Académique Documents

Professionnel Documents

Culture Documents

Core Banking Solution

Transféré par

Mamta GroverCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Core Banking Solution

Transféré par

Mamta GroverDroits d'auteur :

Formats disponibles

Finacle Core Banking Solution

ACCELERATE INNOVATION.

Strengthen your core.

www.infosys.com/fnacle

Universal Banking Solution | Systems Integration | Consulting | Business Process Outsourcing

Finacle 02 Finacle 03

Finacle 02 Finacle 03

he financial services industry has undergone great

transformation. Mergers, consolidation, expansion, shifting

customer preferences, and a continuously evolving complex

regulatory environment are just some of the issues on the minds

of bankers worldwide. With change coming this rapidly, banks

must quickly embrace the new world order and accelerate

growth to stay a step ahead of the competition.

Banking leaders understand that technology is critical for

business growth. And many are burdened with disparate

core systems added piecemeal, over time, and developed on

obsolete technology. These legacy systems are simply not

equipped to readily respond to change. However, bankers,

having grown weary of lengthy deployments and the ensuing

business disruption, have lost enthusiasm for transformation.

Yet, the need to modernize the organization remains as

compel l i ng as ever. A pai n-free approach to banki ng

transformation, with an adaptive solution at the core, will prove

invaluable for banks looking to gear themselves for tomorrow.

Is your bank

ready for

tomorrow?

T

Finacle core banking

Comprehensive ofering to support growth

Finacle core banking solution is a comprehensive,

integrated, yet modular and agile business solution,

addressing all the core needs of banks, in easy-to-

confgure modules. Finacle provides all the building

blocks of business functionality enabling users to

confgure products and processes fexibly in order to

Finacle has a layered Service-Oriented Architecture

(SOA), STP capabilities, Web-enabled technology,

and supports true 24 X 7 operations, so banks can:

Create a diferentiated and unique customer

experience: The Finacle core banking solution

enables banks to provide a hassle-free and

unifed banking experience to customers thats

personalized to their needs.

Expand product oferings: With a robust and

comprehensive core solution, banks can expand

product oferings on demand and stay ahead in a

competitive marketplace.

Configure bundled product suites: The

modular nature of our solution allows banks to

easily confgure bundled product suites to cater to

the growing demands of todays customers.

Ofer diferential pricing: This is not an option but

a need for banks today and our solutions gives

banks the flexibility to offer differential pricing.

adapt to a dynamic environment. With a 360 degree

single source view into customer accounts, banks

can empower customers with relevant information

and delight them with the right oferings, presented

at the right time through the right channel.

Generate right-sell opportunities: Finacle core

banking solution enables a phased, strategic

approach in generating right-sell opportunities.

Eliminate data redundancy: Our core banking

solution helps banks build a master data system

that consolidates all customer and product data

and eliminates redundancy.

Increase the productivity of frontline staff:

Automation and ease-of-operation lends itself to

increase in productivity.

Comply with emerging global regulations:

Compliance is every banks concern. With our

solution banks can rest assured of being compliant

with growing regulations.

Manage growth with proven scalability: The

solution is designed to be scalable and support

your pace of growth.

Finacle 04 Finacle 05

Functional architecture

Finacle 04 Finacle 05

F

u

n

c

t

i

o

n

a

l

S

e

r

v

i

c

e

s

Standing Orders

Bill Payments Liquidity Management Clearing Referral

Sweeps / Pooling Payment Systems Limits / Collaterals

24/7

Integration Framework

Reporting Audit Multi - Calendar Scheduler

Purge Access Control

Multi-lingual Finacle Studio Single Sign On

Workfow (BPEL)

I

n

f

r

a

s

t

r

u

c

t

u

r

e

E

n

t

e

r

p

r

i

s

e

C

R

M

Enterprise Customer Information

Origination Marketing Sales Service Interaction

Communication

Channels

Knowledge

Base

360 Degree

View

P

r

o

d

u

c

t

F

a

c

t

o

r

y

Consumer Banking

Consumer Banking and Wealth Management Corporate Banking and Trade Finance

Wealth Management Solution

Saving & Checking

Insurance Structured Products Mutual Funds

Retail Loans

Mortgages Islamic Banking

Time Deposits

Corporate Banking

Trade Finance

Current / Overdrafts

Forward

Contracts

Export / Import

Financing

Guarantees

Syndication

Securitization Islamic Banking

Commercial Lending

Documentary

Credits Equities Bonds

A

c

c

o

u

n

t

i

n

g

B

a

c

k

b

o

n

e

General Ledger Multi-Currency Transaction Manager

Interest / Tax

Inventory Channel Rules Discounts / Preferential Pricing

Exchange Rates Bank Management Fees / Charges

Signature Verifcation

R

e

u

s

a

b

l

e

B

u

s

i

n

e

s

s

C

o

m

p

o

n

e

n

t

s

Key modules

Enterprise customer information

When more is known about customers - their

demographics, fnancials, preferences, and the

relationship they already have with a bank banks

are in a position to ofer them the right solutions at

the right time.

Finacle enables banks to create and maintain

a single source of customer truth enterprise

customer information fles, across multiple host

systems including Finacle. This helps manage the

various lifecycle stages in a relationship with the

customer and access comprehensive segmentation

information, all through a unifed view.

Flexible and user-defnable templates support KYC

and AML compliance mandates.

Consumer fnance

As consumers ask for new products, banks can

leverage the fexible product defnition capabilities

of Finacle to create new offerings and target

campaigns exactly where they are most relevant.

Each product can be associated with a wide range

of properties and then bundled meaningfully

based on customer input.

Oferings such as savings and checking accounts,

and provision for personal and auto fnance are

easily supported. Multi-layered productsstructured

deposits, multi-currency accounts, top-up deposits,

master term deposits, top-up loans, revolving loans

and securitizationcan be added as needed.

Customer analytics

Any business can beneft from holistic customer

analytics through insightful business reports and

rigorous statistical models. This can be leveraged to

strengthen customer engagement and diferentiate

the service experience.

The customer analytics module supports operations

with comprehensive intelligence, ranging from

data acquisition to reporting and analysis,

leveraging quantitative modeling techniques

and multi-dimensional reporting. It provides

critical information such as customer attrition

scores or proftability measures to help develop

a clear picture of the customer. This information

can also be extended to front-end applications or

combined with online tacit information to help

make timely and efective decisions. There is also

the fexibility to pick and choose specifc customer

analytics functions, relevant to the business, across

the customer life-cycle stages of acquisition,

development, and retention.

Finacle 06 Finacle 07

Clari5

This module leverages a real-time intelligent

conversation and interaction management engine

called Clari5 to add conversational tacit intelligence

to customer interactions in real-time. It not only

displays ofers that may interest customers but

also factors new information in real-time, adjusts to

prompts, and intelligently participates in customer

interactions simulating real human conversation.

It helps assimilate structured, unstructured, real-

time, and ofine information about customers,

across multiple channels and interactions. It has

the embedded intelligence to remember behavior,

make assumptions, understand contexts, seek

answers, and answer queries as well. The result?

All customer interactions are contextual and

personalized.

Wealth management

High net worth individuals and the mass afuent

represent a key growth area for many banks. Finacle

supports rule-based commission confguration

and redemption, relationship-based pricing,

customized customer communication, and a wide

range of related properties for structured products,

insurance products, bonds, and mutual funds.

The wealth management module is tightly

integrated with Finacle core banking and CRM

solutions ensuring unique customer definition,

unified customer portfolio view, and seamless

transacti on processi ng for the banks ver y

important high net worth customers.

Islamic banking

Ofer Shariah-compliant products to customers and

address their needs for Islamic banking along with

international offerings. Get started by initiating

Islamic banking as an add-on product ofering in a

branch of choice and eventually convert the entity

to an independent Islamic banking unit, if required.

Finacle Islamic banking solution is developed from

incisive insight into the Middle East, Far East and

European markets, and is truly geared to address

region-specifc Islamic banking requirements.

Corporate banking

From simple products such as overdrafts and

cash-term l oans to compl ex ones such as

securitization and syndication, this module presents

a powerful range of oferings for corporate banking.

It includes commercial lending essentials such as

multi-currency disbursements and repayments,

Finacle 06 Finacle 07

fexible and varied interest rate setup, commitment

fee setup, crystallization, amortization, and debt

consolidation.

Finacle maintains the corporate customer information

files, corporate deposits, commercial lending,

corporate origination and corporate payments with

comprehensive liquidity management, sweeps

and pool facilities. Its multi-currency enabled

centralized limits and collateral function lets banks

monitor both collateralized lending and online

exposure.

Trade fnance

This module presents an end-to-end solution

for the trade fnance needs of a bank. It is fully

integrated with the payment system and exchange

rate setup, and supports multicurrency processing

of trade products such as:

Documentary credit

Forward contract

Import and export fnancing

Letter of guarantee

Functional services

Reusable business components

Finacle core banking ofers a wide range of

mainstream and bank-defnable services that help

banks diferentiate oferings by creating uniquely

bundled products and services, such as:

Standing orders integrated with payment

systems, enabled for multi-currency, with auto-

execution capabilities

Liquidity management supporting notional

pooling and target balancing structures

Feature-rich bill payment that supports multi-

currency payments and collections

Users can defne which business-enabler

functions of Finacle core banking to turn on,

and then reuse these across various functions,

such as:

Interest rate support for defnition of diferential

and slab-based interest rates

Rule-based Signature Verifcation System (SVS)

Exchange rate structures with multi-tiered

defnitions

Tax structure defnition and application of

withholding tax for defned events

Event-based charges with provisions for online

and batch collection of charges

Remittances ofering comprehensive inter-bank

and intra-bank funds transfer

Payments enabled for Straight Through

Processing (STP)

Flexible and feature-rich clearing services that

support both paper-based and image-based

clearing

Automated exception and approval

management with referrals for fnancial and

non-fnancial exceptions

Support for preferential pricing and discounts,

both ad hoc and based on customer segments

Inventory management

Elaborate channel rules and channel-based

diferential pricing for charges and interest

Rebates, clawbacks, subsidies, planned

prepayments and multi-source repayment

confguration capabilities for retail loans

Direct Selling Agent (DSA) features with

capabilities for sub-DSA, turnover and

commissions calculations

Extensive framework for bank management with

user defnition capabilities, audit trail features,

reporting and exception management

Finacle 08 Finacle 09

Accounting backbone

Finacle core banking has a built-in integrated

fnancial and accounting management system

with multicurrency support, that efectively serves

banks with multiple branches and proft centers.

The integrated general ledger module supports

real-time online updating of transactions and

allows real time generation of statements that

show the banks fnancial position. At the same

time, the transaction manager auto-generates all

batch and online transactions while processing

large transaction volumes, complete with validations

and defned checks.

Infrastructure

Finacle core banking empowers users with a wide

range of utilities to enhance operational efciency

and facilitate ease of use. These include:

24 x 7 capabilities to operate round-the-clock

through branches and channels even during

batch job execution and day-end operations

Integrated, secure, and scalable reporting

infrastructure

Ease of integration with industry standards-

based framework to integrate with existing and

external systems

Single Sign On (SSO) for uniform and common

authentication

Sophisticated security management at application,

database, and user levels with built-in checks and

role-based access

Support for multiple calendars such as Gregorian,

Hijri and Buddha

A Batch Job Scheduler (BJS) to automate invocation,

execution and monitoring of batch jobs at defned

schedules

BPEL/BPML based workflow for automation of

sequential business processes with reduced

manual intervention

Finacle Studio to create bank defnable business

rules and logic for behavior and outcome of

business events

Finacle 08 Finacle 09

Business benefts

Create diferentiated products easily

Finacle core banking ofers an unlimited palette of

features to design and deploy products for diferent

market segments. Its product bundling capabilities

provide the latitude to create offerings with

diferentiated features. With Finacle, bankers can

ofer diferential pricing, set up channel rules, and

easily customize oferings across market segments.

Right-sell to customers efectively

The Enterprise Customer Information File and

CRM capabilities in Finacle ofer a unifed view of

the customer across the entire solution and across

multiple back-end applications, letting users

view the customer from a completely informed

perspective. This information lets banks forge

more meaningful relationships with customers

and aggressively explore right-sell opportunities.

Adapt to change quickly

The SOA allows the banks IT team to make changes

without touching the base code ensuring minimal

vendor dependency, lesser operational risk, and

faster adaptability to changing business conditions.

Increase operational efciency and

productivity

Finacle core banking supports business event

automation and process orchestration, eliminating

manual tasks and reducing process time. The

elimination of error and data redundancies results

in increased branch productivity, and Straight

Through Processing (STP) that, in turn, reduces

turnaround and processing time, increases output

and speeds up response to customers.

Finacle 10 Finacle 11

Finacle helps build tomorrows bank

Finacle from Infosys partners with banks, the world over, to accelerate

innovation and unlock the value levers of their business; enabling them

to create and launch new products and services faster, increase right-sell

efciencies and delight customers, while optimizing processes to support

agile and cost efcient operations.

Bring customers to tomorrows bank with Finacle core banking.

Finacle 10 Finacle 11

Finacle from Infosys partners with banks to transform process, product

and customer experience, arming them with accelerated innovation

that is key to building tomorrows bank.

About Finacle

2012 Infosys Limited, Bangalore, India, Infosys believes the information in this publication is accurate as of its publication date; such information is subject to change without notice. Infosys

acknowledges the proprietary rights of the trademarks and product names of other companies mentioned in this document.

For more information, contact fnacleweb@infosys.com www.infosys.com/fnacle

Vous aimerez peut-être aussi

- Introduction To Corporation AccountingDocument15 pagesIntroduction To Corporation AccountingAlejandrea Lalata100% (2)

- Finacle Core Banking SolutionDocument8 pagesFinacle Core Banking SolutionInfosysPas encore d'évaluation

- Core Banking Solutions FinalDocument6 pagesCore Banking Solutions FinalShashank VarmaPas encore d'évaluation

- Basic Models of Organization DesignDocument13 pagesBasic Models of Organization DesignMamta Grover0% (1)

- Dev EreDocument1 pageDev Ereumuttk5374Pas encore d'évaluation

- Ecommerce in IndiaDocument24 pagesEcommerce in Indiaintellectarun100% (2)

- White Label Travel Portal DevelopmentDocument5 pagesWhite Label Travel Portal DevelopmentwhitelabeltravelportalPas encore d'évaluation

- Infinity ArchitectureDocument57 pagesInfinity Architecturebeimnet100% (2)

- Marketing Management NotesDocument57 pagesMarketing Management NotesKanchana Krishna KaushikPas encore d'évaluation

- Consultancy ReviewerDocument11 pagesConsultancy ReviewerJas75% (8)

- Magic Quadrant For Global Re 368239 PDFDocument38 pagesMagic Quadrant For Global Re 368239 PDFNorberto J. E. GeilerPas encore d'évaluation

- Implementing FlexcubeDocument31 pagesImplementing Flexcubeespee29Pas encore d'évaluation

- Core Banking Systems SurveyDocument71 pagesCore Banking Systems Surveyborisg3100% (1)

- Core Banking Partner GuideDocument19 pagesCore Banking Partner GuideClint JacobPas encore d'évaluation

- SEPA Payment Initiation Format (PAIN.001)Document9 pagesSEPA Payment Initiation Format (PAIN.001)Rajendra PilludaPas encore d'évaluation

- IBM Banking: Core Banking Transformation With System ZDocument16 pagesIBM Banking: Core Banking Transformation With System ZIBMBankingPas encore d'évaluation

- Addison-Open Banking - What The Future HoldsDocument18 pagesAddison-Open Banking - What The Future HoldsRajanPas encore d'évaluation

- Core Banking SystemDocument8 pagesCore Banking Systembudi.hw748Pas encore d'évaluation

- A Case For A Single Loan Origination System For Core Banking ProductsDocument5 pagesA Case For A Single Loan Origination System For Core Banking ProductsCognizant100% (1)

- Core Banking PDFDocument3 pagesCore Banking PDFJanani RaniPas encore d'évaluation

- Vocalink Faster Payment Service ArchitectureDocument8 pagesVocalink Faster Payment Service ArchitectureMike Xpto0% (1)

- Global Payplus BrochureDocument16 pagesGlobal Payplus BrochureGirishPas encore d'évaluation

- T24 Temenos Transact Core BankingDocument2 pagesT24 Temenos Transact Core BankingG V Suhas ReddyPas encore d'évaluation

- Asian Banker - Core Banking ReplacementDocument173 pagesAsian Banker - Core Banking ReplacementHaris APas encore d'évaluation

- Banking Industry Architecture Network: How-To GuideDocument84 pagesBanking Industry Architecture Network: How-To GuideLilia Diaz100% (1)

- Core Banking Union Bank of IndiaDocument36 pagesCore Banking Union Bank of IndiaRakesh Prabhakar Shrivastava100% (2)

- Core Banking Transformation: Solutions To Standardize Processes and Cut CostsDocument16 pagesCore Banking Transformation: Solutions To Standardize Processes and Cut CostsIBMBanking100% (1)

- Backbase Omni Channel Banking Report 2Document52 pagesBackbase Omni Channel Banking Report 2Kıvanç AkdenizPas encore d'évaluation

- SHS Applied - Entrepreneurship CG PDFDocument7 pagesSHS Applied - Entrepreneurship CG PDFPat Che Sabaldana88% (8)

- Banking2025 WhitepaperDocument49 pagesBanking2025 WhitepaperLuka AjvarPas encore d'évaluation

- Backbase The ROI of Omni Channel WhitepaperDocument21 pagesBackbase The ROI of Omni Channel Whitepaperpk8barnesPas encore d'évaluation

- Core Banking Solutions - An AssessmentDocument15 pagesCore Banking Solutions - An AssessmentJaya Prakash100% (4)

- Core Banking SolutionsDocument13 pagesCore Banking Solutionssharmil_jainPas encore d'évaluation

- Core Banking Solution (Final)Document30 pagesCore Banking Solution (Final)prashant jha100% (1)

- Business Case For A New Core Banking Solution - Jul 2012Document13 pagesBusiness Case For A New Core Banking Solution - Jul 2012Francis Ekemu100% (1)

- Demystifying Digital Lending PDFDocument44 pagesDemystifying Digital Lending PDFHitesh DhaddhaPas encore d'évaluation

- Temenos Products Infinity BrochureDocument12 pagesTemenos Products Infinity Brochureelswidi100% (1)

- Murex Services FactsheetDocument16 pagesMurex Services FactsheetG.v. AparnaPas encore d'évaluation

- Core BankingDocument16 pagesCore Bankingaparnasudha136Pas encore d'évaluation

- List of Indian Accounting StandardsDocument2 pagesList of Indian Accounting StandardsMamta Grover100% (2)

- Digital Banking Guide PDFDocument11 pagesDigital Banking Guide PDFBharat VarshneyPas encore d'évaluation

- Core Banking Selection CriteriaDocument5 pagesCore Banking Selection CriteriaMussadaq JavedPas encore d'évaluation

- Core BankingDocument37 pagesCore Bankingnwani25Pas encore d'évaluation

- Core Banking On The Cloud The Catalyst For Innovation Agility and EfficiencyDocument16 pagesCore Banking On The Cloud The Catalyst For Innovation Agility and Efficiencyeon2015Pas encore d'évaluation

- Abm 115 TRMDocument329 pagesAbm 115 TRMgurubabPas encore d'évaluation

- Finacle Universal Banking Solution PDFDocument12 pagesFinacle Universal Banking Solution PDFSsemwogerere TomPas encore d'évaluation

- Finacle Core Banking Solution 2019Document24 pagesFinacle Core Banking Solution 2019Anchal KgsgbPas encore d'évaluation

- SBI Core BankingDocument47 pagesSBI Core Bankingsarthak_ganguly78% (9)

- Finacle Core Banking BrochureDocument32 pagesFinacle Core Banking Brochurechirag randhirPas encore d'évaluation

- SBI Core BankingDocument48 pagesSBI Core BankingshahsuhailPas encore d'évaluation

- Core BankingDocument35 pagesCore Bankingajax248590Pas encore d'évaluation

- TCS BaNCS Research Journal Issue 3 0713 1Document52 pagesTCS BaNCS Research Journal Issue 3 0713 1Poovana Kokkalera PPas encore d'évaluation

- TOGAF and BIAN Service LandscapeDocument43 pagesTOGAF and BIAN Service Landscapehanan100% (1)

- A Case For A Single Loan Origination System For Core Banking Products PDFDocument5 pagesA Case For A Single Loan Origination System For Core Banking Products PDFansh_hcetPas encore d'évaluation

- Microsoft CoreBanking MIRA-B - FinalDocument62 pagesMicrosoft CoreBanking MIRA-B - FinallivccPas encore d'évaluation

- TEMENOS CoreBanking BrochureDocument12 pagesTEMENOS CoreBanking BrochureRahul Tripathi100% (1)

- Lead To Loan BrochureDocument4 pagesLead To Loan Brochurejoe_inbaPas encore d'évaluation

- Overview of FinacleDocument6 pagesOverview of FinacleShabih FatimaPas encore d'évaluation

- Core Bank in Axis BankDocument24 pagesCore Bank in Axis BankNatasha MistryPas encore d'évaluation

- Core Banking SolutionDocument8 pagesCore Banking SolutionKhizar Jamal SiddiquiPas encore d'évaluation

- Core Banking System Selection Services Scope Sheet v3Document3 pagesCore Banking System Selection Services Scope Sheet v3dialanassar100% (2)

- HDFC Core BankingDocument32 pagesHDFC Core Bankingakashshah1069100% (1)

- The a.R.T of Digital Banking at YES BANKDocument40 pagesThe a.R.T of Digital Banking at YES BANKqPas encore d'évaluation

- Core Banking System in SBIDocument4 pagesCore Banking System in SBINilesh Chandra Sinha92% (12)

- Study On Cbs With Tcs - SBIDocument22 pagesStudy On Cbs With Tcs - SBIvarghese.mathewPas encore d'évaluation

- Core Banking System Strategy A Complete Guide - 2020 EditionD'EverandCore Banking System Strategy A Complete Guide - 2020 EditionPas encore d'évaluation

- Banking As A Service A Complete Guide - 2020 EditionD'EverandBanking As A Service A Complete Guide - 2020 EditionPas encore d'évaluation

- Insurance: Presented By: Mamta GroverDocument32 pagesInsurance: Presented By: Mamta GroverMamta GroverPas encore d'évaluation

- Creative and Lateral Thinking ManagementDocument30 pagesCreative and Lateral Thinking ManagementMamta GroverPas encore d'évaluation

- A Study of Impact of Macroeconomic Variables On Performance of NiftyDocument3 pagesA Study of Impact of Macroeconomic Variables On Performance of NiftyMamta GroverPas encore d'évaluation

- Theories of Retail DevelopmentDocument10 pagesTheories of Retail DevelopmentMamta Grover67% (3)

- Global Financial ManagementDocument17 pagesGlobal Financial ManagementMamta GroverPas encore d'évaluation

- Leadership Issues in Globalization: Submitted By: Shivani (082) NameeshaDocument11 pagesLeadership Issues in Globalization: Submitted By: Shivani (082) NameeshaMamta GroverPas encore d'évaluation

- Management Technology, Innovation and ChangeDocument54 pagesManagement Technology, Innovation and ChangeMamta GroverPas encore d'évaluation

- Opportunity AnalysisDocument23 pagesOpportunity AnalysisMamta GroverPas encore d'évaluation

- Attention: Where Attention Lies in Decision Making ProcessDocument3 pagesAttention: Where Attention Lies in Decision Making ProcessMamta GroverPas encore d'évaluation

- Financial InstitutionDocument3 pagesFinancial InstitutionMamta GroverPas encore d'évaluation

- Logistics and Supply Chain Management Assignment PDFDocument13 pagesLogistics and Supply Chain Management Assignment PDFprin_vinPas encore d'évaluation

- Corporate Finance Chapter10Document55 pagesCorporate Finance Chapter10James ManningPas encore d'évaluation

- BesorDocument3 pagesBesorPaul Jures DulfoPas encore d'évaluation

- Special Consideration For The Sole Practitioner Operating As A Management ConsultantDocument3 pagesSpecial Consideration For The Sole Practitioner Operating As A Management ConsultantJessyPas encore d'évaluation

- Contoh CLDocument1 pageContoh CLsuciatyfaisalPas encore d'évaluation

- Graduate School BrochureDocument2 pagesGraduate School BrochureSuraj TalelePas encore d'évaluation

- A Report OnDocument63 pagesA Report OnPriya SharmaPas encore d'évaluation

- Kasus 7.1 Mercator Corp.Document3 pagesKasus 7.1 Mercator Corp.Septiana DA0% (3)

- Final Brand Building ProjectDocument14 pagesFinal Brand Building ProjectSarah TantrayPas encore d'évaluation

- Indirect Verification PDFDocument1 pageIndirect Verification PDFSai FujiwaraPas encore d'évaluation

- MarutiDocument42 pagesMarutiVineet SinglaPas encore d'évaluation

- Resume Vijeesh KumarDocument3 pagesResume Vijeesh KumarunniPas encore d'évaluation

- MEC 1st Year 2018-19 English-Final PDFDocument9 pagesMEC 1st Year 2018-19 English-Final PDFUmesh Kumar MahatoPas encore d'évaluation

- 42 Master IndexDocument734 pages42 Master Indexapi-3702030Pas encore d'évaluation

- The Income Statements: Teori AkuntansiDocument25 pagesThe Income Statements: Teori AkuntansirifaPas encore d'évaluation

- Management 10th Edition Daft Test BankDocument34 pagesManagement 10th Edition Daft Test Bankpatrickpandoradb6i100% (26)

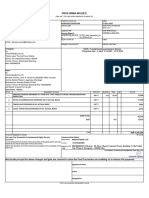

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Document1 pageService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajPas encore d'évaluation

- DMCDocument5 pagesDMCAmarpal YadavPas encore d'évaluation

- Facebook (Wikipedia Extract)Document1 pageFacebook (Wikipedia Extract)sr123123123Pas encore d'évaluation

- Shriram Transport Finance Company LTD: Customer Details Guarantor DetailsDocument3 pagesShriram Transport Finance Company LTD: Customer Details Guarantor DetailsThirumalasetty SudhakarPas encore d'évaluation

- Vested Outsourcing: A Exible Framework For Collaborative OutsourcingDocument12 pagesVested Outsourcing: A Exible Framework For Collaborative OutsourcingJosé Emilio Ricaurte SolísPas encore d'évaluation

- Intellectual Capital Is The Collective Brainpower or Shared Knowledge of A WorkforceDocument3 pagesIntellectual Capital Is The Collective Brainpower or Shared Knowledge of A WorkforceKatherine Rosette ChanPas encore d'évaluation