Académique Documents

Professionnel Documents

Culture Documents

Etolls-What Will Happen If You Can't Pay

Transféré par

kasturiep15Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Etolls-What Will Happen If You Can't Pay

Transféré par

kasturiep15Droits d'auteur :

Formats disponibles

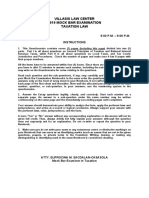

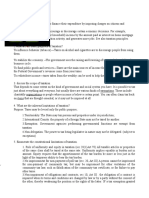

What Will Happen if you Cant/Dont/Wont Pay Etoll Charges?

(Written by Debt Management (info@debtadmin.co.za) for those who Cant/Dont/Wont Pay Etoll Charges). Thank you NewERA (www.newera.org.za). Tony Webbstock is a practicing attorney and has been for 30 years. This is what he has to say about E-tolls. 1. Are Etoll Charges an Example of Bad Government? 1.1. Politicians (especially those chosen by majority rule) should consult with the citizens before st they foist such high charges on them without 1 checking that they can afford them. 1.2. This is the basic problem of democracy - politicians are elected to do the will of the majority but end up (start off?) serving hidden interests! 1.3. That they have committed the nations savings to this hair-brained scheme is nothing short of criminal. 1.4. Who benefits? The Etoll System is an example of someone else other than the taxpayers benefitting from the tax! 2. Cant Pay? 2.1. 2/3 of South African consumers (12 million out of 18 million) are unable to make their current monthly repayments to Creditors as agreed: See the article Rate Cut May be Too Late which nd appeared in The Sunday Independent 22 March 2009 on page 3: Another survey by Unisas bureau for economic research found that for every R10.00 earned, at least R8.40 was spent on debt owed to financial institutions. 2.1.1.Can you run your finances after R8.40 out of every R10.00 (-ie- 16c out of every R1.00 left to you) has been paid to Creditors? 2.1.2.Did the Government consider the inability of motorists to afford the Etoll System before implementation? 2.1.3.It is fair to say that South Africans cant pay more taxes! 3. Dont Pay? 3.1. Now that the Etoll System is rolling from 12/2013, expect an invoice to roll in every 7 days beginning, middle and end of every month month after month, year after year, without 1 iota of consideration having been given to your monthly budget (more money at the beginning of the month and less thereafter if you are balancing you budget). 3.2. If you dont pay each invoice within the 7 day grace period then you lose the discounts making it a nightmare for the Etoll System to give itemised accounts to say nothing about your ability to keep track of what you owe them from time to time! 4. Wont Pay! 4.1. You know that there is something wrong with the Etoll System but, other than the exorbitant Etoll Charges, you cant quite put your finger on it. 4.2. You feel uncomfortable with civil disobedience because you dont know what will happen if you Cant/Dont/Wont Pay Etoll Charges! 5. Non-payment of Etoll Charges is the Equivalent of the Non-Payment of a Traffic Fine: 5.1. Can you go to Jail if you Cant/Dont/Wont Pay Etoll Charges? Debtors cannot be jailed for non-payment of debt - see Coetzee v Government of the Republic of South Africa; Matiso and Others v Commanding Officer, Port Elizabeth Prison, and Others 1995 (4) SA 631 (CC). You can be arrested for failing to appear at a Section 65 (Debtors) Enquiry if the Notice to Appear at Court is served upon you and you ignore it, but only to be brought to Court. 5.2. Fines: The current fine system in use infringement notices, etc - applies to the nonpayment of Etoll Charges. It is unlikely that fines will be issued for failing to pay Etoll Charges as we already have a system which cannot carry the administrative weight to do this. In any event fines dont have to be paid unless a court gives them! And a court wont give them unless you have received notice to appear in court either: 5.2.1.Personally; or 5.2.2.By registered post. 5.3. Metro Police Involvement: Metro Police hardly have the money to print fine books let alone notices to appear in court. In the latter event, should they do this, the Traffic Courts will be clogged and the civil defences set out below will still apply.

5.4. Withholding of Licences: Unless fines are given by court and then not paid, the licensing authorities cannot refuse to withhold the issuing of vehicle licences as is the case at present. 5.5. Collection of Etoll Charges in Traffic (so-called Criminal) Courts: Sanral is trying to create the impression that it will endeavour to collect outstanding Etoll Charges in the Traffic Courts, but there is no provision in the Aarto (Traffic) Act to enable this. 5.6. Section 30 of the Sanral Act: In terms of this section, Sanral will have to sue non-payers for payment of the then outstanding balances on their Etoll Charges in the civil courts. 6. What can You do if You Cant/Dont/Wont Pay Etoll Charges but have to Use the Highways? 6.1. Must road users who Cant/Dont/Wont Pay Etoll Charges stop using the highways when there are no viable alternative routes? 6.2. Our government has: 6.2.1. Hijacking the Highways: The highways are part of our heritage! Those who Cant pay the Etoll Charges have effectively been terrorised by the high charges into thinking that they cant use them! 6.2.2. Taxing the Air: If the politicians decide to tax the air without consulting us and without providing an alternative source, must current air users who cant pay the air tax stop breathing? 6.2.3. Squeezing the Golden Goose: Gauteng is the hub of South African commerce. Look at the number of vehicles that use the highways each day. Consider the exorbitant Etoll Charges that motorists have to pay each day on top of their existing Monthly Necessary Expenses! 6.2.4. Zimbabwe here we Come: We have seen the damage 1 clown at play can do to a nation in 20 short years proving that it is far easier to break an engine than build it up! 7. Defences to a Claim by Sanral for Non-Payment of Etoll Charges: 7.1. The Cant Pay Defence: 7.1.1. Action instituted against those who cant pay Etoll Charges having regard to their Monthly Income & Expenditure / Assets & Liability Form, cant pay Etoll Charges! This fact does not change by virtue of the fact that action is instituted. 7.1.2. The fact that they cannot pay does not mean that they must stop using the highways! It just means that they cannot pay to do so! 7.2. The Affordable Repayment Defence: 7.2.1. Having regard to some road users budgets, it will appear at a Section 65 (Debtors) Financial Enquiry that some of those who Cant/Dont/Wont Pay Etoll Charges can in fact pay something towards the outstanding Etoll account at that time. 7.2.2. This can take up to 4(four) years to appear at the enquiry. 7.2.3. In the meanwhile, and thereafter, the Etoll debtors can continue using the highways! 7.3. The National Credit Act Defence: 7.3.1. Sanral is a credit provider as defined under the NCA; 7.3.2. Sanral enters into a credit agreement as defined under the NCA with road users (consumers) without enquiring into 7.3.2.1. their proposed future use of the Etoll System; or 7.3.2.2. their financial abilities to pay for Etoll Charges whether discounted or not; 7.3.3. Entering into an agreement with consumers would be Reckless Lending on the part of Sanral. 7.3.4. Consumers who cant/dont/wont pay Etoll Charges cant enter into Sanral credit agreements knowing that they wont be able to pay same and so making themselves parties to Reckless Lending. This could lead to them losing the Reckless Lending penalties under the NCA. 7.4. The Consumer Protection Act Defence: 7.4.1. Section 48 of the CPA provides that (1) A supplier must not (a) offer to supply, supply, or enter into an agreement to supply, any goods or services (i) at a price that is unfair, unreasonable or unjust; or (ii) on terms that are unfair, unreasonable or unjust; (b) market any goods or services, or negotiate, enter into or administer a transaction or an agreement for the supply of any goods or services, in a manner that is unfair, unreasonable or unjust; or (c) require a consumer, or other person to whom any goods or services are

supplied at the direction of the consumer (i) to waive any rights; (ii) assume any obligation; or (iii) waive any liability of the supplier, on terms that are unfair, unreasonable or unjust, or impose any such terms as a condition of entering into a transaction. 7.4.2. Are Etolls Unjust/Unfair/Unreasonable? 7.4.2.1. Sanrals service, charges and discounts contravene Section 48(a), (b) or (c) of the CPA; 7.4.2.2. Consumers cannot enter into Sanrals credit agreements without a financial enquiry being held havng regard to their proposed road use! 7.4.2.3. There are many billing errors that Sanral cant / doesnt correct! 7.4.2.4. The Etoll System violates the basic toll road principle that viable alternative routes must be provided; 7.4.2.5. No provision has been made for those road users who cant afford the service! 7.4.2.6. The main arterial routes are involved! 7.4.2.7. The Etoll Charges are exorbitant! 7.4.2.8. The Etoll Charges are unaffordable to most road users; 7.4.2.9. It is a private tax system, not a government tax system; 7.4.2.10. No details regarding who benefits behind the system have been given; 7.4.2.11. The payment periods are unreasonable; 7.4.2.12. The discount system of attempted collection is extortionate; 7.5. The Prescription Defence: 7.5.1. Etoll Charges from 12/2013 will begin to prescribe in 12/2016 (3 years later) if you dont make payment on your account during this period; and 7.5.2. Thereafter, Etoll Charges will become extinguished (ie- become Prescribed (NonExistent) Debt after the 3 year period on a month by month basis for which you cannot be sued (if you have not made a single payment during this period!). 7.5.3. Payment made after 12/2016 in respect of the Etoll Charges that have prescribed cannot revive Prescribed (Non-Existent) Debt! 7.5.4. Any payment made before 12/2016 will interrupt (re-start the running of) prescription in terms of Section 14 of the Prescription Act from the beginning ie- from 12/2013.; 7.6. The Failure to Send out an Invoice Defence: 7.6.1. Sanral must follow road use with an invoice sent out within 7 days setting out their charges before the charges become due and a road user becomes liable for the payment of Etoll Charges. 7.6.2. Sanral are sending out invoices by ordinary post; 7.6.3. How is Sanral going to prove that they sent out invoices at all if receipt is denied? 7.6.4. The postal service is notoriously unreliable! 7.7. The Itemised Account Defence: 7.7.1. The Etoll System is cumbersome to say the least! Considering Sanral trying to keep up with it all, it would have been easier for them to disrupt road users by manual tolls here and there. 7.7.2. However, to collect Sanral will have to prove on a gantry by gantry basis: : 7.7.2.1. road usage; and 7.7.2.2. levies; and 7.7.2.3. invoice posting; and 7.7.2.4. payment; and 7.7.2.5. discount; and 7.7.2.6. discount write back; and 7.7.2.7. running balance; and 7.7.2.8. collection attendances, inter alia. 7.7.3. This is enough to keep them busy. See paragraph #8.2 below. 8. Suggested Steps to be Followed by those Who Cant/Dont/Wont Pay Etoll Charges: 8.1. Stick to your Decision Not to Pay: see the above Prescription Defence in paragraph #7.5 above. Once you make payment without a court order see paragraph #7.1 and 7.2 above prescription is interrupted and must start again. 8.2. Sanral Cant/Wont Sue those who Cant/Dont/Wont Pay Etoll Charges:

8.2.1. Sanral is geared up to follow the usual Informal Collection Proceedings like sms, letters, invoices, etc. 8.2.2. On top of what Sanral has to do to collect its day to day Etoll Charges set out in #7.7.2 above, it is not geared up to sue consumers who Cant/Dont/Wont Pay Etoll Charges; 8.2.3. Sanral will have to sell their unpaid accounts to debt collection companies who are better able to collect; 8.2.4. These debt collection companies cannot buy better rights than Sanral has at the time of sale and the same defences as set out above will still apply to their collection efforts. 8.2.5. So Debt Collectors will try in turn to bamboozle the poor consumer by the usual Informal Collection Proceedings like telephone calls, unbelievable settlement offers and scare / threat tactics into making payment of Prescribed (Non-Existent) Debt! As Outa president Duvenhage said recently its a circus! 8.3. Every Formal Collection Proceeding whether by Sanral or a debt collection company should be defended using one or more of the defences set out above. 8.4. Dont sign anything now or in the future no matter what they tell you eg that you have to sign by law / that it is only a letter to say that they saw you / that they will lock you up, etc. They are trying to get you to sign an acknowledgement of debt or a Garnishee (Salary Deduction) Order. It is easier not to sign now than it is to rectify later! 9. Humpty Dumty 9.1. Humpty Dumpty sat on a wall, Humpty Dumpty had a great fall!, All the king' s horses and all the King' s men, Couldn' t put Humpty together again.... 9.2. It is going to be interesting to see how Government, good or bad, tries to put Humpty together again considering the Rat Cage Effect: 9.2.1. Only businesses will pay Etoll Charges consistently because they think that they will be able to increase their product prices to recover Etoll Charges from those who Cant/Dont/Wont Pay Etoll Charges and from those few who do but are now a good deal poorer; 9.2.2. Sales will dip sharply called stagflation and businesses will have to increase prices to keep their turnovers the same to balance their books (now with Etoll Charges daarby!). 9.2.3. Investors will see profits eaten into and will withdraw their investments; 9.2.4. The Rand will drop further against our trading partners making imports more expensive which will force importers in turn to increase their prices which will force businesses to increase their prices in turn and so on; 9.3. Its a merry-go-round within a circus! 9.4. All things considered, its easier to submit to Jesus and follow his advice (2 Chronicles 7:14) than it is to write this wrong! 10. What is the Solution to a Whole Bunch of Clowns playing on a Merry-go-round in a Circus? 10.1. Dont give up! Never give up! th 10.2. On 5 May 2008, President Zuma said that the ANC would rule until Jesus returns! Writer agrees! 10.3. Jesus is the Messiah / the Christ / the Saviour who rode into Jerusalem on a donkey in fulfilment of the ancient prophecy contained in Zechariah 9.9. Any future claimant to the title Messiah / the Christ / the Saviour will have to do likewise which is unlikely to say the least!! 10.4. Jesus will return with a great cloud of witnesses (Hebrews 12.1) to rule & reign for the benefit of the rich and the poor for 1000 years (Revelation 20/.6)!

11. What Will Happen if you Cant/Dont/Wont Pay Other B-Creditor Debt?

st

11.1. Always remember - your 1 duty to you and your family is to protect your A-Creditors like bond, vehicle and mother-in-law! 11.2. For more information on how to do so - info@debtadmin.co.za

Vous aimerez peut-être aussi

- Citizens' Charter Bill 2011: Salient Features and Criticism ExplainedDocument8 pagesCitizens' Charter Bill 2011: Salient Features and Criticism ExplainedRohanKanhaiPas encore d'évaluation

- Judicial Perfidies 29Document5 pagesJudicial Perfidies 29Raviforjustice RaviforjusticePas encore d'évaluation

- Income Taxation by NickAduana (Answer Key)Document113 pagesIncome Taxation by NickAduana (Answer Key)Samantha Andrea Grefaldia100% (2)

- VAT on Toll Fees CaseDocument7 pagesVAT on Toll Fees CaseR.A. GregorioPas encore d'évaluation

- Approaching A Consumer CourtDocument25 pagesApproaching A Consumer CourtAmit NagaichPas encore d'évaluation

- Income Taxation by Nick Aduana Answer KeyDocument113 pagesIncome Taxation by Nick Aduana Answer KeyJonbon Tabas100% (1)

- Tax Aversion Explained: Causes and SolutionsDocument2 pagesTax Aversion Explained: Causes and SolutionsMazharul Islam AnikPas encore d'évaluation

- Right To Information Act of 2005: A PrimerDocument12 pagesRight To Information Act of 2005: A PrimercdbngrPas encore d'évaluation

- Ch8. RIGHT TO INFORMATION ACT, 2005Document5 pagesCh8. RIGHT TO INFORMATION ACT, 2005sks.in109Pas encore d'évaluation

- How To Submit A RTI ComplaintDocument7 pagesHow To Submit A RTI Complaintghantemahebub006Pas encore d'évaluation

- A. Not Filing Income Tax ReturnsDocument4 pagesA. Not Filing Income Tax ReturnsNishchal AnandPas encore d'évaluation

- General Principles and Scope of TaxationDocument9 pagesGeneral Principles and Scope of TaxationBianca TolosaPas encore d'évaluation

- Ampongan SolmanDocument25 pagesAmpongan SolmanNikolina100% (2)

- Tax Answer BankDocument13 pagesTax Answer BankShadreck VanganaPas encore d'évaluation

- Basic Principles - What You Need To KnowDocument2 pagesBasic Principles - What You Need To KnowMayla Masxcxl100% (1)

- Taxation Lecture by DR LimDocument3 pagesTaxation Lecture by DR LimPatricia Blanca Ramos0% (1)

- Guanlao Post Test ReviewsDocument2 pagesGuanlao Post Test Reviewslena cpaPas encore d'évaluation

- TAXATION - PrelimsDocument8 pagesTAXATION - PrelimsPrincess Dianne CamachoPas encore d'évaluation

- Taxation B QDocument6 pagesTaxation B QChampo RadoPas encore d'évaluation

- Philippine Tax PrinciplesDocument25 pagesPhilippine Tax PrinciplesEuli Mae SomeraPas encore d'évaluation

- Chinta Mukti: .Ctor OrationDocument7 pagesChinta Mukti: .Ctor OrationRudradeep DuttaPas encore d'évaluation

- Aug. 8 TAX MOCK BARDocument21 pagesAug. 8 TAX MOCK BARjessi berPas encore d'évaluation

- SOP For Tackling Fake InvoiceDocument7 pagesSOP For Tackling Fake InvoiceTHABIRA BAGPas encore d'évaluation

- Test 8 Case Studies 23Document22 pagesTest 8 Case Studies 23amaPas encore d'évaluation

- Money Matters EssaysDocument34 pagesMoney Matters Essayslong vichekaPas encore d'évaluation

- One Has To Follow The Following Guidelines While Filing 1st Appeal Under Right To Information Act 2005Document44 pagesOne Has To Follow The Following Guidelines While Filing 1st Appeal Under Right To Information Act 2005Hori LalPas encore d'évaluation

- Bolt Business Terms and ConditionsDocument4 pagesBolt Business Terms and ConditionsRazvanPas encore d'évaluation

- CentralDocument4 pagesCentralAbhishek VashisthPas encore d'évaluation

- Pembagian Jenis Pajak Berdasarkan Lembaga Pemungut PajakDocument13 pagesPembagian Jenis Pajak Berdasarkan Lembaga Pemungut PajakIkhsan Gayo GrandPas encore d'évaluation

- Diaz vs. Secretary of Finance (July 19, 2011)Document8 pagesDiaz vs. Secretary of Finance (July 19, 2011)chrisPas encore d'évaluation

- My Class NotesDocument56 pagesMy Class NotesKavan PatelPas encore d'évaluation

- Tax Notes (Judge B - June 20, 2019) PDFDocument4 pagesTax Notes (Judge B - June 20, 2019) PDFlorelei louisePas encore d'évaluation

- Basic Concepts of Income Tax - Direct vs Indirect TaxesDocument33 pagesBasic Concepts of Income Tax - Direct vs Indirect TaxesDhananjay KumarPas encore d'évaluation

- C.2 - Diaz v. Secretary of FinanceDocument15 pagesC.2 - Diaz v. Secretary of FinanceKristine Irish GeronaPas encore d'évaluation

- Tax Evasion, Tax Avoidance and Tax PlanningDocument20 pagesTax Evasion, Tax Avoidance and Tax PlanningGeetanjali KashyapPas encore d'évaluation

- TAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanDocument6 pagesTAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanPatrick GuetaPas encore d'évaluation

- A Journey To A Research of The TaxationDocument22 pagesA Journey To A Research of The TaxationDanica LusungPas encore d'évaluation

- 87.diaz Vs SecretaryDocument9 pages87.diaz Vs SecretaryClyde KitongPas encore d'évaluation

- Tax 2 VAT CASESDocument136 pagesTax 2 VAT CASEScezz2386Pas encore d'évaluation

- 1_General Principles and Concepts of TaxationDocument10 pages1_General Principles and Concepts of TaxationLovella Dolor LastrellaPas encore d'évaluation

- SalesDocument120 pagesSalespit1xPas encore d'évaluation

- Advantages of Direct TaxesDocument3 pagesAdvantages of Direct TaxesIryna HoncharukPas encore d'évaluation

- Tax Policy Admin MCQDocument22 pagesTax Policy Admin MCQSong OngPas encore d'évaluation

- Diaz v. SOF, GR 193007, 2011Document12 pagesDiaz v. SOF, GR 193007, 2011Santos, CarlPas encore d'évaluation

- 10 Generic English RtiDocument7 pages10 Generic English RtiMalathy KrishnanPas encore d'évaluation

- Taxation LawDocument38 pagesTaxation Lawmrfreak2023Pas encore d'évaluation

- Solutions to Common Problems Faced by Co-operative Housing SocietiesDocument12 pagesSolutions to Common Problems Faced by Co-operative Housing SocietiesPrasadPas encore d'évaluation

- Taxguru - In-How To Write A Reply To Show Cause Notice Under GSTDocument4 pagesTaxguru - In-How To Write A Reply To Show Cause Notice Under GSTMSFPas encore d'évaluation

- 10 steps reduce corruptionDocument2 pages10 steps reduce corruptionMohana RamasamyPas encore d'évaluation

- Taxation ProjectDocument12 pagesTaxation ProjectSagar DhanakPas encore d'évaluation

- Understanding GST: Benefits, Registration Process & Electronic Credit LedgerDocument8 pagesUnderstanding GST: Benefits, Registration Process & Electronic Credit LedgerFlemin GeorgePas encore d'évaluation

- United Nations Convention Against CorruptionDocument9 pagesUnited Nations Convention Against CorruptionRavinder Singh100% (1)

- Examples of Open Questions Principles of TaxationDocument4 pagesExamples of Open Questions Principles of TaxationChristus MbayaPas encore d'évaluation

- Ethiopian Police UniversityDocument12 pagesEthiopian Police Universitynigus goezayehuPas encore d'évaluation

- Taxation (Lecture 1)Document10 pagesTaxation (Lecture 1)Criselda TeanoPas encore d'évaluation

- Object 1 Object 2Document5 pagesObject 1 Object 2icccPas encore d'évaluation

- The IRS Problem Solver: From Audits to Assessments—How to Solve Your Tax Problems and Keep the IRS Off Your Back ForeverD'EverandThe IRS Problem Solver: From Audits to Assessments—How to Solve Your Tax Problems and Keep the IRS Off Your Back ForeverÉvaluation : 2 sur 5 étoiles2/5 (1)

- Resume Template2Document5 pagesResume Template2kasturiep15Pas encore d'évaluation

- Resume Template10Document1 pageResume Template10Kasturie PillayPas encore d'évaluation

- How Rapid Prototyping (3D Printing) WorksDocument1 pageHow Rapid Prototyping (3D Printing) WorksKasturie PillayPas encore d'évaluation

- Mobile Machines PDFDocument6 pagesMobile Machines PDFKasturie PillayPas encore d'évaluation

- How Will Customers Form An Emotional Bond With Cars That Drive ThemselvesDocument2 pagesHow Will Customers Form An Emotional Bond With Cars That Drive Themselveskasturiep15Pas encore d'évaluation

- My Shopping List - 05 Sep 2011 PDFDocument1 pageMy Shopping List - 05 Sep 2011 PDFkasturiep15100% (1)

- Liberty PDFDocument7 pagesLiberty PDFkasturiep15Pas encore d'évaluation

- Schaums 2500 Problemas Resueltos de Mecanica de Fluidos e HidrulicaDocument807 pagesSchaums 2500 Problemas Resueltos de Mecanica de Fluidos e HidrulicaJ Andres Gonzalez83% (23)

- Leading Australian Supplier of Pipes, Valves and FittingsDocument1 pageLeading Australian Supplier of Pipes, Valves and Fittingsdragos_aeroPas encore d'évaluation

- Tutorial LetterDocument11 pagesTutorial Letterkasturiep15Pas encore d'évaluation

- Frontierel PricelstDocument17 pagesFrontierel Pricelstkasturiep15Pas encore d'évaluation

- Thermodynamics - Assignment 1Document10 pagesThermodynamics - Assignment 1kasturiep15Pas encore d'évaluation

- THD291Z 2009 10 e 1Document15 pagesTHD291Z 2009 10 e 1kasturiep15Pas encore d'évaluation

- My Reg CSETDocument189 pagesMy Reg CSETkasturiep15Pas encore d'évaluation

- Marie Campbell: Web DesignerDocument1 pageMarie Campbell: Web DesignerAli hossain AkashPas encore d'évaluation

- FSK Demodulator With PLLDocument5 pagesFSK Demodulator With PLLHema100% (1)

- Sample Demand LetterDocument3 pagesSample Demand LetterShaniemielle Torres-BairanPas encore d'évaluation

- Politics FinalDocument29 pagesPolitics Finalmaychelle mae camanzoPas encore d'évaluation

- Lecture 3 - Evolution of Labour Laws in IndiaDocument13 pagesLecture 3 - Evolution of Labour Laws in IndiaGourav SharmaPas encore d'évaluation

- Introducing Global PoliticsDocument8 pagesIntroducing Global PoliticsMeann Joy BaclayonPas encore d'évaluation

- Speech ExamplesDocument6 pagesSpeech Examplesjayz_mateo9762100% (1)

- The Power Elite and The Secret Nazi PlanDocument80 pagesThe Power Elite and The Secret Nazi Planpfoxworth67% (3)

- Logiq 180 UsuarioDocument414 pagesLogiq 180 UsuariolaboratorioelectroPas encore d'évaluation

- TruShot Product Sheet-05-18 PDFDocument2 pagesTruShot Product Sheet-05-18 PDFAgostina MiniPas encore d'évaluation

- MSDS Orec OzoneDocument2 pagesMSDS Orec OzoneHerni SuharniriyantiPas encore d'évaluation

- Institute of Actuaries of India declares CT1 exam resultsDocument18 pagesInstitute of Actuaries of India declares CT1 exam resultsRohit VenkatPas encore d'évaluation

- Jaclyn Hanley ResumeDocument2 pagesJaclyn Hanley Resumeapi-267867788Pas encore d'évaluation

- Ramdump Modem 2021-06-26 00-06-27 PropsDocument15 pagesRamdump Modem 2021-06-26 00-06-27 PropsKoikoiPas encore d'évaluation

- Vda. de Villanueva vs. JuicoDocument3 pagesVda. de Villanueva vs. JuicoLucas Gabriel Johnson100% (1)

- Clovis Horse Sales Spring 2013 CatalogDocument56 pagesClovis Horse Sales Spring 2013 CatalogClovis Livestock AuctionPas encore d'évaluation

- A. RSQM (DQ-029)Document350 pagesA. RSQM (DQ-029)deso tblPas encore d'évaluation

- Banking DictionaryDocument499 pagesBanking DictionaryVanessa Jenkins100% (4)

- Final Eligible Voters List North Zone 2017 118 1Document12 pagesFinal Eligible Voters List North Zone 2017 118 1Bilal AhmedPas encore d'évaluation

- (Lecture 10 & 11) - Gearing & Capital StructureDocument18 pages(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarPas encore d'évaluation

- Valve Position Monitors: APL 5 Series CSA Approved Type 4X/6Document12 pagesValve Position Monitors: APL 5 Series CSA Approved Type 4X/6Torres Toledo JttPas encore d'évaluation

- 2011 Ringgold County Fair EditionDocument16 pages2011 Ringgold County Fair EditionMountAyrRecordNewsPas encore d'évaluation

- Daily Timecard Entry in HoursDocument20 pagesDaily Timecard Entry in HoursadnanykhanPas encore d'évaluation

- Module 7Document2 pagesModule 7prof_ktPas encore d'évaluation

- Chapter 8 OkDocument37 pagesChapter 8 OkMa. Alexandra Teddy Buen0% (1)

- 280Document6 pages280Alex CostaPas encore d'évaluation

- Lala Lajpat Rai College: Public Relations Project Rough Draft Topic: Nike V/S AdidasDocument34 pagesLala Lajpat Rai College: Public Relations Project Rough Draft Topic: Nike V/S AdidasNikitha Dsouza75% (4)

- Competition Patriotism and Collaboratio PDFDocument22 pagesCompetition Patriotism and Collaboratio PDFAngga PrianggaraPas encore d'évaluation

- AirROC T35 D45 D50 Tech SpecDocument4 pagesAirROC T35 D45 D50 Tech SpecmdelvallevPas encore d'évaluation

- ArraysDocument36 pagesArraysKAMBAULAYA NKANDAPas encore d'évaluation