Académique Documents

Professionnel Documents

Culture Documents

Estate Tax: Difference With Income Tax (Ter)

Transféré par

Equi TinDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Estate Tax: Difference With Income Tax (Ter)

Transféré par

Equi TinDroits d'auteur :

Formats disponibles

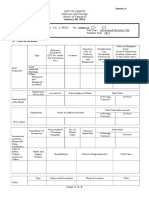

ESTATE TAX

Imposed upon the privilege Of disposing Gratuitously Private properties

DIFFERENCE WITH INCOME TAX (TER) 1. On transfer of property; on income 2. Lower rates (Estate = 5%; Donors = 2%, 15%, 30%); Income = 5-32% 3. Lesser exemptions; More exemptions KINDS 1. 2.

Estate Tax Donors Tax

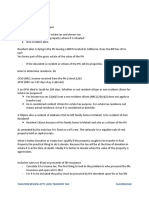

DIFFERENCE OF ESTATE AND DONOR (FARNRED PETERGC) 1. Filed, notice. 2mos after death or after qualifying as executor v None 2. Amount exempt. 200K v 100K 3. Rate. 5-20% v 2-15% 4. Nature of transfer. After death of decedent/between natural persons v During donors lifetime/natural & juridical 5. Requirements. a. Estate Notice required after decedents death in the ff cases: I. Transac subject to estate tax II. Transac exempt from estate tax but more than 20K b. Donors notice of donation not required, EXC: I. To NGOs, if more 50K or more, EXC to EXC i. More than 30% will be used for admin purposes II. To any candidate, political party or coalition of parties 6. Exemptions. Sec. 101 v Sec. 87 7. Deductions. None v Sec. 86 8. Payment of tax due. BOTH Pay as you file 9. Extension of filing return. 30 days (in meritorious cases) v None 10. Time of filing return. W/in 6mos from death v W/in 30days after donation 11. Extension of Payment. a. Estate Gen Rule: No extension; EXC: I. When it will result to undue hardship upon the estate/heirs i. EXC to EXC: When taxpayer is guilty of a. Negligence b. Intentional disregard t R&R c. Fraud b. Donors - None 12. Return. a. Estate: I. A transfer subject to estate tax II. Not subject to estate tax but gross estate = more than 200K

III. Estate consists of registered, registrable prop no matter the value b. Donors transfer subject to donors tax 13. Grant of extension of payment. Requirements: Bond (not exceeding tax (x) 2 plus sureties deemed necessary by commissioner vs None 14. Contents of Return. a. Estate (VOID) I. Value (gross estate) II. Other pertinent info III. If gross estate exceeds 2M, certified by CPA as to assets, deductions, tax due, w/n paid IV. Deductions (Sec. 86) b. Donors (GAPNO) I. Each gift made during the calendar yr (for computing net gifts) II. Allowable and claimed deductions III. Previous net gifts made during the same yr IV. Donees name V. Such other info as may be req by R&R DONATIONS Inter vivos subject to donors tax EXC: 1. Transfers in contemplation of death 2. and revocable transfers, since the control of the decedent is up to the time of his death. Therefore, subject to estate tax Mortis causa to estate tax DEFINITIONS Estate tax An excise tax On the privilege of transmitting prop at the time of death given to a person in controlling the disposition of prop to take effect upon his death not a direct tax on the decedents prop Estate Planning a manner by w/c a person takes step to conserve his property to be transmitted to his heirs by decreasing the estate taxes to be paid upon his death this is lawful since a person has the legal right to decrease the amount he will pay as taxes or avoid themby means w/c the law permits NATURE OF ESTATE TAX 1. excise tax imposed on the privilege of transferring the ownership of prop; not a prop tax 2. ad valorem the tax base is the fair market value as of the time of death of the decedent a. but the appraised value should be which ever is higher of the fair market value i. as assessed by the Commissioner (zonal) ii. as indicated in the schedule of values fixed by the Provincial or City Assessors 3. indirect can be passed to the transferee 4. national imposed only by the national govt, NOT LGUs 5. general revenue raised is for the general purposes 6. progressive rate increases as the base increases

BASES OF IMPOSITION 1. Benefits-Protection Theory State can collect taxes on the reciprocal duties of support and protection 2. Redistribution of Weath since successors inheritance are reduced and transferred to the govt coffers 3. State-partnership Theory State is a silent partner in accumulating wealth 4. Ability to Pay since inheritance is an unearned wealth, it creates the ability to pay REQUISITES (DSD) 1. Decedents death 2. Successor still living at the time of death 3. Successor not disqualified to inherit Time of Trasfer at the death of the decedent Law Applicable law at the time of death Accrual of Tax at the time of death; but obli to pay is w/in 6mos from death Residence permanent home a place where, despite business or employment, the person always intends to return PERSON TAXABLE OF ESTATE TAX 1. Residents and citizens comprising of all properties at the time of his death a. Real or personal b. Tangible or intangible c. All interests therein d. Wherever situated e. Revocable transfers f. Transfers for insufficient consideration 2. Non-resident aliens a. Real properties situated in the PH b. For intangible props subject to Reciprocity Rule GROSS ESTATE FORMULA Gross estate Less: Deductions; Net Share of Surviving Spouse ---------------------------------------------------------------Net Taxable Estate x Tax Rate = Estate Tax Due Less: Tax Credit (if any) VALUATION Real Prop Fair Market Value (FMV) as determined by a. The Commissioner (zonal value) b. The schedule of values of the City or Municipal Assessor c. If no zonal value, FMV in the latest tax dec Personal Prop FMV based on appraisal Shares of stock I. Unlisted a. Unlisted common book value Dont consider appraisal value

Dont consider value of par preffered shares b. Unlisted presferred par value II. Listed the arithmetic mean of the highest and lowest quotation at a date nearest the date of death if none is available on the date of death Right to use, usufruct, habitation, annuity take into account the probable life of the beneficiary according to the basic standard mortality table to be approved by the Sec of Finance on the recommendation of the Insurance Commissioner If there is improvement, its value is the construction cost per bldg permit or the FMV in the latest tax dec COMPUTATION OF GROSS ESTATE A. Resident, non-res citizen; Resident Alien Value at the time of death of a. Real property w/n in PH b. Personal property w/n in PH c. To the extent of the interest therein at the time of death Residency is determined by the intent to return despite business or work B. Non-resident alien a. Real prop in PH b. Personal prop w/situs in PH unless exempted under the reciprocity rule i. Franchise exercised in PH ii. Shares, bonds, obli in a corpo organized and constituted in PH iii. Shares, bonds, obli In an foreign corpo, 85% of its buss is located in PH Even if issued in favor of non-resident bec it has obtained situs in PH iv. Shares, bonds, obli Issued by a foreign corpo But has acquired buss situs in PH v. Shares, bonds, obli In a buss, industry, partnership Established in PH EXCEPTION: Reciprocity Rule a. Total exemption when the alien is a citizen/resident of a country w/c at the time of his death did not impose transfer tax of any character to intangible prop of PH citizens not residing in that country b. Partial exemption when the alien is a citizen/resident of a country w/c at the time of his death did not impose any similar transfer tax or death tax to intangible props of PH citizens not residing in that country INCLUSIONS IN GROSS ESTATE 1. Decedents interest Any interest of the decedent at the time of his death having value or capable of being valued 2. Transfer in Contemplation of Death

Transfer made by the decedent motivated by the thought of impending death although death may not be imminent Transfer by decedent, at any time In contemplation of Or to take effect in possession or enjoyment At or after death When decedent has, at any time, made a transfer where he Reserved for his life Or for a period not ascertainable w/o reference to his death Or any period w/c does not end before his death The possession, enjoyment or right to income of the prop The right (alone or in conjunction w/others) to designate the person who will possess, enjoy the prop or income therefrom

EXCEPTIONS a. Bona fide sale b. Sale for adequate or full consideration in money or moneys worth Transfer in contemplation of death is that where the person retains some control over the property therefore not effecting a full transfer of all interests therein not all transfers made by a dying person qualifies under this classification Transfers made by a person shortly before his/her death and simultaneous to his/her execution of a will is considered transfer in contemplation of death and forms part of gross estate because the intention of the decedent is to avoid estate tax 3-year presumption rule Any transfer made by a person w/in 3 years before his death is considered to be in contemplation of death (THIS WAS ALREADY DELETED by PD1705) Circumstances to Consider (HAGGAM DIVE) I. Age of decedent at the time of transfer II. Health as he knew it before or at transfer III. Interval. Between transfer and death IV. Amount transferred vis-a-vis amount retained V. Nature of disposition of the decedent VI. Existence of a general testamentary scheme of w/c transfers were part VII. Donee-Decedent relationship VIII. Long-established gift-making policy on the part of the decedent IX. Desire of the decedent to avoid the difficulty of managing his prop by transferring to others X. Desire of the decedent to vicariously enjoy the enjoyment of the donees of his prop XI. Desire of the decedent to avoid estate taxes by tansferring to donees inter vivos

3. -

Revocable Transfer A transfer By trust or otherwise Where the enjoyment thereof at the date of death Was subject to change through the exercise of power to alter, amend or revoke Power to AAR may be by the decedent alone Or in conjunction with any other person Where such power is relinquished in contemplation of the decedents death other than a bona fide sale or sale for adequate or full consideration Exists notwithstanding: Exercise of power is subject to precedent giving of notice AAR takes effect only upon the expiration of a stated period after the exercise of power w/n on or before death, notice has been given Power has been exercised In such a case o Proper adjustment shall be made representing the interest w/c would have been excluded from the power if decedent lived o And for such other purpose if notice has been given o Or the power has not been exercised on or before death o Such notice shall be considered given and power exercised Its part of the gross estate bec the transferor can revoke the transfer any time Although decedent did not exercise the power, it still falls under this classification

EXCEPTIONS (when it is not revocable; not usbject to estate tax) I. If the decedents power can only be exercised by the consent of others with interest in the prop II. When decedent was completely divested of such power at the time of death III. Where power is i. subject to contingency ii. beyond decedents control iii. and it did not happen before death IV. The mere right to name trustees i. The right of the decedent to designate himself as the trustee under conditions that did not happen before his death 4. Property Passing Under a General Power of Appointment (GPA) GPA Power to designate a person Who will succeed to the prop of the prior decedent In favor of anybody Himself Estate of decedent Creditors Creditors of his estate EXC:

a. b.

c.

When the donation contains a provision of reversion to the donor (it becomes revocable transfer) If it can only be exercised in favor of One or more classes of persons exclusive of decedent his estate creditors or estate creditors (specific power/SPA) if expressly not exercisable in favor of the abovementioned (specific power/SPA)

PROPERTIES COVERED Those passed by the decedent under GPA by I. his will II. deed executed in contemplation of death or to take effect in possession or enjoyment at death III. deed under w/c he reserves for his life or on a period unascertainable w/o reference ot his death or for any period that does not end before death possession, enjoyment and right to income of prop and right to designate a person to enjoy, possess prop and income thereof EXCEPTIONS: Transferred by bona fide sale or sale with adequate or full consideration DIFFERENCE FROM TRANSFER IN CONTEMPLATION... I. Effectivity ICOD at or after death v GPA for his life or period unascertainable... II. Means by trust or otherwise v under GPA, will or deed

Vous aimerez peut-être aussi

- List of AssetsDocument3 pagesList of AssetsArjam B. Bonsucan80% (5)

- Taxation Law 2 Reviewer (Long)Document44 pagesTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- Estate Tax NotesDocument13 pagesEstate Tax NotesDonFrascoPas encore d'évaluation

- ARTICLE - Death, Real Estate, and Estate TaxesDocument10 pagesARTICLE - Death, Real Estate, and Estate TaxestemporiariPas encore d'évaluation

- Dean Coronel Trial Practice TechniquesDocument13 pagesDean Coronel Trial Practice TechniquesEqui Tin100% (3)

- Guest Name: Date:: Description Rate AmountDocument1 pageGuest Name: Date:: Description Rate AmountKNOWLEDGE JUNCTIONPas encore d'évaluation

- Taxation Law 2 ReviewerDocument44 pagesTaxation Law 2 ReviewerShi MartinezPas encore d'évaluation

- Tax2 Reviewer NotesDocument57 pagesTax2 Reviewer NotescardeguzmanPas encore d'évaluation

- Of Res Mobilia Sequuntur Personam and Situs of Taxation)Document47 pagesOf Res Mobilia Sequuntur Personam and Situs of Taxation)Stephanie ValentinePas encore d'évaluation

- Reviewer On Intro To TaxDocument7 pagesReviewer On Intro To Taxjulius art maputiPas encore d'évaluation

- Module 1 Estate TaxationDocument7 pagesModule 1 Estate TaxationKirstein Hammet DionilaPas encore d'évaluation

- Gross Estate The Value of All The Property, Real or Personal, TangibleDocument40 pagesGross Estate The Value of All The Property, Real or Personal, TangibleRomz NunePas encore d'évaluation

- Transfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationDocument14 pagesTransfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationAnonymous l13WpzPas encore d'évaluation

- Tax Estate TaxDocument13 pagesTax Estate TaxAlbert Baclea-an100% (1)

- TRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitDocument2 pagesTRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitJohn Lester LantinPas encore d'évaluation

- Taxation Law 2 Reviewer PDFDocument58 pagesTaxation Law 2 Reviewer PDFLizCruz-Kim0% (1)

- Taxation Law 2 ReviewerDocument34 pagesTaxation Law 2 ReviewerMa. Cielito Carmela Gabrielle G. Mateo100% (1)

- HQ11 - Estate TaxationDocument18 pagesHQ11 - Estate TaxationJane Oblena100% (1)

- Tax q2 ReviewerDocument3 pagesTax q2 ReviewerDanika S. SantosPas encore d'évaluation

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinPas encore d'évaluation

- TRANSFER TAXES - UpdatedDocument33 pagesTRANSFER TAXES - UpdatedBogs QuitainPas encore d'évaluation

- Tax ReviewDocument22 pagesTax ReviewMarky De AsisPas encore d'évaluation

- Transfer TaxesDocument101 pagesTransfer TaxesAngelo IvanPas encore d'évaluation

- Ordinary DeductionDocument6 pagesOrdinary Deductionar calasangPas encore d'évaluation

- Estate Tax PDFDocument35 pagesEstate Tax PDFRhea Mae Sa-onoyPas encore d'évaluation

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandePas encore d'évaluation

- Estate Tax and Donors Tax With TrainDocument12 pagesEstate Tax and Donors Tax With TrainEspregante RosellePas encore d'évaluation

- The Law That Governs The Impos Ition of Estate TaxDocument22 pagesThe Law That Governs The Impos Ition of Estate TaxAmy Olaes DulnuanPas encore d'évaluation

- TAX With TRAIN LAW - Transfer and Business TaxDocument61 pagesTAX With TRAIN LAW - Transfer and Business TaxRamon AngelesPas encore d'évaluation

- TAX.102 - Estate Tax SuccessionDocument154 pagesTAX.102 - Estate Tax SuccessionkekadiegoPas encore d'évaluation

- Tax 2 ReportDocument88 pagesTax 2 ReportRay John Uy-Maldecer AgregadoPas encore d'évaluation

- Session 2 Tax 102Document8 pagesSession 2 Tax 102Nicolle Irish AguilarPas encore d'évaluation

- Taxrev Notes Estate TaxDocument17 pagesTaxrev Notes Estate TaxYette ViPas encore d'évaluation

- Transfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedDocument16 pagesTransfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedAster Beane AranetaPas encore d'évaluation

- Estate TaxDocument10 pagesEstate TaxKwinie Corpuz0% (1)

- 7 Estate TaxDocument69 pages7 Estate TaxClaire diane CravePas encore d'évaluation

- EstateDocument10 pagesEstateGelyn CruzPas encore d'évaluation

- Estate TaxDocument3 pagesEstate TaxReymar Pan-oyPas encore d'évaluation

- Tax 2 Notes Finals 3Document47 pagesTax 2 Notes Finals 3Boom ManuelPas encore d'évaluation

- Transfer TaxesDocument87 pagesTransfer TaxesMyka FloresPas encore d'évaluation

- Notes in Estate TaxDocument32 pagesNotes in Estate TaxAngelyn SamandePas encore d'évaluation

- Tax 2 Notes Midterms LamosteDocument6 pagesTax 2 Notes Midterms LamosteRoji Belizar HernandezPas encore d'évaluation

- Estate Tax - 1Document61 pagesEstate Tax - 1James C. RecentePas encore d'évaluation

- Estate TaxDocument7 pagesEstate TaxJulia San JosePas encore d'évaluation

- Transfer TaxesDocument25 pagesTransfer Taxeselvira bolaPas encore d'évaluation

- Gross EstateDocument11 pagesGross EstateBiboy GSPas encore d'évaluation

- Estate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeDocument29 pagesEstate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeJoie Tarroza-LabuguenPas encore d'évaluation

- Outline - Estate and DonorsDocument24 pagesOutline - Estate and DonorsCarlo BarrientosPas encore d'évaluation

- 3 - Estate TaxDocument10 pages3 - Estate TaxVernnPas encore d'évaluation

- Tax FinalsDocument30 pagesTax FinalsJennie KimPas encore d'évaluation

- Booklet 1 Introduction To Transfer Tax - Estate TaxDocument51 pagesBooklet 1 Introduction To Transfer Tax - Estate Taxsunkist0091Pas encore d'évaluation

- ReviewerDocument2 pagesReviewerJesse MorantePas encore d'évaluation

- Estate & Donors TaxDocument31 pagesEstate & Donors TaxMea De San AndresPas encore d'évaluation

- Taxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Document96 pagesTaxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Val Escobar Magumun100% (1)

- Estate TaxDocument13 pagesEstate Taxfly awayPas encore d'évaluation

- Tax Lectures TranscribeDocument29 pagesTax Lectures TranscribeNeri DelfinPas encore d'évaluation

- Definition of Estate TaxDocument16 pagesDefinition of Estate TaxCessBacunganPas encore d'évaluation

- Estate Tax and Donor's Tax (Discussion Type - Article)Document14 pagesEstate Tax and Donor's Tax (Discussion Type - Article)Michelle Escudero FilartPas encore d'évaluation

- Taxation Review Atty Lock-Transfer Tax ClaveriacadDocument8 pagesTaxation Review Atty Lock-Transfer Tax Claveriacadamor claveriaPas encore d'évaluation

- SEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponDocument10 pagesSEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponJoy Navaja DominguezPas encore d'évaluation

- Cavili Vs Florendo Case Digest (Evidence)Document2 pagesCavili Vs Florendo Case Digest (Evidence)Equi Tin0% (1)

- FBI Vs FSIDocument2 pagesFBI Vs FSIEqui TinPas encore d'évaluation

- Tongco Vs Vianzon (1927) Case Digest in EvidenceDocument2 pagesTongco Vs Vianzon (1927) Case Digest in EvidenceEqui TinPas encore d'évaluation

- Spouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawDocument3 pagesSpouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawEqui TinPas encore d'évaluation

- Res Gestae and Dead Man's Statute Cases (Evidence)Document6 pagesRes Gestae and Dead Man's Statute Cases (Evidence)Equi TinPas encore d'évaluation

- Tañada Vs Angara Case DigestDocument3 pagesTañada Vs Angara Case DigestEqui Tin100% (2)

- 1 Albino Co Vs CADocument10 pages1 Albino Co Vs CAEqui Tin100% (1)

- Tax Remedies (Reviewer)Document2 pagesTax Remedies (Reviewer)Equi TinPas encore d'évaluation

- Ermita Vs Mayor of Manila Case DigestDocument2 pagesErmita Vs Mayor of Manila Case DigestEqui TinPas encore d'évaluation

- North Cotabato Vs GRP Case DigestDocument5 pagesNorth Cotabato Vs GRP Case DigestEqui TinPas encore d'évaluation

- Co Kim Cham V Tan KehDocument60 pagesCo Kim Cham V Tan KehEqui TinPas encore d'évaluation

- Vivas Vs Monetary Board Case DigestDocument3 pagesVivas Vs Monetary Board Case DigestEqui TinPas encore d'évaluation

- Pascual Vs Sec of Public Works Case DigestDocument4 pagesPascual Vs Sec of Public Works Case DigestEqui TinPas encore d'évaluation

- Rafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Document2 pagesRafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Equi TinPas encore d'évaluation

- Tañada Vs Angara Case DigestDocument3 pagesTañada Vs Angara Case DigestEqui Tin100% (2)

- Depression Among College StudentsDocument17 pagesDepression Among College StudentsEqui TinPas encore d'évaluation

- Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)Document2 pagesFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)Equi Tin50% (2)

- Writ of Execution (Dissected)Document26 pagesWrit of Execution (Dissected)Equi TinPas encore d'évaluation

- Modes of Acquiring Ownership PartialDocument2 pagesModes of Acquiring Ownership PartialEqui TinPas encore d'évaluation

- Writ of Execution (Chopped)Document26 pagesWrit of Execution (Chopped)Equi TinPas encore d'évaluation

- Phil Lawyers Assoc V Agrava Case DigestDocument2 pagesPhil Lawyers Assoc V Agrava Case DigestEqui Tin100% (2)

- Problem Areas in Legal Ethics Case DigestsDocument30 pagesProblem Areas in Legal Ethics Case DigestsEqui Tin100% (1)

- Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)Document2 pagesFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)Equi TinPas encore d'évaluation

- Modes of Discovery (Dissected)Document13 pagesModes of Discovery (Dissected)Equi Tin100% (1)

- Khan V Simbillo Case DigestDocument1 pageKhan V Simbillo Case DigestEqui Tin0% (1)

- Writ of Execution (Chopped)Document26 pagesWrit of Execution (Chopped)Equi TinPas encore d'évaluation

- Katarungang Pambarangay LawDocument6 pagesKatarungang Pambarangay LawAgatha Diane HonradePas encore d'évaluation

- Case DigestDocument10 pagesCase DigestEqui TinPas encore d'évaluation

- CE 11 New Customs and Excise FormDocument2 pagesCE 11 New Customs and Excise FormtotPas encore d'évaluation

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadPas encore d'évaluation

- Moneylion StatementDocument1 pageMoneylion StatementrolphcourtenayPas encore d'évaluation

- Tax Book Part PDFDocument128 pagesTax Book Part PDFTimothy WilliamsPas encore d'évaluation

- OpTransactionHistoryUX326 11 2023Document6 pagesOpTransactionHistoryUX326 11 2023vishwakarmaash75Pas encore d'évaluation

- Accounting For VAT in The Philippines - Tax and Accounting Center, IncDocument8 pagesAccounting For VAT in The Philippines - Tax and Accounting Center, IncJames SusukiPas encore d'évaluation

- Gmail - Booking Confirmation On IRCTC, Train - 09722, 25-Sep-2021, CC, UDZ - AIIDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 09722, 25-Sep-2021, CC, UDZ - AIIMahipal SinghPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)NAGARJUNAPas encore d'évaluation

- CustomInvoice 7670709745Document1 pageCustomInvoice 7670709745budi irawanPas encore d'évaluation

- Rajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.Document2 pagesRajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.arjun guptaPas encore d'évaluation

- Case Digest Ongpin and AlgueDocument4 pagesCase Digest Ongpin and AlgueKatrine Olga Ramones-CastilloPas encore d'évaluation

- GST PPT June19Document65 pagesGST PPT June19yash bhushanPas encore d'évaluation

- TS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalDocument47 pagesTS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalRUSHIL GUPTAPas encore d'évaluation

- CarlosSuperDrug v. DSWD Case DigestDocument2 pagesCarlosSuperDrug v. DSWD Case DigestjohnPas encore d'évaluation

- Invoice RDF11239767Document1 pageInvoice RDF11239767Gaurav GuptaPas encore d'évaluation

- HLB Receipt-2023-01-13Document1 pageHLB Receipt-2023-01-13Nur NabilaPas encore d'évaluation

- What Is An Automated Teller MachineDocument7 pagesWhat Is An Automated Teller MachineNeha SoningraPas encore d'évaluation

- VTP Hilife ThergaonDocument1 pageVTP Hilife ThergaonNiharika YadavPas encore d'évaluation

- English EssayDocument3 pagesEnglish Essayᮓᮔᮤᮚᮜ᮪ᮃᮂᮙᮓ᮪ᮛᮤᮐᮜ᮪ᮓᮂᮤPas encore d'évaluation

- CH 14 Control Accounts Part 1Document8 pagesCH 14 Control Accounts Part 1BuntheaPas encore d'évaluation

- Economic Impact ReportDocument6 pagesEconomic Impact ReportrkarlinPas encore d'évaluation

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancedileepPas encore d'évaluation

- ACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgDocument6 pagesACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgdelightplasticsPas encore d'évaluation

- PDFDocument17 pagesPDFpavan kumar RS0% (1)

- SalesInvoiceImport 02 MARET 2023Document6 pagesSalesInvoiceImport 02 MARET 2023Fakta IdPas encore d'évaluation

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthPas encore d'évaluation

- #60 CIR vs. TMX SalesDocument2 pages#60 CIR vs. TMX SalesJan Rhoneil SantillanaPas encore d'évaluation

- Dave and Diane Starr of New Orleans Louisiana Both ofDocument1 pageDave and Diane Starr of New Orleans Louisiana Both ofCharlottePas encore d'évaluation