Académique Documents

Professionnel Documents

Culture Documents

2011 ITR1 r2

Transféré par

Zafar IqbalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2011 ITR1 r2

Transféré par

Zafar IqbalDroits d'auteur :

Formats disponibles

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year Year

2011-12

PAN AAEPI6565N

PERSONAL INFORMATION

First Name MOHD Flat / Door / Building SANCHAR SADAN Road / Street SHAH NAJAF ROAD Town/City/District LUCKNOW

Middle Name ZAFAR

Last Name IQBAL Status

I - Individual Area / Locallity HAZRATGANJ State 31-UTTAR PRADESH Mobile no (Std code) 9415000786 0522 Pin Code 226001 Date of birth (DD/MM/YYYY) 25/06/1968 Sex (Select) M-Male

FILING STATUS

Email Address zefariqbal@gmail.com Income Tax Ward / Circle JCIT RANGE II,LUCKNOW-N Whether original or revised return?

Phone No Employer Category (if in 2329353 employment) PSU Return filed under section [Pl see Form Instruction] 11 - u/s 139(1) Date 1 2 3 4 1,130,721 0 0

O-Original

If revised, enter Receipt no / Date RES - Resident Residential Status 1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c c 80 CCD 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 13 Balance Tax Payable (10 - 11 - 12) 14 Total Interest Payable 15 Total Tax and Interest Payable (13 + 14) For Office Use Only Receipt No/ Date

100,000

0 0

100,000

TAX COMPUTATION

1,130,721 System Calculated 100,000 0 0 0 0 0 0 0 0 0 0 0 0 100,000 6 1,030,721 7 163,216 8 4,896 9 168,112 10

INCOME & DEDUCTIONS

0 0 168,112 13 0 14 168,112 15 Seal and Signature of Receiving Official

23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] Tax Deduction Income charg Name of the Total tax Account Number SI.No eable under the Employer Deducted (TAN) of the head Salaries Employer (3) (4) (5) (1) (2) LKNB05777C BSNL 1,130,721 168,110 1 2 3 (Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source Other than Salary Tax Deduction Account Number (TAN) of the Deductor (2) Name of the Deductor (3) Total tax Deducted (4) Amount out of (6) claimed for this year (5)

SI.No

(1) 1 2 3 4

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Deposit (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

16 Taxes Paid 0 a Advance Tax (from item 25) 16a b TDS (column 7 of item 23 +column 7 16b 168,110 of item 24) 0 c Self Assessment Tax (item 25) 16c 168,110 17 Total Taxes Paid (16a+16b+16c) 17 2 18 Tax Payable (15-17) (if 15 is greater than 17) 18 0 19 Refund (17-15) if 17 is greater than 15 19 2411000400003 20 Enter your Bank Account number (Mandatory ) Yes 21 Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details 226051568 Savings MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000) VERIFICATION MOHD ZAFAR IQBAL I, (full name in block letters), son/daughter of MUSHTAQUE solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2011-12 Place Date 17/06/2011 Sign here -> LUCKNOW PAN AAEPI6565N 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP REFUND TAXES PAID

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Vous aimerez peut-être aussi

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONIPas encore d'évaluation

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinPas encore d'évaluation

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986Pas encore d'évaluation

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarPas encore d'évaluation

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraPas encore d'évaluation

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123Pas encore d'évaluation

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaPas encore d'évaluation

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamPas encore d'évaluation

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranPas encore d'évaluation

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilPas encore d'évaluation

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasPas encore d'évaluation

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document22 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaPas encore d'évaluation

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58Pas encore d'évaluation

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooPas encore d'évaluation

- 2015 Itr1 PR3Document18 pages2015 Itr1 PR3shubham sharmaPas encore d'évaluation

- ITR Form 1Document7 pagesITR Form 1gj29herePas encore d'évaluation

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvPas encore d'évaluation

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryPas encore d'évaluation

- Enter Necessary Data For Income Tax CalculationDocument15 pagesEnter Necessary Data For Income Tax Calculationsa_mishraPas encore d'évaluation

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconPas encore d'évaluation

- Bir Form 1701Document12 pagesBir Form 1701miles1280Pas encore d'évaluation

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudPas encore d'évaluation

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajPas encore d'évaluation

- Form 16Document4 pagesForm 16Aruna Kadge JhaPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- 1702-EX June 2013 Pages 1 To 2 PDFDocument2 pages1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronPas encore d'évaluation

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sPas encore d'évaluation

- Bir Form 1702-RtDocument8 pagesBir Form 1702-RtShiela PilarPas encore d'évaluation

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDocument6 pagesImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahPas encore d'évaluation

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocument5 pagesQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanPas encore d'évaluation

- QUA04354 Form16Document3 pagesQUA04354 Form16rajanPas encore d'évaluation

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaPas encore d'évaluation

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999Pas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchD'EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchÉvaluation : 5 sur 5 étoiles5/5 (1)

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryD'EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Federal Income Tax: a QuickStudy Digital Law ReferenceD'EverandFederal Income Tax: a QuickStudy Digital Law ReferencePas encore d'évaluation

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryD'EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1D'EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Pas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- J.K. Lasser's Your Income Tax 2024, Professional EditionD'EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionPas encore d'évaluation

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnD'EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnPas encore d'évaluation

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawD'EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Miscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Form X For M Frequen Cy: SL NoDocument9 pagesForm X For M Frequen Cy: SL NoZafar IqbalPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Lease Shalimar1Document5 pagesLease Shalimar1Zafar IqbalPas encore d'évaluation

- Description: I I I I I I II III IV V VI VII Viii IX XDocument17 pagesDescription: I I I I I I II III IV V VI VII Viii IX XZafar IqbalPas encore d'évaluation

- Application For Reimbursement of CEA14-15Document4 pagesApplication For Reimbursement of CEA14-15Zafar IqbalPas encore d'évaluation

- Aurad e Fatiha by Ali Sani Khawaja Syed Ali HamdaniDocument59 pagesAurad e Fatiha by Ali Sani Khawaja Syed Ali HamdaniZafar Iqbal100% (1)

- Deewana Banana Hai To Deewana Bana deDocument2 pagesDeewana Banana Hai To Deewana Bana deZafar IqbalPas encore d'évaluation

- Application Form For Admission To B.Tech. Only Faculty of Engineering &technologyDocument3 pagesApplication Form For Admission To B.Tech. Only Faculty of Engineering &technologyZafar IqbalPas encore d'évaluation

- Csir Admin AparDocument30 pagesCsir Admin AparZafar IqbalPas encore d'évaluation

- 120 Faisla Haft Masla EnglishDocument1 page120 Faisla Haft Masla EnglishZafar IqbalPas encore d'évaluation

- Deewana Banana Hai To Deewana Bana deDocument2 pagesDeewana Banana Hai To Deewana Bana deZafar IqbalPas encore d'évaluation

- Azamgarh LetterDocument1 pageAzamgarh LetterZafar IqbalPas encore d'évaluation

- 1 PaynetDocument1 page1 PaynetZafar Iqbal100% (1)

- Conn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Document3 pagesConn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Zafar IqbalPas encore d'évaluation

- Sir Syed k Mazhabi Aqaid o Afkarسر سید کے مذھبی عقائد و افکارDocument102 pagesSir Syed k Mazhabi Aqaid o Afkarسر سید کے مذھبی عقائد و افکارMuhammad Mughal100% (1)

- Conn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Document3 pagesConn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Zafar IqbalPas encore d'évaluation

- Delhi Metro Route MapDocument1 pageDelhi Metro Route Mapnakulyadav7Pas encore d'évaluation

- Press Release (Mina and Arafat) : TH THDocument4 pagesPress Release (Mina and Arafat) : TH THZafar IqbalPas encore d'évaluation

- Table 5A. Residential Average Monthly Bill by Census Division, and State 2011Document2 pagesTable 5A. Residential Average Monthly Bill by Census Division, and State 2011Zafar IqbalPas encore d'évaluation

- Historical Gold PricesDocument1 658 pagesHistorical Gold PricesZafar IqbalPas encore d'évaluation

- Conn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Document3 pagesConn No 54519 Acct No.11088565 (O) Acct No.2286470000 Book No. 312643913144Zafar IqbalPas encore d'évaluation

- Lucknow inDocument0 pageLucknow inZafar IqbalPas encore d'évaluation

- 120 Faisla Haft Masla EnglishDocument1 page120 Faisla Haft Masla EnglishZafar IqbalPas encore d'évaluation

- An Introduction To The Ulama of Deoband (Urdu) by Maulana Mohammed Shafee Okarvi R.A.Document146 pagesAn Introduction To The Ulama of Deoband (Urdu) by Maulana Mohammed Shafee Okarvi R.A.Abdul Mustafa100% (9)

- Sir Syed k Mazhabi Aqaid o Afkarسر سید کے مذھبی عقائد و افکارDocument102 pagesSir Syed k Mazhabi Aqaid o Afkarسر سید کے مذھبی عقائد و افکارMuhammad Mughal100% (1)

- Azizia Map2010Document1 pageAzizia Map2010Zafar IqbalPas encore d'évaluation

- Aab E Gum by Mushtaq Ahmad YousafiDocument127 pagesAab E Gum by Mushtaq Ahmad Yousafiroadsign100% (1)

- 120 Faisla Haft Masla EnglishDocument1 page120 Faisla Haft Masla EnglishZafar IqbalPas encore d'évaluation

- Key Drivers For Modern Procurement 1Document22 pagesKey Drivers For Modern Procurement 1setushroffPas encore d'évaluation

- PepsiCo Changchun Joint Venture Helpful HintsDocument2 pagesPepsiCo Changchun Joint Venture Helpful HintsLeung Hiu Yeung50% (2)

- Industry Multiples in India: March 2019 - Seventh EditionDocument47 pagesIndustry Multiples in India: March 2019 - Seventh EditionharishPas encore d'évaluation

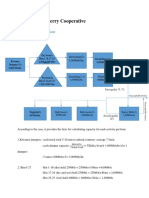

- National Cranberry Case SolutionDocument4 pagesNational Cranberry Case SolutionAli Umer MughalPas encore d'évaluation

- FICO Configuration Transaction CodesDocument3 pagesFICO Configuration Transaction CodesSoumitra MondalPas encore d'évaluation

- Model Project For Milk Processing Plant - NABARDDocument39 pagesModel Project For Milk Processing Plant - NABARDPraneeth Cheruvupalli0% (1)

- Build, Operate and TransferDocument11 pagesBuild, Operate and TransferChloe OberlinPas encore d'évaluation

- Chapter-1: 1.1 Categorization of PostsDocument15 pagesChapter-1: 1.1 Categorization of PostsJyothi PrasadPas encore d'évaluation

- Accounting Changes and Error AnalysisDocument39 pagesAccounting Changes and Error AnalysisIrwan Januar100% (1)

- ch01 Introduction Acounting & BusinessDocument37 pagesch01 Introduction Acounting & Businesskuncoroooo100% (1)

- SR05 - Amruth Pavan Davuluri - How Competitive Forces Shape StrategyDocument14 pagesSR05 - Amruth Pavan Davuluri - How Competitive Forces Shape Strategyamruthpavan09Pas encore d'évaluation

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengPas encore d'évaluation

- Retirement of A PartnerDocument6 pagesRetirement of A Partnershrey narulaPas encore d'évaluation

- Our Friends at The Bank PDFDocument1 pageOur Friends at The Bank PDFAnnelise HermanPas encore d'évaluation

- Drink Recipe Guide 2009Document63 pagesDrink Recipe Guide 2009Joel Suraci100% (1)

- Demand LetterDocument45 pagesDemand LetterBilly JoePas encore d'évaluation

- Datasheet BUK7508-55Document9 pagesDatasheet BUK7508-55Luis PerezPas encore d'évaluation

- Ch7 HW AnswersDocument31 pagesCh7 HW Answerscourtdubs78% (9)

- Economics Course OutlineDocument15 pagesEconomics Course OutlineDavidHuPas encore d'évaluation

- REPORT - Economic and Steel Market Outlook - Quarter 4, 2018Document24 pagesREPORT - Economic and Steel Market Outlook - Quarter 4, 2018Camelia ZlotaPas encore d'évaluation

- Marathon Sponser ProposalDocument9 pagesMarathon Sponser ProposalPrabahar RajaPas encore d'évaluation

- Bar GraphDocument16 pagesBar Graph8wtwm72tnfPas encore d'évaluation

- 1 .Operating Ratio: Year HUL Nestle Britannia MaricoDocument17 pages1 .Operating Ratio: Year HUL Nestle Britannia MaricoSumith ThomasPas encore d'évaluation

- Faasos 140326132649 Phpapp01Document15 pagesFaasos 140326132649 Phpapp01Arun100% (1)

- Irfz 48 VDocument8 pagesIrfz 48 VZoltán HalászPas encore d'évaluation

- Customizing Iss Pis Cofins For CBT v2 1Document33 pagesCustomizing Iss Pis Cofins For CBT v2 1roger_bx100% (1)

- L Oréal Travel Retail Presentation SpeechDocument6 pagesL Oréal Travel Retail Presentation Speechsaketh6790Pas encore d'évaluation

- Income Taxation SchemesDocument2 pagesIncome Taxation SchemesLeonard Cañamo100% (4)

- Working Capital Management For Sugar IndustryDocument12 pagesWorking Capital Management For Sugar Industryselvamech2337100% (4)

- Data StructureDocument6 pagesData Structuremohit1485Pas encore d'évaluation