Académique Documents

Professionnel Documents

Culture Documents

Tax Planning

Transféré par

pushpen5115Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Planning

Transféré par

pushpen5115Droits d'auteur :

Formats disponibles

You are your own boss Self-employment can be an interesting proposition as you g et to play your own boss.

Not just that, a self-employed person can also have in come that is more tax efficient by at least 15% as against similar salary income . Under the tax laws, the income of a self-employed person (freelance writer/jou rnalist, independent consultant, businessman , professional) would fall under th e head of income from business or profession. If you are self-employed , here ar e a few tips that will help you enhance your tax efficiency. Take full advanta ge of all business expenses All your work/business related expenses can be claim ed as business expenses. Vouchers/bills would be required to support expenses an d hence book keeping is important for this category. A variety of expenses inclu ding rent or home office expense, travel costs, communication costs (telephone, internet), business meetings, supplies and utilities can be claimed as expenses. For being deductible , expenses must be both ordinary (common and accepted) and necessary (appropriate and helpful) in your work/business. If such expenses are incurred partly for work purposes and partly for personal purposes, you can ded uct only the workrelated portion. One can also claim depreciation on work relate d assets like laptops/computers , furniture, UPS and vehicles. Hence bills of ca pital expenditures should also be maintained. Bad business debts may also be wri tten off. Losses can also be carried forward for 8 years. Distribution of inco me If you have family members who can help in various aspects of your business , it makes sense to employ them (legitimately ) and offer an appropriate remunera tion . By hiring a family member to work, you will effectively shift a part of y our income to your relative. Your business can take a deduction for reasonable c ompensation paid to an employee , which in turn reduces the amount of taxable bu siness income that flows through to you. One can also form a Hindu Undivided Fam ily (HUF) as a separate entity, which helps further distribute income to this en tity as well. Availing deductions Normal deductions are allowed for self-emplo yed individuals . Section 80C allows investments in PPF (Public Provident Fund), insurance /unit linked insurance plans, pension plans, ELSS (equity linked savi ngs scheme), NSC (National Savings Certificate), infrastructure bonds, FDs (fixe d deposits ) apart from home loan principal repayment. Tuition fees for your chi ld s education can also be claimed. The overall limit of this section is Rs 1 lakh. Section 80D provides deduction for medical insurance premiums of oneself and fam ily upto Rs 15,000. An additional Rs 15,000 can be claimed towards medical premi ums of parents. If you are staying in a rented home you can claim the rent paid as deduction u/s 80GG, upto Rs 24,000, based on certain conditions. If you buy a house, you can claim a deduction of upto Rs 1.5 lakh on interest paid. Hedge your risk & save taxes It is important to have appropriate life insurance cover to offer protection for family, especially since there would be no benefits from the company (if one were salaried) that would have accumulated . If you have li abilities, cover your insurance policy under the Married Women s Property Act, so th at the proceeds of the policy cannot be attached in case of inability to repay l oans. Avail a family floater policy with reasonable cover to protect your family from any major medical costs that might arise. The premiums paid towards life a nd health policies will provide for tax breaks u/s 80C and 80D. TIPS A self em ployed person can enjoy great tax efficiency if his/her finances are well planne d. Remember to avail of depreciation benefits on capital expenditure. Look at wa ys of distributing income within the family and by using the HUF structure. Give priority to tax saving avenues that have the one time payment option and avoid large commitments if your income is irregular. Read more at: http://www.caclubindia.com/forum/tax-planning-for-self-employed-25 380.asp#.UuqfNNKSxBk

The Income Tax Act states, 'Profession implies apparent achievement in special k nowledge as distinguished from mere skill, special knowledge has to be acquired only after study and application.' It covers doctors, lawyers, engineers, architects, accountants, consulting engin eers, artists, musicians, singers and interior decorators, et cetera. These prof essionals also need to file their taxes. How is tax accounted? Mercantile system: Here net profit or loss is calculated after taking into consi deration all income and expenses of a particular accounting period irrespective of whether or not income was received or expenses paid during that accounting pe riod. Cash system: Here a record has to be kept of actual receipts and actual payments of a particular year. Click NEXT to read on. . .

Permissible deductions: Rent, rates, taxes, repairs and insurance of premises utilized for the professio n. Repairs, depreciation and insurance of machinery, plant and furniture utilized f or the profession. Expenditure in respect of scientific research, like in-house research, contribut ion to an approved university, college, or association, etc. Premium in respect of insurance against risk of damage or destruction of stock a nd stores used for profession. Premium in respect of health insurance of the employees. Bonus and commission to employees. Interest on capital borrowed for profession. Contribution to a recognised provident fund or an approved gratuity fund. Bad debts related to the profession. -- Bad debts have to be written off as 'una ble to recover' in the books by the assessee in the previous year. Banking cash transaction tax, securities transaction tax and commodities transac tion tax are allowed as deductions. Any expenditure (not capital and personal) incurred wholly and exclusively for t he profession and within the legal rules. Click NEXT to read on. . .

Expenses not allowed as deduction are: Expenditure on advertisement in any souvenir, etc. of a political party. Any interest, salary, royalty, fees for technical services or other sum payable outside India from which TDS as not been deducted. Any tax calculated on the basis of profits or gains of profession, e.g. income t ax; Wealth tax. Expenses exceeding Rs 20,000, e.g.: X pays Rs 6,000 Rs 20,000 and Rs 20,500 by a ccount payee cheques.

As per income tax, Rs 20,500 paid by bearer cheque will be disallowed. Hence, it is best to pay amounts exceeding Rs 20,000 by cheque. Click NEXT to read on. . .

Things to keep in mind Book-keeping requirements Case 1: If the gross receipts are less that Rs 1.50 lakh (Rs 150,000), the asses see has to maintain his accounts which enables the Income Tax official to comput e the taxable Income. Case 2: If the gross receipts exceed Rs 1.50 lakh, the assessee has to maintain books of accounting like the cash book, journal, ledger, copies of bills exceedi ng Rs 25. Accounts should be maintained either on mercantile basis or cash basis . In case of professional income, accounts have to be audited if gross receipts ex ceed Rs 10 lakh (Rs 1 million). This audit report should be submitted along with the income tax return, before September 30. PAN: Every person whose total sales, turnover or gross receipts are over Rs 500, 000 are required to apply and obtain a Permanent Account Number (PAN). Click NEXT to read on. . .

Advance tax: Since a professional earns his own income, there is no TDS. Hence, he is liable to pay advance tax as he earns income. Thus, advance tax is payable on the basis of estimated income of the current financial year. Advance tax is payable only in cases where tax payable is in excess of Rs 5,000. Payment of advance tax: 30% on or before September 15. 30% on or before December 15. Remaining 40% on or before March 15. If there was shortfall in earlier installment, it should be made up in subsequen t installment Due dates for filing returns: Assessee having income from profession but who do not have to get the accounts a udited under Income Tax or any other law has to file returns by 31st July. Assessee who gets his accounts audited has to file returns by September 30. Return Form : Form ITR 4 needs to be utilized to file returns and can be submitted to either i

n the physical form or in the electronic form with a digital signature.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 1 - N - Thread - On - #Thekashmirfiles - Thread - by - Aabhas24 - Mar 16, 22 - From - RattibhaDocument14 pages1 - N - Thread - On - #Thekashmirfiles - Thread - by - Aabhas24 - Mar 16, 22 - From - Rattibhapushpen5115Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Adhhar Application FarmDocument2 pagesAdhhar Application FarmjaigodaraPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Algo - Strategies-OrbDocument2 pagesAlgo - Strategies-Orbpushpen5115Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A - Complete - Thread - On - Thread - by - Baha1729 - Feb 14, 23 - From - RattibhaDocument9 pagesA - Complete - Thread - On - Thread - by - Baha1729 - Feb 14, 23 - From - Rattibhapushpen5115Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Enrolment Center SearchDocument1 pageEnrolment Center Searchpushpen5115Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Probiotic-Based Cultivation of Clarias B PDFDocument12 pagesProbiotic-Based Cultivation of Clarias B PDFpushpen5115Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Multilayer Farming NotesDocument14 pagesMultilayer Farming Notespushpen5115Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Novel Biofloc Technology (BFT) For Ammonia Assimilation and Reuse in Aquaculture in Situ - IntechOpenDocument22 pagesNovel Biofloc Technology (BFT) For Ammonia Assimilation and Reuse in Aquaculture in Situ - IntechOpenpushpen5115Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Odia GlossaryDocument5 pagesOdia Glossarypushpen5115Pas encore d'évaluation

- Aadhaar Enrolment Correction Form VersionDocument6 pagesAadhaar Enrolment Correction Form VersionFaizan SheikhPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Performance of An Intensive Nursery SystDocument14 pagesPerformance of An Intensive Nursery Systpushpen5115Pas encore d'évaluation

- Nested Generic Type - Generics Basics Generics Java TutorialDocument3 pagesNested Generic Type - Generics Basics Generics Java Tutorialpushpen5115Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Under Deconstruction - The State of Shopify's Monolith - Shopify EngineeringDocument20 pagesUnder Deconstruction - The State of Shopify's Monolith - Shopify Engineeringpushpen5115Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

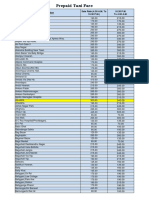

- Taxi FareDocument9 pagesTaxi Farepushpen5115Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Fishes: Administration of Probiotics in The Water in Finfish Aquaculture Systems: A ReviewDocument13 pagesFishes: Administration of Probiotics in The Water in Finfish Aquaculture Systems: A Reviewpushpen5115Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Managing Residual Herbicide RisksDocument18 pagesManaging Residual Herbicide Riskspushpen5115Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Uk ProductsDocument79 pagesUk Productspushpen5115Pas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Java - How To Send Multiple Asynchronous Requests To Different Web Services - Stack OverflowDocument8 pagesJava - How To Send Multiple Asynchronous Requests To Different Web Services - Stack Overflowpushpen5115Pas encore d'évaluation

- Netbeans Installation Guide PDFDocument12 pagesNetbeans Installation Guide PDFpushpen5115Pas encore d'évaluation

- Opening and Closing RankDocument2 pagesOpening and Closing Rankpushpen5115Pas encore d'évaluation

- Open Source Point of Sale - Powered by OSPOS 3.0Document1 pageOpen Source Point of Sale - Powered by OSPOS 3.0pushpen5115Pas encore d'évaluation

- How To Manage A Cloud Server With VestaCPDocument12 pagesHow To Manage A Cloud Server With VestaCPpushpen5115Pas encore d'évaluation

- Opening and Closing Rank-GeneralDocument2 pagesOpening and Closing Rank-Generalpushpen5115Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Retail prices for over 10,000 productsDocument465 pagesRetail prices for over 10,000 productspushpen5115Pas encore d'évaluation

- Guidance for POLITICAL SCIENCE optionalDocument4 pagesGuidance for POLITICAL SCIENCE optionalpushpen5115Pas encore d'évaluation

- 1611Document2 pages1611pushpen5115Pas encore d'évaluation

- Derivatives Involving Absolute ValueDocument2 pagesDerivatives Involving Absolute ValuelfcguardPas encore d'évaluation

- 2nd Syllabi XIIDocument9 pages2nd Syllabi XIIpushpen5115Pas encore d'évaluation

- IIT JEE SyllabusDocument6 pagesIIT JEE Syllabuspushpen5115Pas encore d'évaluation

- Jee Main2013keyDocument35 pagesJee Main2013keypushpen5115Pas encore d'évaluation

- Technical Report 2014 0055Document25 pagesTechnical Report 2014 0055Trisno SupriyantoroPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Description of The Prophet's Fast - Ahlut-Tawhid PublicationsDocument22 pagesThe Description of The Prophet's Fast - Ahlut-Tawhid PublicationsAuthenticTauheed PublicationsPas encore d'évaluation

- BasketballDocument24 pagesBasketballnyi waaaah rahPas encore d'évaluation

- Zeal Court Acid Attack AppealDocument24 pagesZeal Court Acid Attack Appealshanika33% (3)

- Premachandra and Dodangoda v. Jayawickrema andDocument11 pagesPremachandra and Dodangoda v. Jayawickrema andPragash MaheswaranPas encore d'évaluation

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordPas encore d'évaluation

- Expert committee review engineering projectsDocument4 pagesExpert committee review engineering projectsSyed AhmedPas encore d'évaluation

- Authum Infra - PPTDocument191 pagesAuthum Infra - PPTmisfitmedicoPas encore d'évaluation

- v2.6 CCURE Simplex Integration RN 8200-1191-99A0Document5 pagesv2.6 CCURE Simplex Integration RN 8200-1191-99A0Rafael RojasPas encore d'évaluation

- Me Review: Von Eric A. Damirez, M.SCDocument25 pagesMe Review: Von Eric A. Damirez, M.SCKhate ÜüPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- AACC and Proactive Outreach Manager Integration - 03.04 - October 2020Document59 pagesAACC and Proactive Outreach Manager Integration - 03.04 - October 2020Michael APas encore d'évaluation

- Complaint Against Ashok Sangwan, IAS For His Double Standards - Naresh KadianDocument10 pagesComplaint Against Ashok Sangwan, IAS For His Double Standards - Naresh KadianNaresh KadyanPas encore d'évaluation

- Proposed Rule: Income Taxes: Partnership Equity For ServicesDocument9 pagesProposed Rule: Income Taxes: Partnership Equity For ServicesJustia.comPas encore d'évaluation

- Life of Nelson Mandela, Short Biography of Nelson Mandela, Nelson Mandela Life and Times, Short Article On Nelson Mandela LifeDocument4 pagesLife of Nelson Mandela, Short Biography of Nelson Mandela, Nelson Mandela Life and Times, Short Article On Nelson Mandela LifeAmit KumarPas encore d'évaluation

- Sec - Governance ReviewerDocument4 pagesSec - Governance ReviewerAngela Abrea MagdayaoPas encore d'évaluation

- Ordinance IntroducedDocument3 pagesOrdinance IntroducedAlisa HPas encore d'évaluation

- Ato v. Ramos CDDocument2 pagesAto v. Ramos CDKaren AmpeloquioPas encore d'évaluation

- Far Eastern Bank (A Rural Bank) Inc. Annex A PDFDocument2 pagesFar Eastern Bank (A Rural Bank) Inc. Annex A PDFIris OmerPas encore d'évaluation

- Abella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Document4 pagesAbella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Inday LibertyPas encore d'évaluation

- Financial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterDocument202 pagesFinancial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterVISHNUKUMAR S VPas encore d'évaluation

- Vol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandDocument10 pagesVol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandPMVPas encore d'évaluation

- Spec Pro Case DoctrinesDocument4 pagesSpec Pro Case DoctrinesRalph Christian UsonPas encore d'évaluation

- Digital Forensic Tools - AimigosDocument12 pagesDigital Forensic Tools - AimigosKingPas encore d'évaluation

- RBM ListDocument4 pagesRBM ListEduardo CanelaPas encore d'évaluation

- Pacific University Under Federal Investigation For Excluding White PeopleDocument3 pagesPacific University Under Federal Investigation For Excluding White PeopleThe College FixPas encore d'évaluation

- Significance of Wearing of Complete UniformDocument13 pagesSignificance of Wearing of Complete Uniformcherry mae rosaliaPas encore d'évaluation

- RA 7160 Local Government CodeDocument195 pagesRA 7160 Local Government CodeStewart Paul Tolosa Torre100% (1)

- Application Form For Aviation Security Personnel Certification - InstructorDocument4 pagesApplication Form For Aviation Security Personnel Certification - InstructorMoatasem MahmoudPas encore d'évaluation

- Book 1Document9 pagesBook 1Samina HaiderPas encore d'évaluation

- ИБП ZXDU68 B301 (V5.0R02M12)Document32 pagesИБП ZXDU68 B301 (V5.0R02M12)Инга ТурчановаPas encore d'évaluation

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetD'EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetPas encore d'évaluation

- Profit First for Therapists: A Simple Framework for Financial FreedomD'EverandProfit First for Therapists: A Simple Framework for Financial FreedomPas encore d'évaluation

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)