Académique Documents

Professionnel Documents

Culture Documents

FINN 321 Econometrics Muhammad Asim

Transféré par

Haris AliDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FINN 321 Econometrics Muhammad Asim

Transféré par

Haris AliDroits d'auteur :

Formats disponibles

Lahore University of Management Sciences FINN 321 Econometrics

Spring 2012

Instructor Room No. Office Hours Email Telephone Secretary/TA TA Office Hours Course URL (if any)

Muhammad Asim 314 PDC Building TBA Muhammad.Asim@lums.edu.pk 8323 TBA TBA lms.lums.edu.pk

Course Basics Credit Hours Lecture(s) Recitation/Lab (per week) Tutorial (per week) Course Distribution Core Elective Open for Student Category Close for Student Category COURSE DESCRIPTION

4 Nbr of Lec(s) Per Week Nbr of Lec(s) Per Week Nbr of Lec(s) Per Week

Duration Duration Duration

100 Minutes

This course looks at a broad range of regression techniques that are frequently used in economics, operations, finance and marketing. In particular, we look at the criteria used to select a particular estimation method and the scenarios under which the OLS estimator becomes suboptimal. We will look at a range of empirical illustrations, including those related to time series and panel datasets, and become adept at using Stata, our software for the course.

COURSE PREREQUISITE(S) Statistics OR Probability and Statistics OR Statistics and Data Analysis Principles of Microeconomics

COURSE OBJECTIVES To enable students to interpret and critically evaluate econometric analysis reported in many studies in Finance and Economics To equip students to independently conduct and interpret their own econometric analysis To train in properly utilizing econometric analysis in decision making in Economics, Finance, Marketing and Operations.

Learning Outcomes On successful completion students will: be able to develop a suitable regression model for a variety of empirically interesting problems and validate the selected model via a battery of tests be able to compare different estimators based on their finite sample and asymptotic properties develop a basic understanding of time series econometrics and be able to handle and make use of panel data be proficient in the use of Stata for econometric analysis

Lahore University of Management Sciences

Grading Breakup and Policy Assignment(s): 20% Home Work: Quiz(s): 25% Class Participation: 5% Attendance: 5% Midterm Examination: Project: 15% Final Examination: 30% Project: The objective of the project is to provide you an opportunity to apply the skills you learn in class to a real world application. Several data sets will be made available to students for this purpose. The project would require you to pick a data set from this collection and write a short project based on your analysis. The project grade will be determined on the basis of an intelligent use of this data to address the research question and an appropriate interpretation of results. The project would be group-based and we may conduct viva from any of the group members. Students are encouraged to discuss their project with me (during office hours) or with their TAs.

Examination Detail Yes/No: No Combine Separate: Duration: Preferred Date: Exam Specifications:

Midterm Exam

Final Exam

Yes/No: Yes Combine Separate: Combine Duration: 100 minutes Exam Specifications: closed book/ closed notes

COURSE OVERVIEW Week/ Session/ Topics Module Introduction What is econometrics? Steps in empirical economic analysis Causality and Marginal effects 12 The structure of economic data Simple Regression Model Deriving the OLS estimates Units of measurement and functional form Multiple Regression: Estimation Mechanics and Interpretation of OLS Classical Linear Model Assumptions 35 The Gauss-Markov Theorem Properties of OLS Unbiasedness & Efficiency. Multiple Regression: Inference Sampling Distribution of the OLS estimators The t-test testing a single restriction Confidence Intervals Testing multiple restrictions

Recommended Readings Ch1. 1.1, 1.2, 1.4 Ch.2.1, 2.2, 2.4

Objectives/ Application Understand the scope of Econometrics and review regression basics

Ch. 3

Understand the fundamentals of multiple regression analysis, where we allow more than one variable to affect the variable we are trying to explain. Conduct statistical inference related to multiple regression models.

Ch. 4

6 7*

Lahore University of Management Sciences

89 Functional Form and Dummy Variables Dummy independent variables Using dummy variables for multiple categories Interactions using dummy variables Dummy dependent variable Topics in OLS Effects of Data Scaling Functional Form Goodness-of-Fit and Model Selection Prediction and Residual Analysis Functional form mis-specification Missing Data, Outliers Heteroskedasticity Consequences of Heteroskedasticity Robust inference Testing for heteroskedasticity Weighted Least Squares Ch. 7 Learn how to incorporate qualitative information into multiple regression models

Ch. 6.1, 6.2, 6.3, 6.4, 9.1, 9.4

10 12

Learn some additional topics in regression analysis, including advanced functional form issues, data scaling, prediction, goodness of fit, and data problems like presence of outliers

Ch. 8

13-14*

Be able to test for and correct the problem of heteroskedasticity, or non-constant variance, in the error terms

Instrumental Variable Estimation and 2SLS Correlation between X and error; Omitted variable bias (3.3); OLS under measurement 15 16 error (9.3); Using Proxy Variables for Unobserved Explanatory Variables (9.2); IV estimation and the 2SLS; Testing for endogeniety and over-identifying restrictions Regression with Time Series Data Nature of time series data; Examples of TS models; Finite sample properties of OLS under Gauss-Markov assumptions; Functional form, 17-20* dummy variables, index numbers; Trends and seasonality; Stationarity and weakly dependent time series; Using highly persistent time series in regression analysis Panel Data Models Pooling independent cross-sections across time; two-period panel data; differencing with 21-23 more than two time periods: fixed-effects estimation; random-effects models; grouped data; policy analysis (difference-in-difference and panel estimation) Limited Dependent Variable Models and Sample Selection Logit and Probit models for binary response; 24-26* [Depending on time: the Tobit model for corner-solution responses; Censored and Truncated regression;] Sample selection corrections Simultaneous Equation Models The nature of simultaneous equation models; 27 simultaneity bias in OLS; Identifying and estimating a structural equation (vs. reduced form); systems with more than two equations 28 Review * indicates tentative lab sessions

Ch 3.3, 9.2, 9.3, 15.1-15.5

Investigate the problem of endogenous explanatory variables and use the method of instrumental variables as a way of solving the omitted variable problem as well as the measurement error problem Analyze the problems unique to time series data and understand use of functional forms, dummy variables, trends and seasonality in the context of time series regression models

Ch. 10 & 11

Ch 13.1-13.5; 14.1-14.3

Apply multiple regression to independently pooled cross sections and panel data sets via methods commonly used in applied work

Ch 17.1-17.5 (excl. 17.3)

Apply models for limited dependent variables and methods for correcting sample selection bias

Ch 16.1-16.3

Apply the method of two stage least squares to estimate simultaneous equation models

Lahore University of Management Sciences

Textbook(s)/Supplementary Readings Required Text: Wooldridge, Jeffrey M. 2006. Introductory Econometrics. 3 edition. Thomson South-western. Supplementary Texts: Hamilton, Lawrence C. 2006. Statistics with Stata. Thomson Brooks/Cole. Kennedy, Peter. 2008. A Guide to Econometrics. 6 edition. Malden: Blackwell Publishing. Levitt, Steven D., and Stephen J. Dubner. 2009. Freakonomics: A Rogue Economist Explores the Hidden Side of Everything. Harper Perennial. Online Resources To learn STATA you may use: http://www.ats.ucla.edu/stat/stata/ STATA illustrations for all our text book examples are at: http://fmwww.bc.edu/gstat/examples/wooldridge/wooldridge.html The powerpoint slides for the book are also available at: http://www.swlearning.com/economics/wooldridge/wooldridge2e/powerpoint.html

th rd

Vous aimerez peut-être aussi

- STAT 231 OutlineDocument8 pagesSTAT 231 Outlinechampion2007Pas encore d'évaluation

- Applied Linear Regression Models 4th Ed NoteDocument46 pagesApplied Linear Regression Models 4th Ed Noteken_ng333Pas encore d'évaluation

- Collaborative Task M1Document2 pagesCollaborative Task M1umang nathPas encore d'évaluation

- Course Outline - BUS 172 - Introduction To Statistics - IsLDocument5 pagesCourse Outline - BUS 172 - Introduction To Statistics - IsLRabbi AliPas encore d'évaluation

- Quantile Regression Through Linear Programming PDFDocument21 pagesQuantile Regression Through Linear Programming PDFVipul GargPas encore d'évaluation

- Chapter Five and Six Answer PDFDocument3 pagesChapter Five and Six Answer PDFrhealyn ramadaPas encore d'évaluation

- Group Project Software Requirement and DesignDocument42 pagesGroup Project Software Requirement and DesignasdllooPas encore d'évaluation

- The Economics of Inaction: Stochastic Control Models with Fixed CostsD'EverandThe Economics of Inaction: Stochastic Control Models with Fixed CostsPas encore d'évaluation

- KM MicrosoftDocument11 pagesKM MicrosoftHaris Ali100% (1)

- Belt and Road InitiativeDocument17 pagesBelt and Road Initiativetahi69100% (2)

- Lahore University of Management Sciences ECON 330 - EconometricsDocument3 pagesLahore University of Management Sciences ECON 330 - EconometricsshyasirPas encore d'évaluation

- ECON 330-Econometrics-Dr. Farooq NaseerDocument5 pagesECON 330-Econometrics-Dr. Farooq NaseerWahaj KamranPas encore d'évaluation

- Kassahun A CommentedDocument36 pagesKassahun A CommentedGirma MogesPas encore d'évaluation

- FR2202 Financial EconometricsDocument3 pagesFR2202 Financial Econometricscarwasher1Pas encore d'évaluation

- Principles of Economics Lecture and TutorialDocument20 pagesPrinciples of Economics Lecture and TutorialEfeGündönerPas encore d'évaluation

- Pertemuan 7zDocument31 pagesPertemuan 7zAnto LaePas encore d'évaluation

- Schaum Outline SeriesDocument3 pagesSchaum Outline SeriesTg Mukriz0% (1)

- Undergraduate EconometricDocument15 pagesUndergraduate EconometricAcho JiePas encore d'évaluation

- Pre Mfe Prob Feb2011 SyllabusDocument3 pagesPre Mfe Prob Feb2011 SyllabussuperauditorPas encore d'évaluation

- ACCOUNTING Schaum's Outline of Theory and Problems of Managerial AccountingDocument8 pagesACCOUNTING Schaum's Outline of Theory and Problems of Managerial Accountingtanmaybeckham08Pas encore d'évaluation

- Statistics For EconomicsDocument58 pagesStatistics For EconomicsKintu GeraldPas encore d'évaluation

- Introduction To Multiple Linear RegressionDocument49 pagesIntroduction To Multiple Linear RegressionRennate MariaPas encore d'évaluation

- Chapter 5Document34 pagesChapter 5Bereket Desalegn100% (1)

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelD'EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelPas encore d'évaluation

- r5210501 Probability and StatisticsDocument1 pager5210501 Probability and StatisticssivabharathamurthyPas encore d'évaluation

- KaleidaGraph ManualDocument314 pagesKaleidaGraph ManualRoberto Echeverria AlfaroPas encore d'évaluation

- B.SC Maths Syll PDFDocument62 pagesB.SC Maths Syll PDFFaru Shibi0% (1)

- MecoDocument4 pagesMecousamaPas encore d'évaluation

- Workflow of Statistical Data AnalysisDocument105 pagesWorkflow of Statistical Data AnalysissharathdhamodaranPas encore d'évaluation

- An Introduction to Mathematical Analysis for Economic Theory and EconometricsD'EverandAn Introduction to Mathematical Analysis for Economic Theory and EconometricsPas encore d'évaluation

- Chapter 5 Solutions V1Document16 pagesChapter 5 Solutions V1meemahsPas encore d'évaluation

- PanelDocument93 pagesPaneljjanggu100% (1)

- Business Mathematics - I (QTM-110)Document5 pagesBusiness Mathematics - I (QTM-110)ShariqShafiqPas encore d'évaluation

- Recent Advances in Statistics: Papers in Honor of Herman Chernoff on His Sixtieth BirthdayD'EverandRecent Advances in Statistics: Papers in Honor of Herman Chernoff on His Sixtieth BirthdayM. Haseeb RizviPas encore d'évaluation

- Lecture 1 ECN 2331 (Scope of Statistical Methods For Economic Analysis) - 1Document15 pagesLecture 1 ECN 2331 (Scope of Statistical Methods For Economic Analysis) - 1sekelanilunguPas encore d'évaluation

- Advanced Econometrics - HEC LausanneDocument2 pagesAdvanced Econometrics - HEC LausanneRavi SharmaPas encore d'évaluation

- A Quantitative Approach To Profit Optimization and Constraints of Mixed Cropping Pattern in Bargarh District of Western OrissaDocument5 pagesA Quantitative Approach To Profit Optimization and Constraints of Mixed Cropping Pattern in Bargarh District of Western OrissaDhavalaSanthoshKumarPas encore d'évaluation

- Accounting and FinanceDocument49 pagesAccounting and FinanceJoshua PatersonPas encore d'évaluation

- Hull RMFI4 e CH 12Document25 pagesHull RMFI4 e CH 12jlosamPas encore d'évaluation

- ECON 262-Mathematical Applications in Economics-Kiran AroojDocument4 pagesECON 262-Mathematical Applications in Economics-Kiran AroojHaris Ali0% (1)

- Actuarial CT1 Financial Mathematics Sample Paper 2011 by ActuarialAnswersDocument8 pagesActuarial CT1 Financial Mathematics Sample Paper 2011 by ActuarialAnswersActuarialAnswersPas encore d'évaluation

- Dec PG Prospectus 2011 BerhampurDocument34 pagesDec PG Prospectus 2011 Berhampurmy.dear.sirPas encore d'évaluation

- ITC556 Sample Exam + SolutionsDocument11 pagesITC556 Sample Exam + Solutionsswatagoda60% (5)

- Critical Path Analysis A Complete Guide - 2020 EditionD'EverandCritical Path Analysis A Complete Guide - 2020 EditionPas encore d'évaluation

- Association Rule Generation For Student Performance Analysis Using Apriori AlgorithmDocument5 pagesAssociation Rule Generation For Student Performance Analysis Using Apriori AlgorithmthesijPas encore d'évaluation

- E RDocument367 pagesE RshabbirqauPas encore d'évaluation

- Syllabus of Institutional Economics NewDocument2 pagesSyllabus of Institutional Economics NewAksatriya Diwangkara NusantaraPas encore d'évaluation

- mth107 - Elementary Mathematics For EngineersDocument7 pagesmth107 - Elementary Mathematics For EngineersShobhit MishraPas encore d'évaluation

- Economics 20000 SyllabusDocument3 pagesEconomics 20000 SyllabusJulie BrightPas encore d'évaluation

- Linear Programming 4 PDFDocument3 pagesLinear Programming 4 PDFM Arif IlyantoPas encore d'évaluation

- Chapter 5 - Lect NoteDocument8 pagesChapter 5 - Lect Noteorazza_jpm8817Pas encore d'évaluation

- Regression Model and Its ApplicationsDocument30 pagesRegression Model and Its ApplicationsShuyu Jia100% (1)

- CAPMDocument34 pagesCAPMadityav_13100% (1)

- Ize y Yeyati (2003) - Financial DollarizationDocument25 pagesIze y Yeyati (2003) - Financial DollarizationEduardo MartinezPas encore d'évaluation

- Chapter 01Document15 pagesChapter 01Arinze3Pas encore d'évaluation

- Notes On Optimisation TheoryDocument120 pagesNotes On Optimisation TheoryHawkins Chin100% (1)

- Heteroscedasticity3 150218115247 Conversion Gate01Document10 pagesHeteroscedasticity3 150218115247 Conversion Gate01LWANGA FRANCISPas encore d'évaluation

- Bayesian ModelDocument71 pagesBayesian ModelkPas encore d'évaluation

- Calculating Different Types of AnnuitiesDocument7 pagesCalculating Different Types of AnnuitiesZohair MushtaqPas encore d'évaluation

- Employment Application Form - CybernetDocument2 pagesEmployment Application Form - CybernetHaris AliPas encore d'évaluation

- Adamjee Life Assurance Company LTD.: Illustration of Benefits For Khushhali ProductDocument6 pagesAdamjee Life Assurance Company LTD.: Illustration of Benefits For Khushhali ProductHaris AliPas encore d'évaluation

- p3 2016 Jun QDocument11 pagesp3 2016 Jun QHaris AliPas encore d'évaluation

- Illustration NNNNDocument4 pagesIllustration NNNNHaris Ali0% (1)

- Performance & Development Discussion: 1. What Is Going Well?Document2 pagesPerformance & Development Discussion: 1. What Is Going Well?Haris AliPas encore d'évaluation

- Name of The Student: Aamir Iqbal Student ID: VSS31013 Name of The Course: HI6036 Auditing, Assurance and Compliance S1Document5 pagesName of The Student: Aamir Iqbal Student ID: VSS31013 Name of The Course: HI6036 Auditing, Assurance and Compliance S1Haris AliPas encore d'évaluation

- ACC707 Auditing Assurance Services AssignmentDocument2 pagesACC707 Auditing Assurance Services AssignmentHaris AliPas encore d'évaluation

- Performance & Development Discussion: 1. What Is Going Well?Document2 pagesPerformance & Development Discussion: 1. What Is Going Well?Haris AliPas encore d'évaluation

- 2-Mar-2017 - HCP Inclusivity ShujaDocument95 pages2-Mar-2017 - HCP Inclusivity ShujaHaris AliPas encore d'évaluation

- HCP Inclusivity Issues - KhalidDocument15 pagesHCP Inclusivity Issues - KhalidHaris AliPas encore d'évaluation

- HCP Inclusivity Lapse Daily Airtime LogicDocument2 pagesHCP Inclusivity Lapse Daily Airtime LogicHaris AliPas encore d'évaluation

- Critique of The Arguments of Carrs IT DoDocument12 pagesCritique of The Arguments of Carrs IT DoHaris AliPas encore d'évaluation

- Acc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalDocument11 pagesAcc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalHaris AliPas encore d'évaluation

- EE/CS-320 - Computer Organization & Assembly Language (Fall Semester 2013-14) Assignment 2Document11 pagesEE/CS-320 - Computer Organization & Assembly Language (Fall Semester 2013-14) Assignment 2Haris AliPas encore d'évaluation

- Evaluation DocumentDocument19 pagesEvaluation DocumentHaris AliPas encore d'évaluation

- Online Research Diary Evaluation Form (Team 15 - HCI)Document2 pagesOnline Research Diary Evaluation Form (Team 15 - HCI)Haris AliPas encore d'évaluation

- Assessment One DetailsDocument2 pagesAssessment One DetailsHaris AliPas encore d'évaluation

- FINAL FY14 Financial Results Release 180814Document8 pagesFINAL FY14 Financial Results Release 180814Haris AliPas encore d'évaluation

- For The Year Ended 30 June 2013: Newcrest Mining Limited Financial ReportDocument92 pagesFor The Year Ended 30 June 2013: Newcrest Mining Limited Financial ReportHaris AliPas encore d'évaluation

- FINAL 2012 - 2013 Full Year Financial Results 120813Document15 pagesFINAL 2012 - 2013 Full Year Financial Results 120813Haris AliPas encore d'évaluation

- FINAL FY14 Full Year Financial Results Presentation 180814Document37 pagesFINAL FY14 Full Year Financial Results Presentation 180814Haris AliPas encore d'évaluation

- Oil Opportunities in SudanDocument16 pagesOil Opportunities in SudanEssam Eldin Metwally AhmedPas encore d'évaluation

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDocument8 pagesMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnPas encore d'évaluation

- India'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelDocument10 pagesIndia'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelAnonymous cRMw8feac8Pas encore d'évaluation

- Monsoon 2023 Registration NoticeDocument2 pagesMonsoon 2023 Registration NoticeAbhinav AbhiPas encore d'évaluation

- E Money PDFDocument41 pagesE Money PDFCPMMPas encore d'évaluation

- Change Control Procedure: Yogendra GhanwatkarDocument19 pagesChange Control Procedure: Yogendra GhanwatkaryogendraPas encore d'évaluation

- De Mgginimis Benefit in The PhilippinesDocument3 pagesDe Mgginimis Benefit in The PhilippinesSlardarRadralsPas encore d'évaluation

- Part 1Document122 pagesPart 1Astha MalikPas encore d'évaluation

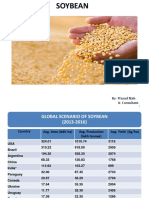

- Soybean Scenario - LaturDocument18 pagesSoybean Scenario - LaturPrasad NalePas encore d'évaluation

- Quijano ST., San Juan, San Ildefonso, BulacanDocument2 pagesQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzPas encore d'évaluation

- Competition Act: Assignment ONDocument11 pagesCompetition Act: Assignment ONSahil RanaPas encore d'évaluation

- Delivering The Goods: Victorian Freight PlanDocument56 pagesDelivering The Goods: Victorian Freight PlanVictor BowmanPas encore d'évaluation

- Business Plan SampleDocument14 pagesBusiness Plan SampleGwyneth MuegaPas encore d'évaluation

- A Glossary of Macroeconomics TermsDocument5 pagesA Glossary of Macroeconomics TermsGanga BasinPas encore d'évaluation

- Annex 106179700020354Document2 pagesAnnex 106179700020354Santosh Yadav0% (1)

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDocument13 pagesFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghPas encore d'évaluation

- MHO ProposalDocument4 pagesMHO ProposalLGU PadadaPas encore d'évaluation

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDocument19 pagesIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Pas encore d'évaluation

- Request BADACODocument1 pageRequest BADACOJoseph HernandezPas encore d'évaluation

- Malta in A NutshellDocument4 pagesMalta in A NutshellsjplepPas encore d'évaluation

- Thai LawDocument18 pagesThai LawsohaibleghariPas encore d'évaluation

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenDocument62 pages© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊPas encore d'évaluation

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyPas encore d'évaluation

- ENG Merchant 4275Document7 pagesENG Merchant 4275thirdPas encore d'évaluation

- What Is InflationDocument222 pagesWhat Is InflationAhim Raj JoshiPas encore d'évaluation

- MBBcurrent 564548147990 2022-12-31 PDFDocument10 pagesMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinPas encore d'évaluation

- Manufactures Near byDocument28 pagesManufactures Near bykomal LPS0% (1)

- Year 2016Document15 pagesYear 2016fahadullahPas encore d'évaluation

- Pembayaran PoltekkesDocument12 pagesPembayaran PoltekkesteffiPas encore d'évaluation