Académique Documents

Professionnel Documents

Culture Documents

Letter To State Dept 14-02-09 KXL

Transféré par

Doug GrandtTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Letter To State Dept 14-02-09 KXL

Transféré par

Doug GrandtDroits d'auteur :

Formats disponibles

Douglas A.

Grandt

PO Box 6603 Lincoln, NE 68506 February 9, 2014

Bureau of Energy Resources, Room 4843 Attn: Keystone XL Public Comments U.S. Department of State 2201 C Street NW Washington, DC 20520 Re: TransCanada permit application for the Keystone XL pipeline Dear John Kerry and Barack Obama: Beginning 1972, my second job following two years doing computer simulations of Prudhoe Bay Reservoir for ExxonMobil, then Humble Oil & Refining Co., was as the first Corporate Planner at a Fortune 500 ocean transportation company transitioning from breakbulk to containerization. Having studied Industrial Engineering/Operations Research and Petroleum Engineering at the University of California (Berkeley) I yearned for a birds-eye-view of the Corporate world and found my ideal niche as understudy for a tough but moral Naval Architect mentor who taught me to speak the language of the Board of Directors in my late 30s. Frankly, I am an engineer/scientist at heartI enjoyed analysis and the search for truth more than the glossy packaged presentations. In many ways, the Final Supplemental Environmental Impact Statement (FSEIS) violates what I have strived to accomplish throughout my entire 42-year career, invalidating all the work that has gone into its preparation. Section 1.4 Market Analysis verbiage in the FSEIS wreaks of a K Street MBA for hire Corporate Strategy Consultants highfalutin and obfuscating lingo. From Section 1.4 Market Analysis 1.4.1.3 Summary of Analysis (page 1.4-8):

Page 1 of 4

Douglas Grandt February 9, 2014

One thing I would never do as a young Corporate Planner is leave unresolved phrases like higher transportation costs could have a substantial impact on oil sands production levels without some explanation as to why such a comment plays no role in the conclusion. Sinful is the poignant phrase that immediately follows: ... possibly in excess of the capacity of the proposed Project. I wonder what the authors, editors and managers had in mind with this: As a result, the price threshold above which pipeline constraints are likely to have a limited impact on future production levels could change if supply costs or production expectations prove different than estimated in this analysis. Do they expect us to believe the conclusions with this hanging out there? The coup de grce of this section: Oil sands production and investment could slow or accelerate depending on oil price trends, regulations, and technological developments, but the potential effects of those factors on the industrys rate of expansion should not be conflated with the more limited effects of individual pipelines. Nowhere is this claim substantiated. This wreaks of pure sales promotionnot objective and transparent analysis constructed to prove a priori that the pipeline and production are not linked. Section 1.4 Market Analysis 1.4.5.4 Implications for Production, beginning at page 1.4-131 presents the same unsubstantiated speculations and circular arguments:

Encl.: My letter dated March 19, 2013 !

Page 2 of 4

Douglas Grandt February 9, 2014

Continuing on page 1.4-132:

What are the assumptions built into the model that generate this conclusion? Model results indicate that if additional pipelines to Canadas West Coast are constructed, they would most likely be utilized regardless of the availability of crossborder pipelines due to the economic attractiveness of the relatively short seaborne shipping distances from Canadian export terminals to refineries in Asia. One fundamental requirement I learned in 1972 was to state my assumptions. We have no way to judge whether the assumptions used here are valid. Continuing on page 1.4-133:

Encl.: My letter dated March 19, 2013 !

Page 3 of 4

Douglas Grandt February 9, 2014

What is the basis for this conclusion and how does it play in the argument? Consequently, imposing a constraint exclusively on future cross-border pipeline capacity does not cause a significant reduction in the modeled prices of oil sands blends or the returns to oil sands producers. The assumptions implied by the statements in the very long paragraph above are speculative, tenuous, and pipe dreams at best. Hinging conclusions on a house of cards is not my idea of professional and objective work. Transparency dictates that the authors lay out the logic of their arguments concisely, clearly and comprehensively in advance of presenting the elements. Simply running models and generating results without a clear explanation is an insult to the audience. In my March 19, 2013, letter during the last 45-day comment period, I stated the following (http://bit.ly/StateDept19Mar13KXL): There is no transparency as to guiding principles and assumptions of the Keystone XL SIES.Unless and until the structure of the SEIS is revealed, and the guidelines and assumptions are clearly laid out for all to see and understand, the SEIS cannot be objectively assessed.Statements that it is consistent with the National Environmental Policy Act are not sufficient. A concise explanation of what is intended to be demonstrated in a problem as complex as this should be demanded by the owner, in this case, the State Dept. I find nothing that clearly demonstrates that Keystone XL would not play an important role the expansion of Canadian bitumen extraction. Lacking such, the intelligent reader should conclude that Keystone would contribute to the deleterious effects of climate change brought about by the combustion of the fossil fuels produced from tarsands that it would transport to market. The Keystone XL pipelinelike other means of bitumen transportdoes nothing to inhibit, slow down or stop the extraction of Canadian bitumen. Keystone XL only has the potential to exacerbate a climate catastrophe. Keystone XL is not in the National Interest. Its only purpose is to move fossil fuels to market. Its construction and operation is contraindicated, as is any other means of transport of the tarsand bitumen from Canada to be burned. Facilitating the transport and combustion of increasing amounts of fossil fuels including bitumen is not in the National Interest because of the disastrous effects of the resulting changes in climate in the USA as well as globally. The Keystone XL pipelines potential to facilitate bitumen excavation and combustion is not in the National Interest. Curtail Keystone XL. Commence Retiring Refineries. Compel the oil industry to Replace Refineries with Renewables. Taking these three actions as quickly as possible is in our National Interest. Sincerely yours, Doug Grandt Encl.: My letter dated March 19, 2013 ! Page 4 of 4

Douglas A. Grandt

P. O. Box 1582 El Dorado, CA 95623 March 19, 2013

U.S. Department of State Attn: Genevieve Walker, NEPA Coordinator 2201 C Street NW, Room 2726 Washington, D.C. 20520

Re: Keystone XL Pipeline SEIS guidelines and assumptions Dear Ms. Walker, There is no transparency as to guiding principles and assumptions of the Keystone XL SIES. Unless and until the structure of the SEIS is revealed, and the guidelines and assumptions are clearly laid out for all to see and understand, the SEIS cannot be objectively assessed. Statements that it is consistent with the National Environmental Policy Act are not sufficient.

This fence is a "wall" of ignorance, arrogance, politics and deceit.

President Obama and Secretary Kerry should send the SEIS back to the drawing board requiring that the basic guidelines and assumptions be clearly stated, and that it be updated with the global impacts of excavation, forest destruction, processing, river contamination (all toxins and carcinogens), transporting, refining, and ultimate burning of the tarsands bitumen. In the late1960s, I degreed in Industrial Engineering, Operations Research and Petroleum Engineering. My first job was with the largest oil production and refining corporation in the world. Doing Corporate Planning (1972-1979), I learned the absolute necessity to document all of the assumptions that were the basis of my work. Now retired, I believe it is fundamental to the credibility of the SEIS that you clearly state the assumptions and expose the biases. Sincerely yours,

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Facts and Specifications: More of The BestDocument2 pagesFacts and Specifications: More of The BestreiazhPas encore d'évaluation

- Manual de TALLER Peugeot Tweet 125Document64 pagesManual de TALLER Peugeot Tweet 125Manuel Crisman FiorielloPas encore d'évaluation

- Top Blowing Rotatory ConvertorDocument4 pagesTop Blowing Rotatory ConvertorVanesa Ramirez CatalanPas encore d'évaluation

- Advances in Chemistry Research - Volume 37 PDFDocument261 pagesAdvances in Chemistry Research - Volume 37 PDFSofiavGuevara100% (2)

- Perkins 2300 2306c-E14Document156 pagesPerkins 2300 2306c-E14Chakroune71% (7)

- S35me-B9 3Document341 pagesS35me-B9 3OleksandrPas encore d'évaluation

- TM 5-5065 Le Roi Compressor, 1954Document356 pagesTM 5-5065 Le Roi Compressor, 1954Advocate100% (1)

- PTJ 1 2013Document100 pagesPTJ 1 2013ranjith_aspPas encore d'évaluation

- Compresor TITAN 130 (Solar)Document86 pagesCompresor TITAN 130 (Solar)Martínez Rodriguez DiegoPas encore d'évaluation

- FurnacesDocument34 pagesFurnacesVinay RamarajuPas encore d'évaluation

- 5,6DK-26 Parts List (HEAVYL FUEL OIL)Document363 pages5,6DK-26 Parts List (HEAVYL FUEL OIL)Victor Valdivia100% (2)

- Water Flooding: Buckely-Leverett TheoryDocument23 pagesWater Flooding: Buckely-Leverett Theoryبشير الزامليPas encore d'évaluation

- 7 Control RegulationDocument351 pages7 Control RegulationtruongPas encore d'évaluation

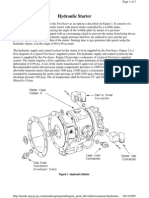

- Figure 1. Hydraulic StarterDocument3 pagesFigure 1. Hydraulic StarterDenis JimenezPas encore d'évaluation

- P086Ti G-Drive: Power RatingDocument3 pagesP086Ti G-Drive: Power Ratingsambuka97567% (3)

- The Very Real Prospect of 5 OilDocument5 pagesThe Very Real Prospect of 5 OilDoug GrandtPas encore d'évaluation

- Ignore The Messengers at Your Own Peril Plan Oils DemiseDocument1 pageIgnore The Messengers at Your Own Peril Plan Oils DemiseDoug GrandtPas encore d'évaluation

- Kiwi (11) and Zozo (8) Climb For #ClimateCrisis Action - W.E.C.A.R.E.Document1 pageKiwi (11) and Zozo (8) Climb For #ClimateCrisis Action - W.E.C.A.R.E.Doug GrandtPas encore d'évaluation

- Gail Tverberg's Incriminating Analysis. What? Worry, You Should!Document1 pageGail Tverberg's Incriminating Analysis. What? Worry, You Should!Doug GrandtPas encore d'évaluation

- Women Demand A Green New Deal & No New Fossil FuelsDocument1 pageWomen Demand A Green New Deal & No New Fossil FuelsDoug GrandtPas encore d'évaluation

- Millions of Youth Will Never Give In, Never, Never, Never-Never Give In!Document1 pageMillions of Youth Will Never Give In, Never, Never, Never-Never Give In!Doug GrandtPas encore d'évaluation

- You Should Know That Oil & Gas Could Trigger An Economic CrashDocument5 pagesYou Should Know That Oil & Gas Could Trigger An Economic CrashDoug GrandtPas encore d'évaluation

- Hold Bronwyn and Her Generation in Your Hearts, Darren Et Al.Document1 pageHold Bronwyn and Her Generation in Your Hearts, Darren Et Al.Doug GrandtPas encore d'évaluation

- Why Is It Time To Make An Endgame Plan For Vladimir?Document1 pageWhy Is It Time To Make An Endgame Plan For Vladimir?Doug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan, or Expect ResistanceDocument1 pageIt's Time To Make Your Endgame Plan, or Expect ResistanceDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For A Cool EarthDocument1 pageIt's Time To Make Your Endgame Plan For A Cool EarthDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan With Scientific FactsDocument1 pageIt's Time To Make Your Endgame Plan With Scientific FactsDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For JeromeDocument1 pageIt's Time To Make Your Endgame Plan For JeromeDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For VladimirDocument1 pageIt's Time To Make Your Endgame Plan For VladimirDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For GretaDocument1 pageIt's Time To Make Your Endgame Plan For GretaDoug GrandtPas encore d'évaluation

- All Considerations Paint A Bleek FutureDocument2 pagesAll Considerations Paint A Bleek FutureDoug GrandtPas encore d'évaluation

- Please Give Your Full Attention To This RequestDocument3 pagesPlease Give Your Full Attention To This RequestDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For SophiaDocument1 pageIt's Time To Make Your Endgame Plan For SophiaDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For NY AG Leticia JamesDocument1 pageIt's Time To Make Your Endgame Plan For NY AG Leticia JamesDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For DominicDocument1 pageIt's Time To Make Your Endgame Plan For DominicDoug GrandtPas encore d'évaluation

- Frack More For Less Return On Investment-Sustainable?Document2 pagesFrack More For Less Return On Investment-Sustainable?Doug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For AlexandriaDocument1 pageIt's Time To Make Your Endgame Plan For AlexandriaDoug GrandtPas encore d'évaluation

- It's Time To Make Your Endgame Plan For MaryDocument1 pageIt's Time To Make Your Endgame Plan For MaryDoug GrandtPas encore d'évaluation

- Reign in and Quash The "Fantasy From ExxonMobil"Document7 pagesReign in and Quash The "Fantasy From ExxonMobil"Doug GrandtPas encore d'évaluation

- WARNING: ExxonMobil's Isn't A Cyclical Down Turn, It Is StructuralDocument6 pagesWARNING: ExxonMobil's Isn't A Cyclical Down Turn, It Is StructuralDoug GrandtPas encore d'évaluation

- There Should Be A Law! Take Over The Reigns!Document5 pagesThere Should Be A Law! Take Over The Reigns!Doug GrandtPas encore d'évaluation

- Stop Undermining Climate Goals-Oil and Electricity Do Not Mix!Document3 pagesStop Undermining Climate Goals-Oil and Electricity Do Not Mix!Doug GrandtPas encore d'évaluation

- OIL & GAS Were The Biggest Losers at The Climate Crisis Town HallDocument9 pagesOIL & GAS Were The Biggest Losers at The Climate Crisis Town HallDoug GrandtPas encore d'évaluation

- You Must Expose The World's Best Kept Dirty Little SecretDocument5 pagesYou Must Expose The World's Best Kept Dirty Little SecretDoug GrandtPas encore d'évaluation

- Thank Your Lucky Stars ExxonMobil Is Not On This List ... YetDocument4 pagesThank Your Lucky Stars ExxonMobil Is Not On This List ... YetDoug GrandtPas encore d'évaluation

- Aircraft and Rocket Engines: A3271 Propulsion IiDocument72 pagesAircraft and Rocket Engines: A3271 Propulsion IiPinapaka Pranay ChowdaryPas encore d'évaluation

- BT20 Setting ToolDocument12 pagesBT20 Setting Toolanthony silvaPas encore d'évaluation

- Circuitoelectrico40007000IParteS082854Z PDFDocument74 pagesCircuitoelectrico40007000IParteS082854Z PDFHector Eugenio Henriquez Delannoy100% (3)

- IK1M SootblowerDocument2 pagesIK1M Sootblowerbigsteve9088Pas encore d'évaluation

- Lyle Carnegie Biomass CanadaDocument32 pagesLyle Carnegie Biomass CanadaMuhammad NaqviPas encore d'évaluation

- Microtechnique: Dr. Esam Qnais Hashemite UniversityDocument13 pagesMicrotechnique: Dr. Esam Qnais Hashemite UniversityEnas AhmadPas encore d'évaluation

- TTM60 61A Service ManualDocument98 pagesTTM60 61A Service ManualAlexandru DiaconuPas encore d'évaluation

- Home Standby Aspbs1cca016Document4 pagesHome Standby Aspbs1cca016Ramon CarreñoPas encore d'évaluation

- Turbocharger Test Stand With A Hot Gas Generator For High - Performance Supercharging SystemsDocument4 pagesTurbocharger Test Stand With A Hot Gas Generator For High - Performance Supercharging SystemsintelligentlovePas encore d'évaluation

- Wobbe IndexDocument2 pagesWobbe IndexLi Fang HuangPas encore d'évaluation

- How To Set Ignition TimingDocument8 pagesHow To Set Ignition Timingbogdanxp2000Pas encore d'évaluation

- Annex II - AMC 20-6 PDFDocument65 pagesAnnex II - AMC 20-6 PDFB777A330Pas encore d'évaluation

- Me423 Chapter 2Document76 pagesMe423 Chapter 2ddhiruPas encore d'évaluation

- Jet Engine MCQDocument9 pagesJet Engine MCQPrem MauryaPas encore d'évaluation

- Plogarithm Edited Report 1 NowDocument44 pagesPlogarithm Edited Report 1 NowSrinivasa bnPas encore d'évaluation