Académique Documents

Professionnel Documents

Culture Documents

Finegold, Barry 2012 SFI Redacted

Transféré par

Massachusetts Citizens for JobsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Finegold, Barry 2012 SFI Redacted

Transféré par

Massachusetts Citizens for JobsDroits d'auteur :

Formats disponibles

Name of Person Reporting: Barry R.

Finegold Current Home Address: Home Phone: Office Phone: 617-722-1612 Fax Number: N/A Office Email: barry.finegold@masenate.gov Name of spouse residing in household: Name of child(ren) residing in household:

2. Filer is a Candidate for the office of State Senator.

3:

Positions Held

This question indicates the reason you are required to file a Statement of Financial Interests and must be completed. Identify each position you held in 2012 or now hold as a PUBLIC OFFICIAL or DESIGNATED PUBLIC EMPLOYEE and report the AMOUNT of INCOME, by category, derived from each position in 2012. If you did not earn any INCOME in any such position in 2012, complete the question, but check the Income Not Applicable box.

1. 2.

Agency in which you serve(d) State Senate House of Representatives

Position Held Senator State Representative

Dates of Employment 1/4/2010 - Present 1/1/1997 - 1/3/2011

Income $60,001 to 100,000 $60,001 to 100,000

4:

Other Government Position(s)

Identify any other government position(s) held in 2012 by you and/or an IMMEDIATE FAMILY member (spouse or dependent child) in any federal, state, county, district or municipal agency, whether compensated or uncompensated, full- or part-time. Please review the Instructions which detail the information that should be disclosed. FILER reported no other government positions.

5:

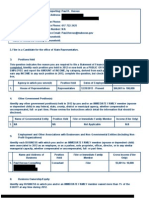

Employment and Other Associations with Businesses and Non-Governmental Entities (Including NonProfit Organizations)

Identify each BUSINESS with which you and/or an IMMEDIATE FAMILY member (spouse or dependent child) were associated in 2012 as an employee, or as a partner, sole proprietor, officer, director, or in any similar managerial capacity, whether compensated or uncompensated, full- or part-time.

Name and Address of Business

Position Held Partner

Filer or Immediate Family Member Filer

Gross Income (Filer Only) $100,000 or more

1. Dalton & Finegold 34 Essex Street Andover MA 01810 2. Gold Title PC 34 Essex Street Andover MA 01810 3. Dresscode

Partner

Filer

$40,001 to 60,000

Owner

Spouse

N/A

Two Elm Square Andover MA 01810

6:

Business Ownership/Equity

Identify any BUSINESS in which you and/or an IMMEDIATE FAMILY member owned more than 1% of the EQUITY at any time during 2012.

1. 2. 3.

Name of Business Gold Title Dresscode Dalton & Finegold

Address of Business 34 Essex Street Andover MA 01810 Elm Square Andover MA 01810 34 Essex Street Andover MA 01810

Precent Owned (Filer Only) 50% 0 50%

7:

Transfer of Ownership/Equity Interests

Identify any EQUITY in a BUSINESS (reported in Question 5 or 6) which you transferred to any IMMEDIATE FAMILY member at any time during 2012. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no transfers of business ownership/equity interests.

8:

Leaves of Absence

Identify any BUSINESS with which you (not an IMMEDIATE FAMILY member) were previously associated and with which you had an understanding at any time during 2012 regarding employment at any future time. FILER reported no leaves of absence.

9:

Gifts

Identify any GIFTS received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no gifts.

10:

Honoraria

Identify any HONORARIUM received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no honoraria.

11:

Reimbursements

Identify any REIMBURSEMENTS received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no reimbursements.

12:

State or Local Government Securities

Identify each SECURITY issued by the Commonwealth or any public agency thereof or county or municipality located in the Commonwealth, owned by you and/or an IMMEDIATE FAMILY member with a fair market value in excess of $1,000, as of December 31, 2012, and report any INCOME received by you at any time from such security in 2012, if such INCOME was in excess of $1,000. Please be aware that state employees who own state bonds and county employees who own county bonds may need to file a disclosure of such ownership with the Commission, in addition to disclosure of such ownership here. Please review the Instructions for more information. FILER reported no state or local government securities.

13:

Securities and Investments

Identify each SECURITY or other INVESTMENT, including the Commonwealths U-Fund, with a fair market value in excess of $1,000, beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. To report SECURITIES and INVESTMENTS held in trust, see Questions 14-21. Any INCOME received by you at any time during 2012 in excess of $1,000 from SECURITIES issued by the Commonwealth or any public agency thereof or county or municipality located in the Commonwealth should be reported in Question 12.

1. 2.

Name of Issuer Dolben Properties Enterprise Bank First Commons Bank Great Western Karmaloop Leader Bank Merrill Lynch Nationwide Northland

Description of Security Real Estate Common Stock

Principal Place of Business or State of Incorporation Massachusetts Massachusetts

Owner (Filer or Immediate Family Member) Filer Filer

3. 4. 5. 6. 7. 8. 9.

Common Stock Mutual Fund Common Stock Common Stock Mutual Fund Mutual Fund Real Estate Mutual Fund Mutual Fund Preferred Stock

Massachusetts Massachusetts Massachusetts Massachusetts Massachusetts Delaware Massachusetts Massachusetts Delaware Massachusetts

Filer Filer Filer Filer Filer Filer Filer Filer Filer and Spouse Filer

10. Openheimer 11. UBS 12. ZIPTR

14:

Business and Charitable Trusts

If you and/or an IMMEDIATE FAMILY member had a beneficial ownership interest or served as a trustee of a BUSINESS or CHARITABLE TRUST as of December 31, 2012, you need to answer this question. You are not required to disclose the address of the BUSINESS or CHARITABLE TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no business or charitable trusts.

15:

Business and Charitable Trust Assets

Report all securities and other investments, with a fair market value in excess of $1,000, held in a BUSINESS or CHARITABLE TRUST(S) and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You are not required to disclose the address of a property held in the BUSINESS or CHARITABLE TRUST(S) if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no business or charitable trust holdings.

16:

Family Trust Assets

Report all SECURITIES and other INVESTMENTS, with a fair market value in excess of $1,000, held in a FAMILY TRUST and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. If your home is held in a FAMILY TRUST, report details on the property in Question 22 if it is located in Massachusetts. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no family trusts.

17:

Realty Trusts

If you and/or an IMMEDIATE FAMILY member had a beneficial ownership interest or served as a trustee of a REALTY TRUST as of December 31, 2012, you need to answer this question. You are not required to disclose the address of the REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed.

Name,Date and Address of Trust

Name of Grantor(s) and Barry Finegold

Name of Trustee(s) and Barry Finegold

Beneficiaries and Barry Finegold

Percentage of Equity Owned (Filer Only) 50%

1. ANB Realty Trust Date: 1/ 15/ 2002

2. DF Realty Trust Date: 2/ 1/ 2003 13-15-17 Main Street N. Andover 22 01845 3. DB Realty Trust Date: 4/ 1/ 2003 One Elm Square Condo Andover 22 01810 4. 34 Essex Realty Trust Date: 6/ 1/ 2006 34 Essex Street Andover 22

Barry Finegold

Barry Finegold

Barry Finegold

100%

Barry Finegold and David Samuels

Barry Finegold and David Samuels

Barry Finegold and David Samuels

50%

Barry Finegold and Bill Dalton

Barry Finegold and Bill Dalton

Barry Finegold and Bill Dalton

50%

01810

18:

Realty Trust: Real Property Assets

Report all real property held in a REALTY TRUST and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You are not required to disclose the address of the REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question Home Address. Please review the Instructions which detail the information that should be disclosed. Name of Trust Address of Property Held in Trust 13-15-17 Main Street N. Andover MA 01845 One Elm Square Andover MA 01810 34 Essex Street Andover MA 01810 Rental Property Description of Property Held in Trust Primary Residence Assessed Value and Net Income Assessed Value: $100,000 or more Net Income: N/A Assessed Value: $100,000 or more Net Income: Less than $1,001 Assessed Value: $100,000 or more Net Income: $1,001 to 5,000 Assessed Value: $100,000 or more Net Income: Less than $1,001 Record Owner(s) (Name(s) on Deed) ANB Realty Trust

1. ANB Realty Trust 2. DF Realty Trust

DF Realty Trust

3. DB Realty Trust

Commercial

DB Realty Trust

4. 34 Essex Realty Trust

Commercial

Barry Finegold, Trustee and Bill Dalton, Trustee

19:

Business, Charitable and Realty Trusts: Mortgage Obligations

Report all mortgages, including home equity and reverse mortgage loans, as of December 31, 2012, on any property held in a BUSINESS, CHARITABLE or REALTY TRUST and disclosed in response to Question 15 and/or 18. You are not required to disclose the address of a BUSINESS, CHARITABLE or REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question Home Address. Please review the Instructions which detail the information that should be disclosed.

Name Of Trust

Address of Property 13-15-17 Main Street N. Andover MA 01845

Creditor Name and Address Enterprise Bank 63 Park Street Andover MA 01810 Lowell co op Turnpike Street N. Andover MA 01845 Enterprise Bank 63 Park Street Andover MA 01810 North shore bank

Original Amount Borrowed and Amount Owed Original Ammount: $100,000 or more Amount Owed: $100,000 or more Original Ammount: $100,000 or more Amount Owed: $100,000 or more Original Ammount: $100,000 or more Amount Owed: $100,000 or more Original Ammount: N/A Amount Owed: N/A

Year Due and Interest Rate Year Due:2022 4.5

1. DF Realty Trust

2. DB Realty Trust

One Elm Square Andover MA 01810

Year Due:2028 5.5

3. 34 Essex Realty Trust

34 Essex Street Andover MA 01810

Year Due:2028 5.375

4. ANB Realty Trust

Year Due:2021 2.99

Main Street Peabody MA 33053

20:

Business, Charitable, Family and Realty Trusts: Purchases/Transfers of Property in Massachusetts Only

Report all purchases by and/or transfers to any BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST of property located in Massachusetts which occurred at any time during 2012. FILER reported no purchase/transfers of realty trust property in Massachusetts.

21:

Business, Charitable, Family and Realty Trusts: Sales/Transfers of Property in Massachusetts Only

Report all sales and/or transfers by any BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST of property located in Massachusetts which occurred at any time during 2012. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no sale/transfers of realty trust property in Massachusetts.

22:

Real Property Owned in Massachusetts

Identify any real property in Massachusetts with an assessed value in excess of $1,000, in which you and/or an IMMEDIATE FAMILY member held an interest as of December 31, 2012. EXCLUDE: Out-of-state property or property located in Massachusetts held for business or rental purposes. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren).

1.

Address of Property

Description of Property Primary Residence

Person(s) Holding Interest Filer and Spouse

Assessed Value (Filer Only) $100,000 or more

23:

Business, Investment and Rental Properties

Identify any real property with an assessed value in excess of $1,000 as of December 31, 2012, regardless of location, including time-sharing arrangements, held for business, investment or rental purposes, in which you and/or an IMMEDIATE FAMILY member had a direct or indirect interest. Property held in a REALTY TRUST should be reported in Question 18. EXCLUDE: Properties held primarily for personal or family use. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren).

Address of Property

Description of Property Rental Property

Person(s) Holding Interest Filer

Assessed Value and Net Income (Filer Only) Assessed Value:$100,000 or more Net Income:$1,001 to 5,000

1. 16 Balmoral Street Unit 107 Andover MA 01810 2. 363 Marlborough Street

Rental Property

Filer and Spouse

Assessed Value:$100,000 or more Net Income:$5,001 to 10,000

Boston MA 02133 3. 429 South Main Street Andover MA 01810 4. Two Elm Square Andover MA 01810 5. 93 Main Street Andover MA 01810 Vacant Land Filer Assessed Value:$40,001 to 60,000 Net Income:Less than $1,001

Commercial

Filer

Assessed Value:$100,000 or more Net Income:Less than $1,001 Assessed Value:$100,000 or more Net Income:$10,001 to 20,000

Commercial

Filer

24:

Real Property Purchases

Identify any real property located in Massachusetts which was purchased by or otherwise transferred to you and/or an IMMEDIATE FAMILY member at any time during 2012. Purchases of property held in a BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST should be reported in Question 20. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no real property purchases.

25:

Real Property Sales

Identify any real property located in Massachusetts which was sold by or otherwise transferred from you and/or an IMMEDIATE FAMILY member at any time during 2012. Sales of real property held in a BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST should be reported in Question 21. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no real property sales.

26:

Mortgage Loan Information

Identify all mortgages, including home equity and reverse mortgage loans, in excess of $1,000, outstanding on December 31, 2012, for which you and/or an IMMEDIATE FAMILY member were obligated. If the mortgage loan was for your current home, exclude the original AMOUNT borrowed or owed. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. For an IMMEDIATE FAMILY member, do not report the AMOUNTS borrowed and owed.

Address of Property

Creditor Name and Address NorthMark Park Street Andover MA 01810 NorthMark Park Street Andover MA 01810

Original Amount Borrowed and Amount Owed Original Amount: $100,000 or more Amount Owed: Less than $1,001

Year Due and Interest Rate 3.25% Varies with Prime Revolving equity line 4.75% 2020

1. 16 Balmoral Street Unit 107 Andover MA 01810 2. 363 Marlborough Street Boston MA

Original Amount: $100,000 or more Amount Owed: $100,000 or more

02133 3. Two Elm Square Andover MA 01810 4. 93 Main Street Andover MA 01810 First National Bank of Ipswitch PO Box 31 Ipswitch MA 01938 Sovereign Bank Main Street Andover MA 01810 Original Amount: $100,000 or more Amount Owed: $100,000 or more 4.5 2033

Original Amount: $100,000 or more Amount Owed: $100,000 or more

4.125 2037

27:

Mortgage Receivable Information

Identify any real property located in Massachusetts on which you and/or an IMMEDIATE FAMILY member held a mortgage as of December 31, 2012. Also identify any real property located out-of-state which was held for business or rental purposes on which you and/or an IMMEDIATE FAMILY member held a mortgage as of December 31, 2012. Report the name and address of the mortgagee (the person obligated to you and/or an IMMEDIATE FAMILY member) and the assessed value by category. If the mortgage is held only by an IMMEDIATE FAMILY member, do not report the assessed value of the property. EXCLUDE: Mortgages on outof-state property if the property is held primarily for personal or family use.

Property Address

Name and Address of Mortgagee Williard Perkins and David Delory 28 Andover Street Andover MA 01810

Description of Property Undeveloped Land

Assessed Value (Filer Only) $40,001 to 60,000

1. 429 South Main Street Andover MA 01810

28:

Other Creditor Information

Identify each debt, loan or other liability, including mortgage(s), home equity and reverse mortgage loans on property located out-of-state, in excess of $1,000, owed by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You must report the loan collateral, which is the property assigned to guarantee payment. EXCLUDE: Any liability of $1,000 or less; installment loans (cars, household effects, etc.); educational loans; medical and dental debts; credit card purchases (other than cash advances); support or alimony obligations; debts owed to a spouse or CLOSE RELATIVE; and debts incurred in the ordinary course of a BUSINESS. Please review the Instructions which detail the information that should be disclosed. FILER reported no other creditor information.

29:

Debts Forgiven

Identify each creditor who at any time during 2012 forgave any indebtedness in excess of $1,000 owed by you and/or an IMMEDIATE FAMILY member. EXCLUDE: Any debts forgiven by a spouse, a CLOSE RELATIVE, or the spouse of a CLOSE RELATIVE. FILER reported no debts forgiven.

1: I Barry R.Finegold certify that: I made a reasonably diligent effort to obtain required information concerning myself and IMMEDIATE FAMILY MEMBER(S); and The information provided on this form is true and complete, to the best of my knowledge.

Submitted under the pains and penalties of perjury.( 5/ 23/ 2013)

The Following Immediate Family Members declined to disclose information: The Following are the specific Question(s) for which answers were declined by each Immediate Family Member: The following are the specific question(s) which I decline to answer in whole or in part, because I assert the information is privileged by law. The explanation of the basis of your claim of privilege is: N/A

Vous aimerez peut-être aussi

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Kafka, Louis 2012 Statement of Financial InterestsDocument6 pagesKafka, Louis 2012 Statement of Financial InterestsMassachusetts Citizens for JobsPas encore d'évaluation

- Humason, Donald 2012 SFI RedactedDocument6 pagesHumason, Donald 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Honan, Kevin 2012 SFI RedactedDocument7 pagesHonan, Kevin 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Kaufman, Jay 2012 Statement of Financial InterestsDocument8 pagesKaufman, Jay 2012 Statement of Financial InterestsMassachusetts Citizens for JobsPas encore d'évaluation

- Joyce, Brian 2012 SFI RedactedDocument7 pagesJoyce, Brian 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Gregoire, Danielle 2012 SFI RedactedDocument6 pagesGregoire, Danielle 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Jehlen, Patricia 2012 SFI RedactedDocument6 pagesJehlen, Patricia 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Hogan, Kate 2012 SFI RedactedDocument7 pagesHogan, Kate 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Holmes, Russell 2012 SFI RedactedDocument6 pagesHolmes, Russell 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Hedlund, Robert 2012 SFI RedactedDocument8 pagesHedlund, Robert 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Howitt, Steven 2012 SFI RedactedDocument10 pagesHowitt, Steven 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Jones, Bradley 2012 SFI RedactedDocument6 pagesJones, Bradley 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Gordon, Kenneth 2012 SFI RedactedDocument6 pagesGordon, Kenneth 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Henriquez, Carlos 2012 SFI RedactedDocument8 pagesHenriquez, Carlos 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Hecht, Jonathan 2012 SFI RedactedDocument9 pagesHecht, Jonathan 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Golden, JR., Thomas A. 2012 SFI RedactedDocument7 pagesGolden, JR., Thomas A. 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Haddad, Patricia 2012 SFI RedactedDocument8 pagesHaddad, Patricia 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Fox, Gloria 2012 SFI RedactedDocument8 pagesFox, Gloria 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Harrington, Sheila 2012 SFI RedactedDocument7 pagesHarrington, Sheila 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Gifford, Susan 2012 SFI RedactedDocument6 pagesGifford, Susan 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Heroux, Paul 2012 SFI RedactedDocument6 pagesHeroux, Paul 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Hill, Bradford 2012 SFI RedactedDocument6 pagesHill, Bradford 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Garry, Colleen 2012 SFI RedactedDocument6 pagesGarry, Colleen 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Galvin, William C. 2012 SFI RedactedDocument7 pagesGalvin, William C. 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Garlick, Denise 2012 SFI RedactedDocument8 pagesGarlick, Denise 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Gobi, Anne 2012 SFI RedactedDocument6 pagesGobi, Anne 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Garballey, Sean 2012 SFI RedactedDocument8 pagesGarballey, Sean 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Finn, Michael 2012 SFI RedactedDocument6 pagesFinn, Michael 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- Fiola, Carole 2012 SFI RedactedDocument7 pagesFiola, Carole 2012 SFI RedactedMassachusetts Citizens for JobsPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 8086 ProgramsDocument61 pages8086 ProgramsBmanPas encore d'évaluation

- Lecture Notes - Sedimentation TankDocument45 pagesLecture Notes - Sedimentation TankJomer Levi PortuguezPas encore d'évaluation

- HDFDJH 5Document7 pagesHDFDJH 5balamuruganPas encore d'évaluation

- All Over AgainDocument583 pagesAll Over AgainJamie Kris MendozaPas encore d'évaluation

- Earth & Life Science Q1 Module 2 - DESIREE VICTORINODocument22 pagesEarth & Life Science Q1 Module 2 - DESIREE VICTORINOJoshua A. Arabejo50% (4)

- International Waiver Attestation FormDocument1 pageInternational Waiver Attestation FormJiabao ZhengPas encore d'évaluation

- Ramesh Dargond Shine Commerce Classes NotesDocument11 pagesRamesh Dargond Shine Commerce Classes NotesRajath KumarPas encore d'évaluation

- The Mckenzie MethodDocument24 pagesThe Mckenzie MethodMohamed ElMeligiePas encore d'évaluation

- Geller (LonginusRhetoric'sCure)Document27 pagesGeller (LonginusRhetoric'sCure)Miguel AntónioPas encore d'évaluation

- ENTH 311 Course Video ReflectionDocument2 pagesENTH 311 Course Video ReflectionJeshua ItemPas encore d'évaluation

- Application of Neutralization Titrations for Acid-Base AnalysisDocument21 pagesApplication of Neutralization Titrations for Acid-Base AnalysisAdrian NavarraPas encore d'évaluation

- Residential Water Piping Installation GuideDocument28 pagesResidential Water Piping Installation GuideMunir RasheedPas encore d'évaluation

- Safe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesDocument48 pagesSafe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesCuesta AndresPas encore d'évaluation

- Factors of Cloud ComputingDocument19 pagesFactors of Cloud ComputingAdarsh TiwariPas encore d'évaluation

- Mendoza CasesDocument66 pagesMendoza Casespoiuytrewq9115Pas encore d'évaluation

- Homeroom Guidance - Activity For Module 1Document3 pagesHomeroom Guidance - Activity For Module 1Iceberg Lettuce0% (1)

- Data Report Northside19Document3 pagesData Report Northside19api-456796301Pas encore d'évaluation

- The Big Banana by Roberto QuesadaDocument257 pagesThe Big Banana by Roberto QuesadaArte Público Press100% (2)

- Affect of CRM-SCM Integration in Retail IndustryDocument8 pagesAffect of CRM-SCM Integration in Retail IndustryRajeev ChinnappaPas encore d'évaluation

- Orbit BioscientificDocument2 pagesOrbit BioscientificSales Nandi PrintsPas encore d'évaluation

- Drainage Pipe Unit Price AnalysisDocument9 pagesDrainage Pipe Unit Price Analysis朱叶凡Pas encore d'évaluation

- Fiegel Kutter Idriss PDFDocument1 pageFiegel Kutter Idriss PDFAvaPas encore d'évaluation

- Assignment 3-WEF-Global Competitive IndexDocument3 pagesAssignment 3-WEF-Global Competitive IndexNauman MalikPas encore d'évaluation

- Coal Bed Methane GasDocument10 pagesCoal Bed Methane GasErrol SmythePas encore d'évaluation

- Journal Entry DiscussionDocument8 pagesJournal Entry DiscussionAyesha Eunice SalvaleonPas encore d'évaluation

- The Voice of PLC 1101Document6 pagesThe Voice of PLC 1101The Plymouth Laryngectomy ClubPas encore d'évaluation

- Topic 8 - Managing Early Growth of The New VentureDocument11 pagesTopic 8 - Managing Early Growth of The New VentureMohamad Amirul Azry Chow100% (3)

- TIA Portal v11 - HMI ConnectionDocument4 pagesTIA Portal v11 - HMI ConnectionasdasdasdasdasdasdasadaPas encore d'évaluation

- The Beatles - Allan Kozinn Cap 8Document24 pagesThe Beatles - Allan Kozinn Cap 8Keka LopesPas encore d'évaluation

- Performance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsDocument31 pagesPerformance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsIBR100% (2)