Académique Documents

Professionnel Documents

Culture Documents

Young Members Revenue

Transféré par

REAL SolutionsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Young Members Revenue

Transféré par

REAL SolutionsDroits d'auteur :

Formats disponibles

National Credit Union Youth Week • April 20-26, 2008

Young Members = Revenue

by Steve Rick and Philip Heckman

Do young members help or hurt MNRC/M as a measure of the average With the help of two credit unions,

your bottom line? Conventional wis- member’s effect on the credit union’s the $36-million Point Plus CU (Stevens

dom says that young members cost balance sheet. Groups of members Point, Wis.) and the $92-million Space

credit unions money, but conventional with a negative MNRC/M (the savers) Age FCU (Aurora, Colo.), we’ll show

wisdom doesn’t always know what it’s provide funds for growth, while the how the Marginal Contributions per

talking about. The following statements MNRC/M for the entire membership Member (MC/M) can begin to shed

are all true: indicates the degree to which UWCU light on young members’ supposed

A. In the short run, most members borrowers add to accumulated earn- unprofitability.

under age 18 are an expense to ings. At UWCU, the overall MNRC/M

the credit union is the annual gauge of the cooperative’s Unconventional

B. As adults, most members now health, which directly benefits all of its Wisdom

under age 18 will add more in members. Although the MC/M of Space Age

revenue than they subtract in Although the MNRC/M can be a members now under the age of 18 is

expense. useful tool for measuring annual

negative, it’s not only what I expect,

C. As adults, some members now progress in overall profitability, to in-

under age 18 will contribute a clude fees in the calculation compro- but what I hope to see. We have a

greater net revenue than their mises its value as a tool for assessing strong emphasis on saving, and these

age-mates who didn’t join until young members’ revenue contributions. results tell me it’s paying off. Our

after age 18. That’s because many fees, such as NSF youth MC/Ms become more nega-

D. Nobody knows quite why C is charges, are punitive. Presumably a tive as our young members approach

true. comprehensive youth program with an age 18. Their share balances are

Few credit unions have challenged educational component would produce growing as they develop sound

conventional wisdom on the supposed more-financially literate adult members saving habits.

“unprofitability” of youth accounts. who make better money management —John Faries, Space Age FCU

Even the most ardent youth advocates decisions. They would be more likely

acknowledge that they believe youth to avoid punitive fees, thereby reduc-

accounts generate more expense than ing total revenue. Mostly for that rea- Overall marginal

revenue. What motivates them is the son, this article will use the following, contributions per

overriding belief that the benefits of even-simpler, formula: member

raising financially literate youth justify Figure 1 shows the MC/M for all

Marginal Contribution credit unions by asset size for January

program costs. They’re convinced that per Member (MC/M)

young members eventually become through September 2007. As you can

“profitable.” And they count on “con- = Total Loan Interest see, for the most part MC/Ms rise

Paid per Member steadily as credit unions become larger

sumer inertia” to keep young members

from switching financial institutions – Total Interest & (except for the $1 billion-plus credit

later. Dividends Earned unions). It’s tempting to conclude that

per Member the positive correlation between credit

But what if a credit union didn’t

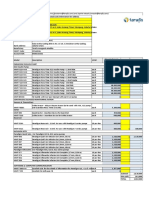

have to lose money on its young mem- Fig. 1

bers? Then no credit union would Marginal Contribution per Member

have an excuse not to have a robust (Interest Paid Minus Dividends Earned)

youth program. Here’s a statistical look

at the conventional wisdom of youth’s $250

“unprofitability:” 207

197 202

200

Marginal contribution 179 $182

162

The 2007 edition of Savingteen in-

150 145

troduced the concept of Marginal Net 127

Revenue Contribution per Member 110

(MNRC/M). MNRC/M equals total loan 101

100 87

interest paid plus total fees paid minus

67

total interest and dividends earned (all

per member). 50 $35

Some credit unions, such as the $1-

billion University of Wisconsin CU

$0

(UWCU) in Madison, use the $0- 0.5- 1-2 2-5 5-10 10-20 20-50 50- 100- 200- 500- $1,000 Overall

0.5 1.0 100 200 500 1,000 +

MNRC/M in strategic planning. UWCU

management and board consider the Asset Range (millions)

2008 SAVINGTEEN • CUNA CENTER FOR PERSONAL FINANCE | 7A

Fig. 2

Marginal Contribution per Member Overall Unconventional

Wisdom

$200 192.57

Space Age’s “core members” are

the ones we captured as youth.

$161.71 Figure 9 shows that the dividends

150 144.69 that Space Age’s adult borrowers in

$126.42 the 20-25 and 30-35 age groups

earned are significantly higher for

100 those who joined before they turned

18, compared to those who joined

after. They not only look to us for

50 loans, but they also make up the

core deposits that we lend out and,

ultimately, need to survive.

$0 —John Faries, Space Age FCU

Point Plus CU Point Plus CU’s Peers Space Age FCU Space Age FCU’s Peers

gages and vehicle loans.

union asset size and MC/M is due to unions, Space Age’s average member But by not probing deeper than this

economies of scale. But the MC/M makes an above–average contribution. gross measure of “profitability,” credit

does not include operational expenses, unions that dismiss the value of youth

so efficiencies are not a factor in this MC/M by current age programs do an injustice to the rev-

trend. Rather, as credit unions become and by age when enue contributions that youth make af-

larger, they tend to offer more sophisti- joined ter age 18. Figure 4, which compares

cated investment instruments that at- Comparing MC/Ms for youth and members by the age at which they

tract more member deposits that make adult members supports conventional joined the credit union, reveals that

possible larger, more profitable loans, wisdom. Clearly, young members as a those who became members as youth

and higher MC/Ms. group are a current drag on both credit do indeed make a positive contribution

Figure 2 shows how the overall unions’ bottom lines (Fig. 3). The fact as adults.

MC/Ms of our sample credit unions that youth make such a poor showing At first glance, Figure 4 also seems

compare. Point Plus’s average member compared to their elders is hardly sur- to reinforce the conventional wisdom

contributes less net revenue than the prising. After all, adults have signifi- that spending on youth doesn’t provide

average member of similar-size credit cantly larger deposit accounts and a sufficient return on investment. How-

unions. And compared to peer credit millions of dollars in profitable mort- ever, that conclusion ignores the fact

Fig. 3 Fig. 4

Marginal Contribution per Member Overall Marginal Contribution per Member Overall

by Current Age by Age When Joined

$250 $250

$218.16

$205.30

200 200

154.59

150 147.42 150

100 100

50 50

34.23

$27.00

-$5.60 -8.11 0

0

-$50 -$50

Point Plus CU Space Age FCU Point Plus CU Space Age FCU

Now <18 Now 18+ Joined <18 Joined 18+

8A | 2008 SAVINGTEEN • CUNA CENTER FOR PERSONAL FINANCE

National Credit Union Youth Week • April 20-26, 2008

Fig. 5 Fig. 6 Fig. 7

Marginal Contribution per Marginal Contribution per Marginal Contribution per

Member (Adults 20-25) Member (Adults 25-30) Member (Adults 30-35)

by Age When Joined by Age When Joined by Age When Joined

$450 $450 $450 $432.37

$411.25

400 400 400

$351.70

350 350 350

300 300 300

250 250 250

206.68

200 200 200

$178.73 177.05

150 150 150

100 100 100

$78.18 73.41

60.92

$48.78

50 50 50 32.32

26.08

$0 $0 $0

Point Plus CU Space Age FCU Point Plus CU Space Age FCU Point Plus CU Space Age FCU

Joined <18 Joined 18+ Joined <18 Joined 18+ Joined <18 Joined 18+

that adults of all ages who joined after MC/Ms of similar-age bars) are better borrowers than their

age 18 include a wider, more financially adults who joined as Point Plus peers who don’t join until

diverse, range of individuals. Conven- minors later (green). And Figure 9 shows that

tional wisdom begins to crumble when Figures 5, 6, and 7 compare the nearly all adults who joined either

we examine groups of adult members MC/Ms of adult members in three nar- credit union as youth are better savers

in narrower age ranges. row age groups by whether they once than their fellow members of the same

were youth members. Conventional age. The challenge is to identify the

wisdom predicts that the adult contri- factors that cause these effects and learn

butions of former youth members never how to influence them.

Unconventional

Wisdom exceed that of their age-mates who

joined after age 18. And three of the six What MC/Ms suggest

To remain viable a credit union needs comparisons shown in Figures 5, 6, and Preliminary marginal contribution

continuing streams of core depositors 7—where the green bars exceed the red analysis leads to the following conclusions:

and quality borrowers. Space Age bars in each Space Age pair—support 1. Exploring youth “profitability” further

relies heavily on indirect lending. this assumption. is desirable. First of all, MC/M compar-

Many of these borrowers have a But consider former Point Plus CU isons among more finely sliced member

loan and a minimum par balance youth members. They defy conventional subgroups over time will help zero in

share account at the credit union, and wisdom by out-performing their age- on what specific programs are most

that’s it. This generates a marginal mates in all three age groups (Figs. 5, 6 effective in raising more “profitable”

contribution that’s much higher than and 7)—where the red bars exceed the members. For example, how would

green in each Point Plus pair. In other graduation from a youth educational

we get from our “core members”

words, MC/Ms of like adults show that program affect the MC/Ms of adults of

alone. Although that’s nice to see, it’s the same age?

young members are a significant rev-

vital that we figure out how to get enue source for Point Plus CU, better Second, this preliminary MC/M analy-

them to move their deposits to us. In than their age-mates who don’t join un- sis reveals nothing about what might be

the meantime, these indirect borrow- til later. As Point Plus CU’s experience influencing adult financial behavior. For

ers provide the resources to offer the attests, youth can be worth pursuing example, did the adult members who

products and services that attract and and serving. joined the credit union as youth do so

retain youth, the core depositors who Figures 8 and 9 go a step further by because their parents have influential

view Space Age as their PFI [primary displaying the income and expense fac- characteristics in common?

financial institution]. tors that go into the Point Plus and Finally, it’s important to make a distinc-

Space Age MC/Ms. Figure 8 shows that, tion between individual and group

—John Faries, Space Age FCU

in all three age groups, adults who MC/Ms. A positive and growing overall

joined Point Plus CU as youth (red MC/M is the sign of a healthy credit

2008 SAVINGTEEN • CUNA CENTER FOR PERSONAL FINANCE | 9A

Fig. 8

Interest Adult Borrowers Paid Unconventional

by Age When Joined Wisdom

$450 $440 Everyone benefits from youth educa-

426

400

tion: Dividends paid to members in-

355 crease and so does interest earned on

350 loans. We plan to continue our youth

300 financial education efforts through our

250

high school branch because we be-

203

214 lieve that education will produce a

200 181 higher marginal contribution per mem-

150 ber between the ages of 20 to 35.

100 $84

We also plan to implement a staff

76

63 53 pay-for-performance plan, and will use

50 33 47

marginal contribution analysis to help

$0

Point Plus CU Space Age FCU Point Plus CU Space Age FCU Point Plus CU Space Age FCU

us determine its effectiveness.

Ages 20-25 Ages 25-30 Ages 30-35 —Gail G. Sawyer, Point Plus CU

Joined <18 Joined 18+

that drive growth. A youth program

Fig. 9

that invites grandparents to match

Dividends Adult Borrowers Earned young savers’ efforts could tap a poten-

by Age When Joined tially deep well of lower-cost funds.

3. Increasing services to youth can in-

$30

Note change in y-axis scale crease the amount of business they do as

compared to Figure 8

24.82

adults. Space Age CU’s data reveal the

25 promising trend that adults who joined

as youth use more credit union servic-

20 es. Among Space Age adults aged 20

to 25, average service use was the

15 14.31 14.37 same (2.0). But average Space Age

service use was 2.4 to 2.0 in favor of

10 adults aged 25 to 30 who joined as

$6.26

6.91 7.25 $7.20 youth, and 2.3 to 2.1 in favor of

5 4.43 4.12 adults aged 30 to 35 who joined as

2.65 3.18 youth.* Credit unions that recognize

1.88

$0

the inertia of consumers to change

Point Plus CU Space Age FCU Point Plus CU Space Age FCU Point Plus CU Space Age FCU providers will use their youth pro-

Ages 20-25 Ages 25-30 Ages 30-35 grams to lock members in for life.

Joined <18 Joined 18+ All in all, these early MC/M data

undermine the conventional wisdom

that young members are a drag on a

union. A credit union with a negative off now. One of the reasons that cur-

credit union’s performance. Let’s con-

overall MC/M must rely on less-profitable rent youth MC/Ms are lower than

tinue to statistically question whether

investment income and less-popular fee adults’ as a group is that youth often

long-standing assumptions about the

income to stay in business. However, an don’t have access to the number one

lack of a return on investment in

individual member with a negative credit union money maker—credit

youth are really true. ■

MC/M based on thousands of dollars in cards. Finding a low-risk way of ex-

low-interest savings and checking ac- tending credit to qualified young * Corresponding service-use-per-member fig-

counts is quite valuable. Such a saver, members under parental supervision ures were not available from Point Plus CU.

who values liquidity over earnings, helps will automatically improve youth

lower a credit union’s cost of funds. MC/Ms by raising interest income. An Steve Rick (srick@cuna.coop) is a CUNA

2. Expanding service to youth can pay example of the kind of opportunity to economist and University of Wisconsin CU

look for might be with the 36% of board member. Pat Wesenberg

school districts that the School Nutri- (Pat@pointpluscu.com) is CEO of Point

Unconventional Plus CU and a CUNA board member. Gail

Wisdom tion Association reports accept credit

and debit payments in their cafeterias. Sawyer (gail@pointpluscu.com) is vice

Our young members are a significant president of operations for Point Plus CU,

On the other side of the balance and John Faries (jfaries@spaceagefcu.org) is

source of revenue. We need to serve sheet, college saving funds, for example, vice president of accounting & marketing

the youth market as a means of survival. which are relatively cheap to administer for Space Age FCU. Philip Heckman

—Pat Wesenberg, Point Plus CU because they have few transactions, are (pheckman@cuna.coop) is CUNA’s director

a desirable way of building the assets of youth and young adult programs.

10A | 2008 SAVINGTEEN • CUNA CENTER FOR PERSONAL FINANCE

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Check Cashing Toolkit FinalDocument49 pagesCheck Cashing Toolkit FinalREAL Solutions0% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Csec Poa January 2018 p2Document21 pagesCsec Poa January 2018 p2Joshua Melville100% (2)

- Savings Products ToolkitDocument86 pagesSavings Products ToolkitREAL SolutionsPas encore d'évaluation

- Certified Credit Union Financial Counselor Training Program: The Vermont StoryDocument9 pagesCertified Credit Union Financial Counselor Training Program: The Vermont StoryREAL SolutionsPas encore d'évaluation

- Community Development Financial Institutions FundDocument22 pagesCommunity Development Financial Institutions FundREAL SolutionsPas encore d'évaluation

- Application Guidelines For TARP Community Development Capital InitiativeDocument4 pagesApplication Guidelines For TARP Community Development Capital InitiativeREAL SolutionsPas encore d'évaluation

- RS League Highlight: PCUA: Fasttracking REAL Solutions: The Pennsylvania StoryDocument12 pagesRS League Highlight: PCUA: Fasttracking REAL Solutions: The Pennsylvania StoryREAL SolutionsPas encore d'évaluation

- RS CU Tomorrow IntroDocument33 pagesRS CU Tomorrow IntroREAL SolutionsPas encore d'évaluation

- Young First Credit CardDocument13 pagesYoung First Credit CardREAL Solutions100% (2)

- Methods For Applied Macroeconomic Research Fabio Canova C °Document14 pagesMethods For Applied Macroeconomic Research Fabio Canova C °jerregPas encore d'évaluation

- Introduction To Vault CoreDocument25 pagesIntroduction To Vault CoreUni QloPas encore d'évaluation

- Presentation - RbiDocument10 pagesPresentation - Rbianandvishnubnair72% (18)

- Salubong Sa Bagong SimulaDocument82 pagesSalubong Sa Bagong SimulaLian Las PinasPas encore d'évaluation

- Cash and Cash EquivalentDocument11 pagesCash and Cash EquivalentWilsonPas encore d'évaluation

- Dumaguete Cathedral Credit Coop VS CirDocument2 pagesDumaguete Cathedral Credit Coop VS CirJuris Formaran100% (2)

- Defining General Options AddendumDocument16 pagesDefining General Options AddendumchinnaPas encore d'évaluation

- Chap 1 - Introduction To AccountingDocument27 pagesChap 1 - Introduction To AccountingMuhamad NazrinPas encore d'évaluation

- Carana BankDocument26 pagesCarana BankRakesh Kolasani NaiduPas encore d'évaluation

- (2018) US-China Trade War WFR: December 2018Document7 pages(2018) US-China Trade War WFR: December 2018Mario Roger HernándezPas encore d'évaluation

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDocument1 pageI. Convertible Currencies With Bangko Sentral:: Run Date/timeLucito FalloriaPas encore d'évaluation

- "Customer Satisfaction On Online Banking of IFIC Bank": An Internship Report OnDocument31 pages"Customer Satisfaction On Online Banking of IFIC Bank": An Internship Report Onrayhan Kobir PervezPas encore d'évaluation

- Collateral Document Delivery Request Form v2Document1 pageCollateral Document Delivery Request Form v2Teena BarrettoPas encore d'évaluation

- Al-Meezan Bank Commercial BankingDocument15 pagesAl-Meezan Bank Commercial Bankingsalman127Pas encore d'évaluation

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsVanessa DozonPas encore d'évaluation

- GL Account Balance QueryDocument5 pagesGL Account Balance QueryKhalil ShafeekPas encore d'évaluation

- Balloon Loan Calculator: InputsDocument9 pagesBalloon Loan Calculator: Inputsmy.nafi.pmp5283Pas encore d'évaluation

- A 2 - Roles and Functions of Various Participants in Financial MarketDocument2 pagesA 2 - Roles and Functions of Various Participants in Financial MarketOsheen Singh100% (1)

- IAE Student Prospective Guide San DiegoDocument15 pagesIAE Student Prospective Guide San DiegoNatalia Díaz GarcíaPas encore d'évaluation

- Preparing FinancialDocument18 pagesPreparing FinancialAbhishek VermaPas encore d'évaluation

- CAT T1 Recording Financial Transactions Course SlidesDocument162 pagesCAT T1 Recording Financial Transactions Course Slideshazril46100% (5)

- ExportDocument28 pagesExportNagarjun AithaPas encore d'évaluation

- SCB GarudaDocument34 pagesSCB Garudaisham1989Pas encore d'évaluation

- The Rise and Plummet of APP's Widjaja Family - WSJDocument10 pagesThe Rise and Plummet of APP's Widjaja Family - WSJEdgar BrownPas encore d'évaluation

- Flip Course LibraryDocument3 pagesFlip Course LibraryRaghavendra PrasadPas encore d'évaluation

- Federal Bank Debit CardDocument10 pagesFederal Bank Debit CardSyncOYLPas encore d'évaluation

- Commercial Banking Project ReportDocument44 pagesCommercial Banking Project ReportAyaz Qaiser100% (1)

- Order FormDocument1 pageOrder FormFirasPas encore d'évaluation

- Engels SEM1 SECONDDocument2 pagesEngels SEM1 SECONDJolien DeceuninckPas encore d'évaluation