Académique Documents

Professionnel Documents

Culture Documents

Psa 800 PDF

Transféré par

shambiruarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Psa 800 PDF

Transféré par

shambiruarDroits d'auteur :

Formats disponibles

Philippine Standard on Auditing 800 THE AUDITORS REPORT ON SPECIAL PURPOSE AUDIT ENGAGEMENTS

PSA 800

PHILIPPINE STANDARD ON AUDITING 800 THE AUDITORS REPORT ON SPECIAL PURPOSE AUDIT ENGAGEMENTS CONTENTS Paragraphs Introduction General Considerations Reports on Financial Statements Prepared in Accordance with a Comprehensive Basis of Accounting other than Generally Accepted Accounting Principles in the Philippines Reports on a Component of Financial Statements Reports on Compliance with Contractual Agreements Reports on Summarized Financial Statements Effective Date Acknowledgment Appendix 1: Examples of Reports on Financial Statements Prepared in Accordance with a Comprehensive Basis of Accounting other than Generally Accepted Accounting Principles in the Philippines Appendix 2: Examples of Reports on Components of Financial Statements Appendix 3: Examples of Reports on Compliance Appendix 4: Examples of Reports on Summarized Financial Statements 1-2 3-8

9-11 12-17 18-20 21-25 26 27-28

PSA 800

Philippine Standards on Auditing (PSAs) are to be applied in the audit of financial statements. PSAs are also to be applied, adapted as necessary, to the audit of other information and to related services. PSAs contain the basic principles and essential procedures (identified in bold type black lettering) together with related guidance in the form of explanatory and other material. The basic principles and essential procedures are to be interpreted in the context of the explanatory and other material that provide guidance for their application. To understand and apply the basic principles and essential procedures together with the related guidance, it is necessary to consider the whole text of the PSA including explanatory and other material contained in the PSA not just that text which is black lettered. In exceptional circumstances, an auditor may judge it necessary to depart from a PSA in order to more effectively achieve the objective of an audit. When such a situation arises, the auditor should be prepared to justify the departure. PSAs need only be applied to material matters.

The PSAs issued by the Auditing Standards and Practices Council (Council) are based on International Standards on Auditing (ISAs) issued by the International Auditing Practices Committee of the International Federation of Accountants.

The ISAs on which the PSAs are based are generally applicable to the public sector, including government business enterprises. However, the applicability of the equivalent PSAs on Philippine public sector entities has not been addressed by the Council. It is the understanding of the Council that this matter will be addressed by the Commission on Audit itself in due course. Accordingly, the Public Sector Perspective set out at the end of an ISA has not been adopted into the PSAs.

PSA 800

Introduction 1. The purpose of this Philippine Standard on Auditing (PSA) is to establish standards and provide guidance in connection with special purpose audit engagements including: Financial statements prepared in accordance with a comprehensive basis of accounting other than generally accepted accounting principles in the Philippines; Specified accounts, elements of accounts, or items in a financial statement (hereafter referred to as reports on a component of financial statements); Compliance with contractual agreements; and Summarized financial statements.

This PSA does not apply to review, agreed-upon procedures or compilation engagements. 2. The auditor should review and assess the conclusions drawn from the audit evidence obtained during the special purpose audit engagement as the basis for an expression of opinion. The report should contain a clear written expression of opinion.

General Considerations 3. The nature, timing and extent of work to be performed in a special purpose audit engagement will vary with the circumstances. Before undertaking a special purpose audit engagement, the auditor should ensure there is agreement with the client as to the exact nature of the engagement and the form and content of the report to be issued. In planning the audit work, the auditor will need a clear understanding of the purpose for which the information being reported on is to be used, and who is likely to use it. To avoid the possibility of the auditors report being used for purposes for which it was not intended, the auditor may wish to indicate in the report the purpose for which the report is prepared and any restrictions on its distribution and use. The auditors report on a special purpose audit engagement, except for a report on summarized financial statements, should include the following basic elements, ordinarily in the following layout:

4.

5.

PSA 800 -2-

(a) (b) (c)

title1 ; addressee; opening or introductory paragraph (i) identification of the financial information audited; and (ii) a statement of the responsibility of the entitys management and the responsibility of the auditor;

(d)

a scope paragraph (describing the nature of an audit) (i) the reference to the PSAs applicable to special purpose audit engagements; and (ii) a description of the work the auditor performed;

(e)

opinion paragraph containing an expression of opinion on the financial information; date of the report; auditors address; and auditors signature.

(f) (g) (h)

A measure of uniformity in the form and content of the auditors report is desirable because it helps to promote the readers understanding. 6. In the case of financial information to be supplied by an entity to government authorities, trustees, insurers and other entities there may be a prescribed format for the auditors report. Such prescribed reports may not conform to the requirements of this PSA. For example, the prescribed report may require a certification of fact when an expression of opinion is appropriate, may require an opinion on matters outside the scope of the audit or may omit essential wording.

1 It may be appropriate to use the term Independent Auditor in the title to distinguish the auditors report from reports that might be

issued by others, such as officers of the entity, or from the reports of other auditors who may not have to abide by the same ethical requirements as the independent auditor.

PSA 800 -3-

When requested to report in a prescribed format, the auditor should consider the substance and wording of the prescribed report and, when necessary, should make appropriate changes to conform to the requirements of this PSA, either by rewording the form or by attaching a separate report. 7. When the information on which the auditor has been requested to report is based on the provisions of an agreement, the auditor needs to consider whether any significant interpretations of the agreement have been made by management in preparing the information. An interpretation is significant when adoption of another reasonable interpretation would have produced a material difference in the financial information. The auditor should consider whether any significant interpretations of an agreement on which the financial information is based are clearly disclosed in the financial information. The auditor may wish to make reference in the auditors report on the special purpose audit engagement to the note within the financial information that describe such interpretations.

8.

Reports on Financial Statements Prepared in Accordance with a Comprehensive Basis of Accounting other than Generally Accepted Accounting Principles in the Philippines 9. A comprehensive basis of accounting comprises a set of criteria used in preparing financial statements which applies to all material items and which has substantial support. Financial statements may be prepared for a special purpose in accordance with a comprehensive basis of accounting other than generally accepted accounting principles in the Philippines (referred to herein as an other comprehensive basis of accounting). A conglomeration of accounting conventions devised to suit individual preference is not a comprehensive basis of accounting. Other comprehensive financial reporting frameworks may include: That used by an entity to prepare its income tax return. The cash receipts and disbursements basis of accounting. The financial reporting provisions of a government regulatory agency.

PSA 800 -4-

10.

The auditors report on financial statements prepared in accordance with another comprehensive basis of accounting should include a statement that indicates the basis of accounting used or should refer to the note to the financial statements giving that information. The opinion should state whether the financial statements are prepared, in all material respects, in accordance with the identified basis of accounting. The term used to express the auditors opinion is present fairly, in all material respects. Appendix 1 to this PSA gives examples of auditors reports on financial statements prepared in accordance with an other comprehensive basis of accounting. The auditor would consider whether the title of, or a note to, the financial statements makes it clear to the reader that such statements are not prepared in accordance with generally accepted accounting principles in the Philippines. For example, a tax basis financial statement might be entitled Statement of Income and ExpensesIncome Tax Basis. If the financial statements prepared on an other comprehensive basis are not suitably titled or the basis of accounting is not adequately disclosed, the auditor should issue an appropriately modified report.

11.

Reports on a Component of Financial Statements 12. The auditor may be requested to express an opinion on one or more components of financial statements, for example, accounts receivable, inventory, an employees bonus calculation or a provision for income taxes. This type of engagement may be undertaken as a separate engagement or in conjunction with an audit of the entitys financial statements. However, this type of engagement does not result in a report on the financial statements taken as a whole and, accordingly, the auditor would express an opinion only as to whether the component audited is prepared, in all material respects, in accordance with the identified basis of accounting. Many financial statement items are interrelated, for example, sales and receivables, and inventory and payables. Accordingly, when reporting on a component of financial statements, the auditor will sometimes be unable to consider the subject of the audit in isolation and will need to examine certain other financial information. In determining the scope of the engagement, the auditor should consider those financial statement items that are interrelated and which could materially affect the information on which the audit opinion is to be expressed.

13.

PSA 800 -5-

14.

The auditor should consider the concept of materiality in relation to the component of financial statements being reported upon. For example, a particular account balance provides a smaller base against which to measure materiality compared with the financial statements taken as a whole. Consequently, the auditors examination will ordinarily be more extensive than if the same component were to be audited in connection with a report on the entire financial statements. To avoid giving the user the impression that the report relates to the entire financial statements, the auditor would advise the client that the auditors report on a component of financial statements is not to accompany the financial statements of the entity. The auditors report on a component of financial statements should include a statement that indicates the basis of accounting in accordance with which the component is presented or refers to an agreement that specifies the basis. The opinion should state whether the component is prepared, in all material respects, in accordance with the identified basis of accounting. Appendix 2 to this PSA gives examples of audit reports on components of financial statements. When an adverse opinion or disclaimer of opinion on the entire financial statements has been expressed, the auditor should report on components of the financial statements only if those components are not so extensive as to constitute a major portion of the financial statements. To do otherwise may overshadow the report on the entire financial statements.

15.

16.

17.

Reports on Compliance with Contractual Agreements 18. The auditor may be requested to report on an entitys compliance with certain aspects of contractual agreements, such as bond indentures or loan agreements. Such agreements ordinarily require the entity to comply with a variety of covenants involving such matters as payments of interest, maintenance of predetermined financial ratios, restriction of dividend payments and the use of the proceeds of sales of property. Engagements to express an opinion as to an entitys compliance with contractual agreements should be undertaken only when the overall aspects of compliance relate to accounting and financial matters within the scope of the auditors professional competence. However, when there are particular matters forming part of the engagement that are outside the auditors expertise, the auditor would consider using the work of an expert. (Refer to PSA 401 for guidance on using the work of an expert.)

19.

PSA 800 -6-

20.

The report should state whether, in the auditors opinion, the entity has complied with the particular provisions of the agreement. Appendix 3 to this PSA gives examples of auditors reports on compliance given in a separate report and in a report accompanying financial statements.

Reports on Summarized Financial Statements 21. An entity may prepare financial statements summarizing its annual audited financial statements for the purpose of informing user groups interested in the highlights only of the entitys financial position and the results of its operations. Unless the auditor has expressed an audit opinion on the financial statements from which the summarized financial statements were derived, the auditor should not report on summarized financial statements. Summarized financial statements are presented in considerably less detail than annual audited financial statements. Therefore, such financial statements need to clearly indicate the summarized nature of the information and caution the reader that, for a better understanding of an entitys financial position and the results of its operations, summarized financial statements are to be read in conjunction with the entitys most recent audited financial statements which include all disclosures required by the relevant financial reporting framework. Summarized financial statements need to be appropriately titled to identify the audited financial statements from which they have been derived, for example, Summarized Financial Information Prepared from the Audited Financial Statements for the Year Ended December 31, 20X1. Summarized financial statements do not contain all the information required by the financial reporting framework used for the annual audited financial statements. Consequently, wording such as present fairly, in all material respects, is not used by the auditor when expressing an opinion on summarized financial statements.

22.

23.

24.

PSA 800 -7-

25.

The auditors report on summarized financial statements should include the following basic elements ordinarily in the following layout: (a) (b) (c) title2 ; addressee; an identification of the audited financial statements from which the summarized financial statements were derived; a reference to the date of the audit report on the unabridged financial statements and the type of opinion given in that report; an opinion as to whether the information in the summarized financial statements is consistent with the audited financial statements from which it was derived. When the auditor has issued a modified opinion on the unabridged financial statements yet is satisfied with the presentation of the summarized financial statements, the audit report should state that, although consistent with the unabridged financial statements, the summarized financial statements were derived from financial statements on which a modified audit report was issued; a statement, or reference to the note within the summarized financial statements, which indicates that for a better understanding of an entitys financial performance and position and of the scope of the audit performed, the summarized financial statements should be read in conjunction with the unabridged financial statements and the audit report thereon; date of the report; auditors address; and auditors signature.

(d)

(e)

(f)

(g) (h) (i)

Appendix 4 to this PSA gives examples of auditors reports on summarized financial statements.

2 See footnote 1.

PSA 800 -8-

Effective Date 26. This standard is effective for special purpose audit engagements for periods ending on or after June 30, 2003. Earlier application is encouraged.

Acknowledgment 27. This PSA, The Auditors Report on Special Purpose Audit Engagements, is based on International Standard on Auditing (ISA) 800 of the same title issued by the International Auditing Practices Committee of the International Federation of Accountants. This PSA differs from ISA 800 mainly with respect to the inclusion of the statement of changes in equity in the introductory paragraph of Appendix 3 under the heading Report Accompanying Financial Statements and the deletion of the section on Public Sector Perspective included in ISA 800.

28.

PSA 800 -9-

This Philippine Standard on Auditing 800 was unanimously approved on June 24, 2002 by the members of the Auditing Standards and Practices Council:

Benjamin R. Punongbayan, Chairman

Antonio P. Acyatan, Vice Chairman

Felicidad A. Abad

David L. Balangue

Eliseo A. Fernandez

Nestorio C. Roraldo

Editha O. Tuason

Joaquin P. Tolentino

Joycelyn J. Villaflores

Carlito B. Dimar

Froilan G. Ampil

Erwin Vincent G. Alcala

Horace F. Dumlao

Isagani O. Santiago

Eugene T. Mateo

Emma M. Espina

Jesus E. G. Martinez

PSA 800 Appendix 1

Examples of Reports on Financial Statements Prepared in Accordance with a Comprehensive Basis of Accounting other than Generally Accepted Accounting Principles in the Philippines

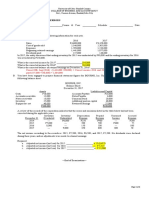

A Statement of Cash Receipts and Disbursements REPORT OF INDEPENDENT AUDITOR We have audited the accompanying statement of ABC Companys cash receipts and disbursements for the year ended December 31, 20X13. This statement is the responsibility of ABC Companys management. Our responsibility is to express an opinion on the accompanying statement based on our audit. We conducted our audit in accordance with generally accepted auditing standards in the Philippines. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statement is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statement. An audit also includes assessing the accounting principles used and significant estimates made by management as well as evaluating the overall statement presentation. We believe that our audit provides a reasonable basis for our opinion. The Companys policy is to prepare the accompanying statement on the cash receipts and disbursements basis. On this basis, revenue is recognized when received rather than when earned, and expenses are recognized when paid rather than when incurred. In our opinion, the accompanying statement presents fairly, in all material respects, the revenue collected and expenses paid by the Company during the year ended December 31, 20X1 in accordance with the cash receipts and disbursements basis as described in Note X.

AUDITOR Date Address

3 Provide suitable identification, such as by reference to page numbers or by identifying the individual statement.

PSA 800 Appendix 1 -2-

Financial Statements Prepared on the Entitys Income Tax Basis

REPORT OF INDEPENDENT AUDITOR We have audited the accompanying income tax basis financial statements of ABC Company for the year ended December 31, 20X14. These statements are the responsibility of ABC Companys management. Our responsibility is to express an opinion on the financial statements based on our audit. We conducted our audit in accordance with generally accepted auditing standards in the Philippines. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 20X1, and its revenues and expenses for the year then ended, in accordance with the basis of accounting used for income tax purposes as described in Note X. AUDITOR

Date Address

4 See footnote 3.

PSA 800 Appendix 2

Examples of Reports on Components of Financial Statements

Schedule of Accounts Receivable REPORT OF INDEPENDENT AUDITOR We have audited the accompanying schedule of accounts receivable of ABC Company for the year ended December 31, 20X15. This schedule is the responsibility of ABC Companys management. Our responsibility is to express an opinion on the schedule based on our audit. We conducted our audit in accordance with generally accepted auditing standards in the Philippines. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the schedule is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the schedule. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the schedule. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the schedule of accounts receivable presents fairly, in all material respects, the accounts receivable of the Company as of December 31, 20X1 in accordance with generally accepted accounting principles in the Philippines.

AUDITOR

Date Address

5 See footnote 3.

PSA 800 Appendix 2 -2-

Schedule of Profit Participation

REPORT OF INDEPENDENT AUDITOR We have audited the accompanying schedule of DEFs profit participation for the year ended December 31, 20X1.6 This schedule is the responsibility of ABC Companys management. Our responsibility is to express an opinion on the schedule based on our audit. We conducted our audit in accordance with generally accepted auditing standards in the Philippines. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the schedule is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the schedule. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the schedule. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the schedule of profit participation presents fairly, in all material respects, DEFs participation in the profits of the Company for the year ended December 31, 20X1 in accordance with the provisions of the employment agreement between DEF and the Company dated June 1, 20X0.

AUDITOR

Date Address

6 See footnote 3.

PSA 800 Appendix 3

Examples of Reports on Compliance

Separate Report REPORT OF INDEPENDENT AUDITOR We have audited ABC Companys compliance with the accounting and financial reporting matters of sections XX to XX inclusive of the Indenture dated May 15, 20X1 with DEF Bank. We conducted our audit in accordance with generally accepted auditing standardsin the Philippines applicable to compliance auditing. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether ABC Company has complied with the relevant sections of the Indenture. An audit includes examining appropriate evidence on a test basis. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the Company was, in all material respects, in compliance with the accounting and financial reporting matters of the sections of the Indenture referred to in the preceding paragraphs as of December 31, 20X1.

Deleted:

AUDITOR

Date Address

PSA 800 Appendix 3 -2-

Report Accompanying Financial Statements REPORT OF INDEPENDENT AUDITOR We have audited the accompanying balance sheet of the ABC Company as of December 31, 20X1, and the related statements of income, changes in equity and cash flows for the year then ended. These financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on these financial statements based on our audit. We have also audited ABC Companys compliance with the accounting and financial reporting matters of sections XX to XX inclusive of the Indenture dated May 15, 20X1 with DEF Bank. We conducted our audits in accordance with generally accepted auditing standards in the Philippines applicable to the audit of financial statements and to compliance auditing. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and about whether ABC Company has complied with the relevant sections of the Indenture. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion: (a) the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 20X1, and the results of its operations and its cash flows for the year then ended in accordance with ...; and the Company was, in all material respects, in compliance with the accounting and financial reporting matters of the sections of the Indenture referred to in the preceding paragraphs as of December 31, 20X1. AUDITOR Date Address

(b)

PSA 800 Appendix 4

Examples of Reports on Summarized Financial Statements

When an Unqualified Opinion Was Expressed on the Annual Audited Financial Statements

REPORT OF INDEPENDENT AUDITOR We have audited the financial statements of ABC Company for the year ended December 31, 20X0, from which the summarized financial statements7 were derived, in accordance with generally accepted auditing standards in the Philippines. In our report dated March 10, 20X1 we expressed an unqualified opinion on the financial statements from which the summarized financial statements were derived. In our opinion, the accompanying summarized financial statements are consistent, in all material respects, with the financial statements from which they were derived. For a better understanding of the Companys financial position and the results of its operations for the period and of the scope of our audit, the summarized financial statements should be read in conjunction with the financial statements from which the summarized financial statements were derived and our audit report thereon.

AUDITOR

Date Address

7 See footnote 3.

PSA 800 Appendix 4 -2-

When a Qualified Opinion Was Expressed on the Annual Audited Financial Statements

REPORT OF INDEPENDENT AUDITOR We have audited the financial statements of ABC Company for the year ended December 31, 20X0, from which the summarized financial statements8 were derived, in accordance with generally accepted auditing standards in the Philippines. In our report dated March 10, 20X1 we expressed an opinion that the financial statements from which the summarized financial statements were derivedpresented fairly, in all material respects, .. except that inventory had been overstated by .... In our opinion, the accompanying summarized financial statements are consistent, in all material respects, with the financial statements from which they were derived and on which we expressed a qualified opinion. For a better understanding of the Companys financial position and the results of its operations for the period and of the scope of our audit, the summarized financial statements should be read in conjunction with the financial statements from which the summarized financial statements were derived and our audit report thereon.

Deleted:

AUDITOR

Date Address

8 See footnote 3.

Vous aimerez peut-être aussi

- 910-Psa 910Document26 pages910-Psa 910Gwenneth BachusPas encore d'évaluation

- CPA Review: Auditing Theory and Other ServicesDocument6 pagesCPA Review: Auditing Theory and Other ServicesshambiruarPas encore d'évaluation

- FULL DISCLOSURE Test BankDocument11 pagesFULL DISCLOSURE Test Bankzee abadillaPas encore d'évaluation

- Zurita - Summary Table For PSAsDocument2 pagesZurita - Summary Table For PSAsNove Jane ZuritaPas encore d'évaluation

- Auditing - Final ExaminationDocument7 pagesAuditing - Final ExaminationFrancis MateosPas encore d'évaluation

- AT - Activity - No. 8 - Substantive Testing - Axl Rome P. FloresDocument3 pagesAT - Activity - No. 8 - Substantive Testing - Axl Rome P. FloresDanielle VasquezPas encore d'évaluation

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaPas encore d'évaluation

- ADVACCDocument3 pagesADVACCCianne AlcantaraPas encore d'évaluation

- CONTINUATION OF AUDTHEO NOTES (AutoRecovered)Document77 pagesCONTINUATION OF AUDTHEO NOTES (AutoRecovered)KarlayaanPas encore d'évaluation

- BPS Quiz Intangibles PRINTDocument3 pagesBPS Quiz Intangibles PRINTSheena CalderonPas encore d'évaluation

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersDocument1 pageLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezPas encore d'évaluation

- ACT631 Assurance Principles, Professional Ethics and Good Governance PDFDocument6 pagesACT631 Assurance Principles, Professional Ethics and Good Governance PDFMarnelli CatalanPas encore d'évaluation

- MAS-02 Cost Terms, Concepts and BehaviorDocument4 pagesMAS-02 Cost Terms, Concepts and BehaviorMichael BaguyoPas encore d'évaluation

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocument27 pagesAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaPas encore d'évaluation

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocument14 pagesAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyPas encore d'évaluation

- Aud Prob Part 2Document52 pagesAud Prob Part 2Ma. Hazel Donita DiazPas encore d'évaluation

- Janet Wooster Owns A Retail Store That Sells New andDocument2 pagesJanet Wooster Owns A Retail Store That Sells New andAmit PandeyPas encore d'évaluation

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoPas encore d'évaluation

- MIdterm ExamDocument8 pagesMIdterm ExamMarcellana ArianePas encore d'évaluation

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lancePas encore d'évaluation

- B. Woods Chapter 04 ElectronicDocument19 pagesB. Woods Chapter 04 ElectronicSteven Andrian GunawanPas encore d'évaluation

- Optical Clinic Financial RecordsDocument3 pagesOptical Clinic Financial RecordsJadon MejiaPas encore d'évaluation

- Practice Set PSA 200Document5 pagesPractice Set PSA 200Krystalah CañizaresPas encore d'évaluation

- ReSA B46 AUD Final PB Exam Questions Answers Solutions 1Document16 pagesReSA B46 AUD Final PB Exam Questions Answers Solutions 1John Gabriel RafaelPas encore d'évaluation

- Jpia CBLDocument14 pagesJpia CBLAngelica CatallaPas encore d'évaluation

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shanePas encore d'évaluation

- Section 1-4 EncodedDocument570 pagesSection 1-4 EncodedPremiu rayaPas encore d'évaluation

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanPas encore d'évaluation

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoPas encore d'évaluation

- Prelims DraftDocument10 pagesPrelims DraftJoshua WacanganPas encore d'évaluation

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- What Is The Correct Amount of Inventory?: SolutionDocument3 pagesWhat Is The Correct Amount of Inventory?: SolutionSofia LaoPas encore d'évaluation

- Auditing and Assurance Principles Pre-Test ReviewDocument9 pagesAuditing and Assurance Principles Pre-Test ReviewKryzzel Anne JonPas encore d'évaluation

- Audit of Educational InstitutionsDocument3 pagesAudit of Educational InstitutionsjajoriaPas encore d'évaluation

- Chapter 9Document4 pagesChapter 9Andrin LlemosPas encore d'évaluation

- ACC410 Week 1 AssignmentDocument3 pagesACC410 Week 1 AssignmentbitofpatiencePas encore d'évaluation

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacPas encore d'évaluation

- AGAP Scholarship ProgramDocument3 pagesAGAP Scholarship ProgramDaneen GastarPas encore d'évaluation

- Months To Go Until They MatureDocument5 pagesMonths To Go Until They MatureJude SantosPas encore d'évaluation

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonPas encore d'évaluation

- Accounting for Government and Not-for-Profit Organizations SIM ManualDocument64 pagesAccounting for Government and Not-for-Profit Organizations SIM Manualalmira garciaPas encore d'évaluation

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoPas encore d'évaluation

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosPas encore d'évaluation

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BPas encore d'évaluation

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasPas encore d'évaluation

- CMA2011 CatalogDocument5 pagesCMA2011 CatalogDaryl DizonPas encore d'évaluation

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenellePas encore d'évaluation

- Bsat 2019Document23 pagesBsat 2019rowena adobasPas encore d'évaluation

- 55026RR 14-2010 Accreditation PDFDocument5 pages55026RR 14-2010 Accreditation PDFlmin34Pas encore d'évaluation

- ACC 211 - Review 2 (Chapters 5, 6, & 7)Document4 pagesACC 211 - Review 2 (Chapters 5, 6, & 7)Brennan Patrick WynnPas encore d'évaluation

- Assignment 02 Correction of Errors Answer KeyDocument1 pageAssignment 02 Correction of Errors Answer KeyDan Andrei BongoPas encore d'évaluation

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonPas encore d'évaluation

- Pronouncements 08 33Document15 pagesPronouncements 08 33Ummu HauraPas encore d'évaluation

- Forming Audit Opinions & Financial ReportsDocument10 pagesForming Audit Opinions & Financial ReportsRufina B VerdePas encore d'évaluation

- Special Purpose Audit ReportsDocument7 pagesSpecial Purpose Audit Reportsbless villahermosaPas encore d'évaluation

- Reporting on Financial Statements (ISA 700Document22 pagesReporting on Financial Statements (ISA 700baabasaamPas encore d'évaluation

- Auditing FinalsDocument29 pagesAuditing FinalsZymelle Princess FernandezPas encore d'évaluation

- Forming Auditor Opinion and Reporting RequirementsDocument8 pagesForming Auditor Opinion and Reporting RequirementsAdzPas encore d'évaluation

- Acctg 163 Auditing Theory Review 6 TmhsDocument11 pagesAcctg 163 Auditing Theory Review 6 TmhsXaviery John Martinez LunaPas encore d'évaluation

- Legal Succession NotesDocument60 pagesLegal Succession NotesshambiruarPas encore d'évaluation

- Quituar Lecture Notes On Sharia ProcedureDocument11 pagesQuituar Lecture Notes On Sharia Procedureshambiruar100% (3)

- Quituar Lecture Notes On Rule On EvidenceDocument6 pagesQuituar Lecture Notes On Rule On EvidenceshambiruarPas encore d'évaluation

- Alunan Vs VelosoDocument3 pagesAlunan Vs VelososhambiruarPas encore d'évaluation

- SB Rules 2003Document45 pagesSB Rules 2003DO SOLPas encore d'évaluation

- Sheikh Mero Lecture Notes in Fiqh and JurisprudenceDocument24 pagesSheikh Mero Lecture Notes in Fiqh and Jurisprudenceshambiruar100% (1)

- Calib Lecture Notes in FiqhDocument9 pagesCalib Lecture Notes in Fiqhshambiruar100% (1)

- Agueda de VeraDocument7 pagesAgueda de VerashambiruarPas encore d'évaluation

- Civil Procedure Case Outline - Rules 6-14 Rule 6: Section Sec. 2, 3Document8 pagesCivil Procedure Case Outline - Rules 6-14 Rule 6: Section Sec. 2, 3shambiruarPas encore d'évaluation

- Intellectual CreationDocument14 pagesIntellectual CreationshambiruarPas encore d'évaluation

- Sanchez vs CA co-owner consent saleDocument1 pageSanchez vs CA co-owner consent saleshambiruar100% (1)

- Calacala Vs RepublicDocument2 pagesCalacala Vs RepublicshambiruarPas encore d'évaluation

- Sales - June 22Document65 pagesSales - June 22shambiruarPas encore d'évaluation

- Land Ti - Week 2Document34 pagesLand Ti - Week 2shambiruarPas encore d'évaluation

- Scope of Suffrage - Case DigestDocument6 pagesScope of Suffrage - Case DigestshambiruarPas encore d'évaluation

- Property-1st Exam Case OutlineDocument5 pagesProperty-1st Exam Case OutlineshambiruarPas encore d'évaluation

- Poea Rules and Regulations On Recruitment and EmploymentDocument39 pagesPoea Rules and Regulations On Recruitment and EmploymentkwinrayPas encore d'évaluation

- Labor Standards CasesDocument79 pagesLabor Standards CasesshambiruarPas encore d'évaluation

- 1.3 Suffrage As A Right and PrivilegeDocument3 pages1.3 Suffrage As A Right and PrivilegeshambiruarPas encore d'évaluation

- Sales - June 22Document65 pagesSales - June 22shambiruarPas encore d'évaluation

- A - Laws Implementing Land RegistrationDocument67 pagesA - Laws Implementing Land RegistrationshambiruarPas encore d'évaluation

- Additional CasesDocument19 pagesAdditional CasesMarry SuanPas encore d'évaluation

- 2 ElectionsDocument60 pages2 ElectionsshambiruarPas encore d'évaluation

- 1.2 Suffrage in GeneralDocument41 pages1.2 Suffrage in GeneralshambiruarPas encore d'évaluation

- 1.5 Role of The JudiciaryDocument11 pages1.5 Role of The JudiciaryshambiruarPas encore d'évaluation

- Nitafan V CIR DigestDocument1 pageNitafan V CIR Digestshambiruar100% (2)

- 1.4 Suffrage As A DutyDocument2 pages1.4 Suffrage As A DutyshambiruarPas encore d'évaluation

- Kapisanan Vs Manila RaidroadDocument2 pagesKapisanan Vs Manila RaidroadshambiruarPas encore d'évaluation

- RCBC Vs IAC Case DigestDocument1 pageRCBC Vs IAC Case Digestshambiruar25% (4)

- STRONGHOLD Vs Republic - Asahi CaseDocument6 pagesSTRONGHOLD Vs Republic - Asahi CaseYram DulayPas encore d'évaluation

- Introduction To AccountingDocument13 pagesIntroduction To AccountingGrow GlutesPas encore d'évaluation

- Muhammad Farooq Safdar: Core CompetenciesDocument2 pagesMuhammad Farooq Safdar: Core CompetenciesNasir AhmedPas encore d'évaluation

- Mohammad RiazDocument4 pagesMohammad Riazali yousifzaiPas encore d'évaluation

- Internal ControlDocument6 pagesInternal ControlAlissaPas encore d'évaluation

- Chapter 1Document27 pagesChapter 1Catherine RiveraPas encore d'évaluation

- Obtaining A Construction Permit in KenyaDocument5 pagesObtaining A Construction Permit in Kenya001Pas encore d'évaluation

- Audit Prsentation On WiproDocument9 pagesAudit Prsentation On WiproNaina ChaudharyPas encore d'évaluation

- Istilah Pajak Dalam Bahasa InggrisDocument6 pagesIstilah Pajak Dalam Bahasa InggrisGraha BeenovaPas encore d'évaluation

- Technical Factsheet: Company Purchase of Own Shares: Issued May 2018Document56 pagesTechnical Factsheet: Company Purchase of Own Shares: Issued May 2018Shaquille RobinsonPas encore d'évaluation

- 5S Implementation ProcedureDocument18 pages5S Implementation Procedurehim123verPas encore d'évaluation

- Hudbay Minerals 2016 Financial StatementsDocument94 pagesHudbay Minerals 2016 Financial StatementsAnonymous au6UvN92kBPas encore d'évaluation

- Scrap Scenarios Process HandlingDocument2 pagesScrap Scenarios Process HandlingRam Manohar100% (1)

- Tax Notes For Construction Industry in AlbaniaDocument117 pagesTax Notes For Construction Industry in AlbaniaEduart GjokutajPas encore d'évaluation

- BPML Annual Report 26th 2019 PDFDocument166 pagesBPML Annual Report 26th 2019 PDFF.m.mahmudul.hasangmail.com HasanPas encore d'évaluation

- Project Qa/Qc Plan: Wade Adams Contracting LLCDocument21 pagesProject Qa/Qc Plan: Wade Adams Contracting LLCnice hossainPas encore d'évaluation

- DefondDocument17 pagesDefondLaksmi Mahendrati DwiharjaPas encore d'évaluation

- NBAA 81st Examination Report Analyzes Candidate PerformanceDocument155 pagesNBAA 81st Examination Report Analyzes Candidate Performancejujuuu mdddPas encore d'évaluation

- Exercise For IMS INTERNAL AUDITINGDocument12 pagesExercise For IMS INTERNAL AUDITINGdhir.ankur100% (2)

- Field Report Tpa Dar Es SalaamDocument29 pagesField Report Tpa Dar Es Salaamporseena83% (18)

- ALFI Swing PricingDocument36 pagesALFI Swing PricingFihri100% (1)

- Nadcap Materials Testing Exp. 30.04.2020Document3 pagesNadcap Materials Testing Exp. 30.04.2020amirkhakzad498Pas encore d'évaluation

- Proposed Transfer of Water Business To SA Water September 2018Document22 pagesProposed Transfer of Water Business To SA Water September 2018Brexa ManagementPas encore d'évaluation

- Chapter 12 070804Document13 pagesChapter 12 070804Shahid Nasir MalikPas encore d'évaluation

- Post TestDocument40 pagesPost TestRubyJadeRoferosPas encore d'évaluation

- Concepts in Enterprise Resource Planning 4th Edition Monk Test BankDocument17 pagesConcepts in Enterprise Resource Planning 4th Edition Monk Test Bankthuydieuazfidd100% (27)

- CVP Analysis & Decision MakingDocument2 pagesCVP Analysis & Decision MakingMasood Ahmad AadamPas encore d'évaluation

- A Study On Perception of Internal AuditDocument12 pagesA Study On Perception of Internal AuditInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Voucher Payment SettlementDocument1 pageVoucher Payment SettlementAnthony VincePas encore d'évaluation

- Human Resource ManagerDocument7 pagesHuman Resource ManagerAsif KureishiPas encore d'évaluation

- Tanzania Revenue Authority: Institute of Tax AdministrationDocument67 pagesTanzania Revenue Authority: Institute of Tax AdministrationJames LemaPas encore d'évaluation