of pairs of prices and wealth for which the max utility that the consumer

can reach is lower than that under pair (p*,w*) then the function defines a convex set. More compactly,

{ }

* *

* *

( , ) is quasiconvex if the set of ( , ) pairs for which ( , ) ( , ) is convex.

i.e., ( , ) : ( , ) ( , ) is convex

v p w p w v p w v p w

p w v p w v p w

<

<

11

Figure #2.10

An alternative way to understand Quasiconvexity uses only good one and two in the axis as follows.

Figure #2.11

Let us construct this figure sequentially. First, when the individual decision-maker is facing budget set

Bp,w, his optimal consumption bundle is x(p,w). Second, when prices and wealth change to p and w, he

faces budget set Bp,w, and therefore selects bundle x(p,w). Third, note that both bundles x(p,w) and

x(p,w) induce an indirect utility function of v(p,w)=v(pw)=ubar. Fourth, we can now construct a linear

combination of prices and wealth

'' ''

'' '

, '' '

(1 )

(1 )

p w

p p p

B

w w w

o o

o o

= +

`

= +

)

This combination of prices and wealth provides us with budget set Bp,w. Finally, note that any

solution to the UMP facing budget set Bp,w must provide a optimal consumption bundle that lies on a

lower indifference curve (associated to a lower utility level) than ubar.

12

WARP and demand

After presenting different properties about the UMP, its solution and its value function, we are now ready

create the optimal consumption bundle obtained in the above UMP with the WARP. Hence, we want to

understand if the consistency requirement imposed by the WARP limits the set of optimal consumption

bundles that individual decision-maker can select when solving the UMP.

WARP and Demand: Take two different consumption bundles

' '

( , ) and ( , ) x p w x p w , both being

affordable under (p,w).

' '

( , ) p x p w w s

When prices and wealth are (p,w), the consumer chooses

' '

( , ) despite ( , ) x p w x p w was also affordable.

Then he reveals a preference for

' '

( , ) over ( , ) x p w x p w when both are affordable. Hence, we should

expect him to choose

' '

( , ) over ( , ) x p w x p w when both are affordable (consistency). Therefore, bundle

( , ) x p w must not be affordable at

' '

( , ) p w because the consumer chooses

' '

( , ) x p w . That is

' '

( , ) p x p w w > . We can conclude that Walrasian demand satisfies WARP if, for two different

consumption bundles,

' '

( , ) ( , ) x p w x p w = :

' ' ' '

( , ) ( , ) p x p w w p x p w w s >

In words, if bundle x(pw) is affordable under budget set Bp,w, then bundle x(p,w) cannot be affordable

under budget set Bp,w.

Let us first present an example of optimal consumption bundles that satisfy WARP. The following figure,

note that bundles x(p,w) and x(p,w) are both affordable under initial prices and wealth, since they both

lie below budget line Bp,w. However bundle x(p,w) is not affordable under final prices and wealth, since

it lies above the budget line Bp,w. Therefore, WARP is satisfied.

Figure #2.12

13

Let us now examine an example in which optimal consumption bundles do not satisfy WARP. The

following figure demand under final prices and wealth, represented by bundle x(p,w), is not affordable

under initial prices and wealth, since it lies above budget line Bp,w.

5

Figure #2.13

Note the general procedure we have been using to test whether two particular bundles satisfy WARP.

First, we check if bundle x(p,w) and x(p,w) are both affordable under the initial prices and wealth.

Graphically, this implies that both bundles lie on or below budget set Bp,w. If this first step of the

procedure is satisfied then we can move to step two. Otherwise, the premise of the WARP is not satisfied,

which doesn't allow us to continue checking whether it is violated of not. In these cases, we say that the

WARP is not violated.

Second, we check if bundle x(p,w) is affordable under final prices and wealth. Graphically, bundle x(p,w)

must lie on or below budget line Bp,w. If this condition is satisfied, then this Walrasian demand violates

WARP. If, in contrast, this second step is not satisfied, then this Walrasian demand satisfies WARP.

6

Let us next evaluate another example in which optimal consumption bundles do not satisfy WARP. The

figure below represents another case in which demand under final prices and wealth, represented by

bundle x(p,w), is not affordable under initial prices and wealth, since it lies above budget line Bp,w.

Figure #2.14

5

Importantly, note that here we can check if the conclusion of the WARP since the premise of WARP is not

satisfied.

6

For more examples and practice about Walrasian demand functions that satisfy or violate WARP, see homework

assignment #2.

14

The following figure represents a similar case.

Figure #2.15

In the following figure, optimal consumption bundle under final prices and wealth, x(p,w) is affordable

under initial prices and wealth, since it lies below the budget line Bp,w. However, the optimal

consumption bundle x(p,w) under the initial prices and wealth is not affordable under the new prices and

wealth, given that it lies above budget line Bp,w. Hence, WARP is not satisfied.

Figure #2.16

In our last example below we see a similar situation as the one represented above. Specifically, the

optimal consumption bundle on the final prices and wealth, x(p,w), is affordable under initial price of

wealth since it lies below budget set Bp,w. However the demand x(p,w) is affordable under the new

prices and wealth since it lies below budget set Bp,w. Therefore, WARP is not satisfied.

7

Figure #2.17

7

In the course website you can find more applications of the WARP to taxes and subsidies, since this type of

policies modify the set of affordable bundles for the individual in a similar fashion as we did in the above figures,

15

Implications of WARP

Interestingly, the WARP has important implications on the set of optimal consumption bundles that a

given consumer chooses before and after a price change. Let us analyze these implications by considering

a reduction in the price of good one as the following figure illustrates by an upward pivoting effect on the

budget line.

Figure #2.18

But, after the price change, we want to adjust the consumers wealth so that he can consume he is initial

demand x(p,w) at the new prices. In other words, we shift the final budget line inwards (reducing this

consumers wealth) until the point at which we reach the initial consumption bundle x(p,w). Importantly,

the budget line after the shift (after the reduction in wealth) is parallel to budget line Bp,w, reflecting the

final price ratio. But, what is in particular the reduction in wealth that we must apply to this consumer in

order for him to afford bundle x(p,w)?

16

Hence, the Slutsky wealth compensation reflects that the consumers wealth has been reduced so that he

can afford his initial consumption bundle before the price change.

8

Given this definition of the Slutsky

wealth compensation, we are now ready to establish a relationship between the law of demand and the

WARP.

This is indeed an important result. It establishes that if, after the price change, the consumers wealth is

compensated a la Slustky as described above, then the WARP becomes equivalent to the law of

demand, i.e., quantity demanded and price move in different directions.

Let us next see one example in which the WARP restricts behavior when we apply Slutsky wealth

compensation.

Figure #2.19

8

in contrast, the so-called Hicksian wealth compensation is such that the wealth level of the individual after the

price change is adjusted so that he can still reach the same indifference curve he was reaching before the price

change. We will comment on this type of wealth compensation later on in this chapter.

17

The figure depicts price change similar to that represented above, where the price of good two is not

affected by the price of good one decreasing. After pivoting outwards the budget line, we apply a Slustky

wealth compensation so that the consumer can afford his initial bundle x(p,w). The consumers budget

line after the wealth compensation is hence Bp,w.

A natural question at this point is where can the optimal consumption bundle under Bp,w, x(p,w), lie.

Let us first examine whether such bundle can lie to the left-hand side of bundle x(p,w) (on segment A).

First, note that the premise of the WARP is satisfied because both bundles x(p,w) and x(p,w) would be

affordable under budget set Bp,w, since they both lie below Bp,w. However bundle x(p,w) is affordable

under final prices and wealth, given that it lies below budget set Bp,w, implying a violation of WARP.

Therefore, bundle x(p,w) cannot lie on segment A. Let us examine whether such bundle can lie to the

right-hand side of bundle x(p,w) (on segment B). First, note that bundle x(p,w) is affordable under initial

prices and wealth, since it lies below budget set Bp,w, but bundle x(p,w) will not be affordable, given

that it would lie above budget set Bp,w. Hence, the premise of the WARP does not hold, and as a

consequence, WARP would be violated if bundle x(p,w) lies on segment B. Thus, bundle x(p,w) must

contain more of good one than bundle x(p,w). We can therefore conclude that a decrease in the price of

good one (when we appropriately compensate wealth effects) leads to an increase in the quantity

demanded for such good. This is what we refer as the compensated law of demand.

9

Note an important distinction between the uncompensated law of demand and the compensated law of

demand we just described. Specifically, the demand for good one can fall as a consequence of a decrease

in the price of good, but only when wealth is compensated, as illustrated in the following figure.

Figure #2.20

This figure depicts a reduction in the price of good one similar to the one that we analyzed before. The

individual demand after the price change is given by x(p,w), where the quantity demanded of good one

9

Interesting practice: can you repeat this analysis for the case of an increase in the price of good one? First, you will

need to pivot the budget line inwards. Second, note that the wealth compensation must imply in this case an increase

in consumers wealth. Finally, you will have a budget set after the wealth compensation with two segments A and B.

Determine which one is restricted or allowed according to WARP.

18

goes down despite of the fact that the group became cheaper. In this case, therefore, the uncompensated

law of demand is not satisfied since quantity demanded and price move in the same direction. This is the

reason why we say that WARP is not a sufficient condition to yield the uncompensated law of demand,

i.e., law of demand for price changes that were not compensated. Hence, WARP and the compensated law

of demand are equivalent, but WARP and the uncompensated law aren't necessarily related. We can

examine the last point by checking whether the WARP was satisfied under the uncompensated law of

demand. In particular, bundle x(p,w) was affordable under the initial budget set Bp,w, but the

consumption bundle after the (uncompensated) price change x(p,w) was not affordable, since it lies

above budget set Bp,w. Therefore, the premise of WARP is not satisfied and hence WARP is not violated.

This example shows a case in which WARP is not violated by the uncompensated law of demand is

violated. As a consequence, this example illustrates that the WARP and the uncompensated law of

demand are not necessarily related.

The Walrasian demand function is differentiable in both prices and wealth under relatively general

conditions. Let us next examine the relationship between the compensated law of demand and the WARP.

In order to do so, let us first totally differentiate the Walrasian demand function, as follows:

( , ) ( , )

p w

dx D x p w dp D x p w dw = +

obtained from the Slutsky wealth compensation

And since the consumer's wealth is compensated,

( , ) (this is the differential analog of ( , ) ).

Substituting,

( , ) ( ,

p w

dw x p w dp w p x p w

dx D x p w dp D x p

= A = A

= +

)[ ( , ) ]

or equivalently,

( , ) ( , ) ( , )

dw

T

p w

w x p w dp

dx D x p w D x p w x p w dp

( = +

Hence, the compensated law of demand, dpdx<=0, can be also expressed as

( , ) ( , ) ( , ) 0

T

p w

dp D x p w D x p w x p w dp ( + s

where the term in brackets is the so-called Slutsky (or substitution) matrix.

11 1

1

( , ) ... ( , )

( , )

( , ) ... ( , )

where

( , ) ( , )

s ( , ) ( , )

L

L LL

l l

lk k

k

s p w s p w

S p w

s p w s p w

x p w x p w

p w x p w

p w

(

(

=

(

(

c c

= +

c c

. .

The next proposition describes the conditions under which the substitution matrix in negative

semidefinite.

19

Proposition: If ( , ) is differentiable, satisfies WL, Homog(0) and WARP, then ( , ) is

negative semidefinite,

x p w S p w

( , ) 0 for any

L

v S p w v v s eR

The fact that the substitution matrix is negative semidefinite implies that all terms in the main diagonal of

the matrix must be weakly negative. In particular, the terms in the main diagonal are sll(p,w), representing

the own-price effect, i.e., how quantity demanded for good L is affected by the price of good L.

10

As described above, the substitution effect sll(p,w) embodies two effects:

(-) for usual goods ( )for normal goods

(+) for Giffen goods (-) for inferior goods

substitution effect (-)