Académique Documents

Professionnel Documents

Culture Documents

Derivative Securities Problem Set 2

Transféré par

Rehan HasanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Derivative Securities Problem Set 2

Transféré par

Rehan HasanDroits d'auteur :

Formats disponibles

ECON 261

Principles of Finance

Derivative Securities

DERIVATIVE SECURITIES: PRACTICE SET 1

Question1 It is May and a trader writes a September call option with a strike price of $20. The stock price is $18, and the option price is $2. Describe the investors cash flows if the option is held until September and the stock price is $25 at this time.

Question 2 Suppose that a June put option on a stock with a strike price of $60 costs $4 and is held until June. Under what circumstances will the holder of the option make a gain? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a short position in the option depends on the stock price at the maturity of the option. (Profit= Payoffcost)

Question 3 In March, a US investor instructs a broker to sell one July put option contract on a stock. The stock price is $42 and the strike price is $40. The option price is $3. Explain what the investor has agreed to. Under what circumstances will the trade prove to be profitable? What are the risks?

Question 4 Suppose that a European put option to sell a share for $60 costs $8 and is held until maturity. Under what circumstances will the seller of the option (the party with the short position) make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the option.

Question 5 A trader buys a European call option and sells a European put option. The options have the same underlying asset, strike price and maturity. Describe the traders position. Under what circumstances does the price of the call equal the price of the put?

(Answers on the next Page)

ECON 261

Principles of Finance

Derivative Securities

ANSWERS Exercise Price can be denoted by Xs or Ks. It doesnt matter what you call i.t

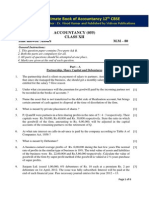

Question1 It is May and a trader writes a September call option with a strike price of $20. The stock price is $18, and the option price is $2. Describe the investors cash flows if the option is held until September and the stock price is $25 at this time. The trader has an inflow of $2 in May and an outflow of $5 in September. The $2 is the cash received from the sale of the option. The $5 is the result of the option being exercised. The investor has to buy the stock for $25 in September and sell it to the purchaser of the option for $20. Question 2 Suppose that a June put option on a stock with a strike price of $60 costs $4 and is held until June. Under what circumstances will the holder of the option make a gain? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a short position in the option depends on the stock price at the maturity of the option. The seller of the option will lose if the price of the stock is below $56.00 in June. (This ignores the time value of money.) The option will be exercised if the price of the stock is below $60.00 in June. The profit as a function of the stock price is shown in Figure S1.2.

6 Profit 4 2 0 50 -2 -4 -6 -8 55 60 65 70 Stock Price

Figure S1.2

Profit from short position In Problem 1.1

ECON 261

Principles of Finance

Derivative Securities

Question 3 In March, a US investor instructs a broker to sell one July put option contract on a stock. The stock price is $42 and the strike price is $40. The option price is $3. Explain what the investor has agreed to. Under what circumstances will the trade prove to be profitable? What are the risks? The investor has agreed to buy 100 shares of the stock for $40 in July (or earlier) if the party on the other side of the transaction chooses to sell. The trade will prove profitable if the option is not exercised or if the stock price is above $37 at the time of exercise. The risk to the investor is that the stock price plunges to a low level. For example, if the stock price drops to $1 by July (unlikely but possible), the investor loses $3,600. This is because the put options are exercised and $40 is paid for 100 shares when the value per share is $1. This leads to a loss of $3,900 which is offset by the premium of $300 received for the options.

Question 4 Suppose that a European put option to sell a share for $60 costs $8 and is held until maturity. Under what circumstances will the seller of the option (the party with the short position) make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the option. Ignoring the time value of money, the seller of the option will make a profit if the stock price at maturity is greater than $52.00. This is because the cost to the seller of the option is in these circumstances less than the price received for the option. The option will be exercised if the stock price at maturity is less than $60.00. Note that if the stock price is between $52.00 and $60.00 the seller of the option makes a profit even though the option is exercised. The profit from the short position is as shown in Figure S9.2.

ECON 261

Principles of Finance

Derivative Securities

+ Question 5 A trader buys a European call option and sells a European put option. The options have the same underlying asset, strike price and maturity. Describe the traders position. Under what circumstances does the price of the call equal the price of the put? The trader has a long European call option with strike price K and a short European put option with strike price K (). Suppose the price of the underlying asset at the maturity of the option is ST . If ST > K , the call option is exercised by the investor and the put option expires worthless. The payoff from the portfolio is ST K . If ST < K , the call option expires worthless and the put option is exercised against the investor. The cost to the investor is K ST . Alternatively we can say that the payoff to the investor is ST K (a negative amount). In all cases, the payoff is ST K , the same as the payoff from the forward contract. The traders position is equivalent to a forward contract with delivery price K . Suppose that F is the forward price. If K = F , the forward contract that is created has zero value. Because the forward contract is equivalent to a long call and a short put, this shows that the price of a call equals the price of a put when the strike price is F.

Vous aimerez peut-être aussi

- ECON 385v1 Assignment 1 (Version B) November 2016Document6 pagesECON 385v1 Assignment 1 (Version B) November 2016hannahPas encore d'évaluation

- Fedex AssignmentDocument20 pagesFedex AssignmentAibak Irshad100% (2)

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaPas encore d'évaluation

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionPas encore d'évaluation

- 45Document9 pages45Anonymous yMOMM9bsPas encore d'évaluation

- T3 (Mathematics and Statistics) Question and Answer Dec 2014 PDFDocument19 pagesT3 (Mathematics and Statistics) Question and Answer Dec 2014 PDFPatience KalengaPas encore d'évaluation

- BKM CH 03 Answers W CFADocument8 pagesBKM CH 03 Answers W CFAAmyra KamisPas encore d'évaluation

- Lecture 1A Introduction and Understanding Cash FlowsDocument20 pagesLecture 1A Introduction and Understanding Cash FlowsJohnPas encore d'évaluation

- Issues and Challenges in Service MarketingDocument10 pagesIssues and Challenges in Service MarketingDivya GirishPas encore d'évaluation

- JPM MCPDocument11 pagesJPM MCPmmmansfiPas encore d'évaluation

- Sensor PM2.5 Con ArduinoDocument7 pagesSensor PM2.5 Con ArduinoIvan Palacios100% (1)

- Business Economics ICFAIDocument20 pagesBusiness Economics ICFAIDaniel VincentPas encore d'évaluation

- Walmart Economic IndicatorsDocument10 pagesWalmart Economic IndicatorsJennifer Scott100% (1)

- BFM SumsDocument57 pagesBFM SumsthamiztPas encore d'évaluation

- Exam FM-August 2010 Financial Mathematics: Learning Objectives I. Interest TheoryDocument6 pagesExam FM-August 2010 Financial Mathematics: Learning Objectives I. Interest Theory18729Pas encore d'évaluation

- Tax TileDocument4 pagesTax TileDrYogesh MehtaPas encore d'évaluation

- Structured Financial Product A Complete Guide - 2020 EditionD'EverandStructured Financial Product A Complete Guide - 2020 EditionPas encore d'évaluation

- Presentation 2: Options Futures and Other Derivatives Hull Pretince HallDocument13 pagesPresentation 2: Options Futures and Other Derivatives Hull Pretince HallYolibi KhunPas encore d'évaluation

- Take Home QuizDocument8 pagesTake Home QuizJean CabigaoPas encore d'évaluation

- CH 05Document4 pagesCH 05vivienPas encore d'évaluation

- Fundamental of Foreign Exchange MarketDocument42 pagesFundamental of Foreign Exchange MarketkopnasjayaPas encore d'évaluation

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonPas encore d'évaluation

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloPas encore d'évaluation

- Chapter 7Document25 pagesChapter 7Cynthia AdiantiPas encore d'évaluation

- BS AssignmentDocument6 pagesBS AssignmentCall DutyPas encore d'évaluation

- Ed - 16wchap07sln For 30 Jan 2018Document7 pagesEd - 16wchap07sln For 30 Jan 2018MarinaPas encore d'évaluation

- Lecture Notes (Financial Economics)Document136 pagesLecture Notes (Financial Economics)americus_smile7474100% (2)

- Liquidity Preference As Behavior Towards Risk Review of Economic StudiesDocument23 pagesLiquidity Preference As Behavior Towards Risk Review of Economic StudiesCuenta EliminadaPas encore d'évaluation

- DerivativesDocument53 pagesDerivativesnikitsharmaPas encore d'évaluation

- Quantitative Methods FinanceDocument2 pagesQuantitative Methods FinanceXiaoouPas encore d'évaluation

- Fabozzi Bmas7 Ch11 ImDocument28 pagesFabozzi Bmas7 Ch11 ImEd williamsonPas encore d'évaluation

- Yield Curve ModelingDocument62 pagesYield Curve ModelingdouglasPas encore d'évaluation

- MLI Brochure Cohort 2Document12 pagesMLI Brochure Cohort 2Talha SuhailPas encore d'évaluation

- CH 003Document25 pagesCH 003bigbufftony100% (1)

- Elasticity EconomicsDocument14 pagesElasticity EconomicsYiwen LiuPas encore d'évaluation

- Mod08 - 09 10 09Document37 pagesMod08 - 09 10 09Alex100% (1)

- IIIrd Sem 2012 All Questionpapers in This Word FileDocument16 pagesIIIrd Sem 2012 All Questionpapers in This Word FileAkhil RupaniPas encore d'évaluation

- Cost Behavior and Cost-Volume RelationshipsDocument75 pagesCost Behavior and Cost-Volume RelationshipsRahul112012Pas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 4Document5 pagesCFA Level 1 Corporate Finance E Book - Part 4Zacharia VincentPas encore d'évaluation

- Fabozzi Bmas7 Ch03 ImDocument27 pagesFabozzi Bmas7 Ch03 ImWakas KhalidPas encore d'évaluation

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiPas encore d'évaluation

- Presentation On The Martingale TheoryDocument31 pagesPresentation On The Martingale TheoryRitankar MandalPas encore d'évaluation

- Dipifr 2006 Jun Q PDFDocument11 pagesDipifr 2006 Jun Q PDFPiyal HossainPas encore d'évaluation

- fn3023 Exc14Document29 pagesfn3023 Exc14ArmanbekAlkinPas encore d'évaluation

- Corporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationDocument64 pagesCorporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationShailesh RathodPas encore d'évaluation

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenPas encore d'évaluation

- Econ 121 Money and Banking: Problem Set 2 Instructor: Chao WeiDocument2 pagesEcon 121 Money and Banking: Problem Set 2 Instructor: Chao WeideogratiasPas encore d'évaluation

- frm指定教材 risk management & derivativesDocument1 192 pagesfrm指定教材 risk management & derivativeszeno490Pas encore d'évaluation

- Reading 31 Slides - Private Company ValuationDocument57 pagesReading 31 Slides - Private Company ValuationtamannaakterPas encore d'évaluation

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukPas encore d'évaluation

- CH 06Document73 pagesCH 06Sarang AdgokarPas encore d'évaluation

- Assignement - 2 Solution Masud RanaDocument16 pagesAssignement - 2 Solution Masud Ranaboom boomPas encore d'évaluation

- BU393 MidtermDocument12 pagesBU393 MidtermNineowPas encore d'évaluation

- Ques 2.20Document46 pagesQues 2.20AkshatAgarwal0% (1)

- F5 Question ACCADocument8 pagesF5 Question ACCARaymond RayPas encore d'évaluation

- Assignment1 - Group 8Document8 pagesAssignment1 - Group 8digamber patilPas encore d'évaluation

- Exam PracticeDocument3 pagesExam PracticeHenry Ng Yong KangPas encore d'évaluation

- Chapter 1 - Practice QuestionsDocument3 pagesChapter 1 - Practice QuestionsSiddhant AggarwalPas encore d'évaluation

- Financia Mathematics Assignment 2024 HMTHCS316Document2 pagesFinancia Mathematics Assignment 2024 HMTHCS316Lovemore MuyamboPas encore d'évaluation

- Solved Problems Resolved Exercises On OptionsDocument15 pagesSolved Problems Resolved Exercises On OptionsScribdTranslationsPas encore d'évaluation

- GB622HOMEWORK2013Document5 pagesGB622HOMEWORK2013Kai ZhouPas encore d'évaluation

- Iskur Paper IzaDocument43 pagesIskur Paper IzaRehan HasanPas encore d'évaluation

- ISKUR Baseline Questionnaire en V17Document15 pagesISKUR Baseline Questionnaire en V17Rehan HasanPas encore d'évaluation

- Consistency Vs UnbiasednessDocument1 pageConsistency Vs UnbiasednessRehan HasanPas encore d'évaluation

- ECON 330 - Practice QuestionsDocument6 pagesECON 330 - Practice QuestionsRehan HasanPas encore d'évaluation

- Derivative Securities Problem Set 1Document1 pageDerivative Securities Problem Set 1Rehan HasanPas encore d'évaluation

- Econ 261: Principles of Finance Quiz 2-40 Marks: InstructionsDocument2 pagesEcon 261: Principles of Finance Quiz 2-40 Marks: InstructionsRehan HasanPas encore d'évaluation

- Muthoot Finance LTDDocument17 pagesMuthoot Finance LTDTushar Dabhade33% (6)

- Presentation Slides: Contemporary Strategy Analysis: Concepts, Techniques, ApplicationsDocument11 pagesPresentation Slides: Contemporary Strategy Analysis: Concepts, Techniques, ApplicationsMonika SharmaPas encore d'évaluation

- Khushairi Bin Che Rani: Work ExperiencesDocument2 pagesKhushairi Bin Che Rani: Work ExperiencesQhairul KhairulPas encore d'évaluation

- 100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryDocument6 pages100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryKristina Phillpotts-BrownPas encore d'évaluation

- Chapter 10 Property, Plant and EquipmentDocument11 pagesChapter 10 Property, Plant and EquipmentAngelica Joy ManaoisPas encore d'évaluation

- Life Cycle CostingDocument34 pagesLife Cycle Costingpednekar30Pas encore d'évaluation

- CTM Macau v6 - May 17Document4 pagesCTM Macau v6 - May 17gopiv2020Pas encore d'évaluation

- Export FinanceDocument59 pagesExport FinanceSagarPas encore d'évaluation

- BIMDocument9 pagesBIMNaseem KhanPas encore d'évaluation

- ELEC2 - Module 1 - Fundamentals Principles of ValuationDocument32 pagesELEC2 - Module 1 - Fundamentals Principles of ValuationMaricar PinedaPas encore d'évaluation

- Marketing Plan THYDocument17 pagesMarketing Plan THYnik_singerstr83% (6)

- Learning Activity 5.2 Concept ReviewDocument4 pagesLearning Activity 5.2 Concept ReviewJames CantornePas encore d'évaluation

- Centralized vs. Decentralized Organizational Structure - ImpDocument2 pagesCentralized vs. Decentralized Organizational Structure - ImpRavi Kumar RabhaPas encore d'évaluation

- Store FormatsDocument13 pagesStore FormatsVijayargavan Pasupathinath100% (1)

- Software QA 1.2.4 Functional Testing Software Evaluation FormDocument7 pagesSoftware QA 1.2.4 Functional Testing Software Evaluation FormEmmanuel Evelyn OguntadePas encore d'évaluation

- CV - Christoph - Pittius - CV - 2011 PDFDocument3 pagesCV - Christoph - Pittius - CV - 2011 PDFonynhoPas encore d'évaluation

- Business Plan DewsoftDocument29 pagesBusiness Plan DewsoftSanjeev AgarwalPas encore d'évaluation

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraPas encore d'évaluation

- Inbound 9092675230374889652Document14 pagesInbound 9092675230374889652Sean Andrew SorianoPas encore d'évaluation

- PT ManunggalDocument4 pagesPT Manunggalnimasz nin9szihPas encore d'évaluation

- Kit KatDocument1 pageKit KattrucnguyenPas encore d'évaluation

- MESFIN PROPOSALedDocument17 pagesMESFIN PROPOSALedethnan lPas encore d'évaluation

- Occupational Health & SafetyDocument30 pagesOccupational Health & SafetyMuhammad Zun Nooren BangashPas encore d'évaluation

- Man Power Resourcing in Reliance JioDocument56 pagesMan Power Resourcing in Reliance JioSomya Trivedi100% (2)

- InnovationMatrix A3Document2 pagesInnovationMatrix A3Nouf Bin IshaqPas encore d'évaluation

- Production and Operation ManagementDocument19 pagesProduction and Operation Managementjuliobueno8974Pas encore d'évaluation

- Women EnterprenuershipDocument3 pagesWomen EnterprenuershipMehul MehtaPas encore d'évaluation

- APT Sungard ModelDocument4 pagesAPT Sungard ModelFabio PolpettiniPas encore d'évaluation