Académique Documents

Professionnel Documents

Culture Documents

MIT15 401F08 Final

Transféré par

floatingbrainDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MIT15 401F08 Final

Transféré par

floatingbrainDroits d'auteur :

Formats disponibles

Name:

MIT ID:

15.401 Sample Final Exam Fall 2008

Please make sure that your copy of the examination contains 25 pages (including this one). Write your name and MIT ID number on every page.

You are allowed two 8 1 11 sheets of notes and one non-programmable non-PDA 2 calculator.

Answer these examination questions without consulting anyone. No scratch paper is allowed; do all your work on these examination pages. You have 180 minutes to complete this examination. Credit for each question is proportional to the amount of time you should spend on it. Therefore, do not agonize over a 10-point question without having tackled a 30-point question. Use only the space provided. Be neat and show your work. You will receive no credit for answers without work. You may receive partial credit for wrong answers with partially correct work. Good luck!

Some Useful Formulas

C NPV = k k=1 (1 + r ) NPV = Price = Price = Rp = E[Rp ] = C k k=1 (1 + r ) D k k=1 (1 + r )

n

= = =

C r C r D r =

1 1 (1 + r)n (Perpetuity) (DDM) D rg

(Annuity)

(1) (2) (3) (4) (5) (6) (7) (8)

D(1 + g )k1 (1 + r)k k=1

n i=1 n i=1

(DDM with growth)

i Ri i E[Ri ]

(Portfolio Return) (Portfolio Expected Return) (Portfolio Variance)

2 2 2 2 2 p = a a + b b + 2a b a b ab

p =

n i=1

i i

(Portfolio Beta) Cov[Ri , Rm ] Var[Rm ] (CAPM)

E[Ri ] = Rf + i (E[Rm ] Rf ) , i

(9)

Fall 2008

15.401 Sample Final Exam

Page 1 of 25

Name:

MIT ID:

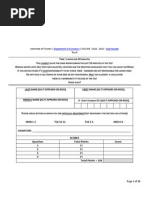

15.401 Final Examination 2008 Grade Sheet

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Total / / / / / / / / / / / 40 15 25 15 10 20 25 30 35 35 250

Fall 2008

15.401 Sample Final Exam

Page 2 of 25

Name:

MIT ID:

Question 1 (40 points): True, false or uncertain? Please explain your answers carefully and fully. No points will be rewarded for a true/false-only answer. a. (5 points, Ch2Q1a) The duration of a bond maturing at date T is always less than the duration of a zero-coupon bond maturing on the same date.

b. (5 points, Ch3Q2) The market price of a share of stock equals the discounted value of the stream of future earnings per share.

Fall 2008

15.401 Sample Final Exam

Page 3 of 25

Name:

MIT ID:

Question 1 (continued): c. (5 points) Growth stocks must have a plowback ratio > 1.

d. (5 points) If a commercial airline wants to hedge its risk against oil prices, it should go short in oil futures.

Fall 2008

15.401 Sample Final Exam

Page 4 of 25

Name:

MIT ID:

Question 1 (continued): e. (5 points) The value of an American call option is always equal to the value of a European call option.

f. (5 points) Holding everything else constant, the price of a European call option is increasing with increasing risk free interest rate.

Fall 2008

15.401 Sample Final Exam

Page 5 of 25

Name:

MIT ID:

Question 1 (continued): g. (5 points) Investors do not get rewarded for bearing idiosyncratic risk.

h. (5 points, CH7Q7) CAPM implies that all risky assets must have a positive risk premium.

Fall 2008

15.401 Sample Final Exam

Page 6 of 25

Name:

MIT ID:

Extra Space for Question 1 only:

Fall 2008

15.401 Sample Final Exam

Page 7 of 25

Name:

MIT ID:

Question 2 (15 points, Ch1Q17): The annual membership fee at your health club is $750 per year and is expected to increase at 5% per year. A life membership is $7,500 and the discount rate is 12%. In order to justify taking the life membership, what would your minimum life expectancy need to be?

Fall 2008

15.401 Sample Final Exam

Page 8 of 25

Name:

MIT ID:

Question 3 (25 points): The current prices of three U.S. treasury bonds are as follows: Maturity Coupon Rate Price 1 0% $97.474 2 5% $99.593 3 6% $100.148 Assume that coupons paid yearly and all bonds have a PAR value of $100. a. (10 points) What are the 1-, 2- and 3-year spot rates?

b. (6 points) What are the year 1 to 2 and year 1 to 3 forward rates?

Fall 2008

15.401 Sample Final Exam

Page 9 of 25

Name:

MIT ID:

Question 3 (continued):

c. (9 points) What is the price of a three-year bond with a 8% annual coupon.

Fall 2008

15.401 Sample Final Exam

Page 10 of 25

Name:

MIT ID:

Extra Space for Question 3 only:

Fall 2008

15.401 Sample Final Exam

Page 11 of 25

Name:

MIT ID:

Question 4 (10 points, Ch7Q16): Consider three stocks: Q, R and S.

Beta Q 0.45 R 1.45 S -0.20

STD (annual) 35% 40% 40%

Forecast for Nov 2009 Dividend Stock Price $0.50 $45 0 $75 $1.00 $20

Use a risk-free rate of 2.0% and an expected market return of 9.5%. The markets standard deviation is 18%. Assume that the next dividend will be paid after one year, at t = 1. a. (5 points) According to the CAPM, what is the expected rate of return of each stock?

b. (5 points) What should todays price be for each stock, assuming the CAPM is correct?

Fall 2008

15.401 Sample Final Exam

Page 12 of 25

Name:

MIT ID:

Extra Space for Question 4 only:

Fall 2008

15.401 Sample Final Exam

Page 13 of 25

Name:

MIT ID:

Question 5 (15 points, Ch3Q20): Company Ts current return on equity (ROE) is 16%. It pays out one-quarter of earnings as cash dividends (payout ratio = .25). Current book value per share is $35. The company has 5 million shares outstanding. Assume that ROE and payout ratio stay constant for the next four years. After that, competition forces ROE down to 10% and the company increases the payout ratio to 60%. The company does not plan to issue or retire shares. The cost of capital is 9.5%. a. (10 points) What is stock T worth?

b. (5 points) How much of stock Ts value is attributable to growth opportunities (PVGO)?

Fall 2008

15.401 Sample Final Exam

Page 14 of 25

Name:

MIT ID:

Extra Space for Question 5 only:

Fall 2008

15.401 Sample Final Exam

Page 15 of 25

Name:

MIT ID:

Question 6 (20 points, Ch4Q5 modied: a) b) identical c) new): Spot and futures prices for Gold and the S&P in September 2007 are given below. 07-September 07-December COMEX Gold ($/oz) $693 $706.42 CME S&P 500 $1453.55 $1472.4 08-June $726.7 $1493.7

Table 1: Gold and S&P 500 Prices on September 7, 2007

a. (12 points) Use prices for gold to calculate the eective annualized interest rate for Dec 2007 and June 2008. Assume that the convenience yield for gold is zero.

b. (4 points) Suppose you are the owner of a small gold mine and would like to x the revenue generated by your future production. Explain how the futures market enables such hedges.

Fall 2008

15.401 Sample Final Exam

Page 16 of 25

Name:

MIT ID:

Question 6 (continued): c. (4 points) Calculate the convenience yield on the S&P index between September 07 and December 07.

Fall 2008

15.401 Sample Final Exam

Page 17 of 25

Name:

MIT ID:

Question 7 (25 points, Ch8Q5): You have developed the technology to use gold to produce high capacity ber optic switches. The technology has cost $ 5 million to develop. You need $50 million of initial capital investment to start production. Sales of the switch sales will be $20 million per year for the next 5 years and then drop to zero. The main cost of production is gold. Each year, you need 20,000 ounces of gold. Gold is currently selling for $250 per ounce. Your supplier thinks that the gold price will appreciated at 5% per year for the next 5 years. The cost of capital is 10% for the ber-optics business. The tax rate is 35%. The capital investment can be depreciated linearly over the next 5 years. a. Calculate the after-tax cash ows of the project.

b. Should you take the project?

Fall 2008

15.401 Sample Final Exam

Page 18 of 25

Name:

MIT ID:

Extra Space for Question 7 only:

Fall 2008

15.401 Sample Final Exam

Page 19 of 25

Name:

MIT ID:

Question 8 (30 points, Ch7Q18): It is November, 2007. The following variance-covariance matrix, for the market (S&P 500) and stocks T and U, is based on monthly data from November 2002 to October 2007. Assume T and U are included in the S&P 500. The betas for T and U are T = 0.727 and U = 0.75.

S &P 500 T U

S &P 500 0.0256 0.0186 0.0192

T U 0.0186 0.0192 0.1225 0.0262 0.0262 0.0900

Average monthly risk premiums from 2002 to 2007 were: S &P 500 : 1.0% T : 0.6% U : 1.1% Assume the CAPM is correct, and that the expected future market risk premium is 0.6% per month. The risk-free interest rate is 0.3% per month. a. (10 points) What were the alphas for stocks T and U over the last 60 months?

Fall 2008

15.401 Sample Final Exam

Page 20 of 25

Name:

MIT ID:

Question 8 (continued):

b. (10 points) What are the expected future rates of return for T and U?

c. (10 points) What are the optimal portfolio weights for the S&P 500, T and U? Explain qualitatively.

Fall 2008

15.401 Sample Final Exam

Page 21 of 25

Name:

MIT ID:

Question 9 (35 points, Ch6Q17modied: a) identical, b) c) new): Expected returns and standard deviations of three risky assets are as follows: Correlations A B C 1.0 .3 .15 .3 1.0 .45 .15 .45 1.0

Expected Return A B C 11% 14.5% 9%

Standard Deviation 30% 45% 30%

a. (10 points) Calculate the expected return and standard deviation of a portfolio of stocks A, B and C. Assume an equal investment in each stock.

b. (15 points) Compute the Sharpe ratio of a portfolio that has 30% in A, 30% in B and 40% C. The risk-free interest rate is 4%.

Fall 2008

15.401 Sample Final Exam

Page 22 of 25

Name:

MIT ID:

Question 9 (continued):

c. (10 points) Assume a portfolio of asset B and C. Determine the weight in asset B, such that the total portfolio risk is minimized.

Fall 2008

15.401 Sample Final Exam

Page 23 of 25

Name:

MIT ID:

Extra Space for Question 9 only:

Fall 2008

15.401 Sample Final Exam

Page 24 of 25

Name:

MIT ID:

Question 10 (35 points, Ch5Q25 modied : a) b) identical c) d) new): You are asked to price options on KYC stock. KYCs stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. KYC does not pay dividend. The risk free rate is 5% (EAR), and the current stock price of KYC is $100.

a. (15 points) Price a European put option on KYC with maturity of 2 years and a strike price of 100.

Fall 2008

15.401 Sample Final Exam

Page 25 of 25

Name:

MIT ID:

Question 10 (continued):

b. (5 points) Price an American put option on KYC with the same characteristics. Is the price dierent? Why or why not?

c. (5 points) Given the price of the put option that you calculated in a), specify the ranges of KYC share price at the options maturity date for which you will be making a net prot.

Fall 2008

15.401 Sample Final Exam

Page 26 of 25

Name:

MIT ID:

Question 10 (continued):

d. (10 points) Suppose you expect the price of KYC stock to have little variance in the future. How would you design a strategy (using options) to take advantage of this?

Fall 2008

15.401 Sample Final Exam

Page 27 of 25

Name:

MIT ID:

Extra Space for Question 10 only:

Fall 2008

15.401 Sample Final Exam

Page 28 of 25

MIT OpenCourseWare http://ocw.mit.edu

15.401 Finance Theory I

Fall 2008

For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms.

Vous aimerez peut-être aussi

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsD'EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsPas encore d'évaluation

- BBK BUMN052S6 2015 Financial ManagementDocument10 pagesBBK BUMN052S6 2015 Financial ManagementVan Der Heijden CPas encore d'évaluation

- BMIT15 401F08 MidtermDocument19 pagesBMIT15 401F08 MidtermJohnPas encore d'évaluation

- Data Interpretation Guide For All Competitive and Admission ExamsD'EverandData Interpretation Guide For All Competitive and Admission ExamsÉvaluation : 2.5 sur 5 étoiles2.5/5 (6)

- Final 2018 QuestionsAndSolutionsDocument37 pagesFinal 2018 QuestionsAndSolutionsLucas X. LiPas encore d'évaluation

- (l5) Decision Making TechniquesDocument20 pages(l5) Decision Making TechniquesBrucePas encore d'évaluation

- Edu 2008 11 Fete ExamDocument22 pagesEdu 2008 11 Fete ExamcalvinkaiPas encore d'évaluation

- Exam I October 2021Document9 pagesExam I October 2021miguelPas encore d'évaluation

- CH5 Tutorial ManagementDocument18 pagesCH5 Tutorial ManagementSam Sa100% (1)

- AF102 Sem 2Document10 pagesAF102 Sem 2horse9118Pas encore d'évaluation

- Exam June 2009 SolutionsDocument15 pagesExam June 2009 SolutionsesaPas encore d'évaluation

- CM SampleExam 2Document10 pagesCM SampleExam 2sarahjohnsonPas encore d'évaluation

- Quantitative Methods II Mid-Term Examination: InstructionsDocument17 pagesQuantitative Methods II Mid-Term Examination: InstructionsSatish Kun Dalai100% (1)

- mcq1 PDFDocument15 pagesmcq1 PDFjack100% (1)

- APS 502 Financial Engineering Final Exam SolutionsDocument4 pagesAPS 502 Financial Engineering Final Exam SolutionsHannaPas encore d'évaluation

- Mth302 Midterm Solved MCQs Mega Collection FileDocument56 pagesMth302 Midterm Solved MCQs Mega Collection FileHanzla InamPas encore d'évaluation

- CIMA Professional Gateway Assessment (CPGA) 20 May 2009 - Wednesday Afternoon SessionDocument26 pagesCIMA Professional Gateway Assessment (CPGA) 20 May 2009 - Wednesday Afternoon Sessionata1986Pas encore d'évaluation

- FIN-469 Investments Analysis Practice Set SolutionsDocument7 pagesFIN-469 Investments Analysis Practice Set SolutionsGilbert Ansah YirenkyiPas encore d'évaluation

- University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainDocument20 pagesUniversity of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainexamkillerPas encore d'évaluation

- Quantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMDocument25 pagesQuantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMShel LeePas encore d'évaluation

- Assignemnt 1-Winter2023Document2 pagesAssignemnt 1-Winter2023Omotara YusufPas encore d'évaluation

- Midterm Exam Investments May 2010 InstructionsDocument5 pagesMidterm Exam Investments May 2010 Instructions张逸Pas encore d'évaluation

- 2009 Sem1Document7 pages2009 Sem1Ella GorelikPas encore d'évaluation

- CVDocument4 pagesCVShiv Shakti SinghPas encore d'évaluation

- IAPMDocument26 pagesIAPMNeelesh ReddyPas encore d'évaluation

- STA 117 Final Exam Term 1, 2012Document13 pagesSTA 117 Final Exam Term 1, 2012Abdullah Zakariyya100% (1)

- Chapter 9Document12 pagesChapter 9Cianne Alcantara100% (2)

- VU Papers B.msDocument7 pagesVU Papers B.msusmaniasPas encore d'évaluation

- ECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerDocument13 pagesECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerKathy Chugg0% (1)

- End Term Examin N: Ot: Ttempt An Fi Qu Tion N Lu in Whi Hi Mpul or - Select One Qu Tion FR M Hun TDocument2 pagesEnd Term Examin N: Ot: Ttempt An Fi Qu Tion N Lu in Whi Hi Mpul or - Select One Qu Tion FR M Hun TBarkha JoonPas encore d'évaluation

- FIN381 202130A KC & KT Final ExamDocument4 pagesFIN381 202130A KC & KT Final ExamChenyu HuangPas encore d'évaluation

- Corporate Finance - Mock ExamDocument8 pagesCorporate Finance - Mock ExamLưu Quỳnh MaiPas encore d'évaluation

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89Pas encore d'évaluation

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbPas encore d'évaluation

- Semester One Final ExaminFinal - Examinationsations 2014 FINM7403Document5 pagesSemester One Final ExaminFinal - Examinationsations 2014 FINM7403williewanPas encore d'évaluation

- Post - AF3313 - Sem 1 Midterm 2015-16Document9 pagesPost - AF3313 - Sem 1 Midterm 2015-16siuyinxddPas encore d'évaluation

- Fall 2010 QMB3250 Exam 1 CDocument11 pagesFall 2010 QMB3250 Exam 1 CJoe SmolerPas encore d'évaluation

- Abdur-Rafay BEE9C 237969 PDFDocument14 pagesAbdur-Rafay BEE9C 237969 PDFAbdur RafayPas encore d'évaluation

- BFC5935 - Sample Exam PDFDocument5 pagesBFC5935 - Sample Exam PDFXue XuPas encore d'évaluation

- WSU Derivatives 200079 FinalExam 2015sem2 SolutionsDocument9 pagesWSU Derivatives 200079 FinalExam 2015sem2 SolutionsTuyết NgânPas encore d'évaluation

- PGDBM SyllybusDocument54 pagesPGDBM SyllybusEd ReyPas encore d'évaluation

- Thapar Institute of Engineering and Technology (Deemed To Be University)Document2 pagesThapar Institute of Engineering and Technology (Deemed To Be University)AdityaPas encore d'évaluation

- Exam Fin 2011Document16 pagesExam Fin 2011alexajungPas encore d'évaluation

- The University of The South Pacific: School of Accounting and FinanceDocument7 pagesThe University of The South Pacific: School of Accounting and FinanceTetzPas encore d'évaluation

- Monash University: Semester One Examination 2008Document19 pagesMonash University: Semester One Examination 2008MichellePas encore d'évaluation

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- ACCG329 Sample Exam PaperDocument25 pagesACCG329 Sample Exam PaperLinh Dieu NghiemPas encore d'évaluation

- ES 301 Assignment #1 engineering economy problems and solutionsDocument2 pagesES 301 Assignment #1 engineering economy problems and solutionsErika Rez LapatisPas encore d'évaluation

- FNCE 401v7 Assignment 1 InstructionsDocument8 pagesFNCE 401v7 Assignment 1 InstructionsDavid Eaton50% (2)

- Model Question Paper - Industrial Engineering and Management - First Semester - DraftDocument24 pagesModel Question Paper - Industrial Engineering and Management - First Semester - Draftpammy313Pas encore d'évaluation

- Exercises On Chapter Five - Return & CAPM Oct. 19 - AnswerDocument10 pagesExercises On Chapter Five - Return & CAPM Oct. 19 - Answerbassant_hegaziPas encore d'évaluation

- Dec 2012 Q-QMDocument12 pagesDec 2012 Q-QMShel LeePas encore d'évaluation

- Quantitative MethodsDocument18 pagesQuantitative MethodsNikhil SawantPas encore d'évaluation

- Mid Term1Document8 pagesMid Term1Abhay Pratap SinghPas encore d'évaluation

- Final Exam Review AssessmentDocument14 pagesFinal Exam Review Assessmentbusinessdoctor23Pas encore d'évaluation

- Final BF FA19 1Document4 pagesFinal BF FA19 1Hasaan RaoPas encore d'évaluation

- The Formula Sheet Will Be Provided Time Allocated For The Exam Is 1.5 HoursDocument5 pagesThe Formula Sheet Will Be Provided Time Allocated For The Exam Is 1.5 HourshaohtsPas encore d'évaluation

- Pre Board - 2 11 EcoDocument3 pagesPre Board - 2 11 EcoNDA AspirantPas encore d'évaluation

- Indian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09Document35 pagesIndian Institute of Management Kozhikode: Financial Management 1 EPGP Kochi Campus Batch 09juilee bhoirPas encore d'évaluation

- Using Oracle's SOA Suite and Cash Management Within A Complex Banking EnvironmentDocument13 pagesUsing Oracle's SOA Suite and Cash Management Within A Complex Banking EnvironmentfloatingbrainPas encore d'évaluation

- BPEL and WorkflowDocument11 pagesBPEL and WorkflowfloatingbrainPas encore d'évaluation

- Fabric ReadthedocsDocument203 pagesFabric ReadthedocsfloatingbrainPas encore d'évaluation

- What You Need To Know About Release 12.2Document6 pagesWhat You Need To Know About Release 12.2floatingbrainPas encore d'évaluation

- BPEL For Workflow DevelopersDocument92 pagesBPEL For Workflow DevelopersfloatingbrainPas encore d'évaluation

- WMS Msca RfidDocument32 pagesWMS Msca Rfidfloatingbrain100% (2)

- Electronic Invoicing in MexicoDocument9 pagesElectronic Invoicing in MexicofloatingbrainPas encore d'évaluation

- Streamline Inventory Item Creation-Maintenance in Complex ValueDocument8 pagesStreamline Inventory Item Creation-Maintenance in Complex ValuefloatingbrainPas encore d'évaluation

- Oracle EBS R121 How To Leverage Your Upgrade To R12.1 With Robust Revenue Recognition AutomationDocument19 pagesOracle EBS R121 How To Leverage Your Upgrade To R12.1 With Robust Revenue Recognition Automationfloatingbrain100% (2)

- WMS Wireless ImplementationDocument17 pagesWMS Wireless ImplementationfloatingbrainPas encore d'évaluation

- 10 Things You Can Do Today To Prepare For Oracle E-Business Suite 12.2Document69 pages10 Things You Can Do Today To Prepare For Oracle E-Business Suite 12.2floatingbrainPas encore d'évaluation

- BPEL For Document ManagementDocument17 pagesBPEL For Document ManagementfloatingbrainPas encore d'évaluation

- Deployment and System Administration of Oracle E-Business Suite 12.2Document64 pagesDeployment and System Administration of Oracle E-Business Suite 12.2floatingbrainPas encore d'évaluation

- Order Management TechnicalDocument26 pagesOrder Management Technicalgt1982100% (4)

- EBS Interfaces Using BPELDocument36 pagesEBS Interfaces Using BPELfloatingbrain80% (5)

- EBS Handson With BPELDocument20 pagesEBS Handson With BPELfloatingbrainPas encore d'évaluation

- WMS Rules Engine ExamplesDocument59 pagesWMS Rules Engine Examplesfloatingbrain78% (9)

- XML Gateway With BPELDocument39 pagesXML Gateway With BPELfloatingbrainPas encore d'évaluation

- Line Status Flow in Order ManagementDocument15 pagesLine Status Flow in Order Managementfloatingbrain100% (7)

- Oracle WMS WIP (White Paper)Document4 pagesOracle WMS WIP (White Paper)floatingbrain67% (3)

- Oracle BPEL TrainingDocument80 pagesOracle BPEL Trainingfloatingbrain100% (5)

- EBS With BPELDocument40 pagesEBS With BPELfloatingbrainPas encore d'évaluation

- Oracle WMS BAR Code (White Paper)Document5 pagesOracle WMS BAR Code (White Paper)floatingbrain100% (2)

- Oracle WMS PICK (White Paper)Document35 pagesOracle WMS PICK (White Paper)floatingbrain100% (16)

- Oracle WMS PICK (White Paper)Document35 pagesOracle WMS PICK (White Paper)floatingbrain100% (16)

- WMS and Order ManagementDocument15 pagesWMS and Order Managementfloatingbrain100% (4)

- What Do You Mean I Need A Warehouse ManagementDocument15 pagesWhat Do You Mean I Need A Warehouse Managementfloatingbrain100% (1)

- Implementing WMSDocument27 pagesImplementing WMSfloatingbrain67% (3)

- Implementing WMS and MSCA in A Wireless EnvironmentDocument48 pagesImplementing WMS and MSCA in A Wireless Environmentfloatingbrain100% (3)

- Dynamics of Interest Rate and Equity VolatilityDocument9 pagesDynamics of Interest Rate and Equity VolatilityZhenhuan SongPas encore d'évaluation

- Consolidated Balance Sheet After Total AcquisitionDocument2 pagesConsolidated Balance Sheet After Total AcquisitiongabrielkollingPas encore d'évaluation

- SEC Advisory PluggleDocument3 pagesSEC Advisory PluggleBobby Olavides SebastianPas encore d'évaluation

- CEILLI Trial Ques EnglishDocument15 pagesCEILLI Trial Ques EnglishUSCPas encore d'évaluation

- Contemporary Issues in Accounting: Solution ManualDocument20 pagesContemporary Issues in Accounting: Solution ManualKeiLiew0% (1)

- BNL StoresDocument6 pagesBNL StoresPrakhar SrivastavaPas encore d'évaluation

- IB Final NotesDocument29 pagesIB Final NotesfarooqsalimPas encore d'évaluation

- The Entering EsDocument95 pagesThe Entering Esthomas100% (1)

- Lehman Brothers Kerkhof Inflation Derivatives Explained Markets Products and PricingDocument81 pagesLehman Brothers Kerkhof Inflation Derivatives Explained Markets Products and Pricingvolcom808Pas encore d'évaluation

- Mkibn20080204 0008eDocument20 pagesMkibn20080204 0008eberznikPas encore d'évaluation

- Bollinger Bands Method - LLDocument4 pagesBollinger Bands Method - LLadoniscalPas encore d'évaluation

- RREEF Investment Outlook 8-10Document15 pagesRREEF Investment Outlook 8-10dealjunkieblog9676Pas encore d'évaluation

- Valuing Congoleum LBO with Sensitivity AnalysisDocument2 pagesValuing Congoleum LBO with Sensitivity Analysishhh100% (1)

- AFFIDAVITDocument2 pagesAFFIDAVITAmit MandavilliPas encore d'évaluation

- Financial Management and AccountsDocument257 pagesFinancial Management and AccountsraggarwaPas encore d'évaluation

- Consultancy Projects NormsDocument3 pagesConsultancy Projects NormsArnab BanerjeePas encore d'évaluation

- Pangea Properties Hires Elliott Young To Join Its Real Estate Investments and Lending PlatformsDocument2 pagesPangea Properties Hires Elliott Young To Join Its Real Estate Investments and Lending PlatformsPR.comPas encore d'évaluation

- Himadri Chemical Research ReportDocument5 pagesHimadri Chemical Research ReportADPas encore d'évaluation

- Expert Witness Testimony Example - Neil Garfield Living LiesDocument16 pagesExpert Witness Testimony Example - Neil Garfield Living LiesForeclosure FraudPas encore d'évaluation

- SAP FI Transaction Code List 1Document10 pagesSAP FI Transaction Code List 1akhilsahu2004Pas encore d'évaluation

- TCS India Process - Separation KitDocument25 pagesTCS India Process - Separation KitT HawkPas encore d'évaluation

- Daily Performance Sheet 7th November 2019 (With SIP Returns)Document489 pagesDaily Performance Sheet 7th November 2019 (With SIP Returns)Prasanta Kumar GoswamiPas encore d'évaluation

- Company PerformanceDocument2 pagesCompany PerformanceZiaZuhdyPas encore d'évaluation

- Project Bond Focus - Fundamentals 2018 FINAL v2Document8 pagesProject Bond Focus - Fundamentals 2018 FINAL v2RishitPas encore d'évaluation

- Unit 5: The Company BlogDocument4 pagesUnit 5: The Company BlogAounaiza AhmedPas encore d'évaluation

- What Is A MemorandumDocument2 pagesWhat Is A MemorandumEric Rivera SabadoPas encore d'évaluation

- Matling Industrial vs Coros (G.R. No. 157802 October 13, 2010Document2 pagesMatling Industrial vs Coros (G.R. No. 157802 October 13, 2010James WilliamPas encore d'évaluation

- Partnership CaseDocument2 pagesPartnership CaseMichael Austin FuPas encore d'évaluation

- Michael Varley ResumeDocument3 pagesMichael Varley ResumeElizabeth YangPas encore d'évaluation

- The Philippine American Life and General Insurance Company vs. The Secretary of Finance and The CIRDocument10 pagesThe Philippine American Life and General Insurance Company vs. The Secretary of Finance and The CIRKennethQueRaymundoPas encore d'évaluation

- GMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)D'EverandGMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)Pas encore d'évaluation

- Digital SAT 5-Hour Quick Prep For DummiesD'EverandDigital SAT 5-Hour Quick Prep For DummiesÉvaluation : 3.5 sur 5 étoiles3.5/5 (5)

- AP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionD'EverandAP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionÉvaluation : 5 sur 5 étoiles5/5 (1)

- MCAT Biology & Biochemistry Practice Questions: High Yield MCAT QuestionsD'EverandMCAT Biology & Biochemistry Practice Questions: High Yield MCAT QuestionsPas encore d'évaluation

- LSAT For Dummies (with Free Online Practice Tests)D'EverandLSAT For Dummies (with Free Online Practice Tests)Évaluation : 4 sur 5 étoiles4/5 (1)

- AP Computer Science A Premium, 2024: 6 Practice Tests + Comprehensive Review + Online PracticeD'EverandAP Computer Science A Premium, 2024: 6 Practice Tests + Comprehensive Review + Online PracticePas encore d'évaluation

- Digital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatD'EverandDigital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatPas encore d'évaluation

- Medical English Dialogues: Clear & Simple Medical English Vocabulary for ESL/EFL LearnersD'EverandMedical English Dialogues: Clear & Simple Medical English Vocabulary for ESL/EFL LearnersPas encore d'évaluation

- AP English Language and Composition Premium, 2024: 8 Practice Tests + Comprehensive Review + Online PracticeD'EverandAP English Language and Composition Premium, 2024: 8 Practice Tests + Comprehensive Review + Online PracticePas encore d'évaluation

- Digital SAT Reading and Writing Practice Questions: Test Prep SeriesD'EverandDigital SAT Reading and Writing Practice Questions: Test Prep SeriesPas encore d'évaluation

- The LSAT Law School Admission Test Study Guide Volume I - Reading Comprehension, Logical Reasoning, Writing Sample, and Analytical Reasoning Review Proven Methods for Passing the LSAT Exam With ConfidenceD'EverandThe LSAT Law School Admission Test Study Guide Volume I - Reading Comprehension, Logical Reasoning, Writing Sample, and Analytical Reasoning Review Proven Methods for Passing the LSAT Exam With ConfidencePas encore d'évaluation

- AP Microeconomics/Macroeconomics Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeD'EverandAP Microeconomics/Macroeconomics Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticePas encore d'évaluation

- GMAT Foundations of Verbal: Practice Problems in Book and OnlineD'EverandGMAT Foundations of Verbal: Practice Problems in Book and OnlinePas encore d'évaluation

- Digital SAT Preview: What to Expect + Tips and StrategiesD'EverandDigital SAT Preview: What to Expect + Tips and StrategiesÉvaluation : 5 sur 5 étoiles5/5 (3)

- Finish What You Start: The Art of Following Through, Taking Action, Executing, & Self-DisciplineD'EverandFinish What You Start: The Art of Following Through, Taking Action, Executing, & Self-DisciplineÉvaluation : 4.5 sur 5 étoiles4.5/5 (94)

- The LSAT Trainer Ultimate Study Guide: Simplified 3 Real LSAT PrepTests + Strategies to Ace the Exam The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!D'EverandThe LSAT Trainer Ultimate Study Guide: Simplified 3 Real LSAT PrepTests + Strategies to Ace the Exam The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!Pas encore d'évaluation

- 50 Successful Harvard Medical School EssaysD'Everand50 Successful Harvard Medical School EssaysPas encore d'évaluation

- SAT Vocabulary Word Rhyminders: 50 Rhyme PackD'EverandSAT Vocabulary Word Rhyminders: 50 Rhyme PackÉvaluation : 2.5 sur 5 étoiles2.5/5 (3)

- The Ultimate UCAT Collection: 3 Books In One, 2,650 Practice Questions, Fully Worked Solutions, Includes 6 Mock Papers, 2019 Edition, UniAdmissions Aptitude Test, UniAdmissionsD'EverandThe Ultimate UCAT Collection: 3 Books In One, 2,650 Practice Questions, Fully Worked Solutions, Includes 6 Mock Papers, 2019 Edition, UniAdmissions Aptitude Test, UniAdmissionsÉvaluation : 4 sur 5 étoiles4/5 (1)

- AP Q&A Psychology, Second Edition: 600 Questions and AnswersD'EverandAP Q&A Psychology, Second Edition: 600 Questions and AnswersPas encore d'évaluation

- AP Physics 1 Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeD'EverandAP Physics 1 Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticePas encore d'évaluation

- Sterling Test Prep AP Physics 2 Practice Questions: High Yield AP Physics 2 Practice Questions with Detailed ExplanationsD'EverandSterling Test Prep AP Physics 2 Practice Questions: High Yield AP Physics 2 Practice Questions with Detailed ExplanationsPas encore d'évaluation

- GMAT Foundations of Math: Start Your GMAT Prep with Online Starter Kit and 900+ Practice ProblemsD'EverandGMAT Foundations of Math: Start Your GMAT Prep with Online Starter Kit and 900+ Practice ProblemsÉvaluation : 4 sur 5 étoiles4/5 (7)

- MCAT General Chemistry Practice Questions: High Yield MCAT QuestionsD'EverandMCAT General Chemistry Practice Questions: High Yield MCAT QuestionsPas encore d'évaluation