Académique Documents

Professionnel Documents

Culture Documents

Formula Sheet

Transféré par

Faizan MotiwalaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Formula Sheet

Transféré par

Faizan MotiwalaDroits d'auteur :

Formats disponibles

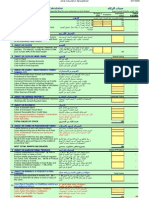

CIMA

Level I Exam Formula Sheet

Alpha:

Beta:

Bond Price:

Bond Value:

CAPM:

Capital Allocation Line through portfolio P:

Capital Market Line:

Correlation:

Covariance:

Covariance:

Derived forward rate for one period at time t:

Dollar weighted return

Effective annual rate:

Estimated bond price change:

The following is a list of formulas for use on the Level I CIMA Exam (memorization is not necessary, but students must be able to

recognize and perform calculations for exam success). The formulas presented on this sheet may be presented in a different

format during your Level II coursework (for example, capital letters or reverse order.) The formulas on this sheet are based on the

textbook and math module used for the Level I. Level II professors and study material may use alternative formulas for Level II

classes. It is important that candidates learn to read a formula and recognize it in different formats.

Expected portfolio return:

Expected portfolio standard deviation:

Expected return:

Variance:

Forward exchange rate:

Forward price:

Future value:

Geometric average return:

Holding period return:

Information Ratio:

Macaulay duration:

Modified duration:

Modigliani squared:

Normal position return:

Portfolio beta:

Portfolio duration:

Sample Formula Sheet for CIMA

Certification

Page 1 of 2

Expected portfolio return:

Expected portfolio standard deviation:

Expected return:

Variance:

Forward exchange rate:

Forward price:

Future value:

Geometric average return:

Holding period return:

Information Ratio:

Macaulay duration:

Modified duration:

Modigliani squared:

Normal position return:

Portfolio beta:

Portfolio duration:

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

Sample Formula Sheet for CIMA

Certification

Page 2 of 2

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

Portfolio standard deviation (two assets):

Portfolio variance:

Present value:

Real rate of return:

Relationship between T-period spot rate and forward rate:

Sharpe ratio:

Standard deviation:

Treynor ratio:

Value added from active asset allocation

Value added from asset selection decision:

Variance:

IMCA is a registered trademark and Investment Management Consultants

Association

SM

and Certifed Investment Management Analyst

SM

are service

marks of Investment Management Consultants Association Inc. and denote the

highest quality of standards and education for fnancial professionals. CIMA

and CIMC are registered certifcation marks of Investment Management

Consultants Association Inc. Investment Management Consultants Association

Inc. does not discriminate in educational opportunities or practices on the

basis of race, color, religion, gender, national origin, age, disability, or any other

characteristic protected by law.

IMCA

5619 DTC Parkway, Suite 500

Greenwood Village, CO 80111

P 303.770.3377

F 303.770.1812

www.IMCA.org

Vous aimerez peut-être aussi

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKD'EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKÉvaluation : 5 sur 5 étoiles5/5 (1)

- Maintenance Schedule For Gas Genset - GE JENBACHERDocument5 pagesMaintenance Schedule For Gas Genset - GE JENBACHERrajputashi92% (12)

- Level III of CFA Program Mock Exam 1 - Solutions (PM)Document60 pagesLevel III of CFA Program Mock Exam 1 - Solutions (PM)Elizabeth Espinosa ManilagPas encore d'évaluation

- BFC5935 - Tutorial 10 SolutionsDocument7 pagesBFC5935 - Tutorial 10 SolutionsXue XuPas encore d'évaluation

- Equity Valuation ModelsDocument37 pagesEquity Valuation ModelsDisha BakshiPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Strategic Financial Management Formula KitDocument85 pagesStrategic Financial Management Formula KitSangeetha HariPas encore d'évaluation

- Planning and Analysis of Reservoir StorageDocument56 pagesPlanning and Analysis of Reservoir Storagekamagara100% (2)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)D'EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Pas encore d'évaluation

- 01 FM&I Chap 7 Part 2 Stock MKTDocument89 pages01 FM&I Chap 7 Part 2 Stock MKTHoàng Lan AnhPas encore d'évaluation

- Company AnalysisDocument22 pagesCompany AnalysistadegebreyesusPas encore d'évaluation

- Equity Valuation ModelsDocument58 pagesEquity Valuation ModelsSarang GuptaPas encore d'évaluation

- Equity ValuationDocument36 pagesEquity ValuationAPas encore d'évaluation

- Fundamental AnalysisDocument25 pagesFundamental AnalysisVishal MalikPas encore d'évaluation

- BVDocument62 pagesBVKetan BhanushaliPas encore d'évaluation

- Chap 4 Stock and Equity Valuation RevisedDocument49 pagesChap 4 Stock and Equity Valuation RevisedHABTAMU TULU100% (1)

- Goals, Values and Performance: OutlineDocument15 pagesGoals, Values and Performance: OutlineNarayanan SubramanianPas encore d'évaluation

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument29 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. Brownk.shaikhPas encore d'évaluation

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100Pas encore d'évaluation

- Econf412 Finf313 Mids SDocument11 pagesEconf412 Finf313 Mids SArchita SrivastavaPas encore d'évaluation

- SS15 FI: Basic Concepts of Securities, Markets, ValuationDocument39 pagesSS15 FI: Basic Concepts of Securities, Markets, ValuationAydin GaniyevPas encore d'évaluation

- Bank Valuation: - OutlineDocument9 pagesBank Valuation: - OutlineKapil KalraPas encore d'évaluation

- Corporate Valuation Mod IDocument29 pagesCorporate Valuation Mod IRavichandran RamadassPas encore d'évaluation

- Refined de PamphilisDocument83 pagesRefined de PamphilisMudit GargPas encore d'évaluation

- Financial Markets: Equity ValuationDocument51 pagesFinancial Markets: Equity ValuationErik WalkerPas encore d'évaluation

- Marie Curie Presentation Financial ReportingDocument28 pagesMarie Curie Presentation Financial ReportingArmantoCepongPas encore d'évaluation

- Fin 435Document73 pagesFin 435rimujaved11Pas encore d'évaluation

- Evaluation of Portfolio Performance MeasuresDocument26 pagesEvaluation of Portfolio Performance MeasuresCarlo Niño GedoriaPas encore d'évaluation

- COL Fundamental AnalysisDocument50 pagesCOL Fundamental AnalysismoxbPas encore d'évaluation

- Managing Strategy For ValueDocument30 pagesManaging Strategy For ValueJorge Alberto SansonePas encore d'évaluation

- Edu 2015 10 Exam FM SyllabusDocument7 pagesEdu 2015 10 Exam FM SyllabusMuneer DhamaniPas encore d'évaluation

- FM MJ21 Examiner's ReportDocument18 pagesFM MJ21 Examiner's ReportZi Qing NgPas encore d'évaluation

- Financial Math Exam—Oct 2014Document6 pagesFinancial Math Exam—Oct 2014crackjak4129Pas encore d'évaluation

- Barclays Capital Retail & Restaurants Conference April 26, 2011Document20 pagesBarclays Capital Retail & Restaurants Conference April 26, 2011rkochersPas encore d'évaluation

- 20a Active ManagementDocument43 pages20a Active ManagementWong XianyangPas encore d'évaluation

- FMI7e ch11Document54 pagesFMI7e ch11lehoangthuchienPas encore d'évaluation

- Week 5 Chapter Outline: Stock Valuation and RiskDocument43 pagesWeek 5 Chapter Outline: Stock Valuation and RiskSaniyaPas encore d'évaluation

- TTCK Chap9 EngDocument16 pagesTTCK Chap9 EngHải NgọcPas encore d'évaluation

- Bond Types, Values 2014Document81 pagesBond Types, Values 2014Kumaravel Ds AshwinPas encore d'évaluation

- Valuation Models: A Guide to Discounted Cash Flow and Comparable Company ApproachesDocument20 pagesValuation Models: A Guide to Discounted Cash Flow and Comparable Company Approachesmohitsinghal26Pas encore d'évaluation

- Por To FolioDocument27 pagesPor To Folioharsh_k619Pas encore d'évaluation

- Measures of Financial RiskDocument18 pagesMeasures of Financial RiskshldhyPas encore d'évaluation

- Cost of CapitalDocument26 pagesCost of CapitalAhmad NaseerPas encore d'évaluation

- The Amex Campus Super Bowl Strategy Case Study VfinalDocument10 pagesThe Amex Campus Super Bowl Strategy Case Study VfinalDeep AgrawalPas encore d'évaluation

- External and Customer Analysis InsightsDocument51 pagesExternal and Customer Analysis InsightsSatish Kumar KarnaPas encore d'évaluation

- TrackInsight ETF Rating MethodologyDocument7 pagesTrackInsight ETF Rating MethodologyELO HELLOPas encore d'évaluation

- Tutorial Slides - Week 3 (Handwriting)Document29 pagesTutorial Slides - Week 3 (Handwriting)RayaPas encore d'évaluation

- Tactical Asset Allocation: A Factor Regression Model TAA Team 01/20/2011Document17 pagesTactical Asset Allocation: A Factor Regression Model TAA Team 01/20/2011frank_z_jPas encore d'évaluation

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument55 pagesInvestment Analysis and Portfolio Management: Lecture Presentation Softwarebhaskar5377Pas encore d'évaluation

- Sample FRM Part 1Document6 pagesSample FRM Part 1Silviu TrebuianPas encore d'évaluation

- Ingenieria Financiera SyllabusDocument6 pagesIngenieria Financiera SyllabusCarlos Enrique Tapia MechatoPas encore d'évaluation

- Selection of Stocks Fundamental and Technical AnalysisDocument52 pagesSelection of Stocks Fundamental and Technical AnalysisKartikyaPas encore d'évaluation

- Dividend DecisionsDocument55 pagesDividend Decisionsparth kPas encore d'évaluation

- AFM - Dividend Policy - PPT - 03-09-2012Document32 pagesAFM - Dividend Policy - PPT - 03-09-2012Ruchita RajaniPas encore d'évaluation

- Wiley CMA Learning System Exam Review 2013, Financial Decision Making, + Test BankD'EverandWiley CMA Learning System Exam Review 2013, Financial Decision Making, + Test BankÉvaluation : 5 sur 5 étoiles5/5 (1)

- Wiley CMA Learning System Exam Review 2013, Financial Decision Making, Online Intensive Review + Test BankD'EverandWiley CMA Learning System Exam Review 2013, Financial Decision Making, Online Intensive Review + Test BankPas encore d'évaluation

- 7 Stock ValuationDocument28 pages7 Stock ValuationShivanitarun100% (1)

- Examination 1-4 Pattern: The Following Grading System Will Be Used To Provide Grades in Exam I-IVDocument2 pagesExamination 1-4 Pattern: The Following Grading System Will Be Used To Provide Grades in Exam I-IVIshan ShahPas encore d'évaluation

- M&A ValuationDocument23 pagesM&A ValuationChinmay KhetanPas encore d'évaluation

- Alpha & BetaDocument41 pagesAlpha & BetaMark SinsheimerPas encore d'évaluation

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelShiv Deep Sharma 20mmb087Pas encore d'évaluation

- Loans & Advances: - Types of Credit FacilitiesDocument9 pagesLoans & Advances: - Types of Credit FacilitiesDrashti RaichuraPas encore d'évaluation

- Undervalue (DCF)Document32 pagesUndervalue (DCF)dav3sworldPas encore d'évaluation

- Data Science in Business Model Predicting Better LoansDocument37 pagesData Science in Business Model Predicting Better LoansPaul ShaafPas encore d'évaluation

- Equity Valuation Concepts and Basic Tools (CFA) CH 10Document28 pagesEquity Valuation Concepts and Basic Tools (CFA) CH 10nadeem.aftab1177Pas encore d'évaluation

- Event Driven Hedge Funds PresentationDocument77 pagesEvent Driven Hedge Funds Presentationchuff6675Pas encore d'évaluation

- 1-25 BINGO: Safety First!Document17 pages1-25 BINGO: Safety First!Faizan MotiwalaPas encore d'évaluation

- Custom Tambola Housie Tickets PDFDocument5 pagesCustom Tambola Housie Tickets PDFFaizan MotiwalaPas encore d'évaluation

- CMA Positions: Dawn Sunday October 11, 2015 - Page 4Document27 pagesCMA Positions: Dawn Sunday October 11, 2015 - Page 4Faizan MotiwalaPas encore d'évaluation

- برنامج حساب زكاه المالDocument3 pagesبرنامج حساب زكاه المالnewlife4me100% (10)

- Limiting Factor AnalysisDocument5 pagesLimiting Factor AnalysisFaizan MotiwalaPas encore d'évaluation

- Internship Report MTMDocument45 pagesInternship Report MTMusmanaltafPas encore d'évaluation

- Iris - Help by FBRDocument5 pagesIris - Help by FBRGulzar Ahmad RawnPas encore d'évaluation

- Freepik Premium License TermsDocument1 pageFreepik Premium License TermsNguyen Viet Trung (FPL HCMK13.3)100% (1)

- Pre Post TestDocument7 pagesPre Post TestFaizan MotiwalaPas encore d'évaluation

- Zakat CalculatorDocument3 pagesZakat CalculatorFaizan MotiwalaPas encore d'évaluation

- CBE Shedule Quarterly Winter 2015 FinalDocument1 pageCBE Shedule Quarterly Winter 2015 FinalFaizan MotiwalaPas encore d'évaluation

- Spinning Project Profile FinalDocument23 pagesSpinning Project Profile FinalFaizan Motiwala67% (3)

- Business Finance SyllabusDocument68 pagesBusiness Finance SyllabusKhalid Mahmood0% (1)

- Ets Ust 3 Update 14 ScreenDocument2 pagesEts Ust 3 Update 14 ScreenFaizan MotiwalaPas encore d'évaluation

- Et Set 4 Update 14 ScreenDocument2 pagesEt Set 4 Update 14 ScreenFaizan MotiwalaPas encore d'évaluation

- Jumbo Touch Remote ImDocument18 pagesJumbo Touch Remote ImFaizan MotiwalaPas encore d'évaluation

- PROJECT PROFILE ON SPINNING MILL (14400 SPINDLESDocument6 pagesPROJECT PROFILE ON SPINNING MILL (14400 SPINDLESAnand Arumugam0% (1)

- MPF Card FormDocument2 pagesMPF Card FormFaizan MotiwalaPas encore d'évaluation

- ICSP Company Law Paper Suggested Answer 2013Document8 pagesICSP Company Law Paper Suggested Answer 2013Faizan MotiwalaPas encore d'évaluation

- Budgeting ExampleDocument17 pagesBudgeting ExampleBikrOm BaRuaPas encore d'évaluation

- Sohail ResumeDocument2 pagesSohail ResumeFaizan MotiwalaPas encore d'évaluation

- Appointment of AuditorDocument16 pagesAppointment of Auditorshahnawaz243Pas encore d'évaluation

- Sohail ResumeDocument2 pagesSohail ResumeFaizan MotiwalaPas encore d'évaluation

- Operations Management IsDocument6 pagesOperations Management IsFaizan MotiwalaPas encore d'évaluation

- Chairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Document26 pagesChairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Faizan MotiwalaPas encore d'évaluation

- Professional CmaDocument3 pagesProfessional CmarehankhananiPas encore d'évaluation

- Operations Management IsDocument6 pagesOperations Management IsFaizan MotiwalaPas encore d'évaluation

- FRM Study Guide 2020Document31 pagesFRM Study Guide 2020Yiu Wai YuenPas encore d'évaluation

- AMFI Mutual Fund (Advisor) Module: Preparatory Training ProgramDocument231 pagesAMFI Mutual Fund (Advisor) Module: Preparatory Training Programallmutualfund100% (5)

- FRM 5 Market Risk Related RisksDocument38 pagesFRM 5 Market Risk Related RisksLoraPas encore d'évaluation

- Submitted To Prepared by Date Document Type Status: "The Market" Mark Raffaelli 13 October 2006 Specification Final 4.4Document20 pagesSubmitted To Prepared by Date Document Type Status: "The Market" Mark Raffaelli 13 October 2006 Specification Final 4.4Raphaël FromEverPas encore d'évaluation

- 5 Additional Q in 4th Edition Book PDFDocument76 pages5 Additional Q in 4th Edition Book PDFBikash KandelPas encore d'évaluation

- Exam3 PRM PDFDocument378 pagesExam3 PRM PDFAlp SanPas encore d'évaluation

- MB331F Question Paper Section ADocument16 pagesMB331F Question Paper Section AJatin GoyalPas encore d'évaluation

- Financial MathsDocument206 pagesFinancial MathsEVANS50% (2)

- The FVA - Forward Volatility AgreementDocument9 pagesThe FVA - Forward Volatility Agreementshih_kaichih100% (1)

- Unit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Document4 pagesUnit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Paulomi LahaPas encore d'évaluation

- Yield Curve Analysis IIDocument41 pagesYield Curve Analysis IIJeevan ThanguduPas encore d'évaluation

- Excelian Learning DevelopmentDocument20 pagesExcelian Learning DevelopmentvasanthakumarchinnuPas encore d'évaluation

- Assets and Liability ManagementDocument42 pagesAssets and Liability Managementssubha123100% (4)

- CFA L3 Bill Campbell Mock 2024 Morning Exam A Case ScenariosDocument24 pagesCFA L3 Bill Campbell Mock 2024 Morning Exam A Case Scenariosriham.goel142Pas encore d'évaluation

- Class 23: Fixed Income, Interest Rate SwapsDocument21 pagesClass 23: Fixed Income, Interest Rate SwapsKarya BangunanPas encore d'évaluation

- Manage Interest Rate Risk with Cross Currency SwapsDocument21 pagesManage Interest Rate Risk with Cross Currency SwapsManish AnandPas encore d'évaluation

- Valuation of Fixed Income SecuritiesDocument29 pagesValuation of Fixed Income SecuritiesTanmay MehtaPas encore d'évaluation

- Investments TutorialDocument3 pagesInvestments TutorialSHU WAN TEHPas encore d'évaluation

- IFRS 17 Simplified Case Study impactsDocument18 pagesIFRS 17 Simplified Case Study impactsAnonymous H1l0FwNYPS0% (1)

- Master Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkDocument124 pagesMaster Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkMayur JainPas encore d'évaluation

- Bond Index PCA ReplicacionDocument58 pagesBond Index PCA ReplicacionricardeusPas encore d'évaluation

- Managing Bond Portfolios: InvestmentsDocument41 pagesManaging Bond Portfolios: InvestmentsmorinPas encore d'évaluation

- True/False Banking & Finance QuizDocument47 pagesTrue/False Banking & Finance QuizJake Manansala100% (1)

- Booth Cleary 2nd Edition Chapter 6 - Bond Valuation and Interest RatesDocument93 pagesBooth Cleary 2nd Edition Chapter 6 - Bond Valuation and Interest RatesQurat.ul.ain MumtazPas encore d'évaluation

- Hull White Prepay OASDocument24 pagesHull White Prepay OASwoodstick98Pas encore d'évaluation

- Case 4Document3 pagesCase 4Rahul BhagatPas encore d'évaluation