Académique Documents

Professionnel Documents

Culture Documents

Capital Gains Important Decisions

Transféré par

Cma Saurabh AroraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Gains Important Decisions

Transféré par

Cma Saurabh AroraDroits d'auteur :

Formats disponibles

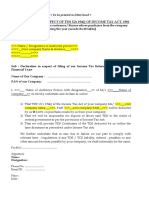

ANALYSIS OF IMPORTANT JUDICIAL DECISIONS REGARDING SECTIONS 54 / 54F OF THE INCOME TAX ACT, 1961 By

Anuradha Chavan Patil

MA. B.Com, LL.B. (Gen.), D.T.L, D.L.L & L.W, G.D.C & A

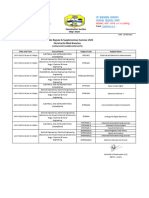

Taxation Advisor Introduction: As per Section 54 of the Income Tax Act, 1961 (the Act), if an assessee invests capital gains arising from sale of long term capital asset being a residential property, in another residential property, he gets the deduction of the amount so invested and thus has to pay no or very little income tax on such capital gains. Similarly, if the entire consideration received on sale of any other long term capital asset is invested in a residential property, the assessee needs to pay no tax on capital gains arising from sale transaction. Certain conditions have to be followed to get such tax benefits. Recently, there have been numerous judicial decisions regarding these conditions. If the army personnel assessees get the knowledge of these decisions, they can make better tax planning. I am writing this article with this aim in mind. Gist of Section 54 as Given in the Act If the assessee is an individual or a Hindu Undivided Family (HUF), and if he has got capital gains arising from transfer of long term capital asset being a residential property (that means sale of a house property after three years from the date of purchase), and if he has purchased a new house during the period from one year before the sale to two years after the sale or has constructed a new house during the period from date of sale to three years after the sale; he will get deduction of capital gains as follows:If the cost of the house purchased is less than the capital gains, deduction of the cost of the house (and tax to be paid on balance amount) and if the capital gains are less than the cost of the house, deduction of capital gains. If the capital gains are not used for such purchase / construction of new house before date of filing tax returns as per section 139 of the Act, such balance amount of capital gains can to be deposited in Capital Gains Account Scheme (CGAS) (to delay paying tax on such capital gains). If the amount of capital gains kept in the CGAS is not utilized for purchase / construction of the house during the period mentioned (three years from the date of sale), then it will be assumed to be income of last year and shall be liable to tax at that time and shall be permitted to be withdrawn after payment of tax. Account can be opened under CGAS in selected branches of all nationalized banks. Gist of Section 54F as Given in the Act Section 54F is similar to section 54. Only difference is that the entire consideration received (less expenses) from transfer of a long term capital asset other than house

property is required to be invested in a new house property. Also, before taking advantage of section 54F, the assessee should not own more than one house. Example: Say Mr. A purchased a house H1 on 01-05- 2000. Say he sold that house on 02-05-2003 for Rs. 12 lakh. Say the indexed purchase cost of house H1 on 02-05-2003 is Rs. 2 lakh. Since the house is sold after holding for more than three years, it will be a case of Long Term Capital Gain (LTCG) eligible for taking benefit under section 54. If Mr. A buys another house H2 for Rs. 10 lakh or more during the period from 03-05-2002 to 02-05-2005 the entire LTCG will be tax free. If the purchase cost of H2 was Rs. 8 lakh, he will have to pay tax on balance Rs. 2 lakh. Alternatively, if he constructs house H2 during the period from 03-05-2003 to 02-05-2006 and the cost of construction is Rs. 10 lakh or more, no tax will be payable on LTCG, if the cost of construction is Rs. 8 lakh, he will have to pay the tax on balance Rs. 2 lakh. If the amount of LTCG is not used for purchase / construction before filing the tax returns of Financial Year 2003-04, he will need to keep the money in CGAS to avoid / delay paying tax on it. If the money kept in CGAS is not used for eligible purpose before 02-05-2006, he will need to pay tax on balance amount and will be allowed to take out the balance amount. Everything else being the same in this example, if Mr. A had a plot instead of house H1, he would have to invest Rs. 12 lakh and not only Rs. 10 lakh to take benefit under section 54F and to avoid paying tax. There have been certain important judicial decisions regarding Section 54 / 54F in past few months. However, these decisions are for litigants of those cases only and one can use them to his advantage only if there are similar facts. For this, entire case decisions have to be thoroughly studied. Also, the jurisdiction of the decision making bodies has to be kept in mind. 1. The Deduction is Available even if the New House is Purchased in Joint Name or in the Name of Family Member. In the case CIT Vs. Ravindra Kumar Arora, [342 ITR 38 Delhi also ITA No. 1106 (2011)], the Delhi High Court held that Section 54F mandates that the house should be purchased by the assessee and it does not stipulate that the house should be purchased in the name of the assessee only. The house was purchased by the assessee and that too in his name and wifes name was also included additionally. Such inclusion of the name of the wife for the above-stated peculiar factual reason should not stand in the way of the deduction legitimately accruing to the assessee. Objective of Section 54F and the like provision such as Section 54 is to provide impetus to the house construction and so long as the purpose of house construction is achieved, such hyper technicality should not impede the way of deduction which the legislature has allowed. (In the given case the Income Tax Officer (ITO) had granted only 50% deduction to the assessee as the purchased house was on joint name) The Madras High Court and Haryana High Court have given similar decisions in the cases CIT Vs Natrajan (2007) 287 ITR 271 (Madras) and in CIT Vs. Gurnam Singh (2010) 327 ITR 278 respectively. Income tax Appellate Tribunal (ITAT) Hyderabad, has given a similar decision on 10-082012 in the case N. Ramkumar Vs. CIT, [ITA No. 1901 / Hyderabad/2011]. In this case, the assessee had purchased a new house in the name of his minor daughter. Entire money was used from the long term capital gains.

2. The Money can be invested in CGAS up 31st March of the Year Following the Assessment Year provided Tax Returns are Not Filed before the Investment Date The due dates for filing Income Tax Returns for the previous financial year are given in Explanation 2 to Section 139(1) of the Act. As per this explanation, the due date is 31st July for persons not required to get their accounts audited by a Chartered Accountant and is 30th September for other assesses. Hence, the assessees are likely to assume that these are the sacrosanct dates for investment under section 54 or 54F. However, it is stated in section 139(4) that any person who has not furnished a return within the time allowed to him under sub-section (1), or within the time allowed under a notice issued under sub-section (1) of section 142, may furnish the return for any previous year at any time before the expiry of one year from the end of the relevant assessment year or before the completion of the assessment, whichever is earlier. That means, if an assessee sells a property being long term capital asset on 01-04-2012 and gets LTCG of any amount say Rs. 50 Lakh, he can invest it in CGAS even on 313-2015 without having to pay any tax, provided he has not filed the income tax returns before that date (and has received no notice under section 142). I strongly advise not to delay beyond 31-03-2014 in such case because of various other consequences. Such a decision is given in the case R.K.P. Elayarajan vs. Deputy CIT [IT Appeal No. 106 (Mds.) of 2012] decided by ITAT Chennai Bench A on 15th June 2012. Similar decisions have been earlier given by Punjab and Harayana High Court in the case CIT Vs. Jagriti Aggarwal 339 ITR 610(P&H): 245 CTR 629 (P&H) [BCAJ], Karnataka High Court and Assam High Court. 3. Residential House must have Basic Amenities for Living The Punjab and Haryana High Court, in the case of Ashok Syal Vs. CIT [IT Appeal No. 566 of 2005], decided on 4th May 2012, held that the term house has not been given any statutory definition, and has to be understood in common parlance. As per dictionary, it means a place or building for human habitation. A building, in order to be habitable by a human being, is ordinarily required to have minimum facilities of washroom, kitchen, electricity, sewerage etc. Merely, building four walls is not sufficient. 4. Section 54F is available even if Borrowed Funds are used for Investment The ITAT Hyderabad Bench A has given an important decision on 15-06-2012 in the case JV Krishna Rao vs. Deputy CIT Circle 3(3) Hyderabad [IT Appeal Nos 1866 & 1867 (HYD) of 2011]. In this case, the assessee received LTCG of Rs. 3,03,77,343 /- from sale of shares. He used the money for some months and invested the amount in CGAS at right time. However, the invested amount included amount of loan taken of Rs. 33,47,333 /-. ITO objected and disallowed the benefit arising out of the loan amount. The tribunal rejected the plea of the income tax department and totally accepted the plea of the assessee. The tribunal stated, as long as the amount as required by the section 54 or section 54F is invested, the benefit has to be given to the assessee. The source of money has no relevance. The plain meaning of this decision is that the LTCG (under section 54) or consideration received (under section 54F) can be used for any purpose whatsoever; however the

required amount must be invested at the required time to avoid paying tax. That money can even be borrowed. 5. Benefit of Section 54F is available even if House is Constructed on Agricultural Land. In the case Assistant CIT Vs. Om Prakash Goyal, [IT Appeal No. 647 (JP) of 2011] decided by the ITAT Jaipur on 02-02-2012, it was held that even if agricultural land was purchased and a house was constructed on that land, the benefit of Section 54F is available. 6. Benefit of Section 54F is to be denied if No House is Constructed within the given period of Three Years. In the case Anu Agarwal Vs. Income Tax Officer, [IT Appeal No. 655 (CHD) of 2011] decided by the ITAT Chandigarh Bench B on 27-11-2012, it was held that if the construction is not completed within the given period of three years, the benefit of Section 54F is not available. If we analyze the above referred decisions, it becomes clear that the judiciary have been taking a lenient view towards assessees as far as granting benefits of Section 54 or Section 54F are concerned. One of the reasons is that the intention of the legislature in introducing Section 54 / 54F as explained in Boards Circular No.346 dated 30th June, 1982 is for encouraging house construction. It is an encouragement given to the assessee to exchange one of the residential houses for another or where he has none to convert any of his long term assets into a residential house. The object behind such a provision is to encourage large scale house building activity or investment in house property to meet acute housing shortage in the country. Therefore, looking at the legislative intent, a liberal interpretation has been given to section 54 / 54F which are beneficial provisions. At the same time, it must be understood that if the beneficial provisions are used merely for tax evasion, the courts are likely to come down harshly on the assessees. (Approximate 2000 Words) -----------------------------------------------------------------------------

Vous aimerez peut-être aussi

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraPas encore d'évaluation

- Goods and Services Tax 2022 English (31!03!2022) Final For Printing-062f0e3be13e397.79281451Document198 pagesGoods and Services Tax 2022 English (31!03!2022) Final For Printing-062f0e3be13e397.79281451Cma Saurabh AroraPas encore d'évaluation

- Delivery Challan Issue For Jobw WorkDocument1 pageDelivery Challan Issue For Jobw WorkCma Saurabh AroraPas encore d'évaluation

- Chart PatternsDocument3 pagesChart PatternsCma Saurabh AroraPas encore d'évaluation

- Solution:: The Following Are The Data Given in The Question For FactoringDocument1 pageSolution:: The Following Are The Data Given in The Question For FactoringCma Saurabh AroraPas encore d'évaluation

- Indian Economic CrisisDocument7 pagesIndian Economic CrisisCma Saurabh AroraPas encore d'évaluation

- Chapt ER: Real Options, Investment Strategy and ProcessDocument18 pagesChapt ER: Real Options, Investment Strategy and ProcessCma Saurabh AroraPas encore d'évaluation

- Challenges and Impact of Disinvestment On Indian Economy: Dr. M. K. Rastogi, Sharad Kr. ShuklaDocument10 pagesChallenges and Impact of Disinvestment On Indian Economy: Dr. M. K. Rastogi, Sharad Kr. ShuklaCma Saurabh AroraPas encore d'évaluation

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument16 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersCma Saurabh AroraPas encore d'évaluation

- Impact of Housing On GDP Employment FULL REPORTDocument94 pagesImpact of Housing On GDP Employment FULL REPORTCma Saurabh AroraPas encore d'évaluation

- Name of Organisation Month: YearDocument6 pagesName of Organisation Month: YearCma Saurabh AroraPas encore d'évaluation

- 33 Revision of Assessment Under Section 264 PDFDocument1 page33 Revision of Assessment Under Section 264 PDFCma Saurabh AroraPas encore d'évaluation

- QUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheDocument3 pagesQUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheCma Saurabh AroraPas encore d'évaluation

- Sec 87A PDFDocument1 pageSec 87A PDFCma Saurabh AroraPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Agricultural Economics 1916Document932 pagesAgricultural Economics 1916OceanPas encore d'évaluation

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- Portrait of An INTJDocument2 pagesPortrait of An INTJDelia VlasceanuPas encore d'évaluation

- Saet Work AnsDocument5 pagesSaet Work AnsSeanLejeeBajan89% (27)

- Ibbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Document2 pagesIbbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Bastián EnrichPas encore d'évaluation

- SME-Additional Matter As Per Latest Syllabus Implementation WorkshopDocument14 pagesSME-Additional Matter As Per Latest Syllabus Implementation WorkshopAvijeet BanerjeePas encore d'évaluation

- 4th Sem Electrical AliiedDocument1 page4th Sem Electrical AliiedSam ChavanPas encore d'évaluation

- Subqueries-and-JOINs-ExercisesDocument7 pagesSubqueries-and-JOINs-ExerciseserlanPas encore d'évaluation

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocument10 pagesResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXPas encore d'évaluation

- On CatiaDocument42 pagesOn Catiahimanshuvermac3053100% (1)

- Datasheet Qsfp28 PAMDocument43 pagesDatasheet Qsfp28 PAMJonny TPas encore d'évaluation

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaPas encore d'évaluation

- Google App EngineDocument5 pagesGoogle App EngineDinesh MudirajPas encore d'évaluation

- Cic Tips Part 1&2Document27 pagesCic Tips Part 1&2Yousef AlalawiPas encore d'évaluation

- L1 L2 Highway and Railroad EngineeringDocument7 pagesL1 L2 Highway and Railroad Engineeringeutikol69Pas encore d'évaluation

- Binary File MCQ Question Bank For Class 12 - CBSE PythonDocument51 pagesBinary File MCQ Question Bank For Class 12 - CBSE Python09whitedevil90Pas encore d'évaluation

- Ikea AnalysisDocument33 pagesIkea AnalysisVinod BridglalsinghPas encore d'évaluation

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Document2 pagesCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoPas encore d'évaluation

- Cs8792 Cns Unit 1Document35 pagesCs8792 Cns Unit 1Manikandan JPas encore d'évaluation

- Basics: Define The Task of Having Braking System in A VehicleDocument27 pagesBasics: Define The Task of Having Braking System in A VehiclearupPas encore d'évaluation

- Environmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsDocument8 pagesEnvironmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsAhmad Zubair Hj YahayaPas encore d'évaluation

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDocument5 pagesThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyPas encore d'évaluation

- Reflections On Free MarketDocument394 pagesReflections On Free MarketGRK MurtyPas encore d'évaluation

- Cabling and Connection System PDFDocument16 pagesCabling and Connection System PDFLyndryl ProvidoPas encore d'évaluation

- ICSI-Admit-Card (1) - 230531 - 163936Document17 pagesICSI-Admit-Card (1) - 230531 - 163936SanjayPas encore d'évaluation

- Manual 40ku6092Document228 pagesManual 40ku6092Marius Stefan BerindePas encore d'évaluation

- NOP PortalDocument87 pagesNOP PortalCarlos RicoPas encore d'évaluation

- 18PGHR11 - MDI - Aditya JainDocument4 pages18PGHR11 - MDI - Aditya JainSamanway BhowmikPas encore d'évaluation

- What Caused The Slave Trade Ruth LingardDocument17 pagesWhat Caused The Slave Trade Ruth LingardmahaPas encore d'évaluation

- Information Security Chapter 1Document44 pagesInformation Security Chapter 1bscitsemvPas encore d'évaluation