Académique Documents

Professionnel Documents

Culture Documents

Halal Investing and Socially Responsible Investing

Transféré par

Lateefat ObaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Halal Investing and Socially Responsible Investing

Transféré par

Lateefat ObaDroits d'auteur :

Formats disponibles

Halal Investing and Socially Responsible Investing Lateefat Oba BSc, FCA, ACS, ACSI, CIFE, AFIIBI Halal

or Shariah-compliant Investing is investing according to the values dictated by Islamic law. Halal means permitted as opposed to Haram which means forbidden. Halal Investing in modern times is based on the guidelines issued by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). Socially responsible investing, the web informs us, is investing according to the investors ethical beliefs and social values. Socially responsible investing is also referred to as ethical or green investing. The guidelines are broad and investors will have to investigate to find the companies or funds that meet their own personal criteria. In the case of Halal Investing the guidelines given by AAOIFI indicate what constitutes haram and should be avoided when investing. Two broad screens are indicated, the industry screen and the financial screen. The Industry Screen forbids investment in companies in the following sectors: Alcoholic beverages Pork products Tobacco products Production and Distribution of Music media Gambling / Casinos Conventional Financial Services Conventional Insurance Hotels serving alcohol or operating casinos Adult Entertainment / Pornography Weapons and defence

The AAOIFI Financial Screen consists of the following financial ratios: Conventional debt/Total market capitalisation < 30%. (Cash + Interest-bearing deposits)/ Total market capitalisation < 30% (Total interest + income from non-compliant activities)/Revenue < 5% Dividend purification is required when the revenue of a company consists of income from non-compliant activities. The proportion of the relevant dividend is calculated and donated to charity. The industries shunned in socially responsible Investing generally include: Alcohol Tobacco Gambling

Defence/Weapon Animal testing Intensive farming Genetic modification or engineering Nuclear power Pornography and other adult entertainment

Socially responsible investing goes further to seek to invest in companies that exhibit positive criteria in the following: Environment Human rights Labour relations Employment equality Community investment

A Halal fund has an added governance structure in the Shariah Board. The Shariah Board ensures the fund is and remains Shariah-compliant. While the haram industries are universal across Halal funds, the exact financial ratios are determined by each funds Shariah Board. This is evident in the financial screen of well-known Islamic Indices shown below: FTSEs MSCI Global Islamic Indices Islamic Indices Total Debt/Total Assets (Cash and Interest-bearing securities)/Total Assets (Cash and Accounts Receivable)/Total Assets Accounts Receivable/Total Assets Non-compliant income other than interest Interest income Non-compliant income and interest income < 33% < 33% < 50% < 5% < 5% < 5% < 33.33% < 33.33% < 33.33% < 70% < 5%

Dow Jones Islamic Indices Total debt/trailing 24-month average market capitalization Cash and interest-bearing securities/trailing 24-month average market capitalization Accounts receivables/trailing 24-month average market capitalization < 33% < 33%

< 33%

Emphasis on Halal Investing is on negative criteria which some, but not all, are found in socially responsible investing. Halal Investing is not explicit in the positive criteria that socially responsible investing emphasise. Are these positive criteria implicit in selection of companies for Halal funds? Could this be the reason Halal investing is not mentioned when socially responsible investing is discussed? Contemporary Islamic jurists exercised their learned opinion to arrive at the screens that are being used. It has been argued that these criteria do not adequately meet Shariah requirements. Full Shariah-compliance in Islamic finance is work-inprogress. One of the jurists, Sheikh Yusuf Talal Delorenzo asserted that the ratios cannot be final word on any of these matters; they are interim tolerance parameters that apply only to non-Muslim owned/operated companies; furthermore the criteria are not to be understood as an endorsement of these corporate practices. Halal investing is based on the tenets of one of the two aspects of Shariah Muamalat, which deals with man-to-man activities. The other aspect is Ibadat which deals with man-to-God worship. Muamalat deals with political, social and economic activities and interactions of man. The aim is to promote social harmony. It follows that Halal investing aims to be socially responsible, it must therefore be seen to be so. Halal investing is open to all and not restricted to Muslims. -o-

Lateefat Oba is a Chartered Accountant, Chartered Stockbroker and an Islamic Finance Consultant.

References:

http://wiki.islamicfinance.de/index.php/Screening http://www.djindexes.com/islamicmarket/?go=shariah-compliance http://www.mscibarra.com/eqb/gimi/islamic/MSCI_Global_Islamic_Indices_IndexSummary_July200 7.pdf http://www.yasaar.org/FTSE-Yasaar_criteria%5B1%5D.pdf http://en.wikipedia.org/wiki/Socially_responsible_investing http://www.islamic-banking.com

CISI Professional Refresher: Investment Principles and Risk

Vous aimerez peut-être aussi

- The Implication of Islamic Law For The Practices of SecuritiesDocument6 pagesThe Implication of Islamic Law For The Practices of Securitiesirfan sururiPas encore d'évaluation

- The Implication of Islamic Law For The Practices of SecuritiesDocument6 pagesThe Implication of Islamic Law For The Practices of Securitiesirfan sururiPas encore d'évaluation

- What Are Halal InvestmentsDocument6 pagesWhat Are Halal InvestmentsahmednmbPas encore d'évaluation

- Assignment - HamzaDocument3 pagesAssignment - HamzaSyeda Mahnoor AliPas encore d'évaluation

- Corporate Governance and Islamic FinanceDocument4 pagesCorporate Governance and Islamic Financehanyfotouh100% (2)

- Vol 12-1..KHALED A. HUSSEIN..Ethical Investment.Document20 pagesVol 12-1..KHALED A. HUSSEIN..Ethical Investment.Maj ImanPas encore d'évaluation

- Discuss The Importance of Islamic Financial Institutions and Markets in Any Economy (Hint: You May Look at This Problem From The FOUR (4) Economic Units' Point of Views) - (5 Marks)Document39 pagesDiscuss The Importance of Islamic Financial Institutions and Markets in Any Economy (Hint: You May Look at This Problem From The FOUR (4) Economic Units' Point of Views) - (5 Marks)Son Go HanPas encore d'évaluation

- Islamic Equity IndicesDocument3 pagesIslamic Equity IndicesroytanladiasanPas encore d'évaluation

- Screening Process in Ftse Shariah Compliance Listed Products Finance EssayDocument18 pagesScreening Process in Ftse Shariah Compliance Listed Products Finance EssayProf. Dr. Mohamed NoorullahPas encore d'évaluation

- Islamic Finance For Investment Managers: White PaperDocument20 pagesIslamic Finance For Investment Managers: White PaperBilal SununuPas encore d'évaluation

- MKT BSD Shariah SCRNGDocument3 pagesMKT BSD Shariah SCRNGprofinvest786Pas encore d'évaluation

- Islamic Finance Effect On Public Islamic Bank BerhadDocument39 pagesIslamic Finance Effect On Public Islamic Bank BerhadHari Dass100% (1)

- CG in Islamic FinanceDocument4 pagesCG in Islamic FinancehanyfotouhPas encore d'évaluation

- MBS Text 6 - All You Need To Know About Shariah InvestingDocument1 pageMBS Text 6 - All You Need To Know About Shariah Investinginatsanathira1011Pas encore d'évaluation

- Islamic Finance Form 3Document13 pagesIslamic Finance Form 3AbdullahiPas encore d'évaluation

- Equity Fund's Islamic ScreeningDocument18 pagesEquity Fund's Islamic ScreeningSikandar EjazPas encore d'évaluation

- Determinants of Attitude Towards Islamic Financing Among Halal-Certified Micro and SMEs A Preliminary InvestigationDocument10 pagesDeterminants of Attitude Towards Islamic Financing Among Halal-Certified Micro and SMEs A Preliminary Investigationtaeyong's baePas encore d'évaluation

- Islamic FinanceDocument8 pagesIslamic FinanceTopmax Training CollegePas encore d'évaluation

- Principles and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Document19 pagesPrinciples and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Dr. Julius B. BertilloPas encore d'évaluation

- Jaffar and Musa (2013) PDFDocument10 pagesJaffar and Musa (2013) PDFMohamed FAKHFEKHPas encore d'évaluation

- CGF ProjectDocument8 pagesCGF ProjectAvaniPas encore d'évaluation

- Islamic Finance - Principles and Types of Islamic FinanceDocument4 pagesIslamic Finance - Principles and Types of Islamic Financebharatjha1732002Pas encore d'évaluation

- Understanding The Nature and Market For PDFDocument15 pagesUnderstanding The Nature and Market For PDFZafirahAhmadFauziPas encore d'évaluation

- Working Paper: Faith-Based Ethical Investing: The Case of Dow Jones Islamic IndexesDocument41 pagesWorking Paper: Faith-Based Ethical Investing: The Case of Dow Jones Islamic IndexesSikandar EjazPas encore d'évaluation

- Essay Week 1 On Islamic FinanceDocument2 pagesEssay Week 1 On Islamic FinanceRuddy Von OhlenPas encore d'évaluation

- Islamic FinanceDocument2 pagesIslamic FinanceKiran KumarPas encore d'évaluation

- 2.0 Research 2.1 Islamic ProductDocument2 pages2.0 Research 2.1 Islamic Productdjayaram144Pas encore d'évaluation

- Entrepreneurship and Islam: An Overview: M. Kabir Hassan and William J. Hippler, IIIDocument9 pagesEntrepreneurship and Islam: An Overview: M. Kabir Hassan and William J. Hippler, IIIRizki RusnaidaPas encore d'évaluation

- SSRN Id1370736Document17 pagesSSRN Id1370736Mohamed MustefaPas encore d'évaluation

- Ethics in Finance - Arun PrakaashDocument11 pagesEthics in Finance - Arun PrakaasharunprakaashPas encore d'évaluation

- DIBPL Modes of Islamic FinancingDocument28 pagesDIBPL Modes of Islamic FinancingAneeka NiazPas encore d'évaluation

- Shariah Stock Screening MethodologyDocument9 pagesShariah Stock Screening MethodologyProf. Dr. Mohamed NoorullahPas encore d'évaluation

- Al Buhaira National Insurance CompanyDocument8 pagesAl Buhaira National Insurance CompanyInnocent ZeePas encore d'évaluation

- Islamic InstrumentsDocument7 pagesIslamic InstrumentslekshmiPas encore d'évaluation

- Developing Halal Compliance ModelDocument8 pagesDeveloping Halal Compliance ModelrosdiabuPas encore d'évaluation

- IB2006 FinalDocument4 pagesIB2006 FinalVictoria BourmpouliaPas encore d'évaluation

- What Is Islamic Finance?: Faleel JamaldeenDocument9 pagesWhat Is Islamic Finance?: Faleel JamaldeenanggiPas encore d'évaluation

- What Is Islamic Finance?: Faleel JamaldeenDocument9 pagesWhat Is Islamic Finance?: Faleel JamaldeenanggiPas encore d'évaluation

- Islamic Finance:Overview and Policy ConcernsDocument1 pageIslamic Finance:Overview and Policy Concernsنور رمضانPas encore d'évaluation

- Corporate Governance in Islamic Financial InstitutionsD'EverandCorporate Governance in Islamic Financial InstitutionsPas encore d'évaluation

- Islam Ethicsand Social Responsability FinalDocument14 pagesIslam Ethicsand Social Responsability Finalbharatjha1732002Pas encore d'évaluation

- 1b at Crossroads Newhorizon-Islamicbanking Iss172 July-Sep09Document4 pages1b at Crossroads Newhorizon-Islamicbanking Iss172 July-Sep09farzaduPas encore d'évaluation

- Principles of Islamic FinanceDocument5 pagesPrinciples of Islamic Financemr basitPas encore d'évaluation

- Prospects and Problems of Shariah-Compliant Finance: Executive SummaryDocument8 pagesProspects and Problems of Shariah-Compliant Finance: Executive SummarysyedtahaaliPas encore d'évaluation

- Issues and Challenges of Shari'ah Audit in Islamic Financial Institutions: A Contemporary ViewDocument11 pagesIssues and Challenges of Shari'ah Audit in Islamic Financial Institutions: A Contemporary ViewAbeerAlgebaliPas encore d'évaluation

- Corporate Governance and Stakeholders Financial Interests in Institution Offering Islamic Financial ServicesDocument32 pagesCorporate Governance and Stakeholders Financial Interests in Institution Offering Islamic Financial ServicesFouad KaakiPas encore d'évaluation

- Ethics in Finance: What Dose Finance MeansDocument5 pagesEthics in Finance: What Dose Finance Meanssinghashish5444Pas encore d'évaluation

- IntroductionDocument21 pagesIntroductionmuhammad jaffarPas encore d'évaluation

- Intan Larasati 2A English For Syariah Banking Islamic Banking and Finance ContextDocument7 pagesIntan Larasati 2A English For Syariah Banking Islamic Banking and Finance ContextMauLana IqbalPas encore d'évaluation

- Socially Responsible Investing - R.pathak - SMU EMBA Intake IIDocument7 pagesSocially Responsible Investing - R.pathak - SMU EMBA Intake IIrahul_pathak2393Pas encore d'évaluation

- Discussion and RecommendationDocument8 pagesDiscussion and RecommendationNuranis QhaleedaPas encore d'évaluation

- Rafik Isaa BeekunDocument5 pagesRafik Isaa BeekunanggitaPas encore d'évaluation

- Islamic Finance and CrowdfundingDocument13 pagesIslamic Finance and CrowdfundingMaghribi Abdou100% (1)

- 2077 5506 1 SMDocument12 pages2077 5506 1 SMInsyirah KadirPas encore d'évaluation

- 6179-Article Text-15651-1-10-20190217Document10 pages6179-Article Text-15651-1-10-20190217Habib Sultan KhelPas encore d'évaluation

- Takeover and AcquisitionsDocument42 pagesTakeover and Acquisitionsparasjain100% (1)

- Capital Irrigation Has Only A General Journal in Its AccountingDocument2 pagesCapital Irrigation Has Only A General Journal in Its AccountingCharlottePas encore d'évaluation

- Hull OFOD10e MultipleChoice Questions and Answers Ch17Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch17Kevin Molly KamrathPas encore d'évaluation

- 2 - AccentForex Competitive Analysis No ScreenshotsDocument1 page2 - AccentForex Competitive Analysis No ScreenshotsTanveer HussainPas encore d'évaluation

- DueDiligence Group7Document104 pagesDueDiligence Group7chhavibPas encore d'évaluation

- Tax Card Moldova EN 2023Document20 pagesTax Card Moldova EN 2023VPas encore d'évaluation

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedPas encore d'évaluation

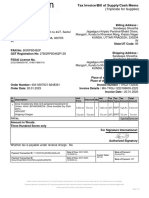

- GST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDocument2 pagesGST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDNYANESHWAR PAWARPas encore d'évaluation

- Cases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)Document22 pagesCases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)RizkyArsSetiawan0% (1)

- DK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookDocument51 pagesDK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookjigyasuPas encore d'évaluation

- Business 9 Week 1 2nd Term Chapter 1 Part 3Document17 pagesBusiness 9 Week 1 2nd Term Chapter 1 Part 3cecilia capiliPas encore d'évaluation

- Valuation 2 Financial Statement AnalysisDocument19 pagesValuation 2 Financial Statement Analysisimperius784Pas encore d'évaluation

- AcquisiShares - Sinar MekarDocument3 pagesAcquisiShares - Sinar Mekarnickong53Pas encore d'évaluation

- Lecture Session 9 - Forecasting Exchange RatesDocument10 pagesLecture Session 9 - Forecasting Exchange Ratesapi-19974928Pas encore d'évaluation

- Unit - 1 Introduction To AuditingDocument10 pagesUnit - 1 Introduction To AuditingDarshan PanditPas encore d'évaluation

- Invoice DocumentDocument1 pageInvoice DocumentrameshPas encore d'évaluation

- Nestlé Finance International LTD.: (Société Anonyme)Document14 pagesNestlé Finance International LTD.: (Société Anonyme)khoi phanPas encore d'évaluation

- Project Management MBA 527 Assignment 1: Problem 18Document5 pagesProject Management MBA 527 Assignment 1: Problem 18Suraj SriramPas encore d'évaluation

- MRTP ActDocument29 pagesMRTP ActawasarevinayakPas encore d'évaluation

- Mock Test Cases BS PL 2023 15.9.23Document7 pagesMock Test Cases BS PL 2023 15.9.23200100175Pas encore d'évaluation

- Chapter 2 Problem SolutionsDocument14 pagesChapter 2 Problem SolutionsAdelia DivandaPas encore d'évaluation

- APU All IncludedDocument69 pagesAPU All IncludedEnxzol KehhPas encore d'évaluation

- Caleb Borke A Former Disc Golf Star Operates Caleb S Discorama PDFDocument1 pageCaleb Borke A Former Disc Golf Star Operates Caleb S Discorama PDFAnbu jaromia0% (1)

- MBFI NotesDocument27 pagesMBFI NotesSrikanth Prasanna BhaskarPas encore d'évaluation

- TAX-CREBA VS Executive Secretary RomuloDocument2 pagesTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- Revenue Regulations No. 02-40Document39 pagesRevenue Regulations No. 02-40saintkarri92% (12)

- Shariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceDocument3 pagesShariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceshahrimanPas encore d'évaluation

- Maybank List ReportDocument3 pagesMaybank List ReportpalmkodokPas encore d'évaluation

- CCAF Africa and Middle East Alternative Finance Report 2017Document64 pagesCCAF Africa and Middle East Alternative Finance Report 2017CrowdfundInsiderPas encore d'évaluation

- Starbucks Corporation - FinancialsDocument3 pagesStarbucks Corporation - FinancialsAtish GoolaupPas encore d'évaluation