Académique Documents

Professionnel Documents

Culture Documents

Practice Exam 2

Transféré par

cornloggerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Practice Exam 2

Transféré par

cornloggerDroits d'auteur :

Formats disponibles

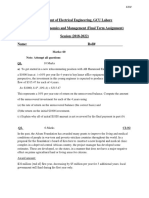

IENG 377 Engineering Economy

Fall 2007 Exam 2

Name:_____________________________________ Row:____________ Seat Number:____________

Work on your own. Answers without proper support wont earn any credit. Use 2 decimal places for final answer unless otherwise specified. Please circle all answers. 1. ABC Manufacturing hired three interns to design a new production process for making leather footballs. The three design alternatives being considered will have capital investment and annual savings as shown in the table below. Assume a useful life of 5 years for each design, no market salvage value, a desired MARR of 10% and an analysis period of 5 years. Unfortunately, ABC Manufacturing hired interns from 3 different schools. Each intern estimated the annual savings differently. Alternative B (Louisville) 760,000 68,000 Not estimated 600,000 Not estimated

Investment Annual Savings Productivity Reduced scrap Fewer injuries Overhead

A (Pitt) 1,240,000 68,000 40,000 660,000 Not estimated

C (WVU) 300,000 120,000 65,000 420,000 25,000

a. For each alternative, what total amount of annual savings should be used in the comparison calculations? A. ____________ B. ____________ C. ____________ b. Calculate the present worth for each alternative. A. ____________

B. ____________

C. ____________

Name:______________________

IENG 377 Engineering Economy

Fall 2007 Exam 2

c.

Which design should be selected on the basis of the Present Worth method?

d. Which design should be selected on the basis of the ROI method?

2.

Two economic alternatives are being considered for the construction of a new computer lab at WVU. Assume no market salvage value at the end of the useful life. Information for the two alternatives are listed below. Assume a MARR of 15%. Alternative Capital investment Annual expenses Useful life (years) A 272,000 28,800 6 B 346,000 19,300 9

a. Using the coterminated assumption and future worth method, which of the two alternatives should be selected?

Name:______________________

IENG 377 Engineering Economy

3.

Fall 2007 Exam 2

The following four alternatives are being considered for a project to increase the fast food sales in the Mountainlair. Assume a MARR of 10%, a useful life and study period of 5 years, and no salvage value for each of the alternatives. Alternative A B $100 23 ?% $150 60 29% C $300 85 13% D

Table 3a

Capital Investment Annual Cash Flow IRR

$50 30 53%

a. Calculate the IRR for alternative B. Choose either 5% or 15%.

b. Which of the alternatives, if any, is not a feasible alternative AND WHY?

Use the table below for questions c and d. Table 3c Incremental Analysis of Alternatives A (C-A) (D-C) Capital Investment Annual Cash Flow $50 30

c.

53% 15% -6% IRR Using values from table 3a, fill in Capital Investment and Annual Cash Flow for (C-A) and (D-C) in table 3c.

d. Which alternative should be chosen based on the incremental investment analysis procedure?

Name:______________________

IENG 377 Engineering Economy

4.

Fall 2007 Exam 2

In year 2000, GE Aviation was considering a long term contract to supply 20 GE-90 aircraft engines per year to Airbus for 5 years (ending in 2004). The sales price of 1 engine was $1.25 million in 2000. The contract stated that Airbus would pay GE on the last day of each year. The price per engine would remain constant at the year 2000 price (i.e. no inflation) and currency would remain constant. If Airbus pays in Euros, GE would immediately exchange the Euros to US Dollars (USD) at the time of payment. Table 4: USD to Euro exchange rate End of Year FX (USD to Euro) 2000 .9731 2001 1.0502 2002 1.1204 2003 .9222 2004 .7786 2005 .7382 a. Using table 4 above, what was the price of 1 engine in Euros in 2000?

b. Using the Euros price calculated in part A, how much revenue would GE earn in USD each year if they agreed to be paid in Euros?

2000 2001 2002 2003 2004

c. If GE was given the option to sell the engines at $1.25 million/engine or the Euros price calculated in part A, which option should they choose? (Assume that GE uses US dollars as its home currency.)

Name:______________________

Vous aimerez peut-être aussi

- Gujarat Technological University: InstructionsDocument2 pagesGujarat Technological University: InstructionsVasim ShaikhPas encore d'évaluation

- Certificate in Advanced Business Calculations: Series 4 Examination 2008Document6 pagesCertificate in Advanced Business Calculations: Series 4 Examination 2008Apollo YapPas encore d'évaluation

- MGTS 301 2014Document8 pagesMGTS 301 2014Utsav PathakPas encore d'évaluation

- Eco ValuationDocument3 pagesEco ValuationAnonymous RbmGbYvPas encore d'évaluation

- Ejercicio 8.24Document27 pagesEjercicio 8.24armand_20042002Pas encore d'évaluation

- FIN5203 GP2 Financial Analysis QuestionsDocument3 pagesFIN5203 GP2 Financial Analysis QuestionsNarasimhaBadri0% (1)

- P2 - Management Accounting - Decision ManagementDocument24 pagesP2 - Management Accounting - Decision ManagementTapan BalaPas encore d'évaluation

- F5 Past ExamsDocument30 pagesF5 Past ExamsBread crumbPas encore d'évaluation

- DeVry BUSN 278 Final Exam 100% Correct AnswerDocument8 pagesDeVry BUSN 278 Final Exam 100% Correct AnswerDeVryHelpPas encore d'évaluation

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhPas encore d'évaluation

- MBA22 - Production & Operations ManagementDocument2 pagesMBA22 - Production & Operations ManagementNayan KanthPas encore d'évaluation

- EEE May 12Document7 pagesEEE May 12Kah Wai TeowPas encore d'évaluation

- IE 2311 Practice Exam 1Document2 pagesIE 2311 Practice Exam 1Zlatan IbrahimovicPas encore d'évaluation

- ECON1202 2004 S2 PaperDocument8 pagesECON1202 2004 S2 Paper1234x3Pas encore d'évaluation

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- ISEDocument6 pagesISEgcaballero16Pas encore d'évaluation

- B5Document35 pagesB5issa adiemaPas encore d'évaluation

- Quiz 3Document4 pagesQuiz 3gautam_hariharanPas encore d'évaluation

- DeVry MATH 533 Final ExamDocument6 pagesDeVry MATH 533 Final ExamdevryfinalexamscomPas encore d'évaluation

- ECO 100Y Introduction To Economics Midterm Test # 2: Last NameDocument11 pagesECO 100Y Introduction To Economics Midterm Test # 2: Last NameexamkillerPas encore d'évaluation

- Engineering Economy - Selection of AlternativesDocument1 pageEngineering Economy - Selection of AlternativesgemnikkicPas encore d'évaluation

- ETW2440 - Business Modelling Methods AssignmentDocument2 pagesETW2440 - Business Modelling Methods AssignmentsubPas encore d'évaluation

- New 2302 Exam2Document10 pagesNew 2302 Exam2Reanne Claudine LagunaPas encore d'évaluation

- Final Exam - F10 - WDocument34 pagesFinal Exam - F10 - WDylan Dale0% (1)

- Mac Exam Sept 09 ExapleDocument5 pagesMac Exam Sept 09 Exaplethomboelens100% (1)

- PM Examiner's Report March June 2022Document23 pagesPM Examiner's Report March June 2022NAVIN JOSHIPas encore d'évaluation

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillPas encore d'évaluation

- D15 Hybrid F5 QPDocument7 pagesD15 Hybrid F5 QPadad9988Pas encore d'évaluation

- MAY06P1BOOKDocument35 pagesMAY06P1BOOKDhanushka RajapakshaPas encore d'évaluation

- DeVry MATH 533 Final Exam 100% Correct AnswerDocument6 pagesDeVry MATH 533 Final Exam 100% Correct AnswerDeVryHelp100% (1)

- AF102 Sem 2Document10 pagesAF102 Sem 2horse9118Pas encore d'évaluation

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- (l5) Decision Making TechniquesDocument20 pages(l5) Decision Making TechniquesBrucePas encore d'évaluation

- Diploma in Management Studies: ACC003 Managerial AccountingDocument8 pagesDiploma in Management Studies: ACC003 Managerial AccountingTania HeatPas encore d'évaluation

- Midterm Answers 2016Document14 pagesMidterm Answers 2016Manan ShahPas encore d'évaluation

- S P A C eDocument3 pagesS P A C eAdanechPas encore d'évaluation

- P1 Management Accounting Performance EvaluationDocument31 pagesP1 Management Accounting Performance EvaluationSadeep MadhushanPas encore d'évaluation

- Review For Exam 3: 11:30 AM - 2:30 PMDocument14 pagesReview For Exam 3: 11:30 AM - 2:30 PMCindy MaPas encore d'évaluation

- F2022 Z Midterm AnalyticalDocument6 pagesF2022 Z Midterm AnalyticalRonak Jyot KlerPas encore d'évaluation

- Production Planning and ControlDocument8 pagesProduction Planning and ControlKamal ChaitanyaPas encore d'évaluation

- Econ-Shu3 s2023 Mid 3 MC AnswersDocument5 pagesEcon-Shu3 s2023 Mid 3 MC AnswersZhuo ChenPas encore d'évaluation

- MA Final Exam Prep Sample 4 PDFDocument18 pagesMA Final Exam Prep Sample 4 PDFbooks_sumiPas encore d'évaluation

- Class Participation 4 - ADMS 1500 A&B - F17 Q1. (5 Marks) Financial Accounting Information and Managerial Accounting Information Have ADocument4 pagesClass Participation 4 - ADMS 1500 A&B - F17 Q1. (5 Marks) Financial Accounting Information and Managerial Accounting Information Have Aaj singhPas encore d'évaluation

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanPas encore d'évaluation

- End of Semester Assessment Acct213Document5 pagesEnd of Semester Assessment Acct213crisleycampos0% (1)

- Performance Management: Friday 6 June 2003Document8 pagesPerformance Management: Friday 6 June 2003chimbanguraPas encore d'évaluation

- This Test Comprises of Two Compulsory Parts, A and B. Time: 4 HoursDocument3 pagesThis Test Comprises of Two Compulsory Parts, A and B. Time: 4 HoursAkshay Yadav Student, Jaipuria Lucknow50% (4)

- Practice Problems Upto Forecasting - Dec 2010Document6 pagesPractice Problems Upto Forecasting - Dec 2010Suhas ThekkedathPas encore d'évaluation

- Acctba3 B Case Term 3 Ay2015-16Document3 pagesAcctba3 B Case Term 3 Ay2015-16Don Pablo0% (1)

- Certificate in Advanced Business Calculations: Series 3 Examination 2008Document7 pagesCertificate in Advanced Business Calculations: Series 3 Examination 2008Apollo YapPas encore d'évaluation

- Submit Assignment in Next Week'S Lecture (18 Assignment Should Be in Print Form Only. Print The Assignment (Back-To-Back) and Answer On The SameDocument7 pagesSubmit Assignment in Next Week'S Lecture (18 Assignment Should Be in Print Form Only. Print The Assignment (Back-To-Back) and Answer On The SameAbdur RafayPas encore d'évaluation

- Bmme 5103Document12 pagesBmme 5103liawkimjuan5961Pas encore d'évaluation

- Test 1Document13 pagesTest 1Moon JeePas encore d'évaluation

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityKashyap TailorPas encore d'évaluation

- 2489Document23 pages2489Mai PhạmPas encore d'évaluation

- ABC L3 Past Paper Series 3 2013Document7 pagesABC L3 Past Paper Series 3 2013b3nzyPas encore d'évaluation

- Economic Insights from Input–Output Tables for Asia and the PacificD'EverandEconomic Insights from Input–Output Tables for Asia and the PacificPas encore d'évaluation

- Guidelines for the Economic Analysis of ProjectsD'EverandGuidelines for the Economic Analysis of ProjectsPas encore d'évaluation

- Economic Indicators for Eastern Asia: Input–Output TablesD'EverandEconomic Indicators for Eastern Asia: Input–Output TablesPas encore d'évaluation

- Cost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan XiDocument4 pagesCost-Benefit Analysis of Urban Fire Stations Management: KANG Canhua, WU Wei Yan Xikeydira_irawanPas encore d'évaluation

- ACF AssignmentDocument27 pagesACF AssignmentAmod GargPas encore d'évaluation

- AsadDocument140 pagesAsadHaseeb Malik100% (1)

- Asi Mba 162 4 Sma 140917Document6 pagesAsi Mba 162 4 Sma 140917Danah Dela RosaPas encore d'évaluation

- The Basics of Capital Budgeting: Evaluating Cash FlowsDocument56 pagesThe Basics of Capital Budgeting: Evaluating Cash FlowsVinit KadamPas encore d'évaluation

- Acc 223 CB PS3 QDocument8 pagesAcc 223 CB PS3 QAeyjay ManangaranPas encore d'évaluation

- G4 Bethesda CompanyDocument37 pagesG4 Bethesda CompanySylvia MiraPas encore d'évaluation

- Teaser PLTMH DominangaDocument1 pageTeaser PLTMH DominangaYayan CahyanaPas encore d'évaluation

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- Intro 3Document14 pagesIntro 3Zack ZhangPas encore d'évaluation

- Instant Download Ebook PDF Accounting and Finance An Introduction 10th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Accounting and Finance An Introduction 10th Edition PDF Scribdphyllis.rodriguez580100% (45)

- Financial Management Lecture NoteDocument50 pagesFinancial Management Lecture NoteTuryamureeba JuliusPas encore d'évaluation

- Volcom Financial Analysis PresentationDocument27 pagesVolcom Financial Analysis PresentationKipley_Pereles_59490% (1)

- Studi Kelayakan Pendirian Pabrik Pakan Ternak Ayam Ras Petelur Di Kota Payakumbuh Oleh: Muhammad Royyan Hidayatullah Azwar HarahapDocument17 pagesStudi Kelayakan Pendirian Pabrik Pakan Ternak Ayam Ras Petelur Di Kota Payakumbuh Oleh: Muhammad Royyan Hidayatullah Azwar Harahapberkas abdulhafidPas encore d'évaluation

- Financial Management - Capital BudgetDocument8 pagesFinancial Management - Capital BudgetDr Rushen SinghPas encore d'évaluation

- Janakan Lagshini English Medium (P/T) 008/AEE/012Document23 pagesJanakan Lagshini English Medium (P/T) 008/AEE/012Lucks JanaPas encore d'évaluation

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- MBA Syllabus: Department of Accounting and Information Systems Jagannath University, DhakaDocument18 pagesMBA Syllabus: Department of Accounting and Information Systems Jagannath University, Dhakasakib990100% (1)

- CL's Handy Formula Sheet: (Useful Formulas From Marcel Finan's FM/2 Book) Compiled by Charles Lee 8/19/2010Document15 pagesCL's Handy Formula Sheet: (Useful Formulas From Marcel Finan's FM/2 Book) Compiled by Charles Lee 8/19/2010Dũng Hữu NguyễnPas encore d'évaluation

- EE Lecture# (3) - Evaluating AlternativesDocument66 pagesEE Lecture# (3) - Evaluating AlternativesgedefayePas encore d'évaluation

- Capital Budgeting & Portfolio TheoryDocument16 pagesCapital Budgeting & Portfolio TheoryYasser SalehPas encore d'évaluation

- Product Construct MayDocument8 pagesProduct Construct MaynnsriniPas encore d'évaluation

- 3.1 - Investiment AppraisalDocument25 pages3.1 - Investiment AppraisalSamrawit DoyoPas encore d'évaluation

- Multinational Business Finance 12th Edition Slides Chapter 19Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 19Alli Tobba100% (1)

- Fin 3233Document5 pagesFin 3233gatete samPas encore d'évaluation

- FINA 5120 - Fall (1) 2022 - Session 2 - IR TVM and DCF - No Arb - 19aug22Document124 pagesFINA 5120 - Fall (1) 2022 - Session 2 - IR TVM and DCF - No Arb - 19aug22Yilin YANGPas encore d'évaluation

- 10Document9 pages10bia070386Pas encore d'évaluation

- Project Profile of Edible OilDocument47 pagesProject Profile of Edible OilManish Bhoyar100% (2)

- R.P. Rustagi - FM - WCMDocument105 pagesR.P. Rustagi - FM - WCMabdulraqeeb alareqiPas encore d'évaluation

- Polymetallic Ores Hydrometallurgical Processing: COBRE LAS CRUCES, S.A. - Seville, SpainDocument24 pagesPolymetallic Ores Hydrometallurgical Processing: COBRE LAS CRUCES, S.A. - Seville, SpainMaria José FuturoPas encore d'évaluation