Académique Documents

Professionnel Documents

Culture Documents

Among The Different Types of Retirement Plans

Transféré par

prabs9869Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Among The Different Types of Retirement Plans

Transféré par

prabs9869Droits d'auteur :

Formats disponibles

Among the different types of retirement plans, there are four main types: government-sponsored plans, personal plans,

annuities, and employersponsored plans.

Government-sponsored Plans: The largest government-sponsored retirement plan is the Social Security plan .

Personal Plans: The most popular example is the Individual Retirement Agreement or IRA, which can come in different types according to their tax treatment .

Annuities: These are contracts established with an insurance company; there are fixed and variable annuities .

Employer-sponsored Plans: The two types of employer-sponsored retirement plans are qualified and non-qualified retirement plans.

Qualified retirement plans meet the Internal Revenue Code requirements and theEmployee Retirement Income Security Act of 1974 (ERISA) requirements. These plans offer several tax benefits: they allow employers to deduct annual allowable contributions for each participant; contributions and earnings on those contributions are tax-deferred until withdrawn for each participant; and some of the taxes can be deferred even further through a transfer into a different type of IRA.

Non-qualified retirement plans are those plans that either do not meet the IRS Code requirements or the ERISA requirements.

Employer-Sponsored Plans

In the rest of this article, we will explore employer-sponsored plans in detail.

Qualified Plans

There are several types of qualified plans: Ads by Google

HDFC Life Term Plan Premium Starts at Just Rs. 2000/yr. No Medicals

upto 75L Cover* Buy Now

www.hdfclife.com/Term-Insurance

Defined benefit plans are company retirement plans, such as pension plans, in which a retired employee receives a specific amount based on salary history and years of service, and in which the employer bears the investment risk. The employee, the employer, or both may make contributions. The maximum amount a participant can contribute each year is the smaller of $160,000 or the average compensations from the three highest consecutive calendar years. These plans are better for people who have 20 years until retirement or less, since the annual contributions can be larger.

Pensions are a type of retirement plan that guarantees a specific amount to be paid out to the employee during retirement. The amount is calculated based on an employees salary, years of service and a fixed percentage rate. The Pension Benefit Guarantee Corporation (PBGC), a federal agency, covers employersponsored pension plans. The insurance covers a monthly maximum amount of about $3,000 for a worker retiring at age 65. Eligibility depends on a companys policy; some companies require service for a certain period of time before an employee can become eligible for a pension plan. If an employee leaves the job, the pension plan stays with the previous employer.

Annuities are defined benefit plans that have fixed monthly payments at the age of retirement. Note that annuities cannot be transferred into an IRA account, so the amount is taxed as regular income the year it is received. There are different options for annuities:

Joint and 50%: The annuity is paid for life and after death, with the spouse receiving half of the amount for the rest of his or her life.

Joint and 66 2/3%: The annuity is paid for life and after death, with the spouse receiving two thirds of that amount for the rest of his or her life.

Joint and 100%: The annuity is paid for life and after death, with the spouse receiving the full amount for the rest of his or her life.

10-year certain & life: The annuity is paid for life; if the participant dies in the first 10 years of retirement, the beneficiary collects the same amount until reaching the 10th year of retirement at which point all payments stop. If the participant dies 10 years or more after retirement, the payments stop at the time of the death.

Life Only: The annuity is paid for life, and after death all payments stop. Lump sum: The participant can take the total cash value of the retirement plan. Defined contribution plans allow the employer and/or employee to make contributions, so that the final benefits depend on how much was in the account and the rate earned by the accounts investments. An individual account must be set up for each participant in the plan. The federal government does not guarantee a participants benefits; instead, the plan is participant-directed, meaning that the employee makes the investment decisions based on the employers options. Contributions have a limit of roughly $50,000 or 25% of the participants total compensation. The different defined contribution plans are:

1. Profit sharing: An employer alone makes contributions based on an employees current-year compensation.

Contributions: Employers can decide what amount and whether to contribute to the plan each year. The maximum that the employer can contribute is 15% whichever is less. In addition, contributions can only be made on the first $170,000.

Eligibility: Employees can be eligible to participate in the plan immediately or after one or two years of employment; the vesting schedule is up to six years.

2. Stock bonus plan: A type of profit sharing plan, where contributions are made in the form of company stock. 3. Money purchase pension plan: A retirement plan with fixed-percentage compensations by the employers. Unlike profit sharing plans, these contributions are mandatory every year, regardless of profits.

Contributions: The maximum that the employer can contribute is 25% of the participants compensation or $40,000, whichever is less. In addition, contributions can only be made on the first $200,000. Unless the plan is integrated with Social Security, all employees contribution must be the same percentage and must be made every year.

Eligibility: Employees can be eligible to participate in the plan immediately or after one or two years of employment; as with profit sharing plans, employees must be 100% vested in the plan.

4. Combination plans: The profit sharing and money purchase plans are often combined by companies that have varied earnings from one year to the next. Through the establishment of proper contribution percentage rates in both plans, the employer can make the maximum contribution in good years and not during more difficult years.

Contributions: The total percentage for contributions in a combined plan cannot be more than the lesser of 100% of compensation or $40,000, and no more than 25% can be contributed to the profit sharing plan.

Eligibility: Employees can be eligible to participate in the combination plan immediately, or after one or two years of employment; if employees are not

allowed to enroll immediately, those participants must be 100% vested at all times. 5. Thrift or savings plan: Contributions are made by both the employer and the employee where the employer can match all or a percentage of the employees contributions. 6. Employee stock ownership plan (ESOP): The employer contributes shares of the companys stock to employees in return for special tax benefits . The shares of the company stock have to vest before a participant receives them. As an example, he vesting period can be 20% a year for 5 years. Employees are eligible to participate in this plan if they work at least 1000 hours in a year. 7. 401(k): A variation of the profit-sharing and thrift plan. Employees make regular tax deferred contributions and the employers can match a portion or all of the employees contributions. 8. 403(b): Another variation of the profit sharing and thrift plan for non-profit organizations. 9. SIMPLE: To learn about the SIMPLE, please visit the SIMPLE page . 10. 11. SEP: To learn about the SEP, please visit the SEP page . Target Benefit Plan: Employers set a target benefit for participants; contributions depend on assumptions of the projection to reach that benefit. Contributions and earnings are tax deferred until withdrawal. 12. Cash Balance Plans: Cash-balance plans are a type of defined contribution retirement plan where employers make annual contributions for each employee; the contributions earn interest at rates similar to Treasury bonds. These plans are recommended for younger employees because the retirement benefit starts building early.

Vous aimerez peut-être aussi

- Nirvana Pension Policy - Tata-AIG: SuitabilityDocument4 pagesNirvana Pension Policy - Tata-AIG: Suitabilityprabs9869Pas encore d'évaluation

- Introduction to Bancassurance: Merging Banking and InsuranceDocument61 pagesIntroduction to Bancassurance: Merging Banking and Insuranceprabs9869Pas encore d'évaluation

- Business Forms Tax ComparisonDocument12 pagesBusiness Forms Tax Comparisonprabs9869Pas encore d'évaluation

- Session 1 Marketing & Business PlanDocument26 pagesSession 1 Marketing & Business Planprabs9869Pas encore d'évaluation

- Birla ProjectDocument45 pagesBirla Projectprabs9869Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

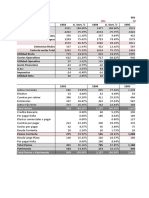

- Pelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di TangerangDocument7 pagesPelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di Tangerangfaesal fazlurahmanPas encore d'évaluation

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KharePas encore d'évaluation

- Finance A Ethics Enron Hyacynthia KesumaDocument1 pageFinance A Ethics Enron Hyacynthia KesumaCynthia KesumaPas encore d'évaluation

- Articles of IncorporationDocument4 pagesArticles of IncorporationRuel FernandezPas encore d'évaluation

- 01 Basilan Estate V CIRDocument2 pages01 Basilan Estate V CIRBasil MaguigadPas encore d'évaluation

- Profitability INTRODUCTIONDocument19 pagesProfitability INTRODUCTIONDEEPAPas encore d'évaluation

- IVALIFE - IVApension Policy BookletDocument12 pagesIVALIFE - IVApension Policy BookletJosef BaldacchinoPas encore d'évaluation

- Accounting 12 Chapter 8Document30 pagesAccounting 12 Chapter 8cecilia capiliPas encore d'évaluation

- Measuring National IncomeDocument71 pagesMeasuring National IncomeMayurRawoolPas encore d'évaluation

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanPas encore d'évaluation

- A Study On Analysis of Cash ManagementDocument73 pagesA Study On Analysis of Cash ManagementchetanPas encore d'évaluation

- Ch08 ReceivablesDocument42 pagesCh08 ReceivablesGelyn CruzPas encore d'évaluation

- Exam Timetable 2013Document2 pagesExam Timetable 2013Bukola BukkyPas encore d'évaluation

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariPas encore d'évaluation

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008Pas encore d'évaluation

- Functions of IDBI BankDocument37 pagesFunctions of IDBI Bankangelia3101Pas encore d'évaluation

- Syllabus FINQ 764 Derivatives and Risk ManagementDocument7 pagesSyllabus FINQ 764 Derivatives and Risk ManagementahmadPas encore d'évaluation

- Calculate employee wagesDocument29 pagesCalculate employee wagesPrashanth IyerPas encore d'évaluation

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaPas encore d'évaluation

- Financial Analysis and Decision Making OutlineDocument8 pagesFinancial Analysis and Decision Making OutlinedskymaximusPas encore d'évaluation

- Audit Module 3 - Financial Statements TemplateDocument11 pagesAudit Module 3 - Financial Statements TemplateSiddhant AggarwalPas encore d'évaluation

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- 7 Things About Support and Resistance That Nobody Tells YouDocument6 pages7 Things About Support and Resistance That Nobody Tells YouAli Abdelfatah Mahmoud100% (1)

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evPas encore d'évaluation

- Microequities Deep Value Microcap Fund IMDocument28 pagesMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdPas encore d'évaluation

- t8. Money Growth and InflationDocument53 pagest8. Money Growth and Inflationmimi96Pas encore d'évaluation

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamPas encore d'évaluation

- Budget Planning and ControlDocument9 pagesBudget Planning and ControlDominic Muli100% (6)

- CTRN Citi Trends Slides March 2017Document18 pagesCTRN Citi Trends Slides March 2017Ala BasterPas encore d'évaluation

- Learn Chinese Exchange CurrencyDocument3 pagesLearn Chinese Exchange CurrencyLuiselza PintoPas encore d'évaluation