Académique Documents

Professionnel Documents

Culture Documents

Cash Flow

Transféré par

magoimoiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cash Flow

Transféré par

magoimoiDroits d'auteur :

Formats disponibles

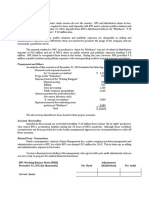

1. In 2011, a typhoon completely destroyed a building belonging to Carpet Corporation.

The building cost Php 2,500,000 and had accumulated depreciation of Php 1,200,000 at the time of the loss. Carpet received a cash settlement from the insurance company and reported a loss of Php 525,000. In Carpet's 2011 cash flow statement, how much would be the net changes that would be reported in the cash flows from investing activities section?

SOLUTION: Book Value of Building Cost Less: Accumulated Depreciation Less: Amount of Loss Cash received from insurance company (Inflow-investing activity) Php 2,500,000 Php 1,200,000 Php 1,300,000 Php 525,000

Php 775,000 increase

2. Darwin Company provided the following relevant information involving its operating activities for the year ended December 31, 2011.

12-31-10 Accrued interest payable recognized Depreciation expense recognized Prepaid expense recognized P 40, 000 72, 800 3, 100

12-31-11 P 50, 000 75, 600 4, 940

For the year ended December 31, 2011, Darwin Company reported a net income after tax of P 648, 000. What is the net cash flow for operating activities that would be shown in the cash flow statement?

SOLUTION: NET INCOME FOR 2011 Adjustment: Depreciation expense, 2011 Increase in accrued interest (50000 40000) Increase in prepaid expense (4940 3100) 75, 600 10, 000 (1840) P 648, 000

CASH PROVIDED BY OPERATING ACTIVITIES

P 731, 760

3. Goldfish company had the following activities during 2011: Acquired 2000 shares of stock in starfish, Inc. for P260, 000. Sold an investment in Water for P350, 000 when the carrying value was P330, 000. Acquired a P500, 000, 4-year certificate of deposit from a bank (during the year, interest of 37500 was paid to Goldfish). Collected dividends of 12000 on available for sale investment. In Goldfish Corporations 2011 statement of cash flows, how much should be the net cash used in investing activities? SOLUTION: Acquisition of 2000 shares of stock in starfish Sale of investment in Water Acquisition of a 4-year certificate of deposit (260000) 350, 000 (500000)

NET CASH FLOW USED IN INVESTING ACTIVITIES P 410, 000

4. The net income for the year ended December 31, 2011 for Knot Corporation was 3,520,000. Additional data follow: Purchase of plant assets Depreciation of plant assets Net decrease in non-cash current assets Dividends declared on plant assets Loss on sale of equipment 2,800,000 1,480,000 290,000 970,000 130,000

What amount should be the cash provided from operating activities in Knots statement of cash flows for the year ended December 31, 2011? SOLUTION: Net Income Depreciation of plant assets Net decrease in non-cash current assets Loss on sale of equipment Cash provided from operating activities 3,520,000 1,480,000 290,000 130,000

5,420,000

5. Bargain Company reported net income of 3,000,000 for 2011. Changes occurred in several balance sheet accounts during 2011 as follows: Investment in associate, carried @ equity Premium on bonds payable Accumulated Depn, caused by major repair of equipment Deferred tax liability 200,000 decrease 150,000 increase 400,000 increase 50,000 decrease

In 2011 statement of cash flows, how much should be reported as net cash provided by operating activities?

SOLUTION: Net Income Increase in investment in associate Decrease in premium on bonds payable Increase in deferred tax liability 3,000,000 (400,000) (50,000) 150,000

Net cash inflow operating activities

2,700,000

Vous aimerez peut-être aussi

- Coursehero 12Document2 pagesCoursehero 12nhbPas encore d'évaluation

- Afar IcpaDocument6 pagesAfar IcpaAndrea Lyn Salonga CacayPas encore d'évaluation

- Acctg26: Intermediate Accounting 3Document33 pagesAcctg26: Intermediate Accounting 3Jeane Mae BooPas encore d'évaluation

- 1Document2 pages1Your MaterialsPas encore d'évaluation

- Quiz Bee4thyrDocument5 pagesQuiz Bee4thyrlalala010899Pas encore d'évaluation

- Standard CostingDocument45 pagesStandard CostingJosua PagcaliwaganPas encore d'évaluation

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDocument2 pagesEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidPas encore d'évaluation

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaPas encore d'évaluation

- Intercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupDocument60 pagesIntercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupPhil MO JoePas encore d'évaluation

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesPas encore d'évaluation

- 162 005Document1 page162 005Angelli LamiquePas encore d'évaluation

- Ad2 1Document13 pagesAd2 1MarjoriePas encore d'évaluation

- Audit Problem Inventories AnswerDocument6 pagesAudit Problem Inventories AnswerJames PaulPas encore d'évaluation

- Chapter 2 - Correction of Errors PDFDocument12 pagesChapter 2 - Correction of Errors PDFRonald90% (10)

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaPas encore d'évaluation

- Chapter 15 PDFDocument5 pagesChapter 15 PDFRenzo RamosPas encore d'évaluation

- Accrual and Cash BasisDocument4 pagesAccrual and Cash BasisShe Enna Ortaleza Ulap100% (1)

- AP-5906 ReceivablesDocument5 pagesAP-5906 Receivablesjhouvan100% (1)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarPas encore d'évaluation

- 5 Questions InventoryDocument15 pages5 Questions Inventoryyousef0% (1)

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezPas encore d'évaluation

- Advance Acctg. Dayag 2013Document39 pagesAdvance Acctg. Dayag 2013Clarize R. Mabiog50% (2)

- Apllied Auditing Q&ADocument10 pagesApllied Auditing Q&APeterJorgeVillarante100% (2)

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoPas encore d'évaluation

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezPas encore d'évaluation

- 1398236Document3 pages1398236mohitgaba19Pas encore d'évaluation

- Installmen Sales ProblemsDocument10 pagesInstallmen Sales ProblemsKristine GoyalaPas encore d'évaluation

- AC11 - Chaapter 7Document34 pagesAC11 - Chaapter 7anon_467190796100% (1)

- Takehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionDocument3 pagesTakehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionYour MaterialsPas encore d'évaluation

- Business Law SurecpaDocument35 pagesBusiness Law SurecpaChessaAlenelLigutom100% (1)

- pg.565-593 of Financial Accounting Book 2014 ValixDocument29 pagespg.565-593 of Financial Accounting Book 2014 ValixPeter Paul Enero Perez50% (2)

- AFAR Final Preboard 2018 PDFDocument22 pagesAFAR Final Preboard 2018 PDFcardos cherryPas encore d'évaluation

- Chapter 18 Part 1Document61 pagesChapter 18 Part 1Hannah KatPas encore d'évaluation

- This Study Resource WasDocument9 pagesThis Study Resource WasAnna TaylorPas encore d'évaluation

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaPas encore d'évaluation

- P2Document18 pagesP2Robert Jayson UyPas encore d'évaluation

- Accounting For Biological Assets: ObjectivesDocument14 pagesAccounting For Biological Assets: Objectivesrajmeet75% (4)

- Advanced Accounting PDocument4 pagesAdvanced Accounting PMaurice Agbayani100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaPas encore d'évaluation

- This Study Resource WasDocument4 pagesThis Study Resource WasReznakPas encore d'évaluation

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorPas encore d'évaluation

- AP Equity 3Document2 pagesAP Equity 3Mark Michael Legaspi100% (1)

- Answer Key - Importing and ExportingDocument4 pagesAnswer Key - Importing and Exportingmaria ronoraPas encore d'évaluation

- Ap.m-1401-Correction of ErrorsDocument12 pagesAp.m-1401-Correction of Errorsjulie anne mae mendozaPas encore d'évaluation

- AudprobDocument3 pagesAudprobJonalyn MoralesPas encore d'évaluation

- Inventory - GP and Retail MethodDocument2 pagesInventory - GP and Retail MethodFlorimar LagdaPas encore d'évaluation

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconPas encore d'évaluation

- QuizDocument2 pagesQuizAlyssa CamposPas encore d'évaluation

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoPas encore d'évaluation

- Private Nor-for-Profit Entities (NPE) : Colleges and Universities, Hospitals, VHWO and Other NPEDocument44 pagesPrivate Nor-for-Profit Entities (NPE) : Colleges and Universities, Hospitals, VHWO and Other NPEYuvia KeithleyrePas encore d'évaluation

- Installment Sales - PretestDocument2 pagesInstallment Sales - PretestCattleyaPas encore d'évaluation

- Exercise 10 Statement of Cash Flows - 054935Document3 pagesExercise 10 Statement of Cash Flows - 054935Hoyo VersePas encore d'évaluation

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanPas encore d'évaluation

- Review Session 6 TEXTDocument6 pagesReview Session 6 TEXTAliBerradaPas encore d'évaluation

- Problem Cash FlowDocument3 pagesProblem Cash FlowKimberly AnnePas encore d'évaluation

- Advance Accounting2 FinalsDocument6 pagesAdvance Accounting2 FinalsClarice Kristine SalesPas encore d'évaluation

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloPas encore d'évaluation

- Assignment 1Document3 pagesAssignment 1PRINCES VIA BATICANPas encore d'évaluation

- Practical Accounting 1Document14 pagesPractical Accounting 1Anonymous Lih1laaxPas encore d'évaluation

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixiePas encore d'évaluation

- MAS With Answers PDFDocument13 pagesMAS With Answers PDF蔡嘉慧100% (1)

- Reflection DynedDocument1 pageReflection DynedmagoimoiPas encore d'évaluation

- Capital Expenditure - ReportDocument8 pagesCapital Expenditure - Reportmagoimoi100% (1)

- Topics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructureDocument5 pagesTopics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructuremagoimoiPas encore d'évaluation

- MAS - Agamata Chapter 3 Answer KeyDocument5 pagesMAS - Agamata Chapter 3 Answer Keymagoimoi100% (3)

- A Compilation of Financial Accounting Problems With Corresponding SolutionDocument1 pageA Compilation of Financial Accounting Problems With Corresponding SolutionmagoimoiPas encore d'évaluation

- Cash and Accrual (DONE!)Document3 pagesCash and Accrual (DONE!)magoimoiPas encore d'évaluation

- Notes (Done!)Document5 pagesNotes (Done!)magoimoiPas encore d'évaluation

- AuditingDocument8 pagesAuditingmagoimoiPas encore d'évaluation

- Single Entry (DONE!)Document8 pagesSingle Entry (DONE!)magoimoi0% (1)

- Bryan T. Lluisma Fin3 BSA-4 TTH 5-6:30pmDocument3 pagesBryan T. Lluisma Fin3 BSA-4 TTH 5-6:30pmBryan LluismaPas encore d'évaluation

- BBA (AccFin) .SYLL 2017-18Document4 pagesBBA (AccFin) .SYLL 2017-18Mengyuan LiPas encore d'évaluation

- CPWD Book FormsDocument168 pagesCPWD Book Formsovishalz100% (1)

- Completing The Accounting Cycle: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument57 pagesCompleting The Accounting Cycle: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedPham Thi Hoa (K14 DN)Pas encore d'évaluation

- Test Bank For Financial Accounting 5th Edition David Spiceland Wayne Thomas Don Herrmann 2Document36 pagesTest Bank For Financial Accounting 5th Edition David Spiceland Wayne Thomas Don Herrmann 2catboat.ferlyzkhx100% (48)

- CMCP Chap 8Document2 pagesCMCP Chap 8Kei SenpaiPas encore d'évaluation

- Tugas Kelompok 2-W4-S5-R3-Grub4Document6 pagesTugas Kelompok 2-W4-S5-R3-Grub4amanda aprilPas encore d'évaluation

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanPas encore d'évaluation

- Chapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDocument49 pagesChapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDesiree De OcampoPas encore d'évaluation

- Chapter - 1 Accounting in ActionDocument19 pagesChapter - 1 Accounting in ActionfuriousTaherPas encore d'évaluation

- Héctor FuentesDocument7 pagesHéctor FuentesHodwardGalvisPas encore d'évaluation

- SAP FI/CO - New General Ledger AccountingDocument113 pagesSAP FI/CO - New General Ledger AccountingKevin Paul Garrido100% (1)

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Job Cost Accounting System: Overview and Analysis: Accounting Principles, Eighth EditionDocument57 pagesJob Cost Accounting System: Overview and Analysis: Accounting Principles, Eighth EditionSiapa KamuPas encore d'évaluation

- Stepping I.T. Up For Cruz-Caymo, Partners, and Associates: I. Point of ViewDocument10 pagesStepping I.T. Up For Cruz-Caymo, Partners, and Associates: I. Point of Viewfreedom chaleePas encore d'évaluation

- Auditing Problems Lecture On Correction of ErrorsDocument6 pagesAuditing Problems Lecture On Correction of Errorskarlo100% (3)

- Financial Accounting and Reporting StandardsDocument1 pageFinancial Accounting and Reporting StandardsAllysa CapunoPas encore d'évaluation

- 2013 SGV Cup Level Up FinalDocument17 pages2013 SGV Cup Level Up FinalAndrei GoPas encore d'évaluation

- Marginal Costing and Absorption CostingDocument10 pagesMarginal Costing and Absorption Costingferos100% (12)

- CH 04Document111 pagesCH 04JessicaPas encore d'évaluation

- Dr. Janet Dantes' JournalDocument2 pagesDr. Janet Dantes' JournalShayne Pagwagan50% (2)

- Commerce Syllabus For UG Honours CourseDocument53 pagesCommerce Syllabus For UG Honours CourseSamar SharmaPas encore d'évaluation

- MSR Leathers vs. S. Palaniappan and AnrDocument4 pagesMSR Leathers vs. S. Palaniappan and AnrShihabAkhandPas encore d'évaluation

- BDO Single Page Summary - IAS-8Document4 pagesBDO Single Page Summary - IAS-8Deep RustagiPas encore d'évaluation

- Topic 3: Introduction To Transaction ProcessingDocument45 pagesTopic 3: Introduction To Transaction ProcessingTeo ShengPas encore d'évaluation

- Professional Judgement FrameworkDocument35 pagesProfessional Judgement FrameworkMaru MasPas encore d'évaluation

- Drill 2Document6 pagesDrill 2trexy jeane sumapigPas encore d'évaluation

- Project ReportDocument11 pagesProject Reportbhumika ADLAKPas encore d'évaluation

- Accounting For Joint Products and by ProductsDocument13 pagesAccounting For Joint Products and by ProductsSteffi CabalunaPas encore d'évaluation

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesPas encore d'évaluation