Académique Documents

Professionnel Documents

Culture Documents

BIR Tax Info

Transféré par

Martin MartelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BIR Tax Info

Transféré par

Martin MartelDroits d'auteur :

Formats disponibles

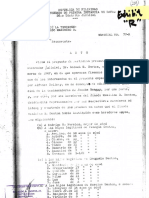

DONORS TAX Tax Rates Effective January 1, 1998 to present The Tax Shall be exempt 0 P 2,000.00 14,000.00 44,000.

00 204,000.00 404,000.00 1,004,000.00 2% 4% 6% 8% 10% 12% 15% 100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00 Of the Excess Over

Net Gift Over

But not Over 100,000.00

Plus

100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00 Notes:

200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00 and over

1. Rate applicable shall be based on the law prevailing at the time of donation. 2. When the gifts are made during the same calendar year but on different dates, the donor's tax computed on the total net gifts during the year.

Donation made to a stranger is subject to 30% of the net gift. A stranger is a person who is not a: brother, sister (whether by whole or half blood), spouse, ancestor and lineal descendants; or . relative by consanguinity in the collateral line within the fourth degree of relationship (up to first cousin). Effective July 28, 1992 to December 31, 1997

Net Gift Over

But not Over 50,000.00

The Tax Shall be exempt 1.5% P 750.00 3,750.00 18,750.00 58,750.00 258,750.00 558,750.00

Plus

Of the Excess Over

50,000.00 100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00

100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 and over

50,000.00 3% 5% 8% 10% 15% 20% 100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00

Donation made to a stranger is subject to 10% of the net gift. A stranger is a person who is not a: brother, sister (whether by whole or half blood), spouse, ancestor and lineal descendants; or . relative by consanguinity in the collateral line within the fourth degree of relationship (up to first cousin). Effective before July 28, 1992 The Tax Shall be exempt 1.5% P 735.00 1,360.00 2,110.00 5,110.00 9,610.00 2.5% 3% 6% 9% 12% 1,000.00 50,000.00 75,000.00 100,000.00 150,000.00 200,000.00 Of the Excess Over

Net Gift Over

But not Over 1,000.00

Plus

1,000.00 50,000.00 75,000.00 100,000.00 150,000.00 200,000.00

50,000.00 75,000.00 100,000.00 150,000.00 200,000.00 300,000.00

300,000.00 400,000.00 500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00 2,000,000.00 Description

400,000.00 500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00 2,000,000.00

21,610.00 36,610.00 54,610.00 80,860.00 110,860.00 145,860.00 185,860.00

15% 18% 21% 24% 28% 32% 36%

300,000.00 400,000.00 500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00

Donors Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of property between two or more persons who are living at the time of the transfer. It shall apply whether the transfer is in trust or otherwise, whether the gift is direct or indirect and whether the property is real or personal, tangible or intangible. Deadlines Within thirty days (30) after the date the gift (donation) is made. A separate return will be filed for each gift (donation) made on the different dates during the year reflecting therein any previous net gifts made during the same calendar year. If the gift (donation) involves conjugal/community/property, each spouse will file separate returns corresponding to his/ her respective share in the conjugal/community property. This rule will also apply in the case of co-ownership over the property. Related Revenue Issuances RR No. 2-2003 and RMO No. 1-98 Codal Reference Sec. 98 to Sec. 104 of the National Internal Revenue Code. Frequently Asked Questions 1. Who are required to file the Donors Tax Return?

Every person, whether natural or juridical, resident or non-resident, who transfers or causes to transfer property by gift, whether in trust or otherwise, whether the gift is direct or indirect and whether the property is real or personal, tangible or intangible. 2. What are the procedures in filing the Donors Tax return? File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with any Authorized Agent Bank (AAB) of the RDO having jurisdiction over the place of the domicile of the donor at the time of the transfer. In places where there are no AAB, the return will be filed directly with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer where the donor was domiciled at the time of the transfer, or if there is no legal residence in the Philippines, with Revenue District No. 39 - South Quezon City. In the case of gifts made by a non-resident alien, the return may be filed with Revenue District No. 39 - South Quezon City, or with the Philippine Embassy or Consulate in the country where donor is domiciled at the time of the transfer. Submit all documentary requirements and proof of payment to the Revenue District Office having jurisdiction over the place of residence of the donor.

3. What donations are tax exempt? Dowries or donations made on account of marriage before its celebration or within one year thereafter, by parents to each of their legitimate, recognized natural, or adopted children to the extent of the first P10,000 Gifts made to or for the use of the National Government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation, institution, accredited non-government organization, trust or philantrophic organization or research institution or organization, provided not more than 30% of said gifts will be used by such donee for administration purposes Encumbrances on the property donated if assumed by the donee in the deed of donation Donations made to the following entities as exempted under special laws: - Aquaculture Department of the Southeast Asian Fisheries Development Center of the Philippines - Development Academy of the Philippines - Integrated Bar of the Philippines - International Rice Research Institute - National Social Action Council - Ramon Magsaysay Foundation - Philippine Inventors Commission

Philippine American Cultural Foundation Task Force on Human Settlement on the donation of equipment, materials and services

4. What are the bases in the valuation of property? If the gift is made in property, the fair market value at that time will be considered the amount of gift. In case of real property, the taxable base is the fair market value as determined by the Commissioner of Internal Revenue (Zonal Value) or fair market value as shown in the latest schedule of values of the provincial and city assessor (MV per Tax Declaration), whichever is higher. If there is no zonal value, the taxable base is the fair market value that appears in the latest tax declaration. If there is an improvement, the value of improvement is the construction cost per building permit and or occupancy permit plus 10% per year after year of construction, or the market value per latest tax declaration.

ESTATE TAX Tax Rates Effective January 1, 1998 up to Present If the Net Estate is: Over But not Over P 200,00.00 P200,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 The Tax Shall be Exempt 0 P 15,000.00 135,000.00 465,000.00 1,215,000.00 5% 8% 11% 15% 20% P 200,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 Plus Of the Excess Over

Effective After July 28, 1992 up to December 31, 1997 If the Net Estate is: Over But not Over P 200,00.00 P200,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 P 15,000.00 135,000.00 495,000.00 1,545,000.00 The Tax Shall be Plus 0% 5% 8% 12% 21% 35% P 200,000.00 500,000.00 2,000,000.00 5,000,000.00 10,000,000.00 Of the Excess Over

Effective Before July 28, 1992 If the Net Estate is: Over But not Over P 10,00.00 P 10,000.00 50,000.00 750,000.00 100,000.00 150,000.00 200,000.00 300,000.00 50,000.00 75,000.00 100,000.00 150,000.00 200,000.00 300,000.00 400,000.00 P 1,200.00 2,200.00 3,450.00 8,450.00 15,950.00 35,950.00 The Tax Shall be Exempt 3% 4% 5% 10% 15% 20% 25% P 10,000.00 50,000.00 75,000.00 100,000.00 150,000.00 200,000.00 300,000.00 Plus Of the Excess Over

400,000.00 500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00 2,000,000.00 3,000,000.00

500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00 2,000,000.00 3,000,000.00

60,950.00 90,950.00 134,700.00 184,700.00 240,950.00 303,450.00 833,450.00 1,393,450.00

30% 35% 40% 45% 50% 53% 56% 60%

400,000.00 500,000.00 625,000.00 750,000.00 875,000.00 1,000,000.00 2,000,000.00 3,000,000.00

Effective September 15, 1950 to December 31, 1972 Estate and Inheritance Tax: From 5,000.00 7,000.00 18,000.00 20,000.00 30,000.00 0 5,000.00 12,000.00 30,000.00 50,000.00 To 5,000.00 12,000.00 30,000.00 50,000.00 70,000.00 ESTATE Exempt 1.0% 2.0% 2.5% 3.0% INHERITANCE Exempt 2& 4% 6% 8%

BIR Form 1801 - Estate Tax Return Description Estate Tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a tax on property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary.

Deadlines File the return within six (6) months from decedent's death. However, the Commissioner may, in meritorious cases, grant extension not exceeding thirty (30) days. The Estate Tax imposed shall be paid at the time the return is filed by the executor or administrator or the heirs. However, when the Commissioner finds that payment on the due date of the Estate Tax or of any part thereof would impose undue hardship upon the estate or any of the heirs, he may extend the time for payment of such tax or any part thereof not to exceed five (5) years, in case the estate is settled through the courts or two (2) years in case the estate is settled extra-judicially. Extension of Time of Filing: When the Commissioner finds that the payment of the estate tax or of any part thereof would imposed undue hardship upon the estate or any of the heirs, he may extend the time for payment of such tax or any part thereof not to exceed five (5) years in case the estate is settled through the courts, or two (2) years in case it settled extra-judicially. Where the request for extension is by reason of negligence, intentional disregard of rules and regulations, or fraud on the part of the taxpayer, no extension will be granted by the Commissioner. If an extension is granted, the Commissioner or his duly authorized representative may require the executor, or administrator, or beneficiary, as the case may be, to furnish a bond in such amount, not exceeding double the amount, not exceeding double the amount of tax and with such sureties as the Commissioner deems necessary, conditioned upon the payment of the said tax in accordance in the terms of extension. The request for extension shall be filed with the Revenue District Officer (RDO) where the estate is required to secure its TIN and file the estate tax return. The application shall be approved by the Commissioner or his duly authorized representative.

Related Revenue Issuances RR No. 2-2003, RMO No. 26-82, RMO No. 31-82, RMC No. 1-98, Codal Reference Sec. 84 to Sec. 97 of the National Internal Revenue Code Frequently Asked Questions 1. Who are required to file the Estate Tax return?

a) The executor or administrator or any of the legal heirs of the decedent or non-resident of the Philippines under any of the following situation: - In all cases of transfer subject to Estate Tax; - Where though exempt from Estate Tax, the gross value of the estate exceeds two hundred thousand P 200,000.00; and - Where regardless of the gross value, the estate consists of registered or registrable property such as real property, motor vehicle, share of stocks or other similar property for which a clearance from the Bureau of Internal Revenue (BIR) is required as a condition precedent for the transfer of ownership thereof in the name of the transferee. b) Where there is no executor or administrator appointed, qualified and acting within the Philippines, then any person in actual or constructive possession of any property of the decedent must file the return. c) The Estate Tax imposed under the Tax Code shall be paid by the executor or administrator before the delivery of the distributive share in the inheritance to any heir or beneficiary. Where there are two or more executors or administrators, all of them are severally liable for the payment of the tax. The estate tax clearance issued by the Commissioner or the Revenue District Officer (RDO) having jurisdiction over the estate, will serve as the authority to distribute the remaining/distributable properties/share in the inheritance to the heir or beneficiary. d) The executor or administrator of an estate has the primary obligation to pay the estate tax but the heir or beneficiary has subsidiary liability for the payment of that portion of the estate which his distributive share bears to the value of the total net estate. The extent of his liability, however, shall in no case exceed the value of his share in the inheritance.

2. What are the procedures in the filing of the Estate Tax Return and payment of the corresponding taxes? a) The Estate Tax Return (BIR Form 1801) shall be filed and payment made with an Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the place of residence of the decedent at the time of his/her death. b) If there is no AAB within the residence of the decedent, the Estate Tax Return must be filed and the payment made with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer of the RDO having jurisdiction over the place of residence of the decedent. c) If the required filer has no legal residence in the Philippines, the Estate Tax return will be filed and payment be made with: - The Office of the Revenue District Officer, Revenue District Office No. 39, South Quezon City; or

- The Philippine Embassy or Consulate in the country where decedent is residing at the time of his/her death. d) Submit all documentary requirements and proof of payment to the Revenue District Office having jurisdiction over the place of residence of the decedent. e) Payment of Estate tax by installment -In case the available cash of the estate is not sufficient to pay its total estate tax liability, the estate may be allowed to pay the tax by installment and a clearance shall be released only with respect to the property, the corresponding/computed tax on which has been paid. 3. What are included in gross estate?

For resident alien decedents/citizens:

a) Real or immovable property, wherever located; b) Tangible personal property, wherever located; c) Intangible personal property, wherever located

For non-resident decedent/non-citizens:

a) Real or immovable property located in the Philippines; b) Tangible personal property located in the Philippines; c) Intangible personal property - with a situs in the Philippines such as: - Franchise which must be exercised in the Philippines - Shares, obligations or bonds issued by corporations organized or constituted in the Philippines - Shares, obligations or bonds issued by a foreign corporation 85% of the business of which is located in the Philippines - Shares, obligations or bonds issued by a foreign corporation if such shares, obligations or bonds have acquired a business situs in the Philippines ( i. e. they are used in the furtherance of its business in the Philippines) - Shares, rights in any partnership, business or industry established in the Philippines 4. What are excluded from gross estate?

GSIS proceeds/ benefits Accruals from SSS Proceeds of life insurance where the beneficiary is irrevocably appointed Proceeds of life insurance under a group insurance taken by employer (not taken out upon his life) War damage payments

Transfer by way of bona fide sales Transfer of property to the National Government or to any of its political subdivisions Separate property of the surviving spouse Merger of usufruct in the owner of the naked title Properties held in trust by the decedent Acquisition and/or transfer expressly declared as not taxable

5. What will be used as basis in the valuation of property?

The properties subject to Estate Tax shall be appraised based on its fair market value at the time of the decedent's death. The appraised value of the real estate shall be whichever is higher of the fair market value, as determined by the Commissioner (zonal value) or the fair market value, as shown in the schedule of values fixed by the Provincial or City Assessor. If there is no zonal value, the taxable base is the fair market value that appears in the latest tax declaration. If there is an improvement, the value of improvement is the construction cost per building permit or the fair market value per latest tax declaration.

6. What are the allowable deductions for Estate Tax purposes? For Resident Decedent

Expenses, losses, indebtedness and taxes

a) Funeral Expenses i. ii. iii. iv. CA 466 - 5 % of gross estate (up to Dec. 31, 1972); PD 69 - 5 % of gross estate but not exceeding P 50,000 (Jan. 1, 1973 to July 27, 1992) RA 7499 - 5 % of gross estate but not exceeding P 100,000 (July 28, 1992 to December 3l, 1997) RA 8424 - 5% of gross estate but not exceeding P 200,000 (Jan. 1,1998)

b) Judicial expenses of the testamentary/intestate proceedings c) Valid claims against the estate d) Claims against insolvent person e) Unpaid mortgages/indebtedness f) Unpaid taxes g) Casualty losses

h) Property previously taxed or vanishing deductions Requisites:

Present decedent must have died within five (5) years from date of death of prior decedent or date of gift The property with respect to which the deduction is claimed must have formed part of the gross estate situated in the Philippines of the prior decedent or taxable gift of the donor The property must be identified as the same property received from prior decedent or donor or the one received in exchange therefore The estate taxes on the transmission of the prior estate or the donors tax on the gift must have been finally determined and paid No vanishing deduction on the property or the property given in exchange therefore was allowed to the prior estate

i) Transfer for public purpose j) Share of surviving spouse k) Medical expenses - those incurred by the decedent within one (1) year prior to his/her death which shall be substantiated with receipts (NOTE: Amount allowable as deduction depends on the law prevailing at the time of death of the decedent). l) Family Home - fair market value but not to exceed P1,000,000.00 m) Standard Deduction - an amount equivalent to P1,000,000.00 (applicable only for death occurring after the effectivity of RA 8424 which is January 1, 1998.) n) Amount received by the heirs under Republic Act No. 4917 (applicable only for death occurring after the effectivity of RA 8424 which is January 1, 1998) For Non-Resident Decedent, not a citizen of the Philippines

Expenses, losses, indebtedness, taxes Property previously taxed Transfer for public use Share in the conjugal property

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Bailbond 2Document2 pagesBailbond 2Martin MartelPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Demand Letter Sample FormDocument3 pagesDemand Letter Sample FormMartin MartelPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Complaint - MiguelDocument2 pagesComplaint - MiguelMartin MartelPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Compliance With Explanation: Republic of The Philippines Department of Labor and EmploymentDocument1 pageCompliance With Explanation: Republic of The Philippines Department of Labor and EmploymentMartin MartelPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Affidavit of Business RetirementDocument1 pageAffidavit of Business RetirementMartin Martel100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Affidavit of Witness: Jestoni TiwoDocument2 pagesAffidavit of Witness: Jestoni TiwoMartin MartelPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Release and Cancellation of MortgageDocument1 pageRelease and Cancellation of MortgageMartin MartelPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Lease Contract SummaryDocument4 pagesLease Contract SummaryMartin MartelPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Exhibit RDocument3 pagesExhibit RMartin MartelPas encore d'évaluation

- Witness Affidavit Coconut Theft CaseDocument2 pagesWitness Affidavit Coconut Theft CaseMartin MartelPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- RELEASE AND CANCELLATION OF MortgageDocument2 pagesRELEASE AND CANCELLATION OF MortgageMartin MartelPas encore d'évaluation

- Entry of AppearanceDocument3 pagesEntry of AppearanceMartin MartelPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Release and Cancellation of MortgageDocument1 pageRelease and Cancellation of MortgageMartin MartelPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Affidavit of Witness: Jestoni TiwoDocument2 pagesAffidavit of Witness: Jestoni TiwoMartin MartelPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Affidavit of Non OperationDocument1 pageAffidavit of Non OperationMartin Martel50% (2)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- SPADocument8 pagesSPAMartin MartelPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Motion To WithdrawDocument2 pagesMotion To WithdrawMartin MartelPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Petition Change BirthdateDocument2 pagesPetition Change BirthdateMartin MartelPas encore d'évaluation

- Non TenancyDocument1 pageNon TenancyMartin MartelPas encore d'évaluation

- Davao Occidental kidnapping case extensionDocument2 pagesDavao Occidental kidnapping case extensionMartin MartelPas encore d'évaluation

- Motion To Render Judgment - FormDocument3 pagesMotion To Render Judgment - FormMartin Martel100% (1)

- Motion To Declare Defendant in Default - FormDocument2 pagesMotion To Declare Defendant in Default - FormMartin Martel100% (1)

- Compliance - FormDocument1 pageCompliance - FormMartin MartelPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Desistance - SampleDocument1 pageDesistance - SampleMartin MartelPas encore d'évaluation

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelPas encore d'évaluation

- Affidavit of Witness - FilmixDocument2 pagesAffidavit of Witness - FilmixMartin MartelPas encore d'évaluation

- 2018 Pointers in Corporation Law and SRC As of Nov 16 2108Document20 pages2018 Pointers in Corporation Law and SRC As of Nov 16 2108Martin MartelPas encore d'évaluation

- Template For Consortium AgreementDocument3 pagesTemplate For Consortium Agreementcatherine teacePas encore d'évaluation

- Investment PrimerDocument39 pagesInvestment PrimerMartin MartelPas encore d'évaluation

- Manual of Regulations On Foreign Exchange TransactionsDocument104 pagesManual of Regulations On Foreign Exchange TransactionsmisakiPas encore d'évaluation

- Rudy Wong Case Analysis of Investment DecisionsDocument7 pagesRudy Wong Case Analysis of Investment DecisionsJuan Camilo Ninco CardenasPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990Pas encore d'évaluation

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshPas encore d'évaluation

- SPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsDocument8 pagesSPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsWaleed Barakat MariaPas encore d'évaluation

- Role of PAODocument29 pagesRole of PAOAjay DhokePas encore d'évaluation

- Government of Andhra Pradesh Backward Classes Welfare DepartmentDocument3 pagesGovernment of Andhra Pradesh Backward Classes Welfare DepartmentDjazz RohanPas encore d'évaluation

- Bbbscamtrackerannualreport Final 2017Document48 pagesBbbscamtrackerannualreport Final 2017KOLD News 13Pas encore d'évaluation

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDocument11 pagesEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoPas encore d'évaluation

- ISGQVAADocument28 pagesISGQVAATBP_Think_Tank100% (1)

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- RBC US Dream HomeDocument36 pagesRBC US Dream HomeJuliano PereiraPas encore d'évaluation

- Arbaminch University College of Business and Economics Department of Accounting and FinancDocument8 pagesArbaminch University College of Business and Economics Department of Accounting and FinancbabuPas encore d'évaluation

- Preventing MSME Fraud with Due DiligenceDocument16 pagesPreventing MSME Fraud with Due Diligencesidh0987Pas encore d'évaluation

- Commercial Real Estate Manager in Los Angeles CA Resume Robert HarrisDocument2 pagesCommercial Real Estate Manager in Los Angeles CA Resume Robert HarrisRobertHarrisPas encore d'évaluation

- Application Summary FormDocument2 pagesApplication Summary Formjqm printingPas encore d'évaluation

- Amazon Intern Job DescriptionsDocument15 pagesAmazon Intern Job Descriptionschirag_dcePas encore d'évaluation

- 2 Philippine Financial SystemDocument11 pages2 Philippine Financial SystemSTELLA MARIE BAUGBOGPas encore d'évaluation

- Section 2. Original Certificates of Title Shall Be Reconstituted From Such of TheDocument2 pagesSection 2. Original Certificates of Title Shall Be Reconstituted From Such of TheAlexylle ConcepcionPas encore d'évaluation

- Chapter No.02: Costs, Concepts, Uses and ClassificationsDocument20 pagesChapter No.02: Costs, Concepts, Uses and ClassificationsNaqibwafaPas encore d'évaluation

- Pre-Incorporation Founders Agreement SummaryDocument13 pagesPre-Incorporation Founders Agreement SummaryAmal Mulia100% (2)

- Mock-2, Sec-ADocument19 pagesMock-2, Sec-AmmranaduPas encore d'évaluation

- Kot Addu Power Company LimitedDocument17 pagesKot Addu Power Company LimitedShanzae KhalidPas encore d'évaluation

- Uts Manajemen KeuanganDocument8 pagesUts Manajemen KeuangantntAgstPas encore d'évaluation

- 2nd Set SVFCDocument15 pages2nd Set SVFCim_donnavierojoPas encore d'évaluation

- Planning Fundamentals: Types, Process and ImportanceDocument236 pagesPlanning Fundamentals: Types, Process and Importancesanthosh prabhu mPas encore d'évaluation

- Chapter 10 - SolutionsDocument25 pagesChapter 10 - SolutionsGerald SusanteoPas encore d'évaluation

- Mathematical Modeling and Computation in FinanceDocument4 pagesMathematical Modeling and Computation in FinanceĐạo Ninh ViệtPas encore d'évaluation

- 4J's Office Supplies and Equipment Trading: Business PlanDocument58 pages4J's Office Supplies and Equipment Trading: Business PlanJM Garaza Del RosarioPas encore d'évaluation

- Chapter 3Document24 pagesChapter 3Irene Mae BeldaPas encore d'évaluation

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Document6 pagesPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarPas encore d'évaluation

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesD'EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesÉvaluation : 4 sur 5 étoiles4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsD'EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- The Payroll Book: A Guide for Small Businesses and StartupsD'EverandThe Payroll Book: A Guide for Small Businesses and StartupsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistD'EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistÉvaluation : 5 sur 5 étoiles5/5 (6)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesD'EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesÉvaluation : 3 sur 5 étoiles3/5 (3)

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)