Académique Documents

Professionnel Documents

Culture Documents

Topic 11 Econ Function - doKKKc

Transféré par

Siti Aisyah RuzelanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Topic 11 Econ Function - doKKKc

Transféré par

Siti Aisyah RuzelanDroits d'auteur :

Formats disponibles

Economic Functions and Government Policy Learning Objectives: At the end of the chapters, students should be able to understand

1. !. %. ). +. .. Economic Functions Of The overnment overnment "udget#$ational The &ource Of overnment 'evenue #(ncome The overnment E*penditure $ational ,ebt#-ublic overnment -olic/

Introduction The topic elaborates on the role of the government and economic functions of a government. The national budget sources of government revenue , e*penditure and debt 0ill be discussed.. Lastl/, tthe topic e*plain on government polic/ be it fiscal polic/ , monetar/ and direct polic/ and its role to combat inflation and unemplo/ment and stimulating economic gro0th. 11.1 Economic Functions Of The Government

The economic role of government can best be defined b/ a classification of its economic polic/ aims. overnment has the important role to ensure the gro0th of the econom/. Among the economic function of the government in the gro0th and development of the countr/ are. This ensures that the price mechanism functions fairl/ and e1uitabl/ for all parties. (n short, the government ensures full emplo/ment, price stabilit/ and stable economic gro0th. &ome of the economic functions of the government are: 1. Providing Legal And Social Frame or! &et legal status of business enterprises, ensures rights of private o0nership, and allo0s the ma2ing and enforcement of contracts. &ervices provided include police po0ers to maintain internal orders, a s/stem of standards for measuring the 0eight and 1ualit/ of products, and a s/stem of mone/ to facilitate the e*changes of goods and services. ". #reating $usiness Environment That Promotes %ealthy #om&etition . 3ompetition is basic regulator/ mechanism in a mar2et econom/. 4ealth/ business environment has to be created in the mar2et to promote the competition. 3ompetition 0ill lead to efficient of resources and in turn 0ill satisf/ the consumer5s needs. The higher price and profit for goods 0ill onl/ sho0 that that value of the good is high, 0hile the lo0er price and profit 0ill onl/ sho0 that there are too man/ of the goods in the mar2et. Therefore economics resources should focus on the profitable industries. For the mar2et that is controlled b/ the monopol/ firm, it can influence the price and 1uantit/ in the mar2et. The/ have the abilit/ either to sell at the higher price or at the higher 1uantit/. enerall/, the selling price must al0a/s above the marginal cost. This sho0s that the monopol/ firm is less effective compared to the free mar2et competition. (n that sense, the vibrant business environment that can stimulate business should be created so that the efficienc/ can be improved and 0ill benefit the consumer as a 0hole.

3. 'edistri(ution And 'eallocation Of Income And )ealth The mar2et s/stem is impersonal. The mar2et price mechanism merel/ distributes goods and services to consumers 0ith an income. (t ma/ distribute income 0ith more ine1ualit/ than societ/ desires. (t does not guarantee a fair distribution of income and 0ealth to all citi6ens. This is because not all citi6ens are from the upper classes. &ome are from the lo0er classes. Therefore, the government has to pla/ its role to ensure that income is distributed more fairl/ among the people. -rice mechanism can onl/ reallocate the goods and 1

services to the consumers that have the resources and income to obtain them, but it cannot guarantee the allocation of income and 0ealth be done fairl/ among the population. Therefore the government has to pla/ their part in order to reallocation the income and 0ealth in a fair 0a/. &ociet/ chooses to redistribute income through a variet/ of government policies and programs: The $e0 Economic -olic/ and $ational ,evelopment -olic/ have been implemented b/ the government to ensure a fairer distribution of income 4. Increasing The Efficiency Of The Allocation Of 'esources 7ar2et failure occurs 0hen competitive mar2et s/stem produce the 80rong8 amount of certain goods or services99spillovers, b: fails to allocate an/ resources 0hatsoever to the production of certain goods and services 0hose output is economicall/ justified99 pubic goods. To increase the efficienc/ of the allocation of resources,economic resources 0ithin a countr/ have to be allocated efficientl/ in order to increase the output 0ithout leaving the negative e*ternalities. 3apital, man9po0er and other inputs or factors of production have to use full/ in full and efficient.A countr/;s economic resources should be utilised efficientl/ to increase output. 3apital, labour force, land and other inputs should be utilised completel/ 0ithout 0aste. For e*ample, to ensure that the 0or2 forces are utilised completel/ in this countr/, the government endeavours to ma2e sure that the resources are utilised meaningfull/. This is done b/ giving incentive to promote the gro0th of some industries and imposing ta* on discouraged usage. *. #reating a Sta(le Economic Environment A stable economic environment is important to create encourage the investment especiall/ the foreign investment. (nvestor 0ill place their investment into a countr/ 0hich has a stable environment because it 0ill lead to the return on their investment.. -olitical stabilit/ and a peaceful countr/ 0ill ensure that job creation can be generated enough for all the population and this 0ill lead to higher standard of living.A stable economic environment is important to encourage investment, especiall/ foreign investment. <suall/, investors /earn for a stable rather than a chaotic economic environment. This is to guarantee the e*pected investment returns. (n addition, a peaceful environment and stable politics are important to the livelihood of the citi6ens and to improve their standard of living. +. #ontrolling The Price Of The ,ecessities Goods. 3ontinuous price increase or inflation on onl/ affect the economic gro0th of the countr/ but it 0ill also reduce the purchasing po0er of the consumers. Therefore, the government needs to monitor the price movement of the basic and necessities goods. The steps ta2en b/ the government in monitoring the price movement 0ill ensure the standard of living and the real value of mone/ 0ill not declining because of the inflation.For e*ample, the monitoring of the price level of goods in the mar2et, especiall/ of basic goods during the holida/ season b/ the government through the 7inistr/ of ,omestic Trade and 3onsumer Affairs. -. Increasing The Government )elfare Activities. The government has the responsibilities to provide the public goods for the public facilit/. "/ doing that, the lo0 income consumer can share the facilit/ that is being provided b/ the government.This is because the lo0er classes are unable to afford lu*urious facilities. E*amples of lu*urious facilities are medical services, health and education. The lo0er classes cannot afford high medical costs. Thus, the government continues to subsidise a large portion of the medical cost, 0hereas the public has to pa/ onl/ lo0 charges.

11." Government $udget .

,ational $udget

A government 0ill formulate a national budget to plan for the sources of revenue and government e*penditure. (t is a document contain a preliminar/ approval plan of public revenue and e*penditure in a /ear. The national budget is the government5s estimation of revenue and e*penditure for the coming /ear. <suall/, the national budget report is presented b/ the 7inister of Finance ever/ October in -arliament. (n the national budget, the government announces the change in ta* rate, introduces ne0 ta*es and repeals the old ones. (n addition, the government announces its e*penditure plan such as the total allocation for management e*penditure and development e*penditure. (n short, the announcement of the national budget attracts all parties as it influences the countr/5s economic activities. Ty&e Of $udget There are % t/pes of government budget : "alanced "udget,&urplus "udget and ,eficit "udget 1. $alanced $udget "alanced budget is a situation, in 0hich estimated revenue of the government during the /ear is e1ual to its anticipated e*penditure. (t is al0a/s advisable to have a balanced budget 0hich 0as based on the polic/ of ;Live within means;. overnment;s revenue should not fall short of e*penditure and should not interfere in economic activities and should just concentrate on the maintenance of internal and e*ternal securit/ and provision of basic economic and social overheads. To achieve this, government has to have enough fiscal discipline so that its e*penditures are e1ual to revenue. ". Sur&lus $udget The budget is a surplus budget 0hen the estimated revenues of the /ear are greater than anticipated e*penditures. =hen government e*penditures are less than ta* revenues in a given /ear, the government is running a budget surplus for that /ear. The surplus budget occurs 0hen ta* collection is more than government e*penditure The revenues from the budget surplus are t/picall/ used to reduce an/ e*isting national debt. &urplus budget sho0s the financial soundness of the government. =hen there is too much inflation, the government can adopt the polic/ of surplus budget as it 0ill reduce aggregate demand. (ncrease in revenue b/ lev/ing ta*es on people reduces their disposable incomes, 0hich other0ise could have been spend on consumption or saved and devoted to capital formation. &ince government spending 0ill be less than its income, aggregate demand 0ill decrease and help to reduce the price level.4o0ever, in modern times, 0hen governments have so man/ social economic > political responsibilities it is virtuall/ impossible to have a surplus budget. &urplus "udget is also called as contractionar/ fiscal polic/. (t is used 0hen econom/ e*perience inflation through increase ta* and reduce government e*penditure or both applied simultaneousl/. /. 0eficit $udget =hen government e*penditures e*ceed government ta* revenues in a given /ear, the government is running a budget deficit for that /ear. The deficit budget occurs 0hen the government5s total e*penditure e*ceeds revenue. Total government e*penditure is less than total government revenue. (t occur 0hen government implement during deflation ?unemplo/ment > recession:9(ncrease in overnment spending ?total e*penditure: and reducing in ta* ?total revenue:. The budget deficit, 0hich is the difference bet0een government e*penditures and ta* revenues, is financed b/ government borro0ing@ the government issues long9term, interest9bearing bonds and uses the proceeds to finance the deficit. &uch deficit amount is generall/ covered through public borro0ings or 0ithdra0ing resources from the accumulated reserve surplus. (n a 0a/ a deficit budget is a liabilit/ of the government as it creates a burden of debt or it reduces the stoc2 of reserves of the government. The budget deficit tends to decrease when GDP

increases

A government 0ith a deficit budget must either borro0 from e*ternal or internal sources, or or use its reserves ,eficit budget is also called as e*pansionar/ fiscal polic/. (t is used 0hen econom/ e*perience unemplo/ment through decrease ta* and reducing government e*penditure or both applied simultaneousl/. 3

Item 2'1 million3 Total Revenue Total Expenditure Overall Budget Type Of Budget

144+ 58 280 51 558 +6 772 Surplus

14465 736 52 166 +13 570 Surplus

1alaysian $udget 1445 1444 "666 56 710 58 677 63 500 62 688 68 161 81 492 -5 978 -9 484 -17 992 Defi it Defi it Defi it

"661 69 610 85 746 -16 136 Defi it

S!ur es" #ala$sian Statisti Department

11./ The Source Of Government 'evenue A government can obtain revenue from man/ sources. (t is an important part of fiscal polic/.(n 7ala/sia, the government revenues can be various such as ta* revenues A direct and indirect ta*es and non9ta* revenues . From the vie0point of households and firms, there are t0o majors 0a/s in 0hich a government can obtain revenue. 1. Ta7 'evenue Ta* revenue is been collected based on the act in la0s that been approved b/ the parliament.The major portion of the revenue is from ta*es. Ta* is a compulsor/ b/ an individual or a firm to the government to be used in the common interest of all. Ta* is a contribution to the revenue of the government so that the government can provide the necessar/ adminstrative services to govern the countr/. (t has t0o t/pe namel/ direct ta*es and indirect ta*es 0irect Ta7es ,irect ta*es are collected b/ the (nland 'evenue "oard ?('":. ,irect ta*es are ta*es imposed directl/ on the pa/ment of 0hich its ta* burden can not be transferred to another part/. ,irect ta* is ta* 0hose burden cannot be transferred from the person on 0hom ta* is imposed to others. E*amples of direct ta* are individual income ta*, compan/ income ta* and petroleum ta*. Personal income ta7 is imposed on ever/ 7ala/sian 0ho receives an income e*ceeding a certain amount in a /ear. (ncome that is charged 0ith personal income ta* includes income from: B "usiness or profession@ B &alaries, allo0ances and bonuses from emplo/ment or jobs@ B (nvestments such as interests and dividends@ and B 'ents. A person having to pa/ income ta* 0ill be given several individual reliefs. The/ are deductions from the total charged income ta*. #om&any income ta7 is charged on limited companies, 0hether private limited or public limited companies. (n !CC1, a compan/ had to pa/ !DE of its profits as the compan/ income ta*. Petroleum Ta7 is imposed on all petroleum companies operating in 7ala/sia. (ts rate is %DE. 1 ! % ) + income ta* on individuals income ta* on corporation petroleum income ta* stamp dut/ real propert/ gains ta*

Indirect Ta7es (ndirect ta*es are collected mainl/ b/ the 'o/al 3ustom and E*cise ,epartment. (ndirect ta* is the ta* 0here part or all of the ta* burden of the ta* can be transferred to another part/. (n man/ cases, producers 0ho have been imposed indirect ta*es 0ill transfer a portion to consumers b/ increasing the price of the goods. Those 0ho have been imposed indirect ta* can transfer it entirel/ to other parties. E*amples are e*port dut/, import dut/, e*cise dut/, sales ta* and service ta*. 1 ! % ) + . ". ,on8Ta7 'evenue The non9ta* revenue is the revenue and government revenue from non9ta* sources that accordance 0ith la0 and act . (t is non9ta* revenues or non9ta* receipts are revenues not generated from ta*. The revenue collected from services provided b/ the government to the people . $on9ta* revenue includes revenue from government services such as business, interest and investment returns, motor vehicle license, interests and returns on investments, court fines and penalties, contributions from foreign governments and international agencies, and cash ro/alt/ from petroleum and gas. $on9ta* revenue includes revenue from government services such as business, interest and investment returns, motor vehicle license, interests and returns on investments, court fines and penalties, contributions from foreign governments and international agencies, and cash ro/alt/ from petroleum and gas. 1 ! % ) + . F fees for issue of license and permit sale of government assets rental of government propert/ fines ,fees and penalties (nterest and return from government investment services that government offers petroleum ro/alt/ import duties e*port duties e*cise duties sales ta* service ta* Others

%!vernment &evenue Item Government Revenue 1 0irect Ta7

Income ta7 3ompanies (ndividual -etroleum 3ooperation Others

2007 &# milli!n ' 53 543 49(6 65 658

32 149 32 149 32 149 32 149 32 149

2008 &# milli!n 53 543 65 658

32 149 32 149 32 149 32 149 32 149

' 49(6

2009 &# milli!n 53 543 65 658

32 149 32 149 32 149 32 149 32 149

' 49(6

Indirect Ta7

(mport ,uties E*port ,uties E*cise ,uties &ales Ta* &ervice Ta* Others

25 722

32 149 32 149 32 149 32 149 32 149

18 (4

25722

32 149 32 149 32 149 32 149 32 149

18 (4

25722

32 149 32 149 32 149 32 149 32 149

18 (4

,on8Ta7 'evenue Total Revenue

44 717 139 885

32 (0 100

44 717 139 885

32 (0 100

44 717 139 885

32 (0 100

11.9 The Government E7&enditure overnment E*penditure can be divided into operating e*penditure and development e*penditure 1. Government O&erating or 1anagement E7&enditure Operating or management e*penditure is a current e*penditure for the purpose of government administration. it includes government spending in various government departments to maintain services and it happens ever/ /ear. (t includes government spending in various government departments to maintain services such as pa/ment of government salaries, purchase of office e1uipment and purchase a vehicle 7anagement e*penditure is the government e*penditure allocation to pa/ for the management cost and government administration. (t is current government e*penditure 0ithin various departments to perpetuate services such as salar/ pa/ment of civil servants, purchase of office e1uipment and motor vehicles for government use. )peratin* +,pen-iture Item Operating Expenditure 1 Emolumen salaries for the civil service -ublic &ervice Allo0ances Overtime allo0ance Su&&lies And Services Travel Allo0ance -ostage and &tamp Fa* and Telephone &tationar/ 3omputer 7aintenance#Furniture Grants and Transfer to State government Su(sidies Pension and Gratitudes 0e(t Service #harge Other E7&enditures (nsurans rentals toll compensations Total Operating Expenditure 20 2 &# milli!n '

/ 9 ! + -

&alaries and emoluments of the relevant allo0ance is the largest e*penditure component, follo0ed b/ supplies and services as 0ell as debt service pa/ments, the rise in 0orld crude oil prices has resulted in increased e*penditure on subsid/ pa/ments. overnment e*penditure for the pa/ment of national debt includes loan pa/ments from the =orld "an2 and developed countries such as Gapan. -ension pa/ments are made to pensioners for their 0elfare. Transfer pa/ment, on the other hand, is the pa/ment b/ the government to individuals, 0hich does not involve an/ change of goods and services, 0here the recipient does not need to repa/. An e*ample of transfer pa/ment is the a0arding of government subsid/ to farmers.

". Government 0evelo&ment E7&enditure ,evelopment e*penditure is government e*penditure for investment purposes to improve facilities in the basic ph/sical infrastructure. overnment development e*penditure is focused on development projects that can boost economic gro0th. ,evelopment e*penditure is the investment e*penditure b/ the government 0hich involves e*pansion in the ph/sical capital of a countr/. For e*ample, government e*penditure in development projects able to increase economic gro0th such as construction of roads, schools and hospitals. As a result of the development e*penditure can onl/ be seen in the long run and it is to raise the socio9economic and economic development services negara.Economic services 0hich focus on improvement on infrastructure is the largest component of e*penditure, follo0ed b/ social services &pecificall/, government e*penditure 0ill be channeled to categories such as securit/ and defense e*penditure, economic and social services, public administration, transfer pa/ments, national debt pa/ments and pension.

Item "evelopment 1 Economic Services Agricultural and &uburban ,evelopment 3ommerce and (ndustr/ Transport Others Social Services Education>Training 7edical>4ealth -ostal and "roadcast 4ousing Others ,ational 0efence and Security General Administration e9government application Total "evelopment Expenditure

Devel!pment +,pen-iture 2007 &# milli!n '

2008 &# milli!n

'

2009 &# milli!n

'

3 9

Economic services encompass e*penditure for agriculture, suburban development, commerce and industr/, transport and others. &ocial services encompass government e*penditure for education, medical, housing, postal and broadcast services. $ational ,efence and &ecurit/ is government e*penditure for securit/ and defense improves and e1uips the national securit/ and defense forces. For e*ample, the purchase of 0eapons and ships to enhance the capabilities of the militar/ forces. eneral administration includes administrative e*penditure of the -ublic &ervices ,epartment, &tatistics ,epartment, 'o/al 3ustoms and E*cise, -rinting, (nland 'evenue "oard and 7inistr/ of 4ome Affairs.

11.* ,ational 0e(t.Sources Of $orro ing.Pu(lic 0e(t The public debt of a particular countr/ is often referred to domesticall/ as government debt or 8the national debt8.$ational debt is a debt incurred b/ the government 0hen the government needed to borro0 the mone/ to finance the budget deficit, either from sources 0ithin the countr/ or abroad. (t encompasses public debt o0ed b/ the federal government, the state government, and even the municipal and local government (t is common practice for governments to borro0 in order to pa/ for the provision of public good 0ithout the use of ta*ation, but it is customar/ to limit that borro0ing in normal times for political reasons and in order to retain its availablit/ for emergencies. $ational debt can be obtained from internal and e*ternal sources. (t accrues over time 0hen the government spends more mone/ than it collects in ta*ation. As a government engages in more deficit spending, the amount of public debt increases. Internal Sources $ational debt from (nternal sources are loans obtained from individuals or organi6ations in the countr/. overnment get a loan through citi6ens and groups 0ithin the countr/ lend the government mone/ to continue operating. (n some 0a/s, this is a lot li2e lending to oneself, since ultimatel/ the responsibilit/ for public debt falls bac2 on the ver/ people lending mone/. the sale of treasur/ bills investment certificates and government securities to the Emplo/ees $ational &avings "an2 ban2 institutions insurance companies others

E7ternal Sources The national debt from e*ternal sources is the outstanding government loans from foreign governments and institutions abroad. A great deal of public debt is e*ternal debt, 0hich is mone/ that is o0ed b/ the government to foreign lenders , either in the form of international organi6ations, other governments, or groups li2e sovereign 0ealth funds 0hich invest in government bonds. The federal government;s e*ternal debt is obtained b/ &ales of government securities in the international financial mar2ets li2e $e0 Hor2, London and To2/o Loans approved overseas projects b/ institutions li2e the =orld "an2, Asian ,evelopment "an2 and others to finance the project

10

The Advantages and 0isadvantages Of $orro ing Advantages of ,ational 0e(t 1. Economic gro th The national debt e*ists 0hen the government ma2es loans to finance economic development projects. (mplementation ofdevelopment projects to generate economic gro0th to create jobs in order to overcome the problem of unemplo/ment in the countr/. Economic recovery from recession "udget deficit to stimulate economic activit/ 0hen the econom/ 0as in recession. overnment involvement in economic activities such as construction of infrastructure 0ill increase aggregate spending in the econom/ and help revive the econom/ out of recession #hannelling domestic savings to &roductive activities ales of treasur/ bills and government securities is a safe tool forcommunit/ savings and higher returns to the people, especiall/ 0heninterest rates in ban2s is ver/ lo0. Funds raised b/ the governmentcan be used to finance development e*penditure. 0isadvantages of ,ational 0e(t Future generations 0ill bear the burden of national debt in the form of higher ta*es to enable government to collect revenue for the pa/ment of the outstanding loan and interest on debt. 1. :ne;ual distri(ution of income -a/ment of interest on the sale of government securities to the public 0ill benefit onl/ those 0ho are and are able to bu/ thesebonds 0hen all segments of societ/ have to bear the ta* burden to pa/ principal and interest on debt. ". The negative im&act of currency outflo during the de(t re&ayment -a/ment of interest and principal repa/ments of e*ternal debt lead to mone/ flo0ing out of the countr/ and foreign e*change reserves 0ill be reduced. Foreign e*change reserve position is not soundcan affect the e*change rate stabilit/. $enefits of 0omestic Loan 1. Alternative secure storage device for the community

2.

3.

"onds issued b/ the government is an additional instrument for people to save. E*amples of 7erde2a &avings "ond issued b/"an2 $egara 7ala/sia for the elderl/ 0ho do not 0or2 full time andalso a member of a retired 7ala/sian arm/. 4igher rate of return of +E per /ear benefit from the interest rates offered b/ other financial instituition ". It is easier to o(tain loans

(t is easier for the government to borro0 from domestic sources 0ith the sale of government securities and government treasur/ bills to financial institutions in countries such as E-F and (nsurance companies. Loans from abroad involving the pa/ment of higher interest rates. Loans in the countr/ can overcome the problem of e*cess li1uidit/ in the countr/.

11

/.

The flo of money out of the country did not occur

Loans in the countr/ does not involve an outflo0 of mone/ from the state for pa/ment of loan interest and principal received b/ the population of the countr/. 9. ,ot e7&osed to ris! of changes in the rate of change.

Loans from domestic sources are not e*posed to the ris2 ofe*change rate changes. (f the government borro0s from foreignsources, the increase in foreign e*change rates 0ill cause debt to increase $enefits of Loan From Overseas 1. )ider Loan 'esources The government has a 0ider mar2et in the international financialmar2et in the sale of government securities such as $e0 Hor2,London, and To2/o. Therefore, the total amount of loans available is greater than the loan in the countr/. 2. 'educe com&etition ith the &rivate sector overnment do not have to compete 0ith the private sector to get loans from state funding sources are limited. Thus, the private sector has sufficient funds to finance investment projects. /. #a&ital flo s to the country Loans from foreign capital inflo0s and lead to further improve long9term capital account position and balance of pa/ments deficit. 0isadvantage Of The #ountry<s Loans 1. Loan 'esources Limited. Although the loans are easil/ available sources, but the mar2et for government securities is limited. Therefore, the total loans from lending sources in the countr/ ma/ not be sufficient to meet government re1uirements. ". 'educe consum&tion and investment overnment competition 0ith the private sector to ac1uire resourcesin the countr/;s limited borro0ing 0ould raise interest rates. The increase in domestic interest rates 0ill reduce consumption and investment in the private sector. 3. 'educing the money su&&ly in the economy &ales of government securities and treasur/ bills of the financial institutions of the government to reduce the li1uidit/ and mone/ suppl/ in the econom/. The decline in e*cess reserves of commercial ban2s to limit the abilit/ of ban2s to create credit 0isadvantage Of Foreign Loans 1. %igher Loan #osts. To attract investors to bu/ government securities in the international financial mar2ets, the government must offer higher interest rates forgovernment securities mar2et. Thus, borro0ing from e*ternal sources involves higher borro0ing costs. ". Outflo of funds a(road 'epa/ment of loans and interest causes mone/ to flo0 out. This reduces the suppl/ of mone/ in the econom/ and reduce national income b/ the fall in aggregate spending. 7one/ flo0s abroad alsoreduce the countr/;s foreign currenc/ reserves and balance of /. E7&osed to the ris! of e7change rate changes.

12

Loans from abroad are e*posed to the ris2 of e*change rate increases. For e*ample, the increase in <.&. dollar 0ill cause more 'inggit 7ala/sia are re1uired to pa/ the debt in <.&. dollar terms.

Item #ational "e$t 1 Internal a. &ale Of Treasur/ "ills b. (nvestment 3ertificates c. overnment &ecurities d. Loan from &tate e. "an2 (nstitutions f. (nsurance 3ompanies g. Others E7ternal a. International 1onetary Fund <nited &tate of America Gapan <nited Iingdom b. Loans on overseas &ro=ect =orld ban2 Asian ,evelopment "an2 9 * + Pu(lic Sector 0e(t Private Sector 0e(t Short Term 0e(t ,ational de(t Total "evelopment Expenditure

.ati!nal De/t 2007 &# milli!n

'

2008 &# milli!n

'

2009 &# milli!n

'

2"

S!ur es" + !n!mi &ep!rt0 #inistr$ )f 1inan e

13

11.+ Government Policy overnment -olic/ also 2no0n as macroeconomic polic/ is a government polic/ that is used to achieve government objectives or economic goals such as higher emplo/ment rate, stable inflation rate, and encouraging economic gro0th.7acroeconomic polic/ involves the use of fiscal , monetar/ and direct polic/. Fiscal polic/ involves changing government spending, ta*es, and transfer pa/ments. 7onetar/ polic/ involves the use of changes in the mone/ suppl/ to affect the level of economic activit/. Fiscal Policy Fiscal polic/ refers to the use of government ta*ation and e*penditure to influence the countr/5s spending, emplo/ment and price levels. (n other 0ords, a fiscal polic/ refers5s to the regulation of the level of government spending ta*ation and public debt. overnment of 7ala/sia carr/ out its fiscal budget polic/ tool 0hen increases its e*penses b/ bu/ing more goods and services. Fiscal polic/ involves the change of ta* rate or government e*penditure or both in order to achieve the government5s economic and social objectives.=hen an econom/ is in recession, the government can increase its output b/ increasing its e*penditure or reducing ta*es or both. This t/pe of fiscal polic/ is 2no0n as e*pansionar/ fiscal polic/. 3onversel/, 0hen an econom/ is booming and the general price ?inflation: has the tendenc/ to increase, the government can implement the contractionar/ fiscal polic/, 0here government e*penditure is decreased or the ta* revenue is increased or both. O$%e&tive of 'i(&al )oli&y Fiscal polic/ is carried out b/ the legislative and#or the e*ecutive branches of government. The t0o main instruments of fiscal polic/ are government e*penditures and ta*es. The government collects ta*es in order to finance e*penditures on a number of public goods and servicesJfor e*ample, high0a/s and national defense. The purpose of a fiscal polic/ is to stabili6e the econom/. Fiscal polic/ as an instrument of polic/ has the follo0ing objectives : &ecuring efficient allocation of economic resources. Attaining and maintaining full emplo/ment. Acceleration the rate of economic gro0th. 3ontrolling the e1uitable distribution of income and 0ealth. Tools of Fiscal Policy The fiscal polic/ consists of t0o main tools, namel/ government e*penditure and ta*es. (nflation ,eflation K overnment e*penditure L overnment e*penditure LTa*es KTa*es 3ontractionar/ Fiscal -olic/ E*pansionar/ Fiscal -olic/

=hen an econom/ is in recession#deflation or unemplo/ment, the government can increase its output b/ increasing its e*penditure or reducing ta*es or both. This t/pe of fiscal polic/ is 2no0n as e*pansionar/ fiscal polic/. 3onversel/, 0hen an econom/ is booming and the general price ?inflation: has the tendenc/ to increase, the government can implement the contractionar/ fiscal polic/, 0here government e*penditure is decreased or the ta* revenue is increased or both.

14

Ty&es of Fiscal Policy Fiscal polic/ can be divided into t0o t/pes, 0hich are: 3ontractionar/ Fiscal -olic/ (s also 2no0n as surplus budget polic/ defined as a decrease in government e*penditures and#or an increase in ta*es that causes the government;s budget deficit to decrease or its budget surplus to increase. This measure slo0s do0n gro0th.The contractionar/ fiscal polic/ is adopted to overcome inflationar/ problems. ,uring inflation, the appropriate fiscal polic/ is to create a budget surplus on order to reduce aggregate spending. The instruments in contractionar/ fiscal policies are the increasing of ta*es and the reduction of government spending.

Figure " 3ombating inflation using contractionar/ fiscal polic/ As real ,- rises above its natural level, prices also rise, prompting an increase in 0ages and other resource prices and causing the S2S curve to shift from S2S1 toS2S!. The end result is inflation of the price level from 31 to 3%, 0ith no change in real ,-. The government can head off this inflation b/ engaging in a contractionary fiscal polic/ designed to reduce aggregate demand b/ enough to prevent the 2D curve from shifting out to 2D!. Again, the government needs onl/ to decrease e*penditures or increase ta*es b/ a small amount because of the multiplier effects that such actions 0ill have. E*pansionar/ Fiscal -olic/ This polic/ is implemented to get the econom/ out of a slump. The government implements this economics polic/ b/ reducing ta*es and increasing government e*penditure. This measure 0ill increase the disposable income 0hich 0ill, in turn, lead to an increase in consumption. The e*pansionar/ fiscal polic/ is adopted to overcome unemplo/ment or recession problems. (n recession, the econom/ suffers from rising unemplo/ment, falling income and shrin2ing econom/ activit/. The government 0ill increase public spending b/ underta2ing public 0or2s programmes and reduce ta*es. The effect of ta* cuts 0ould increase the amount of disposable income of individual and business firms.

15

Figure 1 3ombating a recession using e*pansionar/ fiscal polic/ Assume that the econom/ is initiall/ in a recession. The e1uilibrium level of real ,-, 41, lies belo0 the natural level, 4!, impl/ing that there is less than full emplo/ment of the econom/;s resources. 3onse1uentl/, the recessionar/ climate ma/ persist for a long time. The 0a/ out of this difficult/, according to the Ie/nesians, is to run a budget deficit b/ increasing government e*penditures in e*cess of current ta* receipts. The increase in government e*penditures should be sufficient to cause the aggregate demand curve to shift to the right from 2D1 to 2D!, restoring the econom/ to the natural level of real ,-. 4ence, the government needs onl/ to increase its e*penditures b/ a small amount to cause aggregate demand to increase b/ the amount necessar/ to achieve the natural level of real ,-.

1onetary &olicy The monetar/ polic/ or 2no0n as financial polic/ refers to a polic/ 0hich emplo/s the central ban25s control of the suppl/ of mone/ as an instrument for achieving the objectives of the general economic polic/. A monetar/ ma/ aim to achieve the optimum level of emplo/ment and output , price stabilit/, balance of pa/ment e1uilibrium or other goals of the government5s economic polic/ 0ith the regulation b/ the central ban2 and the cost of credit primaril/ b/ affecting the cash reserves of commercial ban2s in the econom/. Ty&e . Instrument Of 1onetary Policy There are t0o t/pes of monetar/ policies practiced b/ a government. The government ma/ choose to adopt either e*pansionar/ or contractionar/ depending on the circumstances or the situation. The e*pansionar/ aimed at increasing mone/ suppl/ to control unemplo/ment or contractionar/ at reducing mone/ suppl/ to control inflation. The tools of ;uantitative monetar/ polic/ are: 1. ,eed for Statutory 'eserve 3ommercial ban2s, merchant ban2s and financial companies are re1uired to have a statutor/ reserve in the form of cash at the 3entral "an2. This reserve is measured as the percentage of basic deposit. (t does not produce an/ returns and cannot be used to give loans. The change of the statutor/ reserve rate is intended to influence the abilit/ of financial institutions to give loans. 'eserve re1uirements is being used b/ the central ban2 to influence the abilit/ of commercial ban2 to create credit (nflation 'aising the reserve re1uirements increases the amount of re1uired reserves the ban2 must 2eep. This 0ould reduce the abilit/ of ban2 or other financial intermediar/ to provide loans and this has the effect of decreasing the mone/ suppl/ in the econom/ <nemplo/ment ,ecreasing the reserve re1uirements decreases the amount of re1uired reserves the ban2 must 2eep. Therefore stimulating the abilit/ of commercial ban2s to loan more mone/ thus increasing the mone/ suppl/ in the econom/. ". 1inimum Li;uidity 'e;uirement 3ommercial ban2s also have to 2eep li1uidated assets issued b/ "an2 $egara 7ala/sia ?"$7: such as treasur/ bills and government securities. The more re1uired li1uidated assets that are held, the lesser the credit that can be created. The re1uired minimum li1uidated assets are fi*ed b/ "an2 $egara 7ala/sia and are used as a monetar/ polic/ tool to control the 7ala/sian economic stabilit/. (nflation 3entral "an2 0ill increase minimum li;uidity re;uirement <nemplo/ment 3entral "an2 0ill deccrease minimum li;uidity re;uirement /. O&en 1ar!et O&eration 16

This is a tool used b/ the 3entral "an2 to influence the mone/ suppl/ 0hich involves the bu/ing and selling of government securities in the financial mar2et. This activit/ 0ill influence the position of financial institution reserves and conse1uentl/ their abilit/ to give loans. The bu/ing and selling of government securities in the open mar2ets b/ the central ban2 so as to influence the si6e of commercial ban2s5 deposits. (nflation 3entral "an2 sells government securities such as treasur/ bills to commercial ban2s, to the public or financial institutions to dra0 mone/ bac2 from the financial institutions. Thus, the mone/ suppl/ 0ill be reduced in the mar2et, either that o0ned b/ the public or financial institutions . As a result, the cash reserve of the commercial ban2s abilit/ to create credit is reduced. selling of securities.short8term (onds. <nemplo/ment =hen the 3entral "an2 (uy government securities from the commercial ban2s and individuals, this 0ill inject mone/ into the econom/. -a/ment made 0ill increase cash reserves of commercial ban2s and thus commercial ban2s can create more credit,

9. 0iscount O&eration 3entral "an2 is the final source of loan to other ban2s. =hen the 3entral "an2 gives loans to ban2s, the interest rate 2no0n as discount rate is imposed. This rate is determined b/ the 3entral "an2 based on the current situation (nflation A high discount rate 0ill be imposed to reduce the loans to the ban2ing sector. <nemplo/ment A lo0 discount rates 0ill be imposed to encourage loans from commercial ban2s. *. Interest 'ates (nterest rate can be used to influence the cost of borro0ing for consumption. (nflation =hen mone/ suppl/ decrease, a *ig* interest rates mi*ht /e seen as a re5uirement f!r !ntr!llin* !nsumer spen-in*. This 0ill cause the savings to increases but discourage investment and consumption . <nemplo/ment =hen mone/ suppl/ increases, a l!wer interest rate means that it is heaper t! /!rr!w m!ne$6 this ma7es it easier f!r families t! /!rr!w m!ne$ f!r a h!use !r f!r /usinesses ( This 0ill decrease savings but encourage en !ura*es spen-in*0 whi h stimulates firms t! in rease pr!-u ti!n0 thus in reasin* %D3 an- l!werin* unempl!$ment( +. Funding (t is a process 0here government sells long9dated debt ?national savings securit/: rather than short9dated debt ?treasur/ bills:. (nflation (t is the practice of managing the government debt b/ replacing of short term securities 0ith longer term in order to influence the mone/ suppl/. <nemplo/ment 9 The tools of ;ualitative monetar/ polic/ are: A. Selective #redit #ontrols &elective credit controls regulate the e*tension of credit for particular purpose. Tightening selective credit controls 0ill limit certain t/pes of spending and rela*ation 0ill increase spending. i. 'educe control on margin re;uirement

(nflation <nemplo/ment ii. 'educe control on credit mortgage 17

(nflation <nemplo/ment iii.

The central ban2 0ill prevent people from bu/ing assets in mortgages, such as housing The central ban2 0ill encourage people to bu/ assets in mortgages, such as housing

control on credit installment 3entral ban2 0ill prevent people from bu/ing cars on credit installment b/ increasing the minimum do0n pa/ment, reducing the amount of credit loans and shorten the repa/ment period of installment credit central ban2 0ill encourage people from to bu/ cars on credit installment b/ decreasing the minimum do0n pa/ment, increase the amount of credit loans and prolong the repa/ment period of installment credit

(nflation <nemplo/ment

iv.

S&ecial directive

(nflation <nemplo/ment $. 1oral Persuasion 7oral persuasion is 0here the 3entral "an2 organises a direct meeting 0ith commercial ban2s to re1uest some action from them. (t involves the 3entral "an2 advising financial institutions regarding measures that should be ta2en. (t can be conve/ed through a speech, press conference or is informed directl/ b/ the 3entral "an2. To date, moral persuasion has been effective because financial institutions in this countr/ fre1uentl/ adhere to government policies. (nflation <nemplo/ment 3entral "an2 0ill persuade commercial ban2s to reduce loans for speculative purposes 3entral "an2 0ill persuade commercial ban2s to increase lending on certain economic sectors that can accelerate economic gro0th

0irect #ontrol 1easures.Policy :nem&loyment Inflation ,isseminate Labor 7ar2et (nformation (ncrease Labor 7obilit/ 3reation of $e0 Emplo/ment Opportunities Encouraging Foreign (nvestment <pgrade s2ill and technical education and 'etraining (ncreased investment in 0or2er training: 3reation of more emplo/ment opportunities in various economic sectors ,iversif/ economic activit/ ,evelopment of ne0 land Famil/ planning in long run 7oderni6ation of agriculture sector (mprove level of education 'estrict Labor <nion Activit/ -rice control 'ationing Anti9hoarding campaign 3ompulsor/ savings 18

(ncrease the production of neccesities goods 3ontrolling the increase of salar/ and 0ages 3ontrolling prices of ra0 material 'eduction of import ta* on intermediate goods Encourage the development of technolog/ and labor productivit/ 3ontrolling of prices of consumer goods -romoting import substitution industries (ncreasing the local products to reduce imports ,iversif/ing sources of imports &trengthening currenc/ value to reduce the cost of imports

19

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Noxworm Suspension - Google SearchDocument1 pageNoxworm Suspension - Google SearchSiti Aisyah RuzelanPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Internal Heart Monitoring - Google SearchDocument1 pageInternal Heart Monitoring - Google SearchSiti Aisyah RuzelanPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Reading Year 1 - Google SearchDocument1 pageReading Year 1 - Google SearchSiti Aisyah RuzelanPas encore d'évaluation

- Electrochemistry Ch20bDocument13 pagesElectrochemistry Ch20bSiti Aisyah RuzelanPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Interactive ThermometerDocument1 pageInteractive ThermometerSiti Aisyah RuzelanPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Topic 15 International FinanceDocument12 pagesTopic 15 International FinanceSiti Aisyah RuzelanPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Topic 13 BUIDocument31 pagesTopic 13 BUISiti Aisyah RuzelanPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Evolution of Indian Financial SystemDocument2 pagesEvolution of Indian Financial SystemvivekPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

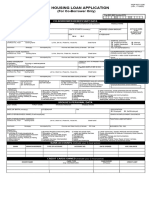

- HLF1036 HousingLoanApplicationCoBorrower V01Document2 pagesHLF1036 HousingLoanApplicationCoBorrower V01Andrei Notario Manila100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- AND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteDocument9 pagesAND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteRajesh RoyPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Oracle SOA 11.1.1.5.0 Admin GuideDocument698 pagesOracle SOA 11.1.1.5.0 Admin GuideConnie WallPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Export-Import Documentation Aditya Kapoor PDFDocument8 pagesExport-Import Documentation Aditya Kapoor PDFPradeepPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Support Letter TemplateDocument2 pagesSupport Letter TemplateRina Lou Lumactud-DumukPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Jawaban Kieso Intermediate Accounting p19-4Document3 pagesJawaban Kieso Intermediate Accounting p19-4nadiaulyPas encore d'évaluation

- Alliance AirDocument3 pagesAlliance AirvikasmPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Cases-CompDocument169 pagesCases-CompDavid John MoralesPas encore d'évaluation

- Despiece Upgrade PDFDocument5 pagesDespiece Upgrade PDFjonbilbaoPas encore d'évaluation

- Child OffendersDocument35 pagesChild OffendersMuhd Nur SadiqinPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Two Nation Theory - Docx NarrativeDocument14 pagesTwo Nation Theory - Docx NarrativeSidra Jamshaid ChPas encore d'évaluation

- Google Hacking CardingDocument114 pagesGoogle Hacking CardingrizkibeleraPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Credit, Background, Financial Check Disclaimer2Document2 pagesCredit, Background, Financial Check Disclaimer2ldigeriePas encore d'évaluation

- Erasmus Training Agreement and Quality CommitmentDocument5 pagesErasmus Training Agreement and Quality CommitmentSofia KatPas encore d'évaluation

- US Xero Certification Attendee NotesDocument67 pagesUS Xero Certification Attendee NotesAli Rehman80% (5)

- Sign in and Invite Your Colleagues and Contacts: Who's in ShareDocument2 pagesSign in and Invite Your Colleagues and Contacts: Who's in ShareAli MustafaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- APHYD00136810000170072 NewDocument3 pagesAPHYD00136810000170072 NewNithin Sunny ChackoPas encore d'évaluation

- CORPORATION An Artificial Being Created by Operation of Law Having The Right of SuccessionDocument26 pagesCORPORATION An Artificial Being Created by Operation of Law Having The Right of SuccessionZiad DnetPas encore d'évaluation

- Legal and Constitutional Rights of Women in IndiaDocument8 pagesLegal and Constitutional Rights of Women in Indiamohitegaurv87100% (1)

- Annual Income Tax ReturnDocument2 pagesAnnual Income Tax ReturnRAS ConsultancyPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Lpe2501 Writing Portfolio Task 1 (Self-Editing Form)Document2 pagesLpe2501 Writing Portfolio Task 1 (Self-Editing Form)Sinorita TenggaiPas encore d'évaluation

- BEED ReapplicationDocument16 pagesBEED ReapplicationDonna Rose CalePas encore d'évaluation

- Eacsb PDFDocument297 pagesEacsb PDFTai ThomasPas encore d'évaluation

- Tab 82Document1 pageTab 82Harshal GavaliPas encore d'évaluation

- Branch - QB Jan 22Document40 pagesBranch - QB Jan 22Nikitaa SanghviPas encore d'évaluation

- Friday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleDocument11 pagesFriday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleTom TuttlePas encore d'évaluation

- Clerkship HandbookDocument183 pagesClerkship Handbooksanddman76Pas encore d'évaluation

- IP in The Digital Economy: Mr. Paul Bodenham Studio Legale AlmaDocument53 pagesIP in The Digital Economy: Mr. Paul Bodenham Studio Legale AlmaMr.Aung Kyaw SoePas encore d'évaluation

- Solvency PPTDocument1 pageSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)