Académique Documents

Professionnel Documents

Culture Documents

7 Things To Know Before Investing in The Philippine Stock Market - Stock Market For Pinoys

Transféré par

Lam LagTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

7 Things To Know Before Investing in The Philippine Stock Market - Stock Market For Pinoys

Transféré par

Lam LagDroits d'auteur :

Formats disponibles

Y

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

Things You Must KNOW or HAVE Before You Start Investing in the Stock Market

Do you think youre ready to start investing? Investing is a High-Level skill in the Game of Wealth. This doesnt mean that its difficult to do. It simply means that you will have to develop a lot of OTHER money skills before you start investing. If you try investing WITHOUT these more basic skills, then investing for you could be very difficult, unsustainable or even impossible. In this article, were going to zoom out from the stock market, and look at the big picture in your path to wealth (I prefer to call it the Game of Wealth). So whether youre only starting or have been investing for a long time already, this article can serve as your checklist if you can and are able to build a good foundation on your investments. With that said, lets get started!

#1 Have the Proper Wealth Mindset

Mindset is all about your personal beliefs when it comes to wealth. Do you think you deserve to be wealthy? Is money important enough for you to study it? Are you afraid of having too much money? Your answers to questions like these determine your wealth mindset, and can actually determine how much success youll be welcoming into your life. One quick way of measuring ones wealth mindset is through these two questions:

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

Who are the top 3 people who have positively influenced your life over the past 3 months? (These must be people you actually like, respect and are willing to learn from). Are these 3 people more successful than you in terms of wealth?

PAUSE for 1 Minute ONLY and try to answer these questions. If you had trouble naming 3 positive influences in your life then youre in trouble of being stuck in negativity. Drop the negative people in your life and seek out positive influences that inspire and motivate you. If the people who positively influence you are NOT more successful than you, then youre lacking in having financially successful role models. The danger here is comfort in financial mediocrity. Youll have a good future, theres no doubt about that. But if you want to have a GREAT future, youll have to surround yourself with GREAT people. If you were quickly able to name 3 people, and these 3 people are wildly so much more successful than you, then youre in good company. Which could be a sign that your mindset right now is transforming to the right wealth mindset. While this quick test generalizes a lot of things, its very accurate. Birds of the same feather, flock together. If you hang-out with people who live on paycheck to paycheck, theres a HUGE chance that youre also doing the same. If you hang out with a lot of entrepreneurs, youre most likely also an entrepreneur or on your way to becoming one. If you want to have the right wealth mindset, then hang out with people who are much more successful than you. (Our discussion on mindset has been purposefully lengthy because its really that important. Anyway, the rest of the items will be much shorter).

#2 Have a Good and Stable Source of Income

I get a lot of email saying I want to invest, but I dont have money or the money I have isnt enough Well, heres the sad part. What can you invest if you dont have any income?

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

If you dont have any income source, or if you think your income is too low, then your best move is to focus on increasing your income first, instead of studying the stock market. Remember that investing can only MULTIPLY what you have. If you multiply zero with 1,000,000 youll still get zero! So if you have zero right now, work on ways to ADD to your wealth first (ex. getting a job even if its part time, starting a business, etc.)

#3 Have a Budget that you Strictly Follow

Sticking to your budget is a prerequisite if you want to start investing. If you dont know how to budget, you wont know how to save. And if you dont know how to save, it is impossible for you to invest. So if you dont have a budget, make one. You can start by simply listing down all your expenses for the next 30 days. This will be a good basis on the estimates of your expenses. If you have a budget but youre unable to follow it, then the trick is to divide the money in advance. You can use jars, envelopes, or maybe even different bank accounts. The important part is that its already subdivided prior to its use.

#4 Know Your Limits to How Much You Give to Friends, Relatives and Charity

We Filipinos love to help others. But sometimes, we have to LIMIT how much to give to some people. Because they can be financial sinkholes. Meaning, no matter how much money you give them, they will always, always, always need more help.

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

(Nov 11, 2013 note: If you can afford to help the victims of Typhoon Yolanda, please do as much as you can However, if you yourself are financially struggling, help yourself first before helping others.)

#5 Have Savings Worth 3 to 6 Times Your Monthly Expenses

The only thing you can predict about life is that it is unpredictable. Think of your emergency fund (savings) as a fence that protects your investment portfolio. It acts as a financial buffer, so that even if bad things happen, your investments can grow at peace, and you wont need to touch it.

#6 Know the Risks You Face and Have the Appropriate Insurance Coverage

Some events in life are just too financially unbearable; for events like these (untimely death, house catching fire, or getting into a car accident) you need to know the world of insurance.

#7 Know Your Personal Financial Goals and the Appropriate Investments for those Goals

There are no best investments of all time. Even I wont say that the stock market is the best investment, because that would just be wrong. There are only best investments for your specific goals.

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

So you start with your goal, and then you select the appropriate investment, depending on your goal. Never start with the investment, then leave out your goal. Thats a recipe for disaster!

So there you have it! The 7 things that will enable you to build a solid financial foundation. How did you do? If you already have and know these 7 things, then congratulations! Youre perfectly fit to start investing in the stock market. From : stockmarketforpinoys by j3 Patino

Philippine Stock Market: Learn a Wiser Way To Grow your Money!

Frequently Asked Questions: SCAM/PYRAMIDING/NETWORKING ba yan? Kung sa tingin mo scam ang SM, Ayala, PLDT, Meralco, Jollibee, BDO, BPI, etc, malamang scam nga.. Pero HINDI po... MALAKING HINDI! Ang isang kumpanya, bago siya maging "publicly listed" company or bago pa man siya mapasama sa stock market, ito ay masusing sinusuri ng mga financial experts ng Philippine Stock Exchange, ang regulatory body sa Philippine Stock Market. Paano mag-start? Bago ka magsimula, I HIGHLY SUGGEST panuorin mo muna at aralin ang 13 episodes ng Pesos and Sense: http://pesosandsense.com/the-tv-show/ para mas malinaw at mas detalyado ang paliwanagan about stock market. ARALIN muna para maintindihan at ma-manage mo ang expectations mo sa investments mo. Ang pesos and sense ay TV Show ng GMA aired last 2011 para i-educate ang pilipino sa stock market. Napanuod ko na ang video paano na mag-start? Visit mo to: https://www.colfinancial.com/ape/Final2/home/open_an_account.asp Fill out ka online application form tapos print mo or download and print mo yung blank application form tapos sulatan mo. Send mo sa COL Financial thru LBC, wait for them to contact you and give your account number, fund your account w/ your P5,000 then wait for them to give your password, tapos OK na Ano ang requirements? 1 Valid ID, 1 Billing Statement Paano kung walang billing statement na nakapangalan sa akin? Pwede yung bill na nakapangalan sa kapamilya mo (same surname, same address) Paano kumita sa Philippine stock Market? (1) Thru Dividends - cut mo sa kita ng company. Parang commission ito mula sa company dahil stockholder ka nila. (2) Thru Price appreciation - over time tataas ang halaga ng stocks na binili mo. So kung nabili mo ng mura tapos over time nagmahal ang presyo at ibinenta mo ito, kita ka na.

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

Magkano ang kikitain ko dyan? Hindi ko alam dahil walang fixed na kita. Ang kita mo at kung gaano ka kabilis kumita ay nakadepende sa (1)performance ng company na binilhan mo ng stocks, (2)perfomance ng ekonomiya, (3)market prices. Magkano ang kita pag may na-refer? WALA PO. Hindi po referral system ang Philippine Stock Market. May possibility ba na malugi? Meron lalo na kung (1) sa mga hindi kilalang negosyo ka nag-invest, (2) nagbenta ka ng stocks at when the price are low (example, crisis. Dapat pag bagsak presyo, wag ka mag-panic. Normal lang yan. Dapat nga mas bumili ka ng stocks kasi mura lang ang presyo. Eventually the market will recover naman and ang trend ng ekonomiya ay palaging pataas) Normal lang ba na pabago-bago ang presyo ng stocks? Oo. Minsan mataas, minsan mababa. Hindi mo mahuhulaan kung kelan tataas or bababa. Pero ang trend naman nyan palagi ay pataas. Pag bumaba ang presyo ng binili kong stocks, lugi na ba ako? Hindi. Pag bumaba ang presyo ng binili kong stocks tapos binenta ko, lugi na ba ako? Oo. Kaya dapat wag kang magbebenta pag mababa ang presyo. Dapat nga mas bumili ka dahil pag nagrecover ang prices at marami kang nabiling stocks when the prices were low, malaki gains mo. Kailangan ba P5,000 every month? Hindi. Pwede ka mag open ng account w/ P5,000 tapos ANY AMOUNT pwede mo i-add sa funds mo ANY BANKING DAY you want. May maintaining balance ba? Wala. Paano pag nakalimutan ko mag-deposit o kung wala akong pera for a particular month? Ok lang, walang kaso yun. Walang fees or charges at wala rin account closure. Depende kasi sayo kung kelan at kung magkano mo gusto mag-deposit or withdraw. Anong stocks ang magandang bilihin? May mga recommended stocks for investment sa Easy Investment Program ng COL Financial. pero para mas ma-maximize ang earning potential ng pera ninyo, I suggest mag-member kayo sa Truly Rich Club (TRC) to receive exclusive Stocks Updates every month. Ano yung Truly Rich Club? Ang Truly Rich Club ay isang group na binuo ni Bro. Bo Sanchez (siya yung nasa episode 1 ng Pesos and Sense). OPTIONAL lang naman ito, pwede ka mag invest sa stock market w/o TRC. May membership fee dito P495/month. Pero sulit naman dahil sa TRC, may Stocks Update na ginagawa ang mga stock analysts nila para i-guide ka which stocks to buy or sell and at what particular time. Ano ang advantage pag TRC member ka? Pag TRC member ka, mas guided ang pag-i-invest mo sa stock market. And dito gumagamit ng Strategic Averaging Method (SAM). Ito yung combination ng Peso-Cost Averaging at Trading. So kung combined ang Peso-Cost averaging, mas mataas ang magiging kita mo compared to EIP only, and mas safe ang pag-iinvest mo compared to Stock Trading only. Paano mag-member sa Truly Rich Club para mas ma-maximize ko ang kikitain ng pera ko?

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

: http://bosanchezmembers.com/amember/go.php?r=46551

Click here Scroll down, click "Philippine Residents" Enter nickname and email and click "JOIN NOW" Choose "No, I'll pass up this great offer." (But if you're willing to pay for SuperGold membership, you may click "Yes...") Fill out the form. (Do not choose credit card if you don't have any. But if you have one, do not select it unless you are "READY" to start investing in the stock market.) Just click continue. Copy the details. You may use this as a reference if you want to pay later when you are "READY" for the stock market. Paano pag nagsara ang broker ko, lugi na ba ako? Hindi. Regulated ang participants sa stock market ng Philippine Stock Exchange, Inc. (PSE). In case magsara ang broker pwede mo makuha ang stocks certificate mo sa PSE at pwede mo ito ilipat sa ibang broker. Ano ang advantage ng Stock Market? Sa stock market, sure yan na hindi scam, basta sa brokers ka lang na naka-list sa www.pse.com.ph mag-oopen ng account. Mas kikita ang pera mo kumpara sa kung pinatulog mo lang ito sa bangko. Mas nakakasigurado na lalago ang pera mo at hindi maglalaho kumpara sa mga networking sa tabi-tabi. Ano ang disadvantage ng Stock Market? Volatile - o mabilis mag fluctuate ang presyo ng stocks. Kailangan ng PASENSYA dito dahil pang LONG TERM ito, kaya bawal ito sa mga taong nagmamadaling kumita. Tandaan ang stock market ay para sa pera mo na pang "Savings". Wag mo i-invest dito yung pera mo for your "cost of living". Paano pag na-dedo ako? Yung stocks mo ay magiging parte ng estate properties mo na pwede manahin ng asawa mo or ng mga anak mo. Pwede mo rin maging ka-joint account ang asawa mo sa account mo kung gusto mo. Kailangan ba tutok ka sa pag mo-monitor ng stocks mo? Hindi naman. Pwede mo i-check ang stocks mo anytime you want. Kahit nga once a month lang ok lang or kung kelan ka lang bibili ng stocks. Paano pag may account na ako tapos ayaw ko na mag stock market, pwede ko ba kuhanin yung pera ko? Oo pwede yan. Ibenta mo lang stocks mo tapos fill out ka ng withdrawal form para ideposit ng COL Financial sa bank account mo yung pera. Pero hindi ibig sabihin nun ay pwede mo makuha ng buo yung pera mo. Mas recommended kung hintayin mo muna mag kulay green yung portfolio mo bago mo ilabas yung pera mo para buo o mas mataas pa yung pera na mailalabas mo mula sa account mo. Ano ang kaibahan ng MUTUAL FUNDS at STOCK MARKET? Sa Mutual Fund, may FUND MANAGER na humahawak ng pondo mo. May mga rules siya na dapat mo sundin at siya ang nagdedesisyon kung saan iinvest ang pera mo. Siyempre, dahil expert sila at sila nagmamanage sa pagpapalago ng pera mo, less risk pero mas malaki ang charges. Kung ihahalintulad sa biyahe, nagko-commute ka lang at nagbabayad sa driver para makarating sa pupuntahan mo. Kahit ZERO knowledge ka sa stocks/mutual funds, ok lang dahil may fund manager ka. Sa Stock Market, ikaw ang bahala sa lahat. You make your own rules. Ikaw bahala sa kung magkano ipopondo mo at kung saan mo ito iinvest. Kung ihahalintulad sa biyahe, you drive your own car and you plan your own route para makarating sa pupuntahan mo. Risky ito KUNG HINDI KA PROPERLY EDUCATED sa stock market kasi baka magpadala ka lang sa takot mo ibenta mo lahat ang stocks mo pag nagcrash ang

PD

F T ra n sf o

rm

PD

F T ra n sf o

rm

er

er

ABB

ABB

bu

bu C lic k he re to

w

y

w.

A B B Y Y.c

3.0

3.0

lic

he

re

om

to

w.

A B B Y Y.c

om

market. Pero kung nauunawaan mo naman ang behavior ng stocks, less risk rin ito. Investor education plays an important role. Ano ang mas maganda MUTUAL FUNDS o STOCK MARKET? Ikaw lang ang makakasagot niyan kung ano ang mas maganda sa palagay mo. May seminar ba para dito? Meron. pwede kayo magpa-register sa: https://www.colfinancial.com/ape/Final2/home/investor_education.asp Mas detalyado ang paliwanag sa mga episodes ng Pesos and Sense kumpara sa 2-hour seminar ng COL Financial. Pero maganda rin kung aattend ka ng seminar sakaling may mga tanong ka pa. Pwede rin kayo mag-apply ng account on the spot after the seminar. Saang stock broker maganda mag-open ng investment account? #1 Online Stock Broker ang COL Financial as ranked by PSE. Performance wise, lamang siya sa ibang online stock brokers like BPI Trade and others.

. Join ka sa group namin: https://www.facebook.com/groups/372835159483562/ at Check mo lang sa group files, marami downloadables dun.. Thanks

COMPLETE GUIDE TO HOW TO BUY STOCKS-COLFINANCIAL ;; http://www.scribd.com/doc/154874621/Complete-Guide-to-How-to-Buy-Stocks-colfinancial How to check your portfolio http://www.scribd.com/doc/154870302/How-to-Check-Your-Portfolio How you sell your stocks col financial http://www.scribd.com/doc/154874232/How-You-Sell-Your-Stocks-Col-Financial How to withdraw funds from your col account http://www.scribd.com/doc/154875141/how-to-withdraw-funds-from-your-col-account INVEST EASILY WITH THE TRULY RICH CLUB http://www.scribd.com/doc/154875790/Invest-Easily-With-the-Truly-Rich-Club paki like po https://www.facebook.com/trulyrichclubmember

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Skin CairDocument1 pageSkin CairLam LagPas encore d'évaluation

- Harcombe DietDocument1 pageHarcombe DietLam LagPas encore d'évaluation

- Korean VocDocument21 pagesKorean VocLam LagPas encore d'évaluation

- Korean LessonsDocument46 pagesKorean LessonsLam Lag100% (1)

- How You Sell Your Stocks Col FinancialDocument11 pagesHow You Sell Your Stocks Col FinancialLam Lag0% (1)

- Iswak OstDocument17 pagesIswak OstLam LagPas encore d'évaluation

- 137 FullDocument3 pages137 FullLam LagPas encore d'évaluation

- Basic Principles of Makeup Work Book 1Document42 pagesBasic Principles of Makeup Work Book 1thanathos1233699100% (5)

- EdtaDocument4 pagesEdtaLam LagPas encore d'évaluation

- Infection Fighting HerbsDocument8 pagesInfection Fighting HerbsLam LagPas encore d'évaluation

- MitDocument7 pagesMitLam LagPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Public Speaking ScriptDocument2 pagesPublic Speaking ScriptDhia MizaPas encore d'évaluation

- Sulzer Centrifugal Pumps - Basic OperationDocument26 pagesSulzer Centrifugal Pumps - Basic OperationMarcelo PerettiPas encore d'évaluation

- Bonding and Adhesives in DentistryDocument39 pagesBonding and Adhesives in DentistryZahn ÄrztinPas encore d'évaluation

- MCQ Cell InjuryDocument19 pagesMCQ Cell InjuryMoaz EbrahimPas encore d'évaluation

- Esc200 12Document1 pageEsc200 12Anzad AzeezPas encore d'évaluation

- Thesis Report KapilDocument66 pagesThesis Report Kapilkapilsharma2686100% (1)

- ត្នោត (Borassus flabellifer L.)Document11 pagesត្នោត (Borassus flabellifer L.)yeangdonalPas encore d'évaluation

- 36 Petroland PD Serie DKDocument7 pages36 Petroland PD Serie DKBayu RahmansyahPas encore d'évaluation

- MPSI OverviewDocument15 pagesMPSI OverviewZaqee AlvaPas encore d'évaluation

- (Jill E. Thistlethwaite) Values-Based Interprofess (B-Ok - CC)Document192 pages(Jill E. Thistlethwaite) Values-Based Interprofess (B-Ok - CC)Ria Qadariah AriefPas encore d'évaluation

- Infographic Humanistic PsychologyDocument2 pagesInfographic Humanistic Psychologyvivain.honnalli.officialPas encore d'évaluation

- Sore Throat, Hoarseness and Otitis MediaDocument19 pagesSore Throat, Hoarseness and Otitis MediaainaPas encore d'évaluation

- Ideal Discharge Elderly PatientDocument3 pagesIdeal Discharge Elderly PatientFelicia Risca RyandiniPas encore d'évaluation

- Death Obituary Cause of Death Ookht PDFDocument4 pagesDeath Obituary Cause of Death Ookht PDFMayerRhodes8Pas encore d'évaluation

- ACLS Post Test (Copy) 낱말 카드 - QuizletDocument18 pagesACLS Post Test (Copy) 낱말 카드 - Quizlet김민길Pas encore d'évaluation

- FS011 Audit Plan Stage 2Document2 pagesFS011 Audit Plan Stage 2Ledo Houssien0% (1)

- This Study Resource WasDocument3 pagesThis Study Resource WasNayre JunmarPas encore d'évaluation

- Traditional Christmas FoodDocument15 pagesTraditional Christmas FoodAlex DumitrachePas encore d'évaluation

- Guarantor Indemnity For Illness or DeathDocument2 pagesGuarantor Indemnity For Illness or Deathlajaun hindsPas encore d'évaluation

- Molarity, Molality, Normality, and Mass Percent Worksheet II Answer Key 11-12 PDFDocument3 pagesMolarity, Molality, Normality, and Mass Percent Worksheet II Answer Key 11-12 PDFGerald KamulanjePas encore d'évaluation

- Drug Abuse - A Threat To Society, Essay SampleDocument3 pagesDrug Abuse - A Threat To Society, Essay SampleAnonymous o9FXBtQ6H50% (2)

- Eye Essentials Cataract Assessment Classification and ManagementDocument245 pagesEye Essentials Cataract Assessment Classification and ManagementKyros1972Pas encore d'évaluation

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniPas encore d'évaluation

- VedasUktimAlA Sanskrit Hindi EnglishDocument47 pagesVedasUktimAlA Sanskrit Hindi EnglishAnantha Krishna K SPas encore d'évaluation

- PC110R 1 S N 2265000001 Up PDFDocument330 pagesPC110R 1 S N 2265000001 Up PDFLuis Gustavo Escobar MachadoPas encore d'évaluation

- Automotive Voltage DropDocument5 pagesAutomotive Voltage Dropashraf.rahim139Pas encore d'évaluation

- June 2019Document64 pagesJune 2019Eric SantiagoPas encore d'évaluation

- Anatomy, Physiology & Health EducationDocument2 pagesAnatomy, Physiology & Health Educationsantosh vaishnaviPas encore d'évaluation

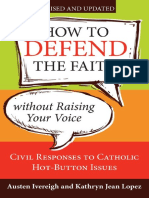

- How To Defend The Faith Without Raising Your VoiceDocument139 pagesHow To Defend The Faith Without Raising Your VoiceCleber De Souza Cunha100% (2)

- Edunsol@gmail - Com, 09996522162, Career Counseling, Direct Admissions, MBBS, BDS, BTECH, MBA, Pharmacy, New Delhi, Mumbai, Pune, Bangalore....Document377 pagesEdunsol@gmail - Com, 09996522162, Career Counseling, Direct Admissions, MBBS, BDS, BTECH, MBA, Pharmacy, New Delhi, Mumbai, Pune, Bangalore....Education SolutionsPas encore d'évaluation