Académique Documents

Professionnel Documents

Culture Documents

Https Doc 0k 0s Apps Viewer - Googleusercontent

Transféré par

Anuranjan TirkeyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Https Doc 0k 0s Apps Viewer - Googleusercontent

Transféré par

Anuranjan TirkeyDroits d'auteur :

Formats disponibles

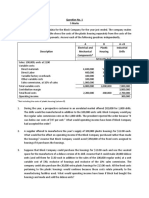

PGP Term II, End-term Examination-2012 Management Accounting

Close Book, Calculators Allowed Time: 2 Hours Faculty: Prof. K N Badhani Note: Attempt any two questions. All question carry equal marks. Maximum Marks: 50

1. Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter product line has been developed. However, Slivens CEO has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in the future years will be initiated. The product selected (call Chap-Off) is a lip balm that will be sold in a lip-stick type tube. The product will be sold to wholesalers in boxes of 24 tubes for $ 8 per box. Because of excess capacity used to manufacture this product during slack season, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $ 90,000 charge for fixed manufacturing overhead will be absorbed by the product under the companys absorption costing system. Using the estimated sales and production of 100,000 boxes of Chap-Off, the accounting department has developed the following cost per box. Direct Material Direct Labour Manufacturing Overheads $3.60 2.00 1.40

Total Cost $ 7.00 The above costs include costs of producing both the lip balm and the tube that contains it. As an alternative to making tubes, Silven has approached a supplier to discuss the possibility of purchasing the tubes for Chap-Off. The purchase price of empty tubes from the supplier would be $1.35 per box of 24 tubes. If Silven Industries accepts the purchase proposal, direct labour and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and direct material cost would be reduced by 25%. Required:

a. Should Silven Industry make or buy the tubes? Give cost calculations to support your answer. b. What would be maximum purchase price of tubes acceptable to Silven Industries? c. Instead of sale of 100,000 boxes, revised estimate shows a sale of 120,000 boxes. At this new volume, additional equipments must be acquired to manufacture the tubes at an annual rental of $40,000. Assuming that the outside supplier will not accept the order for less than 100,0000 boxes, should Silven Industry make or buy the tubes? Show calculations in support of your answer. d. Apart from above cost calculations what other qualitative factors should Silven Industries consider in deciding whether they should make or buy the tubes? 2. Meghraj Cookies bakes cookies for retail stores. The companys best selling cookie is Chocolate Nut Supreme which is marketed as a gourmet cookie and regularly sells for Rs 80 per kg. The standard cost per kg of Chocolate Nut Supreme, based on Maghrajs normal monthly production of Rs 400,000kg, follows: Cost Item Direct Material: Cookie Mix Milk Chocolate Almonds Direct Manufacturing Labour: Mixing Baking ManufacturingOverheads (@324/hr) Total Standard Cost per kg (oz = ounce, min = minute, hr = hour) Quantity Standard Rate Standard Cost per kg Rs 2.00 7.50 5.00 2.40 6.00 16.20 Rs 39.10

10 oz Rs 0.20/oz 5 oz 1.50/oz 1 oz 5.00/oz 1 min 2 min 144/hr 180/hr

Manufacturing overheads are allocated on the basis of labour hours. Meghrajs accountant, Zaheer, prepares monthly reports based on these standard costs. Presented below is November report: Performance Report for the month of November, 2010 Actual Budget Variance Unit (kg) 4,50,000 4,00,000 50,000 (F) Revenue Rs Rs 3,20,00,000 Rs 35,50,000 (F) Direct Material 86,50,000 58,00,000 28,50,000 (U) 3,55,50,000 Direct Labour 34,80,000 33,60,000 1,20,000(U)

Abbas, president of the company, is disappointed with the results. Despite a sizable quantity of cookies sold, the products expected contribution to overall profitability decreased. Abbas has asked Zaheer to identify the reasons why the contribution margin has decreased. Zaheer has gathered the following information to help in his analysis: Usage Report, November 2010 Quantity Direct Material Cookie Mix Milk Chocolate Almonds Direct Manufacturing Labour Mixing Baking Required: a. Analyze sales, direct material and direct labour variances in detail. b. Prepare a report in a tabular form, showing possible reasons for the variances you have computed and suggested corrective actions. 46,50,000 oz 26,60,000 oz 4,80,000 oz 4,50,000 min 8,00,000 min

Actual Cost RS 9,30,000 53,20,000 24,00,000 10,80,000 24,00,000

3. Weller Industries is a decentralized organization with six divisions. The companys Electrical

Division produces a variety of electrical items, including an X52 electrical fitting. The Electrical Division (which is operating at full capacity) sells its fittings to its regular customers for Rs7.50 each; the fitting has variable manufacturing cost of Rs 4.25 and total manufacturing cost of Rs 6.00. The companys Brake Division has asked the Electrical Division to supply it with a large quantity of X52 fittings for only Rs 5.00 each. The Brake Division, which is operating at 50% of capacity, will put the fitting into a brake unit that it will produce and sell to a large commercial airline manufacturer. The cost of brake unit being built by the Brake Division follows:

Purchased parts (from outside vendors) Electrical fitting X52 Other variable costs Fixed overheads Total Cost per Brake unit

3

Amount (Rs) 22.50 5.00 14.00 8.00 49.50

Although the Rs 5.00 price for the X52 fitting represents a substantial discount from the regular Rs 7.50 price, the manager of Brake Division believes that the price concession is necessary if his division is to get the contract for the airplane brake units. He has heard through the grapevine that the airplane manufacturer plans to reject his bid if it is more than Rs 50.00 per brake unit. Thus if the Brake Division is forced to pay the regular Rs 7.50 price for X52 fitting, it will either not get the contract or it will suffer a substantial loss at a time when it is already operating at 50% of capacity. The manager of Brake Division argues that the price concession is imperative to the well-being of both his division and the company as a whole. Weller Industries uses return on Investment (ROI) to measure divisional performance. Required: a. Assume you are the manager of the Electrical Division. Would you recommend your division to supply the X52 fitting to the Brake Division for Rs 5.00 as requested? Why or why not? b. Would it be profitable for the company as whole if the airplane Brakes are sold for Rs 50.00? Show your calculations clearly. c. Assume you are the manager of Brake Division. If Electrical Division supplies you X52 at the price of Rs 7.50 only, will you still like to sell the Brakes to airplane manufacturer at Rs 50.00? Why or why not? d. Assume the Electric Division does not accept the demand of Brake Division to supply X52 at Rs 5.00; however, the Brake Division can get a similar product at this price from outside supplier. Is it advisable to accept the supply from outside supplier? Analyze from the point view of Brake Division as well the company as a whole. e. If Electric Division is not working at full capacity because of demand constraints, will you change your answer to above (d)? If yes, why? What advice will you give to the company in this case? Show your calculations clearly.

Vous aimerez peut-être aussi

- Corporate Financial Analysis with Microsoft ExcelD'EverandCorporate Financial Analysis with Microsoft ExcelÉvaluation : 5 sur 5 étoiles5/5 (1)

- Term ProjectDocument4 pagesTerm ProjectArslan QadirPas encore d'évaluation

- Value Chain Management Capability A Complete Guide - 2020 EditionD'EverandValue Chain Management Capability A Complete Guide - 2020 EditionPas encore d'évaluation

- Case Study 1 Week 3 A BoorDocument3 pagesCase Study 1 Week 3 A BoorABoor092113Pas encore d'évaluation

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookPas encore d'évaluation

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersD'EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersPas encore d'évaluation

- Porter's Five Forces Industry AnalysisDocument10 pagesPorter's Five Forces Industry AnalysiskulsoomalamPas encore d'évaluation

- CH 4Document6 pagesCH 4Jean ValderramaPas encore d'évaluation

- Project:Determining Manufacturing Cost of A Product and Performing CVP AnalysisDocument18 pagesProject:Determining Manufacturing Cost of A Product and Performing CVP Analysistarin rahmanPas encore d'évaluation

- The Correct Answer For Each Question Is Indicated by ADocument19 pagesThe Correct Answer For Each Question Is Indicated by Aakash deepPas encore d'évaluation

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamPas encore d'évaluation

- Analyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDocument2 pagesAnalyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDanang0% (2)

- CHAPTER 5 - Assignment SolutionDocument16 pagesCHAPTER 5 - Assignment SolutionCoci KhouryPas encore d'évaluation

- Chapter 4. Internal AssessmentDocument19 pagesChapter 4. Internal AssessmentLouciaPas encore d'évaluation

- Master Budget Assignment CH 9Document4 pagesMaster Budget Assignment CH 9api-240741436Pas encore d'évaluation

- The Cross-Price Elasticity of Demand For The Two Is CalculatedDocument3 pagesThe Cross-Price Elasticity of Demand For The Two Is CalculatedhaPas encore d'évaluation

- Anagene Case StudyDocument1 pageAnagene Case StudySam Man0% (3)

- CH 1 Assignment - An Overview of Financial Management PDFDocument13 pagesCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonPas encore d'évaluation

- ConAgra Processes Beef Cattle ProductsDocument13 pagesConAgra Processes Beef Cattle ProductsMawaz Khan MirzaPas encore d'évaluation

- Problem Set #1 Solution: Part 1 (Cost of Capital)Document4 pagesProblem Set #1 Solution: Part 1 (Cost of Capital)Shirley YeungPas encore d'évaluation

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Document2 pagesTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengPas encore d'évaluation

- Accounting 1 FinalDocument2 pagesAccounting 1 FinalchiknaaaPas encore d'évaluation

- Soal Tugas Problem Product CostingDocument2 pagesSoal Tugas Problem Product CostingMaria DiajengPas encore d'évaluation

- KisikisiDocument7 pagesKisikisijalunasaPas encore d'évaluation

- If The Coat FitsDocument4 pagesIf The Coat FitsAngelica OlescoPas encore d'évaluation

- ACCT-312:: Exercises For Home Study (From Chapter 6)Document5 pagesACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasPas encore d'évaluation

- Solutions Chapter 7Document39 pagesSolutions Chapter 7Brenda Wijaya100% (2)

- Chapter Problems: High-Low Method EstimatesDocument2 pagesChapter Problems: High-Low Method EstimatesYvonne TotesoraPas encore d'évaluation

- The GainersDocument10 pagesThe Gainersborn2growPas encore d'évaluation

- Paper 8Document63 pagesPaper 8Richa SinghPas encore d'évaluation

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyPas encore d'évaluation

- Exercises FS AnalysisDocument24 pagesExercises FS AnalysisEunicePas encore d'évaluation

- Chapter 12 Solutions ManualDocument68 pagesChapter 12 Solutions Manualmnarv880% (1)

- Variable vs Absorption CostingDocument3 pagesVariable vs Absorption CostingVadim Pilipenko0% (7)

- Budgeting Profit, Sales, Costs & ExpensesDocument19 pagesBudgeting Profit, Sales, Costs & ExpensesFarhan Khan MarwatPas encore d'évaluation

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanPas encore d'évaluation

- Cash Flows IIDocument16 pagesCash Flows IIChristian EstebanPas encore d'évaluation

- Case Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)Document6 pagesCase Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)prathmesh kulkarniPas encore d'évaluation

- Appendix - 8A The Maturity ModelDocument10 pagesAppendix - 8A The Maturity ModelAndreea IoanaPas encore d'évaluation

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- 2010-08-24 190659 PenisonifullDocument10 pages2010-08-24 190659 PenisonifullGauravPas encore d'évaluation

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversPas encore d'évaluation

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaPas encore d'évaluation

- Chapter 5 Financial Decisions Capital Structure-1Document33 pagesChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedPas encore d'évaluation

- Solution Manual For Book CP 4Document107 pagesSolution Manual For Book CP 4SkfPas encore d'évaluation

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasPas encore d'évaluation

- Suggested Homework AnsDocument6 pagesSuggested Homework AnsFeric KhongPas encore d'évaluation

- Jaiib Accounting Module C and Module DDocument340 pagesJaiib Accounting Module C and Module DAkanksha MPas encore d'évaluation

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDocument10 pagesChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosPas encore d'évaluation

- AMA Suggested Telegram Canotes PDFDocument427 pagesAMA Suggested Telegram Canotes PDFAnmol AgalPas encore d'évaluation

- Financial Statements: Analysis of Attock Refinery LimitedDocument1 pageFinancial Statements: Analysis of Attock Refinery LimitedHasnain KharPas encore d'évaluation

- Problem Solving 16Document11 pagesProblem Solving 16Ehab M. Abdel HadyPas encore d'évaluation

- Score:: Points %Document3 pagesScore:: Points %Ketan KulkarniPas encore d'évaluation

- Zong BDocument3 pagesZong BAbdul Rehman AmiwalaPas encore d'évaluation

- Capital Budgeting AnalysisDocument6 pagesCapital Budgeting AnalysisSufyan Ashraf100% (1)

- Sup Questions 4Document17 pagesSup Questions 4Anonymous bTh744z7E6Pas encore d'évaluation

- AccountingDocument9 pagesAccountingVaibhav BindrooPas encore d'évaluation

- Marginal Costing Problems SolvedDocument29 pagesMarginal Costing Problems SolvedUdaya ChoudaryPas encore d'évaluation

- Health Monitoring App For Office Goer Vs Professional AthleteDocument4 pagesHealth Monitoring App For Office Goer Vs Professional AthleteAnuranjan TirkeyPas encore d'évaluation

- Understanding and Accepting The Insecurities of Li 5a2b32391723dd3e747ba8f4Document3 pagesUnderstanding and Accepting The Insecurities of Li 5a2b32391723dd3e747ba8f4nashihaPas encore d'évaluation

- JD For FBsDocument1 pageJD For FBsAnuranjan TirkeyPas encore d'évaluation

- Ascent of Money: "The Safe Houses"-The Other Reason Beside Shelter of Owning A House Is Not Been TalkedDocument1 pageAscent of Money: "The Safe Houses"-The Other Reason Beside Shelter of Owning A House Is Not Been TalkedAnuranjan TirkeyPas encore d'évaluation

- WireframesDocument3 pagesWireframesAnuranjan TirkeyPas encore d'évaluation

- Yes BankDocument5 pagesYes BankAnuranjan TirkeyPas encore d'évaluation

- Assignment 2Document1 pageAssignment 2Anuranjan TirkeyPas encore d'évaluation

- Home Loan Vertical For NoBrokerDocument3 pagesHome Loan Vertical For NoBrokerAnuranjan TirkeyPas encore d'évaluation

- Product ObjectivesDocument2 pagesProduct ObjectivesAnuranjan TirkeyPas encore d'évaluation

- Amc Huvr 060413 9416 IncludeDocument154 pagesAmc Huvr 060413 9416 IncludeAnuranjan TirkeyPas encore d'évaluation

- TT-IV PGP 2013-15 Post Mid TermDocument1 pageTT-IV PGP 2013-15 Post Mid TermAnuranjan TirkeyPas encore d'évaluation

- Real Options BV Lec 14Document49 pagesReal Options BV Lec 14Anuranjan TirkeyPas encore d'évaluation

- Registration Form - Term-IV PGP 2013-15Document1 pageRegistration Form - Term-IV PGP 2013-15Anuranjan TirkeyPas encore d'évaluation

- Following Fellows Have Exceeded Their Limits For The Last WeekDocument1 pageFollowing Fellows Have Exceeded Their Limits For The Last WeekAnuranjan TirkeyPas encore d'évaluation

- Case Study Internet Bubble - Aux Mailles GodefroyDocument4 pagesCase Study Internet Bubble - Aux Mailles GodefroyAnuranjan TirkeyPas encore d'évaluation

- Time Table-Term IV PGP 2013-15 Pre Mid Term - 13.06.2014Document1 pageTime Table-Term IV PGP 2013-15 Pre Mid Term - 13.06.2014Anuranjan TirkeyPas encore d'évaluation

- IIT Kharagpur Graduate Tanmay Kumar Mandal's Academic and Project ProfileDocument2 pagesIIT Kharagpur Graduate Tanmay Kumar Mandal's Academic and Project ProfileAnuranjan TirkeyPas encore d'évaluation

- SPE 53715 Microbial Enhanced Oil Recovery Pilot Test in Piedras Coloradas Field, ArgentinaDocument29 pagesSPE 53715 Microbial Enhanced Oil Recovery Pilot Test in Piedras Coloradas Field, Argentinajpsi6Pas encore d'évaluation

- Name TimeDocument1 pageName TimeAnuranjan TirkeyPas encore d'évaluation

- GujaratDocument12 pagesGujaratAnuranjan TirkeyPas encore d'évaluation

- CV AG Long 20 Oct15Document67 pagesCV AG Long 20 Oct15AhanPas encore d'évaluation

- Lubna Shah W/O Muhammad Naseem 246-R BLK Paragon City: Web Generated BillDocument1 pageLubna Shah W/O Muhammad Naseem 246-R BLK Paragon City: Web Generated BillAli KhokharPas encore d'évaluation

- Perfromance Task 2nd Quarter UcspDocument18 pagesPerfromance Task 2nd Quarter Ucsppalmajulius365Pas encore d'évaluation

- Market Segmentation (Module 4)Document5 pagesMarket Segmentation (Module 4)tom jonesPas encore d'évaluation

- AsdfasdfasdfDocument2 pagesAsdfasdfasdfWaseem AfzalPas encore d'évaluation

- Report of Amul IndiaDocument11 pagesReport of Amul IndianehaPas encore d'évaluation

- SEBI Master Circular For Depositories Till March 2015 - Securities and Exchange Board of India 1 MASTER CIRCULAR CIR/MRD/DP/6/2015 May 07, 2015 - 1430992306107Document111 pagesSEBI Master Circular For Depositories Till March 2015 - Securities and Exchange Board of India 1 MASTER CIRCULAR CIR/MRD/DP/6/2015 May 07, 2015 - 1430992306107Disability Rights AlliancePas encore d'évaluation

- By Gaurav Goyal Assistant Professor, Lmtsom, TuDocument28 pagesBy Gaurav Goyal Assistant Professor, Lmtsom, TuSachin MalhotraPas encore d'évaluation

- Clearing and Settlement PPT: Financial DerivativesDocument24 pagesClearing and Settlement PPT: Financial DerivativesAnkush SheePas encore d'évaluation

- CS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)Document11 pagesCS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)manjinderjodhka8903Pas encore d'évaluation

- Consumer Behavior Unit No 1 NotesDocument6 pagesConsumer Behavior Unit No 1 NotesDrVivek SansonPas encore d'évaluation

- P 20 BV Marathon Notes Divya AgarwalDocument36 pagesP 20 BV Marathon Notes Divya AgarwalrayPas encore d'évaluation

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingPas encore d'évaluation

- Economics Exam Jan 10Document8 pagesEconomics Exam Jan 10Tam DoPas encore d'évaluation

- Chap 18: Open-Economy Macroeconomics: Basic ConceptsDocument4 pagesChap 18: Open-Economy Macroeconomics: Basic ConceptsTrần Ngọc Châu GiangPas encore d'évaluation

- Project-Baumol Sales Revenue Maximization ModelDocument10 pagesProject-Baumol Sales Revenue Maximization ModelSanjana BhabalPas encore d'évaluation

- An Analysis of Customer Satisfaction On Online Selling in Barangay Mactan: Basis For Online Shops and Service ProvidersDocument87 pagesAn Analysis of Customer Satisfaction On Online Selling in Barangay Mactan: Basis For Online Shops and Service ProvidersShela Mae BarroPas encore d'évaluation

- Cost & Management Accounting - Lec 2Document30 pagesCost & Management Accounting - Lec 2Agnes JosephPas encore d'évaluation

- Parle 1Document32 pagesParle 1Manas KumarPas encore d'évaluation

- IB Pitchbook Valuation AnalysisDocument3 pagesIB Pitchbook Valuation AnalysisSumeer BeriPas encore d'évaluation

- Cash Management Techniques: Presented byDocument12 pagesCash Management Techniques: Presented byShivkarVishalPas encore d'évaluation

- Der2019 enDocument194 pagesDer2019 enAbdul AzizPas encore d'évaluation

- 05 Activity 1 - ARG (Reinald Zach Ramos)Document2 pages05 Activity 1 - ARG (Reinald Zach Ramos)Dan DalandanPas encore d'évaluation

- M-127244 Nea 361Document2 pagesM-127244 Nea 361Lonely NessPas encore d'évaluation

- Bond Yields and Yield Calculations ExplainedDocument17 pagesBond Yields and Yield Calculations ExplainedJESSICA ONGPas encore d'évaluation

- Solution Manual For Investment Analysis and Portfolio Management 10th Edition by ReillyDocument6 pagesSolution Manual For Investment Analysis and Portfolio Management 10th Edition by Reillyburholibanumt4ahh9Pas encore d'évaluation

- Week 2 ProblemsDocument4 pagesWeek 2 Problemsbjh1234517% (6)

- Business Mathematics Module 6.1 Margin and Mark UpDocument15 pagesBusiness Mathematics Module 6.1 Margin and Mark UpDavid DuePas encore d'évaluation

- Nike Vertical Integration StrategyDocument8 pagesNike Vertical Integration StrategyvijayhegdePas encore d'évaluation

- Merchandise ManagementDocument32 pagesMerchandise ManagementMonika Sharma100% (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Coloring Book for Adults & Grown Ups : An Easy & Quick Guide to Mastering Coloring for Stress Relieving Relaxation & Health Today!: The Stress Relieving Adult Coloring PagesD'EverandColoring Book for Adults & Grown Ups : An Easy & Quick Guide to Mastering Coloring for Stress Relieving Relaxation & Health Today!: The Stress Relieving Adult Coloring PagesÉvaluation : 2 sur 5 étoiles2/5 (12)

- Martha Stewart's Very Good Things: Clever Tips & Genius Ideas for an Easier, More Enjoyable LifeD'EverandMartha Stewart's Very Good Things: Clever Tips & Genius Ideas for an Easier, More Enjoyable LifePas encore d'évaluation

- Crochet Impkins: Over a million possible combinations! Yes, really!D'EverandCrochet Impkins: Over a million possible combinations! Yes, really!Évaluation : 4.5 sur 5 étoiles4.5/5 (9)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Crochet Pattern Books: The Ultimate Complete Guide to Learning How to Crochet FastD'EverandCrochet Pattern Books: The Ultimate Complete Guide to Learning How to Crochet FastÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Martha Manual: How to Do (Almost) EverythingD'EverandThe Martha Manual: How to Do (Almost) EverythingÉvaluation : 4 sur 5 étoiles4/5 (11)

- 100 Micro Amigurumi: Crochet patterns and charts for tiny amigurumiD'Everand100 Micro Amigurumi: Crochet patterns and charts for tiny amigurumiÉvaluation : 5 sur 5 étoiles5/5 (2)

- Profit First for Therapists: A Simple Framework for Financial FreedomD'EverandProfit First for Therapists: A Simple Framework for Financial FreedomPas encore d'évaluation

- A Life in Stitches: Knitting My Way Through Love, Loss, and Laughter - Tenth Anniversary EditionD'EverandA Life in Stitches: Knitting My Way Through Love, Loss, and Laughter - Tenth Anniversary EditionÉvaluation : 4.5 sur 5 étoiles4.5/5 (23)

- The Basics of Corset Building: A Handbook for BeginnersD'EverandThe Basics of Corset Building: A Handbook for BeginnersÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Crochet Lace: Techniques, Patterns, and ProjectsD'EverandCrochet Lace: Techniques, Patterns, and ProjectsÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Knitting for Anarchists: The What, Why and How of KnittingD'EverandKnitting for Anarchists: The What, Why and How of KnittingÉvaluation : 4 sur 5 étoiles4/5 (51)

- Crochet: Fun & Easy Patterns For BeginnersD'EverandCrochet: Fun & Easy Patterns For BeginnersÉvaluation : 5 sur 5 étoiles5/5 (3)

- Crafts For Adults Basics - The Ultimate Starting Guide For All Craft Beginners To Master The Knowledge & Basics Of Different CraftsD'EverandCrafts For Adults Basics - The Ultimate Starting Guide For All Craft Beginners To Master The Knowledge & Basics Of Different CraftsÉvaluation : 1.5 sur 5 étoiles1.5/5 (3)

- Edward's Menagerie: The New Collection: 50 animal patterns to learn to crochetD'EverandEdward's Menagerie: The New Collection: 50 animal patterns to learn to crochetÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Too Cute Amigurumi: 30 Crochet Patterns for Adorable Animals, Playful Plants, Sweet Treats and MoreD'EverandToo Cute Amigurumi: 30 Crochet Patterns for Adorable Animals, Playful Plants, Sweet Treats and MoreÉvaluation : 5 sur 5 étoiles5/5 (2)

- Crochet Zodiac Dolls: Stitch the horoscope with astrological amigurumiD'EverandCrochet Zodiac Dolls: Stitch the horoscope with astrological amigurumiÉvaluation : 4 sur 5 étoiles4/5 (3)

- Delicate Crochet: 23 Light and Pretty Designs for Shawls, Tops and MoreD'EverandDelicate Crochet: 23 Light and Pretty Designs for Shawls, Tops and MoreÉvaluation : 4 sur 5 étoiles4/5 (11)

- Knit a Box of Socks: 24 sock knitting patterns for your dream box of socksD'EverandKnit a Box of Socks: 24 sock knitting patterns for your dream box of socksPas encore d'évaluation

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Creative Stitches for Contemporary Embroidery: Visual Guide to 120 Essential Stitches for Stunning DesignsD'EverandCreative Stitches for Contemporary Embroidery: Visual Guide to 120 Essential Stitches for Stunning DesignsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Modern Granny Stitch Crochet: Make clothes and accessories using the granny stitchD'EverandModern Granny Stitch Crochet: Make clothes and accessories using the granny stitchÉvaluation : 5 sur 5 étoiles5/5 (1)

- Fabric Manipulation: 150 Creative Sewing TechniquesD'EverandFabric Manipulation: 150 Creative Sewing TechniquesÉvaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Sew Bags: The Practical Guide to Making Purses, Totes, Clutches & More; 13 Skill-Building ProjectsD'EverandSew Bags: The Practical Guide to Making Purses, Totes, Clutches & More; 13 Skill-Building ProjectsÉvaluation : 5 sur 5 étoiles5/5 (3)

- Modern Crochet…For the Beach Babe Goddess: Easy to Use StitchesD'EverandModern Crochet…For the Beach Babe Goddess: Easy to Use StitchesÉvaluation : 3 sur 5 étoiles3/5 (2)

- Cozy Minimalist Home: More Style, Less StuffD'EverandCozy Minimalist Home: More Style, Less StuffÉvaluation : 4 sur 5 étoiles4/5 (154)

- Layers of Meaning: Elements of Visual JournalingD'EverandLayers of Meaning: Elements of Visual JournalingÉvaluation : 4 sur 5 étoiles4/5 (5)