Académique Documents

Professionnel Documents

Culture Documents

Income Tax

Transféré par

dhar009Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Income Tax

Transféré par

dhar009Droits d'auteur :

Formats disponibles

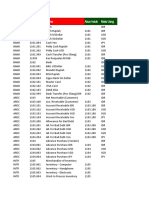

A B C D E Q.

Resident & Ordinarily Resident Resident & NOT Ordinarily Resident Non Resident in India Any one of A, B or C None of A, B and C QUESTION A B C D E

AMIT left India for the first time on May 20, 2003. During the financial year 2005-06, he came to India once on May 27 for a period of 53 days. Determine his residential status for the assessment year 200607? EXPLANATION:- Since AMIT comes to India only for 53 days in the previous year 2005-06, he does not satisfy any of the basic conditions laid down in section 6(1). He is, therefore, non-resident in India for the assessment year 2006-07.

0 1 0 0

AMIT comes to India, for the first time, on April 16, 2003. During his stay in India up to October 5, 2005, he stays at Delhi up to April 10, 2005 and There after remains in Chennai till his departure from India. Determine his residential status for the assessment year 200607. EXPLANATION:- AMIT satisfies one of the basic 0 conditions and only one of the two additional conditions. He is, therefore, resident but not ordinarily resident in India for the assessment year 2006-07.

0 0 0

X, a foreign citizen comes to India, for the first time 0 in the last 30 years on March 20, 2005. On September 1, 2005, he leaves India for Nepal on a business trip. He comes back on February 26, 2006. Determine the residential status of X for the assessment year 2006-07. EXPLANATION:- he is not following any condition so we can say he is NRI. He live in India only for 133 days

1 0 0

Mr. ram Karta of HUF, claims that the HUF is non-resident as the business of HUF is transacted from UK and all the policy decisions are taken there.

Explanation:A HUF is considered to be a non-resident where the control and management of its affairs are situated wholly outside India. In the given case, since all the policy decisions of HUF are taken from UK, the HUF is a non-resident

1 0 0

X a foreign citizen comes to India for the first time on June 20,2011. On S eptember 6,2011 , he leaves India for Burma on business trip. He comes back on January 1,2012. He maintains a dwelling place in India from the date of his arrival (i.e. June 20,2011) till January 15,2012 when he leaves for Kuwait. Determine his residential status for A.Y. 2012-13.

0 0 0

Mr. X, a citizen of India, received salary from the Government of India for the service rendered outside India. Is the salary income chargeable to tax?

0 0 0

Explanation:As per S ection 9(1)(iii), salaries payable by the Government to a citizen of India for services rendered outside India is deemed to accrue or arise in India. Hence, salary received by Mr. X, a citizen of India, from the Government of India for services rendered outside India is chargeable to tax under the head S alaries. But all allowances or perquisites paid outside India by the Government to Indian citizens for their rendering services outside India are exempt under section 10(7).

3.

Are there any restrictions on deduction allowable to the partnership firm in respect of salary and interest to its partners under section 40(b) of the Income-tax Act, 1961? Explanation:(i) The remuneration payable to its working partners and interest payable to partners should be authorized by and in accordance with the partnership deed and should fall after the date of execution of the deed. (ii) The payment of interest to partners is allowable up to 12% p.a. simple interest if it is authorized in the partnership deed and must fall after the date of the deed. (a) On the first `3 lakh of book profit or in the case of loss `1,50,000 or 90%of book profits whichever is more. Ms. Nomi contends that sale of a work of art held by her is not eligible to capital gains tax; is she correct.

4.

Explanation:As per section 2(14)(ii), the term personal effect excludes any work of art. As a result, any work of art will be considered as a capital asset and sale of the same will attract capital gains tax. Thus, the contention of Ms. Nomi is not correct Mr. X, an individual resident woman, wanted to know whether income-tax is attracted on sale of gold and jewelry gifted to her by her parents on the occasion of her marriage in the year 1979 which was purchased at a total cost of `2,00,000 Explanation:Under section 2(14) includes jewelry. Therefore, capital gains is attracted on sale of jewelry, since jewelry is excluded from personal effects. The cost to the previous owner or the fair market value as on 1/4/1981, whichever is more beneficial to assesse, would be treated as the cost of acquisition. Accordingly, in this case, long term capital gain @ 20% will be attracted in the year in which the gold and jewelry is sold by Mr. X

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- A Treatise On Trust Company LawDocument616 pagesA Treatise On Trust Company LawSpencer Barclay100% (2)

- 2023 CA Seal Catalog - Low ResDocument920 pages2023 CA Seal Catalog - Low ResĐức Văn HữuPas encore d'évaluation

- Optimization Methods in Asset Management FAQsDocument10 pagesOptimization Methods in Asset Management FAQsNITIN MISHRA100% (1)

- Project: Customer Service: Part A - QuestionsDocument30 pagesProject: Customer Service: Part A - QuestionsnehaPas encore d'évaluation

- Supply Chain in TataSteel by SK ArangiDocument21 pagesSupply Chain in TataSteel by SK Arangisureshkumararangi25% (4)

- 2go Itinerary MR Alex TarimanDocument1 page2go Itinerary MR Alex TarimanMaica Jarie RiguaPas encore d'évaluation

- Agencyhub The Value of Certification Research ReportDocument9 pagesAgencyhub The Value of Certification Research ReportRaphael CordeiroPas encore d'évaluation

- PECB Certified ISO/IEC 27001 FoundationDocument1 pagePECB Certified ISO/IEC 27001 FoundationJennie LimPas encore d'évaluation

- Assign 2Document10 pagesAssign 2Ravi GuptaPas encore d'évaluation

- Japan Is A Thriving Modern Nation Today in The Asia RegionDocument5 pagesJapan Is A Thriving Modern Nation Today in The Asia RegiontyroxtimebanditPas encore d'évaluation

- Alejandro Herrero Herrera: Senior Project Manager - SAP Senior System/Business AnalystDocument3 pagesAlejandro Herrero Herrera: Senior Project Manager - SAP Senior System/Business AnalystharshPas encore d'évaluation

- OptiStruct For Linear Dynamics v13 Rev20141128 PDFDocument103 pagesOptiStruct For Linear Dynamics v13 Rev20141128 PDFGonzalo Anzaldo50% (2)

- Regal Sales Inc.Document4 pagesRegal Sales Inc.Raschelle MayugbaPas encore d'évaluation

- Consumer Perception Toward Online ShoppingDocument11 pagesConsumer Perception Toward Online ShoppingJIGNESH125Pas encore d'évaluation

- Sapien 1Document3 pagesSapien 1Theo RodriguesPas encore d'évaluation

- Analisis Pengaruh Kualitas Produk, Desain Produk, Persepsi Harga Dan Iklan Terhadap Keputusan Pembelian Bedak Wajah Viva CosmeticsDocument28 pagesAnalisis Pengaruh Kualitas Produk, Desain Produk, Persepsi Harga Dan Iklan Terhadap Keputusan Pembelian Bedak Wajah Viva CosmeticsRetnova NovaPas encore d'évaluation

- Jmfl-Policybazaar Ic 161121Document31 pagesJmfl-Policybazaar Ic 161121Santosh RoutPas encore d'évaluation

- PriceList - Shalimar One World Belvedere Court - 99acresDocument2 pagesPriceList - Shalimar One World Belvedere Court - 99acresrahulPas encore d'évaluation

- Social Media Audit SummaryDocument2 pagesSocial Media Audit Summaryapi-565617118Pas encore d'évaluation

- ACCT 7004 Exam F2022 TemplateDocument17 pagesACCT 7004 Exam F2022 TemplateJesse DanielsPas encore d'évaluation

- Dish TV: IndiaDocument8 pagesDish TV: Indiaashok yadavPas encore d'évaluation

- Unza Management AccountingDocument88 pagesUnza Management AccountingPumulo MubitaPas encore d'évaluation

- ESES DSD SBI tcm90-182718Document36 pagesESES DSD SBI tcm90-182718Edgar KalverssPas encore d'évaluation

- Multi Finance Business Valuation-Case Study-141128Document20 pagesMulti Finance Business Valuation-Case Study-141128nelvyPas encore d'évaluation

- Diffusion Curriculum TheoryDocument41 pagesDiffusion Curriculum TheorySabri AhmadPas encore d'évaluation

- O Senhor É Meu Pastor Sheet Music For Piano (Solo)Document1 pageO Senhor É Meu Pastor Sheet Music For Piano (Solo)Opus TrêsPas encore d'évaluation

- Haryana Aided Schools (Special Pension & Contributory Provident Fund) Rules, 2001Document26 pagesHaryana Aided Schools (Special Pension & Contributory Provident Fund) Rules, 2001sunilPas encore d'évaluation

- Ryanair Business Finance PaperDocument24 pagesRyanair Business Finance PaperJames RobertsPas encore d'évaluation

- Impor Akun Acc OnlineDocument8 pagesImpor Akun Acc Onlinee s tPas encore d'évaluation

- Leasing Presentation Atrium MallDocument31 pagesLeasing Presentation Atrium MallSahaj anandPas encore d'évaluation