Académique Documents

Professionnel Documents

Culture Documents

ACCT 3210 Scavenger Hunt

Transféré par

Habib A IslamTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ACCT 3210 Scavenger Hunt

Transféré par

Habib A IslamDroits d'auteur :

Formats disponibles

ACCT 3210 Accounting Scavenger Hunt Spring 2014 Instructor: Prof. Laura J.

Lachmiller

Student Details: Name: Habib A Islam BGSU I.D: 0020224740 Program: MBA

Section1: 1. Mary Jo White is the current chairman of the SEC. She was sworn in as the chair of SEC on April 10, 2013. The president of the United States of America appoints the Chair of SEC (U.S. Securities and Exchange commission, 2013). 2. During the post war era in the 1920s, there was surge in securities trading. There were a lot of systematic risks involved in the trading of stocks, which the investors did not consider. Besides there were also a lot of fraudulent activities in securities trading which was not regulated by the federal government. As a result an estimated 50 million dollars worth of stock became worthless that belonged to almost 20 million investors, large and small. (U.S. Securities and Exchange Commission, 2013). All these led to the stock market crash in October 1929. Congress held subsequent hearings to identify the cause of the crash and the ways by which such incident can be prevented in the future. To regain public faith in the economy and the money market the congress passed the securities act of 1933 and consequently the securities exchange act of 1934. The latter was responsible for the creation of SEC, which was designed to restore public confidence by providing the investors and the markets with more reliable information and clear rules of honest dealing (U.S. Securities and Exchange Commission, 2013). 3. The SEC was created in 1934. The securities exchange act of 1934 was responsible for its creation. (U.S. Securities and Exchange Commission, 2013). 4. The Basic two objectives of the 1933 securities are cited as such: Companies publicly offering securities for investment dollars must tell the public the truth about their businesses, the securities they are selling, and the risks involved in investing. (U.S. Securities and Exchange Commission, 2013). People who sell and trade securities brokers, dealers, and exchanges must treat investors fairly and honestly, putting investors' interests first. (U.S. Securities and Exchange Commission, 2013).

Section 2: 1. The Electronic Data Gathering, Analysis, and Retrieval system also known as EDGAR is a database which performs automated collection, validation, acceptance and forwarding of submissions by individuals, companies or others who are required by law to file forms with securities and exchange commission of the United States of America. This information can be accede and downloaded for free (U.S. Securities and Exchange Commission, 2013). 2. The report was filed on the 1st of February 2013. The period end date for the report is on the 31st of December. (U.S. Securities and Exchange Commission, 2013). Section 3: 1. The Mission of the FASB is noted as such: The mission of the FASB is to establish and improve standards of financial accounting and reporting that foster financial reporting by nongovernmental entities that provides decision-useful information to investors and other users of financial reports. ( Financial Accounting Standards Board, 2013)

2. The chairman of FSAB is Russell G. Golden and the Board Members are: Russell G. Golden, Daryl E. Buck, Thomas J. Linsmeier, R. Harold Schroeder, Marc A. Siegel, and Lawrence W. Smith. ( Financial Accounting Standards Board, 2013) 3. The FASB was created in 1973 to establish standards of financial reporting, which governs preparation of financial reports by organizations that arent owned by the government. ( Financial Accounting Standards Board, 2013) 4. Disclosure of Foreign Currency Translation Information-FAS issue 1 ( Financial Accounting Standards Board, 2013) 5. The first two of the seven standard setting procedures are as follows: 1. The Board identifies financial reporting issues based on requests/recommendations from stakeholders or through other means. 2. The FASB decides whether to add a project to the technical agenda based on a staffprepared analysis of the issues.

Bibliography: 1. U.S. Securities and Exchange Commission, 2013.(Online) Available at: <http://www.sec.gov/edgar/searchedgar/companysearch.html>(January 15, 2014) 2. U.S. Securities and Exchange Commission, 2013.(Online) Available at: < http://www.sec.gov/edgar/searchedgar/companysearch.html> (January 15, 2014) 3. Financial Accounting Standards Board, 2013. (Online) Available at: <http://www.fasb.org/jsp/FASB/Page/LandingPage&cid=1175805317350> (January 15, 2014)

Vous aimerez peut-être aussi

- Senate Doc 93-62 Title Acknowledgements IntroDocument23 pagesSenate Doc 93-62 Title Acknowledgements IntroJargons Nether EnPas encore d'évaluation

- Talent Management QuestionnaireDocument3 pagesTalent Management QuestionnaireG Sindhu Ravindran100% (2)

- CFA二级 财务报表 习题 PDFDocument272 pagesCFA二级 财务报表 习题 PDFNGOC NHIPas encore d'évaluation

- Chap 012Document20 pagesChap 012Hemali MehtaPas encore d'évaluation

- Johnson OCE Complaint 11.13.23Document6 pagesJohnson OCE Complaint 11.13.23Aaron ParnasPas encore d'évaluation

- WritingAssignment FinActg1B Michelle Kelsey Davis KristinDocument16 pagesWritingAssignment FinActg1B Michelle Kelsey Davis Kristinkrstn_hghtwrPas encore d'évaluation

- MScFE 560 FM - Compiled - Notes - M2 PDFDocument21 pagesMScFE 560 FM - Compiled - Notes - M2 PDFtylerPas encore d'évaluation

- 04.03.23 Re IRNewswires Organized Crime Investigations Issues Worldwide Scam AlertDocument17 pages04.03.23 Re IRNewswires Organized Crime Investigations Issues Worldwide Scam AlertThomas WarePas encore d'évaluation

- Securities and Exchange Commission: Name: Mai Ngoc Duc Class: VISK2012B ID: 304037Document4 pagesSecurities and Exchange Commission: Name: Mai Ngoc Duc Class: VISK2012B ID: 304037Mai Ngoc DucPas encore d'évaluation

- An Analysis of Fraud - Causes Prevention and Notable CasesDocument51 pagesAn Analysis of Fraud - Causes Prevention and Notable CasesCarla RodriguezPas encore d'évaluation

- Commodity Futures Trading Commission: Vol. 78 Friday, No. 76 April 19, 2013Document30 pagesCommodity Futures Trading Commission: Vol. 78 Friday, No. 76 April 19, 2013MarketsWikiPas encore d'évaluation

- CG Assignment 01Document11 pagesCG Assignment 01Aun AbbasPas encore d'évaluation

- Citigroup - A Case Study in Managerial and Regulatory FailuresDocument70 pagesCitigroup - A Case Study in Managerial and Regulatory FailuresJulius NatividadPas encore d'évaluation

- A Global Comparison of Insider Trading RegulationsDocument23 pagesA Global Comparison of Insider Trading Regulationsmaga1991Pas encore d'évaluation

- SEC Testimony On Virtual CurrenciesDocument71 pagesSEC Testimony On Virtual CurrenciesCharles Hoskinson100% (5)

- The SEC's Role in The Global Era: How The SEC Will Protect U.S. Investors in Foreign MarketsDocument27 pagesThe SEC's Role in The Global Era: How The SEC Will Protect U.S. Investors in Foreign MarketsJohanes Alverandy ArioPas encore d'évaluation

- HealthSouth Inc An Instructional Case ExDocument13 pagesHealthSouth Inc An Instructional Case Exgayan vijerathnePas encore d'évaluation

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyPas encore d'évaluation

- Gensler Testimony 9-15-22Document13 pagesGensler Testimony 9-15-22Syed Abdul NasirPas encore d'évaluation

- An Analysis of Fraud - Causes Prevention and Notable CasesDocument51 pagesAn Analysis of Fraud - Causes Prevention and Notable CasesStephen YigaPas encore d'évaluation

- Dodd-Frank ACT: 1. Oversees Wall StreetDocument12 pagesDodd-Frank ACT: 1. Oversees Wall StreetTanishaq bindalPas encore d'évaluation

- CHP 2HW # 1 Slides 1-10Document2 pagesCHP 2HW # 1 Slides 1-10Timothy HartPas encore d'évaluation

- Senate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Document68 pagesSenate Hearing, 111TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2010Scribd Government DocsPas encore d'évaluation

- EXCLUSIVE: Watchdog Demands Senate Ethics Probe Democrat's 'Clear Violation' of Stock Filing Law After DCNF InvestigationDocument2 pagesEXCLUSIVE: Watchdog Demands Senate Ethics Probe Democrat's 'Clear Violation' of Stock Filing Law After DCNF InvestigationGabe KaminskyPas encore d'évaluation

- DTCCDocument13 pagesDTCCGregory DiazPas encore d'évaluation

- See SEC Release No. 33-9150 (October 13, 2010), 75 FR 64182 (October 19, 2010), Available atDocument4 pagesSee SEC Release No. 33-9150 (October 13, 2010), 75 FR 64182 (October 19, 2010), Available atMarketsWikiPas encore d'évaluation

- Future of Money and PaymentsDocument56 pagesFuture of Money and PaymentsCarlos MartinsPas encore d'évaluation

- Mutual Fund: Securities Exchange Act of 1934Document2 pagesMutual Fund: Securities Exchange Act of 1934Vienvenido DalaguitPas encore d'évaluation

- Forensic and Investigative Accounting Module 2Document42 pagesForensic and Investigative Accounting Module 2Jhelson SoaresPas encore d'évaluation

- A Study On U.S. Money MarketDocument58 pagesA Study On U.S. Money Marketgaurav kalamkarPas encore d'évaluation

- Business Environment of USADocument18 pagesBusiness Environment of USAMahendraKochharPas encore d'évaluation

- Bank of AmericaDocument113 pagesBank of AmericaMarketsWikiPas encore d'évaluation

- American AssemblyDocument32 pagesAmerican Assemblyflorinab2010Pas encore d'évaluation

- Financial Reporting and The Securities and Exchange CommissionDocument18 pagesFinancial Reporting and The Securities and Exchange CommissionJordan YoungPas encore d'évaluation

- SEC Crowdfunding Rulemaking Under The JOBS Act - An Opportunity Lost S GuzikDocument29 pagesSEC Crowdfunding Rulemaking Under The JOBS Act - An Opportunity Lost S GuzikCrowdfundInsiderPas encore d'évaluation

- House Hearing, 108TH Congress - Investing For The Future: 529 State Tuition Saving PlansDocument170 pagesHouse Hearing, 108TH Congress - Investing For The Future: 529 State Tuition Saving PlansScribd Government DocsPas encore d'évaluation

- Jan 2010 DCW IssueDocument48 pagesJan 2010 DCW IssueAdil AbrarPas encore d'évaluation

- Money and The Public Debt - Treasury Market Liquidity As A Legal PDocument115 pagesMoney and The Public Debt - Treasury Market Liquidity As A Legal POtrdPas encore d'évaluation

- Financial Markets and ServicesDocument16 pagesFinancial Markets and Servicesriddhima anandPas encore d'évaluation

- Securities Law-An Introduction and OverviewDocument6 pagesSecurities Law-An Introduction and Overviewmuneebmateen01Pas encore d'évaluation

- Senate Hearing, 112TH Congress - Securities Lending in Retirement Plans: Why The Banks Win, Even When You LoseDocument191 pagesSenate Hearing, 112TH Congress - Securities Lending in Retirement Plans: Why The Banks Win, Even When You LoseScribd Government DocsPas encore d'évaluation

- Financial Privacy: Perspectives From The Payment Cards IndustryDocument15 pagesFinancial Privacy: Perspectives From The Payment Cards IndustryFlaviub23Pas encore d'évaluation

- The Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItDocument284 pagesThe Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItSteve B. SalongaPas encore d'évaluation

- Jean Ramirez - Inside Job Movie ReviewDocument14 pagesJean Ramirez - Inside Job Movie ReviewJean Paul RamirezPas encore d'évaluation

- Rule-Comments@sec GovDocument200 pagesRule-Comments@sec GovAbdelmadjid djibrinePas encore d'évaluation

- Elizabeth Warren Letter To SECDocument4 pagesElizabeth Warren Letter To SECdavidsirotaPas encore d'évaluation

- Preliminary Study of India's Insolvency RegimeDocument77 pagesPreliminary Study of India's Insolvency RegimeRheaPas encore d'évaluation

- SecReg Outline 1 - Stern DetailedDocument127 pagesSecReg Outline 1 - Stern Detailedsachin_desai_9Pas encore d'évaluation

- Hearing: Insurance Oversight and Legislative ProposalsDocument131 pagesHearing: Insurance Oversight and Legislative ProposalsScribd Government DocsPas encore d'évaluation

- Emerging Trends of InsiderDocument28 pagesEmerging Trends of InsiderShivamPandeyPas encore d'évaluation

- Diana PrestonDocument9 pagesDiana PrestonMarketsWikiPas encore d'évaluation

- Offshore Financial Centers and Regulatory CompetitionD'EverandOffshore Financial Centers and Regulatory CompetitionPas encore d'évaluation

- Bank of AmericaDocument20 pagesBank of AmericaSingh Gurminder100% (2)

- Company Law II ProjectDocument18 pagesCompany Law II ProjectUday ReddyPas encore d'évaluation

- United States Securities RegulationDocument14 pagesUnited States Securities RegulationAntonia AmpirePas encore d'évaluation

- Bankster Hearings - SchapiroDocument29 pagesBankster Hearings - SchapiroForeclosure FraudPas encore d'évaluation

- IG Reports Re Federal SpendingDocument14 pagesIG Reports Re Federal SpendingJennifer PeeblesPas encore d'évaluation

- Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the BeneficiariesD'EverandFiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the BeneficiariesPas encore d'évaluation

- Understanding Systemic Risk in Global Financial MarketsD'EverandUnderstanding Systemic Risk in Global Financial MarketsPas encore d'évaluation

- Capitol Gains: Exposing and Reforming Government Financial Crimes.D'EverandCapitol Gains: Exposing and Reforming Government Financial Crimes.Pas encore d'évaluation

- The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) ConsequencesD'EverandThe New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) ConsequencesPas encore d'évaluation

- What Has Contributed To The Success of GalanzDocument2 pagesWhat Has Contributed To The Success of GalanzHabib A Islam100% (2)

- Applied Economics Using StataDocument170 pagesApplied Economics Using StataMurali MuthusamyPas encore d'évaluation

- Data CleaningDocument10 pagesData Cleaningmrg1212005Pas encore d'évaluation

- Apple Case StudyDocument11 pagesApple Case StudyHabib A IslamPas encore d'évaluation

- 8.0 Managing BrandsDocument24 pages8.0 Managing BrandsHabib A IslamPas encore d'évaluation

- What Has Contributed To The Success of GalanzDocument2 pagesWhat Has Contributed To The Success of GalanzHabib A Islam100% (2)

- Inference Formulas and AssumptionsDocument7 pagesInference Formulas and AssumptionsHabib A IslamPas encore d'évaluation

- T TableDocument1 pageT TableHabib A IslamPas encore d'évaluation

- Demand Curve of Scharffen Berger: Analysis of The SymptomsDocument1 pageDemand Curve of Scharffen Berger: Analysis of The SymptomsHabib A IslamPas encore d'évaluation

- POP 501 Final SBDocument1 pagePOP 501 Final SBHabib A IslamPas encore d'évaluation

- Behc Beefits at A GlanceDocument1 pageBehc Beefits at A GlanceHabib A IslamPas encore d'évaluation

- Manhattan Gmat Sentence Correction QuestiondDocument53 pagesManhattan Gmat Sentence Correction QuestiondHabib A IslamPas encore d'évaluation

- Practicum Orientation MAMDocument68 pagesPracticum Orientation MAMSonali TiyePas encore d'évaluation

- Course OutlineDocument7 pagesCourse OutlineHabib A IslamPas encore d'évaluation

- Manhattan Gmat Sentence Correction AnswersDocument5 pagesManhattan Gmat Sentence Correction AnswersHabib A IslamPas encore d'évaluation

- CBA Practicum GuideDocument13 pagesCBA Practicum GuideHabib A IslamPas encore d'évaluation

- POP Mock Exam QsDocument2 pagesPOP Mock Exam QsHabib A IslamPas encore d'évaluation

- Standard Normal Distribution TableDocument2 pagesStandard Normal Distribution TableHabib A IslamPas encore d'évaluation

- Durham County Policy Surplus Real PropertyDocument5 pagesDurham County Policy Surplus Real PropertySarahPas encore d'évaluation

- Jesse - Livermore Market ThoughtsDocument5 pagesJesse - Livermore Market ThoughtsbrijeshagraPas encore d'évaluation

- Case Study - Brazil and US - CottonDocument7 pagesCase Study - Brazil and US - CottonDISHA MALHOTRAPas encore d'évaluation

- SOSC 2340 Final ExamDocument8 pagesSOSC 2340 Final Examshak najakPas encore d'évaluation

- Product Development Life Cycle - In-Depth DiscussionDocument2 pagesProduct Development Life Cycle - In-Depth DiscussionFahim IftikharPas encore d'évaluation

- Skill Shortage Is A Crucial Social IssueDocument21 pagesSkill Shortage Is A Crucial Social Issuead4w8rlPas encore d'évaluation

- Dealing With Competition: Competitive ForcesDocument9 pagesDealing With Competition: Competitive Forcesasif tajPas encore d'évaluation

- BankDocument7 pagesBankSheeza NoorPas encore d'évaluation

- Foreign Direct Investments: Joint Venture Licensing Turnkey ContractDocument2 pagesForeign Direct Investments: Joint Venture Licensing Turnkey ContractAdib NazimPas encore d'évaluation

- Ac3143 ch1-4 PDFDocument62 pagesAc3143 ch1-4 PDFNero PereraPas encore d'évaluation

- Sbi NeftformatDocument5 pagesSbi NeftformatPPCPL Chandrapur0% (1)

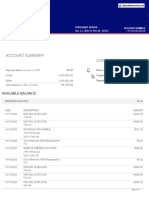

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument22 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRohit RajagopalPas encore d'évaluation

- 10 CIR V CitytrustDocument1 page10 CIR V CitytrustAnn QuebecPas encore d'évaluation

- Why Blue-Collar Workers Quit Their JobDocument4 pagesWhy Blue-Collar Workers Quit Their Jobsiva csPas encore d'évaluation

- Taxation LawDocument7 pagesTaxation LawJoliza CalingacionPas encore d'évaluation

- ACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilityDocument5 pagesACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilitySayadi AdiihPas encore d'évaluation

- 2023-10-22 ConstrainedOptimization (PreviousYearQuestions)Document4 pages2023-10-22 ConstrainedOptimization (PreviousYearQuestions)ManyaPas encore d'évaluation

- HW Microeconomics)Document3 pagesHW Microeconomics)tutorsbizPas encore d'évaluation

- Townhall SustDocument21 pagesTownhall Sustpritom173Pas encore d'évaluation

- Revised Corporation CodeDocument5 pagesRevised Corporation CodekeithPas encore d'évaluation

- PPFAS Monthly Portfolio Report February 28 2023Document44 pagesPPFAS Monthly Portfolio Report February 28 2023DevendraPas encore d'évaluation

- DCF and Pensions The Footnotes AnalystDocument10 pagesDCF and Pensions The Footnotes Analystmichael odiemboPas encore d'évaluation

- Revisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It IndustryDocument6 pagesRevisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It Industrydevi 2021100% (1)

- Question Bank Macro EconomicsDocument4 pagesQuestion Bank Macro EconomicsSalim SharifuPas encore d'évaluation

- Retirement WorksheetDocument55 pagesRetirement WorksheetRich AbuPas encore d'évaluation

- Call For Papers: 11 International Scientific Conference of Business FacultyDocument6 pagesCall For Papers: 11 International Scientific Conference of Business FacultyИванов ХристоPas encore d'évaluation

- Unit 401 Marketing Topic 1Document27 pagesUnit 401 Marketing Topic 1gkzunigaPas encore d'évaluation

- FM - Kelompok 4 - 79D - Assignment CH9, CH10Document8 pagesFM - Kelompok 4 - 79D - Assignment CH9, CH10Shavia KusumaPas encore d'évaluation