Académique Documents

Professionnel Documents

Culture Documents

RR 16-02

Transféré par

Peggy Salazar0 évaluation0% ont trouvé ce document utile (0 vote)

43 vues6 pagesBIR

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBIR

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

43 vues6 pagesRR 16-02

Transféré par

Peggy SalazarBIR

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

1

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

October 11, 2002

REVENUE REGULATIONS NO. 16-2002

Subject : Modes of and Procedure for the Payment of Internal Revenue Taxes

Through Authorized Agent Banks Amending Revenue Regulations

No. 4-97, as amended by Revenue Regulations No. 6-98

To : All Internal Revenue Officers, Authorized Agent Banks, and Others

Concerned

______________________________________________________________________________________

SECTION 1. SCOPE Pursuant to Section 244 of the National Internal

Revenue Code of 1997 (CODE) in relation to Sections 8, 12, 56, 58, 81, 103,

114, 128, 130, 200 and 245, all of the same Code, these Regulations are hereby

promulgated to amend Revenue Regulations No. 4-97, as amended by Revenue

Regulations No. 6-98, on the provisions relative to acceptable modes of payment

of internal revenue taxes coursed through authorized agent banks (AABs), the

recording of such payments and issuance of validated BIR-prescribed deposit

slips which likewise serve as acknowledgement receipts for payments of taxes

deposited by taxpayers for BTR-BIR account, and the control mechanisms to

deter and detect the diversion of tax payments.

SEC. 2. RECORDING OF BIR TAX PAYMENTS BY THE AABs

A) All internal revenue taxes collected through authorized agent banks

(AABs) shall be credited to the demand deposit accounts opened and maintained

by the Bureau of Treasury (BTr) for BIR in the head offices of AABs;

B) Head offices of AABs shall assign and maintain a separate general

ledger account for said BTr demand deposit accounts;

C) Using the online tellering system, the bank tellers shall immediately

post the BIR tax payments they collect by crediting the BTr demand deposit

accounts in the head offices of the AABs, instead of recording them as mere

payables to BTr at the end of each banking day in the AABs backrooms.

D) In filing a tax declaration and making payment to an AAB, a tax payer

must accomplish and submit a BIR-prescribed deposit slip which AABs must

design, print and make available in all participating branches. The deposit slip

must in addition to those needed by the bank, provide for the following

information:

Transaction Date

Name of Taxpayer

TIN

BTR-BIR Account Number

Account Name which must be BTR-BIR

Name of Drawee Bank

Check Number

Bank Debit Advice Number (for debit system payments)

Amount

E) The bank teller shall machine validate the BIR-prescribed deposit slip

accomplished by the taxpayer as evidence that the BIR tax payment was

deposited to the account of the BTr. Said deposit slip shall be accomplished and

issued in triplicate copies, distributed as follows: original (taxpayers copy),

duplicate (AABs copy) and triplicate (to be attached to the tax return.

Additionally, the AAB receiving the tax return/payment form shall also machine

validate and stamp mark the word Received on the return/payment form as

proof of filing the return/payment form and payment of the tax by the taxpayer.

The machine validation on the return/payment form shall reflect the date of

payment, amount paid and transaction code, the name of the bank, branch code,

tellers code and tellers initials.

F) Before 12:00 NN of the following banking day, the head offices of the

AABs shall provide to BTR/BIR the daily total amount of BIR taxes they collected.

G) After receipt of payment but not later than 24 hours thereafter, the AAB

branch shall encode into the LBDE System and transmit to the concerned BIR

Data Center, the below data and copy furnish the AAB head office.

1. Date of the transaction;

2. Name of the taxpayer;

3. Taxpayer Identification Number (TIN) of the taxpayer;

4. Tax type which is being paid for;

5. Return period for the tax type being paid for;

6. Amount of tax paid;

7. Name of the drawee bank and check number, for tax payments

through checks;

SEC. 3. MODES OF PAYMENT TO AABs Aside from the

electronic payment system currently used by some taxpayers in paying

their BIR taxes, the rest shall pay their tax liabilities through any of the

following modes: a) over-the-counter cash payments; b) bank debit

system; or c) check payment system.

a) Over-the-counter cash payment refers to payment of tax liabilities to

authorized agent bank in the currencies (paper bills or coins) that are legal tender

in the Philippines. The maximum amount allowed per tax payment shall not

exceed ten thousand pesos (P10,000.00)

b) Bank debit system refers to the system whereby a taxpayer, through a

bank debit memo/advice, authorizes withdrawals from his/its existing bank

accounts for payment of tax liabilities.

The bank debit system mode is allowed only if the taxpayer has a bank

account with the AAB branch where he/it intends to file and pay his/its tax

return/form/declaration, provided said AAB branch is within the jurisdiction of the

BIR Revenue District Office (RDO) / Large Taxpayers District Office (LTDO)

where the tax payment is due and payable.

c) Checks refers to a bill of exchange or Order Instrument drawn on a

bank payable on demand.

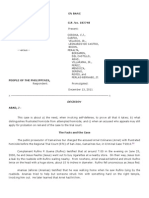

In the issuance and accomplishment of checks for the payment of internal

revenue taxes, as illustrated below, the taxpayer shall indicate in the space

provided for PAY TO THE ORDER OF the following data: (1) presenting/collecting

bank or the bank where the payment is to be coursed and (2) FAO (For the

Account Of) Bureau of Internal Revenue as payee; and under the ACCOUNT

NAME the taxpayer identification number (TIN).

(Below is a sample of a tax check payment where the drawee bank and

presenting bank are different from each other.)

ACCOUNT No. ACCOUNT NAME

Check No. R/T No.

000-249-15522-6

JUAN DELA CRUZ 0765695 01028

TIN: 012--

-

345678-000

LANDBANK BATASAN

SEPT. 16, 2002

PAY TO THE

FAO BUREAU OF INTERNAL REVENUE

ORDER OF

P 1,000,000.00

PESOS ONE MILLION ONLY

RCBC

RIZAL COMMERCIAL

BANKING CORPORATION

A VOC Company

LEGASPI VILLAGE BRANCH

SALCEDO ST. LEGASPI VIL. MAKATI

O76569501028007=:000249155226

D

O

C

U

M

E

N

T

A

R

Y

S

T

A

M

P

S

P

A

I

D

(Signed)

JUAN DELA CRUZ

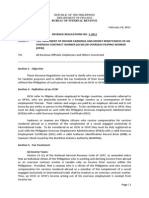

(Below is sample of a check tax payment drawn from and presented to the same

bank.)

The following checks are, however, not acceptable as check payments for

internal revenue taxes:

1 Accommodation checks checks issued or drawn by a party

other than the taxpayer making the payment;

2 Second endorsed checks checks issued to the taxpayer as

payee who indorses the same as payment for taxes;

3 Stale checks checks dated more than six (6) months prior

to presentation to the authorized agent bank;

4 Postdated checks checks dated a day or several days

after the date of presentation to the authorized agent bank;

5 Unsigned checks checks with no signature of the drawer;

6 Checks with alterations/erasures.

AABs accepting checks for the payment of BIR taxes and other charges

must see to it that the check covers one tax type for one return period only.

Moreover, AABs must strictly comply with the systems and procedures for the

reception, processing, clearing and accounting of the checks to be prescribed

under a separate regulation.

Second indorsement of checks which are payable to the Bureau of

Internal Revenue or Commissioner of Internal Revenue is absolutely prohibited.

ACCOUNT No. ACCOUNT NAME

Check No. R/T No.

000-249-15522-6 JUAN DELA CRUZ 0765696 01028

TIN: 012-345678-000

RCBC Legazpi Village

SEPT. 16, 2002

PAY TO THE

FAO BUREAU OF INTERNAL REVENUE

ORDER OF

P 1,000,000.00

PESOS ONE MILLION ONLY

RCBC

RIZAL COMMERCIAL

BANKING CORPORATION

A VOC Company

LEGASPI VILLAGE BRANCH

SALCEDO ST. LEGASPI VIL. MAKATI

O76569601028007=:000249155226

D

O

C

U

M

E

N

T

A

R

Y

S

T

A

M

P

S

P

A

I

D

(Signed)

JUAN DELA CRUZ

SEC. 4. TAX RETURNS PARTLY PAID THRU TAX DEBIT MEMOS

(TDMs) AABs are mandated to accept tax returns/payment forms partly paid

thru any of the modes of payment mentioned in Section 3 hereof and partly thru

TDMs duly and validly issued by the BIR. Before accepting the BIR tax return/

payment form partly paid thru tax debit memo, the AAB shall insure that the

number of the TDM is indicated in the BIR tax return/ payment form in the same

manner that the check number/drawee bank and bank debit advice number are

indicated in the tax return/payment form paid thru check or bank debit system,

respectively. A photocopy of the tax credit certificate (TCC), front and back

page, which was the source of the TDM, together with a copy of the TDM, must

be required from the taxpayer and attached to the BIR tax return/payment form.

TDMs are, however, not acceptable as payments for withholding taxes,

including Fringe Benefit Tax (clarified and implemented under RR No. 2-98, as

amended, and RR No. 3-98), and for taxes, fees and charges collected under

special schemes / procedures / programs of the Government / BIR as discussed

and elucidated in a separate revenue regulation. AABs shall see to it that this

restriction is strictly observed in the BIR tax returns/ payment forms they receive.

SEC. 5. ENROLLMENT OF TAXPAYERS WITH AUTHORIZED AGENT

BANK NOT REQUIRED Taxpayers are not required to enroll with any AAB

where they intend to file tax returns/payment forms and/or pay internal revenue

taxes. Taxpayers may file tax returns/payment forms and pay internal revenue

taxes with any AAB of the appropriate BIR office (Revenue District Office (RDO),

Large Taxpayers District Office (LTDO), or Large Taxpayers Service, etc.,

whichever is applicable) where they are required to file the particular

return/payment form.

SEC. 6. RESPONSIBILITY AND PRIVILEGE OF TAXPAYERS

Taxpayers shall see to it that their tax returns/payment forms with payment are

filed with and internal revenue taxes paid to legitimate AABs of the BIR.

Nonetheless, they may confirm their tax payments with their home RDO / LTDO

or LTDO / RDO where they are required to file tax returns/payment form and pay

internal revenue taxes.

SEC. 7. ADDITIONAL LIABILITIES/RESPONSIBILITIES OF AUTHO-

RIZED AGENT BANKs (AABs).

(a) Any diversion, non-remittance or under-remittance of the taxes

collected by AABs through fault or negligence of the bank accepting such

payment as well as the diversion of any payment for BIR taxes using the facilities

of the bank through fault or negligence of any of the banks personnel shall

subject the bank to civil and criminal liabilities provided for under Sections 248

and 275 of the Tax Code, as amended, and other existing laws, rules and

regulations. AABs shall be liable to the BIR for double the amount of taxes

diverted and unremitted, plus the increments and penalties prescribed by the Tax

Code, as amended, but the total penalties imposed may be reduced on

meritorious grounds subject to the approval of the majority of the members of the

Management Committee (MANCOM) of the BIR, composed of the Commissioner

of Internal Revenue and the four (4) Deputy Commissioners, where the

Commissioner of Internal Revenue votes for such reduction.

(b) The reports of AABs to be submitted to BTr/BIR (under Sec. 2) of

all the tax payments collected shall be in accordance with the forms prescribed

by BIR.

(c) The requirements prescribed in these regulations shall be included

in the accreditation criteria to be mentioned in the Memorandum of Agreement to

be signed by and among the BTR, BIR and the AAB for compliance by all AABs.

SEC. 8. REPEALING CLAUSE All rules and regulations or portions

thereof inconsistent with the provisions of these regulations are hereby modified,

amended or repealed accordingly.

SEC. 9. EFFECTIVITY These regulations shall take effect fifteen days

from date of publication in the Official Gazette or any newspaper of general

circulation. However, to provide sufficient time for AABs to make available to all

participating branches the deposit slip required under Section 2-D, the effectivity

date of the switch-over from the current acknowledgment slip shall be fifteen

days from the effectivity of this Revenue Regulation.

(Original Signed)

JOSE ISIDRO N. CAMACHO

Secretary of Finance

Recommending Approval:

(Original Signed)

GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

Vous aimerez peut-être aussi

- Disney Frozen Elsa Papercraft Craft Printable 0913Document2 pagesDisney Frozen Elsa Papercraft Craft Printable 0913Olya Bugaychuk60% (10)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Legal Forms SyllabusDocument4 pagesLegal Forms SyllabusPeggy SalazarPas encore d'évaluation

- SpecPro Case ListDocument7 pagesSpecPro Case ListPeggy SalazarPas encore d'évaluation

- RA 6426 As AmendedDocument8 pagesRA 6426 As AmendedPeggy SalazarPas encore d'évaluation

- Life of St. OdiliaDocument2 pagesLife of St. OdiliaPeggy SalazarPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaPas encore d'évaluation

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- Civ Pro CodalDocument84 pagesCiv Pro CodalPeggy SalazarPas encore d'évaluation

- Standard Operating Procedure for E-PaymentsDocument18 pagesStandard Operating Procedure for E-PaymentskapsicumPas encore d'évaluation

- RA 10142 Financial Rehabilitation and Insolvency ActDocument25 pagesRA 10142 Financial Rehabilitation and Insolvency ActCharles DumasiPas encore d'évaluation

- RR 16-02Document2 pagesRR 16-02saintkarriPas encore d'évaluation

- Collection of Direct Taxes - OLTASDocument36 pagesCollection of Direct Taxes - OLTASnalluriimpPas encore d'évaluation

- Guidelines for ROR Issuance During Tax DeadlinesDocument7 pagesGuidelines for ROR Issuance During Tax DeadlinestoniPas encore d'évaluation

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8Pas encore d'évaluation

- Rahul's Info About RBI's RoleDocument3 pagesRahul's Info About RBI's RolegandhidisharPas encore d'évaluation

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraPas encore d'évaluation

- GST Circular PDFDocument11 pagesGST Circular PDFNavnera divisionPas encore d'évaluation

- Return of Percentage TaxDocument2 pagesReturn of Percentage TaxfatmaaleahPas encore d'évaluation

- BIR Amends Agreement for Tax Collection Through BanksDocument17 pagesBIR Amends Agreement for Tax Collection Through BanksHarryPas encore d'évaluation

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArlenePas encore d'évaluation

- Revenue, security, election, criminal court deposits registerDocument12 pagesRevenue, security, election, criminal court deposits registermybest friendPas encore d'évaluation

- RMO No. 25-2019Document7 pagesRMO No. 25-2019Jhenny Ann P. SalemPas encore d'évaluation

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonPas encore d'évaluation

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoPas encore d'évaluation

- 2551 MDocument2 pages2551 MAdrian AyrosoPas encore d'évaluation

- Bureau of Internal RevenueDocument13 pagesBureau of Internal Revenuenathalie velasquezPas encore d'évaluation

- 48451rmc No. 1-2010Document3 pages48451rmc No. 1-2010Maureen PascualPas encore d'évaluation

- Streamline TCC Cash ConversionDocument8 pagesStreamline TCC Cash ConversionjohnnayelPas encore d'évaluation

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodPas encore d'évaluation

- RR 3-2016Document5 pagesRR 3-2016Boyet CariagaPas encore d'évaluation

- Guidelines For TDS On GSTDocument5 pagesGuidelines For TDS On GSTPWD HIGHWAYPas encore d'évaluation

- Accounting of Income Tax Collection PerspectiveDocument12 pagesAccounting of Income Tax Collection PerspectiveadilshahkazmiPas encore d'évaluation

- Rmo 40-94Document13 pagesRmo 40-94Raymart SalamidaPas encore d'évaluation

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArlenePas encore d'évaluation

- RMC 1-80Document1 167 pagesRMC 1-80Ramon Augusto Melad LacambraPas encore d'évaluation

- Articles From General Knowledge Today: OLTAS SystemDocument2 pagesArticles From General Knowledge Today: OLTAS Systemniranjan_meharPas encore d'évaluation

- 0605Document6 pages0605Ivy TampusPas encore d'évaluation

- Schedule 1 tax detailsDocument3 pagesSchedule 1 tax detailsAu B ReyPas encore d'évaluation

- Joint guidelines on tax remittanceDocument7 pagesJoint guidelines on tax remittancefred_barillo09Pas encore d'évaluation

- 2551QDocument3 pages2551QJerry Bantilan JrPas encore d'évaluation

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuPas encore d'évaluation

- Memo No 1304Document8 pagesMemo No 1304chandra shekharPas encore d'évaluation

- Bir46 PDFDocument2 pagesBir46 PDFJulia SmithPas encore d'évaluation

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaPas encore d'évaluation

- PenaltiesDocument2 pagesPenaltiesfatmaaleahPas encore d'évaluation

- Bank Bulletin No. 2022-06 - Reiteration of Relevant Policies in The Acceptance of 2021 Annual Income Tax Return and PaymentDocument3 pagesBank Bulletin No. 2022-06 - Reiteration of Relevant Policies in The Acceptance of 2021 Annual Income Tax Return and PaymentRen Mar CruzPas encore d'évaluation

- Tax Deduction at Source BasicsDocument25 pagesTax Deduction at Source BasicsdagliamitPas encore d'évaluation

- TDS AND TCS PROVISIONSDocument55 pagesTDS AND TCS PROVISIONSBeing HumanePas encore d'évaluation

- RB Chapter 3A-Savings Deposits - MITCDocument9 pagesRB Chapter 3A-Savings Deposits - MITCRohit KumarPas encore d'évaluation

- Please Affix Stamp HereDocument4 pagesPlease Affix Stamp HereleomhorPas encore d'évaluation

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanPas encore d'évaluation

- BB 2013Document25 pagesBB 2013Maisie Rose VilladolidPas encore d'évaluation

- Reference Guide South African Revenue Service Payment Rules: Effective Date 09.11.2010Document8 pagesReference Guide South African Revenue Service Payment Rules: Effective Date 09.11.2010biccard7338Pas encore d'évaluation

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoPas encore d'évaluation

- TMAP Tax Updates for November 2017Document13 pagesTMAP Tax Updates for November 2017Mark Lord Morales BumagatPas encore d'évaluation

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresPas encore d'évaluation

- MEMORANDUM D17-1-5: in BriefDocument39 pagesMEMORANDUM D17-1-5: in Briefbiharris22Pas encore d'évaluation

- Tax. 23Document18 pagesTax. 23RahulPas encore d'évaluation

- Modes of Government Disbursements ExplainedDocument24 pagesModes of Government Disbursements ExplainedDjunah ArellanoPas encore d'évaluation

- BO in FinacleDocument9 pagesBO in FinacleShailendra MishraPas encore d'évaluation

- DTI DAO No. 10-10Document4 pagesDTI DAO No. 10-10Peggy SalazarPas encore d'évaluation

- Consti I SyllabusDocument11 pagesConsti I SyllabusPeggy SalazarPas encore d'évaluation

- Personal Information Protection Law (PIPL) of The PRC - en & CNDocument35 pagesPersonal Information Protection Law (PIPL) of The PRC - en & CNPeggy SalazarPas encore d'évaluation

- Colinares Vs PeopleDocument9 pagesColinares Vs PeoplePeggy SalazarPas encore d'évaluation

- Why Is International Law BindingDocument20 pagesWhy Is International Law BindingPeggy SalazarPas encore d'évaluation

- 2011 Course Outline in PALEDocument48 pages2011 Course Outline in PALEboybilisPas encore d'évaluation

- RR 1-2011Document3 pagesRR 1-2011Jaypee LegaspiPas encore d'évaluation

- EXECUTIVE ORDER NO. 226 July 16, 1987Document37 pagesEXECUTIVE ORDER NO. 226 July 16, 1987eskhimhonePas encore d'évaluation

- Abante Vs KJGSDocument1 pageAbante Vs KJGSPeggy SalazarPas encore d'évaluation

- International Law As A Tool For EU PDFDocument20 pagesInternational Law As A Tool For EU PDFPeggy SalazarPas encore d'évaluation

- PAL vs Pascua Ruling Upholds NLRC Conversion of Part-Time to Full-Time StatusDocument2 pagesPAL vs Pascua Ruling Upholds NLRC Conversion of Part-Time to Full-Time StatusPeggy Salazar100% (1)

- 2012 Course Outline in PALEDocument18 pages2012 Course Outline in PALEPeggy SalazarPas encore d'évaluation

- Sample Life PlanDocument8 pagesSample Life PlanPeggy SalazarPas encore d'évaluation

- Fundamental Powers of The State ReviewerDocument5 pagesFundamental Powers of The State ReviewerPeggy SalazarPas encore d'évaluation

- Constitutional Law 11 SyllabusDocument8 pagesConstitutional Law 11 SyllabusLovely Nikki A. CariagaPas encore d'évaluation

- Snowflake InstructionsDocument2 pagesSnowflake InstructionsPeggy SalazarPas encore d'évaluation

- Air PollutionDocument6 pagesAir PollutionPeggy SalazarPas encore d'évaluation

- International Law As A Tool For EU PDFDocument20 pagesInternational Law As A Tool For EU PDFPeggy SalazarPas encore d'évaluation

- For MemorizationDocument2 pagesFor MemorizationPeggy SalazarPas encore d'évaluation

- Act No 3135Document2 pagesAct No 3135Rommel TottocPas encore d'évaluation

- Act 1956 - Insolvency LawDocument22 pagesAct 1956 - Insolvency LawPeggy SalazarPas encore d'évaluation

- New Rules On Notarial PracticeDocument15 pagesNew Rules On Notarial PracticePeggy SalazarPas encore d'évaluation

- Act 1956 - Insolvency LawDocument22 pagesAct 1956 - Insolvency LawPeggy SalazarPas encore d'évaluation