Académique Documents

Professionnel Documents

Culture Documents

Software and Copyrights .Lehmantaxlaw - Com - Tag - Ic-Disc

Transféré par

International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Software and Copyrights .Lehmantaxlaw - Com - Tag - Ic-Disc

Transféré par

International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Droits d'auteur :

Formats disponibles

IC-DISC Archives - LEHMAN TAX LAW

Page 1 of 8

Posts Tagged IC-DISC IC-DISC and United States Exporting of Computer Software, Internet Sales and Licenses

May 7th, 2012 | Author: admin

The Export Disc Corporation Computer Software And Internet Sales And Licenses

By Richard S. Lehman, Esq The IC-DISC has been approved as an acceptable tax planning entity for the export of American produced computer software and programs as early as 1985. In 1998, a very detailed set of Treasury Regulations were issued that have added certainty to this area of the law. Before the issuance of the Software Regulations, there was uncertainty about the taxation of computer program transactions. Computer programs did not fit traditional tax principles. Computer programs are usually sold pursuant to license or user agreements. A computer program transaction is unlike a sale of a physical object since the value of the program copy far exceeds the value of the physical medium on which it is transferred. Computer programs, in fact are transferred electronically. Often, there is no physical medium at all. For purposes of determining the applicability of the DISC to computer software exports, two key analyses are often required. First, (1) is the software export property for DISC purposes and (2) is the software products source of income from without the U.S.? Is the product for use, consumption or sale without the U.S.? In a technical advice memorandum in 1985, the I.R.S. issued guidance on the issue of whether certain computer software programs constituted export property for DISC purposes. That Technical Advice Memorandum reviewed the term export property for DISC purposes in depth and determined in its holding that computer software could indeed be export property. In doing so the Technical Advice not only reviewed the legislative history of the DISC rules it also pointed out the distinctively different treatment that patents, inventions, models, decisions, formulas, or processes whether or not patented, copyrights, goodwill, trademarks, trade brands, franchise or other like property receive under the DISC rules, as opposed to the treatment of films, tapes, records or similar reproductions, for commercial or home use. Copyright law is the basis for the Software Regulations. The Regulations are based on the concept that it is possible to categorize a computer program transaction by analyzing the copyright rights transferred. Like many other tax laws, it is generally accepted that the taxation of payments made pursuant to a contract is determined based on an analysis of the contracts substance, without regard to the labels. The most important distinction created by the Software Regulations is the distinction between copyrighted articles and copyright rights. This basic distinction arises from copyright law. Copyright law distinguishes between the copyright itself, which grants the owner certain rights, and a copy of the copyrighted work. The Copyright Act grants to copyright owners the exclusive right to reproduce the copyrighted work in copies. The Copyright Act states that Ownership of a copyright, or of any of the exclusive rights under a copyright, is distinct from ownership of any material object in which the work is embedded. The Copyright Rights are not export property for DISC purposes while the Copyright Articles are export property. The Export Property analysis in the I.R.S. Technical Advice Memorandum is enlightening. The computer software considered as an example to show the nature of Computer Articles was described in the Technical Advice Memorandum as follows: Mr. X develops, markets and services standardized computer software on a worldwide basis. The software consists of computer programs on magnetic tape. Computer programs are coded instructions to operate the computer to process data in a specified manner. Mr. Xs computer software products are manufactured in the following manner. Computer programmers develop a computer program, which is referred to as source language software (source code). The source code is highly confidential and kept under strictly controlled security at all times. The modifications to the computer programs that are required to keep the software up to date with changing technology and user requirements are made to the source code. The source code is processed by a computer into a master recording, which contains the magnetic impulses a customer will receive. Unlike the source code, the master recording cannot be used to modify a software program. The products that Mr. X markets are tapes made from the master recordings.

The Export Property Analysis

Export property is defined to mean, in general, property that is: 1. Manufactured, produced, grown or extracted in the United States by a person other than a DISC, 2. Held primarily for sale, lease, or rental, in the ordinary course of trade or business, by, or to, a DISC, for direct use, consumption, or disposition outside the United States and 3. Not more than 50 percent of the fair market value of which is attributable to articles imported into the United States.

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 2 of 8

Export property does not include patents, inventions, models, designs, formulas, or processes, whether or not patented, copyrights (other than films, tapes, records, or similar reproductions, for commercial or home use), good will, trademarks, trade brands, franchises, or other like property . . . Although a copyright such as a copyright on a book does not constitute export property, a copyrighted article (such as a book) if not accompanied by a right to reproduce it is export property. The legislative history of the DISC states the following: Although generally the sale or license of a copyright does not produce qualified export receipts (since a copyright is generally not export property), the sale or lease of a copyrighted book, record, or to her articles does generally produce qualified export receipts. Computer software can be export property. Computer software tapes are akin to the copyrighted books, which qualify as export property. Computer programs are standardized programs that are manufactured in the United States by a person other than a DISC and then marketed outside the United States. This is not selling the source code or master recording. Those purchasing or leasing programs do not have the right to reproduce the software.

Copyright Rights

The regulations distinguish between transfers of copyright rights and transfers of copyrighted articles based on the type of rights transferred to the transferee. The transfer is classified as a transfer of a copyright if, as a result of a transaction, a person acquires any one or more of the following rights: (1) the right to make copies of the computer program for purposes of distribution to the public by sale or other transfer of ownership, or by rental, lease or lending; (2) the right to prepare derivative computer programs based on the copyrighted computer program; (3) the right to make a public performance of the computer program; or (4) the right to publicly display the computer program.

Transfers of Computer Programs

The regulations provide rules for classifying transactions involving the transfer of computer programs. A computer program includes any media, user manuals, documentation, database or similar item if the media user manuals, documentation, database or similar item is incidental to the operation of the computer program. A copyrighted article is defined as a copy of a computer program from which the work can be perceived, reproduced, or otherwise communicated, either directly or with the aid of a machine or device. If a person acquires a copy of a computer program but does not acquire any of the four copyright rights, the transfer is classified as a transfer of a copyrighted article. In general, a transfer of a computer program is classified in one of the following ways. 1. 2. 3. 4. A sale or exchange of the legal rights constituting a copyright (which generates income sourced according to the rules for sales of personal property); A license of a copyright (which generates royalty income); A sale or exchange of a copyright article produced under a copyright (which generates income sourced according to the rules for sales of personal property); A lease of a copyright article produced under a copyright (which generates rental income).1

1Additional

rules allow for the classification of a transfer as partially a transfer of services or of know-how. The provision of know-how, in which the transferor retains continuing use of the know how transferred, is presumably most like a license of a copyright.

The following are four examples from the Treasury Regulations that describe the four types of transactions.

Example 1 Sale of Copyright Article

A U.S. corporation, (the U.S. corporation) owns the copyright in a computer program, (the Program).

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 3 of 8

The U.S. corporation, (the U.S. Corporation), makes the Program available, for a fee, on a World Wide Web home page on the Internet. Mr. P, a resident of Country Z, in return for payment to the U.S. Corporation, downloads the Program X (via modem) onto the hard drive of his computer. As part of the electronic communications, P signifies his assent to a license agreement. Mr. P receives the right to use the program on his own computers (for example, a laptop and a desktop). None of the copyright rights have been transferred in this transaction. P has received a copy of the Program. P has acquired solely a copyrighted article. P is properly treated as the owner of a copyrighted article. There has been a sale of a copyrighted article rather than the grant of a lease.

Example 2

The facts are the same as those in Example 1, except that the U.S. Corporation only allows Mr. P, the right to use the Program for one week. If P wishes to use the Program for a further period he must enter into a new agreement to use the program for an additional charge. P is not properly treated as the owner of a copyrighted article. There has been a lease of a copyrighted article rather than a sale.

Example 3

A U.S. Corporation, transfers a disk containing the Program to a Foreign Corporation (the Foreign Corporation) and grants the Foreign Corporation an exclusive license for the remaining term of the copyright to copy and distribute an unlimited number of copies of the Program in the geographic area of the Country in which the Foreign Corporation makes public performances of the Program and publicly displays the Program. Applying the all substantial rights test, the U.S. Corporation will be treated as having sold copyright rights to the Foreign Corporation. The Foreign Corporation has acquired all of the copyright rights in the Program and has received the right to use them exclusively within the Foreign Country.

Example 4

A U.S. corporation, transfers a disk containing the Program to a Foreign Corporation in Country X and grants the Foreign Corporation the non exclusive right to reproduce (either directly or by contracting with another person to do so) and distribute for sale to the public an unlimited number of disks at its factory in return for a payment related to the number of disks copied and sold. The term of the agreement is two years, which is less than the remaining life of the copyright. There is a lease of copyright rights since copyright right have been assigned but for a limited time period only.

The Source of Income Analysis

Once it is determined that a computer program is a copyright article and thus export property for DISC purposes; then the issue is to determine whether the Software Program is being sold for use, consumption of disposition outside of the U.S. This analysis depends upon the source of income rules. Generally under the current rules, the source of income from sales of property depends to varying extents upon both the type of property and whether the property sold or leased is inventory property. Income from the lease of a copyright article must also fit this definition of non U.S. source of income. The user of the computer program is particularly important in the international context. Income earned from commerce between countries must be assigned a source under rules. This requires a determination of whether the transaction is a sale of inventory, a rental of property, a license or sale of intellectual property or the provision of services. The regulations focus on (i) acknowledging the special circumstances of computer programs, (ii) distinguishing between transactions in copyright rights and in copyrighted articles, and (iii) focusing on the economic substance of the transaction over the labels applied, the form and the delivery mechanism. The Software Regulations provide explicit guidance on how to source income arising from transactions categorized under the regulations by cross referencing existing source rules. The regulations provide that income from transactions that are classified as sales or exchanges of copyrighted articles will be sourced under the sections of Internal Revenue Code that determine if income is earned in the United States for tax purposes or earned outside of the United States. Income from the leasing of a computer program will be sourced under different Internal Revenue Code sections.

Source of Income for Sales of Copyrighted Articles

A transfer of intangible property is a sale if the actual facts and circumstances support the fact that the transferor has transferred all substantial rights to the computer software property. A perpetual and exclusive license of intangible property is considered to be a transfer of all substantial rights is also treated as a sale, rather than as a license, for tax purposes. All the facts and circumstances are reviewed to determine whether the transaction transferred all substantial rights to the property in question. A sale of a copyrighted article occurs if sufficient benefits and burdens of ownership have been transferred to the buyer, taking into account all facts and circumstances. This is the same test that generally is applied to determine whether transfers of tangible personal property are sales or leases. The source of income generated by the sale or exchange of a copyrighted article often depends upon whether the sale took place within or without the United States. The Software Regulations provide that the place of sale is determined under the title passage rule. The governing regulation state that a sale of personal property is consummated at the time when and the place where, the rights, title and interest of the seller in the property are transferred to the buyer. The sale shall be deemed to have occurred at the time and place of passage to the buyer of beneficial ownership and the risk of loss. As to the issue of determining the place of sale under the title passage rule, the parties in many cases can agree on where title passes for sales of inventory property generally.

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 4 of 8

Application of the Title Passage Rule

As described above, the source of income generated by the sale or exchange of a copyrighted article often depends upon whether the sale took place within or without the United States. The place of sale is determined under the title passage rule. The Software Regulations recognizes that typical license agreements do not refer to a transfer of property and an electronic transfer is generally not accompanied by the usual indicia of the transfer of title.

Application of the Title Passage Rule

There are important categories of copyrighted article transfers for DISC purposes: (i) a transfer of tangible property, such as a tangible medium in which the copyrighted article is embodied, and/or a hard copy of user manuals and documentation; (ii) (e.g., electronically transmitted copyrighted articles without any hard copy of user manuals and documentation). Either one of these can be the subject of a sale. To comply with the passage of title rules, a DISC may consider language such as: Title to this computer software program, shall pass outside the United States in its agreements when tangible property is being transferred. If non tangible property is delivered, the DISC taxpayers could consider documentation for foreign users (which could be a contract to sign or terms consented to electronically) that states that the vendors delivery obligation shall be complete and risk of loss with respect to the copyrighted article shall pass at the time the program is copied onto the recipients computer at the end users location.

Partial Transfer of a Copyright Article: A Lease

If less than all of the benefits and burdens associated with a copyrighted article have passed to the transferee, the Software Regulations treat the transaction as a lease. Copyright articles can be leased as well as sold. Computer programs do not involve the risk of physical deterioration or physical destruction but they do have the risk of technological obsolescence. If this risk is assumed by the transferee, generally through a transaction in which the transferee makes a single payment in return for the right to use the program copy in perpetuity, then the transferee has assumed the risk of obsolescence and should be treated as the owner of the program copy. However, if the transferee instead makes periodic payment and can cease its use of the program when it chooses, then the transferee has not assumed the relevant benefits and burdens of ownership and the transaction should be considered a lease.

Lease and Rental Source of Income

Under the Software Regulations, income derived from the rental of a copyrighted article is sourced under Section 861(a)(4) and 862(a)(4). As a general rule, rents and royalties are sourced to the place where the leased or licensed property is located, or where the lessee or licensee uses, or is entitled to use the property. Leased property is used where it is physically located at the time of its use by the lessee. Therefore a computer program copy that is rented under a limited duration license should be considered to be used at the place where the computer that hosts the program is physically located while the lessee uses the program. If the copy resides on the lessees computer, the lessor will need to know where that computer is located in order to source its rental income.

If you have additional questions, please contact us today. Value can be lost without good legal advice.

Your Name (required)

Telephone (required)

Your Email (required)

AREA OF INTEREST: U.S. Tax Benefits of Exporting Your Message

Enter the letters and/or numbers in the CAPTCHA code above

Send Posted in Domestic Taxation, Exporting Tax Benefits | Tags: computer software exporting, DISC Commissions, DISC Distribution, DISC Election,

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 5 of 8

DISC Pricing, Export DISC, Export Gross Receipts, export profits, Export Property, ICDISC, internet sales, Producer Loans, richard s lehman, software licenses | Comments Closed

The United States Tax Benefits Of Exporting THE IC-DISC

January 24th, 2012 | Author: admin

By Richard S. Lehman, Esq (PLEASE NOTE: The IC-DISC topic is available as a free online seminar presented by Mr. Lehman) The business world is going to be a tough place for the American exporter in 2013. The dollar will remain strong, keeping U.S. goods high priced, trade to the Euro zone will weaken while the cheap euro makes the Euro Zone highly competitive as exporters. China will contract and desperate competitors and countries will be trying even harder to protect their own. With export profits hard to come by, U.S. taxpayers that sell, lease or license export property which is manufactured, produced or grown in the United States (not more than 50% of which attributable to U.S. imports), can take advantage of strong support for their export profits in the Internal Revenue Code. Export profits can produce substantial tax benefits with little more than establishing a new corporation dedicated almost exclusively to export profits; a separate set of export books and records, and abiding by a relatively simple set of rules that govern Domestic International Sales Corporations (now known as IC-DISC). Rather than being organized as a mere paper entity for receipt of commission income only, an IC-DISC can have more substance and engage in additional export-related activities such as promotional activities, thereby enhancing its income and the benefit of the advantageous tax rates to shareholders.1/ An IC-Disc is compensated by a U.S. taxpayer that manufactures, sells or licenses export property. Typically the U.S. taxpayer that establishes the IC-DISC will be related to the IC-DISC and even own the IC-DISC. The U.S. taxpayer agrees to pay the IC-DISC based on a Commission Agreement. A portion of the U.S. taxpayers export profits are paid to the IC-DISC and the payment is deducted from the profits of the U.S. manufacturer, seller or licensor. The portion of the U.S. taxpayers export profits that are paid to the IC DISC are measured under three profit scenarios. The deduction may exceed more than 50% of the U.S. Taxpayers export profits, depending upon gross income, profitability and costs. In its simplest terms, the IC-DISC is a separate corporation. The income received by the DISC is not taxable to the DISC. The DISC is charged with accounting separately for a U.S. taxpayers export profits and receives more than 50% of the export profits free of any U.S. taxation.2/ The existence of the DISC will be transparent to the export companys customers. The exporter will continue to operate its business in the same manner and its employees will continue to perform the companys manufacturing, sales, billing, shipping and collection functions. The fact that there is a commission agreement between the exporter and the DISC will not have to be disclosed to the exporters customers and no documentation provided to the customers will need to indicate the existence of, or services deemed provided by the DISC. Architects and engineers may also be surprised to learn that their services can also qualify of DISC benefits for construction projects located outside of the U.S. if professional services related to those projects can be performed in the United States. What are the IC-DISC rules that need to be obeyed? IC-DISC Rules The IC-DISC must sell, lease, license or service export property Export property means property: Manufactured, produced, grown or extracted in the United States; held for sale, lease or rental, in the ordinary course of business, for use, consumption or disposition outside the United States; and Not more than 50% of the fair market value of which is attributed to articles imported into the United States. Services Furnished by DISC Services can also be provided by the I.C. DISC if such services are provided by the person who sold or leased the export property to which such services are related. The DISC acts as a commission agent with respect to the sale or lease of such property and with respect to such services that cannot exceed a certain amount of the value of the transaction. The service must be of the type of customarily and usually furnished with the type of transaction in the trade or business in which such sale or lease arose.

IC-DISC REQUIREMENTS

1. A corporation taxable as a corporation, must be formed under the laws of any State or the District of Columbia to be the IC-DISC 2. The corporation must have only one class of stock and minimum capital of $2,500. The IC-DISC shareholders may be related to the IC-DISC. 3. The IC-DISC must take a tax election to be an IC-DISC that must be filed with the Internal Revenue Service within 90 days after the beginning of the tax year of the IC-DISC. 4. The IC-DISC must maintain separate books and records. 5. The IC-DISC must have at least 95% or more of its gross receipts considered to be Qualified Receipts resulting from the DISCs export activities.Qualified export receipts of a DISC include gross receipts from the sale of export property by such DISC, or by any principal for whom the DISC acts as a commission agent. The transaction must be pursuant to the terms of a contract entered into with a purchaser by the DISC or by the principal at any time or by any other person and assigned to the DISC or the principal at any time prior to the shipment of such property to the purchaser. Any agreement, oral or written, which constitutes a contract at law, satisfies the contractual requirement of this paragraph.Qualified export receipts of a DISC include gross receipts from the lease of export property provided that the property is held by a DISC (or by a principal for whom the DISC acts as commission agent with respect to the lease) as an owner or lessee at the beginning of the term of such lease and entered into with the DISC for the DISCS taxable year in which the term of such lease began. 6. The IC-DISC must have at least 95% or more of its assets considered to be Qualified Export Receipts. For a corporation to qualify as a DISC, at the close if its

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 6 of 8

taxable year it must have qualified export assets with an adjusted bases equal to at least 95 percent of the sum of the adjusted bases of all its assets. A qualified export asset held by a DISC is an export property that is a business asset used in the export business, export trade receivables, temporary export investments and several loans that can result from engaging in export financing techniques. Essentially, as a practical matter, this means all IC-DISC gross receipts should be devoted almost totally to the IC-DISC operation. There is no reason to violate either of these formulas. However, there is no requirement that the IC-DISC be an actual operating company except the corporate form must be respected in all regards as with any other corporation. Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayers highest brackets that can range as high as 50% when city, state and federal income taxes are calculated. The Tax Benefits The benefits of the IC-DISC come in two separate fashions. The IC-DISC shareholders may leave the IC-DISC profits in the IC-DISC and defer taxation until actual distribution of the profits or the IC-DISC may distribute profits to its shareholders like any other corporation. Since IC-DISC distributions are considered qualified dividends they are subject to a maximum tax of 15%. Thus the magic of the IC-DISC is to provide both tax deferral and to apply a 15% maximum dividend tax rate to profits that would otherwise be taxable in the U.S. taxpayers highest brackets that can range as high as 50% when city, state and federal income taxes are calculated.2/ Typically the IC-DISC is established, by a related company that is engaged in a United States business that includes gross revenues from both domestic and international sources. The related companys principals will be the direct or indirect owners of the IC-DISC that may be owned directly or any transparent entity, that may be a partnership, or a disregarded entity, such as a one person limited liability company. For the maximum tax advantage the IC-DISC shareholders should avoid double taxation by acting as individual shareholders or using disregarded entities and/or pass through entities. The IC-DISC corporation itself must be a c corporation and may not elect Sub chapter S status.

Tax Deferral There is a cost to take advantage of the tax deferral tax benefit available using an IC-DISC. However, in todays climate and for the foreseeable future, the cost is minimal. The IC-DISC rules provide that an interest charge must be calculated on IC-DISC distributions that are not paid as taxable dividends in the year earned. However, that interest charge is the same as the rates charged on one year Treasury bills that have been ranging at less than 1% per annum. Thus at this time a U.S. Taxpayer may defer the U.S. income tax on 50% or more of its export profits at a cost of less than 1% per year and then eventually distribute those export profits and their tax free earnings at the 15% U.S. dividend rate. Major Savings However, it is extremely important that U.S. taxpayers not be misled by the $10,000,000 annual cap on tax free income that is permitted by an IC-DISC. This $10. Million annual cap does not require the DISC pay taxes on its income of IC-DISC profits over $10.0 Million. The DISC remains tax exempt. This means that IC-DISC profits in excess of $10 Million annually will be immediately taxed to the shareholders as a DISC dividend. Profits in excess of the $10.0 Million maximum are considered automatically annual dividends from the DISC with no deferral privileges. However, while the deferral privileges does not exist, most practitioners believe that the IC-DISC shareholders still will receive the 15% tax rate on the DISC dividends in excess of $10 Million.

The Commission Payments

The commission payments will depend upon the pricing methodology chosen by a DISC to record its share of commission income at the greater of any of the following three pricing arrangements: Gross Receipts Method Under the gross receipts method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 4 percent of the qualified export receipts of the DISC derived from the sale of the export property and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts. Taxable Income Method

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 7 of 8

Under the combined taxable income method of pricing, the transfer price for a sale by the related supplier to the DISC is the price as a result of which the taxable income derived by the DISC from the sale will not exceed the sum of (i) 50 percent of the combined taxable income of the DISC and its related supplier attributable to the qualified export receipts from such sale and (ii) 10 percent of the export promotion expenses of the DISC attributable to such qualified export receipts. Export promotion expenses means those expenses incurred to advance the distribution or sale of export property for use, consumption, or distributions outside of the United States but does not include income taxes. Arms Length Method If the rules of the preceding paragraphs are inapplicable to a sale or a taxpayer does not choose to use them, the transfer price for a sale by the related supplier to the DISC is to be determined on the basis of the sale price actually charged but subject to the rules provided by the rules of sales between related parties. Payment The amount of a transfer price (or reasonable estimate thereof) actually charged by a related supplier to a DISC, or a sales commission (or reasonable estimate thereof) actually charged by a DISC to a related supplier, must be paid no later than 60 days following the close of the taxable year of the DISC during which the transaction occurred. Examples The following are examples of the 4% Percent Gross Receipts and 50-50 Combined Taxable Income Methods of Pricing. Neither example includes any export promotion expenses.

ARTICLE REFERENCES: 1. As will be explained later, the IC stands for an interest charge. This is a cost to be paid to the extent the Domestic International Sales Corporation does not distribute its profits to its shareholders. 2. IC-DISC income is also typically exempt from individual state income taxes. ABOUT THE AUTHOR: Richard S. Lehman, Esq., is a graduate of Georgetown Law School and obtained his Masters degree in taxation from New York University. He has served as a law clerk to the Honorable William M. Fay, U.S. Tax Court and as Senior Attorney, Interpretative Division, Chief Counsels Office, Internal Revenue Service, Washington D.C. Mr. Lehman has been practicing in South Florida for more than 37 years. During Mr. Lehmans career his tax practice has caused him to be involved in an extremely wide array of commercial transactions involving an international and domestic client base. He has served clients from over 50 countries. If you have additional questions please fill out the form below. Your Name (required)

Telephone (required)

Your Email (required)

AREA OF INTEREST: U.S. Tax Benefits of Exporting

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

IC-DISC Archives - LEHMAN TAX LAW

Page 8 of 8

Your Message

Enter the letters and/or numbers in the CAPTCHA code above

Send Posted in Domestic Taxation | Tags: american exporter, american exporting, DISC Distribution, Export DISC, Export Gross Receipts, export profits, Export Property, ICDISC, IC-DISC Commissions, IC-DISC Election, IC-DISC Owner, IC-DISC Pricing, Producer Loans, richard lehman, richard s lehman, tax lawyer, united states taxation | Comments Closed Richard S. Lehman, Esq., Tax Attorney | Telephone: 561-3681113 Contact Us | LEHMAN TAX LAW Blawgs and website 2013

http://www.lehmantaxlaw.com/tag/ic-disc/

7/11/2013

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Lesson 5-Consumer Arithmetic - UnlockedDocument12 pagesLesson 5-Consumer Arithmetic - UnlockedDuval PearsonPas encore d'évaluation

- Fiestan Vs Court of AppealsDocument2 pagesFiestan Vs Court of Appeals'mhariie-mhAriie TOotPas encore d'évaluation

- Insurance Law Case DigestsDocument80 pagesInsurance Law Case DigestsVincent ArnadoPas encore d'évaluation

- Policyloanapplicationform PDFDocument2 pagesPolicyloanapplicationform PDFEdgar Compala100% (1)

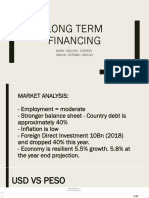

- LONG TERM FINANCING Finma FinalDocument36 pagesLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Sales Digests Compilation - Missing Dizon NavarraDocument30 pagesSales Digests Compilation - Missing Dizon NavarraRomnick JesalvaPas encore d'évaluation

- Software and Copyrights .Lehmantaxlaw - Com - Tag - Ic-DiscDocument8 pagesSoftware and Copyrights .Lehmantaxlaw - Com - Tag - Ic-DiscInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- IC-DISC Audit Guide ADocument72 pagesIC-DISC Audit Guide AInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- WWW - Law.cornell - Edu CFR Text 26 1.992-2Document4 pagesWWW - Law.cornell - Edu CFR Text 26 1.992-2International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- WWW - Irs.gov Businesses International Businesses IC DISCDocument52 pagesWWW - Irs.gov Businesses International Businesses IC DISCInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- 927 (G) Treatment of Shared FSC's (1) in General: Ffective Ate of MendmentDocument1 page927 (G) Treatment of Shared FSC's (1) in General: Ffective Ate of MendmentInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Tax Private Disc Impl - HTMLDocument4 pagesTax Private Disc Impl - HTMLInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- M&D 0711news Ic Disc 2011.Htm Source GooglDocument4 pagesM&D 0711news Ic Disc 2011.Htm Source GooglInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- IC DISC Webcast SlidesDocument53 pagesIC DISC Webcast SlidesInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Reasons For The Ic DiscDocument4 pagesReasons For The Ic DiscInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Generic Ic Disc PresentationDocument55 pagesGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Ic Disc PresentationDocument47 pagesIc Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Ic Disc PresentationDocument47 pagesIc Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Media 1840Document21 pagesMedia 1840International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Overview of IcDocument4 pagesOverview of IcInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Cases California Calapp3d 195 326.HTMLDocument5 pagesCases California Calapp3d 195 326.HTMLInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- CooperWilliam TC WPDDocument7 pagesCooperWilliam TC WPDInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Election To Be Treated As An Interest Charge DISC: H I Identifying NumberDocument2 pagesElection To Be Treated As An Interest Charge DISC: H I Identifying NumberInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Cases California Calapp3d 229 784.HTMLDocument7 pagesCases California Calapp3d 229 784.HTMLInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Export Tax IC DISC RevenueDocument13 pagesExport Tax IC DISC RevenueInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- 2008 Ic Disc StatsDocument24 pages2008 Ic Disc StatsInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Media 1840Document21 pagesMedia 1840International Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Cases California Calapp3d 229 784.HTMLDocument7 pagesCases California Calapp3d 229 784.HTMLInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- 2006 Stats Ic DiscDocument12 pages2006 Stats Ic DiscInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- 2006 Stats Ic DiscDocument9 pages2006 Stats Ic DiscInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- 00icdisc Irs PaperDocument13 pages00icdisc Irs PaperInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Election To Be Treated As An Interest Charge DISC: H I Identifying NumberDocument2 pagesElection To Be Treated As An Interest Charge DISC: H I Identifying NumberInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- ServicesDocument2 pagesServicesInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Pas encore d'évaluation

- Rapid Response To Internet Leads Drives ConversionDocument3 pagesRapid Response To Internet Leads Drives Conversionapi-26000027Pas encore d'évaluation

- Tender For Third Bay Extention 2nd Phase 060809Document808 pagesTender For Third Bay Extention 2nd Phase 060809shivamdubey12Pas encore d'évaluation

- Ceo AssignmentDocument17 pagesCeo AssignmentANINDA NANDIPas encore d'évaluation

- AHS ExpensesDocument331 pagesAHS ExpensescoopermathesonPas encore d'évaluation

- Cash Flow Know How - Lindsey JeanDocument40 pagesCash Flow Know How - Lindsey JeanMahid SamadPas encore d'évaluation

- Accounts - Module 2 Books and Trial BalanceDocument18 pagesAccounts - Module 2 Books and Trial Balance9986212378Pas encore d'évaluation

- RSK4801 Assignment 01 Suggested SolutionsDocument15 pagesRSK4801 Assignment 01 Suggested Solutionsmovo786Pas encore d'évaluation

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDocument4 pagesGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshPas encore d'évaluation

- FINDocument10 pagesFINAnbang XiaoPas encore d'évaluation

- GE Waynesboro Plant News (1972)Document178 pagesGE Waynesboro Plant News (1972)Ed PalmerPas encore d'évaluation

- Exam MLC 2013 FallDocument54 pagesExam MLC 2013 Fallsteellord123Pas encore d'évaluation

- Micro Finance and NGO'sDocument50 pagesMicro Finance and NGO'sMunish Dogra100% (1)

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfsgauravpooja808Pas encore d'évaluation

- Accounting For IntangiblesDocument14 pagesAccounting For Intangiblesmanoj17188100% (2)

- Petitioners vs. vs. Respondents: First DivisionDocument16 pagesPetitioners vs. vs. Respondents: First DivisionSabPas encore d'évaluation

- BANKING Sector India and Swot AnalysisDocument16 pagesBANKING Sector India and Swot AnalysisPrateek Rastogi93% (14)

- Internship Report On HBLDocument79 pagesInternship Report On HBLbbaahmad89Pas encore d'évaluation

- Objective Questions FinalDocument48 pagesObjective Questions FinalAvijitneetika Mehta100% (1)

- Affidavit of UndertakingDocument2 pagesAffidavit of Undertakingnemo_nadalPas encore d'évaluation

- CONCEPT AND ROLE OF BANKING June 22 PDFDocument210 pagesCONCEPT AND ROLE OF BANKING June 22 PDFgizachewnani2011Pas encore d'évaluation

- Bank of International Settlements Quarterly Review: Detailed Tables March 2011Document137 pagesBank of International Settlements Quarterly Review: Detailed Tables March 2011creditplumberPas encore d'évaluation

- Chuck Nwokocha: Presented byDocument41 pagesChuck Nwokocha: Presented byJan Dave OgatisPas encore d'évaluation

- Standard Government Chart of Accounts Ngas Chart of AccountsDocument22 pagesStandard Government Chart of Accounts Ngas Chart of AccountsNoelle RillonPas encore d'évaluation

- Sealway 16801Document2 pagesSealway 16801klecio silvaPas encore d'évaluation