Académique Documents

Professionnel Documents

Culture Documents

The ECB - EUR22 Trillion Is Missing - ZeroHedge

Transféré par

g-petersTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The ECB - EUR22 Trillion Is Missing - ZeroHedge

Transféré par

g-petersDroits d'auteur :

Formats disponibles

The ECB - EUR22 Trillion Is Missing | ZeroHedge

http://www.zerohedge.com/news/2012-10-02/ecb-eur22-trillion-missing

The ECB - EUR22 Trillion Is Missing

Submitted by Tyler Durden on 10/02/2012 09:02 -0400

European Central Bank

Gross Domestic Product

Money Supply

Reality

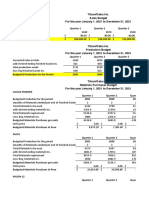

Via Mark J. Grant, author of Out of the Box, The ECB: The Missing Assets/Liabilities To treat your facts with imagination is one thing, but to imagine your facts is another. -John Burroughs Yesterday I published the assets/liabilities of the European Central Bank as provided by them. I provided some analysis that I thought was relevant as I also asked all of you to look at the numbers yourself. To be quite open; I was stunned by the data they provided and shocked by the implications. I had not seen the data in any other source or commented about by anyone and the subject, while admittedly complex, and perhaps made more complex by design, is a huge wake-up call for anyone investing in Europe. The ECB lists, as of the end of the 1st quarter of 2012, 16.304 trillion Euros ($ 21.032 trillion) in assets and 17.334 trillion Euros ($22.631 trillion) in liabilities. It is right there in black and white as I showed in the ECB provided data that I presented yesterday. However when you get to their consolidated balance sheet you find the numbers they bandy about in public to be a ledger of 3.240 trillion Euros ($4.00 trillion) and you catch your breath and pause. Utilizing normal American accounting practices this variance would be impossible and yet here it is; staring us all right in the face. Europe has put a stop payment on our reality check! -The Wizard I can report that I did hear from a number of large institutions yesterday that also looked at the numbers themselves and were stunned. Conversations were held, questions were asked and I think an accurate summation of the conversations was that everyone was in some state or another of astonishment. The numbers were not my numbers after all and while many good issues were raised in terms of how to properly analyze the data that was presented there was a clear sense that we were being duped by the European Central Bank and played for suckers. Reality is the leading cause of stress amongst those in touch with it. -Jane Wagner Forget that the liabilities are greater than the assets and forget that that both have increased rather appreciably in the last several years and just concentrate on the size of the numbers presented and then ask the central questions; who is responsible for these assets and liabilities and where are they counted? We know that they are not counted at the ECB as they are not a part of their consolidated balance sheet. You may ask how this is possible and I re-print, once again, the applicable note from the ECB: Recognition of assets and liabilities An asset or liability is only recognized in the Balance Sheet when it is probable that any associated future economic benefit will flow to or from the ECB, substantially all of the associated risks and rewards have been transferred to the ECB, and the cost or value of the asset or the amount of the obligation can be measured reliably. So there is the rationale, like it or not, but then where are these assets/liabilities counted? We are talking about $21.032 trillion in assets here and $22.631 trillion in liabilities which are larger numbers that all of the GDP of Europe. We can surmise that the ECB does not count these loans, securitizations and collateral as they belong to a given nation or a bank guaranteed by the nation or the securitization is guaranteed by some country but the rub is the country doesnt count them either. When a European nation reports out its debt to GDP ratio I knew that they did not count contingent liabilities and I knew that government backed bank bonds were not included and I knew that regional debt guaranteed by the government was not included but this, and the sheer size of it, had lain underneath everyones radar. Think of it; twenty-two trillion dollars worth of assets and liabilities and accounted for nowhere. No need to worry anymore about Target2; a mere tuppence at one trillion dollars, a decimal point. Just exactly what these assets and liabilities might be is anyones guess. Just which nations generated them is also anyones guess as no data or explanation is provided. Just what any countrys real debt to GDP ratio might be if these assets/liabilities were included in the equation is also anyones guess but I think it is safe to assume that the

1 van 1

4-10-2012 4:45

Vous aimerez peut-être aussi

- Charter of The United NationsDocument28 pagesCharter of The United NationsgonzomarxPas encore d'évaluation

- Sovereignty of The PeopleSOVEREIGNTY OF THE PEOPLEDocument6 pagesSovereignty of The PeopleSOVEREIGNTY OF THE PEOPLEg-petersPas encore d'évaluation

- Ss Fourth Reich PlansDocument188 pagesSs Fourth Reich Plansg-petersPas encore d'évaluation

- Using Ground Potential EnergyDocument5 pagesUsing Ground Potential Energyg-petersPas encore d'évaluation

- Crystal RadioDocument14 pagesCrystal RadioyourmothersucksPas encore d'évaluation

- Take Back Your PowerDocument42 pagesTake Back Your Poweranon-51752295% (21)

- Vaccine Report - International Medical Council On VaccinationDocument6 pagesVaccine Report - International Medical Council On VaccinationEtienne De La Boetie275% (4)

- Introdução Geral À Tecnologia KesheDocument1 pageIntrodução Geral À Tecnologia Keshejotasantos6Pas encore d'évaluation

- Lawsuit ComplaintDocument22 pagesLawsuit Complaintg-peters100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CommoditiesDocument122 pagesCommoditiesAnil TiwariPas encore d'évaluation

- QuestionnaireDocument5 pagesQuestionnaireDivya BajajPas encore d'évaluation

- NAFTA Verification and Audit ManualDocument316 pagesNAFTA Verification and Audit Manualbiharris22Pas encore d'évaluation

- Goldenson 2020Document123 pagesGoldenson 2020wajicePas encore d'évaluation

- Materi 9A Bench MarkingDocument66 pagesMateri 9A Bench Markingapi-3756301100% (5)

- BXL22 23437Document1 pageBXL22 23437zilaniPas encore d'évaluation

- Salary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Document2 pagesSalary Slip & Transfer Confirmation: Date: Period: Bank: Account # Name: Title: Dept: Emp #Adheesh SanthoshPas encore d'évaluation

- List of SAP Status CodesDocument19 pagesList of SAP Status Codesmajid D71% (7)

- IP-A1 SiddharthAgrawal 19A2HP405Document2 pagesIP-A1 SiddharthAgrawal 19A2HP405Debanjan MukherjeePas encore d'évaluation

- Kabushi Kaisha Isetan Vs IacDocument2 pagesKabushi Kaisha Isetan Vs IacJudee Anne100% (2)

- MNM3702 Full Notes - Stuvia PDFDocument57 pagesMNM3702 Full Notes - Stuvia PDFMichaelPas encore d'évaluation

- Suse Ha Saphana WPDocument17 pagesSuse Ha Saphana WPaterchenPas encore d'évaluation

- A Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomeDocument1 pageA Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomebiniamPas encore d'évaluation

- Factory Audit ReportDocument33 pagesFactory Audit ReportMudit Kothari100% (1)

- HSC Economics Essay QuestionsDocument5 pagesHSC Economics Essay QuestionsYatharth100% (1)

- Accounting Concepts and Principles PDFDocument9 pagesAccounting Concepts and Principles PDFDennis LacsonPas encore d'évaluation

- Business IdeasDocument9 pagesBusiness IdeasGienelle BermidoPas encore d'évaluation

- Share Holders Right To Participate in The Management of The CompanyDocument3 pagesShare Holders Right To Participate in The Management of The CompanyVishnu PathakPas encore d'évaluation

- Alliance Governance at Klarna: Managing and Controlling Risks of An Alliance PortfolioDocument9 pagesAlliance Governance at Klarna: Managing and Controlling Risks of An Alliance PortfolioAbhishek SinghPas encore d'évaluation

- Saji DDDD DDDDDocument37 pagesSaji DDDD DDDDTalha Iftekhar Khan SwatiPas encore d'évaluation

- Acctg 202 Di Pa FinalDocument10 pagesAcctg 202 Di Pa FinalJoshua CabinasPas encore d'évaluation

- Sps Oco V Limbaring DigestDocument1 pageSps Oco V Limbaring DigestReena MaPas encore d'évaluation

- TOA Reviewer (UE) - Bank Reconcilation PDFDocument1 pageTOA Reviewer (UE) - Bank Reconcilation PDFjhallylipmaPas encore d'évaluation

- BCDR AT&T Wireless CommunicationsDocument17 pagesBCDR AT&T Wireless CommunicationsTrishPas encore d'évaluation

- Unit 4 The Hospitality Industry: Ntroduction To Tourism HMGTDocument44 pagesUnit 4 The Hospitality Industry: Ntroduction To Tourism HMGTdilanocockburnPas encore d'évaluation

- El 1204 HHDocument6 pagesEl 1204 HHLuis Marcelo HinojosaPas encore d'évaluation

- Announcement Invitation For Psychotest (October)Document17 pagesAnnouncement Invitation For Psychotest (October)bgbfbvmnmPas encore d'évaluation

- Aeon Corporate EthicsDocument0 pageAeon Corporate EthicsTan SuzenPas encore d'évaluation

- SM TAYTAY - New Tenant Profile Form PDFDocument2 pagesSM TAYTAY - New Tenant Profile Form PDFtokstutonPas encore d'évaluation

- AccountingDocument13 pagesAccountingbeshahashenafe20Pas encore d'évaluation