Académique Documents

Professionnel Documents

Culture Documents

CH 03

Transféré par

Shoaib AkhtarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH 03

Transféré par

Shoaib AkhtarDroits d'auteur :

Formats disponibles

File: ch03

Multiple Choice Questions

1. a. . c. d.

Which of the following is not a characteristic of investments companies? pooled investing diversification managed portfolios reduced e!penses

"ns: d #ifficult$: moderate %ef: &nvesting &ndirectl$

'.

&n order to avoid pa$ing income ta!es( an investment compan$ must:

a. e classified as a non)profit organi*ation . invest onl$ in municipal onds. c. pass on interest( dividends( and capital gains to the stoc+holders. d. e registered as a closed)end investment compan$. "ns: c #ifficult$: moderate %ef: &nvesting &ndirectl$

3. a. . c. d.

&nvestment companies must register with the ,-C under the provisions of the: ,ecurities "ct of 1.33 ,ecurities -!change "ct of 1.3/ Malone$ "ct of 1.30 &nvestment Compan$ "ct of 1./0

"ns: d #ifficult$: eas$ %ef: &nvesting &ndirectl$

/.

1he most popular t$pe of investment compan$ is a:

Chapter 1hree &ndirect &nvesting

'3

a. . c. d.

unit investment trust. mutual fund. closed)end investment compan$ real estate investment trust.

"ns: #ifficult$: eas$ %ef: 1$pes of &nvestment Companies

2. "n unmanaged fi!ed income securit$ portfolio handled $ an independent trustee is +nown as a: a. . c. d. 3un+ ond fund closed)end investment compan$. unit investment trust. hedge fund.

"ns: c #ifficult$: moderate %ef: 1$pes of &nvestment Companies

4. a. . c. d.

Which of the following is a ma3or o 3ective of unit investment trusts? capital preservation capital gains current income ta! deferment

"ns: a #ifficult$: moderate %ef: 1$pes of &nvestment Companies

5. a. . c. d.

" ma3or difference etween a closed)end investment compan$ and an open)end investment compan$ is that: closed)end investment companies are generall$ much ris+ier. their securit$ portfolios are su stantiall$ different. closed)end investment companies are passive investments and open)ends are not. closed)end companies have a more fi!ed capitali*ation.

"ns: d #ifficult$: moderate %ef: 1$pes of &nvestment Companies

Chapter 1hree &ndirect &nvesting '/

0. a. . c. d.

. Which of the following generall$ trade on stoc+ e!changes? unit investment trusts closed)end investment companies open)end investment companies "ll trade on stoc+ e!changes

"ns: #ifficult$: moderate %ef: 1$pes of &nvestment Companies

.. a. . c. d.

Which of the following statements concerning the trend in investment compan$ growth is true? 1he recent trend shows more growth in closed)end investment companies. 1he recent trend shows more growth in unit investment trusts. 1he recent trend shows more growth in open)end investment companies. "ll investment companies have een growing at an e6ual rate.

"ns: c #ifficult$: eas$ %ef: 1$pes of &nvestment Companies

10. a. . c. d.

Which of the following is not one of the characteristics of e!change traded funds 7-1Fs8? 1he$ are passive portfolios. 1he$ are managed investments. 1he$ often trac+ a particular sector of the mar+et. "ll of the a ove are characteristics of -1Fs.

"ns: #ifficult$: moderate %ef: 1$pes of &nvestment Companies

11. a. . c. d.

&t is not important to have a secondar$ mar+et for mutual funds ecause: investors hold the securities till maturit$. investors trade etween themselves. investors sell their shares ac+ to the compan$. an+s will cash their shares as long as the$ have accounts at the an+.

'2

Chapter 1hree &ndirect &nvesting

"ns: c #ifficult$: eas$ %ef: 1$pes of &nvestment Companies

1'. a. . c. d.

Which of the following -1F9s 7e!change traded fund8 provides e!posure to 200 :.,.large)capitali*ation companies? ,pider Clu s Cu es #iamonds

"ns: a #ifficult$: moderate %ef: 1$pes of &nvestment Companies 13. a. . c. d. Which of the following is not true regarding -1Fs? 1he$ trade on e!changes li+e individual stoc+s. 1he$ can e ought on margin or sold short. 1he$ have management fees higher than other mutual funds. "ll of the a ove are true regarding -1Fs.

"ns: c #ifficult$: moderate %ef: 1$pes of &nvestment Companies

1/. a. . c. d.

" group of mutual funds with a common management are +nown as: fund s$ndicates. fund conglomerates. fund families. fund comple!es.

"ns: d #ifficult$: eas$ %ef: 1$pes of Mutual Funds

12. a.

Which of the following is not true regarding mone$ mar+et funds? 1he$ charge no sales charge( redemption fee or management fee.

'4

Chapter 1hree &ndirect &nvesting

. c. d.

1heir ma!imum average maturit$ is .0 da$s. ;ormall$( there are no capital gains or losses on their shares. "ll of the a ove are true.

"ns: a #ifficult$: difficult %ef: 1$pes of Mutual Funds

14. a. . c. d.

&f a mutual fund holds a su stantial amount of 1reasur$ ills( this is pro a l$ a7an8: ta!)e!empt fund. conservative ond fund. income fund mone$ mar+et mutual fund.

"ns: d #ifficult$: eas$ %ef: 1$pes of Mutual Funds

15. a. . c. d.

Which of the following is true regarding value funds and growth funds? <alue funds see+ stoc+s that are cheap $ fundamental standards while growth funds see+ stoc+s with high current earnings. =rowth funds t$picall$ outperform value funds. <alue funds and growth funds tend to perform well at different times. "ll of the a ove are true.

"ns: c #ifficult$: difficult %ef: 1$pes of Mutual Funds

10. a. . c. d.

&nde! funds provide low)cost( passive investment e!posure in a similar fashion to: h$ rid mutual funds mone$ mar+et mutual funds e!change)traded funds e6uit$ income funds

"ns: c #ifficult$: moderate %ef: 1$pes of Mutual Funds

Chapter 1hree &ndirect &nvesting

'5

1.. a. . c. d.

;et asset value ta+es into account: oth reali*ed and unreali*ed capital gains. onl$ reali*ed capital gains. onl$ unreali*ed capital gains. neither reali*ed or unreali*ed capital gains.

"ns: a #ifficult$: difficult %ef: 1he Mechanics of &nvesting &ndirectl$ '0. a. . c. d. &f ;"< > mar+et price of a fund( then the fund: is selling at a discount. is selling at a premium. is an inde! fund. is an -1F.

"ns: a #ifficult$: moderate %ef: 1he Mechanics of &nvesting &ndirectl$

'1. a. . c. d.

Which of the following funds would have the highest e!pense ratio? ,?#% @,pidersA -1F &shares 1rust F1,-BCinhua China '2 Fund -1F <anguard &nternational <alue Fund Morgan ,tanle$ ,D? 200 &nde! Fund

"ns: a #ifficult$: moderate %ef: 1he Mechanics of &nvesting &ndirectl$

''. a. . c. d.

" loading fee is a: t$pe of income ta!. management fee. origination fee. sales charge.

"ns: d #ifficult$: moderate

Chapter 1hree &ndirect &nvesting '0

%ef: 1he Mechanics of &nvesting &ndirectl$

'3. a. . c. d.

" 1' )1 fee is a: redemption fee. sales charge distri ution fee. loading fee.

"ns: c #ifficult$: difficult %ef: 1he Mechanics of &nvesting &ndirectl$

'/. a. . c. d.

;o)load funds sell: at net asset value. elow net asset value. a ove net asset value. at a discount.

"ns: a #ifficult$: eas$ %ef: 1he Mechanics of &nvesting &ndirectl$

'2. a. . c. d.

;o)loads charge no sales fee ecause: the$ are legall$ prohi ited from doing so. the$ charge a redemption fee instead. the$ have no sales force. the$ charge a 1' )1 fee instead.

"ns: c #ifficult$: moderate %ef: 1he Mechanics of &nvesting &ndirectl$

'4. a. . c.

Which of the following t$pes of mutual fund shares t$picall$ does not charge a front)end sales charge ut does impose a redemption fee that declines over time? Class " shares Class E shares Class C shares

'.

Chapter 1hree &ndirect &nvesting

d.

Class # shares

"ns: #ifficult$: difficult %ef: 1he Mechanics of &nvesting &ndirectl$

'5. a. . c. d.

Which ro+erage firm was charged in '00/ with allowing late trading of mutual funds for some of its clients? Merrill F$nch -. F. Gutton Charles ,chwa -dward #. Hones

"ns: d #ifficult$: moderate %ef: 1he Mechanics of &nvesting &ndirectl$

'0. a. . c. d.

Which of the following statements regarding fund e!penses and performance is true? 1he higher)performing funds generall$ have the highest e!penses. 1he stoc+ funds generall$ have higher e!penses than ond funds. 1he inde! funds generall$ have higher e!penses than non)inde! funds. 1he lower performing funds generall$ have the highest e!penses.

"ns: d #ifficult$: difficult %ef: 1he Mechanics of &nvesting &ndirectl$

'..

&n the mutual fund industr$( the most common performance measure is a h$pothetical rate of return which assumes performance is constant over the entire period and is +nown as the: cumulative total return. average annual total return. total inde!ed return. compounded geometric return.

a. . c. d.

"ns: #ifficult$: moderate %ef: &nvestment Compan$ ?erformance

Chapter 1hree &ndirect &nvesting

30

30. a. . c. d.

In average( which t$pe of mutual fund is e!pected to have the highest performance? mone$ mar+et funds ond funds e6uit$ funds municipal ond funds

"ns: c #ifficult$: eas$ %ef: &nvestment Compan$ ?erformance

31. a. . c. d.

Which of the following t$pes of funds tends to +eep '2J of its assets in the securities of :.,. companies?. emerging mar+ets funds single)countr$ funds international funds glo al funds

"ns: d #ifficult$: difficult %ef: &nvesting &nternationall$ 1hrough &nvestment Companies

3'. a. . c. d.

,ingle)countr$ funds have traditionall$: outperformed international funds. underperformed international funds. een open)end. een closed)end.

"ns: d #ifficult$: moderate %ef: 1he Future of &ndirect &nvesting

33. a. . c. d.

1he ' largest fund supermar+ets are: Merrill F$nch and Charles ,chwa -dward #. Hones and <anguard <anguard and Fidelit$ Charles ,chwa and Fidelit$

31

Chapter 1hree &ndirect &nvesting

"ns: d #ifficult$: moderate %ef: 1he Future of &ndirect &nvesting

3/. a. . c. d.

" portfolio of directl$)owned individual securities guided $ an investment manager is +nown as a: &%". &M". ,M". #C".

"ns: c #ifficult$: moderate %ef: 1he Future of &ndirect &nvesting

32. a. . c. d.

:nregulated companies that see+ to e!ploit various mar+et opportunities and re6uire a su stantial investment from investors are +nown as: derivatives. options. hedge funds. ,M"s.

"ns: c #ifficult$: moderate %ef: 1he Future of &ndirect &nvesting

1rue)False Questions

1.

-ach investment compan$ investor shares in the returns of the fundKs portfolio and also shares in the cost of running the fund.

"ns: 1 #ifficult$: eas$ %ef: &nvesting &ndirectl$

'.

Eu$ing shares of a mutual fund is an e!ample of indirect investing.

3'

Chapter 1hree &ndirect &nvesting

"ns: 1 #ifficult$: eas$ %ef: &nvesting &ndirectl$

3. 1o 6ualif$ as a regulated investment compan$( a fund must distri ute at 20 percent of its ta!a le income to the shareholders. "ns: F #ifficult$: moderate %ef: &nvesting &ndirectl$

least

/. :nder the ,ecurities "ct of 1.33( investment companies are re6uired to with the ,-C. "ns: F #ifficult$: moderate %ef: &nvesting &ndirectl$

register

2.

Most unit investment trusts are considered active investments.

"ns: F #ifficult$: moderate %ef: 1$pes of &nvestment Companies

4.

-1Fs are managed investment portfolios that offer investors targeted diversification.

"ns: F #ifficult$: moderate %ef: 1$pes of &nvestment Companies

5.

Man$ -1Fs report little or no capital gains over the $ears giving them greater ta! efficienc$ than man$ mutual funds.

"ns: 1 #ifficult$: moderate %ef: 1$pes of &nvestment Companies

Chapter 1hree &ndirect &nvesting

33

0.

Closed)end investment companies t$picall$ sell additional shares of their own stoc+ ever$ few $ears.

"ns: F #ifficult$: moderate %ef: 1$pes of &nvestment Companies

..

"lmost 50 percent of all :.,. households owned mutual funds as of '002.

"ns: F #ifficult$: eas$ %ef: 1$pes of Mutual Funds

10.

&nvestment compan$ managers see+ to increase the si*e of the funds eing managed since the cost of overseeing additional amounts of mone$ rises less than the revenue rate.

"ns: 1 #ifficult$: moderate %ef: 1$pes of Mutual Funds

11.

"ppro!imatel$ 02 percent of mone$ mar+et assets are in non)ta!a le funds.

"ns: F #ifficult$: moderate %ef: 1$pes of Mutual Funds

1'. Lou would e!pect a value fund to u$ stoc+ ased on a sound earnings record while growth funds might invest in companies with no earnings record at all. "ns: 1 #ifficult$: moderate %ef: 1$pes of Mutual Funds

13. "ns: F

Foaded funds generall$ outperform the no)load funds.

Chapter 1hree &ndirect &nvesting

3/

#ifficult$: difficult %ef: 1$pes of Mutual Funds

1/.

Eoth open)end and closed)end investment compan$ shares ma$ sell at a discount from ;"<.

"ns: F #ifficult$: moderate %ef: 1$pes of Mutual Funds

12.

" 1' )1 fee is used to cover a fundKs cost of distri ution.

"ns: 1 #ifficult$: moderate %ef: 1$pes of Mutual Funds

14. &nvestors desiring no)load funds must generall$ see+ them out since there is no sales force. "ns: 1 #ifficult: eas$ %ef: 1$pes of Mutual Funds

15.

;o)load funds charge a one)time e!pense fee to cover all operating e!penses.

"ns: F #ifficult$: difficult %ef: 1$pes of Mutual Funds

10.

1he net asset value of a mutual fund does not consider unreali*ed capital gains.

"ns: F #ifficult$: difficult %ef: Mechanics of &nvesting &ndirectl$

Chapter 1hree &ndirect &nvesting

32

1.. &nde! funds tend to have lower e!penses than other funds ecause the$ don9t incur the costs of professional portfolio management. "ns: 1 #ifficult$: moderate %ef: Mechanics of &nvesting &ndirectl$

'0.

1otal return for a mutual fund includes capital gains less an$ reinvested dividends.

"ns: F #ifficult$: difficult %ef: &nvestment Compan$ ?erformance

'1.

:nder its new s$stem( Morningstar ran+s funds against compara le funds in appro!imatel$ 20 categories.

"ns: 1 #ifficult$: moderate %ef: &nvestment Compan$ ?erformance

''.

&t is possi le under the new Morningstar ratings that one class of shares of a mutual fund can have a different rating that another class of shares of the same mutual fund.

"ns: 1 #ifficult$: moderate %ef: &nvestment Compan$ ?erformance '3. ,urvivorship ias occurs when mutual funds are merged or li6uidated and onl$ surviving fundsK performance is reported.

"ns: 1 #ifficult$: moderate %ef: &nvestment Compan$ ?erformance

'/. "ns: 1

=lo al funds tend to hold a higher percentage of their portfolio in :.,. securities than do international funds.

Chapter 1hree &ndirect &nvesting

34

#ifficult$: difficult %ef: &nvesting &nternationall$ 1hrough &nvestment Companies

'2.

1he ma3or advantage of ,eparatel$ Managed "ccounts 7,M"8 is control and the direct owner ma$ e a le to specif$ investment restrictions.

"ns: 1 #ifficult$: difficult %ef: Future of &ndirect &nvesting

'4.

Gedge funds t$picall$ re6uire a large initial investment and ma$ have restrictions on how 6uic+l$ investors can withdraw their funds.

"ns: 1 #ifficult$: moderate %ef: Future of &ndirect &nvesting

,hort)"nswer Questions

1.

Eriefl$ e!plain the fees charged $ funds.

"nswer: Foad fees are sales charges( management fees include advisor$ fees and operating e!penses( and 1' )1 fees are mar+eting e!penses. #ifficult$: moderate

'.

What are the main differences etween a closed)end and an open)end investment compan$?

"nswer: " closed)end investment compan$ has a fi!ed num er of shares( and the price depends on suppl$ and demand. "n open)end fund9s shares increase as long as new investors contri ute mone$( and the price is the net asset value of the securities owned. #ifficult$: moderate

3.

What is the difference etween the insurance offered $ the ,ecurities &nvestor ?rotection Corporation 7,&?C8 and that offered $ the Federal #eposit &nsurance Corporation 7F#&C8?

35

Chapter 1hree &ndirect &nvesting

"nswer: 1he F#&C insures accounts at an+s from an+ failures. 1he ,&?C provides insurance against the ro+erage compan$ going an+rupt. #ifficult$: moderate

/.

Would one e!pect to find higher ?B- ratios in an aggressive growth fund or in growth and income fund?

"nswer: Ine would e!pect higher ?B-s in an aggressive growth fund ecause investors are willing to pa$ a high current price for e!pected future growth. #ifficult$: moderate

2.

Would $ou recommend a 42)$ear old retiree to invest all of hisBher retirement assets in an income fund?

"nswer: ?ro a l$ not. 1he retiree will pro a l$ have a long time to live and should consider investing part of the portfolio in growth funds to provide protection against inflation. #ifficult$: moderate

4.

Lou have decided to invest in an aggressive growth fund for long)run future needs. Lou have a pu lication listing a num er of such funds with their most recent 1')month total returns. &s this a good predictor of future performance?

"nswer:

;ot necessaril$. 1he est fund last $ear ma$ or ma$ not e in the ran+ings ne!t $ear. 1he literature is divided on the usefulness of past performance in predicting fund performance in the future. ,ome investors prefer longer)run performance measures such as five)$ear or ten)$ear compounded returns( ut none are sure)fire guides to future performance. #ifficult$: difficult

5.

Gow is the individual investor9s income ta! position affected $ owning investment companies compared to owning securities directl$?

"nswer: 1he investor9s ta! position should e the same whether heBshe invests indirectl$ through an investment compan$ or directl$ in the securities themselves. 1he investment companies are intermediaries that pass on income and losses to the shareholder. #ifficult$: difficult

Chapter 1hree &ndirect &nvesting

30

0.

#oes one mutual fund provide all the diversification that an investor needs?

"nswer: Ine fund t$picall$ has man$ 7perhaps several hundred8 securities( which should provide ade6uate diversification for ris+s that are uni6ue to an$ particular compan$. ;onetheless( some investors prefer to invest in several funds in order to participate in more than one mar+et and to gain some protection from mar+et ris+ in a particular mar+et. #ifficult$: moderate

Critical 1hin+ingB-ssa$ Questions

1.

&s an investor a le to achieve significant diversification $ purchasing a single) countr$ fund?

"nswer: 1he fund itself might e well diversified within that countr$ if the fund owns a wide variet$ of securities. Gowever( an investor is see+ing international diversification would not e well diversified in terms of countr$ ris+ and e!change)rate ris+. #ifficult$: moderate

'.

What are some of the advantages individual investors see+ $ u$ing mutual funds or closed)end investment compan$ shares rather than through purchasing securities directl$?

"nswer: ,u stantial diversification even for a small amount of funds( professional management 76uestioned $ some8( international securities( capa ilit$ to participate in the mone$ mar+et with a small investment. #ifficult$: moderate

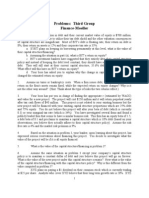

1.

"n environmentall$)friendl$ alanced mutual fund egan the $ear with a net asset value 7;"<8 of M1'.'2 per share. #uring the $ear it received M1.00 dividend and interest income( M0.'2 in reali*ed capital gains( and M0.20 in unreali*ed capital gains. ;inet$ percent of the income and all of the reali*ed capital gain were distri uted to shareholders. Calculate the $ear)end ;"<. Eeginning ;"< &ncome from investment operations net investment income net reali*ed and unreali*ed gain 7M.'2 N .208 1otal income from investment operations M1.00 0.52 M1.52 M1'.'2

"ns:

Chapter 1hree &ndirect &nvesting

3.

Fess distri utions to shareholders from net investment income 7.0J ! M18 from net reali*ed capital gain 1otal distri ution -nding ;"< #ifficult$: moderate

7M0..08 70.'28 7M1.128 M1'.02

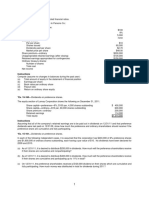

'.

"n aggressive e6uit$ mutual fund egan the $ear with a net asset value 7;"<8 of M4.20 per share. #uring the $ear it received M0.12 dividend income( M1.'2 in reali*ed capital losses( and M0.20 in unreali*ed capital gains. ;inet$ percent of the income was distri uted to shareholders. Calculate the $ear)end ;"<. Eeginning ;"< &ncome from investment operations net investment income net reali*ed and unreali*ed gain 7)M1.'2 N .208 1otal income from investment operations M0.12 70.528 7M0.408 7M0.1328 ) O 7M0.1328 M4.20

"ns:

Fess distri utions to shareholders from net investment income 7.0J ! M.128 from net reali*ed capital gain 1otal distri ution #ifficult$: moderate

3.

Lou invested M10(000 10 $ears ago into Fl$)E$);ight Fund which has reported performance 7average annual total return8 of 11.1'J over this 10)$ear period. What would $our ending wealth position e?

"ns: on a financial calculator: 10000 ?<( 11.1' interest rate( 10 ;( 0 pmt( solve for F< P M'0(50'.45. ,u tract $our initial investment of M10(000( which results in M10(50'.45 cumulative total dollar return. #ifficult$: moderate

Chapter 1hree &ndirect &nvesting

/0

Vous aimerez peut-être aussi

- Barrons 10.july.2023Document103 pagesBarrons 10.july.2023mariuscsmPas encore d'évaluation

- Solution For "Financial Statement Analysis" Penman 5th EditionDocument16 pagesSolution For "Financial Statement Analysis" Penman 5th EditionKhai Dinh Tran64% (28)

- BEC 0809 AICPA Newly Released QuestionsDocument22 pagesBEC 0809 AICPA Newly Released Questionsrajkrishna03Pas encore d'évaluation

- Case #84 Risk and Rates of Return - Filmore EnterprisesDocument9 pagesCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Name Company Email: Vksmal@gmail - Co MDocument15 pagesName Company Email: Vksmal@gmail - Co MBilal Memon0% (1)

- Investment Bank Slides by Jahid ModifiedDocument30 pagesInvestment Bank Slides by Jahid ModifiedAyesha Islam AkhiPas encore d'évaluation

- Commissioner of Internal Revenue v. Vicente RufinoDocument2 pagesCommissioner of Internal Revenue v. Vicente RufinoRafaelPas encore d'évaluation

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)D'EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Pas encore d'évaluation

- Chap 014 Testbank Financial Statement AnalysisDocument111 pagesChap 014 Testbank Financial Statement AnalysisOther Side100% (3)

- Chap 016Document77 pagesChap 016limed1100% (1)

- The Index Revolution: Why Investors Should Join It NowD'EverandThe Index Revolution: Why Investors Should Join It NowPas encore d'évaluation

- BCG 100 Global Challenges 2009Document38 pagesBCG 100 Global Challenges 2009kinshuksPas encore d'évaluation

- Chap 012Document77 pagesChap 012limed1100% (1)

- Modern Financial Management Solutions ManualDocument559 pagesModern Financial Management Solutions Manualrutemarlene40Pas encore d'évaluation

- 10 Chapter Two Investment AlternativesDocument15 pages10 Chapter Two Investment AlternativesMuhammad HarisPas encore d'évaluation

- Chap 012Document77 pagesChap 012sucusucu3Pas encore d'évaluation

- Capital BudgetingDocument34 pagesCapital BudgetingHija S YangePas encore d'évaluation

- Chap 004Document46 pagesChap 004Jose MartinezPas encore d'évaluation

- Fin 3013 Chapter 4Document46 pagesFin 3013 Chapter 4PookguyPas encore d'évaluation

- Harvesting The Business Venture Investment: True-False QuestionsDocument8 pagesHarvesting The Business Venture Investment: True-False Questionsbia070386Pas encore d'évaluation

- Chapter 1 Introduction: True/Falqe QuestionsDocument13 pagesChapter 1 Introduction: True/Falqe QuestionsĐoàn Ngọc Thành LộcPas encore d'évaluation

- 2.corporate Goals F12Document14 pages2.corporate Goals F12Jenny ChePas encore d'évaluation

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386Pas encore d'évaluation

- Types and Costs of Financial Capital: True-False QuestionsDocument8 pagesTypes and Costs of Financial Capital: True-False Questionsbia070386Pas encore d'évaluation

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliPas encore d'évaluation

- Financial Management - MasenoDocument42 pagesFinancial Management - MasenoPerbz JayPas encore d'évaluation

- Chapter Seventeen Mutual Funds and Hedge FundsDocument17 pagesChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaPas encore d'évaluation

- Internal Assignment Financial Management: Submission Date: 9 November 2012Document14 pagesInternal Assignment Financial Management: Submission Date: 9 November 2012Ranjeet KumarPas encore d'évaluation

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega Filehaider_shah882267Pas encore d'évaluation

- Capital StructureDocument13 pagesCapital StructureAjay ManchandaPas encore d'évaluation

- Leverage TheoryDocument5 pagesLeverage TheorySuman SinghPas encore d'évaluation

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraPas encore d'évaluation

- Orca Share Media1678615963308 7040625649368839273Document41 pagesOrca Share Media1678615963308 7040625649368839273Angeli Shane SisonPas encore d'évaluation

- Chapter 11 Dividend Policy: 1. ObjectivesDocument8 pagesChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourPas encore d'évaluation

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomePas encore d'évaluation

- 71731754-My-Quiz-Week-1 Managerial Finance PDFDocument3 pages71731754-My-Quiz-Week-1 Managerial Finance PDFGrad Student100% (1)

- Fabozzi ETF SolutionsDocument10 pagesFabozzi ETF SolutionscoffeedancePas encore d'évaluation

- Chapter 01 - Introduction To Corporate FinanceDocument38 pagesChapter 01 - Introduction To Corporate FinanceHaytham MagdyPas encore d'évaluation

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Pas encore d'évaluation

- OTC Derivatives General Paper 112010 AaaaDocument5 pagesOTC Derivatives General Paper 112010 Aaaaredearth2929Pas encore d'évaluation

- Multinational Cost of CapitalDocument35 pagesMultinational Cost of CapitalNesma El ShahedPas encore d'évaluation

- Forex MGMT SFMDocument98 pagesForex MGMT SFMsudhir.kochhar3530Pas encore d'évaluation

- Paper 12: Financial Management and International FinanceDocument12 pagesPaper 12: Financial Management and International FinanceRajat PawanPas encore d'évaluation

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Document12 pagesChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourPas encore d'évaluation

- Ratio Analysis: OV ER VIE WDocument40 pagesRatio Analysis: OV ER VIE WSohel BangiPas encore d'évaluation

- Chapter 10-Statement of Cash Flows: Multiple ChoiceDocument26 pagesChapter 10-Statement of Cash Flows: Multiple ChoiceAsma JamshaidPas encore d'évaluation

- Evaluating Financial Performance: True-False QuestionsDocument10 pagesEvaluating Financial Performance: True-False QuestionsTayyabaSharifPas encore d'évaluation

- Cost of Capital, Valuation and Strategic Financial Decision MakingDocument6 pagesCost of Capital, Valuation and Strategic Financial Decision MakingBaskar SelvanPas encore d'évaluation

- Multiple Choice QuestionsDocument50 pagesMultiple Choice Questionsagileal2000Pas encore d'évaluation

- The Cost of Capital: Learning ObjectivesDocument24 pagesThe Cost of Capital: Learning ObjectivesMarshallBruce123Pas encore d'évaluation

- ch10 Intro To FinanceDocument44 pagesch10 Intro To Financebrookelynn145Pas encore d'évaluation

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictPas encore d'évaluation

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7Pas encore d'évaluation

- MAS - Cost of Capital 11pagesDocument11 pagesMAS - Cost of Capital 11pageskevinlim186100% (1)

- Your ResultsDocument26 pagesYour ResultsSidra KhanPas encore d'évaluation

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDocument3 pagesHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraPas encore d'évaluation

- Handout For 7.8 FinmanDocument7 pagesHandout For 7.8 FinmanRed VelvetPas encore d'évaluation

- Chapter 01 Lasher PFMDocument20 pagesChapter 01 Lasher PFMShibin Jayaprasad100% (1)

- 431 FinalDocument6 pages431 FinalfPas encore d'évaluation

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoPas encore d'évaluation

- Hedge-Funds: How Big Is Big?Document11 pagesHedge-Funds: How Big Is Big?a5600805Pas encore d'évaluation

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsD'EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsPas encore d'évaluation

- Muhammad Suleman: EsumeDocument2 pagesMuhammad Suleman: EsumeShoaib AkhtarPas encore d'évaluation

- MCB Internship Report 2011Document58 pagesMCB Internship Report 2011Shoaib AkhtarPas encore d'évaluation

- English Portion: Paper of 2013Document8 pagesEnglish Portion: Paper of 2013Shoaib AkhtarPas encore d'évaluation

- Shoaib MCBDocument86 pagesShoaib MCBShoaib AkhtarPas encore d'évaluation

- Shoaib AkhtarDocument2 pagesShoaib AkhtarShoaib AkhtarPas encore d'évaluation

- About Edhi FoundationDocument20 pagesAbout Edhi FoundationShoaib Akhtar0% (2)

- Declaration of SecrecyDocument1 pageDeclaration of SecrecyShoaib AkhtarPas encore d'évaluation

- Subject Knowledge Management: Assignment NO.2Document10 pagesSubject Knowledge Management: Assignment NO.2Shoaib AkhtarPas encore d'évaluation

- Elements of Educational ProcessDocument5 pagesElements of Educational ProcessShoaib Akhtar83% (12)

- Hazrat Muhammad S A W Ideal TeacherDocument6 pagesHazrat Muhammad S A W Ideal TeacherShoaib Akhtar80% (5)

- Curriculum Vitae: Khubaib AkhtarDocument2 pagesCurriculum Vitae: Khubaib AkhtarShoaib AkhtarPas encore d'évaluation

- CRM 10.0000@Www - Computer.org@generic 747719BF653FDocument10 pagesCRM 10.0000@Www - Computer.org@generic 747719BF653FShoaib AkhtarPas encore d'évaluation

- Group For Knowledge Management Presentation: Class MBA 7 MorningDocument1 pageGroup For Knowledge Management Presentation: Class MBA 7 MorningShoaib AkhtarPas encore d'évaluation

- Leadership and Types of Leadership StyleDocument2 pagesLeadership and Types of Leadership StyleShoaib AkhtarPas encore d'évaluation

- Whistleblower: Misconduct Law Public Interest Fraud CorruptionDocument5 pagesWhistleblower: Misconduct Law Public Interest Fraud CorruptionShoaib AkhtarPas encore d'évaluation

- EU Establishment No. - List of All Milk Manufacturers MMP - NZ - enDocument9 pagesEU Establishment No. - List of All Milk Manufacturers MMP - NZ - enSurapong BhubhiromratPas encore d'évaluation

- 5264920318Document93 pages5264920318Jagadeesh AtukuriPas encore d'évaluation

- Consolidated FDI Policy, 2017Document113 pagesConsolidated FDI Policy, 2017Latest Laws TeamPas encore d'évaluation

- Updated Company List Bandhan BankDocument1 183 pagesUpdated Company List Bandhan Banksabefoy840Pas encore d'évaluation

- Chapter c5Document25 pagesChapter c5bobPas encore d'évaluation

- Indiabulls Power IPO: 2. DB Realty LTD (DBRL)Document4 pagesIndiabulls Power IPO: 2. DB Realty LTD (DBRL)D Attitude KidPas encore d'évaluation

- UG Bulletin2018FinalDocument39 pagesUG Bulletin2018FinalAman KumarPas encore d'évaluation

- BP, Reliance in $7.2 BN Oil Deal: Market ResponseDocument22 pagesBP, Reliance in $7.2 BN Oil Deal: Market ResponseAnkit PareekPas encore d'évaluation

- PROBLEM NO. 2 - Current and Noncurrent LiabilitiesDocument3 pagesPROBLEM NO. 2 - Current and Noncurrent LiabilitiesMark Michael LegaspiPas encore d'évaluation

- Debacle of Satyam Computers Limited: A Case Study of India's EnronDocument40 pagesDebacle of Satyam Computers Limited: A Case Study of India's EnronSultana ChowdhuryPas encore d'évaluation

- IBL AR18 - Book PDFDocument170 pagesIBL AR18 - Book PDFHEMKESH CONHYEPas encore d'évaluation

- L-04 Industrial ManagementDocument12 pagesL-04 Industrial ManagementTanyaMathurPas encore d'évaluation

- Indicatorul Valoarea AdaugataDocument12 pagesIndicatorul Valoarea Adaugatababy_bluero5575Pas encore d'évaluation

- S3651323 - A3 - Governance Research EssayDocument7 pagesS3651323 - A3 - Governance Research EssayTai LuongPas encore d'évaluation

- IAP Book 2017 18 PDFDocument168 pagesIAP Book 2017 18 PDFBdbdPas encore d'évaluation

- William Blair and BDA Advise STS On Its Sale To Adler Pelzer GroupDocument3 pagesWilliam Blair and BDA Advise STS On Its Sale To Adler Pelzer GroupPR.comPas encore d'évaluation

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayPas encore d'évaluation

- Sahara ScamDocument3 pagesSahara ScamAgrim Dewan100% (1)

- GNM Escalation For Vlooking UpDocument29 pagesGNM Escalation For Vlooking Upandrewnkhuwa17Pas encore d'évaluation

- SAP Certified Consultant ListDocument64 pagesSAP Certified Consultant ListPhani PrakashPas encore d'évaluation

- Revisiting The Viability To Allow Dual-Class Share Structure Companies To List in The Financial Market of Hong KongDocument49 pagesRevisiting The Viability To Allow Dual-Class Share Structure Companies To List in The Financial Market of Hong KongDan Andrei BongoPas encore d'évaluation

- Bse 20191204Document50 pagesBse 20191204BellwetherSataraPas encore d'évaluation

- Annuual Report-2018-19Document102 pagesAnnuual Report-2018-19Ahm FerdousPas encore d'évaluation

- Less Than Wholly Owned REPORTDocument40 pagesLess Than Wholly Owned REPORTrichelledelgadoPas encore d'évaluation

- Hyperion Financial Management - Proof of ConceptDocument17 pagesHyperion Financial Management - Proof of ConceptJB ManjunathPas encore d'évaluation