Académique Documents

Professionnel Documents

Culture Documents

NuWare - Exhibits

Transféré par

Sandeep ChowdhuryTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NuWare - Exhibits

Transféré par

Sandeep ChowdhuryDroits d'auteur :

Formats disponibles

Assignment questions 1.

In general, what types of issues come to mind when you hear analysts question a firm's "earnings quality"? 2. Why is Harry Malone concerned about relying on Nuware's reported performance? If Nuware follows GAA 3. Assume the role of Hereford and restate Nuware's 2003 earnings as if the company had used a similar acco After such restatement, do Nuware's earnings and earnings growth remain superior to that of R. P. Stuart? 4. Would you characterize the accounting discretion applied by Nuware management as aggressive? Do you t

ts question a firm's "earnings quality"? d performance? If Nuware follows GAAP, shouldn't the company's reported financial statements be reliable? if the company had used a similar accounting method and assumptions. main superior to that of R. P. Stuart? re management as aggressive? Do you think the company has been "managing" earnings?

Exhibit 1 NuWare Inc. Consolidated Statement of Operations (in thousands except per share amounts) For the fiscal year ended January 31, 2003 2002 2001 Net sales 1,754,861 1,709,254 1,611,498 Operating costs and expenses Cost of sales (including occupancy costs) 1,001,892 1,009,893 919,871 Selling, general and administrative expenses 586,124 555,508 565,475 Depreciation and amortization 36,356 32,196 30,229 Operating income Non-operating (income) and expenses: Interest and investment income Interest expense Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Dividend declared per share Average shares outstanding during the period: Basic Diluted 130,489 (9,382) 2,508 137,363 50,784 86,579 0.86 0.82 0.16 100,883 105,823 111,657 (5,784) 2,290 115,151 42,576 72,575 0.72 0.70 0.16 100,883 103,972 95,923 (5,014) 3,048 97,889 36,220 61,669 0.62 0.60 0.15 99,631 102,003

Exhibit 2 NuWare Inc. Consolidated Balance Sheets (in thousands except per share amounts) As of January 31, 2003 ASSETS Current assets: Cash, including AFS investments Beneficial interest in securitized receivables Accounts receivable, net of reserves Inventories Prepaid expenses and other current assets

192,114 40,538 295,888 247,502 56,179 832,221 374,493 49,411 1,256,125

Property, net Other noncurrent assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Accounts payable Gift cards, gift certificates and merchandise credits outstanding Accrued income taxes payable Other accrued liabilities Total current liabilities Long-term debt Other noncurrent liabilities Shareholders' equity: Common stock, $0.10 par, 500 million authorized 100,883,000 shares issued Paid-in capital Retained earnings Cumulative other comprehensive income (loss) Less: 10,045,000 and 7,362,000 common shares in treasury, at cost Commitments and contingencies Total Liabilities and Shareholders' equity

393 176,702 117,495 35,798 192,348 522,736 25,007 54,962

10,088 479,074 314,124 (11,210) (138,656) 653,420 1,256,125

As of January 31, 2002

2003

2002

55,609 34,620 363,424 230,911 43,286 727,850 370,262 47,985 1,146,097

AFS investments Reserve for doubtful accounts

59,716 9,438

35,076 16,140

356 129,076 139,852 29,738 170,053 469,075 25,356 43,264

10,088 440,190 243,257 (4,702) (80,521) 608,312 1,146,007 Treasury stock No. of treasury shares 138,656,000 1,004,500 80,521,000 7,362,000

Exhibit 3 NuWare Inc. Selected Excerpts from Notes to Financial Statements (Source: Notes to Consolidated Financial Statemet, Nuware, Inc. Annual Report) 2003 Use of Estimates Cash and Receivables 2002

Merchandise Inventories Valued at the lowest of Cost (LIFO method) or market (Retail method) LIFO adjustment to ending inventory: Old method New method Effect of accounting policy change in 2002: Net income lower by basic EPS lower by diluted EPS lower by Cumulative effect of accounting change Total charges to cost of sales include: Occupancy costs If FIFO method of inventory valuation is used, Value of inventories would have been higher by

33,000 35,100 2,100 0.02 0.02 Not ascertainable

45,000 29,500

44,000 35,100

Plant, Property and Equipment Furniture and equipment Buildings Leasehold improvements Accumulated depreciation -

Historic cost Historic cost Historic cost

SLM SLM

3 - 10 30 Min( useful life, term of lease) 268,500

304,500

Depreciation expenses

35,698

31,572

Financial Instruments fair value <-- market data, valuation techniques AFS investments: Unrealized holding gains shown on Balance sheet net realized gains on sale of AFS investments

6,700

4,800

Revenue Recognition

Advertising and marketing costs policy on Promotional costs Advertising costs Marketing and promotional costs of which, portion deferred at end of the fiscal years

62,211 20,527 10,200

67,450 17,561 8,700

Short-term and long-term debt Long-term debt, including current maturities: 7-10% Debentures Medium-term notes Sinking fund debentures less: current maturities Long-term maturities

24,438 785 177 25,400 393 25,007

24,467 1,050 195 25,712 356 25,356

Stock compensation

Effect on net income if fair-value based method has been applied Net income, as reported 86,580 Less: expense under fair value method, net of tax 1,071 Pro forma net income 85,509 Pro forma earnings per share

72,575 707 71,868

Basic Diluted

0.85 0.81

0.71 0.69

2001

Not ascertainable

44,000

years years Min( useful life, term of lease)

26,620

3,700

58,727 19,044

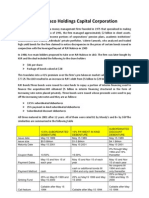

Exhibit 4 Sears, Roebuck and Company Earnings Sensitivity Analysis as example Receivables and inventory source Reported Earnings and non-recurring items Net sales Net income before taxes Tax expense Net income after taxes Average effective tax rate Non-recurring charges before tax Adjusted Net income after tax Accounts Receivable Analysis Reported Values: Gross receivables Reserve for uncollectibles Net receivables Bad debt expense Write-offs Inferred values and computed ratios Reserve / Accounts Receivable Change in reserve / Accounts receivable Accounts receivables turnover Days receivables turnover Effect of 0.73% shift in Reserve / Acc. Rec. As a % of NI (with nonrecurring items) As a % of NI (without nonrecurring items) Inventory Analysis Reported Values: Inventory (LIFO) LIFO Reserve Cost of goods sold (LIFO) I/S I/S I/S I/S computed I/S computed 2001 41,078 1,202 467 735 38.9% 1,064 1,386 2000 40,937 2,174 831 1,343 38.2% 251 1,498 1999 39,484 2,357 904 1,453 38.4% 41 1,478

B/S B/S B/S I/S footnotes

29,321 1,166 28,155 1,866 1,386

21,108 686 20,422 884 958

21,937 760 21,177 871 1,085

3.98% 0.73% 1.69 216 131.00 17.8% 9.5%

3.25% -0.21% 1.97 185 95.00 7.1% 6.3%

3.46% -0.73% 1.82 201 99.00 6.8% 6.7%

B/S footnotes I/S

4,912 591 26,322

5,618 566 26,899

5,069 595 25,627

Inferred values and computed ratios Inventory (FIFO) Cost of goods sold (FIFO) Inventory Turnover (LIFO) Inventory Turnover (FIFO) Days Inventory Turnover (LIFO) Days Inventory Turnover (FIFO) Effect of LIFO on Reported Earnings As a % of NI (with nonrecurring items) As a % of NI (without nonrecurring items)

5,503 26,297 5.00 4.50 73.01 81.11 -15.3 -2.1% -1.1%

6,184 26,928 5.03 4.55 72.51 80.30 17.9 1.3% 1.2%

5,664 25,711 4.93 4.41 74.00 82.80 51.8 3.6% 3.5%

1998 41,575 1,838 766 1,072 41.7%

23,240 974 22,266 1,287

4.19%

5,322 679 27,444

6,001

Exhibit 5 R. P. Stuart Company Consolidated Statement of Operations (in thousands except per share amounts) For the fiscal year ended January 31, 2003 2002 2001 567,411 525,697 502,292 352,682 316,500 305,401 214,729 209,197 196,891 164,550 156,942 149,884 4,603 5,371 4,584 45,576 46,884 42,423

Net sales Cost of sales (including occupancy costs) Gross profit Selling, general and administrative expenses Store preopening expenses Income from operations Non-operating (income) and expenses: Interest and investment income Interest expense Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Dividend declared per share Average shares outstanding during the period: Basic Diluted

(883) 4,884 41,575 16,214 25,361 0.80 0.77

(1,294) 4,999 43,179 16,836 26,343 0.85 0.83

(1,180) 5,238 38,365 14,956 23,409 0.78 0.75

31,649 32,960

31,105 31,876

30,064 31,199

Exhibit 6 R. P. STUART COMPANY Consolidated Balance Sheets (in thousands except per share amounts) As of January 31, 2003 ASSETS Current assets: Cash and Cash equivalents Credit receivables, net of allowances Merchandise inventories Other current assets Total current assets Property and equipment, gross Accumulated depreciation Goodwill Other assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Accounts payable Accrued income taxes payable Accrued compensation Other accrued liabilities Total current liabilities Long-term debt Other noncurrent liabilities Shareholders' equity: Preferred stock, $0.01 par value: 6,500,000 shares authorized none issue and outstanding Common stock, $0.01 par, 80 million shares authorized Issued and outstanding: 31,649,743 and 31,105,437 shares Additional Paid-in capital Retained earnings Cumulative other comprehensive income (loss)

45,420 269,115 131,344 16,789 462,668 430,256 (135,692) 4,178 9,287 770,697

4,809 73,990 15,082 8,305 28,986 131,172 13,216 55,091

316 275,089 295,813 -

Less: common shares in treasury, at cost Commitments and contingencies

571,218 571,218 770,697

Total Liabilities and Shareholders' equity

As of January 31, 2002

2003

2002

111,815 217,123 109,829 11,107 449,874 356,096 (116,092) 4,340 10,080 704,298

Allowances for card receivables 12,650

10,327

3,468 81,592 29,993 18,506 18,251 151,810 15,498 44,035

311 220,056 272,588 -

492,955 492,955 704,298

Exhibit 7 R. P. STUART COMPANY Selected Excerpts from Notes to Financial Statements

Exhibit 8 Miscellaneous Profitability Statistics Nuware, Inc. 2002

2003 Net income Net income per diluted share Return on Assets Return on Equity Average effective tax rate EPS growth Sales growth Gross profit margin USD 86,579 USD 0.82 13.72% 37.0% 17.2% 2.7% 42.9%

2001

USD 72,575 USD 61,669 USD 0.70 USD 0.60 11.93% 37.0% 15.5% 6.1% 40.9%

37.0%

42.9%

us Profitability Statistics R. P. Stuart Company 2003 2002 2001 USD 25,361 USD 0.77 4.8% 39.0% -6.9% 7.9% 62.2% USD 26,343 USD 0.83 5.3% 39.0% 10.1% 4.7% 60.2% USD 23,409 USD 0.75

39.0%

60.8%

Vous aimerez peut-être aussi

- NuWare 1 PagerDocument1 pageNuWare 1 Pagervelusn100% (1)

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligPas encore d'évaluation

- Calaveras Vineyards ExhibitsDocument9 pagesCalaveras Vineyards ExhibitsAbhishek Mani TripathiPas encore d'évaluation

- UST IncDocument16 pagesUST IncNur 'AtiqahPas encore d'évaluation

- Buffett CaseDocument15 pagesBuffett CaseElizabeth MillerPas encore d'évaluation

- USTDocument4 pagesUSTJames JeffersonPas encore d'évaluation

- SUN Brewing (A)Document6 pagesSUN Brewing (A)Ilya KPas encore d'évaluation

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenPas encore d'évaluation

- Innocents Abroad: Currencies and International Stock ReturnsDocument24 pagesInnocents Abroad: Currencies and International Stock ReturnsGragnor PridePas encore d'évaluation

- Comparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDocument3 pagesComparing Bloomin' Brands to Chipotle Using P/E and PEG RatiosDoritosxuPas encore d'évaluation

- Case 9 Questions - Linear TechnologyDocument1 pageCase 9 Questions - Linear TechnologybuddhacrisPas encore d'évaluation

- Midland Case Instructions 1Document3 pagesMidland Case Instructions 1Bibhuti AnandPas encore d'évaluation

- Tata Steel's $12B Acquisition of Corus GroupDocument29 pagesTata Steel's $12B Acquisition of Corus GroupbarphaniPas encore d'évaluation

- Cost of Capital at AmeritradeDocument3 pagesCost of Capital at AmeritradeAnkur JainPas encore d'évaluation

- Integrative Case 10 1 Projected Financial Statements For StarbucDocument2 pagesIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyPas encore d'évaluation

- DMUU Assignment2 - GroupCDocument4 pagesDMUU Assignment2 - GroupCJoyal ThomasPas encore d'évaluation

- Suggested Questions - Baker Adhesives V2Document10 pagesSuggested Questions - Baker Adhesives V2Debbie RicePas encore d'évaluation

- Rosario FinalDocument13 pagesRosario FinalDiksha_Singh_6639Pas encore d'évaluation

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaresatherbd21100% (4)

- Ameritrade Case Sheet Cost of EquityDocument31 pagesAmeritrade Case Sheet Cost of Equitytripti maheshwariPas encore d'évaluation

- Gainesville Machine Tools Corp financial projections and analysisDocument2 pagesGainesville Machine Tools Corp financial projections and analysisAbhinav Singh100% (1)

- Surecut Shears, Inc.Document2 pagesSurecut Shears, Inc.RAHUL SHARMAPas encore d'évaluation

- A Note On Leveraged RecapitalizationDocument5 pagesA Note On Leveraged Recapitalizationkuch bhiPas encore d'évaluation

- Sun Microsystems Financials and ValuationDocument6 pagesSun Microsystems Financials and ValuationJasdeep SinghPas encore d'évaluation

- Kraft Foods Case SummaryDocument2 pagesKraft Foods Case Summaryrkodo1126Pas encore d'évaluation

- Daktronics E Dividend Policy in 2010Document26 pagesDaktronics E Dividend Policy in 2010IBRAHIM KHANPas encore d'évaluation

- 683 Sol 01Document715 pages683 Sol 01ottiePas encore d'évaluation

- Full ReportDocument20 pagesFull ReportSakshi Sidana100% (1)

- 18-Conway IndustriesDocument5 pages18-Conway IndustriesKiranJumanPas encore d'évaluation

- Arcadian Business CaseDocument20 pagesArcadian Business CaseHeniPas encore d'évaluation

- BCE: INC Case AnalysisDocument6 pagesBCE: INC Case AnalysisShuja Ur RahmanPas encore d'évaluation

- TDC Case FinalDocument3 pagesTDC Case Finalbjefferson21Pas encore d'évaluation

- Case Background: Case - TSE International CompanyDocument9 pagesCase Background: Case - TSE International CompanyAvinash AgrawalPas encore d'évaluation

- Krispy Kreme's Financial DeclineDocument3 pagesKrispy Kreme's Financial Declineleo147258963100% (2)

- Case Study - Corp Finance - Padgett Paper ProductsDocument26 pagesCase Study - Corp Finance - Padgett Paper ProductsJed Estanislao100% (1)

- Krispy Kreme Doughnuts Financial AnalysisDocument9 pagesKrispy Kreme Doughnuts Financial Analysisdmaia12Pas encore d'évaluation

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73Pas encore d'évaluation

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Eaton Corporation Portfolio Transformation ValuationDocument1 pageEaton Corporation Portfolio Transformation ValuationSulaiman AminPas encore d'évaluation

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingPas encore d'évaluation

- Managing Economic Exposure-New Chapter 11Document4 pagesManaging Economic Exposure-New Chapter 11MohsinKabirPas encore d'évaluation

- Marriott Corporation Case SolutionDocument6 pagesMarriott Corporation Case Solutionanon_671448363Pas encore d'évaluation

- Note 2 PDFDocument17 pagesNote 2 PDFHemanthReddyOntedhuPas encore d'évaluation

- Padgett Paper Products Case StudyDocument7 pagesPadgett Paper Products Case StudyDavey FranciscoPas encore d'évaluation

- MM 5009 Financial Management Yeats Valves and Control Inc.: Group 10Document11 pagesMM 5009 Financial Management Yeats Valves and Control Inc.: Group 10ppPas encore d'évaluation

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaPas encore d'évaluation

- YVCDocument2 pagesYVCnetterinder0% (1)

- FPLDocument20 pagesFPLJasmani CervantesPas encore d'évaluation

- Case QuestionsDocument8 pagesCase QuestionsUsman ShakoorPas encore d'évaluation

- AT&T/McCaw Merger Valuation and Negotiation StrategyDocument9 pagesAT&T/McCaw Merger Valuation and Negotiation StrategySong LiPas encore d'évaluation

- Firm ValuationDocument7 pagesFirm ValuationShahadat Hossain50% (2)

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDocument5 pagesBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedPas encore d'évaluation

- Preeti 149Document16 pagesPreeti 149Preeti NeelamPas encore d'évaluation

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Document15 pages(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Pas encore d'évaluation

- Infosys Consolidated Financial Statements ReviewDocument13 pagesInfosys Consolidated Financial Statements ReviewLalith RajuPas encore d'évaluation

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhPas encore d'évaluation

- Macy's 10-K AnalysisDocument39 pagesMacy's 10-K Analysisapb5223Pas encore d'évaluation

- Apple 2014 Q2Document54 pagesApple 2014 Q2ikiqPas encore d'évaluation

- JFHFFDocument18 pagesJFHFFUjjwal SharmaPas encore d'évaluation

- Exam: 310-081 Titl E: Sun Certified Web Component Developer For The Java 2 Platform, EnterpriseDocument80 pagesExam: 310-081 Titl E: Sun Certified Web Component Developer For The Java 2 Platform, EnterprisesslbsPas encore d'évaluation

- SampleDocument120 pagesSamplesslbsPas encore d'évaluation

- Classic Pen CompanyDocument11 pagesClassic Pen CompanysslbsPas encore d'évaluation

- FAQ - Edu Loan To IIM StudentsDocument3 pagesFAQ - Edu Loan To IIM StudentssslbsPas encore d'évaluation

- Test 3 JavaDocument9 pagesTest 3 JavasslbsPas encore d'évaluation

- Loan Application Form: Part-I Cent VidyarthiDocument8 pagesLoan Application Form: Part-I Cent VidyarthiSandeep ChowdhuryPas encore d'évaluation

- Collection RigorDocument1 pageCollection RigorsslbsPas encore d'évaluation

- Communication Questions 1Document3 pagesCommunication Questions 1sslbsPas encore d'évaluation

- Java MockDocument51 pagesJava MocksslbsPas encore d'évaluation

- Classic Pen CompanyDocument11 pagesClassic Pen CompanysslbsPas encore d'évaluation

- CH14 ABC systems 練習題Document3 pagesCH14 ABC systems 練習題sslbsPas encore d'évaluation

- Cost Volume Profit AnalysisDocument25 pagesCost Volume Profit AnalysissslbsPas encore d'évaluation

- ACE Customer Service CaseDocument3 pagesACE Customer Service CasePayas TalwarPas encore d'évaluation

- Corporate Strategy PDFDocument1 pageCorporate Strategy PDFsslbsPas encore d'évaluation

- Understand Des PDFDocument29 pagesUnderstand Des PDFsslbsPas encore d'évaluation

- PilgrimBankData - GRP - 8BDocument1 449 pagesPilgrimBankData - GRP - 8BsslbsPas encore d'évaluation

- Gate Form PDFDocument2 pagesGate Form PDFsslbsPas encore d'évaluation

- Marketing PDFDocument4 pagesMarketing PDFsslbsPas encore d'évaluation

- Optimal SoftwareDocument1 pageOptimal SoftwaresslbsPas encore d'évaluation

- OPTICAL MULTICAST ROUTING FOR VIDEO CONFERENCINGDocument9 pagesOPTICAL MULTICAST ROUTING FOR VIDEO CONFERENCINGsslbsPas encore d'évaluation

- Set up sports complex tentsDocument3 pagesSet up sports complex tentssslbsPas encore d'évaluation

- Point and Interval Estimation For Population Mean PDFDocument27 pagesPoint and Interval Estimation For Population Mean PDFsslbsPas encore d'évaluation

- 776Document28 pages776sslbsPas encore d'évaluation

- IBM DB2 9.7 Academic Workshop - Course WorkbookDocument343 pagesIBM DB2 9.7 Academic Workshop - Course WorkbookR. Gaurav AgarwalPas encore d'évaluation

- 10 1 1 128 2918Document12 pages10 1 1 128 2918sslbsPas encore d'évaluation

- Communicating Via A Pipe: #Include #Include #Define BUFSIZE 80Document2 pagesCommunicating Via A Pipe: #Include #Include #Define BUFSIZE 80sslbsPas encore d'évaluation

- Set up sports complex tentsDocument3 pagesSet up sports complex tentssslbsPas encore d'évaluation

- CalciumDocument1 pageCalciumsslbsPas encore d'évaluation

- OS Lab Assignments - Process Pipes & Command ExecutionDocument2 pagesOS Lab Assignments - Process Pipes & Command ExecutionsslbsPas encore d'évaluation