Académique Documents

Professionnel Documents

Culture Documents

497691document Retention Policy

Transféré par

scorpion.0411Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

497691document Retention Policy

Transféré par

scorpion.0411Droits d'auteur :

Formats disponibles

***This sample is provided solely for informational purposes.

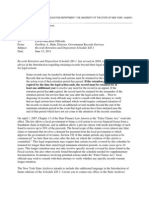

Nothing in this document constitutes legal advice*** D OCUMENT R ETENTION AND D ESTRUCTION P OLICY

OF

E AST H ARLEM A RTS

A RTICLE I Purpose

East Harlem Arts (the Corporation) acknowledges its responsibility to preserve information relating to litigation, audits and investigations, and to remain in compliance with federal and state reporting laws. The Sarbanes-Oxley Act of 2002 makes it a crime to alter, cover up, falsify, or destroy any document to prevent its use in an investigation or official proceeding. Failure on the part of directors, officers, or employees of the Corporation to retain certain corporate records can result in civil and criminal sanctions against the Corporation and its directors, officers, members or employees and disciplinary action against responsible individuals. The purpose of this Document Retention and Destruction Policy (the Policy) is to: (a) ensure that all non-critical records are retained for no longer than the minimum period required by law (see Schedule B, Records Retention Schedule), thereby eliminating storage space problems and minimizing expense; ensure that all critical records, are retained either permanently or for the required period (see Schedule B, Records Retention Schedule); and ensure that records are destroyed pursuant to a standard policy that has been developed for business reasons. A RTICLE II Corporate Records The corporate records of the Corporation (the Corporate Records) include all records produced by directors, officers, members or employees, whether in paper or electronic form. The Corporate Records include memoranda, e-mail, contracts, minutes, voicemail, reports, receipts and revenue filings regardless of where the document is stored, including network servers, desktop or laptop computers and handheld computers and other wireless devices with text messaging capabilities.

(b)

(c)

A RTICLE III Document Retention and Destruction a. Length of Retention. The Corporate Records should be retained for the relevant period set forth on Schedule B. The categories listed on Schedule B are intended to be general and should be interpreted as including all types of records relating to that category, including correspondence, notes, and reports. Documents sent to storage should be identified by category and should specify a scheduled destruction date in accordance with Schedule B. b. Scheduled Destruction. The elected secretary of the board of directors of the Corporation (the Secretary) shall be responsible for ensuring that any scheduled destruction of the Corporate Records is carried out in accordance with Schedule B and this Policy. c. Prohibited Destruction. Destruction of records relating to litigation or governmental investigations may constitute a criminal offense. The Secretary shall be responsible for suspending destruction of any Corporate Records as soon as any litigation, governmental investigation or audit, civil action or enforcement proceeding is suspected, reasonably anticipated or commenced against the Corporation, its officers, directors, members or employees. d. Reporting Requirement. A director, officer, member, or employee with knowledge of potential or actual litigation, an external audit, investigation or similar proceeding involving the Corporation, must report this information to the Board of Directors as soon as possible. e. Electronic Records. This Policy shall apply to all records regardless of whether the records are stored on paper or on computer hard drives, floppy disks or other electronic media. See Schedule A, Guidelines for the Disposition of Electronic Mail Messages. From time to time the Corporation may establish additional retention or destruction policies or schedules. Notwithstanding the foregoing, if any member or employee believes or is informed by the Corporation that certain records are relevant to litigation or potential litigation, then those records must be preserved until the board of directors determines the records are no longer needed. A RTICLE IV Administration and Oversight The Secretary is responsible for the administration and enforcement of this Policy. Either the Secretary or another responsible person must monitor compliance with the retention periods. That person is specifically charged with overseeing periodic reviews of records in accordance with the policy.

A RTICLE V Adoption of Policy This policy was adopted on ______ __, 2008 by resolution of the board of directors.

A NNEX A E AST H ARLEM A RTS

DOCUMENT RETENTION AND DESTRUCTION POLICY ACKNOWLEDGEMENT

I, ____________________, the undersigned check one [ ] Member [ ] Officer and/or Director [ ] Employee of the East Harlem Arts (the Corporation) affirm that: a. b. c. I have received a copy of the Corporations Document Retention and Destruction Policy; I have read and understand the policy; and I agree to comply with the policy. ______________________________ Name: Title:

Schedule A Guidelines for Disposition of Electronic Mail Messages East Harlem Arts-related e-mail messages are corporate records and must be managed according to this Policy. As per Schedule B, general e-mail correspondence should be deleted after one year. E-mail that contains or attaches other records should be retained for the period relevant for the contained or attached record. An e-mail message that does not meet the definition of a record (i.e., personal e-mail or junk e-mail) should be deleted immediately from the system. East Harlem Arts e-mail servers are NOT intended for long-term record retention. E-mail messages and any associated attachment(s) with retention periods greater than three (3) years should be kept in similar fashion to paper records or electronically stored in an appropriate file on the network drive. The printed or electronic copy of the e-mail message must contain the following header information: who sent the message; who the message was sent to; date and time the message was sent; and the subject of the message.

An e-mail message can be deleted once a paper copy has been printed or the email message has been stored electronically. The paper copy or the electronic copy must be retained for the appropriate time period per this record retention policy.

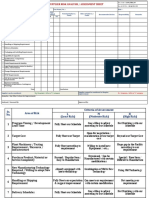

Schedule B Records Retention Schedule Category of File Corporate Records Item Articles of Incorporation, Bylaws, Minute books Board meeting agendas & materials Conflict of interest disclosure forms Accounts payable ledgers and schedules Auditor management letters, audit reports Bank deposits & statements Bank reconciliations Charitable organization registration statements (filed with New York State Attorney General) Checks (for important payments and purchases) Contracts, notes & agreements Correspondence general (including e-mail) Correspondence legal and important matters Depreciation Schedules Expense analyses/expense distribution schedules Financial statements (audited) IRS Form I-9 (store separate from personnel file) Policies occurrence type and claims-made types Accident reports, Claims (after settlement), Fire inspection reports Group disability records Safety (OSHA) reports Deeds, Mortgages, and Bills of Sale Leases (expired) Correspondence with legal counsel or accountants, not otherwise listed IRS exemption determination & related correspondence Tax audit closing letters and Tax returns Timecards Withholding tax statements Fund agreements (signed) and correspondence Gift acknowledgments Retention Period Permanent 7 years 7 years 7 years Permanent 3 years 2 years 7 years Permanent 7 years after all obligations end 1 year Permanent Permanent 7 years Permanent Greater of 1 year after end of service, or 3 years Permanent 7 years 7 years after end of benefits Permanent Permanent 7 years after all obligations end 7 years after return is filed Permanent Permanent 3 years 10 years Permanent Permanent

Correspondence, Finance & Administration

Insurance

Real Estate

Tax

Development

Category of File

Item Trust agreements and correspondence

Retention Period 7 years after termination of trust 7 years after completion of funded program 7 years after application is declined or withdrawn 7 years after all obligations end 1 year Permanent 7 years from date of termination 10 years 7 years after all obligations end Permanent

Community Philanthropy

Approved grant applications, acknowledgement letters Declined/withdrawn grant applications Consultant contracts/files Employment applications and resumes nonemployees Employee handbooks, orientation & training materials Employee personnel files, payroll records and timesheets Workers compensation claims (after settlement) Software licenses & support agreements Trademark registrations and copyrights

Human Resources

Technology

Vous aimerez peut-être aussi

- Audit And Compliance A Complete Guide - 2021 EditionD'EverandAudit And Compliance A Complete Guide - 2021 EditionPas encore d'évaluation

- Document Retention Program PolicyDocument6 pagesDocument Retention Program PolicyMazhar Ali JoyoPas encore d'évaluation

- KL - Record Disposal and Retention PolicyDocument16 pagesKL - Record Disposal and Retention PolicyParameswaran Lakshmynarayanan100% (2)

- HIPAA Security Gap Assessment Audit ReportDocument62 pagesHIPAA Security Gap Assessment Audit ReportfrerePas encore d'évaluation

- Maryland Transportation Audit ReportDocument22 pagesMaryland Transportation Audit ReportDaniel MillerPas encore d'évaluation

- Procedure On Risk ManagementDocument14 pagesProcedure On Risk ManagementRajagopal RamaswamyPas encore d'évaluation

- Records Retention PolicyDocument8 pagesRecords Retention PolicyWadek1960100% (1)

- ISO 9001 Compliance Audit Schedule ExampleDocument5 pagesISO 9001 Compliance Audit Schedule ExampleMohamedPas encore d'évaluation

- Records Retention Policy and ScheduleDocument7 pagesRecords Retention Policy and Schedulewindli2012Pas encore d'évaluation

- 13 Internal Audit Procedure Integrated Preview enDocument3 pages13 Internal Audit Procedure Integrated Preview enBogdan CorneaPas encore d'évaluation

- ISO 9001 Audit Gap Analysis ChecklistDocument54 pagesISO 9001 Audit Gap Analysis Checklistsaravanan ramkumarPas encore d'évaluation

- Computer & Network Procedures To Manage IT SystemsDocument4 pagesComputer & Network Procedures To Manage IT SystemsJohn GreenPas encore d'évaluation

- I General: Internal Audit ChecklistDocument33 pagesI General: Internal Audit ChecklistHimanshu GaurPas encore d'évaluation

- Internal Audit ProcedureDocument12 pagesInternal Audit ProcedureCyber GuruPas encore d'évaluation

- Data Retention Archivingand DestructionDocument19 pagesData Retention Archivingand DestructionMajanja AsheryPas encore d'évaluation

- IA Audit Report - SampleDocument6 pagesIA Audit Report - SampleMounirDridi100% (1)

- RiskTreatmentPlanTemplate ISO27001Document15 pagesRiskTreatmentPlanTemplate ISO27001Yulian SaniPas encore d'évaluation

- Example of Business Continuity PlanDocument26 pagesExample of Business Continuity PlanAmishPas encore d'évaluation

- 17 - Procedure - Control of Records ProcessDocument4 pages17 - Procedure - Control of Records ProcessSaAhRaPas encore d'évaluation

- DOC06 - ISO 27001-2013 ISMS Manual TOPDocument25 pagesDOC06 - ISO 27001-2013 ISMS Manual TOPIRIE100% (1)

- (Y C N) D B P & P: OUR Ompany AME ATA Reach Olicy RoceduresDocument11 pages(Y C N) D B P & P: OUR Ompany AME ATA Reach Olicy Roceduresburak yesilderya0% (1)

- Supplier Audit ChecklistDocument21 pagesSupplier Audit ChecklistAnonymous W2gdmMVhoM100% (2)

- Audit WorkprogramDocument29 pagesAudit WorkprogramMakarand LonkarPas encore d'évaluation

- 17 - Procedure - Control of Records ProcessDocument4 pages17 - Procedure - Control of Records ProcessSaAhRa100% (1)

- Information Risk PDFDocument11 pagesInformation Risk PDFJose Carlos Laura RamirezPas encore d'évaluation

- PR-5 - Docuent Control ProcedureDocument7 pagesPR-5 - Docuent Control ProcedureSAMEER JAVEDPas encore d'évaluation

- CISO Appointment LetterDocument1 pageCISO Appointment Letternanand91550% (2)

- Data Retention Policy TemplateDocument2 pagesData Retention Policy Templatewaleed100% (1)

- Internal Audit ChecklistDocument6 pagesInternal Audit Checklistkarlkristoff9950100% (5)

- Vendor Management Policy and Procedures PDFDocument9 pagesVendor Management Policy and Procedures PDFPrashant Shenoy100% (1)

- Standard Operating Procedure Audit Program PDFDocument14 pagesStandard Operating Procedure Audit Program PDFamnarjayaPas encore d'évaluation

- Internal Audit ISO 9001-2008 Checklist 1-20-12Document43 pagesInternal Audit ISO 9001-2008 Checklist 1-20-12TravisPas encore d'évaluation

- Corrective Action Request (CAR)Document2 pagesCorrective Action Request (CAR)tanto_deep_15Pas encore d'évaluation

- InternalAuditSOP 012413Document8 pagesInternalAuditSOP 012413zubair90Pas encore d'évaluation

- NIST SP 800-171r1Document125 pagesNIST SP 800-171r1Fabio MartinezPas encore d'évaluation

- (Company Name) : (Company Group, Division, Location)Document8 pages(Company Name) : (Company Group, Division, Location)prasad_kcp100% (1)

- Document Control ProcessDocument7 pagesDocument Control Processbrenda smithPas encore d'évaluation

- Capa Risk RCADocument53 pagesCapa Risk RCAMahmood KhanPas encore d'évaluation

- Supplier Risk Analysis or Assessment With Supplier SelectionDocument2 pagesSupplier Risk Analysis or Assessment With Supplier SelectionHarjeet Singh100% (1)

- 3-YR Internal Audit PlanDocument9 pages3-YR Internal Audit PlanJb LavariasPas encore d'évaluation

- Document and Records ManagementDocument3 pagesDocument and Records ManagementarnoldPas encore d'évaluation

- Document Control-SOPDocument2 pagesDocument Control-SOPnivil_thomasPas encore d'évaluation

- The Beginner's Guide To CAPA SmartsheetDocument1 pageThe Beginner's Guide To CAPA SmartsheetIan Flor FloresPas encore d'évaluation

- NIST Sp800-34-Rev1nov11-2010Document149 pagesNIST Sp800-34-Rev1nov11-2010Alberto Pazmiño ProañoPas encore d'évaluation

- Internal Audit ProcedureDocument4 pagesInternal Audit Procedureelisma fitriPas encore d'évaluation

- ISO 27001 Controls and Checklist - MineDocument17 pagesISO 27001 Controls and Checklist - MineSonya100% (1)

- Internal Audit of Procurement Activity - A Case StudyDocument5 pagesInternal Audit of Procurement Activity - A Case StudyGurvinder Mann Singh PradhanPas encore d'évaluation

- Pii Awareness Training: Don'T Be Tomorrow'S HeadlinesDocument38 pagesPii Awareness Training: Don'T Be Tomorrow'S HeadlinesPeter PanPas encore d'évaluation

- Records Retention PolicyDocument167 pagesRecords Retention PolicyBrian GaineyPas encore d'évaluation

- Control of Documents ProcedureDocument5 pagesControl of Documents Procedureaileen_macayanPas encore d'évaluation

- ISMS Control of Risks and OpportunitiesDocument6 pagesISMS Control of Risks and OpportunitiesAmine RachedPas encore d'évaluation

- Shankar Subramaniyan: ISO27001: Implementation & Certification Process OverviewDocument24 pagesShankar Subramaniyan: ISO27001: Implementation & Certification Process Overviewje100% (1)

- Complaints Management ProcedureDocument18 pagesComplaints Management Procedureanku4frenzPas encore d'évaluation

- 14 Domains of ISO 27001: Cybersecurity Career LauncherDocument9 pages14 Domains of ISO 27001: Cybersecurity Career LauncherRohanPas encore d'évaluation

- QMS Internal Auditor TrainingDocument43 pagesQMS Internal Auditor TrainingJan Francis Wilson MapacpacPas encore d'évaluation

- IT General Control Audit Work ProgramDocument7 pagesIT General Control Audit Work Programមនុស្សដែលខកចិត្ត ជាងគេលើលោកPas encore d'évaluation

- Corrective And Preventive Action A Complete Guide - 2020 EditionD'EverandCorrective And Preventive Action A Complete Guide - 2020 EditionPas encore d'évaluation

- Information risk management Complete Self-Assessment GuideD'EverandInformation risk management Complete Self-Assessment GuideÉvaluation : 3 sur 5 étoiles3/5 (1)

- Document Retention PolicyDocument13 pagesDocument Retention Policyjmontalvo8404Pas encore d'évaluation

- Instalacion WIndows Server 2012 - Dell R720Document13 pagesInstalacion WIndows Server 2012 - Dell R720Alfonso La Rosa SandónPas encore d'évaluation

- DM Quick Guides AnnotationsDocument2 pagesDM Quick Guides Annotationsscorpion.0411Pas encore d'évaluation

- Catalogues and KeywordsDocument28 pagesCatalogues and Keywordsscorpion.0411Pas encore d'évaluation

- Developing A Standards-Based Records Management Program: Frank Mcgovern Product Marketing EngineerDocument36 pagesDeveloping A Standards-Based Records Management Program: Frank Mcgovern Product Marketing Engineerscorpion.0411Pas encore d'évaluation

- Taxonomy Matrix White PaperDocument12 pagesTaxonomy Matrix White Paperscorpion.0411Pas encore d'évaluation

- E Mail MGMTDocument12 pagesE Mail MGMTscorpion.0411Pas encore d'évaluation

- SOP02 Ordering Supplies From The WarehouseDocument7 pagesSOP02 Ordering Supplies From The Warehousescorpion.0411Pas encore d'évaluation

- The SecretaryDocument3 pagesThe Secretaryscorpion.0411Pas encore d'évaluation

- Instructions For Java PatchesDocument3 pagesInstructions For Java Patchesscorpion.0411Pas encore d'évaluation

- Ecm StrategyDocument35 pagesEcm Strategyscorpion.0411Pas encore d'évaluation

- Aus Sme CG ToolkitDocument86 pagesAus Sme CG ToolkitlispatPas encore d'évaluation

- Beginning Java 2 JDK 5Document33 pagesBeginning Java 2 JDK 5scorpion.0411100% (1)

- Policy Records Management Functional Retention and Disposal ScheduleDocument9 pagesPolicy Records Management Functional Retention and Disposal Schedulescorpion.0411Pas encore d'évaluation

- 1109 S 1Document12 pages1109 S 1scorpion.0411Pas encore d'évaluation

- Notes On Plato's PhaedrusDocument3 pagesNotes On Plato's Phaedrusscorpion.0411Pas encore d'évaluation

- TaxonomyDocument37 pagesTaxonomyscorpion.0411Pas encore d'évaluation

- Bus Class ChemDocument77 pagesBus Class Chemscorpion.0411Pas encore d'évaluation

- Introduction To R3-SAP R3 ABAP4 TrainingDocument33 pagesIntroduction To R3-SAP R3 ABAP4 Trainingscorpion.0411Pas encore d'évaluation

- Recommended ExecutableDocument12 pagesRecommended Executablescorpion.0411Pas encore d'évaluation

- Relationship Between IEC StandardsDocument1 pageRelationship Between IEC Standardsscorpion.0411Pas encore d'évaluation

- Sales and Operations Planning The Key To Continuous Demand SatisfactionDocument14 pagesSales and Operations Planning The Key To Continuous Demand Satisfactionscorpion.0411Pas encore d'évaluation

- Healthcare Provider Performance InsightDocument4 pagesHealthcare Provider Performance Insightscorpion.0411Pas encore d'évaluation

- White Paper On Technical Development Approach For Sap Implemention ProjectsDocument10 pagesWhite Paper On Technical Development Approach For Sap Implemention ProjectsAniket PandePas encore d'évaluation

- Taxonomy Development AdviceDocument3 pagesTaxonomy Development Advicescorpion.0411Pas encore d'évaluation

- FX Made Easy - James DicksDocument1 pageFX Made Easy - James Dicksscorpion.0411Pas encore d'évaluation

- TASD41Document124 pagesTASD41scorpion.0411100% (2)

- Mon - Am - 3 - Hare-Brown ISMSDocument27 pagesMon - Am - 3 - Hare-Brown ISMSscorpion.0411Pas encore d'évaluation

- Encl 1Document3 pagesEncl 1scorpion.0411Pas encore d'évaluation

- PowerOfSimplicity Jack Trout (Summary)Document14 pagesPowerOfSimplicity Jack Trout (Summary)fundo100% (1)

- Soundarya Lahari Yantras Part 6Document6 pagesSoundarya Lahari Yantras Part 6Sushanth Harsha100% (1)

- International Freight 01Document5 pagesInternational Freight 01mature.ones1043Pas encore d'évaluation

- Quanta To QuarksDocument32 pagesQuanta To QuarksDaniel Bu100% (5)

- Contemporary Philippine Arts From The Regions: Quarter 1Document11 pagesContemporary Philippine Arts From The Regions: Quarter 1JUN GERONAPas encore d'évaluation

- Sheltered 2 Item Recycle ListDocument5 pagesSheltered 2 Item Recycle ListRachel GPas encore d'évaluation

- Mathematics - Mathematics of Magic - A Study in Probability, Statistics, Strategy and Game Theory XDocument32 pagesMathematics - Mathematics of Magic - A Study in Probability, Statistics, Strategy and Game Theory XHarish HandPas encore d'évaluation

- Operator'S Manual Diesel Engine: 2L41C - 2M41 - 2M41ZDocument110 pagesOperator'S Manual Diesel Engine: 2L41C - 2M41 - 2M41ZMauricio OlayaPas encore d'évaluation

- Low Speed Aerators PDFDocument13 pagesLow Speed Aerators PDFDgk RajuPas encore d'évaluation

- Battery Checklist ProcedureDocument1 pageBattery Checklist ProcedureKrauser ChanelPas encore d'évaluation

- EQ JOURNAL 2 - AsioDocument3 pagesEQ JOURNAL 2 - AsioemanPas encore d'évaluation

- Veritas™ High Availability Agent For WebSphere MQ Installation and Configuration Guide / WebSphere MQ InstallationDocument64 pagesVeritas™ High Availability Agent For WebSphere MQ Installation and Configuration Guide / WebSphere MQ InstallationkarthickmsitPas encore d'évaluation

- Raksha Mantralaya Ministry of DefenceDocument16 pagesRaksha Mantralaya Ministry of Defencesubhasmita sahuPas encore d'évaluation

- Outline Calculus3Document20 pagesOutline Calculus3Joel CurtisPas encore d'évaluation

- Paul Spicker - The Welfare State A General TheoryDocument162 pagesPaul Spicker - The Welfare State A General TheoryTista ArumPas encore d'évaluation

- Ismb ItpDocument3 pagesIsmb ItpKumar AbhishekPas encore d'évaluation

- Crisis of The World Split Apart: Solzhenitsyn On The WestDocument52 pagesCrisis of The World Split Apart: Solzhenitsyn On The WestdodnkaPas encore d'évaluation

- Current Trends and Issues in Nursing ManagementDocument8 pagesCurrent Trends and Issues in Nursing ManagementMadhu Bala81% (21)

- Daily Lesson Log Quarter 1 Week 1Document5 pagesDaily Lesson Log Quarter 1 Week 1John Patrick Famadulan100% (1)

- Guideline - Research ProposalDocument38 pagesGuideline - Research ProposalRASPas encore d'évaluation

- Preparing For CPHQ .. An Overview of Concepts: Ghada Al-BarakatiDocument109 pagesPreparing For CPHQ .. An Overview of Concepts: Ghada Al-BarakatiBilal SalamehPas encore d'évaluation

- Advocacy Firm Business Plan by SlidesgoDocument40 pagesAdvocacy Firm Business Plan by SlidesgoirinaPas encore d'évaluation

- An Eastern Orthodox Understanding of The Dangers of Modernity and TechnologyDocument10 pagesAn Eastern Orthodox Understanding of The Dangers of Modernity and TechnologyTimothy ZelinskiPas encore d'évaluation

- Procter and Gamble - MarketingDocument10 pagesProcter and Gamble - MarketingIvana Panovska100% (5)

- Marketing Micro and Macro EnvironmentDocument8 pagesMarketing Micro and Macro EnvironmentSumit Acharya100% (1)

- SDN Van NotesDocument26 pagesSDN Van Notesmjsmith11Pas encore d'évaluation

- Stucor Qp-Ec8095Document16 pagesStucor Qp-Ec8095JohnsondassPas encore d'évaluation

- Iec Codes PDFDocument257 pagesIec Codes PDFAkhil AnumandlaPas encore d'évaluation

- Plain English Part 2Document18 pagesPlain English Part 2ابو ريمPas encore d'évaluation

- Tyler Nugent ResumeDocument3 pagesTyler Nugent Resumeapi-315563616Pas encore d'évaluation

- Spring 2010 - CS604 - 1 - SolutionDocument2 pagesSpring 2010 - CS604 - 1 - SolutionPower GirlsPas encore d'évaluation