Académique Documents

Professionnel Documents

Culture Documents

Case Digest On Tax

Transféré par

gullabrianedwardDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Case Digest On Tax

Transféré par

gullabrianedwardDroits d'auteur :

Formats disponibles

G.R. No.

L-7859

December 22, 1955

WALTER LUTZ, as Judicial Administrator of the Intestate Estate of the deceased Antonio Jayme Ledesma, plaintiff-appellant, vs. J. ANTONIO ARANETA, as the Collector of Internal Revenue, defendant-appellee. REYES, J.B L., J.: Facts: This case was initiated in the Court of First Instance of Negros Occidental to test the legality of the taxes imposed by Commonwealth Act No. 567, otherwise known as the Sugar Adjustment Act.

Promulgated in 1940, the due to the threat to our industry by the imminent imposition of export taxes upon sugar as provided in the Tydings-McDuffe Act, and the "eventual loss of its preferential position in the United States market"; wherefore, the national policy was expressed "to obtain a readjustment of the benefits derived from the sugar industry by the component elements thereof" and "to stabilize the sugar industry so as to prepare it for the eventuality of the loss of its preferential position in the United States market and the imposition of the export taxes."

In section 2, Commonwealth Act 567 provides for an increase of the existing tax on the manufacture of sugar, on a graduated basis, on each picul of sugar manufactured; while section 3 levies on owners or persons in control of lands devoted to the cultivation of sugar cane and ceded to others for a consideration, on lease or otherwise a tax equivalent to the difference between the money value of the rental or consideration collected and the amount representing 12 per centum of the assessed value of such land.

Plaintiff, Walter Lutz, in his capacity as Judicial Administrator of the Intestate Estate of Antonio Jayme Ledesma, seeks to recover from the Collector of Internal Revenue the sum of P14,666.40 paid by the estate as taxes, under section 3 of the Act, for the crop years 1948-1949 and 19491950; alleging that such tax is unconstitutional and void, being levied for the aid and support of the sugar industry exclusively, which in plaintiff's opinion is not a public purpose for which a tax

may be constitutionally levied. The action having been dismissed by the Court of First Instance, the plaintiffs appealed the case directly to this Court (Judiciary Act, section 17).

ISSUE: Whether or not the CA No. 567 or Sugar Adjustment Act is constitutional and for public purpose.

HELD: The basic defect in the plaintiff's position is his assumption that the tax provided for in Commonwealth Act No. 567 is a pure exercise of the taxing power. Analysis of the Act, and particularly of section 6, will show that the tax is levied with a regulatory purpose, to provide means for the rehabilitation and stabilization of the threatened sugar industry. In other words, the act is primarily an exercise of the police power.

This Court can take judicial notice of the fact that sugar production is one of the great industries of our nation, sugar occupying a leading position among its export products; that it gives employment to thousands of laborers in fields and factories; that it is a great source of the state's wealth, is one of the important sources of foreign exchange needed by our government, and is thus pivotal in the plans of a regime committed to a policy of currency stability. Its promotion, protection and advancement, therefore redounds greatly to the general welfare. Hence it was competent for the legislature to find that the general welfare demanded that the sugar industry should be stabilized in turn; and in the wide field of its police power, the lawmaking body could provide that the distribution of benefits therefrom be readjusted among its components to enable it to resist the added strain of the increase in taxes that it had to sustain.

Once it is conceded, as it must, that the protection and promotion of the sugar industry is a matter of public concern, it follows that the Legislature may determine within reasonable bounds what is necessary for its protection and expedient for its promotion. Here, the legislative discretion must be allowed fully play, subject only to the test of reasonableness; and it is not contended that the means provided in section 6 of the law bear no relation to the objective pursued or are oppressive in character. If objective and methods are alike constitutionally valid, no reason is seen why the state may not levy taxes to raise funds for their prosecution and attainment. Taxation may be made the implement of the state's police power.

That the tax to be levied should burden the sugar producers themselves can hardly be a ground of complaint; indeed, it appears rational that the tax be obtained precisely from those who are to be benefited from the expenditure of the funds derived from it. At any rate, it is inherent in the power to tax that a state be free to select the subjects of taxation, and it has been repeatedly held that "inequalities which result from a singling out of one particular class for taxation, or exemption infringe no constitutional limitation".

From the point of view we have taken it appears of no moment that the funds raised under the Sugar Stabilization Act, now in question, should be exclusively spent in aid of the sugar industry, since it is that very enterprise that is being protected. It may be that other industries are also in need of similar protection; that the legislature is not required by the Constitution to adhere to a policy of "all or none." As ruled in Minnesota ex rel. Pearson vs. Probate Court, 309 U. S. 270, 84 L. Ed. 744, "if the law presumably hits the evil where it is most felt, it is not to be overthrown because there are other instances to which it might have been applied;" and that "the legislative authority, exerted within its proper field, need not embrace all the evils within its reach".

G.R. No. L-21183

September 27, 1968

VICTORIAS MILLING CO., INC., plaintiff-appellant, vs. THE MUNICIPALITY OF VICTORIAS, PROVINCE OF NEGROS OCCIDENTAL, defendant-appellant. SANCHEZ, J.: Facts: Ordinance 1 (1956) was approved by the municipal council of Victorias by way of an amendment to 2 municipal ordinances separately imposing license taxes on operators of sugar centrals and sugar refineries. The changes were: (1) with respect to sugar centrals, by increasing the rates of license taxes; and (2) as to sugar refineries, by increasing the rates of license taxes as well as teh range of graduated schedule of annual output capacity. Victorias Milling questioned the validity of Ordinance 1 as it, among others, allegedly singled out Victorias Milling Co. since it is the only operator of a sugar central and a sugar refinery within the jurisdiction of the municipality. Issue: Whether Ordinance 1 is discriminatory. Held: The ordinance does not single out Victorias as the only object of the ordinance but is made to apply to any sugar central or sugar refinery which may happen to operate in the municipality. The fact that Victorias Milling is actually the sole operator of a sugar central and a sugar refinery does not make the ordinance discriminatory. The ordinance is unlike that in Ormoc Sugar Company vs. Municipal Board of Ormoc City, which specifically spelled out Ormoc Sugar as the subject of the taxation, the name of the company herein was never mentioned in the ordinance.

VILLEGAS v. HIU CHIONG TSAI PAO HO G.R. No. L-29646, November 10, 1978 Fernandez,J,: FACTS: On February 22, 1968, the Municipal Board of Manila passed City Ordinance No. 6537. The said city ordinance was also signed by then Manila Mayor Antonio J. Villegas (Villegas). Section 1 of the said city ordinance prohibits aliens from being employed or to engage or participate in any position or occupation or business enumerated therein, whether permanent, temporary or casual, without first securing an employment permit from the Mayor of Manila and paying the permit fee of P50.00 except persons employed in the diplomatic or consular missions of foreign countries, or in the technical assistance programs of both the Philippine Government and any foreign government, and those working in their respective households, and members of religious orders or congregations, sect or denomination, who are not paid monetarily or in kind. Hiu Chiong Tsai Pao Ho (Tsai Pao Ho) who was employed in Manila, filed a petition with the CFI of Manila to declare City Ordinance No. 6537 as null and void for being discriminatory and violative of the rule of the uniformity in taxation. The trial court declared City Ordinance No. 6537 null and void. Villegas filed the present petition.

ISSUE: Whether or not City Ordinance No. 6537 is a tax or revenue measure.

RULING: Yes. The contention that City Ordinance No. 6537 is not a purely tax or revenue measure because its principal purpose is regulatory in nature has no merit. While it is true that the first part which requires that the alien shall secure an employment permit from the Mayor involves the exercise of discretion and judgment in the processing and approval or disapproval of applications for employment permits and therefore is regulatory in character the second part which requires the payment of P50.00 as employee's fee is not regulatory but a revenue measure. There is no logic or justification in exacting P50.00 from aliens who have been cleared for

employment. It is obvious that the purpose of the ordinance is to raise money under the guise of regulation.

G.R. No. L-18994

June 29, 1963

MELECIO R. DOMINGO, as Commissioner of Internal Revenue, petitioner, vs. HON. LORENZO C. GARLITOS, in his capacity as Judge of the Court of First Instance of Leyte, and SIMEONA K. PRICE, as Administratrix of the Intestate Estate of the late Walter Scott Price,respondents. LABRADOR, J.: Facts: InDomingo vs. Moscoso (106 PHIL 1138), the Supreme Court declared as final and executory the order of the Court of First Instance of Leyte for the payment of estate and inheritance taxes, charges and penalties amounting to P40,058.55 by the Estate of the late Walter Scott Price. The petition for execution filed by the fiscal, however, was denied by the lower court. The Court held that the execution is unjustified as the Government itself is indebted to the Estate for 262,200; and ordered the amount of inheritance taxes be deducted from the Governments indebtedness to the Estate. Issue: Whether a tax and a debt may be compensated. Held: The court having jurisdiction of the Estate had found that the claim of the Estate against the Government has been recognized and an amount of P262,200 has already been appropriated by a corresponding law (RA 2700). Under the circumstances, both the claim of the Government for inheritance taxes and the claim of the intestate for services rendered have already become overdue and demandable as well as fully liquidated. Compensation, therefore, takes place by operation of law, in accordance with Article 1279 and 1290 of the Civil Code, and both debts are extinguished to the concurrent amount.

G.R. No. L-26521

December 28, 1968

EUSEBIO VILLANUEVA, ET AL., plaintiff-appellee, vs. CITY OF ILOILO, defendants-appellants. CASTRO, J.: Facts: On 30 September 1946, the Municipal Board of Iloilo City enacted Ordinance 86 imposing license tax fees upon tenement house (P25); tenement house partly engaged or wholly engaged in and dedicated to business in Baza, Iznart, and Aldeguer Streets (P24 per apartment); and tenement house, partly or wholly engaged in business in other streets (P12 per apartment). The validity of such ordinance was challenged by Eusebio and Remedios Villanueva, owners of four tenement houses containing 34 apartments. The Supreme Court held the ordinance to be ultra vires. On 15 January 1960, however, the municipal board, believing that it acquired authority to enact an ordinance of the same nature pursuant to the Local Autonomy Act, enacted Ordinance 11 (series of 1960), Eusebio and Remedios Villaniueva assailed the ordinance anew. Issue: Whether Ordinance 11 violate the rule of uniformity of taxation. Held: The Court has ruled that tenement houses constitute a distinct class of property; and that taxes are uniform and equal when imposed upon all property of the same class or character within the taxing authority. The fact that the owners of the other classes of buildings in Iloilo are not imposed upon by the ordinance, or that tenement taxes are imposed in other cities do not violate the rule of equality and uniformity. The rule does not require that taxes for the same purpose should be imposed in different territorial subdivisions at the same time. So long as the burden of tax falls equally and impartially on all owners or operators of tenement houses similarly classified or situated, equality and uniformity is accomplished. The presumption that tax statutes are intended to operate uniformly and equally were not overthrown herein.

Maceda vs. Macaraig GR 88291, 31 May 1991 En Banc, Gancayco (J) Facts: Commonwealth Act 120 created NAPOCOR as a public corporation to undertake the development of hydraulic power and the production of power from other sources. RA 358 (1949) granted NAPOCOR tax and duty exemption privileges. RA 6395 (1971) revised the charter of the NAPOCOR, tasking it to carry out the policy of the national electrification, and provided in detail NAPOCORs tax exceptions. PD 380 (1974) specified that NAPOCORs exemption includes all taxes, etc. imposed directly or indirectly. PD 938 integrated the exemptions in favor of GOCCs including their subsidiaries; however, empowering the President or the Minister of Finance, upon recommendation of the Fiscal Incentives Review Board (FIRB) to restore, partially or completely, the exemptions withdrawn or revised. The FIRB issued Resolution 10-85 (7 February 1985) restoring the duty and tax exemptions privileges of NAPOCOR for period 11 June 1984- 30 June 1985. Resolution 1-86 (1January 1986) restored such exemption indefinitely effective 1 July 1985. EO 93 (1987) again withdrew the exemption. FIRB issued Resolution 1787 (24 June 1987) restoring NAPOCORs exemption, which was approved by the President on 5 October 1987. Since 1976, oil firms never paid excise or specific and ad valorem taxes for petroleum products sold and delivered to NAPOCOR. Oil companies started to pay specific and ad valorem taxes on their sales of oil products to NAPOCOR only in 1984. NAPOCOR claimed for a refund (P468.58 million). Only portion thereof, corresponding to Caltex, was approved and released by way of a tax credit memo. The claim for refund of taxes paid by PetroPhil, Shell and Caltex amounting to P410.58 million was denied. NAPOCOR moved for reconsideration, starting that all deliveries of petroleum products to NAPOCOR are tax exempt, regardless of the period of delivery. Issue: Whether NAPOCOR cease to enjoy exemption from indirect tax when PD 938 stated the exemption in general terms.

Held: NAPOCOR is a non-profit public corporation created for the general good and welfare, and wholly owned by the government of the Republic of the Philippines. From the very beginning of the corporations existence, NAPOCOR enjoyed preferential tax treatment to enable the corporation to pay the indebtness and obligation and effective implementation of the policy enunciated in Section 1 of RA 6395. From the preamble of PD 938, it is evident that the provisions of PD 938 were not intended to be strictly construed against NAPOCOR. On the contrary, the law mandates that it should be interpreted liberally so as to enhance the tax exempt status of NAPOCOR. It is recognized principle that the rule on strict interpretation does not apply in the case of exemptions in favor of government political subdivision or instrumentality. In the case of property owned by the state or a city or other public corporations, the express exception should not be construed with the same degree of strictness that applies to exemptions contrary to the policy of the state, since as to such property exception is the rule and taxation the exception.

CIR vs Filinvest Development Corporation July 19, 2011 Perez, J.: Facts:

G.R. No. 163653

Filinvest Development Corporation extended advances in favor of its affiliates and supported the same with instructional letters and cash and journal vouchers. The BIR assessed Filinvest for deficiency income tax by imputing an arms length interest rate on its advances to affiliates. Filinvest disputed this by saying that the CIR lacks the authority to impute theoretical interest and that the rule is that interests cannot be demanded in the absence of a stipulation to the effect. ISSUE: Can the CIR impute theoretical interest on the advances made by Filinvest to its affiliates?

HELD: NO. Despite the seemingly broad power of the CIR to distribute, apportion and allocate gross income under (now) Section 50 of the Tax Code, the same does not include the power to impute theoretical interests even with regard to controlled taxpayers transactions. This is true even if the CIR is able to prove that interest expense (on its own loans) was in fact claimed by the lending entity. The term in the definition of gross income that even those income from whatever source derived is covered still requires that there must be actual or at least probable receipt or realization of the item of gross income sought to be apportioned, distributed, or allocated. Finally, the rule under the Civil Code that no interest shall be due unless expressly stipulated in writing was also applied in this case.

The Court also ruled that the instructional letters, cash and journal vouchers qualify as loan agreements that are subject to DST.

G.R. No. L-25299

July 29, 1969

COMMISSIONER OF INTERNAL REVENUE, petitioner, vs. ITOGON-SUYOC MINES, INC., and THE COURT OF TAX APPEALS, respondents. FERNANDO, J.: Facts: Itogon-Suyoc Mines filed its income tax return for the fiscal year 1959 to 1960. Four months later, it filed an amended income tax return, reporting a loss. It thus sought a refund from the Commissioner. When it filed its income tax return on the next year, it deducted an amount representing alleged tax credit for overpayment for the preceding fiscal year. The Commissioner imposed an amount P1,512.83 as 1% monthly interest on the amount of P13,155.20 from January to December 1962. The basis for such assessment was allegedly the absence of a legal right to deduct said amount before the tax credit or refund is approved by the Commissioner. Issue: Whether the assessment on interest was justified. Held: The Tax Code provides that interest upon the amount determined as a deficiency shall be assessed and shall be paid upon notice and demand from the Commissioner at the rate therein specified. It made clear, however, in an earlier provision found in the same section that if in any preceding year, the taxpayer was entitled to a refund of any amount due as tax, such amount, if not refunded, may be deducted from the tax to be paid. Although the imposition of monthly interest does not constitute penalty but a just compensation to the State for the delay in paying the tax and for the concomitant use by the taxpayer of funds that rightfully should be in governments hands; in light of the overpayment for 1959 and 1960, it cannot be said that the taxpayer was guilty of delay enabling it to utilize the money. The company is entitled to refund.

G.R. No. 179343

January 21, 2010

FISHWEALTH CANNING CORPORATION, Petitioner, vs. COMMISSIONER OF INTERNAL REVENUE, Respondent. CARPIO MORALES, J.: FACTS: Petitioner was assessed for income tax, Value Added Tax and withholding tax. After Court of Tax Appeals issued a Final Decision on Disputed Assessment, Petitioner filed a Letter of Reconsideration with the CIR instead of appealing the same to the Court of Tax Appeals within 30 days. The CIR then issued a Preliminary Collection Letter which prompted the Petitioner to file its Petition with the Court of Tax Appeals. CIR argued that the Petition with the Court of Tax Appeals was filed out of time. ISSUE: Did the filing of a Reconsideration toll the running of the 30-day period to appeal to the Court of Tax Appeals? HELD: NO. A Motion for Reconsideration of the denial of the administrative protest does not toll the 30-day period to appeal to the Court of Tax Appeals.

G.R. No. 139736 October 17, 2005 BANK OF THE PHILIPPINE ISLANDS, Petitioner, vs. COMMISSIONER OF INTERNAL REVENUE, Respondent. CHICO-NAZARIO, J.: Facts: Petitioner BPI, sold $500,000 in 1985 to the Central Bank for the total amount of $1,000,000.O n O c t o b e r 1 9 8 9 , t h e deficiency of documentary tax on its BIR assessed BPI for tax

aforementioned sales of foreign bills

of exchange. BPI filed and protested the assessment on1989 through its counsel. BPI did not receive any immediate reply to its protest. On 1992 BIR issued a warrant of Distraint and/or Levy against the petitioner. The warrant was served on 1992 but never heard anything from the BIR until the 1997 when the reconsideration wasdenied.BPI filed a petition for Review with the CTA and raised prescription as a defense. It alleged that the right to collect must be done within 3 years only, but the BIR waited more than 7years to deny the protest. BIR reiterated its position and remained silent as regards the issue on prescription.CTA rendered the decision in favor BIR stating that the action has not prescribed but the sale of foreign currency is not subject to documentary stamp tax. Further the assessment was order for cancellation because the transaction between BPI and the Central Bank was tax exempt. T h e C A s u s t a i n e d t h e f i n d i n g o f t h e C A T t h a t t h e a c t i o n h a s n o t y e t p r e s c r i b e d , b u t i t adopted the position of the BIR that the sale of foreign currency was not tax exempt.

Issue : Whether or not the BIR had a right to collect from BPI.

Held: The Supreme Court ruled that the action for collection had already prescribed. The period to collect the deficiency is limited to 3 years as provided by Section 203 of the Tax Code. The statute of limitation on collection may be interrupted or suspended by a valid waiver executed in accordance with paragraph (d) of Sections 223 and 224 of the

Tax Code as amended. The purpose of the limitation is to protect the taxpayer form the prolonged and unreasonable assessment and investigation by the BIR.

G.R. No. 151857. April 28, 2005 CALAMBA STEEL CENTER, INC. (formerly JS STEEL CORPORATION), Petitioners, vs. COMMISSIONER OF INTERNAL REVENUE, Respondents. PANGANIBAN, J.: Facts: Petitioner is a domestic corporation engaged in the manufacture of steel blanks for the useb y m a n u f a c t u r e r o f a u t o m o t i v e s , e l e c t r i c a l , e l e c t r o n i c s i n i n d u s t r i a l a n d h o u s e h o l d appliances.In its amended Corporate Annual Income Tax Return on 1996 it declared a net taxable income of Php 9.4 Million, tax credits of Php 6.7 Million and tax due in the amount of Php 3.3Million. It also reported quarterly payments for the second and third quarters of 1995 in the amount of Php 2.3 M and Php 1.08 M respectively. The petitioner contended in the 1997 case that it is entitled to a refund. The refund was due to the income tax withheld and remitted in its behalf by withholding agents. Such withheld as indicated in the 1997 return were no utilized in 1996 due to its income loss for the three quarters of 1996.

Issue: Whether or not a tax refund may be claimed even beyond the taxable year following the tax credit arises.

Held: Yes. But the claimant must prove that it is entitled to such refund. Tax refund has the same nature of tax exemption and such must be construed strictly against the one claiming it. NIRC provided that the only limitation as regards the tax refund is that such must be made within two years for the payment. Calamba steel had complied with such requirement. The act of the counsel in submitting the final adjustment after the trial has been conducted was accepted by the court because the rules of ordinary procedure are applied suppletorily.Moreover the Court said that Judicial notice could have been taken by the CA and the CTA of the 1996 final adjustment return made by Calamba Steel in another case pending in the CTA.

CIR vs. CTA, July 21, 1994, 234 SCRA 348 Facts: A petition for review of the decision of the BIR denying tax ref u n d o f Citytrust was filed with the CTA. It was submitted for decision based solely on the p l e a d i n g s a n d e v i d e n c e s u b m i t t e d b y C i t y t r u s t . C I R w a s denied its day in Court because of its inability to present evidence by r e a s o n o f t h e f a i l u r e o f i t s T a x Credit/Refund Division to transmit records of the case to the Solicitor General. The CTA rendered its decision ordering BIR to grant a refund to City trust, CA affirmed.

Issue: Is the neglect, omission, error or mistake committed by the officers or agents of the State binding upon the Government?

Held: No, it is a long and firmly settled rule of law that the Government is not bound by the errors committed by its agents. In the performance of its government functions, the State cannot be estopped by the neglect of its agents and officers. Although the Government may generally be estopped through the affirmative acts of public officers acting within their authority, their neglect or omission of public duties as exemplified in this case will not and should not produce that effect. Nowhere is the aforestated rule truer than in the field of taxation. It is axiomatic that the Government cannot and must not be estopped particularly in matters involving taxes. Taxes are the lifeblood of the nationthroughwhichtheg o v e r n m e n t a g e n c i e s c o n t i n u e s t o o p e r a t e a n d w i t h w h i c h t h e S t a t e a f f e c t s i t s functions for the welfare of its constituents. The errors of certain administrative officers should never be allowed to jeopardize the Governmentsfinancialposition,e s p e c i a l l y i n t h e c a s e a t b a r w h e r e t h e a m o u n t i n v o l v e s m i l l i o n s o f p e s o s t h e collection whereof, if justified, stands to be prejudiced just because of bureaucratic lethargy.

Vous aimerez peut-être aussi

- Train p1 vs. NircDocument76 pagesTrain p1 vs. NircJannina Pinson RancePas encore d'évaluation

- (Type Text) (Type Text) Michele Ann R. SamsonDocument4 pages(Type Text) (Type Text) Michele Ann R. SamsonMichelePas encore d'évaluation

- Acfrogdprovkknpmiymoxfmxhym9qwlmqtch247odtchpanrgjjpszg2ohf5ydtabykg91 r9pgqgnnr y 9pfokiank BGK Unux17sgrjytzk47bf2ujabh5njeov0mkhjvvp2svrdrgi52b7nDocument261 pagesAcfrogdprovkknpmiymoxfmxhym9qwlmqtch247odtchpanrgjjpszg2ohf5ydtabykg91 r9pgqgnnr y 9pfokiank BGK Unux17sgrjytzk47bf2ujabh5njeov0mkhjvvp2svrdrgi52b7nrexshalynlagartoPas encore d'évaluation

- Schonberg, Harold - The Lives of The Great Composers (1997)Document662 pagesSchonberg, Harold - The Lives of The Great Composers (1997)Inés SuárezPas encore d'évaluation

- Golden Arches Development Corporation vs. St. Francis Square Holdings., Inc. GR183843Document6 pagesGolden Arches Development Corporation vs. St. Francis Square Holdings., Inc. GR183843albemartPas encore d'évaluation

- Rotary HandbookDocument78 pagesRotary HandbookEdmark C. DamaulaoPas encore d'évaluation

- Assignment in Civil Law Review 2 Feb. 16, 2021Document19 pagesAssignment in Civil Law Review 2 Feb. 16, 2021Lielet MatutinoPas encore d'évaluation

- How Does It Work?: Train Law Vs Nirc What Is NIRC?Document7 pagesHow Does It Work?: Train Law Vs Nirc What Is NIRC?Bryant R. CanasaPas encore d'évaluation

- Manila Electric Vs Province of LagunaDocument5 pagesManila Electric Vs Province of LagunaKenmar NoganPas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument11 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEmilee TerestaPas encore d'évaluation

- Busi Environment MCQDocument15 pagesBusi Environment MCQAnonymous WtjVcZCg57% (7)

- Local Government Taxation (Bangcal, Eleccion)Document25 pagesLocal Government Taxation (Bangcal, Eleccion)Filiusdei100% (1)

- Gabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFDocument2 pagesGabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFatelierimkellerPas encore d'évaluation

- Japanese Erotic Fantasies: Sexual Imagery of The Edo PeriodDocument12 pagesJapanese Erotic Fantasies: Sexual Imagery of The Edo Periodcobeboss100% (4)

- VAT Digest PDFDocument31 pagesVAT Digest PDFangelicaPas encore d'évaluation

- Delta Vs Niu KimDocument3 pagesDelta Vs Niu KimjessapuerinPas encore d'évaluation

- Implementation of Brigada EskwelaDocument9 pagesImplementation of Brigada EskwelaJerel John Calanao90% (10)

- 001 - 008 Pil Cases Batch 1 PandiDocument113 pages001 - 008 Pil Cases Batch 1 PandirehnegibbPas encore d'évaluation

- Comparison of The Rules On Evidence (07.05.2020) - v2 FinalDocument44 pagesComparison of The Rules On Evidence (07.05.2020) - v2 FinalConcerned CitizenPas encore d'évaluation

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochPas encore d'évaluation

- Torts - Finals.case PrinciplesDocument78 pagesTorts - Finals.case PrinciplesJillandroPas encore d'évaluation

- Dee Hwa Liong Foundation Medical Center v. Asiamed Supplies and EquipmentDocument1 pageDee Hwa Liong Foundation Medical Center v. Asiamed Supplies and EquipmentRafaelPas encore d'évaluation

- Knitting TimelineDocument22 pagesKnitting TimelineDamon Salvatore100% (1)

- (DGC) Civpro NotesDocument16 pages(DGC) Civpro NotesDianne ComonPas encore d'évaluation

- PDF Issue 1 PDFDocument128 pagesPDF Issue 1 PDFfabrignani@yahoo.comPas encore d'évaluation

- 2018 Memaid TaxDocument230 pages2018 Memaid TaxManuel B. Sales IVPas encore d'évaluation

- Mercrev2 PDFDocument42 pagesMercrev2 PDFManuel VillanuevaPas encore d'évaluation

- Labor PrinciplesDocument5 pagesLabor PrinciplesRose de DiosPas encore d'évaluation

- Surviving Hetzers G13Document42 pagesSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- Remedial Law Review 2 Cases For MidtermsDocument13 pagesRemedial Law Review 2 Cases For Midtermskim bok jooPas encore d'évaluation

- Wilgen Loon, Et. Al. vs. Power Master, Inc., Tri-C General Services and Sps. AlumisinDocument2 pagesWilgen Loon, Et. Al. vs. Power Master, Inc., Tri-C General Services and Sps. AlumisinDennis Jay Dencio Paras100% (1)

- 1 Lutz Vs Araneta DigestDocument2 pages1 Lutz Vs Araneta DigestAljay Labuga100% (2)

- Law On ObliConDocument45 pagesLaw On ObliConErPas encore d'évaluation

- I. Taxpayers Ii. Situs of TaxationDocument18 pagesI. Taxpayers Ii. Situs of TaxationJennylyn Biltz AlbanoPas encore d'évaluation

- Lego v. Lakeshore Equip. - ComplaintDocument21 pagesLego v. Lakeshore Equip. - ComplaintSarah BursteinPas encore d'évaluation

- 1 CIR V Central DrugDocument1 page1 CIR V Central DrugNae RinPas encore d'évaluation

- Civpro AttyDocument141 pagesCivpro AttyRhei BarbaPas encore d'évaluation

- People v. Opida y QuiambaoDocument8 pagesPeople v. Opida y Quiambaoescolastico u. cruz, jr.Pas encore d'évaluation

- Labor Standards CasesDocument114 pagesLabor Standards CasesKareen BaucanPas encore d'évaluation

- WILLS (Ilagan & Taleon) Full Text 01 Arts. 774-803Document137 pagesWILLS (Ilagan & Taleon) Full Text 01 Arts. 774-803kayePas encore d'évaluation

- Chapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationDocument22 pagesChapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationJeeren PepitoPas encore d'évaluation

- Writ of Continuing Mandamus WTF Bullshit AtayDocument8 pagesWrit of Continuing Mandamus WTF Bullshit AtayJohn Michael LequiganPas encore d'évaluation

- Legend International Resorts Limited V. Kilusang Manggagawa NG Legenda (Kml-Independent)Document11 pagesLegend International Resorts Limited V. Kilusang Manggagawa NG Legenda (Kml-Independent)ChaPas encore d'évaluation

- CrimRev Notes - Book IDocument34 pagesCrimRev Notes - Book IAgnes Bianca MendozaPas encore d'évaluation

- 15 Progressive Development V QCDocument11 pages15 Progressive Development V QCrgtan3Pas encore d'évaluation

- Dongon v. Rapid Movers and Forwarders Co., Inc.Document9 pagesDongon v. Rapid Movers and Forwarders Co., Inc.Sarah RiveraPas encore d'évaluation

- Legres IDocument8 pagesLegres ICJPas encore d'évaluation

- THELMA VDA. DE CANILANG, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. FactsDocument24 pagesTHELMA VDA. DE CANILANG, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. FactsMarkB15Pas encore d'évaluation

- 1-CIR Vs General Foods, Inc. - GR NO. 143672Document1 page1-CIR Vs General Foods, Inc. - GR NO. 143672Jason BUENAPas encore d'évaluation

- Important Cases in Transportation Law (Midterm Coverage)Document154 pagesImportant Cases in Transportation Law (Midterm Coverage)Shielah BaguecPas encore d'évaluation

- Law On Taxation MidtermDocument32 pagesLaw On Taxation Midtermroselleyap20Pas encore d'évaluation

- Philippine Global Communication v. de VeraDocument19 pagesPhilippine Global Communication v. de VeraJesse Myl MarciaPas encore d'évaluation

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADocument2 pagesBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloPas encore d'évaluation

- Election Law CasesDocument9 pagesElection Law Casescode4salePas encore d'évaluation

- HR MT Slides 2016Document5 pagesHR MT Slides 2016AllisonPas encore d'évaluation

- Republic of The Philippines Regional Trial Court - Judicial Region Branch - City ofDocument2 pagesRepublic of The Philippines Regional Trial Court - Judicial Region Branch - City ofJean UcolPas encore d'évaluation

- Southern Cross Cement Vs Phil Cement MFGDocument13 pagesSouthern Cross Cement Vs Phil Cement MFGMatet Molave-Salcedo100% (1)

- Fort Bonifacio V CirDocument4 pagesFort Bonifacio V CirJasPas encore d'évaluation

- Civil Procedure Case Digests FinalsDocument62 pagesCivil Procedure Case Digests FinalsJui ProvidoPas encore d'évaluation

- 17.republic Vs AFP RetirementDocument2 pages17.republic Vs AFP RetirementJoseph DimalantaPas encore d'évaluation

- CivPro General Principles DoctrinesDocument4 pagesCivPro General Principles DoctrinesElaine Viktoria DayanghirangPas encore d'évaluation

- RMC No. 51-2014Document2 pagesRMC No. 51-2014Lorenzo BalmoriPas encore d'évaluation

- Case Digests On Civil ProcedureDocument21 pagesCase Digests On Civil ProcedureAingel Joy DomingoPas encore d'évaluation

- Co-Ownership, Partition, Possession: Property Lecture 4 - 2019Document18 pagesCo-Ownership, Partition, Possession: Property Lecture 4 - 2019Cindy-chan DelfinPas encore d'évaluation

- Koko Pimentel vs. Zubiri ProtestDocument42 pagesKoko Pimentel vs. Zubiri ProtestPolitical JaywalkerPas encore d'évaluation

- Prosecution: Court Clerk of Court CourtDocument13 pagesProsecution: Court Clerk of Court CourtBurnt SantosPas encore d'évaluation

- Civ1 4SCDE1920 Doctrines PersonsDocument47 pagesCiv1 4SCDE1920 Doctrines PersonsSpartansPas encore d'évaluation

- 138186-1979-Aratuc v. Commission On ElectionsDocument27 pages138186-1979-Aratuc v. Commission On ElectionsChristian VillarPas encore d'évaluation

- San Beda Corporation Law ReviewerDocument29 pagesSan Beda Corporation Law ReviewerMuhammad FadelPas encore d'évaluation

- Tax Case DigestDocument38 pagesTax Case DigestJonaliza O. Belleza100% (1)

- Minutes of Second English Language Panel Meeting 2023Document3 pagesMinutes of Second English Language Panel Meeting 2023Irwandi Bin Othman100% (1)

- Paytm Wallet TXN HistoryDec2021 7266965656Document2 pagesPaytm Wallet TXN HistoryDec2021 7266965656Yt AbhayPas encore d'évaluation

- NegotiationDocument29 pagesNegotiationNina LeePas encore d'évaluation

- Project Initiation & Pre-StudyDocument36 pagesProject Initiation & Pre-StudyTuấn Nam NguyễnPas encore d'évaluation

- RA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021Document201 pagesRA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021jillyyumPas encore d'évaluation

- Anglais OverconsumptionDocument3 pagesAnglais OverconsumptionAnas HoussiniPas encore d'évaluation

- NSBM Student Well-Being Association: Our LogoDocument4 pagesNSBM Student Well-Being Association: Our LogoMaithri Vidana KariyakaranagePas encore d'évaluation

- Tugas Etik Koas BaruDocument125 pagesTugas Etik Koas Baruriska suandiwiPas encore d'évaluation

- ReadmeDocument2 pagesReadmeParthipan JayaramPas encore d'évaluation

- 755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsDocument3 pages755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsuhjdrftPas encore d'évaluation

- Unit 2 Organisational CultureDocument28 pagesUnit 2 Organisational CultureJesica MaryPas encore d'évaluation

- Inversion in Conditional SentencesDocument2 pagesInversion in Conditional SentencesAgnieszka M. ZłotkowskaPas encore d'évaluation

- A Wolf by The Ears - Mattie LennonDocument19 pagesA Wolf by The Ears - Mattie LennonMirPas encore d'évaluation

- Why Study in USADocument4 pagesWhy Study in USALowlyLutfurPas encore d'évaluation

- Final Advert For The Blue Economy PostsDocument5 pagesFinal Advert For The Blue Economy PostsKhan SefPas encore d'évaluation

- Martin, BrianDocument3 pagesMartin, Brianapi-3727889Pas encore d'évaluation

- Effectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonDocument109 pagesEffectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonKent Wilson Orbase Andales100% (1)

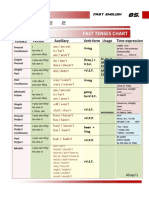

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezPas encore d'évaluation

- Year 1 Homework ToysDocument7 pagesYear 1 Homework Toyscyqczyzod100% (1)

- Schmemann, A. - Introduction To Liturgical TheologyDocument85 pagesSchmemann, A. - Introduction To Liturgical Theologynita_andrei15155100% (1)